|

市场调查报告书

商品编码

1611486

碳化硅(SiC)的专利形势的分析(2024年)Silicon Carbide (SiC) Patent Landscape Analysis 2024 |

|||||||

了解 SiC 产业的最新 IP 演变和趋势。

调查整个 SiC 供应链的专利活动。

SiC 技术:复杂且快速发展的前景

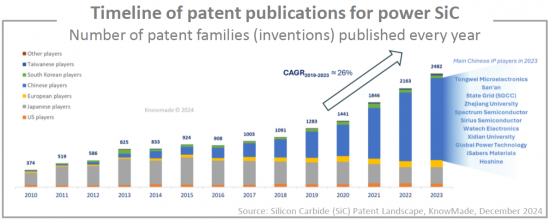

在 2022 年碳化硅 (SiC) 专利格局中,KnowMade 透露,SiC 装置的智慧财产权 (IP) 活动正在增加。许多历史悠久的智慧财产权公司在此期间寻求扩大其碳化硅发明的保护范围。随着电动车 (EV) 推动功率 SiC 市场的崛起,SiC 公司在欧洲和中国等行业战略地区申请了更多专利。同时,电动车的繁荣促使许多新进业者加速了 SiC 技术的开发,因此年轻 SiC 市场的早期领导者可能会维持甚至加速其智慧财产权活动,为未来几年的激烈竞争做好准备。你做。在这种情况下,主要的 SiC 公司可能会利用专利来保护市场占有率并获得进入 SiC 行业所需的大量投资。市场竞争的加剧在知识产权领域已经很明显。

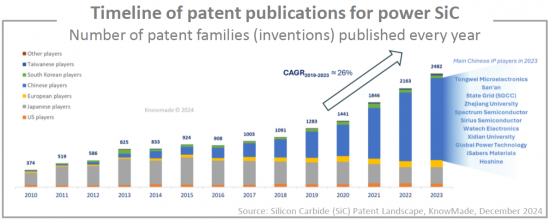

中美之间的地缘政治紧张局势也促使专利申请量增加,并加速全球(尤其是中国)本土半导体生态系统的形成。 2023年,中国企业将占整个SiC供应链专利公开量的70%以上,新进市场的企业数量也可圈可点,其中包括许多涉足SiC晶圆产业的企业。随着许多公司参与SiC晶圆的开发,中国已经成功遏制了供应短缺的局面,但激烈的价格竞争让许多供应商迎来了经济不稳定的时代。这种新情况可能有利于碳化硅晶圆供应商之间的专利诉讼。

本报告提供全球碳化硅(SiC)产业调查分析,超过1万9,000件的专利的Excel资料库之外又加上,全球专利趋势的说明,及主要企业的IP简介等资讯。

目录

简介

- 报告背景

- 报告的目的

- 研究策略和范围

- 阅读指南:在报告中找到正确的讯息

- 专利检索、选择与分析技术

- 专利分析术语

Excel资料库

- Excel 文件,包含本研究所选取的所有专利以及权利人透过统计分析得出的完整数据。

摘要整理

- 亮点

- 关于SiC基板、SiC功率元件、SiC封装模组和SiC电路的供应链细分领域

- 主要知识产权公司的时间表

- 活跃的智慧财产权公司、不活跃的智慧财产权公司、新进入的智慧财产权公司

- 主要专利申请人:依细分市场划分

- 主要知识产权公司:依国家划分

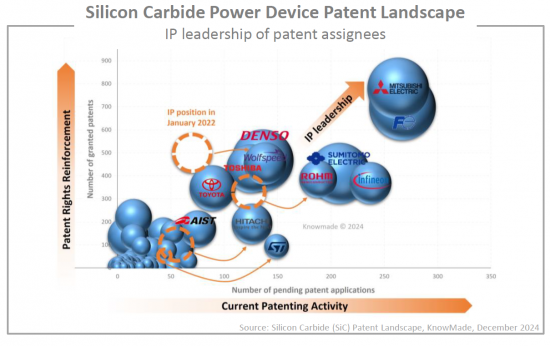

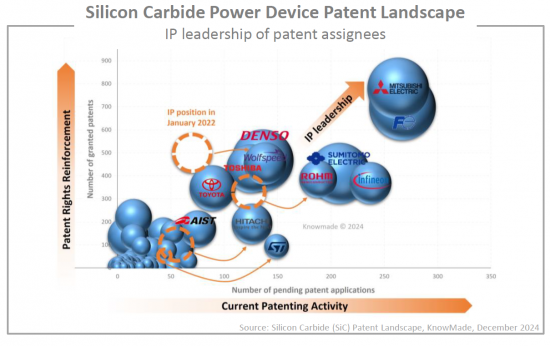

- 专利权人的智慧财产权领导力

专利形势的分析

专利状况概览

- 主要趋势

- 主要专利持有者

- 主要知识产权公司在整个供应链中的定位

- 知识产权新进入者公司

- 近期智慧财产权联盟及专利交易

- 聚焦中国知识产权企业

- SiC专利领域的中国主要企业

- 中国知识产权新进者

- 中国近期的智慧财产权联盟与专利交易

- 中国企业进行全球智慧财产权活动

SiC衬底专利状况

- (包括与散装、外延片、生长设备、精加工/切片相关的专利)

- 专利公布的时间序列变化:按子细分

- 主要专利持有者排名

- 主要专利持有者:按细分领域

- 现存专利的地理范围

- 主要专利持有人和专利申请人:按国家划分

- 专利权人的智慧财产权领导力

- 专注于体 SiC 和裸 SiC 晶圆

- 聚焦SiC外延片

SiC功率元件专利状况

- (包括与二极体、MOSFET 和其他装置及技术方面相关的专利)

- 专利公布的时间序列变化:按子细分

- 主要专利持有者排名

- 主要专利持有者:按细分领域

- 现存专利的地理范围

- 主要专利持有人和专利申请人:按国家划分

- 专利权人的智慧财产权领导力

- 聚焦碳化硅二极体

- 聚焦SiC MOSFET(平面、沟槽MOSFET)

SiC功率模组专利状况

- (包括与封装、模组、封装、晶片连接、寄生效应、热问题等相关的专利)

- 主要专利持有者排名

- 现存专利的地理范围

- 主要专利持有人和专利申请人:按国家划分

- 专利权人的智慧财产权领导力

SiC电路的专利状况

- 主要专利持有者排名

- 现存专利的地理范围

- 主要专利持有人和专利申请人:按国家划分

- 专利权人的智慧财产权领导力

主要的SiC IDM的IP简介

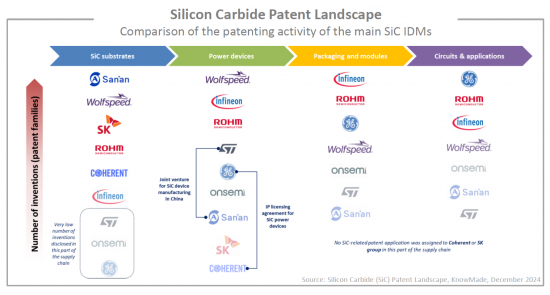

- 主要的SiC IDM的比较

- 专利公布的时间序列变化

- 整个 SiC 供应链的专利活动水准和智慧财产权组合的可执行性

- 专利持有者在整个 SiC 供应链中的智慧财产权领导地位

- SiC MOSFET专利持有者的智慧财产权领先地位

- 有效专利组合的地理范围

- 全球智慧财产权领导地位

- IP简介

- 关于每家公司:SiC 专利组合概览(专利活动、专利法律地位、地理范围、技术范围)、最新智慧财产权动态。

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- 关于每家公司:SiC 专利组合概览(专利活动、专利法律地位、地理范围、技术范围)、最新智慧财产权动态。

KnowMade的简报

Figure out the latest IP evolutions and trends in the SiC industry.

Explore the patenting activities across the SiC supply chain.

Key features:

- PDF>170 slides

- Excel database containing all patents analyzed in the report (>19,000 patent families), including segmentations + hyperlink to updated online database (legal status, documents etc.)

- Describing the global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Identifying the main patent assignees and the IP newcomers in the different segments of the supply chain.

- Determining the status of their patenting activity (active/inactive) and their IP dynamics (ramping up, slowing down, steady).

- Identifying the IP collaborations (patent co-filings) and IP transfers (changes of patent ownership).

- Providing a detailed picture of the Chinese SiC ecosystem focusing on the patenting activity of Chinese entities.

- Patents categorized in 5 main supply chain segments and 10 main sub-segments: bulk SiC & bare SiC wafers, epitaxial SiC substrates (incl. growth apparatus, finishing), SiC devices (diodes, planar MOSFETs, trench MOSFETs), SiC modules (thermal issues, parasitics, die-attach, encapsulation), circuits.

- IP profile of main players: Patent portfolio overview (IP dynamics, segmentation, legal status, geographic coverage, etc.)

SiC technology: A complex and fast-evolving landscape

In the Silicon Carbide (SiC) patent landscape 2022, KnowMade found out that the intellectual property (IP) activities were ramping up for SiC devices. Many historical IP players aimed to increase the perimeter of protection for their SiC inventions at this time. Electric vehicles (EV) had been driving the emergence of the power SiC market, prompting SiC companies to file more patents in strategic regions for this industry, such as Europe and China. In parallel, early leaders in the young SiC market have maintained or even accelerated their IP activities to prepare for a stronger competition in the next few years, since the EV boom led many new players to speed up the development of SiC technology. In this context, patents may be leveraged by leading SiC companies to protect their market share and thereby secure the large investments that have been required to enter the SiC industry. The growing competition in the market is already conspicuous in the IP landscape.

Geopolitical tensions between US and China have also triggered an increase in patent filings, accelerating the formation of local semiconductor ecosystems across the world, especially in China. In 2023, Chinese players were responsible for more than 70% of patent publications across the whole SiC supply chain, with an impressive number of newcomers, of which many companies involved in the SiC wafer industry. With such a high number of companies involved in SiC wafer developments, China has already succeeded in stopping the shortage situation but opened a period of economic instability for many suppliers due to a fierce price competition. This new context may favor patent litigations between SiC wafer suppliers.

Patent landscape overview

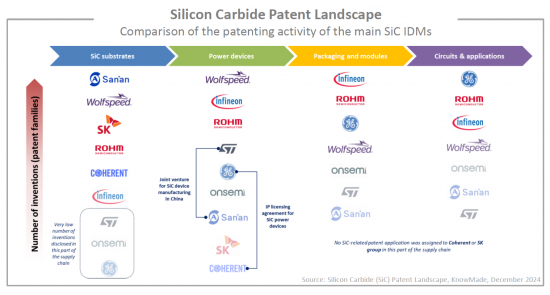

The first section of the Silicon Carbide (SiC) Patent Landscape report 2024 describes the global patent competition across the SiC supply chain by identifying the main IP players and newcomers and positioning their patent portfolios in each part of the SiC supply chain. The SiC patent portfolios are also analyzed geographically to highlight important markets in the IP strategy of SiC companies.

For SiC power devices, the patent analysis has been split into diodes, MOSFET and other SiC devices. What's more, for SiC MOSFET, the IP competitive analysis is available for planar MOSFET and trench MOSFET separately. It highlights the fact that most companies in the SiC patent landscape have integrated trench MOSFET in their technological roadmap, leading to an acceleration in patent filings in this area. As a result, trench MOSFET has become an increasingly competitive IP space in recent years.

Furthermore, a special focus is made on China which stands out by the explosion of the number of patent assignees in recent years, and an IP activity that is strongly dominated by domestic patent filings. Few players stand out by filing patent applications outside China. Interestingly, due to the very high patenting activity in China, patent analysis has become very relevant to describe such a dense ecosystem and make it less opaque to global competitors.

Eventually, the patent analysis highlights the IP activities of main market players, which are facing strong competition from many players in this landscape. They are either future market competitors, future integrators of SiC devices such as automotive Tiers-1 and OEM, or even potential suppliers (SiC equipment, materials). Indeed, patents may also be instrumental in negotiations and partnerships across the future SiC supply chain.

IP profiles of key players

The second section of the Silicon Carbide (SiC) Patent Landscape report 2024 focuses on the IP activities of main SiC device market players and/or companies investing significantly into building a vertically-integrated infrastructure for SiC. Such companies have adopted an IDM business model and look to integrate within the company every step of SiC manufacturing, from material growth, to device manufacturing and packaging. Interestingly, the comparison of their IP activities highlights quite differentiated IP strategies. While certain companies heavily rely on patents to assert their position in the market, other companies have not significantly developed their patent portfolio across the SiC supply chain. Regarding the geographic distribution of patent filings, there are also some discrepancies between players, showing the relative importance of the different markets for each company (US, Japan, Europe, China, South Korea and Taiwan).

This patent analysis provides a complete overview of the SiC patent portfolios held by Wolfspeed, Infineon, onsemi, Rohm, SK, STMicroelectronics, Coherent (and its licensor General Electric) and San'an. By focusing on the recent patenting activities of such players, it is possible to detect small signals, such as involvement in new technological areas (e.g., superjunction structures, trench MOSFET), or a strong IP activity in new regions. As such, it may provide some indications regarding the strategic plans of the company. Eventually, this review of the latest patent publications details the recent evolutions of SiC technology at every level of the supply chain.

Useful Excel patent database

This report includes an extensive Excel database with the 19,000+ patent families (inventions) analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and segments (bulk SiC, epitaxial SiC substrates, SiC diodes, planar SiC MOSFETs, trench SiC MOSFETs, SiC modules, circuits, etc.). Additionally, the Excel file comprises the complete data by assignee from the statistical analyses, including the number of patent families, timeline of patenting activity, number of granted patents and pending patent applications, and geographical coverage of patent portfolio.

Companies mentioned in the report (non-exhaustive)

Mitsubishi Electric, Sumitomo Electric, Denso, Fuji Electric, Toyota Group, Hitachi, Infineon, Toshiba, Rohm, Resonac, Panasonic , Wolfspeed, SICC, CETC, Nissan, State Grid (SGCC), General Electric, San'an, LG Corporation, CRRC, ABB, Hyundai, Siemens, Global Power Technology, Shindengen Electric Manufacturing, STMicroelectronics, CEC, FerroTec Holdings, Synlight Crystal, Onsemi, Bosch, Disco, Kansai Electric Power (KEPCO), TankeBlue, SK group, Tongwei Microelectronics, Midea, BASiC Semiconductor, TYSiC - Tianyu Semiconductor Technology, PN Junction Semiconductor, iSabers Materials, Spectrum Semiconductor, Shin-Etsu, KY Semiconductor, Sanken Electric, Gree Electric Appliances, Century Goldray (CENGOL), Sharp, Kyocera, Watech Electronics, Sirius Semiconductor, Huawei, Proterial (Hitachi Metals), Senic, Toyo Tanso, Shanghai Hestia Power, Coherent, YASC - Anhui Yangtze Advanced Semiconductor, GlobalWafers, BYD, Northrop Grumman, Microchip Technology, EpiWorld, Volkswagen Group, Sumitomo Metal Mining, JRC - Japan Radio, Semikron Danfoss, Chongqing Wattscience Electronic Technology, Hoshine, Power Integrations, Meidensha Electric Manufacturing, StarPower Semiconductor, United Nova Technology (UNT), Soitec, Delta Electronics, ZF, Guangzhou Summit Crystal Semiconductor (GZSC), Jiangsu Jixin Advanced Materials, Xiner, Huaxinwei Semiconductor Technology (Beijing) , Semisouth Lab, Beijing Microcore Technology, Hypersics Semiconductor, SiCentury, Macrocore Semiconductor, Daikin Industries, Nissin Electric, Raytheon Technologies, NCE Power, etc.

TABLE OF CONTENTS

INTRODUCTION

- Context of the report

- Objectives of the report

- Research strategy and scope of the report

- Reading guide: find the right information in the report

- Methodology for patent search, selection and analysis

- Terminology for patent analysis

EXCEL DATABASE

- Excel file that includes all patent selected for this study, along with the complete data by assignee from the statistical analyses.

EXECUTIVE SUMMARY

- Highlights

- For each supply chain segment SiC substrates, SiC power devices, SiC packaging & modules, and SiC circuits:

- Timeline of main IP players

- IP players still active, IP players no longer active, IP newcomers

- Leading patent assignees by sub-segments

- Leading IP players by country

- IP leadership of patent assignees

PATENT LANDSCAPE ANALYSIS

Patent Landscape Overview

- Main trends

- Main patent owners

- Position of main IP players across the supply chain

- IP newcomers

- Recent IP collaborations & patent transactions

- Focus on Chinese IP players

- Main Chinese companies in the SiC patent landscape

- Chinese IP newcomers

- Recent Chinese IP collaborations & patent transactions

- Chinese entities with global IP activities

SiC Substrate Patent Landscape

- (Includes patents related to bulk, epiwafers, growth apparatus, and finishing & slicing)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on Bulk SiC and bare SiC wafers

- Focus on SiC epitaxial wafers

SiC Power Devices Patent Landscape

- (Includes patents related to diodes, MOSFETs, other devices and technological aspects)

- Time evolution of patent publications by sub-segments

- Ranking of main patent assignees

- Main patent assignees by sub-segments

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

- Focus on SiC diodes

- Focus on SiC MOSFETs (planar and trench MOSFETs)

SiC Power Modules Patent Landscape

- (Includes patents related to packaging, modules, encapsulation, die-attach, parasitics, thermal issues, etc.)

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

SiC Circuits Patent Landscape

- Ranking of main patent assignees

- Geographic coverage of alive patents

- Main patent owners and patent applicants by countries

- IP leadership of patent assignees

IP PROFILES OF MAIN SiC IDM

- Comparison between main SiC IDM

- Time evolution of patent publications

- Level of patenting activity and IP portfolio enforceability across the SiC supply chain

- IP leadership of patent assignees across the SiC supply chain

- IP leadership of patent assignees for SiC MOSFET

- Geographical coverage of alive patent portfolio

- IP leadership across the world

- IP profiles

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.

- Wolfspeed

- Infineon

- ROHM

- STMicroelectronics

- onsemi

- SK group

- Coherent

- General Electric

- San'an

- For each player: SiC patent portfolio overview (patenting activity, patent legal status, geographical coverage, technology coverage), and latest IP developments.