|

市场调查报告书

商品编码

1397822

房地产管理市场:按产品、业主、地理位置、最终用途、2023-2030 年全球预测Property Management Market by Offering (Services, Solution), Ownership (In-House, Third Party), Deployment, Geographic Location, End-Use - Global Forecast 2023-2030 |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

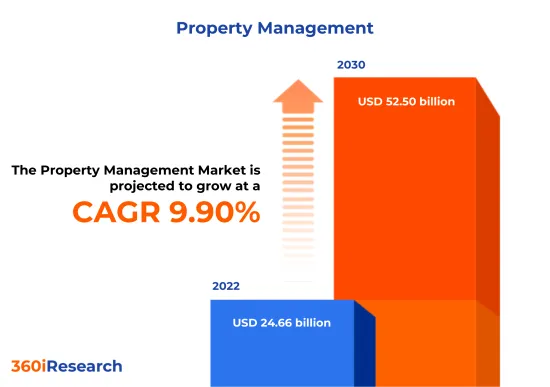

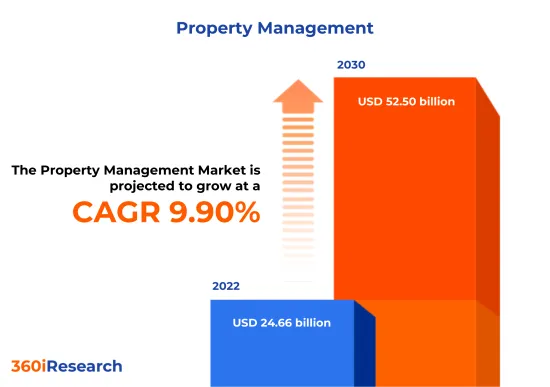

房地产管理市场预计将从 2022 年的 246.6 亿美元增至 2030 年的 525 亿美元,预测期内复合年增长率为 9.90%。

全球物业管理市场

| 主要市场统计 | |

|---|---|

| 基准年[2022] | 246.6亿美元 |

| 预测年份 [2023] | 270.3亿美元 |

| 预测年份 [2030] | 525亿美元 |

| 复合年增长率(%) | 9.90% |

FPNV定位矩阵

FPNV定位矩阵是评估房地产管理市场的重要工具。透过分析与业务策略和产品满意度相关的关键指标来全面评估供应商。这使得使用者能够根据自己的具体资讯做出明智的决策。进阶分析将供应商分为四个像限,每个象限都有不同程度的成功:前沿 (F)、探路者 (P)、利基 (N) 和重要 (V)。洞察力使决策者能够充满信心地驾驭市场。

市场占有率分析

市场占有率分析为供应商的市场形势提供了宝贵的见解。评估对整体收益、客户群和其他关键指标的影响可以全面了解公司的业绩及其面临的竞争环境。该分析还揭示了研究期间的竞争水平,例如市场占有率增长、碎片化、主导地位和行业整合。

该报告对以下几个方面提供了宝贵的见解:

1-市场渗透率:提供有关市场动态和主要企业产品的全面资讯。

2-市场开拓:详细分析新兴和成熟细分市场的渗透率,以突出利润丰厚的商机。

3- 市场多元化:有关新产品发布、开拓地区、最新发展和投资的详细资讯。

4-竞争评估与资讯:对主要企业的市场占有率、策略、产品、认证、监管状况、专利状况、製造能力进行全面评估。

5- 产品开发与创新:对未来技术、研发活动以及突破性产品开发的智力见解。

本报告解决了以下关键问题:

1-房地产管理市场的市场规模和预测是多少?

2- 房地产管理市场中哪些产品、细分市场、应用和领域具有最高的投资潜力?

3-房地产管理市场的竞争策略架构是怎么样的?

4-房地产管理市场的最新技术趋势和法规结构是什么?

5-房地产管理市场主要供应商的市场占有率是多少?

6-进入物业管理市场合适的型态或策略手段是什么?

目录

第一章 前言

第二章调查方法

第三章执行摘要

第四章市场概况

第五章市场洞察

- 市场动态

- 促进因素

- 都市化和工业化导致建设活动增加

- 数位化和自动化技术在建筑领域的快速引入

- 电子商务产业在全球持续扩张

- 抑制因素

- 整合物业管理软体和服务相关的高成本

- 机会

- 房地产管理解决方案技术创新进展

- 物业管理解决方案在海洋休閒区的潜在应用

- 任务

- 物业管理软体安全和资料隐私问题

- 促进因素

- 市场区隔分析

- 我们提供什么:开发提供全套解决方案的下一代平台

- 所有权:对利用专业知识、网路和购买力的第三方管理服务的需求不断增长

- 采用:最小的初始资本支出和可扩展性提高了云端基础的房地产管理系统的采用

- 地理位置:由于单户住宅、连栋住宅和低层公寓的增加,全部区域的需求增加

- 最终用途:在整个工业建筑中部署,以适应改进的功能和物流

- 市场趋势分析

- 增强的物业管理软体整合以及美洲地区主要企业的强大影响力

- 由于亚太地区人口成长和投资增加,住宅建设需求增加

- 欧洲、中东和非洲地区越来越多地采用物业管理解决方案,对量身定制的物业管理策略的需求强劲

- 高通膨的累积效应

- 波特五力分析

- 价值炼和关键路径分析

- 法律规范

第六章 房地产管理市场:依提供方式

- 介绍

- 服务

- 管理服务

- 专业的服务

- 咨询与培训

- 整合部署

- 支援与维护

- 解决方案

- 客户关係管理

- 设施管理

- 资产维护和管理

- 租赁会计和房地产管理

- 预约管理

- 工作空间与搬迁管理

- 计划管理

- 安全和监控管理

第七章 房地产管理市场:依所有权分类

- 介绍

- 自己的公司

- 第三者

第八章 房地产管理市场:依发展分类

- 介绍

- 在云端

- 本地

第九章 房地产管理市场:按地区

- 介绍

- 地区

- 郊区

- 城市

第十章房地产管理市场:依最终用途分类

- 介绍

- 商业大厦

- 办公大楼

- 零售店

- 购物中心

- 工业大厦

- 物流设施

- 生产设施

- 仓库

- 设施建设

- 政府大楼

- 医院

- 学校

- 住宅

第十一章美洲房地产管理市场

- 介绍

- 阿根廷

- 巴西

- 加拿大

- 墨西哥

- 美国

第十二章亚太房地产管理市场

- 介绍

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 菲律宾

- 新加坡

- 韩国

- 台湾

- 泰国

- 越南

第十三章欧洲、中东和非洲房地产管理市场

- 介绍

- 丹麦

- 埃及

- 芬兰

- 法国

- 德国

- 以色列

- 义大利

- 荷兰

- 奈及利亚

- 挪威

- 波兰

- 卡达

- 俄罗斯

- 沙乌地阿拉伯

- 南非

- 西班牙

- 瑞典

- 瑞士

- 土耳其

- 阿拉伯聯合大公国

- 英国

第14章竞争形势

- FPNV定位矩阵

- 市场占有率分析:主要企业

- 主要企业竞争情境分析

- 併购

- 合约、合作和伙伴关係

- 新产品发布和功能增强

- 投资、资金筹措

- 奖项/奖励/扩展

第15章竞争组合

- 主要公司简介

- Accruent, LLC

- AppFolio, Inc.

- Aspire Systems

- Avail

- Avenue

- Boom Properties

- Bozzuto & Associates, Inc.

- Breezeway Homes, Inc.

- CBRE, Inc.

- CDG Property Management

- Colliers International Property Consultants, Inc.

- CoreLogic, Inc.

- Cortland

- CoStar Group, Inc.

- Credit Agricole SA

- Cushman & Wakefield PLC

- DoorLoop Inc.

- Entrata, Inc.

- Eptura, Inc.

- Greystar Global Enterprise, LLC

- HappyCo, Inc.

- Hemlane, Inc.

- Hines Group

- Hitachi, Ltd.

- Hive Properties

- Hughes Group Limited

- Inhabit

- Innago, LLC

- International Business Machines Corporation

- IQware Inc.

- Jones Lang LaSalle Incorporated

- LeaseHawk, LLC

- Lincoln Property Company

- Livly, Inc

- London Computer Systems

- ManageCasa Inc.

- Matterport, Inc.

- MRI Software LLC

- Mynd Management, Inc.

- MyndLeaseX

- Nexus Property Management

- Ohmyhome Limited

- Oracle Corporation

- Planon Group

- Property Boulevard, Inc.

- Property Matrix

- PURE Property Management Company

- RealPage, Inc.

- Realpha Asset Management, Inc.

- Reapit Limited

- Rentec Direct LLC

- RentRedi, Inc.

- ResMan, LLC

- Roers Companies

- Royal York Property Management Franchising, inc.

- SAP SE

- Savills PLC

- Smart Property Systems Inc.

- Spacewell International NV

- Square Yards Group

- Strangford Management Ltd

- TenantCloud, LLC

- Tribe Property Technologies Inc.

- Trimble Inc.

- TurboTenant, Inc.

- Yardi Systems, Inc.

- Zumper, Inc.

- 主要产品系列

第十六章附录

- 讨论指南

- 关于许可证和定价

The Property Management Market is projected to reach USD 52.50 billion by 2030 from USD 24.66 billion in 2022, at a CAGR of 9.90% during the forecast period.

Global Property Management Market

| KEY MARKET STATISTICS | |

|---|---|

| Base Year [2022] | USD 24.66 billion |

| Estimated Year [2023] | USD 27.03 billion |

| Forecast Year [2030] | USD 52.50 billion |

| CAGR (%) | 9.90% |

Market Segmentation & Coverage:

This research report analyzes various sub-markets, forecasts revenues, and examines emerging trends in each category to provide a comprehensive outlook on the Property Management Market.

Based on Offering, market is studied across Services and Solution. The Services is further studied across Managed Services and Professional Services. The Professional Services is further studied across Consulting & Training, Integration & Deployment, and Support & Maintenance. The Solution is further studied across Customer Relationship Management, Facility Management, Project Management, and Security & Surveillance Management. The Facility Management is further studied across Asset Maintenance & Management, Lease Accounting & Real Estate Management, Reservation Management, and Workspace & Relocation Management. The Solution commanded largest market share of 65.32% in 2022, followed by Services.

Based on Ownership, market is studied across In-House and Third Party. The Third Party commanded largest market share of 61.87% in 2022, followed by In-House.

Based on Deployment, market is studied across On-Cloud and On-Premise. The On-Premise commanded largest market share of 56.25% in 2022, followed by On-Cloud.

Based on Geographic Location, market is studied across Rural, Suburban, and Urban. The Urban commanded largest market share of 49.42% in 2022, followed by Suburban.

Based on End-Use, market is studied across Commercial Buildings, Industrial Buildings, Institutional Buildings, and Residential Buildings. The Commercial Buildings is further studied across Office Buildings, Retail Stores, and Shopping Malls. The Industrial Buildings is further studied across Distribution Facilities, Manufacturing Facilities, and Warehouses. The Institutional Buildings is further studied across Government Buildings, Hospitals, and Schools. The Residential Buildings commanded largest market share of 25.26% in 2022, followed by Commercial Buildings.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 42.52% in 2022, followed by Europe, Middle East & Africa.

Market Statistics:

The report provides market sizing and forecasts across 7 major currencies - USD, EUR, JPY, GBP, AUD, CAD, and CHF; multiple currency support helps organization leaders to make well-informed decisions. In this report, 2018 to 2021 are considered as historical years, 2022 is base year, 2023 is estimated year, and years from 2024 to 2030 are considered as forecast period.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is an indispensable tool for assessing the Property Management Market. It comprehensively evaluates vendors, analyzing key metrics related to Business Strategy and Product Satisfaction. This enables users to make informed decisions tailored to their specific needs. Through advanced analysis, vendors are categorized into four distinct quadrants, each representing a different level of success: Forefront (F), Pathfinder (P), Niche (N), or Vital (V). Be assured that this insightful framework empowers decision-makers to navigate the market with confidence.

Market Share Analysis:

The Market Share Analysis offers invaluable insights into the vendor landscape Property Management Market. By evaluating their impact on overall revenue, customer base, and other key metrics, we provide companies with a comprehensive understanding of their performance and the competitive environment they confront. This analysis also uncovers the level of competition in terms of market share acquisition, fragmentation, dominance, and industry consolidation during the study period.

Key Company Profiles:

The report delves into recent significant developments in the Property Management Market, highlighting leading vendors and their innovative profiles. These include Accruent, LLC, AppFolio, Inc., Aspire Systems, Avail, Avenue, Boom Properties, Bozzuto & Associates, Inc., Breezeway Homes, Inc., CBRE, Inc., CDG Property Management, Colliers International Property Consultants, Inc., CoreLogic, Inc., Cortland, CoStar Group, Inc., Credit Agricole S.A., Cushman & Wakefield PLC, DoorLoop Inc., Entrata, Inc., Eptura, Inc., Greystar Global Enterprise, LLC, HappyCo, Inc., Hemlane, Inc., Hines Group, Hitachi, Ltd., Hive Properties, Hughes Group Limited, Inhabit, Innago, LLC, International Business Machines Corporation, IQware Inc., Jones Lang LaSalle Incorporated, LeaseHawk, LLC, Lincoln Property Company, Livly, Inc, London Computer Systems, ManageCasa Inc., Matterport, Inc., MRI Software LLC, Mynd Management, Inc., MyndLeaseX, Nexus Property Management, Ohmyhome Limited, Oracle Corporation, Planon Group, Property Boulevard, Inc., Property Matrix, PURE Property Management Company, RealPage, Inc., Realpha Asset Management, Inc., Reapit Limited, Rentec Direct LLC, RentRedi, Inc., ResMan, LLC, Roers Companies, Royal York Property Management Franchising, inc., SAP SE, Savills PLC, Smart Property Systems Inc., Spacewell International NV, Square Yards Group, Strangford Management Ltd, TenantCloud, LLC, Tribe Property Technologies Inc., Trimble Inc., TurboTenant, Inc., Yardi Systems, Inc., and Zumper, Inc..

The report offers valuable insights on the following aspects:

1. Market Penetration: It provides comprehensive information about key players' market dynamics and offerings.

2. Market Development: In-depth analysis of emerging markets and penetration across mature market segments, highlighting lucrative opportunities.

3. Market Diversification: Detailed information about new product launches, untapped geographies, recent developments, and investments.

4. Competitive Assessment & Intelligence: Exhaustive assessment of market shares, strategies, products, certifications, regulatory approvals, patent landscape, and manufacturing capabilities of leading players.

5. Product Development & Innovation: Intelligent insights on future technologies, R&D activities, and breakthrough product developments.

The report addresses key questions such as:

1. What is the market size and forecast for the Property Management Market?

2. Which products, segments, applications, and areas hold the highest investment potential in the Property Management Market?

3. What is the competitive strategic window for identifying opportunities in the Property Management Market?

4. What are the latest technology trends and regulatory frameworks in the Property Management Market?

5. What is the market share of the leading vendors in the Property Management Market?

6. Which modes and strategic moves are suitable for entering the Property Management Market?

Table of Contents

1. Preface

- 1.1. Objectives of the Study

- 1.2. Market Segmentation & Coverage

- 1.3. Years Considered for the Study

- 1.4. Currency & Pricing

- 1.5. Language

- 1.6. Limitations

- 1.7. Assumptions

- 1.8. Stakeholders

2. Research Methodology

- 2.1. Define: Research Objective

- 2.2. Determine: Research Design

- 2.3. Prepare: Research Instrument

- 2.4. Collect: Data Source

- 2.5. Analyze: Data Interpretation

- 2.6. Formulate: Data Verification

- 2.7. Publish: Research Report

- 2.8. Repeat: Report Update

3. Executive Summary

4. Market Overview

- 4.1. Introduction

- 4.2. Property Management Market, by Region

5. Market Insights

- 5.1. Market Dynamics

- 5.1.1. Drivers

- 5.1.1.1. Rising construction activities due to urbanization and industrialization

- 5.1.1.2. Rapid adoption of digitalization and automated technologies in the construction sector

- 5.1.1.3. Continuous expansion of eCommerce sector worldwide

- 5.1.2. Restraints

- 5.1.2.1. High cost associated with integration of property management software and services

- 5.1.3. Opportunities

- 5.1.3.1. Growing technological innovations in property management solutions

- 5.1.3.2. Emerging potential application of property management solutions in recreational marine areas

- 5.1.4. Challenges

- 5.1.4.1. Security and data privacy issues with property management software

- 5.1.1. Drivers

- 5.2. Market Segmentation Analysis

- 5.2.1. Offering: Development of next-generation platform to deliver full-suite solutions

- 5.2.2. Ownership: Rising demand for third-party management services to leverage expertise, networks, and purchasing power

- 5.2.3. Deployment: Rising adoption of cloud-based property management systems due to minimal initial capital expenditure and scalability

- 5.2.4. Geographic Location: Increasing demand across suburban regions with a boost in single-family homes, townhouses, and low-rise apartments

- 5.2.5. End-Use: Deployment across industrial buildings to meet rising functionality and logistics

- 5.3. Market Trend Analysis

- 5.3.1. Increasing integration of property management software coupled with solid presence of key players in the Americas region

- 5.3.2. Rising demand for residential construction due to increasing population coupled with growing investment in the APAC region

- 5.3.3. Increased adoption of property management solutions and significant demand for tailored strategies for property management in EMEA region

- 5.4. Cumulative Impact of High Inflation

- 5.5. Porter's Five Forces Analysis

- 5.5.1. Threat of New Entrants

- 5.5.2. Threat of Substitutes

- 5.5.3. Bargaining Power of Customers

- 5.5.4. Bargaining Power of Suppliers

- 5.5.5. Industry Rivalry

- 5.6. Value Chain & Critical Path Analysis

- 5.7. Regulatory Framework

6. Property Management Market, by Offering

- 6.1. Introduction

- 6.2. Services

- 6.3.1. Managed Services

- 6.3.2. Professional Services

- 6.3.3.1. Consulting & Training

- 6.3.3.2. Integration & Deployment

- 6.3.3.3. Support & Maintenance

- 6.3. Solution

- 6.4.1. Customer Relationship Management

- 6.4.2. Facility Management

- 6.4.3.1. Asset Maintenance & Management

- 6.4.3.2. Lease Accounting & Real Estate Management

- 6.4.3.3. Reservation Management

- 6.4.3.4. Workspace & Relocation Management

- 6.4.3. Project Management

- 6.4.4. Security & Surveillance Management

7. Property Management Market, by Ownership

- 7.1. Introduction

- 7.2. In-House

- 7.3. Third Party

8. Property Management Market, by Deployment

- 8.1. Introduction

- 8.2. On-Cloud

- 8.3. On-Premise

9. Property Management Market, by Geographic Location

- 9.1. Introduction

- 9.2. Rural

- 9.3. Suburban

- 9.4. Urban

10. Property Management Market, by End-Use

- 10.1. Introduction

- 10.2. Commercial Buildings

- 10.3.1. Office Buildings

- 10.3.2. Retail Stores

- 10.3.3. Shopping Malls

- 10.3. Industrial Buildings

- 10.4.1. Distribution Facilities

- 10.4.2. Manufacturing Facilities

- 10.4.3. Warehouses

- 10.4. Institutional Buildings

- 10.5.1. Government Buildings

- 10.5.2. Hospitals

- 10.5.3. Schools

- 10.5. Residential Buildings

11. Americas Property Management Market

- 11.1. Introduction

- 11.2. Argentina

- 11.3. Brazil

- 11.4. Canada

- 11.5. Mexico

- 11.6. United States

12. Asia-Pacific Property Management Market

- 12.1. Introduction

- 12.2. Australia

- 12.3. China

- 12.4. India

- 12.5. Indonesia

- 12.6. Japan

- 12.7. Malaysia

- 12.8. Philippines

- 12.9. Singapore

- 12.10. South Korea

- 12.11. Taiwan

- 12.12. Thailand

- 12.13. Vietnam

13. Europe, Middle East & Africa Property Management Market

- 13.1. Introduction

- 13.2. Denmark

- 13.3. Egypt

- 13.4. Finland

- 13.5. France

- 13.6. Germany

- 13.7. Israel

- 13.8. Italy

- 13.9. Netherlands

- 13.10. Nigeria

- 13.11. Norway

- 13.12. Poland

- 13.13. Qatar

- 13.14. Russia

- 13.15. Saudi Arabia

- 13.16. South Africa

- 13.17. Spain

- 13.18. Sweden

- 13.19. Switzerland

- 13.20. Turkey

- 13.21. United Arab Emirates

- 13.22. United Kingdom

14. Competitive Landscape

- 14.1. FPNV Positioning Matrix

- 14.2. Market Share Analysis, By Key Player

- 14.3. Competitive Scenario Analysis, By Key Player

- 14.3.1. Merger & Acquisition

- 14.3.1.1. Entrata Acquires Rent Dynamics, Positioning it to Transform How Multifamily Residents Build Credit and Improve Financial Health

- 14.3.1.2. CoreLogic Boosts its Proptech Powers with Acquisition of Digital Real Estate Marketing Firm Plezzel

- 14.3.2. Agreement, Collaboration, & Partnership

- 14.3.2.1. BLVD Residential Expands Relationship with Pagaya's Darwin Homes, Adds 1,000 Homes to Darwin's Platform

- 14.3.2.2. Oracle Teams with Wyndham to Bring OPERA Cloud to 2,000 Additional Hotels

- 14.3.2.3. LeaseHawk and Leading Rental Network Partner to Enhance AI-Powered Listings for Multifamily Properties

- 14.3.3. New Product Launch & Enhancement

- 14.3.3.1. AppFolio Unveils Realm-X, the Property Management Industry's First-Ever Generative AI Conversational Interface

- 14.3.3.2. MRI Software Launches Flexible Property Portal to Drive Tenant Engagement

- 14.3.3.3. Rentec Direct Upgrades Portal In Its Property Management Software Platform

- 14.3.3.4. Hines Launches its Property Management Services Offering in France

- 14.3.4. Investment & Funding

- 14.3.4.1. Habyt Raises USD 42 Million for Home and Hotel Rental Platform: Startup Funding Roundup

- 14.3.5. Award, Recognition, & Expansion

- 14.3.5.1. Royal York Property Management Receives Official Accreditations From Canadian Financial Institutions

- 14.3.1. Merger & Acquisition

15. Competitive Portfolio

- 15.1. Key Company Profiles

- 15.1.1. Accruent, LLC

- 15.1.2. AppFolio, Inc.

- 15.1.3. Aspire Systems

- 15.1.4. Avail

- 15.1.5. Avenue

- 15.1.6. Boom Properties

- 15.1.7. Bozzuto & Associates, Inc.

- 15.1.8. Breezeway Homes, Inc.

- 15.1.9. CBRE, Inc.

- 15.1.10. CDG Property Management

- 15.1.11. Colliers International Property Consultants, Inc.

- 15.1.12. CoreLogic, Inc.

- 15.1.13. Cortland

- 15.1.14. CoStar Group, Inc.

- 15.1.15. Credit Agricole S.A.

- 15.1.16. Cushman & Wakefield PLC

- 15.1.17. DoorLoop Inc.

- 15.1.18. Entrata, Inc.

- 15.1.19. Eptura, Inc.

- 15.1.20. Greystar Global Enterprise, LLC

- 15.1.21. HappyCo, Inc.

- 15.1.22. Hemlane, Inc.

- 15.1.23. Hines Group

- 15.1.24. Hitachi, Ltd.

- 15.1.25. Hive Properties

- 15.1.26. Hughes Group Limited

- 15.1.27. Inhabit

- 15.1.28. Innago, LLC

- 15.1.29. International Business Machines Corporation

- 15.1.30. IQware Inc.

- 15.1.31. Jones Lang LaSalle Incorporated

- 15.1.32. LeaseHawk, LLC

- 15.1.33. Lincoln Property Company

- 15.1.34. Livly, Inc

- 15.1.35. London Computer Systems

- 15.1.36. ManageCasa Inc.

- 15.1.37. Matterport, Inc.

- 15.1.38. MRI Software LLC

- 15.1.39. Mynd Management, Inc.

- 15.1.40. MyndLeaseX

- 15.1.41. Nexus Property Management

- 15.1.42. Ohmyhome Limited

- 15.1.43. Oracle Corporation

- 15.1.44. Planon Group

- 15.1.45. Property Boulevard, Inc.

- 15.1.46. Property Matrix

- 15.1.47. PURE Property Management Company

- 15.1.48. RealPage, Inc.

- 15.1.49. Realpha Asset Management, Inc.

- 15.1.50. Reapit Limited

- 15.1.51. Rentec Direct LLC

- 15.1.52. RentRedi, Inc.

- 15.1.53. ResMan, LLC

- 15.1.54. Roers Companies

- 15.1.55. Royal York Property Management Franchising, inc.

- 15.1.56. SAP SE

- 15.1.57. Savills PLC

- 15.1.58. Smart Property Systems Inc.

- 15.1.59. Spacewell International NV

- 15.1.60. Square Yards Group

- 15.1.61. Strangford Management Ltd

- 15.1.62. TenantCloud, LLC

- 15.1.63. Tribe Property Technologies Inc.

- 15.1.64. Trimble Inc.

- 15.1.65. TurboTenant, Inc.

- 15.1.66. Yardi Systems, Inc.

- 15.1.67. Zumper, Inc.

- 15.2. Key Product Portfolio

16. Appendix

- 16.1. Discussion Guide

- 16.2. License & Pricing

LIST OF FIGURES

- FIGURE 1. PROPERTY MANAGEMENT MARKET RESEARCH PROCESS

- FIGURE 2. PROPERTY MANAGEMENT MARKET SIZE, 2022 VS 2030

- FIGURE 3. PROPERTY MANAGEMENT MARKET SIZE, 2018-2030 (USD MILLION)

- FIGURE 4. PROPERTY MANAGEMENT MARKET SIZE, BY REGION, 2022 VS 2030 (%)

- FIGURE 5. PROPERTY MANAGEMENT MARKET SIZE, BY REGION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 6. PROPERTY MANAGEMENT MARKET DYNAMICS

- FIGURE 7. PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2022 VS 2030 (%)

- FIGURE 8. PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 9. PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2022 VS 2030 (%)

- FIGURE 10. PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 11. PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2022 VS 2030 (%)

- FIGURE 12. PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 13. PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2022 VS 2030 (%)

- FIGURE 14. PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 15. PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2022 VS 2030 (%)

- FIGURE 16. PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 17. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 18. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 19. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY STATE, 2022 VS 2030 (%)

- FIGURE 20. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY STATE, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 21. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 22. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 23. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2030 (%)

- FIGURE 24. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2022 VS 2023 VS 2030 (USD MILLION)

- FIGURE 25. PROPERTY MANAGEMENT MARKET, FPNV POSITIONING MATRIX, 2022

- FIGURE 26. PROPERTY MANAGEMENT MARKET SHARE, BY KEY PLAYER, 2022

LIST OF TABLES

- TABLE 1. PROPERTY MANAGEMENT MARKET SEGMENTATION & COVERAGE

- TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2022

- TABLE 3. PROPERTY MANAGEMENT MARKET SIZE, 2018-2030 (USD MILLION)

- TABLE 4. GLOBAL PROPERTY MANAGEMENT MARKET SIZE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 5. PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 6. PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 7. PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 8. PROPERTY MANAGEMENT MARKET SIZE, BY MANAGED SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 9. PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 10. PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 11. PROPERTY MANAGEMENT MARKET SIZE, BY CONSULTING & TRAINING, BY REGION, 2018-2030 (USD MILLION)

- TABLE 12. PROPERTY MANAGEMENT MARKET SIZE, BY INTEGRATION & DEPLOYMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 13. PROPERTY MANAGEMENT MARKET SIZE, BY SUPPORT & MAINTENANCE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 14. PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, BY REGION, 2018-2030 (USD MILLION)

- TABLE 15. PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 16. PROPERTY MANAGEMENT MARKET SIZE, BY CUSTOMER RELATIONSHIP MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 17. PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 18. PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 19. PROPERTY MANAGEMENT MARKET SIZE, BY ASSET MAINTENANCE & MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 20. PROPERTY MANAGEMENT MARKET SIZE, BY LEASE ACCOUNTING & REAL ESTATE MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 21. PROPERTY MANAGEMENT MARKET SIZE, BY RESERVATION MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 22. PROPERTY MANAGEMENT MARKET SIZE, BY WORKSPACE & RELOCATION MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 23. PROPERTY MANAGEMENT MARKET SIZE, BY PROJECT MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 24. PROPERTY MANAGEMENT MARKET SIZE, BY SECURITY & SURVEILLANCE MANAGEMENT, BY REGION, 2018-2030 (USD MILLION)

- TABLE 25. PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 26. PROPERTY MANAGEMENT MARKET SIZE, BY IN-HOUSE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 27. PROPERTY MANAGEMENT MARKET SIZE, BY THIRD PARTY, BY REGION, 2018-2030 (USD MILLION)

- TABLE 28. PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 29. PROPERTY MANAGEMENT MARKET SIZE, BY ON-CLOUD, BY REGION, 2018-2030 (USD MILLION)

- TABLE 30. PROPERTY MANAGEMENT MARKET SIZE, BY ON-PREMISE, BY REGION, 2018-2030 (USD MILLION)

- TABLE 31. PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 32. PROPERTY MANAGEMENT MARKET SIZE, BY RURAL, BY REGION, 2018-2030 (USD MILLION)

- TABLE 33. PROPERTY MANAGEMENT MARKET SIZE, BY SUBURBAN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 34. PROPERTY MANAGEMENT MARKET SIZE, BY URBAN, BY REGION, 2018-2030 (USD MILLION)

- TABLE 35. PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 36. PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 37. PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 38. PROPERTY MANAGEMENT MARKET SIZE, BY OFFICE BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 39. PROPERTY MANAGEMENT MARKET SIZE, BY RETAIL STORES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 40. PROPERTY MANAGEMENT MARKET SIZE, BY SHOPPING MALLS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 41. PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 42. PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 43. PROPERTY MANAGEMENT MARKET SIZE, BY DISTRIBUTION FACILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 44. PROPERTY MANAGEMENT MARKET SIZE, BY MANUFACTURING FACILITIES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 45. PROPERTY MANAGEMENT MARKET SIZE, BY WAREHOUSES, BY REGION, 2018-2030 (USD MILLION)

- TABLE 46. PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 47. PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 48. PROPERTY MANAGEMENT MARKET SIZE, BY GOVERNMENT BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 49. PROPERTY MANAGEMENT MARKET SIZE, BY HOSPITALS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 50. PROPERTY MANAGEMENT MARKET SIZE, BY SCHOOLS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 51. PROPERTY MANAGEMENT MARKET SIZE, BY RESIDENTIAL BUILDINGS, BY REGION, 2018-2030 (USD MILLION)

- TABLE 52. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 53. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 54. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 55. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 56. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 57. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 58. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 59. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 60. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 61. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 62. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 63. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 64. AMERICAS PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 65. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 66. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 67. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 68. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 69. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 70. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 71. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 72. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 73. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 74. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 75. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 76. ARGENTINA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 77. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 78. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 79. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 80. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 81. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 82. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 83. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 84. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 85. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 86. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 87. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 88. BRAZIL PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 89. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 90. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 91. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 92. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 93. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 94. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 95. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 96. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 97. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 98. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 99. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 100. CANADA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 101. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 102. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 103. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 104. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 105. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 106. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 107. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 108. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 109. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 110. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 111. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 112. MEXICO PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 113. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 114. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 115. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 116. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 117. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 118. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 119. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 120. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 121. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 122. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 123. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 124. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 125. UNITED STATES PROPERTY MANAGEMENT MARKET SIZE, BY STATE, 2018-2030 (USD MILLION)

- TABLE 126. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 127. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 128. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 129. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 130. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 131. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 132. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 133. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 134. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 135. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 136. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 137. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 138. ASIA-PACIFIC PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 139. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 140. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 141. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 142. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 143. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 144. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 145. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 146. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 147. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 148. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 149. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 150. AUSTRALIA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 151. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 152. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 153. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 154. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 155. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 156. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 157. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 158. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 159. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 160. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 161. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 162. CHINA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 163. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 164. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 165. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 166. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 167. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 168. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 169. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 170. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 171. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 172. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 173. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 174. INDIA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 175. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 176. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 177. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 178. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 179. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 180. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 181. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 182. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 183. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 184. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 185. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 186. INDONESIA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 187. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 188. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 189. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 190. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 191. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 192. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 193. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 194. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 195. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 196. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 197. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 198. JAPAN PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 199. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 200. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 201. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 202. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 203. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 204. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 205. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 206. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 207. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 208. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 209. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 210. MALAYSIA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 211. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 212. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 213. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 214. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 215. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 216. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 217. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 218. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 219. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 220. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 221. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 222. PHILIPPINES PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 223. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 224. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 225. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 226. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 227. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 228. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 229. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 230. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 231. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 232. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 233. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 234. SINGAPORE PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 235. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 236. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 237. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 238. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 239. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 240. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 241. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 242. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 243. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 244. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 245. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 246. SOUTH KOREA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 247. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 248. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 249. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 250. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 251. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 252. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 253. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 254. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 255. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 256. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 257. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 258. TAIWAN PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 259. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 260. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 261. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 262. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 263. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 264. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 265. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 266. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 267. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 268. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 269. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 270. THAILAND PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 271. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 272. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 273. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 274. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 275. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 276. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 277. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 278. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 279. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 280. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 281. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 282. VIETNAM PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 283. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 284. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 285. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 286. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 287. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 288. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 289. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 290. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 291. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 292. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 293. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 294. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 295. EUROPE, MIDDLE EAST & AFRICA PROPERTY MANAGEMENT MARKET SIZE, BY COUNTRY, 2018-2030 (USD MILLION)

- TABLE 296. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 297. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 298. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 299. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 300. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 301. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 302. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 303. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 304. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 305. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 306. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 307. DENMARK PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 308. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 309. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 310. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 311. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 312. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 313. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 314. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 315. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 316. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 317. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 318. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 319. EGYPT PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 320. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 321. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 322. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 323. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 324. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 325. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 326. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 327. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 328. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLION)

- TABLE 329. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY COMMERCIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 330. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY INDUSTRIAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 331. FINLAND PROPERTY MANAGEMENT MARKET SIZE, BY INSTITUTIONAL BUILDINGS, 2018-2030 (USD MILLION)

- TABLE 332. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY OFFERING, 2018-2030 (USD MILLION)

- TABLE 333. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY SERVICES, 2018-2030 (USD MILLION)

- TABLE 334. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY PROFESSIONAL SERVICES, 2018-2030 (USD MILLION)

- TABLE 335. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY SOLUTION, 2018-2030 (USD MILLION)

- TABLE 336. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY FACILITY MANAGEMENT, 2018-2030 (USD MILLION)

- TABLE 337. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY OWNERSHIP, 2018-2030 (USD MILLION)

- TABLE 338. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY DEPLOYMENT, 2018-2030 (USD MILLION)

- TABLE 339. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY GEOGRAPHIC LOCATION, 2018-2030 (USD MILLION)

- TABLE 340. FRANCE PROPERTY MANAGEMENT MARKET SIZE, BY END-USE, 2018-2030 (USD MILLIO