|

市场调查报告书

商品编码

1904934

全球合成润滑油市场:市场分析与机会Global Synthetic Lubricants: Market Analysis and Opportunities |

||||||

价格

如有价格方面的疑问请按下「询问」键来信查询

简介目录

本报告分析了全球合成润滑油市场,提供了主要成长国家的商机、各细分市场的需求驱动因素以及主要供应商的竞争格局等资讯。

影响全球合成润滑油产业的关键主题

商品化与高阶化

- 对所有汽车/工业产品类型进行排名和评分,以评估其商品化和高端化程度,以及值得关注的关键驱动因素和趋势。

- 评估了这两个细分市场的成长机会。

电气化、效率、技术与法规

- 分析重点但不限于工业油和流体,以及合成油渗透潜力最大的产业/产品类别。

- 根据工业4.0、物联网、机器人和合成油的潜在溢出效应进行排名和评分。

- 评估在这些领域具有成功潜力或能力的供应商,并了解其原因。

OEM 的影响

- 了解 OEM 的影响、技术和建议(出厂和售后服务),以及它们对供应链和最终用户决策过程的影响。

通路/细分市场动态

- 考察合成树脂在各个渠道/细分市场的当前和未来渗透率。

- 分析并评估成长机会和潜在的颠覆性因素/趋势。

竞争活动与压力

- 评估定价、品牌、产品特性与优势、通路、原物料采购及长期成功等因素所面临的竞争活动与压力。

供应商定位 - 市占率

- 比较全球领先的汽车和工业合成材料供应商、区域供应商、独立供应商、自有品牌供应商、OEM 原厂供应商和特种供应商的产品组合,分析 PCMO/HDMO 的分级(经济型、旗舰型、高端型)、定价、功效、价值主张、策略和长期成功。

简介目录

Product Code: Y634I

Global Synthetic Lubricants: Market Analysis and Opportunities

- Provides a comprehensive analysis of trends in synthetic lubricants, along with opportunities, challenges and trends in select countries across consumer, commercial and industrial segments.

- Synthetics outperform other categories providing opportunities for suppliers to grow both volume and value.

This report will deliver to subscribers:

- Business opportunities in synthetic lubricants for key growth country markets around the world

- Demand drivers and outlook for synthetic and semi-synthetic lubricants by product, segment and country

- Competitive landscape by key suppliers with estimated market shares and marketing activities by segment

Regional coverage: Global -with focus on 9key country markets across the world

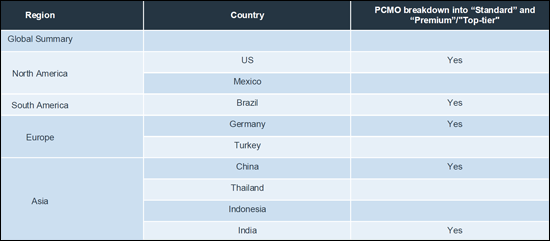

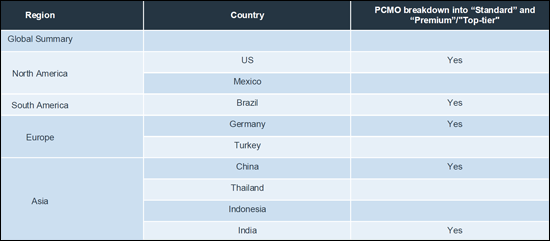

New - more granular market view: Full synthetic PCMO will be split into "Flagship" (Standard) and "Premium" in 5 key markets to evaluate different trends and opportunities for those market segments

Leading themes to be covered that are shaping the Global Synthetic Lubricants industry

Commoditization and Premiumization

- Rank and rate all automotive and industrial product types to assess levels of commoditization and premiumization and what are the driving forces and trends to monitor?

- Assess opportunities in both spaces for growth

Electrification, Efficiency, Technology, Regulation

- Analysis skewed but not exclusive to industrial oils, fluids and sectors/product categories with the greatest potential for synthetics penetration

- Rank and rate Industry 4.0, IoT, Robotics and the potential pull through effect for synthetics

- Assess suppliers most likely/capable to win in the space and why

OEM Influence & Impact

- Understand OEM influence, technology and recommendations (factory and service fill) and how it impacts the supply chain and end users' decision process

Channel/sector dynamics

- Examine synthetics' current/future penetration by channel/sector

- Rank and rate growth opportunities and potential disruptors/trends

Competitive Activity and Pressure

- Assess activity and pressure against factors such as pricing, branding, product features and benefits, distribution focus, feedstock sourcing and long-term success

Supplier Positioning -Market Share

- Review-compare-contrast global majors, regional independents, private label, OEM genuine and specialty suppliers' automotive and industrial synthetics product portfolio, tiering in PCMO/HDMO (value, flagship, premium), pricing, effectiveness, value proposition, strategies and long-term success

NEW for the 9th edition of the report will be an assessment and examination of the tiering of full synthetic PCMO in 5 key country markets

- Suppliers have been observed extending their full synthetic PCMO offer into two distinct tiers or categories: Flagship and Premium

- Objectives behind this trend can be viewed as (1) a means to maintain existing end user awareness and loyalty; (2) a hedge against growing competition from peers, private label, distributor house and OEM genuine oil brands among others; (3) protection against revenue and margins erosion as the full synthetic PCMO market skews towards commoditization

- Flagship can be viewed as a supplier existing or standard product offering featuring leading viscosity grades targeted to the specific needs of the vehicle parc and consumers, while meeting all OEM and industry specifications

- Premium aims to elevate the flagship offer through additional features and benefits such as extended performance and protection claims tied to higher mileage, e.g., 15K-20K miles / 24K-32K km, cleanliness, improved mileage/fuel economy, reduced friction, and sludge protection

- To convey Premium to end users, suppliers will use for example, distinct pac type graphics/colors/designs, elevated advertising, marketing and promotional efforts, and a price premium over their flagship offer

- The aim of this NEW content is to qualitatively and quantitatively explore the success of this tactic across 5 similar yet different country markets, identify which suppliers are currently active, how receptive are B2B participants and specifically, which trade classes (Installed / Retail) offer the most potential and opportunity for success and why

02-2729-4219

+886-2-2729-4219