|

市场调查报告书

商品编码

1548967

KYC/KYB 系统的全球市场:2024-2029Global KYC/KYB Systems Market: 2024-2029 |

||||||

| 关键统计 | |

|---|---|

| 2024年总支出 | 308亿美元 |

| 2029年总支出 | 529亿美元 |

| 2024年至2029年的市场成长率 | 71% |

| 预测週期 | 2024-2029 |

研究包对不断发展的市场提供了详细而富有洞察力的分析,以帮助利益相关者(包括金融机构、电子商务平台、监管机构和技术供应商)了解未来的成长、主要趋势和竞争格局。

该套件包括对 KYC/KYB 系统市场采用和未来成长的资料的存取、市场的最新趋势和机会,以及打击身份欺诈和洗钱方面 19个市场领导者的完整列表。

主要功能

- 市场动态:对KYC/KYB 系统当前发展和细分市场成长的区域成长分析、对构成KYC/KYB 系统领域的全球监管框架的评估、KYC/KYB 系统主要市场趋势、市场扩展挑战、未来前景和见解、线上交易和金融犯罪增加带来的挑战以及监管参与增加的潜在好处、透过下一代技术实现客户和企业的数位化,包括对用于整合的多种身份验证方法的评估

- 主要要点和策略建议:详细分析 KYC/KYB 系统市场的主要成长机会和研究结果,以帮助金融机构、监管机构、电子商务平台等利害关係人,等等,还包括重大战略建议。

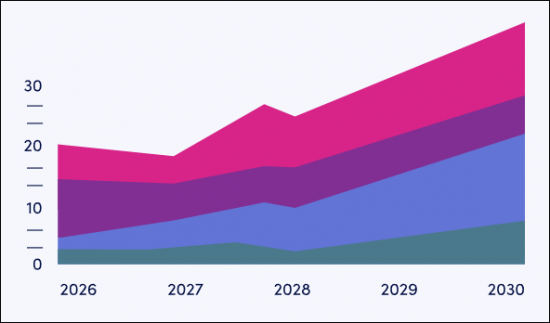

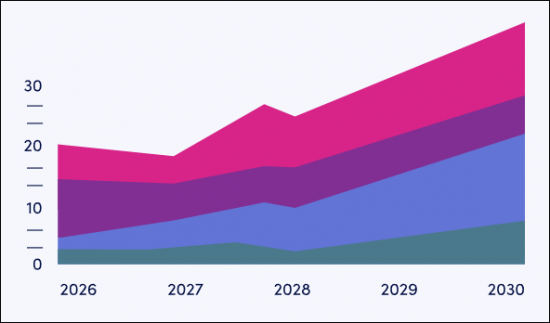

- 基准产业预测:概述包含 KYC/KYB 系统的总收入预测,分为消费者和企业用例。也列出了全球在 KYC/KYB 系统上的支出,分为五个金融业和五个非金融业。

- Juniper Research 竞争排行榜:Juniper Research 的竞争排行榜对 19 家 KYC/KYB 系统供应商的能力进行了评估。

范例

市场资料与预测报告:

全面分析当前市场状况并解释策略建议和预测结果。

市场趋势与策略报告:

全面分析当前市场状况并提出策略建议。

市场资料与预测报告

研究套件包括对 74个表格和超过 26,720个资料点中的一整套预测资料的存取。研究套件包括以下指标:

- 使用第三方 KYC/KYB 系统的公司总数

- 用于 KYC/KYB 系统的总金额(分为金融业和其他行业)

Juniper Research 互动式预测 Excel 有以下功能:

- 统计分析:显示一段时间内所有地区和国家的资料,并可搜寻特定指标。可以轻鬆修改图表并将其汇出到剪贴簿。

- 国家/地区资料工具:此工具可查看预测期间内的所有区域和国家指标。可以缩小搜寻栏中显示的指标范围。

- 国家比较工具:使用者可以选择国家/地区并针对特定国家/地区进行比较。也可以汇出图表。

- 假设分析:五种互动式场景让使用者比较预测假设。

市场趋势与策略报告

本报告详细研究了 KYC/KYB 系统市场格局,并评估了影响快速成长市场的趋势和演变的因素。为了因应网路金融犯罪和诈欺增加带来的挑战,重点地区KYC/KYB法律的製定和修订,以及许多下一代技术方法用来数位化地支持客户和企业,KYC/KYB系统供应商策略机会的全面分析

竞争排行榜报告

竞争对手排行榜报告提供了KYC/KYB系统领域19家主要供应商的详细评估和市场定位。

目录

市场趋势与策略

第1章 要点与策略建议

- 要点

- 策略建议

第2章 市场状况

- 简介

- 主要趋势与驱动因素

- 未来展望

- 身份验证和 KYC/KYB 系统

- 资料库验证

- 一般生物辨识身分验证

- 指纹

- 脸

- 音讯

- 活体检测

- 深度伪造检测

- 行为生物识别

- 新的生物辨识身分验证

- 虹膜

- 视网膜

- 手形

- 静脉模式识别

- 一般生物辨识身分验证

竞争排行榜

第1章 KYC/KYB 系统:竞争排行榜

- 为什么要阅读这份报告?

- 供应商简介

- AU10TIX

- Data Zoo

- Encompass Corporation

- Entrust

- Experian

- Fenergo

- Jumio

- Know Your Customer

- LexisNexis Risk Solutions

- Minerva

- Moody's

- Persona

- Sardine

- Shufti Pro

- Socure

- Sumsub

- Veriff

第2章 未来领导者指数:KYC/KYB系统

- 未来领导者供应商简介

- Baselayer

- Dotfile

- Gatenox

- Labrys

- Parcha

- Quadrata

- TransactionLink

- Vespia

- Juniper Research 未来领导者指数评估方法

- 限制和解释

资料和预测

第1章 全球KYC/KYB体系预测

第2章 全球KYC/KYB系统市场

- 全球 KYC/KYB 系统市场

- 使用第三方 KYC/KYB 系统的公司数量

- 第三方 KYC/KYB 系统的总支出

第3章 金融业务:预测全球 KYC/KYB 系统

- 使用第三方 KYC/KYB 系统的金融业者总数

- 第三方 KYC/KYB 系统的总支出:按金融提供者划分

- 使用第三方 KYC/KYB 系统的银行总数

- 银行业第三方 KYC/KYB 系统的总支出

- 使用第三方 KYC/KYB 系统的金融科技公司总数

- 金融科技业第三方 KYC/KYB 系统的总支出

- 使用第三方 KYC/KYB 系统的保险公司总数

- 保险业第三方反洗钱系统的总支出

- 使用第三方 KYC/KYB 系统的投资公司总数

- 投资业第三方 KYC/KYB 系统的总支出

- 使用第三方反洗钱系统的贷款公司总数

- 贷款产业第三方 KYC/KYB 系统的总支出

第4章 专业公司和其他公司:预测全球 KYC/KYB 系统

- 使用第三方 KYC/KYB 系统的专业公司和其他公司总数

- 第三方 KYC/KYB 系统的总支出:专业公司与其他公司

- 使用第三方 KYC/KYB 系统的游戏和赌博运营商总数

- 游戏与博弈产业第三方 KYC/KYB 系统的总支出

- 使用第三方 KYC/KYB 系统的电子商务公司总数

- 电子商务产业第三方 KYC/KYB 系统的总支出

- 使用第三方 KYC/KYB 系统的承运商总数

- 电信业第三方 KYC/KYB 系统的总支出

- 使用第三方 KYC/KYB 系统的医疗保健提供者总数

- 医疗保健产业第三方 KYC/KYB 系统的总支出

- 实施第三方 KYC/KYB 系统的房地产企业总数

- 房地产行业第三方 KYC/KYB 系统的总支出

| KEY STATISTICS | |

|---|---|

| Total spend in 2024: | $30.8bn |

| Total spend in 2029: | $52.9bn |

| 2024 to 2029 market growth: | 71% |

| Forecast period: | 2024-2029 |

'KYC/KYB Systems ~ LexisNexis Risk Solutions and Experian Revealed as Market Leaders'

Overview

Our "KYC/KYB Systems" research suite provides a detailed and insightful analysis of an evolving market; enabling stakeholders such as financial institutions, eCommerce platforms, regulatory agencies and technology vendors to understand future growth, key trends and the competitive environment.

The suite includes several different options that can be purchased separately, including access to data that maps adoption and future growth of the KYC/KYB systems market. The research in this insightful study uncovers the latest trends and opportunities within the market, and provides extensive analysis of the 19 market leaders in the fight against identity fraud and money laundering. The coverage can also be purchased as a Full Research Suite, containing all of these elements, at a substantial discount.

Collectively, these documents provide a critical tool for understanding the rapidly evolving KYC/KYB systems market; allowing banks and technology vendors to shape their future strategy. Its unparalleled coverage makes this research suite an incredibly useful resource for charting the future of such an uncertain and rapidly growing market.

Key Features

- Market Dynamics: The banking market share research also includes a regional market growth analysis on the current development and segment growth of KYC/KYB systems; an assessment of the global regulatory frameworks that have shaped the KYC/KYB systems realm. Also provided are a future outlook of, and insights into, key trends and market expansion challenges within the KYC/KYB systems market. The research addresses challenges posed by the increase of online transactions and financial crime and the potential benefits of increasing regulatory involvement, and an assessment of the many identity verification approaches used to digitally onboard customers and businesses through next-generation technology.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and key findings within the KYC/KYB systems market, accompanied by key strategic recommendations for stakeholders including financial institutions, regulatory bodies, eCommerce platforms and more.

- Benchmark Industry Forecasts: The overview includes forecasts for total revenue for KYC/KYB systems, split by consumer vs business use cases. Also included is the global spend on KYC/KYB systems; split across five financial and five non-financial industry segments.

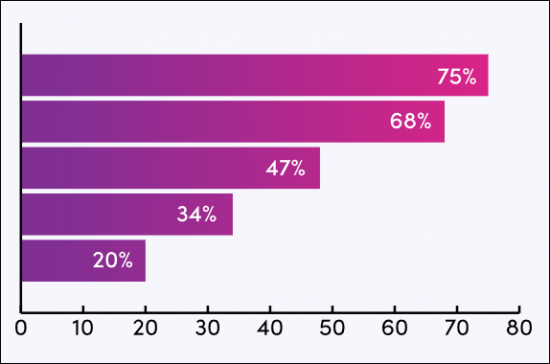

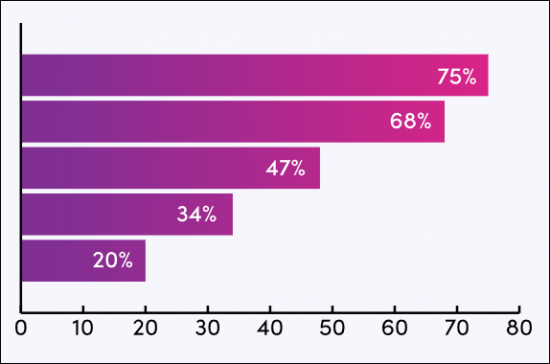

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 19 KYC/KYB Systems vendors, via the Juniper Research Competitor Leaderboard.

- Juniper Research Future Leaders Index: Key player capability and capacity assessment for eight KYC/KYB Systems vendors, via the Juniper Research Future Leaders Index; including:

- Baselayer

- Dotfile

- Gatenox

- Labrys

- Parcha

- Quadrata

- TransactionLink

- Vespia

SAMPLE VIEW

Market Data & Forecasting Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations and a walk-through of the forecasts.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasting Report

This market-leading research suite for the "KYC/KYB Systems" market includes access to the full set of forecast data of 74 tables and over 26,720 datapoints. Metrics in the research suite include:

- Total Number of Companies Using Third-party KYC/KYB Systems

- Total Spend on KYC/KYB Systems (split across the financial sector and other industries)

These metrics are provided for the following key market verticals:

- Financial Industries

- Banking

- Fintech

- Insurance

- Investment

- Lending

- Non-financial Industries

- Gaming & Gambling

- eCommerce

- Telco

- Healthcare

- Real Estate

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics; displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select countries and compare each of them for specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions, via five interactive scenarios

Market Trends & Strategies Report

This report examines the "KYC/KYB Systems" market landscape in detail; assessing market trends and factors shaping the evolution of the rapidly growing market. The report delivers comprehensive analysis of the strategic opportunities for KYC/KYB systems providers; addressing challenges posed by the increase in online financial crime and illicit activities, the development and revision of KYC/KYB laws across key regions, and the many next generation technological approaches used to digitally onboard customers and businesses.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 19 leading vendors in the "KYC/KYB Systems" space. These vendors are positioned as established leaders, leading challengers or disruptors and challengers, based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool that provides an at-a-glance view of the competitive landscape in a market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.1.1. The History of Regulatory Frameworks

- Figure 2.1: Basel III Framework

- 2.1.2. The Current KYC Regulatory Landscape

- Figure 2.2: Factors Determining Customers' Potential Risk Level

- i. KYC (Know Your Customer)

- Figure 2.4: Verification Alternatives to KYC

- iii. KYI (Know Your Investor)

- iv. KYP (Know Your Patient)

- v. KYD (Know Your Data)

- vi. Age Verification

- 2.1.3. Shifting and Emerging Regulatory Landscape

- i. EU - AI Act

- Figure 2.6: Fundamental Aims of the EU's AI Act

- ii. China - Deepfake Legislation

- Figure 2.7: China's Deepfake Legislation Requirements

- iii. US - Texas HB (House Bill) 1181

- Figure 2.8: Texas House Bill 1181 Key Developments

- iv. India - Digital KYC

- v. UAE

- i. EU - AI Act

- 2.1.1. The History of Regulatory Frameworks

- 2.2. Key Trends and Driver

- 2.2.1. Combatting Financial Fraud and Corruption

- 2.2.2. Increase in Digital Nomads

- Figure 2.9: Scenarios that Utilise KYC Verification across Various Industries

- 2.2.3. Expansion of Remote Verification

- 2.2.4. Ongoing KYC Processes

- 2.3. Future Outlook

- 2.3.1. Increased Use of Advanced AI and Machine Learning

- 2.3.2. Greater Emphasis on Biometric Verification

- 2.3.3. Blockchain for Immutable Verification Records

- 2.3.4. Adoption of SSI (Self-sovereign Identity) Models

- Digital Onboarding: Verification Technologies

- 3.1. Identification Verification & KYC/KYB Systems

- 3.1.1. Document Verification

- i. Document Scanning

- ii. MRZ (Machine-readable Zones)

- iii. Embedded Chips

- 3.1.2. Document Reading

- 3.1.3. Using Documents for Verification

- i. Photo IDs

- ii. Age Verification

- iii. Linked Biometrics

- 3.1.1. Document Verification

- 3.2. Database Verification

- 3.2.1. Common Biometrics

- i. Fingerprint

- ii. Facial

- iii. Voice

- iv. Liveness Detection

- v. Deepfake Detection

- vi. Behavioural Biometrics

- 3.2.2. Emerging Biometrics

- i. Iris

- ii. Retina

- iii. Handprint

- iv. Vein Patter Recognition

- 3.2.1. Common Biometrics

Competitor Leaderboard

1. KYC/KYB Systems - Competitor Leaderboard

- 1.1.1. Why Read This Report

- KYC/KYB Systems Market Takeaways

- Table 1.1: Juniper Research Competitor Leaderboard KYC/KYB Systems Market Vendors & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard KYC/KYB Systems Vendors

- Table 1.3: Juniper Research Competitor Leaderboard Vendors and Positioning

- Table 1.4: Juniper Research Competitor Leaderboard for KYC/KYB Systems Heatmap

- Table 1.4: Juniper Research Competitor Leaderboard for KYC/KYB Systems Heatmap (Continued)

- KYC/KYB Systems Market Takeaways

- 1.2. Vendor Profiles

- 1.2.1. AU10TIX

- i. Corporate

- Table 1.5: AU10TIX's Investment Rounds ($m), 2019-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.2. ComplyAdvantage

- 1.2.3. Data Zoo

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.4. Encompass Corporation

- i. Corporate

- Table 1.7: Encompass' Investment Rounds ($m), 2016-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.5. Entrust

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.6. Experian

- i. Corporate

- Table 1.8: Experian's Financial Snapshot ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.7. Fenergo

- i. Corporate

- Table 1.9: Fenergo's Investment Rounds ($m), 2013-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.8. Jumio

- i. Corporate

- Table 1.10: Jumio's Investment Rounds ($m), 2010-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.9. Know Your Customer

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.10. LexisNexis Risk Solutions

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.11. Minerva

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.12. Moody's

- i. Corporate

- Table 1.11: Moody's Financial Snapshot ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 1.12: Moody's KYC ecosystem

- Figure 1.13: Moody's GRID PEP risk rating system

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.13. Persona

- i. Corporate

- Table 1.14: Persona's Investment Rounds ($m), 2019-2021

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.14. Sardine

- i. Corporate

- Table 1.15: Sardine's Investment Rounds ($m), 2021-2024

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.15. Shufti Pro

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.16. Socure

- i. Corporate

- Table 1.16: Socure's Investment Rounds ($m), 2015-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.17. Sumsub

- i. Corporate

- Table 1.17: Sumsub's Investment Rounds ($m), 2017-2022

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate

- 1.2.18. Trulioo

- i. Corporate

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 1.2.19. Veriff

- i. Corporate

- Table 1.18: Veriff's Funding Rounds ($m), 2018-2022

- ii. Geographic Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offering

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- Table 1.19: Juniper Research Competitor Leaderboard Scoring Criteria: KYC/KYB Systems

- i. Corporate

- 1.2.1. AU10TIX

2. Future Leaders Index: KYC/KYB Systems

- Table 2.1: Juniper Research Future Leaders Index - KYC/KYB Systems Vendors & Product Portfolio

- Figure 2.2: Juniper Research Future Leaders Index - KYC/KYB Systems

- Table 2.3: Juniper Research Future Leaders Vendors - KYC/KYB Systems

- Table 2.4: Juniper Research Future Leaders Index Heatmap: KYC/KYB Systems

- 2.1. Future Leaders Vendor Profiles

- 2.1.1. Baselayer

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.2. Dotfile

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Gatenox

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. Labrys

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. Parcha

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Quadrata

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. TransactionLink

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Vespia

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. Baselayer

- 2.1. Juniper Research Future Leader Index Assessment Methodology

- 2.2. Limitations & Interpretations

- Table 2.5: Juniper Research Future Leader Index: KYC/KYB Systems

Data & Forecasting

1. Global KYC/KYB Systems Forecast

- 1.1.1. Introduction

- 1.1.2. Methodology

- Figure 1.1: KYC/KYB Systems Forecast Methodology for Financial Businesses (Banks, Fintechs, Insurance, Investment, Lending)

- Figure 1.2: KYC/KYB Systems Forecast Methodology for Professional and Other Businesses (Gambling & Gaming, eCommerce, Telco, Healthcare, and Real Estate)

2. Global KYC/KYB Systems Market

- 2.1. Global KYC/KYB Systems Market

- 2.1.1. Number of Businesses Using Third-party KYC/KYB Systems

- Figure & Table 2.1: Total Number of Businesses using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 2.1.2. Total Spend of Third-party KYC/KYB Systems

- Figure & Table 2.2: Total Spend on Third-party AML Systems per annum ($m), Split by 8 Key Regions, 2024-2029

- 2.1.1. Number of Businesses Using Third-party KYC/KYB Systems

3. Financial Businesses: Global KYC/KYB Systems Forecast

- 3.1.1. Total Number of Financial Businesses Using Third-party KYC/KYB Systems

- Figure & Table 3.1: Total Number of Financial Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024 - 2029

- Table 3.2: Total Number of Financial Businesses Using Third-party KYC/KYB Systems per annum, Split by Industry 2024-2029

- 3.1.2. Total Spend on Third-party KYC/KYB Systems by Financial Businesses

- Figure & Table 3.3: Total Spend on Third-party AML Systems by Financial Businesses per annum ($m), Split by 8 Key Regions, 2024-2029

- Table 3.4: Total Spend on Third-party KYC/KYB Systems by Financial Businesses per annum ($m), Split by Industry, 2024-2029

- 3.1.3. Total Number of Banks Using Third-party KYC/KYB Systems

- Figure & Table 3.5: Total Number of Banks Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.4. Total Spend on Third-party KYC/KYB Systems in the Banking Industry

- Figure & Table 3.6: Total Spend on Third-party KYC/KYB Systems in the Banking Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.5. Total Number of Fintechs Using Third-party KYC/KYB Systems

- Figure & Table 3.7: Total Number of Fintechs Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions. 2024-2029

- 3.1.6. Total Spend on Third-party KYC/KYB Systems in the Fintech Industry

- Figure & Table 3.8: Total Spend on Third-party KYC/KYB Systems in the Fintech Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.7. Total Number of Insurance Companies Using Third-Party KYC/KYB Systems

- Figure & Table 3.9: Total Number of Insurance Companies Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.8. Total Spend on Third-party AML Systems in the Insurance Industry

- Figure & Table 3.10: Total Spend on Third-party KYC/KYB Systems in the Insurance Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.9. Total Number of Investment Companies Using Third-party KYC/KYB Systems

- Figure & Table 3.11: Total Number of Investment Companies Using Third-party KYC/KYB Systems per annum, Split by 8 Key Regions, 2024-2029

- 3.1.10. Total Spend on the Third-party KYC/KYB Systems in the Investment Industry

- Figure & Table 3.12: Total Spend on Third-party KYC/KYB Systems in the Investment Industry per annum ($m), Split by 8 Key Regions, 2024-2029

- 3.1.11. Total Number of Lending Companies Using Third-party AML Systems

- Figure & Table 3.13: Total Number of Lending Companies Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 3.1.12. Total Spend on the Third-party KYC/KYB Systems in the Lending Industry

- Figure & Table 3.14: Total Spend on Third-party KYC/KYB Systems in the Lending Industry per annum ($m), Split by 8 Key Regions, 2024-2029

4. Professional and Other Businesses: Global KYC/KYB Systems Forecast

- 4.1.1. Total Number of Professional and Other Businesses Using Third-Party KYC/KYB Systems

- Figure & Table 4.1: Total Number of Professional and Other Businesses using Third-Party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- Table 4.2: Total Number of Professional and Other Businesses Using Third-party KYC/KYB, Split by Industry, 2024-2029

- 4.1.2. The Total Spend on Third-party KYC/KYB System by Professional and Other Businesses

- Figure & Table 4.3: Total Spend on Third-party KYC/KYB System by Professional and Other Businesses ($m), Split by 8 Key Regions, 2024-2029

- Table 4.4: Total Spend on Third-party KYC/KYB System by Professional and Other Businesses ($m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Total Number of Gaming & Gambling Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.5: Total Number of Gaming & Gambling Businesses Using Third-party KYC/KYB Systems (m), Split by 8 Key Regions, 2024-2029

- 4.1.4. Total Spend on Third-party KYC/KYB Systems in the Gaming & Gambling Industry

- Figure & Table 4.6: Total Spend on Third-party KYC/KYB Systems in the Gaming & Gambling industry ($m), Split by 8 Key Regions, 2024 - 2029

- 4.1.5. Total Number of eCommerce Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.7: Total number of eCommerce Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.6. Total Spend on Third-party KYC/KYB Systems in the eCommerce Industry

- Figure & Table 4.8: Total Number of eCommerce Businesses Using Third-party KYC/KYB Systems in the eCommerce Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.7. Total Number of Telco Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.9: Total Number of Telco Businesses using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.8. Total Spend on Third-party KYC/KYB Systems in the Telco Industry

- Figure & Table 4.10: Total Spend on Third-party KYC/KYB Systems in the Telco Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.9. Total Number of Healthcare Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.11: Total number of Healthcare Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.10. Total Spend on Third-party KYC/KYB Systems in the Healthcare Industry

- Figure & Table 4.12: Total Spend on Third-party KYC/KYB Systems in the Healthcare Industry ($m), Split by 8 Key Regions, 2024-2029

- 4.1.11. Total Number of Real Estate Businesses Using Third-party KYC/KYB Systems

- Figure & Table 4.13: Total Number of Real Estate Businesses Using Third-party KYC/KYB Systems, Split by 8 Key Regions, 2024-2029

- 4.1.12. Total Spend on Third-party KYC/KYB Systems in the Real Estate Industry

- Figure & Table 4.14: Total Spend on Third-party KYC/KYB Systems in the Real Estate Industry ($m), Split by 8 Key Regions, 2024 - 2029