|

市场调查报告书

商品编码

1780346

固体冷却市场:冷却系统、冷却系统、热电冷却、电热冷却、磁热冷却、冷却器、空调、空调、冰箱、冷冻库- 预测至 2030 年Solid State Cooling Market by Cooling System, Refrigeration System, Thermoelectric Cooling, Electrocaloric Cooling, Magnetocaloric Cooling, Chiller, Cooler, Air Conditioner, Refrigerator and Freezer - Global Forecast to 2030 |

||||||

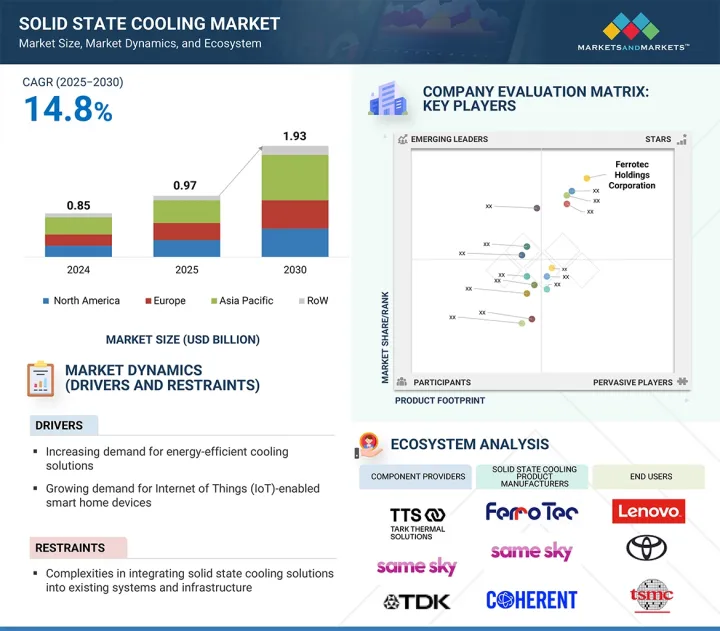

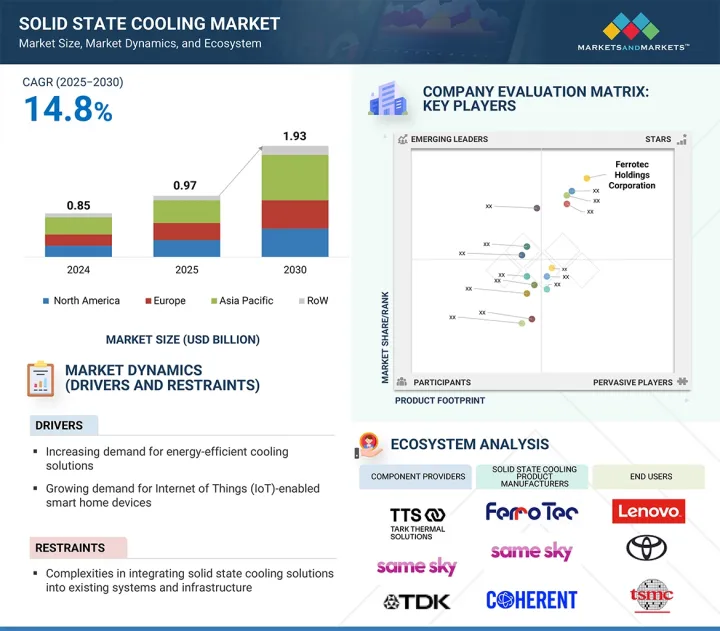

预计全球固体冷却市场规模在 2025 年将达到 9.7 亿美元,到 2030 年将达到 19.3 亿美元,2025 年至 2030 年的复合年增长率为 14.8%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 产品、技术、产业、区域 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

敏感医疗设备对静音和无振动冷却的需求日益增长,以及工业自动化、通讯和半导体製造领域对低维护热感解决方案的日益普及,是主要驱动因素。此外,电动车越来越多地使用固体冷却技术来控制电池和驾驶室的局部温度,这也推动了对固体冷却系统的需求。

“预计到 2025 年,冰箱市场将占据冷冻系统市场的最大份额。”

由于冰箱在住宅、商业和医疗领域的广泛应用,预计到2025年,冰箱领域将在冷冻系统固体冷却市场中占据最大份额。固体冷却冰箱采用热电冷却技术,与传统系统相比具有许多优势,包括运转安静、体积小巧、无需冷媒以及维护成本低。这些特性使其特别适合小型冷冻需求,例如迷你冰箱、可携式医疗储存单元以及高端家电的专用冷冻设备。此外,市场对节能环保冷冻方案的需求日益增长,以及可携式和紧凑型冷冻系统在医疗和个人用途上的日益普及,将继续推动该产品的主导地位。随着材料效率的提高和製造成本的下降,固体冷却冰箱正成为已开发市场和新兴市场更可行、更具吸引力的解决方案。

“预计 2025 年至 2030 年期间,空调领域将成为製冷系统市场中复合年增长率最高的领域。”

预计空调领域将在预测期内在冷却系统市场中实现最高的复合年增长率,这得益于对紧凑、节能、无冷媒的传统 HVAC 系统替代品日益增长的需求。固体冷却空调系统,尤其是基于热电和电热技术的系统,可安静运作、精确控制温度,并可融入局部或个人气候区。随着对永续性和旨在减少传统空调气体排放的环境法规的日益关注,产业和消费者正在寻求用于住宅、汽车和商业应用的固体冷却解决方案。持续的研发和材料进步正在提高系统性能和扩充性,使固体冷却空调作为空间受限和离网环境中的下一代空调解决方案越来越有吸引力。

“预计2025年至2030年期间,中国将在全球固体冷却市场中呈现最高的复合年增长率。”

预测期内,中国预计将成为全球固体冷却市场复合年增长率最高的国家,这得益于其电子製造业基地的快速扩张、电动车的强劲发展势头,以及工业、工业和消费领域对节能散热解决方案的需求不断增长。在政府优惠政策和研发资金的支持下,减少对传统冷媒系统依赖的措施正在推动固体冷却技术的普及。此外,关键零件製造商的布局、国内消费的不断增长以及热电材料的持续进步,使中国成为全球市场的关键成长引擎。

本报告研究了全球固体冷却市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 固体冷却市场为企业带来诱人机会

- 固体冷却市场:按产品

- 固体冷却市场:依行业

- 固体冷却市场(按地区)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 主要企业冷却器平均售价(2024年)

- 冷却器平均售价趋势(按地区)(2020-2024)

- 价值链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 专利分析

- 贸易分析

- 导入数据

- 汇出数据

- 大型会议和活动(2025-2026年)

- 案例研究分析

- 标准和监管环境

- 监管机构、政府机构和其他组织

- 固体冷却市场相关标准与法规

- 波特五力分析

- 主要相关利益者和采购标准

- 2025年美国关税对固体冷却市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对产业的影响

第六章固体冷却系统的组成部分

- 介绍

- 冷冻系统元件

- TEC模组(冷气级)

- 紧凑型控制单元

- 热感界面材料

- 冷冻系统的其他部件

- 冷却系统元件

- 大容量TEC模组/连锁TEC

- 智慧控制板

- 散热器和散热片

- 热感界面材料

- 冷却系统的其他部件

第七章固体冷却市场:依产品

- 介绍

- 冷冻系统

- 冰箱

- 冷冻库

- 冷却系统

- 空调

- 冷却器

- 冷却器

第 8 章固体冷却市场:按技术

- 介绍

- 热电冷却

- 电热冷却

- 磁热冷却

- 其他技术

第九章固体冷却市场:依行业

- 介绍

- 车

- 消费性电子和半导体

- 医疗保健

- 其他行业

第 10 章固体冷却市场(按区域)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 中东

- 南美洲

- 非洲

第十一章竞争格局

- 介绍

- 主要参与企业的策略/优势,2020 年 1 月至 2025 年 4 月

- 收益分析(2020-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 品牌/产品比较

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十二章:公司简介

- 主要企业

- COHERENT CORP.

- DELTA ELECTRONICS, INC.

- FERROTEC HOLDINGS CORPORATION

- TARK THERMAL SOLUTIONS

- KOMATSU LTD.

- CRYSTAL LTD.

- SAME SKY

- SOLID STATE COOLING SYSTEMS, INC.

- TE TECHNOLOGY, INC.

- TEC MICROSYSTEMS GMBH

- 其他公司

- ALIGN SOURCING LLC.

- AMS TECHNOLOGIES AG

- EVERREDTRONICS

- XIAMEN HICOOL ELECTRONICS CO., LTD.

- INHECO INDUSTRIAL HEATING & COOLING GMBH

- KRYOTHERM

- MERIT TECHNOLOGY GROUP

- PHONONIC

- SHEETAK INC.

- THERMONAMIC ELECTRONICS (JIANGXI) CORP., LTD.

- WELLEN TECHNOLOGY CO., LTD.

- EUROPEAN THERMODYNAMICS LTD.

- THERMOELECTRIC COOLING AMERICA CORPORATION

- MEERSTETTER ENGINEERING

- CUSTOM THERMOELECTRIC, LLC

第十三章 附录

The global solid state cooling market is expected to reach USD 0.97 billion in 2025 and USD 1.93 billion by 2030, registering at a CAGR of 14.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Technology, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for silent, vibration-free cooling in sensitive medical and laboratory devices and the growing adoption of low-maintenance thermal solutions in industrial automation, telecom, and semiconductor manufacturing are key drivers. Furthermore, the increasing use of solid state cooling in electric vehicles for localized battery and cabin temperature control augments the demand for solid state cooling systems.

"Refrigerators segment is expected to hold the largest share of the market for refrigeration systems in 2025."

The refrigerators segment is expected to hold the largest share of the solid state cooling market for refrigeration systems in 2025 due to their widespread use across residential, commercial, and medical applications. Solid state cooling refrigerators, which utilize thermoelectric cooling, offer several advantages over traditional systems, including silent operation, compact size, no use of refrigerants, and low maintenance. These features make them particularly suitable for small-scale cooling needs such as mini-fridges, portable medical storage units, and specialty refrigeration in premium consumer appliances. Additionally, the increasing demand for energy-efficient and environmentally friendly refrigeration options and the rising adoption of portable and compact refrigeration systems in healthcare and personal use continue to drive its dominance. As material efficiency improves and manufacturing costs decline, solid state cooling refrigerators are becoming a more viable and attractive solution for developed and emerging markets.

"Air conditioners segment is projected to witness the highest CAGR in market for cooling systems segment between 2025 and 2030."

The air conditioners segment is expected to register the highest CAGR in the market for cooling systems during the forecast period due to the growing demand for compact, energy-efficient, and refrigerant-free alternatives to traditional HVAC systems. Solid state cooling air conditioning systems, particularly those based on thermoelectric and electrocaloric technologies, offer silent operation, precise temperature control, and the potential for integration into localized or personal climate zones. With increasing focus on sustainability and environmental regulations targeting the reduction of greenhouse gas emissions from conventional air conditioners, industries and consumers are exploring solid state cooling solutions for residential, automotive, and commercial applications. Ongoing R&D and material advancements improve system performance and scalability, making solid state cooling air conditioning increasingly attractive for next-generation climate control solutions in space-constrained or off-grid environments.

"China is expected to exhibit the highest CAGR in the global solid state cooling market from 2025 to 2030."

China is likely to exhibit the highest CAGR in the global solid state cooling market during the forecast period due to its rapidly expanding electronics manufacturing base, strong push for electric vehicle adoption, and growing demand for energy-efficient thermal solutions across medical, industrial, and consumer sectors. The focus on reducing reliance on conventional refrigerant-based systems, supported by favorable government policies and R&D funding, boosts the adoption of solid state cooling technologies. Additionally, the presence of major component manufacturers, rising domestic consumption, and ongoing advancements in thermoelectric materials position China as a key growth engine in the global market.

Extensive primary interviews were conducted with key industry experts in the solid state cooling market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 15%, Europe - 20%, Asia Pacific - 55%, and RoW - 10%

Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) are some of the key players in the solid state cooling market.

Research Coverage:

This research report categorizes the solid state cooling market based on product (cooling systems and refrigeration systems), technology (thermoelectric cooling, electrocaloric cooling, magnetocaloric cooling, and other technologies), vertical (automotive, consumer electronics & semiconductors, healthcare, and other verticals), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the solid state cooling market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the solid state cooling ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall solid state cooling market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (surging demand for energy-efficient cooling solutions; rising implementation of IoT-enabled smart home devices; growing adoption of electric and hybrid electric vehicles; booming data center industry), restraints (high initial investment and manufacturing costs associated with solid state cooling technology; complexities in integrating solid state cooling solutions into existing systems and infrastructure; regulatory barriers and standards compliance requirements in healthcare and automotive industries), opportunities (emerging applications of solid state cooling technology in aerospace, defense, and consumer sectors; growing industrialization and urbanization), and challenges (complexities in designing and engineering solid state cooling systems for diverse applications and operating conditions; shortage of qualified experts with technical know-how regarding thermoelectric cooling and thermal management) influencing the growth of the solid state cooling market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the solid state cooling market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the solid state cooling market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the solid state cooling market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) in the solid state cooling market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLID STATE COOLING MARKET

- 4.2 SOLID STATE COOLING MARKET, BY PRODUCT

- 4.3 SOLID STATE COOLING MARKET, BY VERTICAL

- 4.4 SOLID STATE COOLING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for energy-efficient cooling solutions

- 5.2.1.2 Rising implementation of IoT-enabled smart home devices

- 5.2.1.3 Growing adoption of electric and hybrid electric vehicles

- 5.2.1.4 Thriving data center industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and manufacturing costs associated with solid state cooling technology

- 5.2.2.2 Complexities associated with integrating solid state cooling solutions into existing systems and infrastructure

- 5.2.2.3 Regulatory barriers and standards compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment in aerospace, defense, and consumer sectors

- 5.2.3.2 Expanding industrialization and urbanization

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with designing and engineering solid state cooling systems

- 5.2.4.2 Shortage of qualified experts with technical knowledge

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION, 2020-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Thermoelectric cooling

- 5.8.1.2 Magnetic cooling

- 5.8.1.3 Electrocaloric cooling

- 5.8.1.4 Thermoelastic cooling

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Heat exchangers

- 5.8.2.2 Thermal interface materials (TIMs)

- 5.8.2.3 Temperature sensors and control systems

- 5.8.2.4 Power electronics and drivers

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Thermal management solutions

- 5.8.3.2 Energy harvesting systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 INTEL INTEGRATED PHONONIC'S SOLID STATE COOLING TECHNOLOGY INTO ITS DATA CENTERS TO REDUCE ENERGY CONSUMPTION AND ENVIRONMENTAL IMPACT

- 5.12.2 THERMO FISHER SCIENTIFIC INCORPORATED TE TECHNOLOGY'S SOLID-STATE COOLING MODULES INTO ITS ULTRA-LOW TEMPERATURE FREEZERS TO ENSURE PRECISE TEMPERATURE CONTROL AND STABILITY

- 5.12.3 BMW GROUP IMPLEMENTED II-VI MARLOW'S THERMOELECTRIC COOLING MODULES IN ELECTRIC VEHICLES TO ENSURE EFFICIENT OPERATION AND PREVENT OVERHEATING

- 5.12.4 PHILIPS HEALTHCARE INTEGRATED LAIRD'S SOLID-STATE COOLING MODULES INTO ITS MEDICAL IMAGING EQUIPMENT TO MAINTAIN OPTIMAL OPERATING TEMPERATURE

- 5.12.5 NASA PARTNERED WITH ATG TO DEVELOP SOLID STATE COOLING SYSTEMS FOR SPACE MISSIONS

- 5.13 STANDARDS AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS AND REGULATIONS RELATED TO SOLID STATE COOLING MARKET

- 5.13.2.1 International Electrotechnical Commission (IEC) standards

- 5.13.2.2 Underwriters Laboratories (UL) Standards

- 5.13.2.3 ISO standards

- 5.13.2.4 Energy star certification

- 5.13.2.5 Safety regulations

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF 2025 US TARIFF ON SOLID STATE COOLING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON VERTICALS

6 COMPONENTS OF SOLID STATE COOLING SYSTEMS

- 6.1 INTRODUCTION

- 6.2 REFRIGERATION SYSTEM COMPONENTS

- 6.2.1 TEC MODULES (REFRIGERATION-GRADE)

- 6.2.2 COMPACT CONTROL UNITS

- 6.2.3 THERMAL INTERFACE MATERIALS

- 6.2.4 OTHER COMPONENTS IN REFRIGERATION SYSTEMS

- 6.3 COOLING SYSTEM COMPONENTS

- 6.3.1 HIGH-CAPACITY TEC MODULES/CASCADE TECS

- 6.3.2 SMART CONTROL BOARDS

- 6.3.3 HEAT SPREADERS & HEAT SINKS

- 6.3.4 THERMAL INTERFACE MATERIALS

- 6.3.5 OTHER COMPONENTS IN COOLING SYSTEMS

7 SOLID STATE COOLING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 REFRIGERATION SYSTEMS

- 7.2.1 REFRIGERATORS

- 7.2.1.1 Advancements in materials science, semiconductor technology, and thermal management to boost segmental growth

- 7.2.2 FREEZERS

- 7.2.2.1 Increasing demand for energy-efficient and environmentally friendly cooling solutions to drive market

- 7.2.1 REFRIGERATORS

- 7.3 COOLING SYSTEMS

- 7.3.1 AIR CONDITIONERS

- 7.3.1.1 Growing demand for cooling solutions with precise control and minimal maintenance to boost demand

- 7.3.2 COOLERS

- 7.3.2.1 Surging demand for compact and high-power electronics to offer lucrative growth opportunities

- 7.3.3 CHILLERS

- 7.3.3.1 Increasing demand for precise temperature control in medical equipment to support market growth

- 7.3.1 AIR CONDITIONERS

8 SOLID STATE COOLING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 THERMOELECTRIC COOLING

- 8.2.1 GROWING APPLICATIONS IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND MEDICAL DEVICES TO FOSTER MARKET GROWTH

- 8.2.2 TYPES OF THERMOELECTRIC COOLING

- 8.2.2.1 Single-stage

- 8.2.2.2 Multi-stage

- 8.2.2.3 Thermocycler

- 8.3 ELECTROCALORIC COOLING

- 8.3.1 CLIMATE-FRIENDLY COOLING AND RAPID RESPONSE TIME TO DRIVE MARKET

- 8.4 MAGNETOCALORIC COOLING

- 8.4.1 LOW ENERGY CONSUMPTION AND REDUCED NOISE LEVELS TO FOSTER MARKET GROWTH

- 8.5 OTHER TECHNOLOGIES

9 SOLID STATE COOLING MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 ACCELERATED EV ADOPTION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.2.2 CASE STUDY: BMW COLLABORATED WITH GENTHERM TO INTEGRATE SOLID STATE COOLING SYSTEMS IN ITS VEHICLES FOR PERSONALIZED CLIMATE CONTROL

- 9.2.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON AUTOMOTIVE VERTICAL

- 9.3 CONSUMER ELECTRONICS & SEMICONDUCTOR

- 9.3.1 RISE OF EDGE COMPUTING AND ALWAYS-ON FEATURES IN MOBILE AND IOT DEVICES TO BOOST DEMAND

- 9.3.2 CASE STUDY: INTEL COLLABORATED WITH TARK THERMAL SOLUTIONS TO INTEGRATE SOLID STATE COOLING TECHNOLOGY INTO CPUS FOR EFFICIENT HEAT DISSIPATION AND THERMAL MANAGEMENT

- 9.3.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON CONSUMER ELECTRONICS & SEMICONDUCTOR VERTICAL

- 9.4 HEALTHCARE

- 9.4.1 EMPHASIS ON ADDRESSING TEMPERATURE MANAGEMENT CHALLENGES AND IMPROVING PATIENT CARE TO FUEL MARKET GROWTH

- 9.4.2 CASE STUDY: PFIZER COLLABORATED WITH PHONONIC TO DEPLOY SOLID STATE COOLING TECHNOLOGY IN VACCINE STORAGE UNITS TO ENSURE PRECISE TEMPERATURE CONTROL

- 9.4.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON HEALTHCARE VERTICAL

- 9.5 OTHER VERTICALS

- 9.5.1 CASE STUDY: BOEING COLLABORATED WITH LAIRD THERMAL SYSTEMS TO IMPLEMENT SOLID STATE COOLING TECHNOLOGY IN AIRCRAFT AVIONICS SYSTEMS TO ENHANCE COMPONENT RELIABILITY AND LONGEVITY

- 9.5.2 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON OTHER VERTICALS

10 SOLID STATE COOLING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing number of construction projects to boost demand

- 10.2.3 CANADA

- 10.2.3.1 Growing investment in data centers to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rapid urbanization and infrastructure development to boost demand

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Emphasis on developing electric vehicle infrastructure to accelerate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Adoption of Industry 4.0 and smart manufacturing techniques to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising focus on reducing greenhouse gases to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising focus on developing energy-efficient buildings to offer lucrative growth opportunities

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Emphasis on energy conservation and carbon emissions reduction to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Increasing need for advanced cooling solutions in healthcare sector to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Thriving electronics & semiconductor industries to fuel market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Rapid economic development and infrastructure expansion to foster market growth

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Rising investment in green technologies to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Increasing awareness of environmental impact of traditional cooling methods to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-APRIL 2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 KEY PLAYERS IN SOLID STATE COOLING MARKET, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.7.5.1 Company footprint

- 11.7.5.2 Product footprint

- 11.7.5.3 Technology footprint

- 11.7.5.4 Vertical footprint

- 11.7.5.5 Region footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 11.8.5.1 List of startups/SMEs

- 11.8.6 COMPANY FOOTPRINT: STARTUPS/SMES

- 11.8.6.1 Company footprint

- 11.8.6.2 Product footprint

- 11.8.6.3 Technology footprint

- 11.8.6.4 Vertical footprint

- 11.8.6.5 Region footprint

- 11.9 COMPETITIVE SCENARIOS

- 11.9.1 PRODUCT/SERVICE LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 COHERENT CORP.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DELTA ELECTRONICS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Service launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 FERROTEC HOLDINGS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 TARK THERMAL SOLUTIONS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 KOMATSU LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 CRYSTAL LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 SAME SKY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches

- 12.1.7.3.2 Deals

- 12.1.8 SOLID STATE COOLING SYSTEMS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product/Service launches

- 12.1.9 TE TECHNOLOGY, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 TEC MICROSYSTEMS GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product/Service launches

- 12.1.1 COHERENT CORP.

- 12.2 OTHER PLAYERS

- 12.2.1 ALIGN SOURCING LLC.

- 12.2.2 AMS TECHNOLOGIES AG

- 12.2.3 EVERREDTRONICS

- 12.2.4 XIAMEN HICOOL ELECTRONICS CO., LTD.

- 12.2.5 INHECO INDUSTRIAL HEATING & COOLING GMBH

- 12.2.6 KRYOTHERM

- 12.2.7 MERIT TECHNOLOGY GROUP

- 12.2.8 PHONONIC

- 12.2.9 SHEETAK INC.

- 12.2.10 THERMONAMIC ELECTRONICS (JIANGXI) CORP., LTD.

- 12.2.11 WELLEN TECHNOLOGY CO., LTD.

- 12.2.12 EUROPEAN THERMODYNAMICS LTD.

- 12.2.13 THERMOELECTRIC COOLING AMERICA CORPORATION

- 12.2.14 MEERSTETTER ENGINEERING

- 12.2.15 CUSTOM THERMOELECTRIC, LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024 (USD)

- TABLE 3 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION (USD)

- TABLE 4 ROLE OF PARTICIPANTS IN SOLID STATE COOLING ECOSYSTEM

- TABLE 5 LIST OF KEY PATENTS IN SOLID STATE COOLING MARKET, 2020-2024

- TABLE 6 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 8 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON SOLID STATE COOLING MARKET

- TABLE 14 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 18 SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 19 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 20 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 22 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 24 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 25 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 26 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 27 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 28 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 REFRIGERATION SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 32 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 33 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 34 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 35 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 COOLING SYSTEMS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 COOLING SYSTEMS: SOLID STATE COOLING MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 SOLID STATE COOLING MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 46 SOLID STATE COOLING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 47 COMPARATIVE STUDY OF DIFFERENT SOLID STATE COOLING TECHNOLOGIES AND THEIR POTENTIAL

- TABLE 48 SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 49 SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 50 AUTOMOTIVE: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 AUTOMOTIVE: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS & SEMICONDUCTOR: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS & SEMICONDUCTOR: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 HEALTHCARE: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 HEALTHCARE: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 OTHER VERTICALS: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 OTHER VERTICALS: SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 SOLID STATE COOLING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 62 NORTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 63 NORTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 64 NORTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 65 NORTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 66 US: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 67 US: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 US: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 69 US: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 70 CANADA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 71 CANADA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 72 CANADA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 73 CANADA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 74 MEXICO: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 75 MEXICO: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 76 MEXICO: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 77 MEXICO: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 78 EUROPE: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 EUROPE: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 82 EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 83 EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 84 UK: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 85 UK: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 86 UK: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 87 UK: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 88 GERMANY: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 89 GERMANY: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 90 GERMANY: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 91 GERMANY: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 92 FRANCE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 93 FRANCE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 94 FRANCE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 95 FRANCE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 96 ITALY: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 97 ITALY: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 98 ITALY: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 99 ITALY: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 100 REST OF EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 101 REST OF EUROPE: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 102 REST OF EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 103 REST OF EUROPE: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 104 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY COUNTRY, 2025-2030(USD MILLION)

- TABLE 106 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 110 CHINA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 111 CHINA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 112 CHINA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 113 CHINA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 114 JAPAN: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 115 JAPAN: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 116 JAPAN: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 117 JAPAN: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 118 SOUTH KOREA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 119 SOUTH KOREA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 120 SOUTH KOREA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 121 SOUTH KOREA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030 (USD MILLION)

- TABLE 126 ROW: SOLID STATE COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 127 ROW: SOLID STATE COOLING MARKET, BY REGION, 2025-2030(USD MILLION)

- TABLE 128 ROW: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 129 ROW: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 130 ROW: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 131 ROW: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 132 MIDDLE EAST: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 133 MIDDLE EAST: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 134 MIDDLE EAST: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 135 MIDDLE EAST: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 136 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 137 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 138 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH AMERICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 140 AFRICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 141 AFRICA: SOLID STATE COOLING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 142 AFRICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2021-2024 (USD MILLION)

- TABLE 143 AFRICA: SOLID STATE COOLING MARKET, BY PRODUCT, 2025-2030(USD MILLION)

- TABLE 144 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SOLID STATE COOLING MARKET

- TABLE 145 DEGREE OF COMPETITION

- TABLE 146 SOLID STATE COOLING MARKET: PRODUCT FOOTPRINT

- TABLE 147 SOLID STATE COOLING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 148 SOLID STATE COOLING MARKET: VERTICAL FOOTPRINT

- TABLE 149 SOLID STATE COOLING MARKET: REGION FOOTPRINT

- TABLE 150 SOLID STATE COOLING MARKET: LIST OF STARTUPS/SMES

- TABLE 151 SOLID STATE COOLING MARKET: PRODUCT FOOTPRINT

- TABLE 152 SOLID STATE COOLING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 153 SOLID STATE COOLING MARKET: VERTICAL FOOTPRINT

- TABLE 154 SOLID STATE COOLING MARKET: REGION FOOTPRINT

- TABLE 155 SOLID STATE COOLING MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020-APRIL 2025

- TABLE 156 SOLID STATE COOLING MARKET: DEALS, JANUARY 2020-APRIL 2025

- TABLE 157 SOLID STATE COOLING: EXPANSIONS, JANUARY 2020-APRIL 2025

- TABLE 158 COHERENT CORP.: COMPANY OVERVIEW

- TABLE 159 COHERENT CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 COHERENT CORP.: PRODUCT/SERVICE LAUNCHES

- TABLE 161 COHERENT CORP.: DEALS

- TABLE 162 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 163 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 DELTA ELECTRONICS, INC.: PRODUCT/SERVICE LAUNCHES

- TABLE 165 FERROTEC HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 166 FERROTEC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 FERROTEC HOLDINGS CORPORATION: DEALS

- TABLE 168 FERROTEC HOLDINGS CORPORATION: EXPANSIONS

- TABLE 169 TARK THERMAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 170 TARK THERMAL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 TARK THERMAL SOLUTIONS: PRODUCT/SERVICE LAUNCHES

- TABLE 172 TARK THERMAL SOLUTIONS: DEALS

- TABLE 173 KOMATSU: COMPANY OVERVIEW

- TABLE 174 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 CRYSTAL LTD.: COMPANY OVERVIEW

- TABLE 176 CRYSTAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 SAME SKY: COMPANY OVERVIEW

- TABLE 178 SAME SKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 179 SAME SKY: PRODUCT/SERVICE LAUNCHES

- TABLE 180 SAME SKY: DEALS

- TABLE 181 SOLID STATE COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 182 SOLID STATE COOLING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 SOLID STATE COOLING SYSTEMS: PRODUCT/SERVICE LAUNCHES

- TABLE 184 TE TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 185 TE TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 186 TEC MICROSYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 187 TEC MICROSYSTEMS GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 TEC MICROSYSTEMS GMBH: PRODUCT/SERVICE LAUNCHES

List of Figures

- FIGURE 1 SOLID STATE COOLING MARKET AND REGIONAL SCOPE

- FIGURE 2 SOLID STATE COOLING MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED FROM SALES OF SOLID STATE COOLING PRODUCTS AND SOLUTIONS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SOLID STATE COOLING MARKET, 2021-2030

- FIGURE 9 COOLING SYSTEMS SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 10 THERMOELECTRIC COOLING TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 11 CONSUMER ELECTRONICS & SEMICONDUCTOR VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 12 ASIA PACIFIC DOMINATED SOLID STATE COOLING MARKET IN 2024

- FIGURE 13 SURGING DEMAND FOR RELIABLE AND ENERGY-EFFICIENT SOLUTIONS TO DRIVE MARKET

- FIGURE 14 COOLING SYSTEMS TO DOMINATE MARKET IN 2030

- FIGURE 15 CONSUMER ELECTRONICS & SEMICONDUCTOR SEGMENT TO LEAD MARKET IN 2030

- FIGURE 16 ASIA PACIFIC TO DOMINATE MARKET IN 2030

- FIGURE 17 SOLID STATE COOLING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 GLOBAL EV CAR SALES, 2024

- FIGURE 20 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 SOLID STATE COOLING MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024

- FIGURE 25 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION, 2020-2024

- FIGURE 26 SOLID STATE COOLING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 KEY PLAYERS IN SOLID STATE COOLING ECOSYSTEM

- FIGURE 28 FUNDING AND RELATED DEALS IN SOLID STATE TECHNOLOGY, 2021-2024

- FIGURE 29 NUMBER OF PATENTS GRANTED IN SOLID STATE COOLING MARKET, 2015-2024

- FIGURE 30 IMPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 8418-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 PORTER'S FIVE FORCES: SOLID STATE COOLING MARKET

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 35 COOLING SYSTEMS TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 36 THERMOELECTRIC TECHNOLOGY TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 37 AUTOMOTIVE SEGMENT TO BE FASTEST-GROWING VERTICAL DURING FORECAST PERIOD

- FIGURE 38 SOLID STATE COOLING MARKET FOR ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 NORTH AMERICA: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 40 EUROPE: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: SOLID STATE COOLING MARKET

- FIGURE 42 ROW: SOLID STATE COOLING MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 44 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 45 COMPANY VALUATION, 2024

- FIGURE 46 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 47 BRAND/PRODUCT COMPARISON

- FIGURE 48 SOLID STATE COOLING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 SOLID STATE COOLING MARKET: COMPANY FOOTPRINT

- FIGURE 50 SOLID STATE COOLING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 SOLID STATE COOLING MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 52 COHERENT CORP.: COMPANY SNAPSHOT

- FIGURE 53 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 54 FERROTEC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 KOMATSU: COMPANY SNAPSHOT