|

市场调查报告书

商品编码

1072647

锂离子电池硅负极专利情况分析(2022)Silicon Anode for Li-ion Batteries Patent Landscape 2022 |

||||||

本报告重点关注锂离子电池硅负极,包括分析主要IP趋势、主要专利技术、近期发展趋势、主要IP公司/新进入者,以及IP战略/材料优势。

报告的主要特点

- PDF 包含 180 张幻灯片

- Excel 文件 + 在线数据库 12,300 个专利家族

- 已公布专利的时间序列转变、专利申请国等知识产权趋势

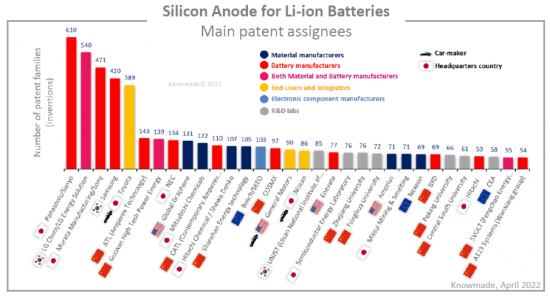

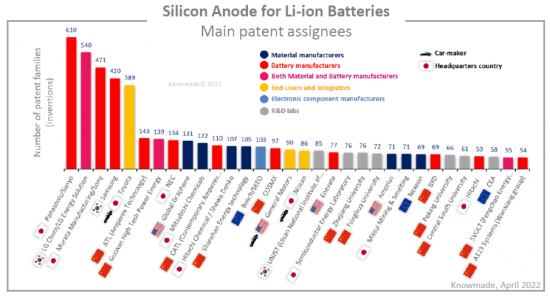

- 主要专利权人排名

- 知识产权领域的新进入者

- 供应链专利分类(负极材料、负极、黏合剂、电解液、电芯等)

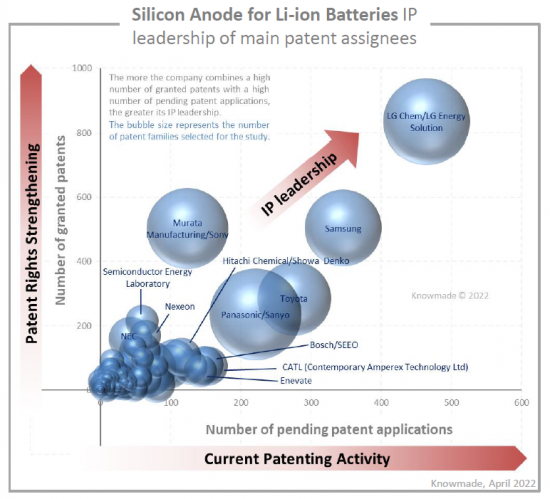

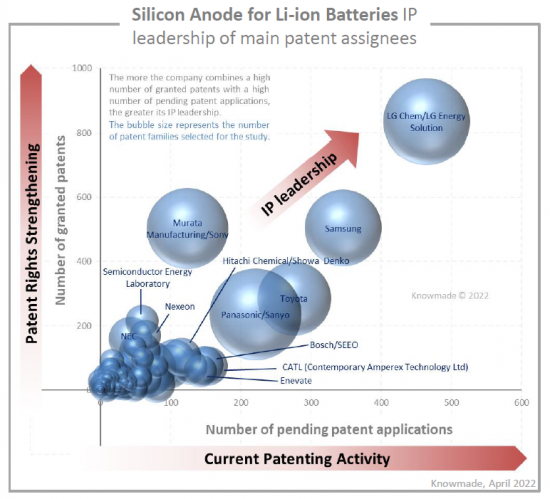

- 主要参与者的知识产权定位和专利组合的相对实力

- 目前主要技术途径

- 主要参与者 17 知识产权概况:知识产权动态、专利的法律地位和地理范围、知识产权战略、关键专利、近期专利发展等。

- Excel 数据库,包含报告中分析的所有专利(包括专利类别和最新在线数据库的超链接)

KnowMade 分析师已对 24,700 多个与硅负极锂离子电池(电极材料、电极、电解质、电池芯)供应链相关的专利族(发明)进行分类,我们选择并分析了专利和专利申请。我们还确定了 1,800 多个涉及硅负极专利的不同专利权人。在全球范围内获得的专利中有很大一部分反映了锂离子电池的硅负极技术已经在一定程度上成熟,正在被工业界采用。一方面,许多专利申请仍在等待中,这意味着解决硅负极电池技术问题的研发仍在进行中。

供应链中的主要 IP 参与者和新 IP 进入者

本报告概述了最积极申请专利的公司以及新进入该领域的公司。此外,专利细分明确了专利权人对每个供应链环节(负极材料、电极、电池芯)的定位、硅负极材料的主要专利(形态、成分、製造工艺)以及近期专利发展的重点。最重要的是,我们专注于中国的初创公司和生态系统。

直到 2010 年代上半年,硅阳极的专利由日本公司(日立化成、昭和电工、三井物产、松下/三洋、索尼、NEC、丰田等)和韩国两大电池公司颁发公司(LG Chem、Samsung)虽然被垄断,但中国公司的知识产权活动自2015年以来呈指数级增长,如今已占专利的45%。

中国的IP领导者是ATL、Guoxuan High-Tech、CATL、Shanhan Energy、COSMX、SVOLT、New Keli Chemical、EVE Energy、Yinlong Energy。只有欧洲(Bosch/Seeo、Nexeon、CEA)和美国(Global Graphene、General Motors、Enevate、Amprius)拥有锂离子电池硅阳极的专利,只有少数日本公司没有。三大汽车製造商丰田、通用汽车和日产拥有多项专利。

在过去几年中,包括许多初创企业在内的 170 多家公司已进入该领域。QingTao Energy Development、Sila Nanotechnologies、StoreDot、Wildcat Discovery Technology、Battflex、Coreshell Technologies、3DBattery、QuantumScape、AnteoTech、Enwires、Blue Current、Graphenix Development、Cenate、SilLion(被Tesla收购)、OneD Materials、Enevate、Amprius、Nexeon、Nanospan、NanoGraf、Group14 Technologies、Qnovo

关注主要参与者的专利组合

本报告详细分析了 17 个主要知识产权参与者和最有前途的新进入者。三星、LG化学/LG能源解决方案、松下/三洋、村田製作所/索尼、CATL、SVOLT、丰田、日立化成/昭和电工、信越化学、三菱化学、BTR New Energy Material、Shanhan Energy、Nexeon、Aprius、StoreDot、Global Graphene、Goxuan High-Tech等各个玩家,我们将通过分析主要专利和近期IP发展,总结IP组合,明确IP战略。

了解技术趋势

专利属于供应链环节(负极材料、负极、粘合剂、电解质、电池)。本报告由硅阳极材料、硅阳极和电池单元组成,分析了主要的知识产权参与者、新的知识产权进入者、主要专利和最近的知识产权发展。在这份报告中,Knowmade 对专利中设想的主要硅基材料,以改善硅负极材料的充电/放电循环特性和电化学性能,提高良率,降低材料合成成本和环境负担等方面进行了高度重视。

便捷的Excel专利数据库

此外,本报告附有一个 Excel 数据库,其中包含本研究分析的 12,300 多个专利家族(发明)。这个方便的专利数据库可以通过多种方式进行搜索。 Excel 数据包括专利公开号、最新在线数据库的超链接(原件、法律状态等)、优先权日期、标题、摘要、专利权人、专利的当前法律状态、细分(负材料)。底片、活页夹、电池电池、电解质、设备等)都包括在内。

目录

简介

- 上下文

- 电池领域的挑战

- 硅阳极的主要优缺点

- 硅阳极锂离子电池主要挑战及改进解决方案

- 调查范围

- 报告的主要功能

- 专利形势研究背景

调查方法

- 专利检索、选择和分析

- 专利分析术语

- 主要参与者和主要专利

亮点

专利情况概述

- 专利公布时间表

- 专利公布时间表:主要专利申请人

- 主要 IP 参与者的时间表:按类型

- 公司总部变更

- 主要专利权人

- 自 2020 年以来最活跃的专利申请人

- 按公司类型划分的主要专利权人

- 主要专利权人:专利公开背景

- 主要IP新进入者

- 中国主要专利权人

- 2020年以来最活跃的中国专利申请人

- 中国主要专利持有人:按公司类型

- 电池製造商

- 材料製造商

- 汽车製造商

- 初创公司和专业製造商

- 专利的当前法律状态

- 专利权人的知识产权领导力

- 特定国家/地区的专利公开活动

- 有效专利的地理分布

- 主要专利权人:有效专利的地理范围

- 中国主要运营商的IP战略

- 供应链环节的定义

- 方便的 Excel 数据库支持各种搜索

- 专利公布时间表: 段:

- 主要专利权人和细分市场

- 主要 IP 新进入者和细分市场

- 主要初创企业和细分市场

- 主要汽车製造商和细分市场

- 中国主要的 IP 玩家和细分市场

- 按细分市场划分的主要专利权人

- 按供应链细分的着名 IP 参与者

- 专利诉讼

硅负极材料

- 主要专利权人

- 自 2020 年以来最活跃的专利申请人

- 主要IP新进入者

- 主要的初创公司

- 主要汽车製造商

- 知识产权领导

- IP 屏蔽的可能性

- 专利组合实力指数

- 主要专利

- 近期发展

硅阳极

- 主要专利权人

- 自 2020 年以来最活跃的专利申请人

- 主要IP新进入者

- 主要的初创公司

- 主要汽车製造商

- 知识产权领导

- IP 屏蔽的可能性

- 专利组合实力指数

- 主要和近期发展

电池

- 主要专利权人

- 自 2020 年以来最活跃的专利申请人

- 主要IP新进入者

- 主要的初创公司

- 主要汽车製造商

- 知识产权领导

- IP 屏蔽的可能性

- 专利组合实力指数

- 主要和近期发展

主要IP玩家的IP简介

- Samsung

- LG Chem/Energy Solutions

- Panasonic/Sanyo

- Murata/Sony

- CATL

- SVOLT

- Toyota

- Hitachi Chemical/Show Denko

- Shin Etsu

- Mitsubishi Chemical

- BTR

- Shanshan

- Nexeon

- Amprius

- StoreDot

- Global Graphene

- Guoxuan High Tech Power Energy

结论

关于Knowmade

How have industry leaders and start-ups positioned their pawns to address the glorious potential of silicon anode-based Li-ion batteries?

Report's Key Features:

- PDF with > 180 slides

- Excel file + Online database > 12,300 patent families

- IP trends, including time evolution of published patents and countries of patent filings.

- Ranking of main patent assignees.

- Newcomers in the IP landscape.

- Patent categorization by supply chain segments (anode materials, anode, binder, electrolyte, battery cell, etc.).

- IP position of key players, and relative strength of their patent portfolios.

- Current main technological approaches.

- IP profiles of 17 key players, including IP dynamics, legal status and geographical coverage of patents, IP strategies, key patents and recent IP developments.

- Excel database with all patents analyzed in the report, including patent segmentation and hyperlinks to an updated online database.

Knowmade's analysts have selected and analyzed more than 24,700 patents and patent applications grouped in more than 12,300 patent families (inventions) related to the whole supply chain of silicon anode-based Li-ion batteries (electrode materials, electrodes, electrolytes, battery cells). We have identified more than 1,800 different patent assignees involved in the Silicon anode patent landscape. The significant proportion of patents granted worldwide reflects a certain maturity of silicon anode technology for Li-ion batteries which is now being adopted by the industry. Nevertheless, numerous patent applications are still pending, meaning that R&D developments are still ongoing to solve technical issues related to silicon anode batteries

Leading IP players and IP newcomers across the supply chain

The report provides a clear overview of the most active patent applicants as well as a presentation of newcomers to the patent landscape. Furthermore, patent segmentation reveals the IP position of patent assignees by supply chain segments (anode material, electrode, battery cell) and highlights their key patent and recent IP developments for silicon anode materials (morphologies, compositions, manufacturing processes). Special attention has been paid to start-ups and Chinese ecosystem.

The silicon anode patent landscape was dominated by Japanese entities (Hitachi Chemical, Showa Denko, Mitsui, Panasonic/Sanyo, Sony, NEC, Toyota, etc.) and the two major South Korean battery companies (LG Chem, Samsung) until the early 2010s, but the IP activity from Chinese entities has exploded since 2015, representing today 45% of the patents.

The Chinese IP leaders are ATL, Guoxuan High-Tech, CATL, Shanshan Energy, COSMX, SVOLT, New Keli Chemical, EVE Energy and Yinlong Energy. Only a few Europeans (Bosch/Seeo, Nexeon and CEA) and Americans (Global Graphene, General Motors, Enevate and Amprius) have patents on silicon anodes for Li-ion batteries. The three main car manufacturers Toyota, General Motors and Nissan are present in the IP landscape.

We have identified more than 170 IP newcomers entering the patent landscape the last few years, including numerous start-ups: QingTao Energy Development, Sila Nanotechnologies, StoreDot, Wildcat Discovery Technology, Battflex, Coreshell Technologies, 3DBattery, QuantumScape, AnteoTech, Enwires, Blue Current, Graphenix Development, Cenate, SilLion (acquired by Tesla), OneD Materials, Enevate, Amprius, Nexeon, Nanospan, NanoGraf, Group14 Technologies, Qnovo, etc.

Focus on key players' patent portfolios

The report provides a detailed analysis of 17 key IP players and most promising IP newcomers: Samsung, LG Chem/LG Energy Solution, Panasonic/Sanyo, Murata/Sony, CATL, SVOLT, Toyota, Hitachi Chemical/Showa Denko, Shin-Etsu Chemical, Mitsubishi Chemical, BTR New Energy Material, Shanshan Energy, Nexeon, Amprius, StoreDot, Global Graphene, Guoxuan High-Tech. For each player, we summarize their IP portfolio, unveil their IP strategies by analyzing their key patents and recent IP developments.

Understand the technological trends

The patents have been categorized by supply chain segment (anode material, anode, binder, electrolyte, battery cell. The report comprises specific parts dedicated to silicon anode materials, silicon anode and battery cell, in which the key IP players, IP newcomers, key patents and recent IP development related to are analyzed. In this report, Knowmade highlights the main silicon-based materials which are envisioned in patents to improve the cyclability and electrochemical performances of silicon anode materials, increase the yields and reduce the cost and environment impact of the material synthesis.

Useful Excel patent database

The report also includes an Excel database with the 12,300+ patent families (inventions) analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to an updated online database (original documents, legal status, etc.), priority dates, title, abstract, patent assignees, patent's current legal status, and segments (anode material, anode, binder, battery cell, electrolyte, equipment, etc.).

Companies mentioned in the report (Non-exhaustive)

A123 Systems (Wanxiang group), Amprius, ATL (Amperex Technology), BAK Battery, BASF, Bosch/SEEO, BTR New Energy Material, BYD, Canrd New Energy Technology, CATL (Contemporary Amperex Technology Ltd), Chery Automobile, COSMX, Enevate, EVE Energy, Fujifilm, Furukawa, General Motors, Global Graphene, GS Yuasa, Guoxuan High Tech Power Energy, Hitachi , Hitachi Chemical / Showa Denko, Hitachi Maxell, Huawei, Hyundai/Kia, JSR, LG Chem/LG Energy Solution, MGL New Materials, Mitsubishi Chemicals, Mitsui Chemicals, Mitsui Mining & Smelting, MU Ionic Solutions, Murata Manufacturing/Sony, NEC, New Keli Chemical, Nexeon, Nissan, Panasonic/Sanyo, Samsung, Sekisui Chemical, Shanshan Energy technology, Shin Etsu Chemical, SK Innovation, Soundgroup, Sumitomo Electric Industries, Sunwoda, SVOLT (Fengchao Energy Technology), TDK, Tinci Materials Technology, Toshiba, Toyota, Ube Industries, Umicore, Wacker Chemie, Yinlong Energy, Zeon, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context

- Challenges in battery field

- Main advantages and drawbacks of silicon anode

- Main challenges and improvement solutions for Silicon anode lithium-ion battery

- Scope of the report

- Key features of the report

- Why study the patent landscape

METHODOLOGY

- Patent search, selection and analysis

- Terminology for patent analysis

- Key players & Key patents

HIGHLIGHTS

PATENT LANDSCAPE OVERVIEW

- Timeline of patent publications

- Time evolution of patent publications - Main patent applicants

- Timeline of Main IP players by typology

- Time evolution of company headquarters

- Main patent assignees

- Most active patent applicants since 2020

- Main patent assignees by company type

- Main patent assignees: time evolution of patent publications

- Main IP newcomers

- Main Chinese patent assignees

- Most active Chinese patent applicants since 2020

- Main Chinese patent assignees by company type

- Battery Manufacturers

- Material Manufacturers

- Car Manufacturer

- Start-ups and Pure players

- Current legal status of patents

- IP leadership of patent assignees

- Patenting activity by publication country

- Geographical distribution of alive patents

- Main patent assignees: geographical coverage of alive patents

- IP Strategy of the main Chinese entities

- Definition of supply chain segments

- Useful Excel database allows multi-criteria searches

- Time evolution of patent publications by segment

- Main patent assignees versus Segments

- Main IP newcomers versus Segments

- Main start-ups versus segments

- Main car-makers versus segments

- Main Chinese IP players versus segments

- Main patent assignees by segment

- Noteworthy IP players by supply chain segment

- Patent Litigations

FOCUS ON SILICON ANODE MATERIAL

- Main patent assignees

- Most active patent applicants since 2020

- Main IP newcomers

- Main start-ups

- Main car-makers

- IP Leadership

- IP blocking potential

- Strength index of patent portfolios

- Key patents

- Main and recent developments

FOCUS ON SILICON ANODE

- Main patent assignees

- Most active patent applicants since 2020

- Main IP newcomers

- Main start-ups

- Main car-makers

- IP Leadership

- IP blocking potential

- Strength index of patent portfolios

- Main and recent developments

FOCUS ON BATTERY CELLS

- Main patent assignees

- Most active patent applicants since 2020

- Main IP newcomers

- Main start-ups

- Main car-makers

- IP Leadership

- IP blocking potential

- Strength index of patent portfolios

- Main and recent developments

IP PROFILES OF KEY IP PLAYERS

- Samsung, LG Chem/Energy Solutions, Panasonic/Sanyo, Murata/Sony, CATL, SVOLT, Toyota, Hitachi Chemical/Show Denko, Shin Etsu, Mitsubishi Chemical, BTR, Shanshan, Nexeon, Amprius, StoreDot, Global Graphene, Guoxuan High Tech Power Energy