|

市场调查报告书

商品编码

1790690

全球碳足迹管理市场(至 2030 年)按组件(解决方案/服务)、部署模式(本地/云端)、组织规模(企业/中型/小型企业)、行业垂直和地区划分Carbon Footprint Management Market by Component (Solutions, Services), Deployment Mode (On-premises, Cloud), Organization Size (Corporate Enterprises, Mid-Tier Enterprises, Small Businesses), Vertical, and Region - Global Forecast to 2030 |

||||||

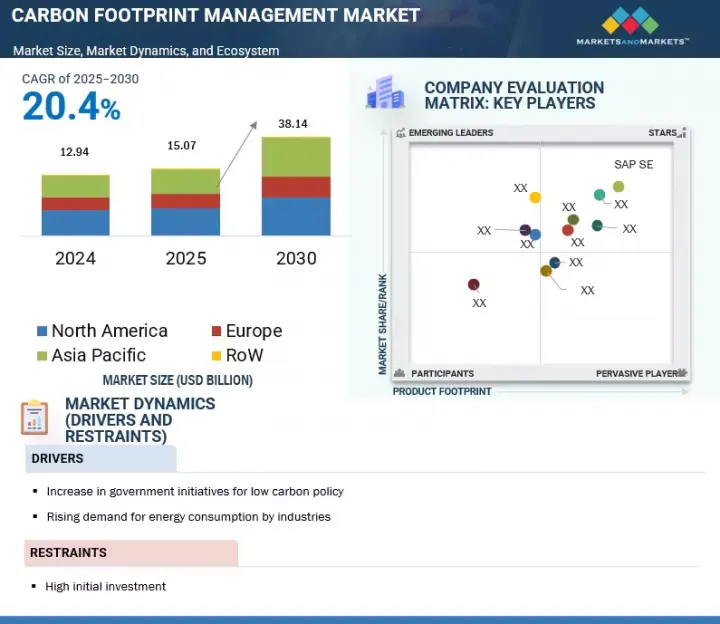

预计碳足迹管理市场将从 2025 年的 150.7 亿美元成长到 2030 年的 381.4 亿美元,预测期内的复合年增长率为 20.4%。

政府措施减少碳排放的倡议不断增加、工业能源消费量不断增加以及企业对永续性报告的日益重视是推动碳足迹管理市场的主要因素。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(美元) |

| 按部门 | 按组件、部署模式、组织规模、行业和地区 |

| 目标区域 | 亚太地区、北美、欧洲、中东和非洲、南美 |

世界各国政府正在实施严格的环境法规,鼓励各行各业采用碳监测解决方案。同时,各行各业日益增长的能源需求也迫使企业提高能源利用效率并减少排放。此外,企业越来越重视环境、社会和管治(ESG) 合规性,这进一步加速了碳足迹管理解决方案的采用。

根据行业垂直度,预计製造业在预测期内将实现最高的复合年增长率。

这是由于政府和业界推出了各种法规来支持绿色和永续的经济活动。许多国家、地区和地方政府都推出了碳排放税和能源税等相关措施,以减少温室气体排放。截至2024年,全球整体已实施或计画实施的碳定价倡议(碳排放税)超过65项,约占全球排放的22%。此外,许多国家正在对其商业和工业部门征收严格的税收和法规,以鼓励它们减少碳足迹,从而支持製造业的成长。

根据部署情况,预计云端技术部门将在 2030 年占据最大的市场占有率。

云端运算需求的快速成长是碳足迹管理的主要驱动力,其驱动力源自于能源优化、先进的冷却技术、伺服器虚拟以及主要供应商对可再生能源的日益依赖等因素。这种转变使企业在扩展数位化业务的同时,能够大幅减少碳足迹。云端运算的采用带来了许多优势,包括更高的IT安全、全天候支援、扩充性和更快的业务速度。这些优势使得云端基础的解决方案对各行各业都极具吸引力。此外,根据需求灵活地扩展或缩减资源,可以优化成本并提高效率。

按地区划分,预计北美将在预测期内占据市场主导地位。

北美引领碳足迹管理市场,预计在预测期内仍将维持强劲地位。这一领先地位归功于该地区积极应对气候变迁的立场,包括更严格的环境法规、企业永续发展计画以及对绿色技术的投资。此外,快速的经济变化和公众对碳排放上升的认识不断提高,也推动了对有效碳管理解决方案的需求。随着越来越多的公司和政府将气候行动放在首位,预计该地区将继续成长,支持向永续、低碳未来的转型。

本报告调查了全球碳足迹管理市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 价值链分析

- 生态系统

- 案例研究分析

- 技术分析

- 定价分析

- 2025-2026年重要会议和活动

- 监管机构、政府机构和其他组织

- 碳足迹管理法规

- 碳足迹管理标准

- 专利分析

- 波特五力分析

- 主要相关利益者和采购标准

- 采购标准

- 产生人工智慧/人工智慧对碳足迹管理市场的影响

- 全球宏观经济展望

- 2025年美国关税的影响—概述

6. 碳足迹管理市场(依组织规模)

- 大公司

- 中型公司

- 小型企业

7. 碳足迹管理市场(依产业垂直划分)

- 製造业

- 食品/饮料

- 金属和采矿

- 化学/材料

- 电子设备/消费品

- 车

- 製药和医疗保健

- 其他的

- 能源公用事业

- 住宅及商业建筑

- 运输/物流

- 资讯科技/通讯

- 金融服务

- 政府

8. 碳足迹管理市场(按组件)

- 解决方案

- 服务

- 咨询

- 整合和部署

- 支援和维护

9. 碳足迹管理市场(依部署模式)

- 云

- 本地

第十章 碳足迹管理市场(按地区)

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 南美洲

第十一章竞争格局

- 主要企业招募策略

- 前五大公司市场占有率分析

- 前五大公司收益分析

- 品牌/产品比较

- 估值和财务指标

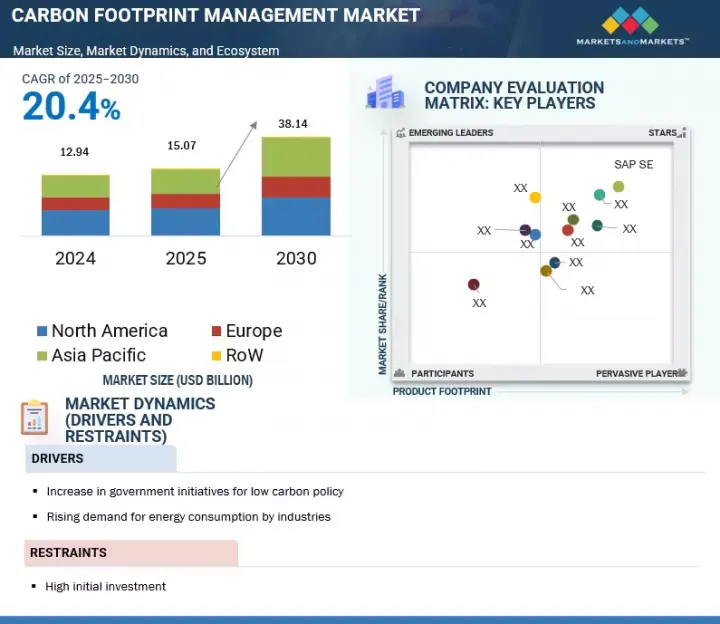

- 公司评估矩阵:主要企业

- Start-Ups/小型企业估值象限

- 竞争场景

第十二章:公司简介

- 主要企业

- SAP SE

- SALESFORCE, INC.

- ENGIE

- SCHNEIDER ELECTRIC

- IBM

- CARBON FOOTPRINT LTD.

- ISOMETRIX

- INTELEX

- TRINITY CONSULTANTS, INC.

- DAKOTA SOFTWARE CORPORATION

- ENABLON

- ENVIROSOFT

- ENVIANCE

- ACCUVIO

- ESP

- 其他公司

- PROCESSMAP

- NATIVE

- ENERGYCAP, LLC.

- LOCUS TECHNOLOGIES

- ECOTRACK

- CARBON TRUST

第十三章 附录

The carbon footprint management market is estimated to be valued at USD 15.07 billion in 2025 and USD 38.14 billion by 2030, recording a CAGR of 20.4% during the forecast period. Increasing government initiatives to reduce carbon emissions, rising industrial energy consumption, and growing corporate emphasis on sustainability reporting are key factors driving the carbon footprint management market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Component, By Deployment Mode, By Organization Size, By Vertical, and Region |

| Regions covered | Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

Governments worldwide implement strict environmental rules, prompting industries to adopt carbon monitoring solutions. Meanwhile, higher energy demands across different sectors force organizations to improve their usage and reduce emissions. Additionally, businesses are putting more emphasis on environmental, social, and governance (ESG) compliance, further accelerating the adoption of carbon footprint management solutions.

"By vertical, the manufacturing segment is expected to record the highest CAGR in the carbon footprint management market during the forecast period."

The manufacturing industry, by vertical, is expected to grow at the highest CAGR from 2025 to 2030, owing to various government and industry regulations to support green and sustainable economic activities. Several national, regional, and local governments have enacted carbon taxes and related measures, such as energy taxes, to reduce greenhouse gas emissions. As of 2024, over 65 carbon pricing initiatives-carbon taxes-are in place or scheduled globally, covering about 22% of world emissions. Additionally, to reduce their carbon footprint, many nations impose strict tax rules and regulations on their business and industrial sectors, contributing to the segmental growth.

"Based on deployment mode, the cloud technology segment is projected to hold the largest market share in 2030."

The cloud technology segment is expected to hold the largest share of the carbon footprint management market in 2030. The surge in cloud computing demand is a major boon for carbon footprint management, due to optimized energy use, advanced cooling, server virtualization, and increasing reliance on renewable energy by major providers. This shift enables companies to significantly cut their carbon footprint as they scale digital operations. Cloud deployment offers numerous benefits, including enhanced IT security, around-the-clock support, greater scalability, and increased operational speed. These advantages make cloud-based solutions highly attractive to organizations across various sectors. It provides flexibility by allowing businesses to scale their resources up or down based on demand, which optimizes costs and improves efficiency.

"North America is expected to dominate the carbon footprint management market between 2025 and 2030."

North America led the carbon footprint management market and is expected to maintain its strong position during the forecast period. This leadership stems from the region's proactive approach to tackling climate change through stricter environmental regulations, corporate sustainability initiatives, and investments in green technologies. Additionally, rapid economic shifts and a growing public awareness of the increasing carbon emissions augment the demand for effective carbon management solutions. As more businesses and governments prioritize climate action, the region is likely to see continued growth in this sector, supporting its transition toward a more sustainable and low-carbon future.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

By Designation: C-Level - 35%, Directors - 25%, and Others - 40%

By Region: Asia Pacific - 60%, North America - 10%, Europe - 15%, and RoW - 15%

Others include sales managers, engineers, and regional managers.

Note: Tier 1 Company-Revenue > USD 5 billion, Tier 2 Company-Revenue between USD 50 million and USD 5 billion, and Tier 3 Company-Revenue < USD 50 million

The global carbon footprint management market is dominated by a few major players with an extensive regional presence and many local players. Players in the carbon footprint management market include SAP SE (Germany), Salesforce, Inc. (US), ENGIE (France), Schneider Electric (France), IBM (US), Carbon Footprint Ltd. (UK), IsoMetrix (Australia), Intelex Technologies (Canada), Trinity Consultants, Inc. (US), Dakota Software Corporation (US), Enablon (France), Envirosift (UK), Enviance (US), Accuvio (Ireland), ESP (UK), Ideagen (UK), Native (US), EnergyCAP, LLC. (US), Locus Technologies (US), EcoTrack (US), and The Carbon Trust (UK).

Research Coverage:

The report defines, describes, and forecasts the carbon footprint management market by component, deployment mode, organization size, vertical, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market, including the analysis of the competitive landscape, market dynamics, market estimates in terms of value and volume, and future trends in the carbon footprint management market.

Key Benefits of Buying the Report

- Analysis of key drivers (Increasing government initiatives to reduce carbon emissions, Rising demand for energy consumption by industries, COP27 implementation to limit global warming), restraints (High upfront costs), opportunities (shift toward cloud computing and paperless economy), and challenges (comprehensive measuring, monitoring, and reporting scope) influencing the growth of the carbon footprint management market.

- Product Development/Innovation: Product development and innovation in the carbon footprint management market increasingly rely on AI-powered analytics, IoT-enabled real-time monitoring, and blockchain for transparent carbon tracking. Companies launch platforms that automate emissions measurement, improve predictive capabilities, and connect with ESG frameworks. This allows for more precise, scalable, and practical industry carbon reduction strategies.

- Market Development: Google Cloud and SAP announced the expansion of their relationship, unveiling new integrations between Google Workspace and SAP's flagship cloud ERP, SAP S/4HANA Cloud. These native integrations are expected to enable customers to connect core SAP software designed for running all mission-critical processes in the cloud with the collaborative capabilities of Google Docs and Google Sheets to innovate how work gets done across the enterprise.

- Market Diversification: SAP entered an agreement to acquire Signavio, a leader in enterprise business process intelligence and process management. This acquisition aimed to help companies rapidly understand, improve, transform, and manage their business processes at scale and was integrated into SAP's Business Process Intelligence portfolio. Signavio's solutions can support risk management and compliance efforts and provide greater visibility into third-party-related processes.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as SAP SE (Germany), Salesforce, Inc. (US), ENGIE (France), Schneider Electric (France), IBM (US), and Carbon Footprint Ltd. (UK), is conducted.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key data from primary sources

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- 2.3.3.1 Regional analysis

- 2.3.3.2 Country analysis

- 2.3.3.3 Demand-side assumptions

- 2.3.3.4 Demand-side calculations

- 2.3.4 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Supply-side calculations

- 2.3.4.2 Supply-side assumptions

- 2.3.5 FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR KEY PLAYERS IN CARBON FOOTPRINT MANAGEMENT MARKET

- 4.2 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION

- 4.3 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE AND COUNTRY, 2024

- 4.4 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT

- 4.5 CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE

- 4.6 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 4.7 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 4.8 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

- 4.9 CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing government initiatives to reduce carbon emissions

- 5.2.1.2 Rising demand for energy consumption by industries

- 5.2.1.3 COP27 implementation to limit global warming

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Shift toward cloud computing and paperless economy

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges in comprehensively measuring, monitoring, and reporting Scope 3 emissions

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.3.1 CARBON FOOTPRINT MANAGEMENT SOFTWARE VENDORS

- 5.3.2 SYSTEM INTEGRATORS AND SERVICE PROVIDERS

- 5.3.3 END USERS

- 5.3.4 POST-SALE SERVICES

- 5.4 ECOSYSTEM

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 SASFIN BANK LTD USES ISOMETRIX SOFTWARE TO MITIGATE RISK

- 5.5.2 BEN & JERRY'S OFFSET PROVIDES SEED FUNDING FOR MORE SUSTAINABLE AGRICULTURE

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 BLOCKCHAIN-BASED CARBON FOOTPRINT MANAGEMENT DEVELOPMENT

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF CARBON FOOTPRINT SOFTWARE SUBSCRIPTIONS, BY COMPANY

- 5.8 KEY CONFERENCES & EVENTS, 2025-2026

- 5.9 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 REGULATIONS RELATED TO CARBON FOOTPRINT MANAGEMENT

- 5.11 STANDARDS RELATED TO CARBON FOOTPRINT MANAGEMENT

- 5.12 PATENT ANALYSIS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON CARBON FOOTPRINT MANAGEMENT MARKET

- 5.16.1 ADOPTION OF GEN AI/AI IN CARBON FOOTPRINT MANAGEMENT MARKET

- 5.16.2 IMPACT OF GEN AI/AI, BY VERTICAL

- 5.16.3 IMPACT OF GEN AI/AI ON CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION

- 5.17 GLOBAL MACROECONOMIC OUTLOOK

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECAST

- 5.17.3 IMPACT OF INFLATION ON CARBON FOOTPRINT MANAGEMENT MARKET

- 5.18 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT ON REGION

6 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 6.1 INTRODUCTION

- 6.2 CORPORATES/ENTERPRISES

- 6.2.1 RISING PRESSURE TO ADOPT SUSTAINABLE SOLUTIONS TO DRIVE MARKET

- 6.3 MID-TIER ENTERPRISES

- 6.3.1 STAKEHOLDER SUPPORT TO GOVERN ADOPTION TO BOOST MARKET

- 6.4 SMALL BUSINESSES

- 6.4.1 LACK OF AWARENESS AMONG SMALL BUSINESSES TO LIMIT GROWTH

7 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- 7.2 MANUFACTURING

- 7.2.1 RISKS RELATED TO NON-COMPLIANCE TO INCREASE IMPLEMENTATION

- 7.2.2 FOOD & BEVERAGES

- 7.2.2.1 Elimination of waste and inefficiency in production, distribution, and consumption - key drivers

- 7.2.3 METALS & MINING

- 7.2.3.1 Significant role in reducing global carbon footprint to drive segment

- 7.2.4 CHEMICAL & MATERIALS

- 7.2.4.1 Importance of Scope 3 emission reporting to fuel adoption

- 7.2.5 ELECTRONICS & CONSUMER GOODS

- 7.2.5.1 Solutions to help set near-term and long-term carbon emission targets

- 7.2.6 AUTOMOTIVE

- 7.2.6.1 Rising demand due to pressure from investors and government

- 7.2.7 PHARMACEUTICAL & HEALTHCARE

- 7.2.7.1 Automation to increase adoption

- 7.2.8 OTHERS

- 7.3 ENERGY & UTILITIES

- 7.3.1 RISING DEMAND FOR ENERGY TO LEAD TO INCREASING EMISSIONS

- 7.4 RESIDENTIAL & COMMERCIAL BUILDINGS

- 7.4.1 BENEFITS OF SIMULATION IN BUILDING ENERGY EFFICIENCY TO DRIVE MARKET

- 7.5 TRANSPORTATION & LOGISTICS

- 7.5.1 IMPROVED EFFICIENCY AND REDUCED COMPLEXITY TO DRIVE DEMAND

- 7.6 IT & TELECOM

- 7.6.1 SHIFT TO GREEN INFRASTRUCTURE AND SUPPLY CHAIN DECARBONIZATION TO DRIVE MARKET

- 7.7 FINANCIAL SERVICES

- 7.7.1 HIGH EMPHASIS ON LOWERING CARBON EMISSIONS TO BOOST MARKET

- 7.8 GOVERNMENT

- 7.8.1 HIGHER CONTRIBUTION TOWARD CARBON REDUCTION OBJECTIVES

8 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 SOLUTIONS

- 8.2.1 INCREASING FOCUS ON EMISSION REDUCTION PLANS TO FUEL SEGMENT

- 8.3 SERVICES

- 8.3.1 NEED FOR HIGH EXPERTISE AND KNOWLEDGE ABOUT CARBON FOOTPRINT MANAGEMENT

- 8.3.2 CONSULTING

- 8.3.3 INTEGRATION & DEPLOYMENT

- 8.3.4 SUPPORT & MAINTENANCE

9 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.2 CLOUD

- 9.2.1 EASE OF EXECUTION AND INCREASED DATA SECURITY

- 9.3 ON-PREMISES

- 9.3.1 LOWER ADOPTION RATES DUE TO INCREASING AUTOMATION

10 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 BY COMPONENT

- 10.2.2 BY SERVICE

- 10.2.3 BY DEPLOYMENT MODE

- 10.2.4 BY ORGANIZATION SIZE

- 10.2.5 BY VERTICAL

- 10.2.6 BY MANUFACTURING INDUSTRY

- 10.2.7 BY COUNTRY

- 10.2.7.1 US

- 10.2.7.1.1 Regulations on ESG disclosure and NDC targets to drive market

- 10.2.7.2 Canada

- 10.2.7.2.1 Sector-wise emission reduction strategy to boost demand

- 10.2.7.3 Mexico

- 10.2.7.3.1 Move toward energy-efficient and low-carbon footprint sustainable buildings and cities to boost market

- 10.2.7.1 US

- 10.3 EUROPE

- 10.3.1 BY COMPONENT

- 10.3.2 BY SERVICE

- 10.3.3 BY DEPLOYMENT MODE

- 10.3.4 BY ORGANIZATION SIZE

- 10.3.5 BY VERTICAL

- 10.3.6 BY MANUFACTURING INDUSTRY

- 10.3.7 BY COUNTRY

- 10.3.7.1 Germany

- 10.3.7.1.1 Federal carbon and GHG neutrality act to boost deployment

- 10.3.7.2 France

- 10.3.7.2.1 Initiatives to support decarbonization of emission-intensive sectors to boost market

- 10.3.7.3 UK

- 10.3.7.3.1 Focus on reducing emissions from power, transport, and building sectors to propel market

- 10.3.7.4 Rest of Europe

- 10.3.7.1 Germany

- 10.4 ASIA PACIFIC

- 10.4.1 BY COMPONENT

- 10.4.2 BY SERVICES

- 10.4.3 BY DEPLOYMENT MODE

- 10.4.4 BY ORGANIZATION SIZE

- 10.4.5 BY VERTICAL

- 10.4.6 BY MANUFACTURING INDUSTRY

- 10.4.7 BY COUNTRY

- 10.4.7.1 China

- 10.4.7.1.1 High returns associated with development and production of low-carbon technologies to drive market

- 10.4.7.2 India

- 10.4.7.2.1 Goals to reduce carbon emissions by 1 billion tons by 2030 to fuel market growth

- 10.4.7.3 Japan

- 10.4.7.3.1 Active participation by companies to achieve carbon neutrality goals to propel market

- 10.4.7.4 Singapore

- 10.4.7.4.1 Active participation in multinational emission control efforts to drive market

- 10.4.7.5 Australia

- 10.4.7.5.1 National framework on greenhouse gases and energy reporting to boost market growth

- 10.4.7.6 Rest of Asia Pacific

- 10.4.7.1 China

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 BY COMPONENT

- 10.5.2 BY SERVICE

- 10.5.3 BY DEPLOYMENT MODE

- 10.5.4 BY ORGANIZATION SIZE

- 10.5.5 BY VERTICAL

- 10.5.6 BY MANUFACTURING INDUSTRY

- 10.5.7 BY COUNTRY

- 10.5.7.1 Saudi Arabia

- 10.5.7.1.1 Launch of government initiatives to tackle emissions to propel market

- 10.5.7.2 UAE

- 10.5.7.2.1 Initiatives to improve quality of environment to boost market growth

- 10.5.7.3 Rest of Middle East & Africa

- 10.5.7.1 Saudi Arabia

- 10.6 SOUTH AMERICA

- 10.6.1 BY COMPONENT

- 10.6.2 BY SERVICE

- 10.6.3 BY DEPLOYMENT MODE

- 10.6.4 BY ORGANIZATION SIZE

- 10.6.5 BY VERTICAL

- 10.6.6 BY MANUFACTURING INDUSTRY

- 10.6.7 BY COUNTRY

- 10.6.7.1 Brazil

- 10.6.7.1.1 Focus on CO2 emission reduction to meet climate neutrality goals to drive demand

- 10.6.7.2 Rest of South America

- 10.6.7.1 Brazil

11 COMPETITIVE LANDSCAPE

- 11.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

- 11.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 11.4 BRAND/PRODUCT COMPARISON

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 PERVASIVE PLAYERS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Component footprint

- 11.6.5.4 Deployment mode footprint

- 11.6.5.5 Vertical footprint

- 11.7 STARTUP/SME EVALUATION QUADRANT, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SAP SE

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SALESFORCE, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Right to win

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 ENGIE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 SCHNEIDER ELECTRIC

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 IBM

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 CARBON FOOTPRINT LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 ISOMETRIX

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.8 INTELEX

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 TRINITY CONSULTANTS, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.10 DAKOTA SOFTWARE CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.11 ENABLON

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.12 ENVIROSOFT

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 ENVIANCE

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Deals

- 12.1.14 ACCUVIO

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 ESP

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.1 SAP SE

- 12.2 OTHER PLAYERS

- 12.2.1 PROCESSMAP

- 12.2.2 NATIVE

- 12.2.3 ENERGYCAP, LLC.

- 12.2.4 LOCUS TECHNOLOGIES

- 12.2.5 ECOTRACK

- 12.2.6 CARBON TRUST

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT

- TABLE 2 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE

- TABLE 3 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE

- TABLE 4 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

- TABLE 5 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION

- TABLE 6 CARBON FOOTPRINT MANAGEMENT MARKET SNAPSHOT

- TABLE 7 ROLE OF CARBON FOOTPRINT MANAGEMENT IN ECOSYSTEM

- TABLE 8 AVERAGE SELLING PRICES OF CARBON FOOTPRINT SUBSCRIPTIONS, 2024

- TABLE 9 INDICATIVE SELLING PRICE OF CARBON FOOTPRINT SOFTWARE SUBSCRIPTIONS, 2024

- TABLE 10 CARBON FOOTPRINT MANAGEMENT MARKET: CONFERENCES & EVENTS, 2025-2026

- TABLE 11 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REGULATIONS FOR CARBON FOOTPRINT MANAGEMENT

- TABLE 16 STANDARDS FOR CARBON FOOTPRINT MANAGEMENT

- TABLE 17 CARBON FOOTPRINT MANAGEMENT MARKET: KEY PATENTS

- TABLE 18 PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 20 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 21 WORLD GDP GROWTH, 2021-2028 (USD TRILLION)

- TABLE 22 INFLATION RATE (ANNUAL PERCENT CHANGE), 2024

- TABLE 23 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION)

- TABLE 24 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 25 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 26 CORPORATES/ENTERPRISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 CORPORATES/ENTERPRISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 MID-TIER ENTERPRISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 MID-TIER ENTERPRISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 SMALL BUSINESSES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 SMALL BUSINESSES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 33 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 34 MANUFACTURING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 MANUFACTURING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 MANUFACTURING: CARBON FOOTPRINT MANAGEMENT MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 37 MANUFACTURING: CARBON FOOTPRINT MANAGEMENT MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 38 FOOD & BEVERAGES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 FOOD & BEVERAGES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 METALS & MINING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 METALS & MINING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 CHEMICAL & MATERIALS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 CHEMICAL & MATERIALS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 ELECTRONICS & CONSUMER GOODS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ELECTRONICS & CONSUMER GOODS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 AUTOMOTIVE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 AUTOMOTIVE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 PHARMACEUTICAL & HEALTHCARE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 PHARMACEUTICAL & HEALTHCARE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 OTHERS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 OTHERS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 ENERGY & UTILITIES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 ENERGY & UTILITIES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 RESIDENTIAL & COMMERCIAL BUILDINGS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 RESIDENTIAL & COMMERCIAL BUILDINGS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 TRANSPORTATION & LOGISTICS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 TRANSPORTATION & LOGISTICS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 IT & TELECOM: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 IT & TELECOM: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 FINANCIAL SERVICES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 FINANCIAL SERVICES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 GOVERNMENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 GOVERNMENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 65 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 66 SOLUTIONS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 SOLUTIONS: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 SERVICES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 SERVICES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 71 CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 72 CONSULTING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 CONSULTING: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 INTEGRATION & DEPLOYMENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 INTEGRATION & DEPLOYMENT: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 SUPPORT & MAINTENANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 SUPPORT & MAINTENANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 79 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 80 CLOUD: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 CLOUD: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 ON-PREMISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 ON-PREMISES: CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 CARBON FOOTPRINT MANAGEMENT MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 87 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 88 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 89 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 101 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 102 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 103 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 104 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 105 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 106 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 107 US: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 108 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 109 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 111 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 112 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 113 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 114 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 115 CANADA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 116 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 117 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 118 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 119 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 120 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 121 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 122 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 123 MEXICO: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 124 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 126 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 127 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 128 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 138 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 139 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 140 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 141 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 143 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 144 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 145 GERMANY: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 146 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 147 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 148 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 149 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 150 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 151 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 152 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 153 FRANCE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 154 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 155 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 156 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 157 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 158 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 159 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 160 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 161 UK: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 162 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 163 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 164 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 165 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 166 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 167 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 168 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 169 REST OF EUROPE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 170 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 171 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 172 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 173 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 174 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 175 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 176 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 177 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 178 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 179 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 180 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 181 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 182 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 183 ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 184 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 185 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 186 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 187 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 188 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 189 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 190 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 191 CHINA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 192 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 193 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 194 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 195 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 196 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 197 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 198 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 199 INDIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 200 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 201 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 202 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 203 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 204 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 205 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 206 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 207 JAPAN: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 208 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 209 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 210 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 211 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 212 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 213 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 214 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 215 SINGAPORE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 216 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 217 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 218 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 219 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 220 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 221 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 222 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 223 AUSTRALIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 225 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 226 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 227 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 228 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 231 REST OF ASIA PACIFIC: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 246 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 247 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 248 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 249 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 250 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 251 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 252 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 253 SAUDI ARABIA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 254 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 255 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 256 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 257 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 258 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 259 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 260 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 261 UAE: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 270 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 271 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 272 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 273 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 274 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 275 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 276 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 277 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 278 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 279 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 280 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 281 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY MANUFACTURING INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 282 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 283 SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 284 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 285 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 286 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 287 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 288 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 289 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 290 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 291 BRAZIL: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 292 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 293 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 294 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 295 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 296 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2024 (USD MILLION)

- TABLE 297 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 298 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 299 REST OF SOUTH AMERICA: CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD MILLION)

- TABLE 300 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2020 -JULY 2025

- TABLE 301 DEGREE OF COMPETITION

- TABLE 302 CARBON FOOTPRINT MANAGEMENT MARKET: COMPANY FOOTPRINT

- TABLE 303 CARBON FOOTPRINT MANAGEMENT MARKET: REGION FOOTPRINT

- TABLE 304 CARBON FOOTPRINT MANAGEMENT MARKET: COMPONENT FOOTPRINT

- TABLE 305 CARBON FOOTPRINT MANAGEMENT MARKET: DEPLOYMENT MODE FOOTPRINT

- TABLE 306 CARBON FOOTPRINT MANAGEMENT MARKET: VERTICAL FOOTPRINT

- TABLE 307 CARBON FOOTPRINT MANAGEMENT MARKET: KEY STARTUPS/SMES

- TABLE 308 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 309 PRODUCT LAUNCHES, JANUARY 2020-JULY 2025

- TABLE 310 DEALS, JANUARY 2020-JULY 2025

- TABLE 311 CARBON FOOTPRINT MANAGEMENT MARKET: EXPANSIONS, JANUARY 2020- JULY 2025

- TABLE 312 SAP SE: COMPANY OVERVIEW

- TABLE 313 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 SAP SE: DEALS

- TABLE 315 SALESFORCE, INC.: COMPANY OVERVIEW

- TABLE 316 SALESFORCE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 ENGIE: COMPANY OVERVIEW

- TABLE 318 ENGIE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 320 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 SCHNEIDER ELECTRIC: DEALS

- TABLE 322 IBM: COMPANY OVERVIEW

- TABLE 323 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 324 IBM: PRODUCT LAUNCHES

- TABLE 325 CARBON FOOTPRINT LTD.: COMPANY OVERVIEW

- TABLE 326 CARBON FOOTPRINT LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 ISOMETRIX: COMPANY OVERVIEW

- TABLE 328 ISOMETRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 ISOMETRIX: PRODUCT LAUNCHES

- TABLE 330 ISOMETRIX: DEALS

- TABLE 331 INTELEX: COMPANY OVERVIEW

- TABLE 332 INTELEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 INTELEX: DEALS

- TABLE 334 INTELEX: EXPANSIONS

- TABLE 335 TRINITY CONSULTANTS, INC.: COMPANY OVERVIEW

- TABLE 336 TRINITY CONSULTANTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 TRINITY CONSULTANTS, INC.: DEALS

- TABLE 338 DAKOTA SOFTWARE CORPORATION: COMPANY OVERVIEW

- TABLE 339 DAKOTA SOFTWARE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 DAKOTA SOFTWARE CORPORATION: DEALS

- TABLE 341 ENABLON: COMPANY OVERVIEW

- TABLE 342 ENABLON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 ENABLON: DEALS

- TABLE 344 ENVIROSOFT: COMPANY OVERVIEW

- TABLE 345 ENVIROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 346 ENVIANCE: COMPANY OVERVIEW

- TABLE 347 ENVIANCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 ENVIANCE: PRODUCT LAUNCHES

- TABLE 349 ENVIANCE: DEALS

- TABLE 350 ACCUVIO: COMPANY OVERVIEW

- TABLE 351 ACCUVIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 ACCUVIO: DEALS

- TABLE 353 ESP: COMPANY OVERVIEW

- TABLE 354 ESP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 CARBON FOOTPRINT MANAGEMENT MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 CARBON FOOTPRINT MANAGEMENT MARKET: RESEARCH DESIGN

- FIGURE 3 CARBON FOOTPRINT MANAGEMENT MARKET: DATA TRIANGULATION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR CARBON FOOTPRINT MANAGEMENT

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF CARBON FOOTPRINT MANAGEMENT

- FIGURE 9 SUPPLY-SIDE ANALYSIS

- FIGURE 10 NORTH AMERICA HELD LARGEST SHARE OF CARBON FOOTPRINT MANAGEMENT MARKET IN 2024

- FIGURE 11 SOLUTIONS SEGMENT TO LEAD CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT

- FIGURE 12 CLOUD SEGMENT TO COMMAND MARKET IN 2025 AND 2030

- FIGURE 13 CORPORATES/ENTERPRISES TO BE LARGEST SEGMENT IN 2030

- FIGURE 14 MANUFACTURING SEGMENT TO DOMINATE CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

- FIGURE 15 REGULATIONS FOR REDUCTION OF CARBON EMISSIONS TO BOOST CARBON FOOTPRINT MANAGEMENT MARKET BETWEEN 2025 AND 2030

- FIGURE 16 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 CLOUD SEGMENT AND US ACCOUNTED FOR LARGEST MARKET SHARE IN NORTH AMERICA IN 2024

- FIGURE 18 SOLUTIONS SEGMENT TO DOMINATE CARBON FOOTPRINT MANAGEMENT MARKET IN 2030

- FIGURE 19 CONSULTING SEGMENT TO LEAD CARBON FOOTPRINT MANAGEMENT MARKET IN 2030

- FIGURE 20 CLOUD SEGMENT TO ACCOUNT FOR LARGER SHARE OF CARBON FOOTPRINT MANAGEMENT MARKET IN 2030

- FIGURE 21 CORPORATES/ENTERPRISES TO BE LARGEST SEGMENT, BY ORGANIZATION SIZE, IN 2030

- FIGURE 22 MANUFACTURING TO BE DOMINANT VERTICAL IN CARBON FOOTPRINT MANAGEMENT MARKET IN 2030

- FIGURE 23 METALS & MINING TO LEAD MARKET AMONG MANUFACTURING INDUSTRIES IN 2030

- FIGURE 24 MARKET DYNAMICS FOR CARBON FOOTPRINT MANAGEMENT MARKET

- FIGURE 25 VALUE CHAIN ANALYSIS

- FIGURE 26 CARBON FOOTPRINT MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS FOR CARBON FOOTPRINT MANAGEMENT MARKET

- FIGURE 28 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP VERTICALS

- FIGURE 30 IMPACT OF GEN AI/AI ON CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL

- FIGURE 31 CARBON FOOTPRINT MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024

- FIGURE 32 CARBON FOOTPRINT MANAGEMENT MARKET, BY VERTICAL, 2024

- FIGURE 33 CARBON FOOTPRINT MANAGEMENT MARKET, BY COMPONENT, 2024

- FIGURE 34 CARBON FOOTPRINT MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2024

- FIGURE 35 CARBON FOOTPRINT MANAGEMENT MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 36 CARBON FOOTPRINT MANAGEMENT MARKET: SHARE OF EACH REGION, 2024

- FIGURE 37 SNAPSHOT: NORTH AMERICA CARBON FOOTPRINT MANAGEMENT MARKET

- FIGURE 38 SNAPSHOT: EUROPE CARBON FOOTPRINT MANAGEMENT MARKET

- FIGURE 39 CARBON FOOTPRINT MANAGEMENT MARKET SHARE ANALYSIS, 2024

- FIGURE 40 TOP PLAYERS IN CARBON FOOTPRINT MANAGEMENT MARKET FROM 2020 TO 2024

- FIGURE 41 BRAND/PRODUCT COMPARISON

- FIGURE 42 COMPANY VALUATION

- FIGURE 43 FINANCIAL METRICS

- FIGURE 44 CARBON FOOTPRINT MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 CARBON FOOTPRINT MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 SAP SE: COMPANY SNAPSHOT

- FIGURE 47 SALESFORCE, INC. GROUP: COMPANY SNAPSHOT

- FIGURE 48 ENGIE: COMPANY SNAPSHOT

- FIGURE 49 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT