|

市场调查报告书

商品编码

1876465

全球地面行动无线(LMR) 市场(至 2030 年)按类型(携带式/车载式)、技术和频段(25-174MHz、200-512MHz 和 700MHz 以上)划分Land Mobile Radio Market by Type (Hand Portable, In-Vehicle), Technology, Frequency (25-174 MHz, 200-512 MHz, 700 MHZ & above) - Global Forecast to 2030 |

||||||

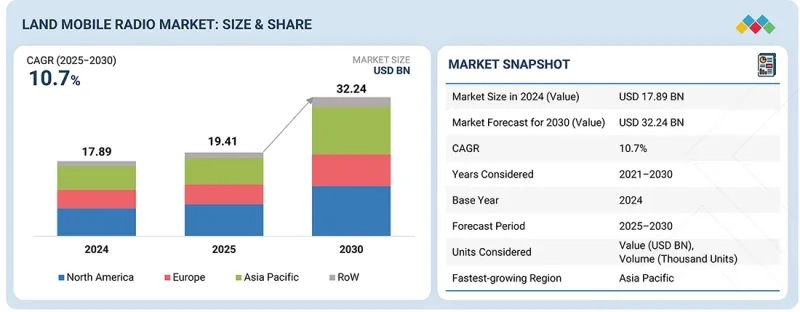

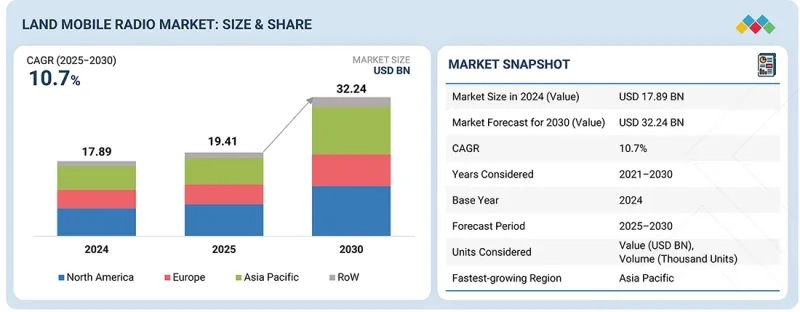

预计地面行动无线(LMR) 市场将从 2024 年的 178.9 亿美元成长到 2030 年的 322.4 亿美元,2025 年至 2030 年的复合年增长率为 10.7%。

陆地移动无线电(LMR)服务被警察、消防和紧急医疗服务部门用于与指挥中心进行互通性和协调。 LMR服务通讯广,可远距使用,高度可靠。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 部分 | 按技术、类型、频率、应用和区域划分 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

此外,LMR系统还具有在行动电话覆盖不到或手机连接不稳定的地区发挥作用的潜力。同时,公共部门也越来越多地采用这些方法作为其最关键的通讯链路。

「按类型划分,在预测期内,携带式的增速将超过车载(移动)设备。”

携带式无线电因其便利的移动性,被安全负责人和建筑、电力等行业的员工广泛使用。虽然车载通讯设备也能在行驶过程中运作,但携带式兼具行动性和基本功能。此外,这些携带式无线电通讯即时讯息,无需现场等待,即可将讯息直接传递给所有操作人员,从而提高职场效率。

从技术角度来看,在预测期内,数位技术将在市场份额上超越类比技术。

数位陆地行动无线电 (LMR) 系统拥有传统双向无线对讲机系统所不具备的独特功能,例如文字通讯、遥测和高品质资料传输。它采用分时多工(TDM) 和频分复用 (FDM) 等先进技术,能够有效利用无线电频谱。数位 LMR 的主要优势在于其音讯品质的提升,这得益于先进的纠错和噪音抑制技术。此外,数位 LMR 的容量也比类比系统更大,允许多个用户同时共用单一频道。

预计在预测期内,美国将占据北美最大的市场份额。

美国市场的成长归功于主要企业的存在以及政府对满足日益增长的陆地行动无线电(LMR)需求的重视,包括先进的资讯服务(LTE)、群组通讯和4G技术,以及为各种行动分配高频率。在美国,LMR设备的主要客户是政府相关人员及其主要承包商,他们需要用于军事和商业用途的先进加密解决方案。此外,在军事和商业领域,安全负责人使用各种无线电系统,包括车载无线电、手持无线电和机载无线电,这些系统使用不同的频段进行通讯和资料通讯。

本报告调查了全球地面行动无线(LMR) 市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、按各个细分市场、地区/主要国家/地区进行的详细分析、竞争格局以及主要企业的概况。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 未满足的需求和差距

- 相互关联的市场与跨产业机会

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 大型会议和活动

- 影响客户业务的趋势/干扰因素

- 投资和资金筹措方案

- 案例研究分析

- 美国关税

第六章:透过科技、专利、数位化和人工智慧的应用实现策略颠覆

- 主要技术

- 互补技术

- 邻近技术

- 技术蓝图

- 专利分析

- 人工智慧将如何影响陆地移动机器人市场

- 相互关联的邻近市场生态系统及其对市场参与者的影响

第七章 监理环境

- 地方法规和合规性

第八章:顾客状况与购买行为

- 决策流程

- 主要相关利益者和采购评估标准

- 招募障碍和内部挑战

- 各行业尚未满足的需求

第九章地面行动无线(LMR)市场按类型划分

- 携带式的

- 车载(移动)

第十章 按技术分類的地面行动无线(LMR)市场

- 模拟

- 数位的

- TETRA

- DIGITAL MOBILE RADIO

- PROJECT 25

第十一章 依频率分類的地面行动无线(LMR)市场

- 25-174 MHz (VHF)

- 200~512 MHz (UHF)

- 700 MHz 以上(超高频)

第十二章地面行动无线(LMR)市场依应用领域划分

- 商业的

- 零售

- 运输

- 公用事业

- 矿业

- 其他的

- 公安

- 军事/国防

- 国防安全保障

- 紧急医疗服务

- 消防部门

- 其他的

第十三章地面行动无线(LMR)市场区域划分

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 其他的

- 亚太地区

- 宏观经济展望

- 中国

- 日本

- 韩国

- 印度

- 其他的

- 其他地区

- 宏观经济展望

- 中东和非洲

- 南美洲

第十四章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 收入分析

- 市占率分析

- 估值和财务指标

- 品牌/产品对比

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小企业

- 竞争场景

第十五章:公司简介

- 主要企业

- SEPURA LIMITED

- MOTOROLA SOLUTIONS, INC.

- L3HARRIS TECHNOLOGIES, INC.

- JVCKENWOOD CORPORATION

- THALES

- ICOM INC.

- BK TECHNOLOGIES

- HYTERA COMMUNICATIONS CORPORATION LIMITED

- LEONARDO SPA

- CODAN LIMITED

- 其他公司

- WEAVIX

- REPLAY INC

- GOTENNA

- TALKPOD TECHNOLOGY CO., LTD.

- QUANZHOU YANTON ELECTRONICS CO., LTD

- KMOBILE COMMUNICATION CO., LTD (ESTALKY)

- COMMCRETE

- ESCHAT

- BOTTLE

- BEARTOOTH

- AIRACOM LIMITED

- TELDIO CORPORATION

- COMMUNICATIONS-APPLIED TECHNOLOGY

- ZETRON

- POWERTRUNK

第十六章调查方法

第十七章附录

The land mobile radio market is projected to grow from USD 17.89 billion in 2024 to reach USD 32.24 billion by 2030, growing at a CAGR of 10.7% from 2025 to 2030. Land mobile radio services are used by police, fire, and emergency medical service agencies for interoperability amongst themselves as well as with dispatch centers. Land mobile radio services have a wide range that extends over long distances, which makes them dependable.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Type, Frequency, Application and Region |

| Regions covered | North America, Europe, APAC, RoW |

Furthermore, LMR systems may be utilized in areas devoid of any mobile phone signal whatsoever or those with an erratic pattern of cell connectivity. At the same time, public safety departments are progressively employing these methods on the most essential lines of communication.

"By type, the hand-portable segment is projected to witness a higher growth rate than the in-vehicle (mobile) segment during the forecast period."

Hand-portable radios are widely utilized by safety officials and employees in sectors like building and power supply, providing ease of movement and comfort. Mobile communication devices in cars work during travel, but portable ones provide mobility and basic features. Additionally, instant messaging is facilitated through these hand-held radios. They eliminate languidness and facilitate issues targeted to all operators directly, leading to an increase in workplace effectiveness.

"By technology, the digital segment is projected to account for a larger market share than the analog segment during the forecast period."

Digital land mobile radio brings out unique aspects of conventional two-way radio systems, including text messaging, telemetry, and high-quality transmission of data. They allow better utilization of radio spectrum by employing sophisticated techniques like time-division multiplexing (TDM) and frequency-division multiplexing (FDM). The significant benefits accruing from using digital LMR are enhanced sound quality resulting from advanced error correction as well as noise suppression methods. Additionally, digital LMRs possess more room compared to their analog counterparts; hence, numerous users could share one channel at a time.

"The US is projected to account for the largest market size in North America during the forecast period."

The growth of the US market is due to the presence of major players and the government's focus on meeting the increasing demand for land mobile radios, including advanced data services (LTE), group communications, 4th generation technology, as well as allocating high-frequency bands for versatile operations. Major customers of LMR devices in the US are government officials and their prime contractors who require high-level encryption solutions for military and commercial purposes. Moreover, in the military and commercial sectors, safety personnel use various radio systems, such as vehicle-mounted radios, hand-held radios, or airborne radios, which operate on different frequencies for voice and data communication.

The study contains insights from various industry experts, such as component suppliers, Tier 1 companies, and OEMs. Extensive primary interviews were conducted with key industry experts in the land mobile radio market space to determine and verify the market size for various segments and subsegments gathered through secondary research.

The breakdown of primary participants for the report is shown below.

- By Company Type: Tier 1 - 20%, Tier 2 - 25%, and Tier 3 - 55%

- By Designation: C-level Executives - 30%, Directors - 30%, and Others - 40%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, and RoW - 10%

Notes:

- Others include Technology Heads, Media Analysts, Sales Managers, Marketing Managers, and Product Managers.

The three tiers of companies are based on their total revenue as of 2024. Given below is the classification of tiers:

Tier : > USD 1 billion; Tier 2: USD 500 million-1 billion; and Tier 3: < USD 500 million

Prominent players profiled in this report include Sepura Limited (UK), Motorola Solutions, Inc. (US), L3Harris Technologies, Inc. (US), JVCKENWOOD Corporation (Japan), Thales (France), Icom Inc. (Japan), BK Technologies (US), Hytera Communications Corporation Limited (China), Leonardo S.p.A. (Italy), and Codan Limited (Australia). Scottish Communications Group (UK), JNB Electronics PTY LTD. (Australia), Burk Technology (US), Anritsu (Japan), Midland Radio (US), Maxon America, Inc. (US), Helios (Australia), Retevis (China), Crescend Technologies, LLC3 (US), Viavi Solutions Inc. (US), Tait Communications (New Zealand), Simoco Wireless Solutions (UK), Entel Group (UK), Tera (US), and PierCon Solutions (US).

Report Coverage

The report defines, describes, and forecasts the land mobile radio market based on type, technology, frequency, application, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the land mobile radio market. Additionally, it analyzes competitive developments, such as acquisitions, product launches, expansions, and actions carried out by the key players.

Reasons to Buy This Report

The report will help market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall land mobile radio market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. It will help them understand the pulse of the market and will provide them with information on key drivers, restraints, opportunities, and challenges.

Additionally, the report will provide insights into the following pointers:

- Analysis of key drivers (Transition from analog to digital LMR technologies), restraints (High deployment and maintenance costs for large-scale LMR infrastructure), opportunities (Integration of LMR with IoT, GPS, and data analytics for advanced field operations), and challenges (Interoperability issues between multi-vendor and multi-technology systems) of the land mobile radio market

- Product development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product launches in the land mobile radio market

- Market Development: Comprehensive information about lucrative markets across various regions

- Market Diversification: Exhaustive information about products launched, untapped geographies, recent developments, and investments in the land mobile radio market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players like Sepura Limited (UK), Motorola Solutions, Inc. (US), L3Harris Technologies, Inc. (US), JVCKENWOOD Corporation (Japan), and Thales (France), among others, in the land mobile radio market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIONS SHAPING LAND MOBILE RADIO MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAND MOBILE RADIO MARKET

- 3.2 LAND MOBILE RADIO MARKET, BY TECHNOLOGY

- 3.3 LAND MOBILE RADIO MARKET, BY TYPE

- 3.4 LAND MOBILE RADIO MARKET, BY FREQUENCY

- 3.5 LAND MOBILE RADIO MARKET, BY APPLICATION

- 3.6 LAND MOBILE RADIO MARKET, BY REGION

- 3.7 LAND MOBILE RADIO MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Transition from analog to digital LMR technologies

- 4.2.1.2 Adoption of hybrid LMR-LTE/5G systems for seamless communication

- 4.2.1.3 Growing government investments in public safety and defense communication networks

- 4.2.1.4 Increasing demand for secure and encrypted communication channels

- 4.2.2 RESTRAINTS

- 4.2.2.1 High deployment and maintenance costs of large-scale LMR infrastructure

- 4.2.2.2 Limited spectrum availability and regulatory constraints

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Integration of LMR with IoT, GPS, and data analytics for advanced field operations

- 4.2.3.2 Expansion in emerging markets driven by smart city and infrastructure projects

- 4.2.4 CHALLENGES

- 4.2.4.1 Interoperability issues between multi-vendor and multi-technology systems

- 4.2.4.2 Cybersecurity risks in digital and hybrid communication environments

- 4.2.1 DRIVERS

- 4.3 UNMET NEEDS AND WHITE SPACES

- 4.3.1 UNMET NEEDS IN LAND MOBILE RADIO MARKET

- 4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4.1 INTERCONNECTED MARKETS

- 4.4.2 CROSS-SECTOR OPPORTUNITIES

- 4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

- 4.5.1 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT FROM NEW ENTRANTS

- 5.2.2 THREAT FROM SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN GLOBAL LAND MOBILE RADIO (LMR) MARKET

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIO TYPES, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY

- 5.6.3 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION

- 5.6.4 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA (HS CODE 852560)

- 5.7.2 EXPORT DATA (HS CODE 852560)

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT & FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MOTOROLA HELPED OAKLAND COUNTY IMPLEMENT ADVANCED COMMUNICATION SOLUTION TO BOOST OPERATIONAL EFFICIENCY

- 5.11.2 ISTANBUL NEW AIRPORT IMPLEMENTED DIGITAL RADIO SYSTEM TO ENSURE RELIABLE AND SECURE COMMUNICATION ACROSS AIRPORT

- 5.11.3 CODON RADIO SOLUTIONS ASSISTED ROYAL MALAYSIA POLICE IN IMPLEMENTING NEW COMMUNICATION SYSTEM TO IMPROVE COVERAGE AND RELIABILITY

- 5.11.4 NESA IMPLEMENTED SEPURA SINE RAKEL SYSTEM TO PROVIDE IMPROVED COVERAGE AND INTEGRATION CAPABILITIES

- 5.11.5 THALES APPROVED IRISH DEFENSE FORCES' SOFTWARE-DEFINED RADIOS TO EXPEDITE DIGITAL TRANSFORMATION

- 5.12 US 2025 TARIFF

- 5.12.1 KEY TARIFF RATES

- 5.12.2 PRICE IMPACT ANALYSIS

- 5.12.3 IMPACT OF REGION/COUNTRY

- 5.12.3.1 US

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.4 IMPACT ON KEY APPLICATIONS

- 5.12.4.1 Commercial

- 5.12.4.2 Public safety

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION

- 6.1 KEY TECHNOLOGIES

- 6.1.1 DIGITAL SIGNAL PROCESSING

- 6.1.2 TRUNKED RADIO SYSTEMS

- 6.1.3 PUSH-TO-TALK OVER CELLULAR

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ENCRYPTION

- 6.3 ADJACENT TECHNOLOGIES

- 6.3.1 IOT

- 6.4 TECHNOLOGY ROADMAP

- 6.5 PATENT ANALYSIS

- 6.6 IMPACT OF AI ON LAND MOBILE RADIO MARKET

- 6.6.1 TOP USE CASES AND MARKET POTENTIAL

- 6.6.2 BEST PRACTICES IN LAND MOBILE RADIO MARKET

- 6.6.3 CLIENTS' READINESS TO ADOPT AI IN LAND MOBILE RADIO MARKET

- 6.7 INTERCONNECTED ADJACENT MARKET ECOSYSTEM AND IMPACT ON MARKET PLAYERS

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.1.3 REGULATIONS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS VERTICALS

9 LAND MOBILE RADIO MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 HAND-PORTABLE 91 9.2.1 GROWING DEMAND FOR HAND-PORTABLE AND EASY-TO-USE MOBILE COMMUNICATION TO DRIVE MARKET

- 9.3 IN-VEHICLE (MOBILE)

- 9.3.1 PRESSING NEED FOR SECURED OPERATIONS AND CONSTANT CONNECTIVITY TO BOOST DEMAND

10 LAND MOBILE RADIO MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 ANALOG

- 10.2.1 GROWING USE OF ANALOG LAND MOBILE RADIO SYSTEMS IN PUBLIC SAFETY SECTOR TO BOOST DEMAND

- 10.3 DIGITAL

- 10.3.1 IMPROVED VOICE CLARITY AND ENHANCED DATA CAPABILITIES TO FOSTER MARKET GROWTH

- 10.3.2 TETRA

- 10.3.2.1 Ability to offer advanced functionalities to boost demand

- 10.3.3 DIGITAL MOBILE RADIO

- 10.3.3.1 Increasing need for DMR in domestic and short-range industrial settings to boost demand

- 10.3.4 PROJECT 25

- 10.3.4.1 Ability to offer backward compatibility and interoperability with other systems to drive market

- 10.3.5 OTHER DIGITAL TECHNOLOGIES

11 LAND MOBILE RADIO MARKET, BY FREQUENCY

- 11.1 INTRODUCTION

- 11.2 25-174 MHZ (VHF)

- 11.2.1 RISING USE IN FM BROADCASTING AND MISSION-CRITICAL COMMUNICATIONS TO DRIVE MARKET

- 11.3 200-512 MHZ (UHF)

- 11.3.1 ABILITY TO OFFER ENHANCED MOBILITY AND IMPROVED SOUND QUALITY IN ADVERSE WEATHER CONDITIONS TO SPUR DEMAND

- 11.4 700 MHZ & ABOVE (SHF)

- 11.4.1 INCREASING USE IN COMMERCIAL, INDUSTRIAL, AND MILITARY SECTORS TO FOSTER MARKET GROWTH

12 LAND MOBILE RADIO MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 COMMERCIAL

- 12.2.1 RETAIL

- 12.2.1.1 Growing demand for multi-language settings to drive market

- 12.2.2 TRANSPORTATION

- 12.2.2.1 Rising focus on security across land, air, and sea transport to boost demand

- 12.2.3 UTILITY

- 12.2.3.1 Focus on regulating power outage to foster growth

- 12.2.4 MINING

- 12.2.4.1 Pressing need for improved communication and safety technologies at mining sites to accelerate demand

- 12.2.5 OTHER COMMERCIAL APPLICATIONS

- 12.2.1 RETAIL

- 12.3 PUBLIC SAFETY

- 12.3.1 MILITARY & DEFENSE

- 12.3.1.1 Ability to offer encrypted channels and secured communication to boost demand

- 12.3.2 HOMELAND SECURITY

- 12.3.2.1 Advent of new technology standards to drive market

- 12.3.3 EMERGENCY & MEDICAL SERVICES

- 12.3.3.1 Integration of digital and trunked systems to accelerate demand

- 12.3.4 FIRE DEPARTMENT

- 12.3.4.1 Rising demand for reliable and uninterrupted radio communication tools to foster market growth

- 12.3.5 OTHER PUBLIC SAFETY APPLICATIONS

- 12.3.1 MILITARY & DEFENSE

13 LAND MOBILE RADIO MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK

- 13.2.2 US

- 13.2.2.1 Advancements in wideband technology to offer lucrative growth opportunities

- 13.2.3 CANADA

- 13.2.3.1 Rising emphasis on developing digital trunking systems and narrowband technologies to drive market

- 13.2.4 MEXICO

- 13.2.4.1 Government-led initiatives to modernize communication infrastructure to spur demand

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Growing shift from analog to digital communication systems to boost demand

- 13.3.3 UK

- 13.3.3.1 Rising demand for reliable and secure communication systems in transportation and utilities sectors to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Increasing deployment of standardized technologies to offer lucrative growth opportunities

- 13.3.5 ITALY

- 13.3.5.1 Digital transformation and public safety modernization to drive growth

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK

- 13.4.2 CHINA

- 13.4.2.1 Low cost of digital terminals to boost demand

- 13.4.3 JAPAN

- 13.4.3.1 Growing application of LMR technology in railways to spur demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Ongoing developments in mobile communication devices to accelerate demand

- 13.4.5 INDIA

- 13.4.5.1 Ongoing developments in mobile communication to accelerate demand

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW (REST OF THE WORLD)

- 13.5.1 MACROECONOMIC OUTLOOK

- 13.5.2 MIDDLE EAST & AFRICA

- 13.5.2.1 Rising need to enhance security and emergency response capabilities to accelerate demand

- 13.5.2.2 GCC Countries

- 13.5.2.3 Rest of Middle East

- 13.5.3 SOUTH AMERICA

- 13.5.3.1 Growing privatization of telecommunication services to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 14.3 REVENUE ANALYSIS, 2021-2024

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Regional footprint

- 14.7.5.3 Application footprint

- 14.7.5.4 Technology footprint

- 14.7.5.5 Type footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SEPURA LIMITED

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 MOTOROLA SOLUTIONS, INC.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 L3HARRIS TECHNOLOGIES, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 JVCKENWOOD CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 THALES

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Other developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 ICOM INC.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.7 BK TECHNOLOGIES

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.8 HYTERA COMMUNICATIONS CORPORATION LIMITED

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.9 LEONARDO S.P.A.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 CODAN LIMITED

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.1 SEPURA LIMITED

- 15.2 OTHER PLAYERS

- 15.2.1 WEAVIX

- 15.2.2 REPLAY INC

- 15.2.3 GOTENNA

- 15.2.4 TALKPOD TECHNOLOGY CO., LTD.

- 15.2.5 QUANZHOU YANTON ELECTRONICS CO., LTD

- 15.2.6 KMOBILE COMMUNICATION CO., LTD (ESTALKY)

- 15.2.7 COMMCRETE

- 15.2.8 ESCHAT

- 15.2.9 BOTTLE

- 15.2.10 BEARTOOTH

- 15.2.11 AIRACOM LIMITED

- 15.2.12 TELDIO CORPORATION

- 15.2.13 COMMUNICATIONS-APPLIED TECHNOLOGY

- 15.2.14 ZETRON

- 15.2.15 POWERTRUNK

16 RESEARCH METHODOLOGY

- 16.1 RESEARCH DATA

- 16.1.1 SECONDARY DATA

- 16.1.1.1 List of key secondary sources

- 16.1.1.2 Key data from secondary sources

- 16.1.2 PRIMARY DATA

- 16.1.2.1 List of key interview participants

- 16.1.2.2 Breakdown of primaries

- 16.1.2.3 Key data from primary sources

- 16.1.2.4 Key industry insights

- 16.1.3 SECONDARY AND PRIMARY RESEARCH

- 16.1.1 SECONDARY DATA

- 16.2 MARKET SIZE ESTIMATION

- 16.2.1 BOTTOM-UP APPROACH

- 16.2.1.1 Approach to estimate market size using bottom-up analysis (supply side)

- 16.2.2 TOP-DOWN APPROACH

- 16.2.2.1 Approach to estimate market size using top-down analysis (demand side)

- 16.2.1 BOTTOM-UP APPROACH

- 16.3 DATA TRIANGULATION

- 16.4 RESEARCH ASSUMPTIONS

- 16.5 RISK ASSESSMENT

- 16.6 RESEARCH LIMITATIONS

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LAND MOBILE RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 3 ROLE OF PLAYERS IN LAND MOBILE RADIO MARKET ECOSYSTEM

- TABLE 4 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY TYPE, 2021-2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION, 2021-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- TABLE 8 IMPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 11 RECIPROCAL TARIFF RATES ADJUSTED BY US

- TABLE 12 LIST OF PATENTS APPLIED/GRANTED, JUNE 2021-NOVEMBER 2025

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING AI IN LAND MOBILE RADIO MARKET

- TABLE 15 INTERCONNECTED ADJACENT MARKET ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- TABLE 21 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 22 UNMET NEEDS IN LAND MOBILE RADIO MARKET, BY APPLICATION

- TABLE 23 LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 26 LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 27 HAND-PORTABLE: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 28 HAND-PORTABLE: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 IN-VEHICLE (MOBILE): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 IN-VEHICLE (MOBILE): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 32 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 33 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 34 LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 35 ANALOG: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 ANALOG: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 DIGITAL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 DIGITAL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 40 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 41 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 42 DIGITAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 43 TETRA: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 TETRA: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DMR: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 DMR: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 P25: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 P25: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 OTHER DIGITAL TECHNOLOGIES: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 OTHER DIGITAL TECHNOLOGIES: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 52 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 53 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 54 LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 55 25-174 MHZ (VHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 25-174 MHZ (VHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 200-512 MHZ (UHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 200-512 MHZ (UHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 700 MHZ & ABOVE (SHF): LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 700 MHZ & ABOVE (SHF): LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 62 LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 64 LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 65 COMMERCIAL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 COMMERCIAL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 68 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 69 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 70 COMMERCIAL: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 71 RETAIL: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 RETAIL: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 TRANSPORTATION: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TRANSPORTATION: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 UTILITY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 UTILITY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MINING: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 MINING: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 OTHER COMMERCIAL APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 OTHER COMMERCIAL APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 84 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 85 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 86 PUBLIC SAFETY: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 87 MILITARY & DEFENSE: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 MILITARY & DEFENSE: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 HOMELAND SECURITY: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 HOMELAND SECURITY: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 EMERGENCY & MEDICAL SERVICES: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 EMERGENCY & MEDICAL SERVICES: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 FIRE DEPARTMENT: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 FIRE DEPARTMENT: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 OTHER PUBLIC SAFETY APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 OTHER PUBLIC SAFETY APPLICATIONS: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 100 LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (THOUSAND UNITS)

- TABLE 101 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 104 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 105 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 108 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 109 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 112 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 113 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 116 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 117 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 122 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 123 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 126 NORTH AMERICA: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 127 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: LAND MOBILE RADIO MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 US: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 US: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 US: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 132 US: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 133 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 134 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 135 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 136 US: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 137 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 140 US: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 141 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 142 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 143 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 144 US: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 145 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 148 US: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 149 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 150 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 151 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 152 US: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 153 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 154 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 155 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 156 US: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 157 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 158 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 159 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 160 EUROPE: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 161 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 162 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 164 EUROPE: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 165 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 166 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 168 EUROPE: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 169 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 170 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 172 EUROPE: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 173 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 EUROPE: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 177 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 178 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 180 EUROPE: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 181 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 182 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 183 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 184 EUROPE: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 185 EUROPE: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 187 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 188 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 190 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 191 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 194 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 195 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 196 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 198 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 199 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 200 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 202 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 203 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 204 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 206 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 207 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 208 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 210 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 211 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 212 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 214 ASIA PACIFIC: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 215 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 216 ASIA PACIFIC: LAND MOBILE RADIO MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 217 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 218 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 219 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 220 ROW: LAND MOBILE RADIO MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 221 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 222 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 223 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND UNITS)

- TABLE 224 ROW: LAND MOBILE RADIO MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND UNITS)

- TABLE 225 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 226 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 227 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 228 ROW: LAND MOBILE RADIO MARKET FOR DIGITAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 229 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (USD MILLION)

- TABLE 230 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (USD MILLION)

- TABLE 231 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2021-2024 (THOUSAND UNITS)

- TABLE 232 ROW: LAND MOBILE RADIO MARKET, BY FREQUENCY, 2025-2030 (THOUSAND UNITS)

- TABLE 233 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 234 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 235 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 236 ROW: LAND MOBILE RADIO MARKET, BY APPLICATION, 2025-2030 (THOUSAND UNITS)

- TABLE 237 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 238 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 239 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 240 ROW: LAND MOBILE RADIO MARKET FOR COMMERCIAL, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 241 ROW: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 242 ROW: LAND MOBILE RADIO MARKET FOR PUBLIC SAFETY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 243 ROW: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 244 ROW: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: LAND MOBILE RADIO MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: LAND MOBILE RADIO MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 247 OVERVIEW OF STRATEGIES ADOPTED BY LAND MOBILE RADIO PROVIDERS

- TABLE 248 LAND MOBILE RADIO MARKET SHARE ANALYSIS, 2024

- TABLE 249 LAND MOBILE RADIO MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 250 LAND MOBILE RADIO MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 251 LAND MOBILE RADIO MARKET: TECHNOLOGY FOOTPRINT, 2024

- TABLE 252 LAND MOBILE RADIO MARKET: TYPE FOOTPRINT, 2024

- TABLE 253 LAND MOBILE RADIO MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 254 LAND MOBILE RADIO MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 255 LAND MOBILE RADIO MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-SEPTEMBER 2025

- TABLE 256 LAND MOBILE RADIO MARKET: DEALS, JANUARY 2021-SEPTEMBER 2025

- TABLE 257 SEPURA LIMITED: COMPANY OVERVIEW

- TABLE 258 SEPURA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 SEPURA LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 260 SEPURA LIMITED: DEALS

- TABLE 261 MOTOROLA SOLUTIONS, INC.: COMPANY OVERVIEW

- TABLE 262 MOTOROLA SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 MOTOROLA SOLUTIONS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 264 MOTOROLA SOLUTIONS, INC.: DEALS

- TABLE 265 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 266 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 268 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 269 JVCKENWOOD CORPORATION: COMPANY OVERVIEW

- TABLE 270 JVCKENWOOD CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERING

- TABLE 271 JVCKENWOOD CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 272 JVCKENWOOD CORPORATION: DEALS

- TABLE 273 THALES: COMPANY OVERVIEW

- TABLE 274 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 THALES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 276 THALES: DEALS

- TABLE 277 THALES: OTHER DEVELOPMENTS

- TABLE 278 ICOM INC.: COMPANY OVERVIEW

- TABLE 279 ICOM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 ICOM INC.: DEALS

- TABLE 281 BK TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 282 BK TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 BK TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 284 BK TECHNOLOGIES: DEALS

- TABLE 285 HYTERA COMMUNICATIONS CORPORATION LIMITED: COMPANY OVERVIEW

- TABLE 286 HYTERA COMMUNICATIONS CORPORATION LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 287 HYTERA COMMUNICATIONS CORPORATION LIMITED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 288 HYTERA COMMUNICATIONS CORPORATION LIMITED: DEALS

- TABLE 289 LEONARDO S.P.A.: COMPANY OVERVIEW

- TABLE 290 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 CODAN LIMITED: COMPANY OVERVIEW

- TABLE 292 CODAN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 WEAVIX: COMPANY OVERVIEW

- TABLE 294 RELAY INC: COMPANY OVERVIEW

- TABLE 295 GOTENNA: COMPANY OVERVIEW

- TABLE 296 TALKPOD TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 297 QUANZHOU YANTON ELECTRONICS CO., LTD: COMPANY OVERVIEW

- TABLE 298 KMOBILE COMMUNICATION CO., LTD (ESTALKY): COMPANY OVERVIEW

- TABLE 299 COMMCRETE: COMPANY OVERVIEW

- TABLE 300 ESCHAT: COMPANY OVERVIEW

- TABLE 301 BOTTLE: COMPANY OVERVIEW

- TABLE 302 BEARTOOTH: COMPANY OVERVIEW

- TABLE 303 AIRACOM LIMITED: COMPANY OVERVIEW

- TABLE 304 TELDIO CORPORATION: COMPANY OVERVIEW

- TABLE 305 COMMUNICATIONS-APPLIED TECHNOLOGY: COMPANY OVERVIEW

- TABLE 306 ZETRON: COMPANY OVERVIEW

- TABLE 307 POWERTRUNK: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL LAND MOBILE RADIO MARKET, 2025-2030 (USD MILLION)

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LAND MOBILE RADIO MARKET (2021-2025)

- FIGURE 5 DISRUPTIONS INFLUENCING LAND MOBILE RADIO MARKET GROWTH

- FIGURE 6 HIGH-GROWTH SEGMENTS IN LAND MOBILE RADIO MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 INCREASING DEMAND FOR SECURE AND ENCRYPTED COMMUNICATION CHANNELS TO DRIVE MARKET

- FIGURE 9 DIGITAL SEGMENT TO ACHIEVE HIGHER CAGR THAN ANALOG SEGMENT DURING FORECAST PERIOD

- FIGURE 10 HAND-PORTABLE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 700 MHZ & ABOVE (SHF) SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 12 COMMERCIAL SEGMENT TO WITNESS HIGHER GROWTH THAN PUBLIC SAFETY SEGMENT DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 14 CHINA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 LAND MOBILE RADIO MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 IMPACT ANALYSIS OF MARKET DRIVERS

- FIGURE 17 IMPACT ANALYSIS OF MARKET RESTRAINTS

- FIGURE 18 IMPACT ANALYSIS OF MARKET OPPORTUNITIES

- FIGURE 19 IMPACT ANALYSIS OF MARKET CHALLENGES

- FIGURE 20 LAND MOBILE RADIO MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 LAND MOBILE RADIO MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 LAND MOBILE RADIO MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIO TYPES, BY KEY PLAYER, 2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY TYPE, 2021-2024 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY FREQUENCY 2021-2024 (USD)

- FIGURE 26 AVERAGE SELLING PRICE TREND OF LAND MOBILE RADIOS, BY APPLICATION, 2021-2024 (USD)

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024 (USD)

- FIGURE 28 IMPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 852560-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR LAND MOBILE RADIO MARKET PLAYERS

- FIGURE 31 INVESTMENT & FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 32 EVOLUTION OF LAND MOBILE RADIO TECHNOLOGIES

- FIGURE 33 PATENTS APPLIED AND GRANTED, 2013-2024

- FIGURE 34 LAND MOBILE RADIO MARKET: FACTORS INFLUENCING DECISION-MAKING

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR APPLICATIONS

- FIGURE 36 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 37 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 38 HAND-PORTABLE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE THAN IN-VEHICLE (MOBILE) SEGMENT BY 2030

- FIGURE 39 DIGITAL SEGMENT TO EXHIBIT SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 40 700 MHZ & ABOVE (SHF) SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 41 PUBLIC SAFETY SEGMENT TO LEAD MARKET IN 2025

- FIGURE 42 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2030

- FIGURE 43 NORTH AMERICA: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 44 US TO ACCOUNT FOR LARGEST MARKET IN 2025

- FIGURE 45 EUROPE: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 46 GERMANY TO ACCOUNT FOR LARGEST MARKET IN 2025

- FIGURE 47 ASIA PACIFIC: LAND MOBILE RADIO MARKET SNAPSHOT

- FIGURE 48 CHINA TO ACCOUNT FOR LARGEST SHARE IN 2030

- FIGURE 49 MIDDLE EAST & AFRICA TO LEAD LAND MOBILE RADIO MARKET IN 2030

- FIGURE 50 REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2021-2024 (USD MILLION)

- FIGURE 51 LAND MOBILE RADIO MARKET: MARKET SHARE OF KEY PLAYERS

- FIGURE 52 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA), 2025

- FIGURE 54 BRAND/PRODUCT COMPARISON

- FIGURE 55 LAND MOBILE RADIO MARKET: COMPETITIVE EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 LAND MOBILE RADIO MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 57 LAND MOBILE RADIO MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 MOTOROLA SOLUTIONS, INC.: COMPANY SNAPSHOT

- FIGURE 59 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 60 JVCKENWOOD CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 THALES: COMPANY SNAPSHOT

- FIGURE 62 ICOM INC.: COMPANY SNAPSHOT

- FIGURE 63 BK TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 64 LEONARDO S.P.A.: COMPANY SNAPSHOT

- FIGURE 65 CODAN LIMITED: COMPANY SNAPSHOT

- FIGURE 66 LAND MOBILE RADIO MARKET: RESEARCH DESIGN

- FIGURE 67 LAND MOBILE RADIO MARKET: RESEARCH FLOW

- FIGURE 68 LAND MOBILE RADIO MARKET: BOTTOM-UP APPROACH

- FIGURE 69 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY LAND MOBILE RADIO MANUFACTURERS

- FIGURE 70 LAND MOBILE RADIO MARKET: TOP-DOWN APPROACH

- FIGURE 71 DATA TRIANGULATION