|

市场调查报告书

商品编码

1889067

癌症及抗体偶联物专利趋势分析(2025)Cancer & Antibody Conjugates Patent Landscape Analysis 2025 |

|||||||

抗体偶联物 (ADC) 和放射免疫偶联物开启癌症治疗新纪元

主要特点:

- PDF>100 张投影片

- Excel 文件:3,761 个专利族

- 智慧财产权趋势,包括专利公开随时间的变化及申请国家/地区

- 主要专利持有人排名

- 主要参与者的智慧财产权地位及专利组合相对实力

- 细分:抗体(液态肿瘤、仅液态肿瘤、实体肿瘤、仅实体肿瘤)、依主要适应症细分、连接子(可裂解、不可裂解)、有效载荷(药物、放射性同位素)

- 合作及新进者分析

- 包含本报告分析的所有专利的 Excel 资料库(分段资讯 + 指向更新的线上资料库的超连结:法律地位、文件等)

利用抗体进行标靶细胞毒性治疗:癌症偶联物的策略性洞察

癌症抗体偶联物,包括抗体药物偶联物 (ADC) 和放射免疫偶联物,透过将单株抗体的选择性与小分子药物或放射性核素的细胞毒性相结合,实现高度靶向的肿瘤细胞杀伤,正在重塑肿瘤学领域。最近的一项回顾报告称,目前全球约有 15 种 ADC 获准用于治疗血液系统恶性肿瘤和实体肿瘤,另有 200 多种 ADC 正在进行临床试验,400 多种 ADC 正在研发中,凸显了这种治疗方式的快速发展。同时,现代免疫肿瘤学领域对放射免疫偶联物 (RIC) 的兴趣也重新燃起。儘管历史上仅有两种产品获批用于治疗非何杰金氏淋巴瘤,但新兴的临床和临床前数据凸显了它们在精准递送治疗性放射线方面的潜力,尤其是在与其他全身疗法和免疫标靶疗法联合使用时。这些免疫偶联物为难治性疾病的治疗开闢了新途径,拓展了其在早期治疗阶段的应用,并催生了治疗性诊断策略,但它们也面临着毒性、抗药性机制、放射性同位素处理和复杂生产过程等挑战。在这个高度动态的市场环境中,了解主要公司如何围绕抗体、有效载荷、连接子、放射性核素、靶向分子和偶联技术构建其知识产权,对于预测未来的竞争格局、确保市场自由以及指导抗体药物偶联物(ADC)市场的战略决策至关重要。

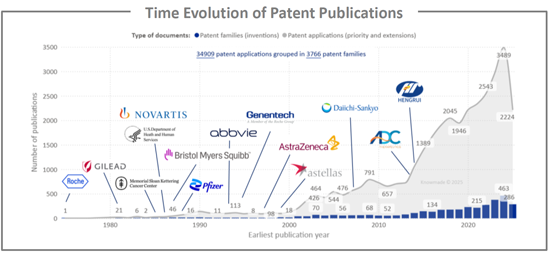

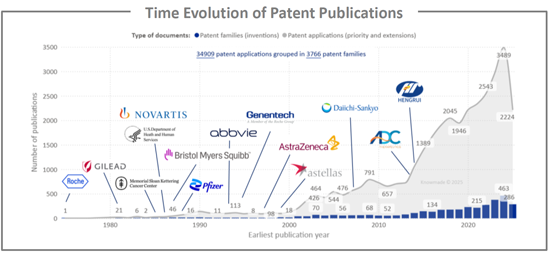

纵观抗体偶联药物 (ADC) 专利揭露的历史,我们可以清楚地看到一个趋势:漫长的发现阶段之后,一旦临床疗效得到证实,申请量就会迅速增长。从 20 世纪 70 年代末到 21 世纪初,每年只有少数专利族提交申请,主要由罗氏等早期拓荒者和学术癌症中心提交。在首批 ADC 获准上市,且临床探索扩展到血液系统恶性肿瘤和乳癌领域后,申请活动开始增加,自 2010 年以来呈现出明显的陡峭成长曲线。这与进入临床阶段的 ADC 数量不断增加以及下一代产品逐步获批(全球已批准 15 种 ADC,开展超过 1500 项临床试验)相吻合。 2018 年至 2024 年间,年度申请数量翻了一番以上,达到每年约 500 个新的专利族。这主要得益于密集的研发投入,包括高效拓扑异构酶I靶向有效载荷(如deruxtecan和govitecan)、新型连接子和位点特异性偶联技术,以及适应症从血液系统恶性肿瘤扩展到实体瘤。在此期间,除了传统的西方製药公司(罗氏/基因泰克、诺华、辉瑞、百时美施贵宝、艾伯维、阿斯特捷利康、吉利德)之外,专注于抗体偶联药物(ADC)的生物技术公司以及快速发展的亚洲公司(如第一三共和恆瑞)也进入了市场,这反映了该领域激烈的全球合作竞争以及积极的许可和全球竞争活动以及积极的许可和全球竞争的全球竞争。近年来略有波动或趋于平稳,以及每个专利家族的专利申请数量较高,表明在日趋成熟但创新迅速的ADC市场中,正从早期技术积累阶段过渡到产品组合整合和地域扩张阶段,这为相关抗体-放射性同位素偶联物(ARC)的发展铺平了道路。

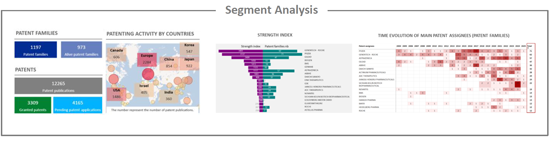

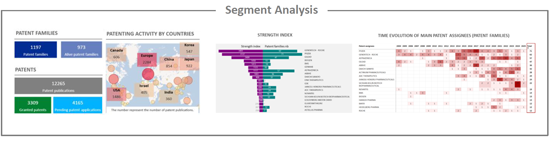

细分市场分析

为了更清楚地了解抗体药物偶联物 (ADC) 领域的创新趋势和研发策略,我们将专利格局分为三大关键技术组成部分:抗体、连接子和有效载荷。每个组成部分在决定 ADC 的特异性、稳定性和治疗特性方面都发挥着关键作用。此智慧财产权模式又细分为八个部分:抗体(依主要适应症划分,包括血液肿瘤、仅用于血液肿瘤、实体肿瘤和仅用于实体肿瘤)、连接子(可裂解型和不可裂解型)以及有效载荷(药物和放射性同位素)。

辨识智慧财产权领域的新兴公司

在持有与双特异性抗体和癌症相关的专利族的公司中,我们发现了147家新进者。这些公司既有新创企业,也有在该领域开发首创技术的成熟企业。大多数新进业者(76家公司)位于中国。在这些创新公司中,有可能出现一家成为下一代医疗保健独角兽企业,吸引大型公司的收购。

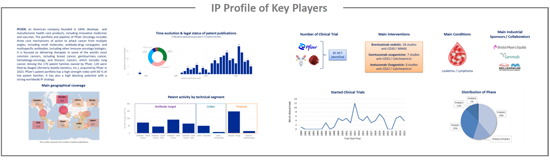

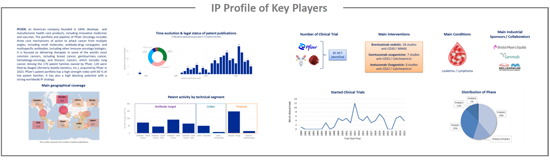

主要进入者的智慧财产权概况

本知识产权研究对主要进入者进行了选择和概述。对主要进入者的专利组合分析包括所有权资讯、专利组合概述、专利揭露趋势、主要地域覆盖范围以及依技术领域划分的有效专利。在此智慧财产权概况概述之后,我们提供了关键专利的技术内容描述以及临床试验摘要表。

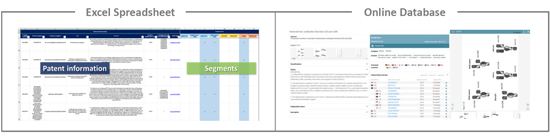

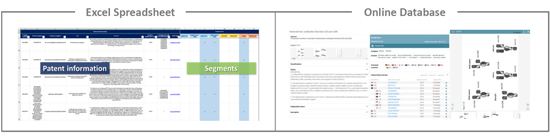

此外,本报告还包含一个Excel电子表格,其中列出了本研究分析的3,761个专利族。这个实用的专利资料库支援多条件检索,包括专利公开号、指向来源文件的超连结、优先权日、标题、摘要、专利权人、每项专利的当前法律状态以及专利分割。它还包含一个“专利线上资料库”,用于更新每份专利文件的法律状态。

本报告中提及的部分公司名单:

|

|

|

等等

目录

引言

- 什么是抗体偶联物?

- 肿瘤学领域的首批批准、机会与挑战

- 研究范围

- 专利检索、筛选与分析

- 检索策略

- Excel资料库

- 阅读指南

摘要整理

专利概况

- 专利公开数量随时间的变化

- 专利申请数最多的申请人排名

- 主要参与者的当前法律地位

- 专利库的法律地位

- 目前主要知识产权持有人分布图

- 主要专利受让人随时间的变化

新晋企业

- 中国企业

- 其他企业

主要申请人的智慧财产权地位

- 专利智慧财产权领导地位申请人

- 专利申请人知识产权现有技术阻断潜力

- 专利引用

- 专利组合实力指数

专利分段

- 意义

- 依技术划分的主要受让人

- 抗体部分

- 连接子部分

- 有效载荷部分

主要参与者的智慧财产权概况

- 概述、关键专利和临床试验:

- 辉瑞

- 基因泰克

- 罗氏

- 艾伯维

- 阿斯特捷利康 吉利德

研究方法

KNOWMADE简报

联络我们

ADC and Radioimmunoconjugates Ignite a New Era in Cancer Therapy

Key Features:

- PDF > 100 slides

- Excel file: 3761 patent families

- IP trends, including time evolution of published patents and countries of patent filings

- Ranking of main patent assignees

- Key players' IP position and relative strength of their patent portfolios

- Segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only-segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

- Analysis of collaborations and newcomers.

- Excel database containing all patents analyzed in the report, including segmentations + hyperlink to updated online database (legal status, documents, etc.)

Harnessing Antibodies for Targeted Cytotoxicity: Strategic Insights into Cancer Conjugates

Cancer antibody conjugates - encompassing antibody-drug conjugates (ADCs) and radioimmunoconjugates - are reshaping oncology by coupling the selectivity of monoclonal antibodies with the cytotoxic power of small-molecule drugs or radionuclides to achieve highly targeted tumor cell killing. Recent reviews report that around 15 ADCs are now approved worldwide for hematologic malignancies and solid tumors, while more than 200 additional ADCs are in clinical trials and over 400 are in development, underscoring the rapid expansion of this modality. In parallel, radioimmunoconjugates are experiencing renewed interest in the era of modern immuno-oncology: despite only two products historically approved for non-Hodgkin's lymphoma, new clinical and preclinical data highlight their potential to deliver therapeutic radiation with precision, particularly when combined with other systemic or immune-targeted therapies. Together, these immunoconjugates open avenues to treat refractory disease, expand into earlier lines of therapy and enable theragnostic strategies, while still facing challenges related to toxicity, resistance mechanisms, radioisotope handling and complex manufacturing. In this highly dynamic context, understanding how key players position their intellectual property on antibodies, payloads, linkers, radionuclides, targets and conjugation technologies is critical to anticipate future competition, secure freedom-to-operate and guide strategic decisions in the cancer antibody conjugate market.

The time evolution of ADC patent publications highlights a long exploratory phase followed by a steep acceleration once the modality was clinically validated. From the late 1970s to mid-2000s, only a handful of patent families were filed each year, mainly by early pioneers such as Roche and academic cancer centers. Activity begins to rise after the first ADC approvals and wider clinical exploration in hematologic malignancies and breast cancer, and then clearly inflects after 2010, in line with the growing number of ADCs entering the clinic and the progressive approval of next-generation products (15 approved ADCs worldwide and >1500 clinical trials). Between 2018 and 2024, annual filings more than double, reaching close to 500 new patent families per year, driven by intensive R&D on highly potent topoisomerase 1 based payloads such as deruxtecan and govitecan, new linker and site-specific conjugation technologies, and expansion from hematologic cancers into solid tumors. Over this period the landscape also broadens from traditional Western pharma (Roche/Genentech, Novartis, Pfizer, BMS, AbbVie, AstraZeneca, Gilead) to include specialized ADC biotechs and fast-growing Asian players such as Daiichi Sankyo and Hengrui, reflecting intense global competition and a strong licensing/partnering dynamic in this field. The slight peak or plateau in the most recent years, combined with the large number of patent applications per family, suggests a transition from early technology build-up to portfolio consolidation and geographic extension, in a maturing but still rapidly innovating ADC market that also paves the way for related antibody-radioisotope conjugates.

Analysis by segment

To better characterize innovation trends and R&D strategies in the ADC field, the patent landscape has been segmented into three main technological components: antibody, linker, and payload. Each component plays a crucial role in defining the specificity, stability, and therapeutic profile of an ADC. This IP landscape features the following 8 types of segmentation: Antibody (liquid cancer, liquid cancer only, solid cancer, solid cancer only - segmentation based on claims), Linker (cleavable, uncleavable) and Payload (drugs, radioisotopes).

Identifying the companies that have recently emerged in the IP landscape

Among the players owning patent families related to Bispecific Ab & cancer, 147 newcomers were identified. These companies are either start-up firms or established companies developing their first technology in the field. Most IP newcomers are based in China (76). It is possible that one of these innovative companies could become one of the next healthcare unicorns that the big corporations will be tempted to acquire.

IP profile of key players

This IP study includes a selection and description of main players. The patent portfolio analysis of main players includes a description of the assignee, patent portfolio description, time evolution of patent publication, main geographical coverage and live patents by technical segment. This IP profile overview is followed by the description of the technological content of their key patents and by a table with its clinical trials.

Moreover, the report includes an Excel spreadsheet with the 3761 patent families analyzed in this study. This useful patent database allows for multi-criteria searches and includes patent publication numbers, hyperlinks to the original documents, priority dates, titles, abstracts, patent assignees, each patent's current legal status and segmentation. The report also includes a Patent Online Database which legal status are updated for each patent document.

Companies mentioned in this report (non-exhaustive list):

|

|

|

etc.

TABLE OF CONTENTS

INTRODUCTION

- What are antibody conjugates?

- First approvals, opportunities & challenges in oncology

- Scope of the report

- Patent search, selection and analysis

- Search strategy

- Excel database

- Reading guide

EXECUTIVE SUMMARY

PATENT LANDSCAPE OVERVIEW

- Time evolution of patent publications

- Ranking of most prolific patent applicants

- Current legal status of the main players

- Patent legal status of the corpus

- Mapping of main current IP holders

- Time evolution of main patent assignees

NEWCOMERS

- Chinese companies

- Other companies

IP POSITION OF MAIN APPLICANTS

- IP leadership of patent applicants

- IP prior art blocking Potential of patent applicants

- Patent citation

- Strength index of patent portfolios

PATENT SEGMENTATION

- Definition

- Main assignees by technology

- antibody moiety

- Linker

- Payload moiety

IP PROFILE OF KEY PLAYERS

- Overview, key patents & clinical trials of:

- Pfizer

- Genentech

- Roche

- AbbVie

- AstraZeneca

- Gilead

METHODOLOGY

- Patent search

- Terminologies

- Key IP players

- Key patents

- selection and analysis