|

市场调查报告书

商品编码

1828243

锂离子电池正极活性材料回收的专利趋势分析(2025年)Li-ion Battery Cathode Active Material Recycling Patent Landscape Analysis 2025 |

|||||||

全球锂离子电池正极活性材料回收专利竞争中的主要和新进入者有哪些?

主要特点

- PDF 120 张投影片

- Excel 资料库包含本报告分析的所有专利(超过 3,900 个同族专利)

- 全球专利趋势,包括专利公布时间表和专利申请国家/地区

- 按地区分类的主要专利申请人和新进入者

- 专注于主要公司专利组合

- 以正极活性材料类型分类的专利(锂三元氧化物、锂磷酸盐、其他正极活性材料 (CAM)、锂和锂前驱体)

对永续供应链日益增长的兴趣和需求,正在推动创新者加入锂离子电池正极活性材料回收的专利竞争电池。

随着电动车 (EV)、再生能源储存系统和便携式电子产品的迅速普及,锂离子电池的需求呈指数级增长。为了建立更永续的供应链,并增强对材料匮乏国家关键矿产供应商的独立性,人们对锂、钴、镍和锰等关键原料的兴趣日益浓厚。这种供应集中,加上环境问题和不断变化的监管框架,正在推动对永续报废管理策略的需求,特别是报废锂离子电池及其正极材料的回收利用。

正极材料是锂离子电池中最有价值且资源密集的组成部分。这些材料包括层状氧化物,如 NMC(LiNiMnCoO2)、NCA(LiNiCoAlO2)和 LCO(LiCoO2),多阴离子材料,如 LFP(LiFePO4)和 LMFP(LiMnFePO4),以及尖晶石,如 LMO(LiMn2O4)。每种化学品的回收和再利用都面临独特的课题和机会。高效率的回收不仅可以减少对原始采矿的依赖,还可以降低电池製造的环境足迹,并有助于实现政府和产业设定的循环经济目标。

为此,本报告旨在全面分析与锂离子电池正极活性材料 (CAM) 回收相关的专利模式。

本报告的总体目标如下:

- 识别并绘製每个技术领域(锂和锂前驱体、锂三元氧化物、锂磷酸盐和其他正极材料)的关键智慧财产权参与者。 评估同族专利的地理分布和专利申请的法律状态,使利害关係人能够了解其策略定位并应对竞争格局。

这些洞察将支持不断发展的锂离子电池回收领域的研发、投资和政策决策。

动态智慧财产权格局

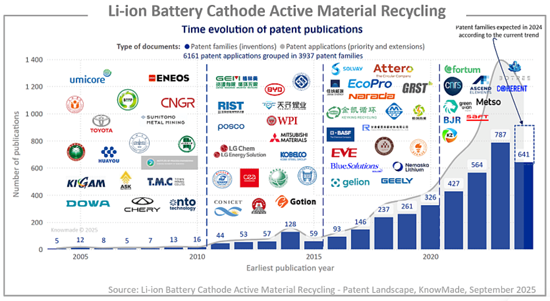

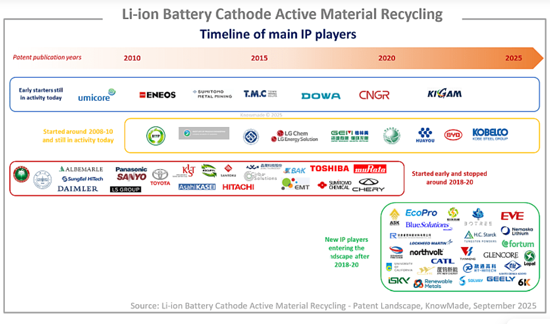

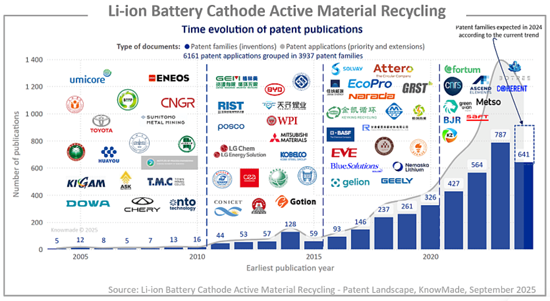

在本报告中,Knowmade分析师从3,900多个专利族(发明)中筛选并分析了6,100多项与锂离子电池正极活性材料回收相关的专利和专利申请。这一显着增长清楚地表明,包括大型企业、新创公司和研发实验室在内的众多实体对该技术表现出浓厚的兴趣。继Umicore、Eneos和住友金属矿业(例如LG化学/LGES、GEM和Brunp Recycling Technology)等早期进入该领域的企业之后,他们现在正与Asaka Riken、EcoPro和Blue Solutions等新进入者竞争。

辨识关键趋势与关键参与者的智慧财产权地位

智慧财产权竞争分析必须反映参与者的愿景,并制定进入锂离子电池可视性储存 (CAM) 回收领域并发展业务的策略。在本报告中,KnowMade 分析师全面概述了竞争格局和关键参与者。报告涵盖了专利申请量、专利申请人、申请国家以及关键技术领域(锂和锂前驱体、锂三元氧化物、锂磷酸盐等)的智慧财产权动态和关键趋势。报告还识别了知识产权领域的领导者、最活跃的专利申请人以及新进入者。本报告也揭示了该领域中一些不为人知的公司和新进者。

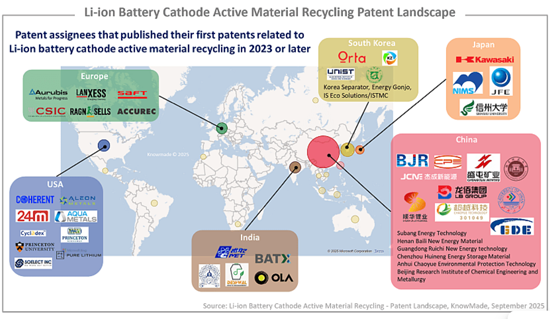

新专利申请人进入

自2023年以来,中国企业已成为锂离子电池CAM回收专利市场的主要新进者。 BJR、CP Lighting和Chengtun Mining Group处于领先地位,其次是东亚的智慧财产权进入者,例如韩国的Orta Materials和Korea Zinc,以及日本的JFE和川崎重工。本报告重点在于各国主要进入者和新进者的专利组合。

便利的 Excel 专利资料库

本报告还包含一个全面的 Excel 资料库,其中包含本研究中分析的所有专利,包括专利资讯(编号、日期、受让人、标题、摘要等)、指向更新的线上资料库的超连结(源文本、法律状态等)以及细分领域(锂及锂前驱体、锂三元氧化物、锂磷酸盐、其他正极材料)。

报告中涉及的公司(非详尽)

- 中国:邦普循环科技、中南大学、中科院製程工程研究所、荆门格林美新材料股份有限公司、南都电源、北京理工大学、天齐锂业、国轩高科、凯景再生资源、北控科技集团、RSK先进材料、株冶炼集团、亿纬锂能、兰州理工大学等。

- 欧洲:优美科、巴斯夫、CEA、Blue Solutions、威立雅、Aurubis、富腾、美卓、弗劳恩霍夫应用研究所等。

- 日本:埃内奥斯集团、住友金属矿、同及控股、TMC(城镇矿业公司)、朝霞理研、丰田、三菱材料、神户钢铁、三井金属矿业、住友化学/田中化学、日立等。

- 韩国:SK集团、LG化学/LG能源解决方案、韩国地质矿产资源研究院 (KIGAM)、EcoPro、韩国工业技术研究院 (RIST)、浦项製铁、Cosmochemical、韩国科学技术研究院 (KIST)、Dongwoo FinceChem 等。

- 美国:Ascend Elements、伍斯特理工学院、OnTo Technology、Albemarle、洛克希德马丁/UT Battelle、Cirba Solutions、Coherent、加州大学、Libus987、Urban Mining、24M technologies、6K inc. Aleon Metals、Aquacles、Li-Cy Metal 等。

- 其他地区:CSIR(科学与工业研究理事会)、Attero Recycling、Conicet、Gelion Technologies、Green Li-ion、印第安纳理工学院、Frontier Lithium、Hydro-Quebec 等。

目录

简介

摘要整理

专利形势概要

- 主要趋势和IP参与企业

- 专利揭露时间序列

- 主要专利权人

- 知识产权参与者时间轴

- 专利申请主要国家/地区

- 已授权和待批专利的地理覆盖范围

- 参与者专利的地理分布专利组合

- 专利的当前法律状态(已授权、待审、已过期)

- 主要专利持有者

- 专利申请的主要参与者

- 专利权人的智慧财产权领导力

- 参与者的专利组合强度指数

- 关注回收公司

- 关注2023年及以后的智慧财产权新进者

技术领域

- 依正极活性材料回收细分的技术

- 专利出版品随时间的变化

- 依正极活性材料回收划分的主要专利权人

- 以正极活性材料划分的专利出版趋势

- 锂和锂前驱体回收领域专利权人的智慧财产权领导力

- 锂三元氧化物领域专利权人的智慧财产权领导力回收利用

- 磷酸锂回收领域专利权人的智慧财产权领导力

- 其他CAM回收领域专利权人的智慧财产权领导力

关注总部所在国家的智慧财产权进入者

- 针对每个总部所在国家,列出主要专利权人、智慧财产权新进入者、专利组合的地理范围、专利组合的技术范围、主要进入者的智慧财产权概况。

- 中国的IP参与企业

- 日本的IP参与企业

- 韩国的IP参与企业

- 美国的IP参与企业

- 欧洲的IP参与企业

- 其他地区

另纸

- 专利搜寻,选择,分析的调查手法

- 用语

noumeidopurezenteshon

Who are the key players and newcomers in the global IP race for Li-ion batteries cathode active materials recycling?

Key features:

- PDF>120 slides

- Excel database containing all patents analyzed in the report (>3,900 patent families), including patent segmentations and hyperlinks to an updated online database.

- Global patenting trends, including time evolution of patent publications, countries of patent filings, etc.

- Main patent assignees and IP newcomers grouped by geographical area.

- Focus on selected key IP players' portfolios

- Patents categorized by type of cathode active material (Li Ternary Oxides, Li Phosphates, Other CAM, Li & Li Precursors).

The growing interest in, and need for, a sustainable supply chain has driven innovators into an IP race in Li-ion battery CAM recycling

The rapid adoption of electric vehicles (EVs), renewable energy storage systems, and portable electronics has fueled an exponential increase in the demand for Lithium-ion batteries. The interest in critical raw materials such as lithium, cobalt, nickel, and manganese, increased, to instate a more sustainable supply chain and increase the independence of materials-scarce countries from critical minerals suppliers. This concentration of supply, coupled with environmental concerns and evolving regulatory frameworks, has intensified the need for sustainable end-of-life management strategies, particularly the recycling of spent Li-ion batteries and their cathode materials.

Cathode materials represent the most valuable and resource-intensive components of Li-ion batteries. These include layered oxides like NMC (LiNiMnCoO2), NCA (LiNiCoAlO2), and LCO (LiCoO2); polyanion materials such as LFP (LiFePO4) and LMFP (LiMnFePO4); and spinels like LMO (LiMn2O4). Each chemistry presents unique challenges and opportunities for recovery and reuse. Efficient recycling not only reduces reliance on virgin mining but also lowers the environmental footprint of battery production, contributing to the circular economy goals set by governments and industries.

In this context, the present report aims to provide a comprehensive analysis of the patent landscape related to the recycling of cathode active materials (CAM) from Li-ion batteries.

The general objectives of the present report are:

- to identify and map the key IP players in each chosen technological segment (Li & Li precursors, Li ternary oxides, Li phosphates, other cathode materials).

- to assess the geographical distribution of patent families, legal status of patent applications, helping stakeholders understand strategic positioning and navigate their competitive environment.

This insight will support R&D, investment, and policy decisions in the evolving field of Li-ion battery recycling.

A dynamic IP landscape

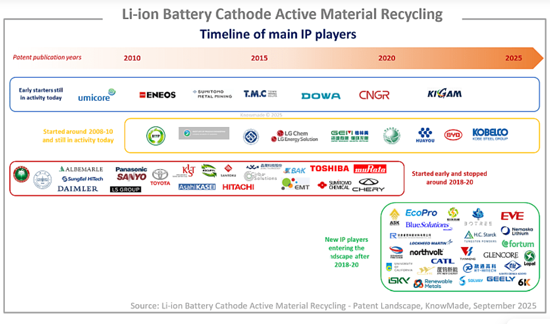

In this report, Knowmade's analysts have selected and analyzed over 6,100 patents and patent applications from more than 3,900 patent families (inventions) related to Li-ion battery cathode active materials recycling. This significant rise clearly demonstrates a strong interest in the technology from various entities, including large companies, start-ups, and R&D labs. Early entrants in this space such as Umicore, Eneos, and Sumitomo Metal Mining were followed over the years by other patent applicants (e.g., LG Chem/LGES, GEM, Brunp Recycling Technology), and they are now competing with more recent new entrants in the patent landscape such as Asaka Riken, EcoPro, and Blue Solutions.

Revealing main trends and key players' IP position

IP competition analysis should reflect the vision of players with a strategy to enter and develop their business in the Li-ion battery CAM recycling field. In this report, KnowMade's analysts provide a comprehensive overview of the competitive IP landscape and the main players involved. The report covers IP dynamics and key trends in terms of patents applications, patent assignees, filing countries, and technological segment of interest (Li & Li precursors, Li ternary oxides, Li phosphates, etc.). It also identifies the IP leaders, most active patent applicants, and new entrants in the IP landscape. The report also sheds light on under-the-radar companies and new players in this field.

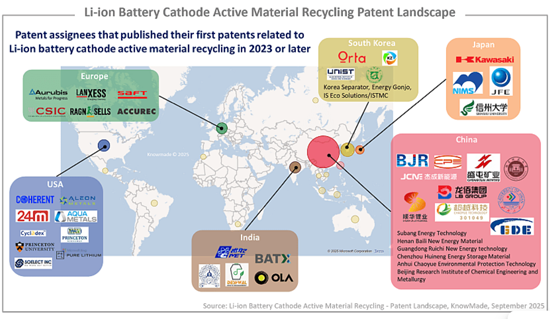

Entry of new patent applicants

Since 2023, Chinese entities have established themselves as dominant newcomers in the Li-ion battery CAM recycling patent landscape. BJR, CP Lighting, and Chengtun Mining Group are leading the field, while other East Asian IP players such as Orta Materials and Korea Zinc from South Korea, and JFE and Kawasaki Heavy Industries from Japan are following closely behind. Dedicated sections of the report focus on the patent portfolios of key players and IP new entrants from various countries.

Useful Excel patent database

This report also includes an extensive Excel database with all patents analyzed in this study, including patent information (numbers, dates, assignees, title, abstract, etc.) and hyperlinks to an updated online database (original documents, legal status, etc.), and affiliation segments (Li & Li precursors, Li ternary oxides, Li phosphates, other cathode materials).

Companies mentioned in the report (non-exhaustive)

- From China: Brunp Recycling technology, Central South University, Institute of Process Engineering-CAS, GEM (Jingmen Gelinmei New Materials), Narada Power Source, Beijing Institute of Technology, Tianqi Lithium, Guoxuan High Tech Power Energy / Gotion, Keyking Recycling, BGRIMM Technology Group, RSK Advanced materials, Zhuzhou Smelter Group, EVE Energy, Lanzhou University of Technology, and more

- From Europe: Umicore, BASF, CEA, Blue Solutions, Veolia, Aurubis, Fortum, Metso, Fraunhofer, and more

- From Japan: Eneos Group, Sumitomo Metal Mining, Dowa Holdings, TMC (Town Mining Corporation), Asaka Riken, Toyota, Mitsubishi materials, Kobe Steel, Mitsui Mining and Smelting, Sumitomo Chemical/Tanaka Chemical, Hitachi, and more

- From South Korea: SK Group, LG Chem/LG Energy Solution, KIGAM (Korea Insttitue of Geoscience and Mineral Resources), EcoPro, RIST (Research Institute of Industrial Science and Technology), Posco, Cosmochemical, KIST (Korea Institute of Science & Technology), Dongwoo Fince Chem, and more

- From USA: Ascend Elements, Worcester Polytechnic Institute, OnTo Technology, Albemarle, Lockheed Martin/UT Battelle, Cirba Solutions, Coherent, University of California, Libus987, Urban Mining, 24M technologies, 6K inc. Aleon Metals, Aqua Metals, Li-Cycle, and more

- From the rest of the World: CSIR (Council of Scientific and Industrial Research), Attero Recycling, Conicet, Gelion Technologies, Green Li-ion, Indiana Institute of Technology, Frontier Lithium, Hydro-Quebec, and more

TABLE OF CONTENTS

INTRODUCTION

- Context & objectives of the report

- Scope of the report

- Excel database

- Basic knowledge of IP to better understand this report

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- Main Trends and IP Players

- Time evolution of patent publications

- Main patent assignees

- Timeline of IP players

- Main countries of patent filings

- Geographic coverage of granted patents and pending applications

- Geographical distribution of players' patent portfolios

- Current legal status of patents (granted, pending, dead)

- Main players owning granted patents

- Main players that hold pending patent applications

- IP leadership of patent assignees

- Strength index of players' patent portfolios

- Focus on Recycling Companies

- Focus on IP Newcomers Since 2023

TECHNOLOGICAL SEGMENTS

- Technology breakdown by cathode active materials recycling

- Time evolution of patent publications

- Main patent assignees by cathode active materials recycling

- Time evolution of patent publications by cathode active materials

- IP leadership of patent assignees for Li & Li Precursors recycling

- IP leadership of patent assignees for Li Ternary Oxides recycling

- IP leadership of patent assignees for Li Phosphates recycling

- IP leadership of patent assignees for other CAM recycling

FOCUS ON IP PLAYERS BY HEADQUARTERS COUNTRY

- For each headquarters country: main patent assignees, IP newcomers, geographical coverage of patent portfolios, technical coverage of patent portfolios, and IP profile of key players.

- Chinese IP players

- Japanese IP players

- South Korean IP players

- American IP players

- European IP players

- Rest of the World

ANNEX

- Methodology for patent search, selection and analysis

- Terminology