|

市场调查报告书

商品编码

1566487

加盟店诈欺防止的全球市场:2024-2029年Global Merchant Fraud Prevention Market: 2024-2029 |

||||||

| 主要统计 | |

|---|---|

| 全球电子商务诈骗受害额 (2024年): | 440亿美元 |

| 全球电子商务诈骗受害额 (2029年): | 1,090亿美元 |

| 电子商务诈骗受害额的成长率 (2024~2029年): | 141% |

| 预测期间: | 2024-2029年 |

"电子商务诈骗受害额预计2029年超越1,070亿美元"

本报告调查了全球商家诈欺防制市场,概述了诈欺的主要类型、用于检测和预防诈欺的解决方案和关键技术、各个类别的损害程度,并总结了以下趋势和预测: FDP 软体支出,以及使用瞻博网路研究竞争排行榜对竞争格局的分析。

主要功能

- 市场动态:深入了解市场中的主要诈欺趋势以及市场扩张的挑战。讨论电子商务诈欺的演变、技术进步、实施新的商家诈欺解决方案的障碍,包括识别可疑和真实的活动,以及分析发生诈欺的多个用例。它还对电子商务商家造成的欺诈损害的未来进行了展望。

- 主要要点和策略建议:对主要市场发展机会和调查结果的详细分析提供了有关商家如何应对欺诈交易和欺诈行为增加的信息,并提供了欺诈检测和预防的策略建议。

- 基准产业预测:此预测包括有关航空公司电子票券、远端数位产品和远端实体产品诈欺程度的数据。这些行业按线上和行动交易进行细分。这些数据还包括电子商务企业对反诈欺解决方案的采用和支出水准。

- 瞻博网路研究竞赛排行榜:分析商家诈欺侦测和预防产业的领导企业,并评估 16 家商家诈欺侦测和预防供应商的能力和能力。

样品view

市场资料·预测报告:

市场趋势·策略报告:

市场数据/预测报告

商家诈欺侦测和预防市场研究套件包括对由 55 个表格和 25,000 多个资料点组成的完整预测资料集的存取。此调查套件包括以下指标:

- 电子商务商家的交易总数

- 每年因 CNP(无卡)电子商务商家诈欺造成的总损失

- 采用 FDP(诈欺侦测与预防)解决方案的电子商务商家总数

- 电子商务商家在 FDP 解决方案上花费的总金额

- 电子商务商家诈欺交易的百分比(基于金额)

这些指标由以下主要市场提供:

- 航空公司电子机票

- 航空公司电子机票

- 航空机票

- 远端数位产品

- 远端线上数位产品

- 远端行动数位产品

- 远端实体产品

- 远端线上实体产品

- 远端行动实体产品

- FDP 软体

- 诈欺率

Juniper Research 互动式预测 Excel 有以下功能:

- 统计分析:您可以搜寻资料期间所有地区/国家显示的特定指标。可以轻鬆修改图表并将其汇出到剪贴簿。

- 国家/地区资料工具:此工具可让您查看预测期间内的所有区域和国家指标。使用者可以缩小搜寻栏中显示的指标范围。

- 国家比较工具:使用者可以选择国家/地区并针对特定国家/地区进行比较。该工具包括汇出图表的功能。

- 假设分析:让使用者将预测指标与自己的假设进行比较。

目录

市场趋势·策略

第1章 重要点和策略性推荐事项

- 重要点

- 策略性推荐事项

第2章 市场形势

- 定义和范围

- 会员店诈欺的类型

- 第一方欺诈

- 退款欺诈

- 友善的骗局

- 滥用政策

- ATO 诈欺

- 其他

- 干净的诈欺行为

- 联盟行销诈欺

- 殭尸网络

- 三角测量欺诈

- 合成身分诈欺

- 第一方欺诈

- 用于侦测和防止商家诈欺的解决方案

- 商家诈欺侦测与预防工具

- 生物辨识认证

- 行为分析

- 标记化

- API

- 3D安全认证

- 商家诈欺侦测与预防工具

- 实体产品与数位产品

第3章 新兴加盟店诈欺防止市场

- 主要主题和相关领域

- 主要趋势与当前市场推动因素

- 电子商务快速崛起

- 新的诈欺方法和策略

- 客户缺乏对新科技的了解

- 深假

- 降低业务成本

- BNPL

- 技术

- AI

- ML

- 加盟店诈欺防止API

- PSD2

- 3DS2由于生物识别的交易的认证

- 认证方法

- 3DS2影响

第4章 市场区隔分析

- 各种受到诈欺影响的商家

- 远端数位和实体产品

- 数位商品

- 物理性的商品

- 主要课题

- 有组织的诈欺

- 缺乏生物特征认证

竞争排行榜

第1章 Juniper Research的排行榜

第2章 业者简介

- 加盟店诈欺防止业者简介

- Accertify

- ACI Worldwide

- ClearSale

- Discover Financial Services

- Forter

- Fraudio

- Kount

- Mastercard

- Microsoft

- Riskified

- RSA Security

- Signifyd

- TransUnion

- Vesta

- Visa Acceptance Solutions

- Worldpay

- 评估手法

资料·预测

第1章 加盟店诈欺防止的预测:调查手法

第2章 机票的预测

- 线上航空电子票

- 线上航空电子票的年度发行总数

- 诈欺线上航空公司电子票发行的总数

- 诈欺线上航空公司电子票交易的总额

- 行动航空m票

- 行动航空m票的年度发行总数

- 诈欺行动航空m票发行的总数

- 诈欺行动航空m票交易的总额

第3章 远隔数位商品的预测

- 线上远隔数位商品

- 远端线上购买数位产品的总交易金额(不包括机票)

- 欺诈性远端线上数位产品购买总数

- 欺诈性远端线上数位产品交易总额

- 行动远隔数位商品

- 远端行动数位产品购买交易总金额(不含机票)

- 欺诈性远端行动数位产品购买总数

- 欺诈性远端行动数位产品交易总额

第4章 远隔物理商品的预测

- 远端线上实体产品

- 远端线上商品购买交易总数

- 欺诈性远端线上商品购买总数

- 欺诈性远端线上商品交易总额

- 远端行动实体产品

- 远端行动实体产品购买的交易总数

- 欺诈性远端行动产品购买总数

- 欺诈性远端行动产品交易总额

第5章 FDP软体的预测

- FDP支出

- 在 FDP 上支出的电子商务商家数量

- 包括航空公司在内的电子商务 CNP 交易总额

- 电子商务商家的 FDP 支出总额

| KEY STATISTICS | |

|---|---|

| eCommerce fraud value globally in 2024: | $44 billion |

| eCommerce fraud value globally in 2029: | $109 billion |

| Total eCommerce fraud value growth between 2024 & 2029: | 141% |

| Forecast period: | 2024-2029 |

'eCommerce Fraud to Exceed $107 Billion in 2029'

Overview

Our merchant fraud detection and prevention research suite provides detailed analysis of this rapidly changing market; allowing fraud prevention platform providers to gain an understanding of key fraud trends and challenges, potential growth opportunities, and the competitive environment.

Providing multiple options that can be purchased separately, the research suite includes access to data mapping the future growth of the merchant fraud detection and prevention market. The detailed study reveals the latest opportunities and trends within the market, and an insightful document containing an extensive analysis of 16 merchant fraud detection and prevention providers within the space. Aspects such as the use of artificial intelligence and machine learning by both providers and fraudsters, identity theft and synthetic identity use, and the challenges and new techniques for identifying legitimate customers are explored throughout the report. The coverage can also be purchased as a Full Research Suite, containing all of these elements, and includes a substantial discount.

Collectively, these elements provide an effective tool for understanding this constantly evolving market; allowing merchant fraud detection and prevention vendors and providers to set out their future strategies to tackle fraudulent activity among online purchases. Its unparalleled coverage makes this research suite an incredibly useful resource for gauging the future of this complex market.

Key Features

- Market Dynamics: Insights into key fraud trends and market expansion challenges within the merchant fraud detection and prevention market. It addresses the challenges posed by the evolving nature of eCommerce fraud, technological advancements, barriers to adopting new merchant fraud solutions, including discerning between suspicious activity and genuine behaviour, and analysing multiple use cases where fraudulent activity occurred. The research also provides a future outlook on the landscape of eCommerce merchant fraud.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within market, accompanied by key strategic recommendations for merchant fraud detection and prevention providers on how they can tackle the rise in fraudulent transactions and attempts.

- Benchmark Industry Forecasts: The forecasts include data on fraud levels within airline eTickets, remote digital goods, and remote physical goods. These sectors are split by online and mobile transactions; allowing for splits by consumer eCommerce shopping preferences to be evaluated. The data also includes adoption and spend levels by eCommerce merchants on fraud prevention solutions.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 16 merchant fraud detection and prevention vendors, via the Juniper Research Competitor Leaderboard, featuring analysis around major players in the merchant fraud detection and prevention industry.

SAMPLE VIEW

Market Data & Forecasts Report:

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

Market Trends & Strategies Report:

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts Report

The market-leading research suite for the merchant fraud detection and prevention market includes access to the full set of forecast data, consisting of 55 tables and over 25,000 datapoints. Metrics in the research suite include:

- Total Number of eCommerce Merchant Transactions.

- Total Annual Transaction Value of CNP (Card-not-present) eCommerce Merchant Fraud.

- Total Number of eCommerce Merchants Employing FDP (Fraud Detection & Prevention) Solutions.

- Total Spend on FDP Solutions by eCommerce Merchants.

- Proportion of eCommerce Merchant Transactions That Are Fraudulent, By Value.

These metrics are provided for the following key market verticals:

- Airline eTickets

- Airline eTickets

- Airline mTickets

- Remote Digital Goods

- Remote Online Digital Goods

- Remote Mobile Digital Goods

- Remote Physical Goods

- Remote Online Physical Goods

- Remote Mobile Physical Goods

- FDP Software

- Fraud Rates

The Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users benefit from the ability to search for specific metrics, displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets the user look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via the search bar.

- Country Comparison Tool: Users can select countries and compare each of them for specific countries. The ability to export graphs is included in this tool.

- What-if Analysis: Here, users can compare forecast metrics against their own assumptions. 5 interactive scenarios.

Market Trends & Strategies Report

This report examines the merchant fraud detection and prevention market landscape in detail; assessing different market trends and factors that are shaping the evolution of this growing market, such as biometric verification, artificial intelligence, and machine learning, as well as exploring and analysing the different types of fraud that target online merchants, including credit card fraud and friendly fraud. The report delivers comprehensive analysis of the strategic opportunities for merchant fraud detection and prevention providers; addressing key vertical and developing challenges, and how vendors should navigate these. As well as looking into merchant fraud detection and prevention use cases where fraudulent transactions occur, it also includes evaluation of the different markets that are targeted by fraudsters and the key challenges that online merchants are likely to face, such as the nefarious use of artificial intelligence and machine learning by fraudsters.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 16 leading vendors in the merchant fraud solution space. These vendors are positioned as an established leader, leading challenger, or disruptor and challenger based on capacity and capability assessments, including their use of technologies such as artificial intelligence, machine learning, and biometrics. The 16 merchant fraud detection and prevention vendors consist of:

|

|

This document is centred around the Juniper Research Competitor Leaderboard, a vendor positioning tool that provides an at a glance view of the competitive landscape in the merchant fraud detection and prevention market, backed by a robust methodology.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways

- 1.2. Strategic Recommendations

2. Market Landscape

- 2.1. Introduction

- 2.2. Definitions & Scope

- 2.3. Types of Merchant Fraud

- Figure 2.1: Visualisation of Merchant Fraud

- 2.3.1. First-party Fraud

- i. Chargeback Fraud

- ii. Friendly Fraud

- iii. Policy Abuse

- 2.3.2. ATO Fraud

- 2.3.3. Other Types of Fraud

- i. Clean Fraud

- ii. Affiliate Fraud

- iii. Botnets

- iv. Triangulation Fraud

- Figure 2.2: Visualisation of Triangulation Fraud

- v. Synthetic Identity Fraud

- 2.4. Solutions Used in Merchant Fraud Detection & Prevention

- 2.4.1. Merchant Fraud Detection & Prevention Tools

- Figure 2.3: Methods of Merchant Fraud Prevention

- i. Biometrics

- ii. Behavioural Analytics

- iii. Tokenisation

- iv. APIs

- v. 3D Secure Authentication

- 2.4.1. Merchant Fraud Detection & Prevention Tools

- 2.5. Physical & Digital Goods

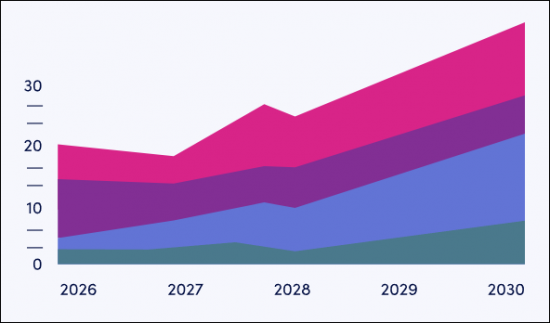

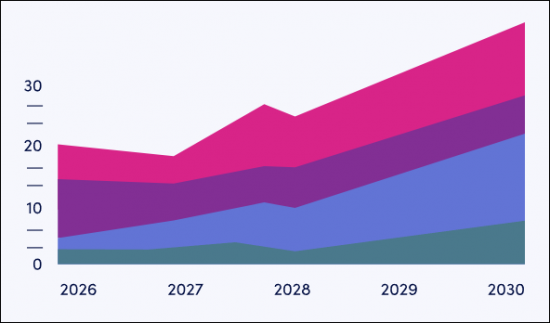

- Figure 2.4: Total Value of Fraudulent CNP Transactions Globally ($m), Split by Segment, 2024-2029

- 2.5.1. Remote Physical Goods

- Figure 2.5: Total Value of Fraudulent Remote Physical Goods Purchases Globally ($m), Split by 8 Key Regions, 2024-2029

- 2.5.2. Remote Digital Goods

- Figure 2.6: Total Value of Fraudulent Remote Digital Goods Purchases Globally ($m), Split by 8 Key Regions, 2024-2029

3. Emerging Merchant Fraud Prevention Market

- 3.1. Key Themes & Areas Involved

- 3.2. Key Trends & Current Market Drivers

- 3.2.1. Rapid Rise of eCommerce

- 3.2.2. Emerging Fraudulent Methods & Tactics

- i. Generative AI

- ii. FaaS

- 3.2.3. Customers are Poorly Educated on New Technologies

- 3.2.4. Deepfakes

- 3.2.5. Cutting Business Costs

- 3.3. BNPL

- i. BNPL Fraud Methods

- ii. BNPL Fraud Prevention Methods

- 3.4. Technologies

- 3.4.1. AI

- i. Benefits of AI in Merchant Fraud Prevention

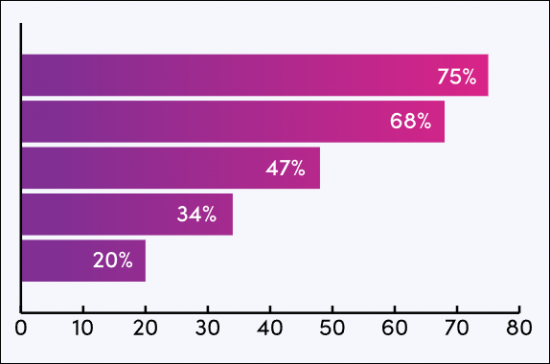

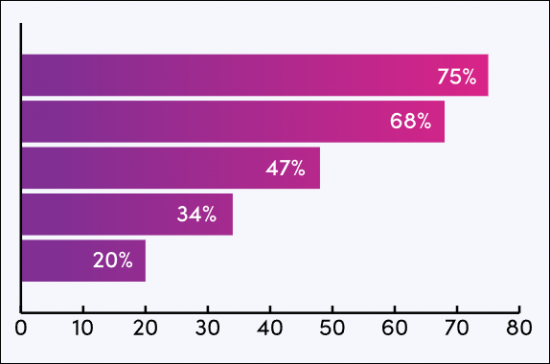

- Figure 3.1: AI Benefits in Merchant Fraud Prevention

- ii. Drawbacks of AI in Merchant Fraud Prevention

- i. Benefits of AI in Merchant Fraud Prevention

- 3.4.2. ML

- i. Benefits of ML in Merchant Fraud Prevention

- ii. Drawbacks of ML in Merchant Fraud Prevention

- 3.4.3. Merchant Fraud Prevention APIs

- 3.4.1. AI

- 3.5. PSD2

- 3.5.1. How PSD2 Affects Merchants

- 3.6. 3DS2 & Biometric Authorisation of Transactions

- 3.6.1. Methods of Authentication

- i. OTPs

- ii. Biometrics

- Figure 3.2: Types of Biometric Authentication

- 3.6.2. 3DS2 Implications

- 3.6.1. Methods of Authentication

4. Segment Analysis

- 4.1. Introduction

- 4.1.1. Different Merchants Who Are Affected by Fraud

- i. Generalist Retailers

- ii. Specialist Retailers

- iii. Streaming Services

- iv. Hospitality

- 4.1.1. Different Merchants Who Are Affected by Fraud

- 4.2. Remote Digital & Physical Goods

- 4.2.1. Digital Goods

- Figure 4.1: Total Number of Transactions for Remote Digital Goods (m), Split by 8 Key Regions, 2024-2029

- i. Video Games

- ii. Music

- iii. Video

- iv. Ticketing

- 4.2.2. Physical Goods

- Figure 4.2: Total Value of Remote Physical Goods Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- i. Impact of the COVID-19 Pandemic

- 4.2.1. Digital Goods

- 4.3 Key Challenges

- 4.3.1. Organised Fraud

- i. Noir's Organisation

- ii. REKK

- iii. AI Music Streaming Scam

- 4.3.2. Lack of Physical Biometrics

- 4.3.1. Organised Fraud

Competitor Leaderboard

1. Juniper Research Competitor Leaderboard

- 1.1. Why Read This Report?

- Table 1.1: Juniper Research Competitor Leaderboard Vendors: Merchant Fraud Detection & Prevention

- Figure 1.2: Juniper Research Competitor Leaderboard - Merchant Fraud Detection & Prevention

- Table 1.3: Juniper Research Competitor Leaderboard: Merchant Fraud Detection & Prevention Vendor Ranking

- Table 1.4: Juniper Research Competitor Leaderboard Merchant Fraud Detection & Prevention - Heatmap

2. Vendor Profiles

- 2.1. Merchant Fraud Prevention Vendor Profiles

- 2.1.1. Accertify

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.1: Accertify's Four Key Areas for Chargeback Management

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.2. ACI Worldwide

- i. Corporate

- Table 2.2: ACI Worldwide Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.3. ClearSale

- i. Corporate

- Table 2.3: ClearSale Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.4. Discover Financial Services

- i. Corporate

- Table 2.4: Discover Financial Services Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.5. Forter

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.6. Fraudio

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.5: Fraudio's Centralised ML AI Brain

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.7. Kount

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.8. Mastercard

- i. Corporate

- Table 2.6: Mastercard Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.9. Microsoft

- i. Corporate

- Table 2.7: Microsoft Dynamics 365 Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.10. Riskified

- i. Corporate

- Table 2.8: Riskified Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.11. RSA Security

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.12. Signifyd

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.13. TransUnion

- i. Corporate

- Table 2.9: TransUnion Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Opportunities

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.14. Vesta

- i. Corporate

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.10: Visualisation Displaying Vestas Payment Guarantee

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- 2.1.15. Visa Acceptance Solutions

- i. Corporate

- Table 2.11: Visa Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.12: How Visa Acceptance Solutions' Payer Authentication Works

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.16. Worldpay

- i. Corporate

- Table 2.13: Worldpay Revenue ($m), 2022-2023

- ii. Geographical Spread

- iii. Key Clients and Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Opportunities

- i. Corporate

- 2.1.1. Accertify

- 2.2. Juniper Research Leaderboard Assessment Methodology

- 2.2.1. Limitations & Interpretations

- Table 2.14: Juniper Research Merchant Fraud Prevention Assessment Criteria

- 2.2.1. Limitations & Interpretations

Data & Forecasting

1. Merchant Fraud Prevention Forecast Methodology

- 1.1. Methodology & Assumptions

- Figure 1.1: Airline Tickets Forecast Methodology

- Figure 1.2: Remote Digital Goods Forecast Methodology

- Figure 1.3: Remote Physical Goods Forecast Methodology

- Figure 1.4: FDP Software Forecast Methodology

2. Airline Tickets Forecasts

- 2.1. Online Airline eTickets

- 2.1.1. Total Number of Online Airline eTickets Issued per Annum

- Figure & Table 2.1: Total Number of Online Airline eTickets Issued Globally per annum (m), Split by 8 Key Regions, 2024-2029

- 2.1.2. Total Number of Fraudulent Online Airline eTickets Issued

- Figure & Table 2.2: Total Number of Fraudulent Online Airline eTickets Issued Globally (m), Split by 8 Key Regions, 2024-2029

- 2.1.3. Total Value of Fraudulent Online Airline eTicket Transactions

- Figure & Table 2.3: Total Value of Fraudulent Online Airline eTicket Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- 2.1.1. Total Number of Online Airline eTickets Issued per Annum

- 2.2. Mobile Airline mTickets

- 2.2.1. Total Number of Mobile Airline mTickets Issued per Annum

- Figure & Table 2.4: Total Number of Mobile Airline mTickets Issued per Annum Globally (m), Split by 8 Key Regions, 2024-2029

- 2.2.2. Total Number of Fraudulent Mobile Airline mTickets Issued

- Figure & Table 2.5: Total Number of Fraudulent Mobile Airline mTickets Issued Globally (m), Split by 8 Key Regions, 2024-2029

- 2.2.3. Total Value of Fraudulent Mobile Airline mTicket Transactions

- Figure & Table 2.6: Total Value of Fraudulent Mobile Airline mTicket Transactions Globally ($m), Split b 8 Key Regions, 2024-2029

- 2.2.1. Total Number of Mobile Airline mTickets Issued per Annum

3. Remote Digital Goods Forecasts

- 3.1. Online Remote Digital Goods

- 3.1.1. Total Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets

- Figure & Table 3.1: Total Number of Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets, Globally (m), Split by 8 Key Regions, 2024-2029

- 3.1.2. Total Number of Fraudulent Remote Online Digital Goods Purchases

- Figure & Table 3.2: Total Number of Fraudulent Remote Digital Goods Purchases Globally (m), Split by 8 Key Regions, 2024-2029

- 3.1.3. Total Value of Fraudulent Remote Online Digital Goods Transactions

- Figure & Table 3.3: Total Value of Fraudulent Remote Online Digital Goods Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- 3.1.1. Total Transactions for Remote Online Digital Goods Purchases, Less Airline Tickets

- 3.2. Mobile Remote Digital Goods

- 3.2.1. Total Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets

- Figure & Table 3.4: Total Number of Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets, Globally (m), Split by 8 Key Regions, 2024-2029

- 3.2.2. Total Number of Fraudulent Remote Mobile Digital Goods Purchases

- Figure & Table 3.5: Total Number of Fraudulent Remote Mobile Digital Goods Purchased Globally (m), Split by 8 Key Regions, 2024-2029

- 3.2.3. Total Value of Fraudulent Remote Mobile Digital Goods Transactions

- Figure & Table 3.6: Total Value of Fraudulent Remote Mobile Digital Goods Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- 3.2.1. Total Transactions for Remote Mobile Digital Goods Purchases, Less Airline Tickets

4. Remote Physical Goods Forecasts

- 4.1. Remote Online Physical Goods

- 4.1.1. Total Transactions for Remote Online Physical Goods Purchases

- Figure & Table 4.1: Total Transactions for Remote Online Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2024-2029

- 4.1.2. Total Number of Fraudulent Remote Online Physical Goods Purchases

- Figure & Table 4.2: Total Number of Fraudulent Remote Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2024-2029

- 4.1.3. Total Value of Fraudulent Remote Online Physical Goods Transactions

- Figure & Table 4.3: Total Value of Fraudulent Remote Online Physical Goods Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- 4.1.1. Total Transactions for Remote Online Physical Goods Purchases

- 4.2. Remote Mobile Physical Goods

- 4.2.1. Total Transactions for Remote Mobile Physical Goods Purchases

- Figure & Table 4.4: Total Transactions for Remote Mobile Physical Goods Purchases Globally (m), Split by 8 Key Regions, 2024-2029

- 4.2.2. Total Number of Fraudulent Remote Mobile Physical Goods Purchases

- Figure & Table 4.5: Total Number of Fraudulent Remote Mobile Physical Goods Purchases (m), Split by 8 Key Regions, 2024-2029

- 4.2.3. Total Value of Fraudulent Remote Mobile Physical Goods Transactions

- Figure & Table 4.6: Total Value of Fraudulent Remote Mobile Physical Goods Transactions Globally ($m), Split by 8 Key Regions, 2024-2029

- 4.2.1. Total Transactions for Remote Mobile Physical Goods Purchases

5. FDP Software Forecasts

- 5.1. FDP Spend

- 5.1.1. Number of eCommerce Merchants That Spend on FDP

- Figure & Table 5.1: Number of eCommerce Merchants That Spend on FDP Globally (m), Split by 8 Key Regions, 2024-2029

- 5.1.2. Total Value of eCommerce CNP Transactions, Including Airlines

- Figure & Table 5.2: Total Value of eCommerce CNP Transactions, Including Airline, Globally ($m), Split by 8 Key Regions, 2024-2029

- 5.1.3. Total FDP Spend by eCommerce Merchants

- Figure 5.3: Total FDP Spend by eCommerce Merchants Globally ($m), Split by 8 Key Regions, 2024-2029

- 5.1.1. Number of eCommerce Merchants That Spend on FDP