|

市场调查报告书

商品编码

1784315

全球云端 OSS/BSS 市场(至 2030 年):依解决方案、OSS、BSS、云端类型、营运商类型和地区划分Cloud OSS BSS Market by Solutions, OSS, BSS, Cloud Type, Operator Type, and Region -Global Forecast to 2030 |

||||||

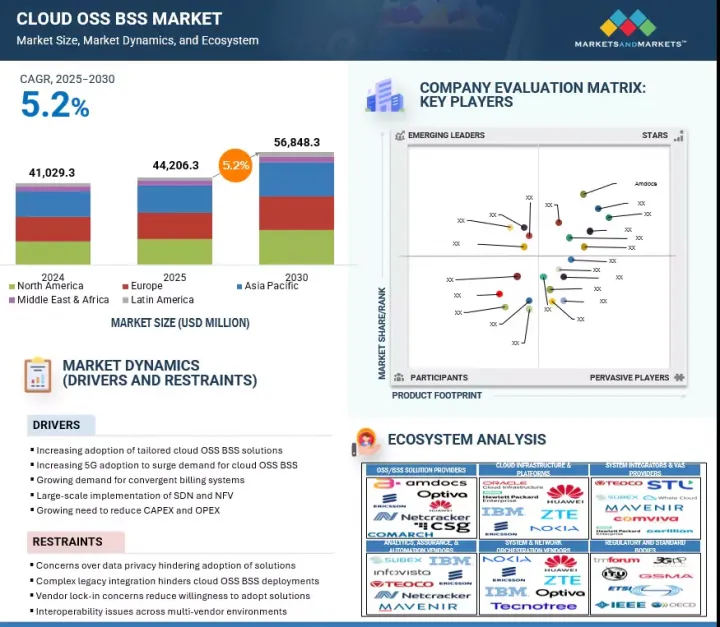

预计云端 OSS BSS 市场规模将从 2025 年的 442.063 亿美元成长到 2030 年的 568.483 亿美元,预测期内的复合年增长率为 5.2%。

随着通讯服务供应商(CSP) 寻求敏捷、可程式设计的平台来管理动态虚拟网络,SDN 和 NFV 的大规模采用正在加速云端 OSS BSS 解决方案的普及。个人化和配套服务服务的需求日益增长,也推动了人们对可自订 OSS BSS 解决方案的兴趣,以提升客户体验。随着服务组合和 IT 架构日益复杂,云端原生 OSS BSS 平台提供的灵活性、可扩展性和自动化功能,可实现即时营运和高效的服务交付。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 金额(美元) |

| 按细分市场 | 组件型、云端型、电信商型(移动式、固定式) |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

复杂的旧有系统整合是云端OSS BSS应用的主要限制因素。这是因为传统的本机系统通常依赖专有架构和自订接口,而这些接口与现代API驱动的平台不相容。此外,遗留OSS和BSS模组之间的资料孤岛和不一致的资料模型加剧了整合风险,导致服务中断和合规性挑战,从而限制了市场的成长。

预计北美在预测期内将实现最高的成长率。

这主要源于对5G部署的大量投资、不断增长的行动数据流量以及对即时业务收益盈利日益增长的需求。 AT&T、Verizon和T-Mobile等主要通讯服务供应商正积极推动其数位转型策略,采用云端基础的OSS BSS平台。例如,Verizon与Oracle合作部署了云端原生OSS BSS堆迭,以提高服务敏捷性和客户体验。这些趋势表明,北美营运商对可扩展、支援AI的OSS BSS功能的需求日益增长,而成熟的超大规模资料中心业者生态系统以及强调数位创新和基础设施现代化的法规结构则进一步支持了这一需求。

该地区成熟的通讯基础设施,加上通讯服务供应商和技术供应商之间的战略联盟,为 OSS BSS 创新创造了极其肥沃的环境。 Netcracker 和 Telenet 的混合云端BSS 部署等合作展示了云端原生平台如何实现业务效率、即时收费和大规模服务整合。此类实施证明了混合云端和公共云端模型在管理大规模网路环境和复杂服务生态系统方面的有效性。随着北美服务供应商继续优先考虑自动化、可扩展性和以客户为中心,云端 OSS BSS 平台已成为下一代连接和数位服务交付的基础。这一持续趋势使该地区成为全球向现代 OSS BSS 框架转型的关键驱动力。

本报告调查了全球云端 OSS BSS 市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概况及产业趋势

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 云OSS BSS简史

- 生态系分析

- 案例研究分析

- 价值链分析

- 定价分析

- 技术分析

- 专利分析

- 影响客户业务的趋势/中断

- 波特五力分析

- 监管状况

- 主要相关利益者和采购标准

- 大型会议及活动

- 云端OSS BSS市场技术蓝图

- 人工智慧/生成式人工智慧对云端OSS BSS市场的影响

- 投资金筹措场景

- 云端OSS BSS市场的最佳实践

- 美国关税:对云端OSS BSS市场的影响

6. 云端 OSS BSS 市场(依组件)

- 解决方案

- 营运支援系统

- 业务支援系统

- 服务

- 专业服务

- 託管服务

7. 云端OSS BSS市场(依云端类型)

- 公共云端

- 私有云端

- 混合云端

8. 云端OSS BSS市场(依运营商类型)

- 行动电信商

- 固定运算符

- 网际服务供应商

- 卫星通讯供应商

- 有线网路营运商

9. 云端OSS BSS市场(按地区)

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 其他的

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他的

- 拉丁美洲

- 巴西

- 墨西哥

- 其他的

第十章 竞争格局

- 概述

- 主要企业策略

- 收益分析

- 市场占有率分析

- 估值和财务指标

- 品牌/产品比较

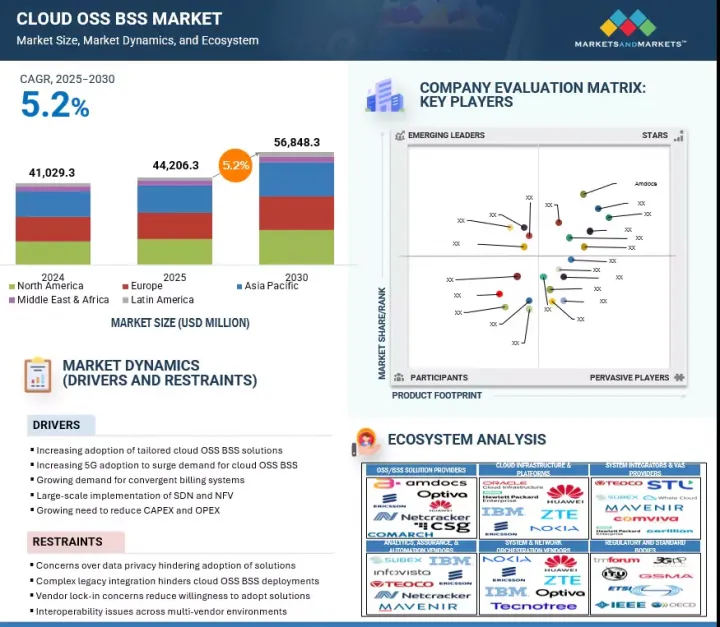

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 竞争情境和趋势

第十一章 公司简介

- 主要企业

- AMDOCS

- SALESFORCE

- NEC

- ERICSSON

- ORACLE

- HUAWEI

- HPE

- OPTIVA

- NOKIA

- CSG

- ZTE

- COMARCH

- SUBEX

- TEOCO

- IBM

- INFOVISTA

- COMVIVA

- CERILLION

- WHALE CLOUD

- HUGHES

- MAVENIR

- STL

- TECNOTREE

- Start-Ups/中小企业

- BILL PERFECT

- TELGOO5

- NMSWORKS SOFTWARE

- WAVELO

- CHIKPEA

- BLUECAT

- KENTIK

- KNOT SOLUTIONS

第 12 章:相邻/相关市场

第十三章 附录

The Cloud OSS BSS market is estimated to be USD 44,206.3 million in 2025, and it is projected to reach USD 56,848.3 million by 2030 at a compound annual growth rate (CAGR) of 5.2%. The large-scale implementation of SDN and NFV is accelerating the adoption of cloud OSS BSS solutions, as CSPs seek agile, programmable platforms to manage dynamic and virtualized networks. Rising demand for personalized services and bundled offerings is also driving interest in customized OSS BSS solutions that enhance customer experience. As service portfolios and IT architectures become more complex, cloud-native OSS BSS platforms offer the flexibility, scalability, and automation needed to support real-time operations and efficient service delivery.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million |

| Segments | By Component, By Cloud Type, By Operator Type (Mobile Operator, Fixed Operator) |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Complex legacy integration poses a significant restraint on cloud OSS BSS deployments, as outdated on-premises systems often rely on proprietary architecture and bespoke interfaces that are incompatible with modern, API-driven platforms. Moreover, data silos and inconsistent data models across legacy OSS and BSS modules exacerbate integration risks, leading to service disruptions and compliance challenges, thus restricting market growth.

"Services component segment is expected to grow at the highest CAGR during the forecast period"

The services segment is projected to register the highest CAGR in the Cloud OSS BSS market during the forecast period, as communication service providers increasingly seek managed, outcome-based partnerships to accelerate transformation. Key drivers of this trend include the need for rapid deployment, continuous optimization of cloud-native solutions, and reducing in-house development and operational burden. CSPs facing talent constraints and complexity in AI and containerized platforms prefer partner-led managed services and integration support.

Clients are driven by regulatory compliance, SLA guarantees, uptime, and the change management capabilities that cloud OSS/BSS services can provide. A recent example is a collaboration between Amdocs and a leading North American operator to provide managed deployment and operational services for its AI-enabled monetization and orchestration platforms. Similarly, CSG partnered with AWS to deliver fully managed mediation, billing, and analytics services under a service-level commitment. These developments underscore how CSPs are gravitating to service-centric models that offer scalability, assurance, and continuous innovation without significant capital expenditure or internal complexity.

"Hybrid cloud type segment is expected to grow with the highest CAGR during the forecast period"

The hybrid cloud segment is projected to register the highest CAGR in the Cloud OSS BSS market during the forecast period. This growth is primarily attributed to the increasing need among communication service providers (CSPs) for deployment models that offer flexibility, data sovereignty, and seamless integration between legacy systems and modern cloud-native platforms. Hybrid cloud architecture enables CSPs to retain control over sensitive data and core operations while benefiting from the scalability, agility, and innovation of public cloud environments. It also facilitates phased migration strategies, minimizes vendor lock-in, and accommodates diverse regulatory and operational requirements across global markets.

Moreover, hybrid cloud supports the modernization of critical OSS BSS functions such as converged charging, service orchestration, and customer experience management without causing operational disruption. For instance, Netcracker's collaboration with Telenet deployed a hybrid cloud digital BSS solution that enabled agile service delivery and real-time customer engagement. As CSPs navigate complex network landscapes, the hybrid model continues to emerge as a strategic enabler of transformation and long-term operational efficiency.

"North America will register the highest growth rate during the forecast period"

North America is anticipated to record the highest compound annual growth rate (CAGR) in the Cloud OSS BSS market during the forecast period, primarily driven by substantial investments in 5G deployment, increasing mobile data traffic, and the growing need for real-time service monetization. Leading communication service providers (CSPs) such as AT&T, Verizon, and T-Mobile are actively advancing their digital transformation strategies through the adoption of cloud-based OSS BSS platforms. For instance, Verizon partnered with Oracle to deploy a modern, cloud-native OSS BSS stack to improve service agility and customer experience. These developments underscore the rising demand among North American operators for scalable, AI-enabled OSS BSS capabilities, further supported by a well-established hyperscaler ecosystem and regulatory frameworks that emphasize digital innovation and infrastructure modernization.

The region's mature telecom infrastructure, in combination with strategic alliances between CSPs and technology providers, fosters a highly conducive environment for OSS BSS innovation. Collaborations such as the Netcracker and Telenet hybrid cloud BSS deployment demonstrate the ability of cloud-native platforms to deliver enhanced operational efficiency, real-time billing, and seamless service orchestration at scale. These implementations validate the effectiveness of hybrid and public cloud models in managing high-volume network environments and complex service ecosystems. As North American service providers continue to prioritize automation, scalability, and customer-centricity, cloud OSS BSS platforms are becoming a foundational element in enabling next-generation connectivity and digital service delivery. This sustained momentum positions the region as a key driver in the global shift toward modern OSS BSS frameworks.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 34%, Tier 2 - 43%, and Tier 3 - 23%

- By Designation: C-level - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, ROW - 5%

The major players in the Cloud OSS BSS market include Amdocs (US), Salesforce (US), NEC (Japan), Ericsson (Sweden), Oracle (US), Huawei (China), Hewlett Packard Enterprise (US), Optiva (Canada), Nokia (Finland), CSG International (US), ZTE Corporation (China), Comarch (Finland), Subex (India), Sterlite Technologies Limited (India), TEOCO Corporation (US), IBM Corporation (US), InfoVista (US), Comviva (India), Cerillion (UK), Tecnotree (Finland), Whale Cloud (Whale Cloud), Bill Perfect (US), Telgoo5 (US), NMSWorks Software (India), Wavelo (US), ChikPea (US), BlueCat (US), Kentik (US), Knot Solutions (India), Hughes Network Systems (US), and Mavenir Systems (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their Cloud OSS BSS market footprint.

Research Coverage

The market study covers the Cloud OSS BSS market size across different segments. It aims to estimate the market size and growth potential across various segments, including component, cloud type, operator type, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global Cloud OSS BSS market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers (Increasing adoption of tailored cloud OSS BSS solutions, Rising 5G adoption to surge demand for cloud OSS BSS, Growing demand for convergent billing systems, Large-scale implementation of SDN and NFV, Growing need to reduce CAPEX and OPEX), restraints (Concerns over data privacy hindering adoption of solutions), opportunities (Adoption of cloud technologies to transform telecom industry, Growth of telecom industry with next-generation operation systems and software framework, Operators taking service innovation to next level for monetizing and marketing IoT), and challenges (High volume of customer transactions and increasing complexities in network management, Lack of technical proficiency for implementing cloud-native OSS BSS solutions) influencing the growth of the Cloud OSS BSS market

2. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Cloud OSS BSS market

3. Market Development: Comprehensive information about lucrative markets - analysis of the Cloud OSS BSS market across various regions

4. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Cloud OSS BSS market

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Amdocs (US), Salesforce (US), NEC (Japan), Ericsson (Sweden), Oracle (US), Huawei (China), Hewlett Packard Enterprise (US), Optiva (Canada), Nokia (Finland), CSG International. (US), ZTE Corporation (China), Comarch (Finland), Subex (India), Sterlite Technologies Limited (India), TEOCO Corporation (US), IBM Corporation (US), InfoVista (US), Comviva (India), Cerillion (UK), Tecnotree (Finland), Whale Cloud (Whale Cloud), Bill Perfect (US), Telgoo5 (US), NMSWorks Software (India), Wavelo (US), ChikPea (US), BlueCat (US), Kentik (US), Knot Solutions (India), Hughes Network Systems (US), and Mavenir Systems (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 List of primary sources

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKUP AND DATA TRIANGULATION

- 2.4 MARKET FORECAST

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CLOUD OSS BSS MARKET

- 4.2 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SOLUTIONS

- 4.3 EUROPE: CLOUD OSS BSS MARKET, BY SOLUTIONS

- 4.4 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SOLUTIONS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of tailored cloud OSS BSS solutions

- 5.2.1.2 Increasing 5G adoption to surge demand for cloud OSS BSS

- 5.2.1.3 Growing demand for convergent billing systems

- 5.2.1.4 Large-scale implementation of SDN and NFV

- 5.2.1.5 Growing need to reduce CAPEX and OPEX

- 5.2.2 RESTRAINTS

- 5.2.2.1 Concerns over data privacy hindering adoption of solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of cloud technologies to transform telecom industry

- 5.2.3.2 Growth of telecom industry with next-generation operation systems and software framework

- 5.2.3.3 Operators taking service innovation to next level for monetizing and marketing IoT

- 5.2.4 CHALLENGES

- 5.2.4.1 High volume of customer transactions and increasing complexities in network management

- 5.2.4.2 Lack of technical proficiency for implementing cloud-native OSS BSS solutions

- 5.2.1 DRIVERS

- 5.3 BRIEF HISTORY OF CLOUD OSS BSS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CASE STUDY 1: IMPLEMENTATION OF DIGITALONE AND CATALOGONE SOLUTIONS TO BE DEVELOPED BY AMDOCS TO IMPROVE CUSTOMER EXPERIENCE

- 5.5.2 CASE STUDY 2: TELSTRA AND ERICSSON COLLABORATED TO TRANSFORM PREPAID CUSTOMER EXPERIENCE

- 5.5.3 CASE STUDY 3: STARHUB ADOPTED ERICSSON'S BILLING SOLUTION TO AUTOMATE MANUAL BILLING PROCESS

- 5.5.4 CASE STUDY 4: DEPLOYMENT OF ORACLE COMMUNICATION BILLING AND REVENUE MANAGEMENT SOLUTIONS TO SUPPORT DIRECT-TO-CONSUMER STRATEGY

- 5.5.5 CASE STUDY 5: DEPLOYMENT OF OPTIVA'S BSS SOLUTION TO IMPROVE BILLING PROCESS

- 5.6 VALUE CHAIN ANALYSIS

- 5.6.1 SOLUTION PROVIDERS

- 5.6.2 CONNECTIVITY PROVIDERS

- 5.6.3 SYSTEM INTEGRATORS

- 5.6.4 SERVICE PROVIDERS

- 5.6.5 END USERS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF CLOUD OSS BSS INTEGRATED SOLUTIONS, BY KEY PLAYERS, 2024

- 5.7.1.1 Average Pricing for OSS/BSS Integrated Solutions, By Key Vendors, 2024

- 5.7.2 INDICATIVE PRICING ANALYSIS OF CLOUD BSS SOLUTIONS, BY KEY PLAYERS, 2024

- 5.7.2.1 Indicative Pricing for BSS Solutions, By Key Vendors, 2024

- 5.7.1 AVERAGE SELLING PRICE OF CLOUD OSS BSS INTEGRATED SOLUTIONS, BY KEY PLAYERS, 2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Artificial intelligence and machine learning

- 5.8.1.2 Microservices and Cloud Native Architectures

- 5.8.1.3 Digital Twin

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Software-defined Networking

- 5.8.2.2 Network Function Virtualization

- 5.8.2.3 Multi-access Edge Computing

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 DevOps and Continuous Integration/Continuous Deployment

- 5.8.3.2 Cybersecurity Solutions

- 5.8.3.3 Open APIs and Interoperability Standards

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1.1 Federal Communications Commission

- 5.12.1.2 Office of Communications

- 5.12.1.3 Ministry of Industry and Information Technology

- 5.12.1.4 Telecommunications Regulatory Authority

- 5.12.1.5 Federal Telecommunications Institute

- 5.12.1.6 The International Organization for Standardization 27001

- 5.12.1.7 International Organization for Standardization/International Electrotechnical Commission 27018

- 5.12.2 KEY REGULATIONS AND FRAMEWORKS

- 5.12.2.1 General Data Protection Regulation

- 5.12.2.2 Digital Millennium Copyright Act

- 5.12.2.3 SOC 2

- 5.12.2.4 Federal Information Security Management Act

- 5.12.1 REGULATORY BODIES, AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR CLOUD OSS BSS MARKET

- 5.15.1 CLOUD OSS BSS ROADMAP TILL 2030

- 5.15.1.1 Short-term roadmap (2025-2026)

- 5.15.1.2 Mid-term roadmap (2027-2028)

- 5.15.1.3 Long-term roadmap (2029-2030)

- 5.15.1 CLOUD OSS BSS ROADMAP TILL 2030

- 5.16 IMPACT OF AI/GENERATIVE AI ON CLOUD OSS BSS MARKET

- 5.16.1 USE CASES OF GENERATIVE AI IN CLOUD OSS BSS

- 5.17 INVESTMENT AND FUNDING SCENARIO, 2024

- 5.18 BEST PRACTICES IN CLOUD OSS BSS MARKET

- 5.19 IMPACT OF 2025 US TARIFF-CLOUD OSS BSS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.3.1 Strategic Shifts and Emerging Trends

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 China

- 5.19.4.3 Europe

- 5.19.4.4 Asia Pacific (excluding China)

- 5.19.5 IMPACT ON END-USE INDUSTRY

- 5.19.5.1 Telecommunication Service Providers (CSPs/Telcos)

6 CLOUD OSS BSS MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.2 SOLUTIONS

- 6.2.1 SOLUTIONS: CLOUD OSS BSS MARKET DRIVERS

- 6.2.2 OPERATIONS SUPPORT SYSTEM

- 6.2.2.1 Network Management & Orchestration

- 6.2.2.1.1 Network Management & Orchestration: Cloud OSS BSS Market Drivers

- 6.2.2.2 Resource Management

- 6.2.2.2.1 Resource Management: Cloud OSS BSS Market Drivers

- 6.2.2.3 Analytics & Assurance

- 6.2.2.3.1 Analytics & Assurance: Cloud OSS BSS market drivers

- 6.2.2.4 Service Design & Fulfillment

- 6.2.2.4.1 Service Design & Fulfillment: Cloud OSS BSS Market Drivers

- 6.2.2.1 Network Management & Orchestration

- 6.2.3 BUSINESS SUPPORT SYSTEM

- 6.2.3.1 Billing & Revenue Management

- 6.2.3.1.1 Billing & Revenue Management: Cloud OSS BSS Market Drivers

- 6.2.3.2 Product Management

- 6.2.3.2.1 Product Management: Cloud OSS BSS Market Drivers

- 6.2.3.3 Customer Management

- 6.2.3.3.1 Customer Management: Cloud OSS BSS Market Drivers

- 6.2.3.4 Others

- 6.2.3.1 Billing & Revenue Management

- 6.3 SERVICES

- 6.3.1 SERVICES: CLOUD OSS BSS MARKET DRIVERS

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Professional Services: Cloud OSS BSS Market Drivers

- 6.3.2.2 Consulting

- 6.3.2.3 Integration & Deployment Services

- 6.3.2.4 Training, Support, & Maintenance Service

- 6.3.3 MANAGED SERVICES

- 6.3.3.1 Managed Service: Cloud OSS BSS Market Drivers

7 CLOUD OSS BSS MARKET, BY CLOUD TYPE

- 7.1 INTRODUCTION

- 7.2 PUBLIC CLOUD

- 7.2.1 ACCELERATE OSS BSS DEPLOYMENT WITH SCALABLE AND COST-EFFECTIVE INFRASTRUCTURE

- 7.2.2 PUBLIC CLOUD: CLOUD OSS BSS MARKET DRIVERS

- 7.3 PRIVATE CLOUD

- 7.3.1 STRENGTHEN DATA SECURITY AND CONTROL FOR MISSION-CRITICAL OSS BSS FUNCTIONS

- 7.3.2 PRIVATE CLOUD: CLOUD OSS BSS MARKET DRIVERS

- 7.4 HYBRID CLOUD

- 7.4.1 ENABLE FLEXIBLE OSS BSS TRANSFORMATION WHILE PRESERVING LEGACY INVESTMENTS

- 7.4.2 HYBRID CLOUD: CLOUD OSS BSS MARKET DRIVERS

8 CLOUD OSS BSS MARKET, BY OPERATOR TYPE

- 8.1 INTRODUCTION

- 8.2 MOBILE OPERATOR

- 8.2.1 MOBILE OPERATOR: CLOUD OSS BSS MARKET DRIVERS

- 8.3 FIXED OPERATOR

- 8.3.1 FIXED OPERATOR: CLOUD OSS BSS MARKET DRIVERS

- 8.3.2 INTERNET SERVICE PROVIDER

- 8.3.3 SATELLITE COMMUNICATION PROVIDER

- 8.3.4 CABLE NETWORK OPERATOR

9 CLOUD OSS BSS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: CLOUD OSS BSS MARKET DRIVERS

- 9.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.3 UNITED STATES

- 9.2.3.1 Telecom modernization with government-backed cloud OSS BSS adoption to drive market

- 9.2.4 CANADA

- 9.2.4.1 Growth of 5G with Cloud OSS and BSS driven by rising CAPEX and network innovation to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: CLOUD OSS BSS MARKET DRIVERS

- 9.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.3 UNITED KINGDOM

- 9.3.3.1 Smart connectivity with Cloud OSS BSS and 5G collaborations to boost market

- 9.3.4 GERMANY

- 9.3.4.1 Surge in cloud OSS BSS adoption through public safety partnerships and industrial IoT expansion to drive growth

- 9.3.5 FRANCE

- 9.3.5.1 Adoption of Cloud OSS BSS backed by smart city initiatives to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: CLOUD OSS BSS MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.3 CHINA

- 9.4.3.1 Accelerating Cloud OSS BSS leadership with SDN partnerships and strategic ICT push to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Advancing Cloud OSS and BSS through government-supported ICT growth and global technology collaborations to enhance development

- 9.4.5 INDIA

- 9.4.5.1 Driving growth in Cloud OSS BSS through 5G rollouts, telecom modernization, and strategic vendor partnerships to fuel demand

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 CLOUD OSS BSS MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.3 KINGDOM OF SAUDI ARABIA

- 9.5.3.1 Vision 2030, 5G expansion, and core network collaborations to boost demand for Cloud OSS BSS solutions

- 9.5.4 UNITED ARAB EMIRATES

- 9.5.4.1 Cloud OSS BSS momentum with Vision 2031 and 5G-led digital infrastructure to drive market

- 9.5.5 SOUTH AFRICA

- 9.5.5.1 Innovation in OSS BSS with telco modernization and public-private digital programs to boost growth

- 9.5.6 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: CLOUD OSS BSS MARKET DRIVERS

- 9.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.3 BRAZIL

- 9.6.3.1 Surge in regional telecom activities to boost demand for OSS BSS

- 9.6.4 MEXICO

- 9.6.4.1 Increase in infrastructure investments, mobile integration, and data-driven telecom expansion to drive market

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 10.7.5.1 Company footprint

- 10.7.5.2 Regional footprint

- 10.7.5.3 Component footprint

- 10.7.5.4 Cloud type footprint

- 10.7.5.5 Operator type footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- 10.9.1 NEW PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 MAJOR COMPANIES

- 11.1.1 AMDOCS

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SALESFORCE

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NEC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM View

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ERICSSON

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 ORACLE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.4 MnM view

- 11.1.6 HUAWEI

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 HPE

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 OPTIVA

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 NOKIA

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches and enhancements

- 11.1.9.3.2 Deals

- 11.1.10 CSG

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches and enhancements

- 11.1.10.3.2 Deals

- 11.1.11 ZTE

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches and enhancements

- 11.1.12 COMARCH

- 11.1.12.1 Business overview

- 11.1.12.2 Products/Solutions/Services offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Product launches and enhancements

- 11.1.12.3.2 Deals

- 11.1.13 SUBEX

- 11.1.14 TEOCO

- 11.1.15 IBM

- 11.1.16 INFOVISTA

- 11.1.17 COMVIVA

- 11.1.18 CERILLION

- 11.1.19 WHALE CLOUD

- 11.1.20 HUGHES

- 11.1.21 MAVENIR

- 11.1.22 STL

- 11.1.23 TECNOTREE

- 11.1.1 AMDOCS

- 11.2 STARTUP/SMES PLAYERS

- 11.2.1 BILL PERFECT

- 11.2.2 TELGOO5

- 11.2.3 NMSWORKS SOFTWARE

- 11.2.4 WAVELO

- 11.2.5 CHIKPEA

- 11.2.6 BLUECAT

- 11.2.7 KENTIK

- 11.2.8 KNOT SOLUTIONS

12 ADJACENT/RELATED MARKET

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 TELECOM SERVICE ASSURANCE MARKET -GLOBAL FORECAST 2026

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Telecom service assurance, by component

- 12.2.2.2 Telecom service assurance market, by operator type

- 12.2.2.3 Telecom service assurance market, by deployment mode

- 12.2.2.4 Telecom service assurance market, by organization size

- 12.2.2.5 Telecom service assurance, by region

- 12.3 NETWORK MANAGEMENT SYSTEM MARKET - GLOBAL FORECAST 2024

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Network management system market, by component

- 12.3.2.2 Network management system market, by deployment mode

- 12.3.2.3 Network management system market, by organization size

- 12.3.2.4 Network management system market, by end-user

- 12.3.2.5 Network management system market, by service provider

- 12.3.2.6 Network management system market, by vertical

- 12.3.2.7 Network management system market, by region

- 12.4 SOFTWARE DEFINED NETWORKING MARKET -GLOBAL FORECAST 2025

- 12.4.1 MARKET DEFINITION

- 12.4.2 MARKET OVERVIEW

- 12.4.2.1 Software-defined defined networking market, by component

- 12.4.2.2 Software-defined networking market, by SDN type

- 12.4.2.3 Software-defined networking market, by end-user

- 12.4.2.4 Software-defined networking market, by organization size

- 12.4.2.5 Software-defined networking market, by enterprise vertical

- 12.4.2.6 Software-defined networking market, by region

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATION

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 PRIMARY RESPONDENTS: CLOUD OSS BSS MARKET

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 CLOUD OSS BSS MARKET: ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE FOR OSS/BSS INTEGRATED SOLUTIONS

- TABLE 6 INDICATIVE PRICING ANALYSIS FOR BSS SOLUTIONS, BY KEY PLAYERS, 2024

- TABLE 7 LIST OF MAJOR PATENTS

- TABLE 8 CLOUD OSS BSS MARKET: PORTER'S FIVE FORCES

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 15 KEY BUYING CRITERIA FOR CLOUD OSS BSS MARKET

- TABLE 16 CLOUD OSS BSS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 19 CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 20 SOLUTIONS: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 21 SOLUTIONS: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 CLOUD OSS BSS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 23 CLOUD OSS BSS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 24 OPERATIONS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 25 OPERATIONS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 OPERATIONS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 27 OPERATIONS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 NETWORK MANAGEMENT & ORCHESTRATION: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 NETWORK MANAGEMENT & ORCHESTRATION: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 RESOURCE MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 RESOURCE MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 ANALYTICS & ASSURANCE: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 ANALYTICS & ASSURANCE: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 SERVICE DESIGN & FULFILLMENT: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 SERVICE DESIGN & FULFILLMENT: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 BUSINESS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 BUSINESS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 BUSINESS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 39 BUSINESS SUPPORT SYSTEM: CLOUD OSS BSS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 BILLING & REVENUE MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 BILLING & REVENUE MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 PRODUCT MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 PRODUCT MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 CUSTOMER MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 45 CUSTOMER MANAGEMENT: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 OTHERS: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 OTHERS: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030(USD MILLION)

- TABLE 50 CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 51 CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 52 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 53 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 PROFESSIONAL SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 CONSULTING SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 57 CONSULTING SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 INTEGRATION & DEPLOYMENT SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 INTEGRATION & DEPLOYMENT SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 TRAINING, SUPPORT, & MAINTENANCE SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 TRAINING, SUPPORT, & MAINTENANCE SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 MANAGED SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 MANAGED SERVICES: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 65 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 66 PUBLIC CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 PUBLIC CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 PRIVATE CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 PRIVATE CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 HYBRID CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 HYBRID CLOUD: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 73 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 74 MOBILE OPERATOR: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 MOBILE OPERATOR: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 FIXED OPERATOR: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 FIXED OPERATOR: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 NORTH AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 81 NORTH AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 82 NORTH AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 83 NORTH AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 84 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 85 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: CLOUD OSS BSS MARKET, BY, COUNTRY, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: CLOUD OSS BSS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 UNITED STATES: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 99 UNITED STATES: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 100 UNITED STATES: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 101 UNITED STATES: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 102 UNITED STATES: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 103 UNITED STATES: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 104 UNITED STATES: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 105 UNITED STATES: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 106 UNITED STATES: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 107 UNITED STATES: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 108 UNITED STATES: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 109 UNITED STATES: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 110 UNITED STATES: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 111 UNITED STATES: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 112 UNITED STATES: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 113 UNITED STATES: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 119 EUROPE: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 122 EUROPE: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 123 EUROPE: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 125 EUROPE: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 127 EUROPE: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 129 EUROPE: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: CLOUD OSS BSS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 131 EUROPE: CLOUD OSS BSS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 133 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 134 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 135 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 136 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 137 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 138 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 139 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 140 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 141 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 143 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 144 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 145 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 146 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 147 UNITED KINGDOM: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 154 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 156 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 158 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 160 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 161 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 163 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 165 ASIA PACIFIC: CLOUD OSS BSS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 166 CHINA: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 167 CHINA: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 168 CHINA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 169 CHINA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 170 CHINA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 171 CHINA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 172 CHINA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 173 CHINA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 174 CHINA: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 175 CHINA: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 176 CHINA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 177 CHINA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 178 CHINA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 179 CHINA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 180 CHINA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 181 CHINA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 183 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: CLOUD OSS BSS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 200 KSA: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 201 KSA: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 202 KSA: CLOUD OSS BSS MARKET, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 203 KSA: CLOUD OSS BSS MARKET, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 204 KSA: CLOUD OSS BSS MARKET, BY OSS, 2020-2024 (USD MILLION)

- TABLE 205 KSA: CLOUD OSS BSS MARKET, BY OSS, 2025-2030 (USD MILLION)

- TABLE 206 KSA: CLOUD OSS BSS MARKET, BY BSS, 2020-2024 (USD MILLION)

- TABLE 207 KSA: CLOUD OSS BSS MARKET, BY OSS, 2025-2030 (USD MILLION)

- TABLE 208 KSA: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 209 KSA: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 210 KSA: CLOUD OSS BSS MARKET, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 211 KSA: CLOUD OSS BSS MARKET, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 212 KSA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 213 KSA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 214 KSA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 215 KSA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 216 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 217 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 218 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 219 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 220 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 221 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 222 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 223 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 224 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 225 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 226 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 227 LATIN AMERICA: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 228 LATIN AMERICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 229 LATIN AMERICA: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 230 LATIN AMERICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 231 LATIN AMERICA: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 232 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 233 LATIN AMERICA: CLOUD OSS BSS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 234 BRAZIL: CLOUD OSS BSS MARKET, BY COMPONENT, 2020-2024 (USD MILLION)

- TABLE 235 BRAZIL: CLOUD OSS BSS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 236 BRAZIL: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2020-2024 (USD MILLION)

- TABLE 237 BRAZIL: CLOUD OSS BSS MARKET, BY COMPONENT, BY SOLUTION, 2025-2030 (USD MILLION)

- TABLE 238 BRAZIL: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2020-2024 (USD MILLION)

- TABLE 239 BRAZIL: CLOUD OSS BSS MARKET, BY SOLUTION, BY OSS, 2025-2030 (USD MILLION)

- TABLE 240 BRAZIL: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2020-2024 (USD MILLION)

- TABLE 241 BRAZIL: CLOUD OSS BSS MARKET, BY SOLUTION, BY BSS, 2025-2030 (USD MILLION)

- TABLE 242 BRAZIL: CLOUD OSS BSS MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 243 BRAZIL: CLOUD OSS BSS MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 244 BRAZIL: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2020-2024 (USD MILLION)

- TABLE 245 BRAZIL: CLOUD OSS BSS MARKET, BY SERVICE, BY PROFESSIONAL SERVICE, 2025-2030 (USD MILLION)

- TABLE 246 BRAZIL: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2020-2024 (USD MILLION)

- TABLE 247 BRAZIL: CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025-2030 (USD MILLION)

- TABLE 248 BRAZIL: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2020-2024 (USD MILLION)

- TABLE 249 BRAZIL: CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025-2030 (USD MILLION)

- TABLE 250 OVERVIEW OF STRATEGIES ADOPTED BY KEY CLOUD OSS BSS VENDORS

- TABLE 251 CLOUD OSS BSS MARKET: DEGREE OF COMPETITION

- TABLE 252 CLOUD OSS BSS MARKET: REGIONAL FOOTPRINT

- TABLE 253 CLOUD OSS BSS MARKET: COMPONENT FOOTPRINT

- TABLE 254 CLOUD OSS BSS MARKET: CLOUD TYPE FOOTPRINT

- TABLE 255 CLOUD OSS BSS MARKET: OPERATOR TYPE FOOTPRINT

- TABLE 256 CLOUD OSS BSS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 257 CLOUD OSS BSS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 258 CLOUD OSS BSS: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2022-JUNE 2025

- TABLE 259 CLOUD OSS BSS MARKET: DEALS, 2022-2025

- TABLE 260 AMDOCS: BUSINESS OVERVIEW

- TABLE 261 AMDOCS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 262 AMDOCS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 263 AMDOCS: DEALS

- TABLE 264 SALESFORCE: BUSINESS OVERVIEW

- TABLE 265 SALESFORCE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 266 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 267 SALESFORCE: DEALS

- TABLE 268 NEC: BUSINESS OVERVIEW

- TABLE 269 NEC: PRODUCTS/SOLUTIONS OFFERED

- TABLE 270 NEC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 271 NEC: DEALS

- TABLE 272 ERICSSON: BUSINESS OVERVIEW

- TABLE 273 ERICSSON: PRODUCTS/SOLUTIONS OFFERED

- TABLE 274 ERICSSON: PRODUCT LAUNCHES

- TABLE 275 ERICSSON: DEALS

- TABLE 276 ORACLE: BUSINESS OVERVIEW

- TABLE 277 ORACLE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 278 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 279 ORACLE: DEALS

- TABLE 280 HUAWEI: BUSINESS OVERVIEW

- TABLE 281 HUAWEI: PRODUCTS/SOLUTIONS OFFERED

- TABLE 282 HUAWEI: PRODUCT LAUNCHES

- TABLE 283 HUAWEI: DEALS

- TABLE 284 HPE: BUSINESS OVERVIEW

- TABLE 285 HPE: PRODUCTS OFFERED

- TABLE 286 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 287 HPE: DEALS

- TABLE 288 OPTIVA: BUSINESS OVERVIEW

- TABLE 289 OPTIVA: PRODUCTS OFFERED

- TABLE 290 OPTIVA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 291 OPTIVA: DEALS

- TABLE 292 NOKIA: BUSINESS OVERVIEW

- TABLE 293 NOKIA: PRODUCTS OFFERED

- TABLE 294 NOKIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 295 NOKIA: DEALS

- TABLE 296 CSG: BUSINESS OVERVIEW

- TABLE 297 CSG: PRODUCTS OFFERED

- TABLE 298 CSG: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 299 CSG: DEALS

- TABLE 300 ZTE: BUSINESS OVERVIEW

- TABLE 301 ZTE: PRODUCTS OFFERED

- TABLE 302 ZTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 303 COMARCH: BUSINESS OVERVIEW

- TABLE 304 COMARCH: PRODUCTS/SOLUTIONS OFFERED

- TABLE 305 COMARCH: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 306 COMARCH: DEALS

- TABLE 307 TELECOM SERVICE ASSURANCE MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 308 TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 309 TELECOM SERVICE ASSURANCE MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- TABLE 310 TELECOM SERVICE ASSURANCE MARKET, BY OPERATOR TYPE, 2021-2026 (USD MILLION)

- TABLE 311 TELECOM SERVICE ASSURANCE MARKET, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- TABLE 312 TELECOM SERVICE ASSURANCE MARKET, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 313 TELECOM SERVICE ASSURANCE MARKET, BY REGION, 2021-2026 (USD MILLION)

- TABLE 314 NORTH AMERICA: TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 315 EUROPE: TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 316 ASIA PACIFIC: TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 317 MIDDLE EAST & AFRICA: TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 318 LATIN AMERICA: TELECOM SERVICE ASSURANCE MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 319 GLOBAL NETWORK MANAGEMENT SYSTEM MARKET SIZE AND GROWTH RATE, 2017-2024 (USD MILLION AND Y-O-Y %)

- TABLE 320 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2017-2024 (USD MILLION)

- TABLE 321 NETWORK MANAGEMENT SYSTEM MARKET, BY SOLUTION, 2017-2024 (USD MILLION)

- TABLE 322 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE, 2017-2024 (USD MILLION)

- TABLE 323 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE, 2017-2024 (USD MILLION)

- TABLE 324 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2017-2024 (USD MILLION)

- TABLE 325 NETWORK MANAGEMENT SYSTEM MARKET, BY END-USER, 2017-2024 (USD MILLION)

- TABLE 326 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE PROVIDER, 2017-2024 (USD MILLION)

- TABLE 327 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 328 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 329 NORTH AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 330 EUROPE: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 331 ASIA PACIFIC: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 332 MIDDLE EAST & AFRICA: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 333 LATIN AMERICA: NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2017-2024 (USD MILLION)

- TABLE 334 SOFTWARE- DEFINED NETWORKING MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- TABLE 335 SOFTWARE-DEFINED NETWORKING MARKET, BY SDN TYPE, 2019-2025 (USD MILLION)

- TABLE 336 SOFTWARE-DEFINED NETWORKING MARKET, BY END-USER, 2019-2025 (USD MILLION)

- TABLE 337 SOFTWARE-DEFINED NETWORKING MARKET, BY ORGANIZATION SIZE, 2019-2025 (USD MILLION)

- TABLE 338 ENTERPRISE VERTICALS: SOFTWARE-DEFINED NETWORKING MARKET, 2019-2025 (USD MILLION)

- TABLE 339 SOFTWARE-DEFINED NETWORKING MARKET, BY REGION, 2019-2025 (USD MILLION)

- TABLE 340 NORTH AMERICA: SOFTWARE-DEFINED NETWORKING MARKET, BY ENTERPRISE VERTICAL, 2019-2025 (USD MILLION)

- TABLE 341 EUROPE: SOFTWARE-DEFINED NETWORKING MARKET, BY ENTERPRISE VERTICAL, 2019-2025 (USD MILLION)

- TABLE 342 ASIA PACIFIC: SOFTWARE-DEFINED NETWORKING MARKET, BY ENTERPRISE VERTICAL, 2019-2025 (USD MILLION)

- TABLE 343 MIDDLE EAST & AFRICA: SOFTWARE-DEFINED NETWORKING MARKET, BY ENTERPRISE VERTICAL, 2019-2025 (USD MILLION)

- TABLE 344 LATIN AMERICA: SOFTWARE-DEFINED NETWORKING MARKET, BY ENTERPRISE VERTICAL, 2019-2025 (USD MILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CLOUD OSS BSS MARKET: RESEARCH DESIGN

- FIGURE 3 CLOUD OSS BSS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (DEMAND-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF CLOUD OSS BSS MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF CLOUD OSS BSS MARKET

- FIGURE 6 CLOUD OSS BSS MARKET: TOP-DOWN APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN CLOUD OSS BSS MARKET

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE): CLOUD OSS BSS MARKET

- FIGURE 9 CLOUD OSS BSS MARKET: DATA TRIANGULATION

- FIGURE 10 CLOUD OSS BSS MARKET, 2025-2030 (USD MILLION)

- FIGURE 11 CLOUD OSS BSS MARKET, BY COMPONENT, 2025 VS. 2030 (USD MILLION)

- FIGURE 12 CLOUD OSS BSS MARKET, BY CLOUD TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 13 CLOUD OSS BSS MARKET, BY OPERATOR TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 14 CLOUD OSS BSS MARKET, BY REGION, 2025 VS. 2030 (USD MILLION)

- FIGURE 15 NEED FOR OPERATIONAL AND BUSINESS EFFICIENCY IN TELECOM SECTOR TO SIGNIFICANTLY IMPACT GROWTH OF CLOUD OSS BSS MARKET

- FIGURE 16 NETWORK MANAGEMENT & ORCHESTRATION AND BILLING & REVENUE MANAGEMENT SEGMENTS TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2025

- FIGURE 17 NETWORK MANAGEMENT & ORCHESTRATION AND BILLING & REVENUE MANAGEMENT TO HOLD MAJOR MARKET SHARES IN 2025

- FIGURE 18 NETWORK MANAGEMENT & ORCHESTRATION AND BILLING & REVENUE MANAGEMENT SEGMENTS LEAD MARKET IN 2025

- FIGURE 19 CLOUD OSS BSS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 SUBSCRIBER PENETRATION TRENDS, BY REGI0N, 2024 VS. 2030

- FIGURE 21 SMARTPHONE ADOPTION TRENDS, BY REGI0N, 2024 VS. 2030

- FIGURE 22 BRIEF HISTORY OF CLOUD OSS BSS

- FIGURE 23 CLOUD OSS BSS MARKET: ECOSYSTEM

- FIGURE 24 CLOUD OSS BSS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 LIST OF MAJOR PATENTS FOR CLOUD OSS BSS

- FIGURE 26 CLOUD OSS BSS MARKET: TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

- FIGURE 27 CLOUD OSS BSS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 29 KEY BUYING CRITERIA

- FIGURE 30 USE CASES OF GENERATIVE AI IN CLOUD OSS BSS

- FIGURE 31 CLOUD OSS BSS MARKET: INVESTMENT AND FUNDING SCENARIO, 2024 (USD MILLION)

- FIGURE 32 SOLUTIONS SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 33 BUSINESS SUPPORT SYSTEM SEGMENT EXPECTED TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 34 NETWORK MANAGEMENT & ORCHESTRATION SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 35 BILLING & REVENUE MANAGEMENT SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 MANAGED SERVICES SEGMENT EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 INTEGRATION & DEPLOYMENT SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 38 PUBLIC CLOUD SEGMENT EXPECTED TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 39 MOBILE OPERATOR SEGMENT EXPECTED TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 43 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2020-2024

- FIGURE 44 SHARE OF LEADING COMPANIES IN CLOUD OSS BSS MARKET, 2024

- FIGURE 45 FINANCIAL METRICS OF KEY CLOUD OSS BSS VENDORS

- FIGURE 48 CLOUD OSS BSS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 49 CLOUD OSS BSS MARKET: COMPANY FOOTPRINT

- FIGURE 50 CLOUD OSS BSS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 51 AMDOCS: COMPANY SNAPSHOT

- FIGURE 52 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 53 NEC: COMPANY SNAPSHOT

- FIGURE 54 ERICSSON: COMPANY SNAPSHOT

- FIGURE 55 ORACLE: COMPANY SNAPSHOT

- FIGURE 56 HPE: COMPANY SNAPSHOT

- FIGURE 57 OPTIVA: COMPANY SNAPSHOT

- FIGURE 58 NOKIA: COMPANY SNAPSHOT

- FIGURE 59 CSG: COMPANY SNAPSHOT

- FIGURE 60 ZTE: COMPANY SNAPSHOT