|

市场调查报告书

商品编码

1798377

全球聚乳酸市场(按等级、原料、应用、最终用途产业和地区划分)- 2030 年预测Polylactic Acid Market by Grade, Application, End-use Industry, Raw Material, and Region - Global Forecast to 2030 |

||||||

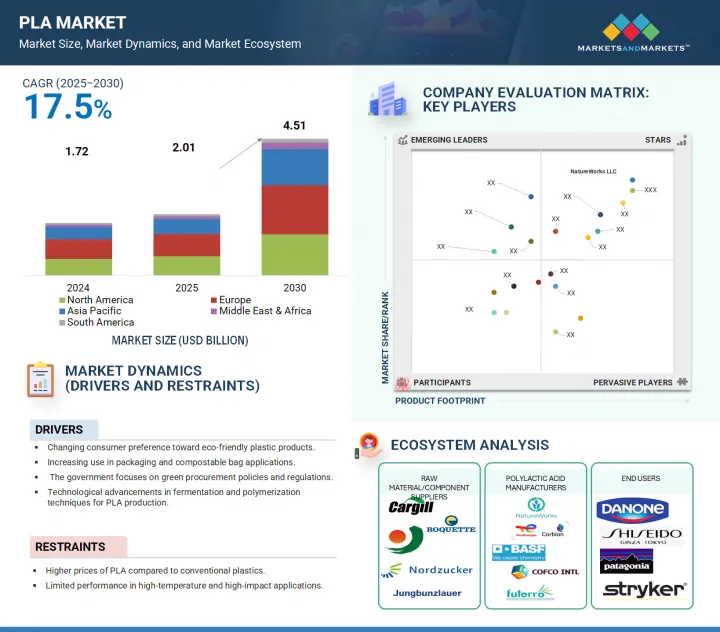

全球聚乳酸 (PLA) 市场规模预计将从 2025 年的 20.1 亿美元扩大到 2030 年的 45.1 亿美元,预测期内复合年增长率为 17.5%。

这种成长很大程度上是由于食品和饮料产业对可堆肥包装的需求不断增加,以及新的大型工业PLA 生产工厂的启动,特别是在亚太、欧洲和北美地区。

| 调查范围 | |

|---|---|

| 调查年份 | 2023-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元/十亿美元) 数量(千吨) |

| 部分 | 按等级、原料、用途、最终用途行业和地区 |

| 目标区域 | 亚太地区、北美、欧洲、中东和非洲、南美 |

此外,PLA 耐热性和化学可回收性的持续发展,为汽车、电子产品和耐用消费品等应用领域创造了更广泛的市场发展机会。得益于生物精炼厂的投资、原料多元化以及品牌对永续包装开发的投入,市场发展前景依然乐观。生物医疗医疗设备市场、复合材料和低碳製造系统等领域的新应用也有望带来长期成长机会。

薄膜和片材应用领域预计将成为聚乳酸 (PLA) 市场中成长速度第二快的领域。由于其优异的透明度、密封性以及在某些情况下的生物分解性,PLA 薄膜被广泛应用于各种领域,包括食品软包装、农用地膜、个人护理包装和各种标籤应用。在这一细分市场中,全球正逐渐放弃使用传统的多层塑胶薄膜,加上对经认证的可堆肥包装产品的需求日益增长,这促进了 PLA 基薄膜作为替代材料的推广应用。支持全球可堆肥包装倡议的计划表明,PLA 基薄膜在压层、热封和涂层应用以及其他积极追求永续产品的领域中的应用日益广泛。

预计到2024年,挤出级PLA领域将成为PLA市场中成长第二快的领域,这得益于包装、建筑和消费应用领域对生物基片材、薄膜和型材日益增长的需求。 PLA能够利用标准挤出设备,且具有更高的耐热性和机械稳定性,使其成为刚性和柔性应用中传统聚合物的可行替代品。挤出领域正在进一步发展,因为它越来越多地被用作翻盖式容器、泡壳包装、层压材料和其他包装产品的可行替代品,尤其是在需要可成型性、透明度和可堆肥性的情况下。随着食品包装和工业片材市场转向更永续的材料,挤出级PLA领域提供了经济实惠的替代方案,同时能够实现大规模高效加工,从而减少整体环境影响。共挤和多层PLA结构等其他创新可能有助于扩大该领域的国际影响力。

到2024年,玉米粉将成为继甘蔗之后成长速度第二快的聚乳酸(PLA)原料来源。玉米淀粉仍是乳酸发酵中最主要且最容易取得的原料,尤其是在北美、欧洲和中国。其强大的供应链、极具竞争力的价格以及较高的可发酵糖含量等优势,使其对大规模聚乳酸(PLA)生产极具吸引力。消费者和监管机构对生物分解性包装和农业薄膜日益增长的需求,尤其是在拥有成熟玉米加工基础设施的新兴市场,将推动玉米基聚乳酸(PLA)市场的发展。此外,正在进行的非基因改造玉米发酵研究以及碳效率更高的生产方法的开发,可能会提升人们的永续性意识,并改善玉米淀粉的市场前景。

预计到2024年,中东和非洲将成为全球成长第二快的聚乳酸(PLA)区域市场。人们对塑胶污染的认识不断提高,生物基包装替代品的采用以及该地区致力于实现永续发展目标(SDG)的努力,这些因素共同推动了这一发展。中东和非洲各国政府正在推出立法,以减少一次性塑胶的使用,在该地区运营的跨国快速消费品公司也因其永续性的承诺而转向使用聚乳酸(PLA)基材料。此外,海湾地区、南非和北非国家食品包装、消费品和农业部门的扩张为PLA的应用提供了良好的基础。该地区还拥有具有成本竞争力的生物质资源,并正在吸引外国对绿色技术和生物基产业的直接投资,这进一步推动了PLA市场的成长。

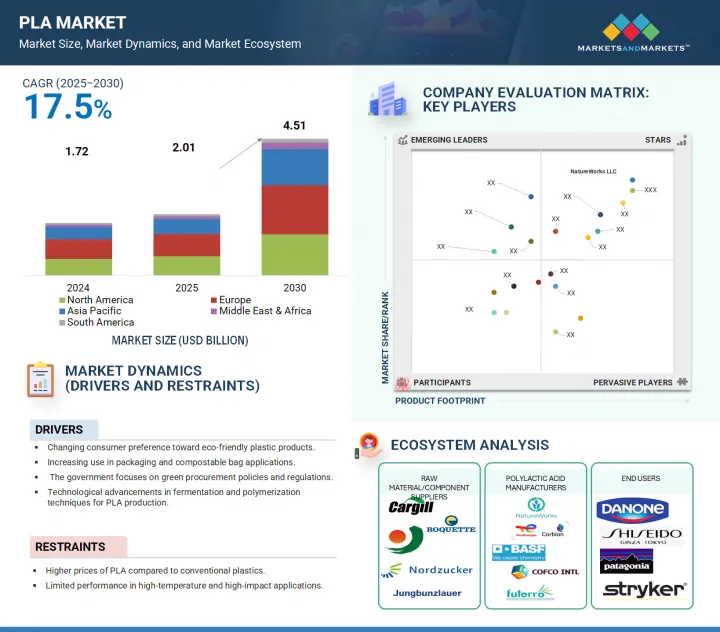

参与公司:NatureWorks LLC(美国)、TotalEnergies Corbion(荷兰)、 BASF SE(德国)、中粮集团(中国)、Futerro(比利时)、Danimer Scientific(美国)、东丽株式会社(日本)、赢创工业(德国)、三菱化学株式会社(日本)、尤株式会社(日本)、赢创工业(德国)、三菱化学株式会社(日本)、尤株式会社(日本)。

该研究包括对 PLA 市场这些主要企业的详细竞争分析,包括他们的公司简介、最新发展和主要市场策略。

调查对象

本研究报告根据等级(热成型级、射出成型级、挤出级、吹塑成型级)、应用(硬质热成型产品、薄膜和片材、瓶子)、最终用途行业(包装、消费品、农业、纺织、生物医学)、原材料(甘蔗、玉米粉、木薯、甘蔗)和地区(亚太地区、北美、欧洲、南美、中东和非洲)对 PLA 市场进行细分。本报告的范围包括影响 PLA 市场成长的驱动因素、限制因素、挑战和机会的详细资讯。对主要产业参与者的全面分析提供了有关他们的业务概况、产品供应和关键策略的见解,例如与 PLA 市场相关的合作伙伴关係、协议、产品发布、业务扩展和收购。此外,它还对 PLA 产业生态系统中的新兴新兴企业进行了竞争分析。

本报告为市场领导和新进业者提供整个聚乳酸市场及其细分市场的收益估算。该报告旨在帮助相关人员了解竞争格局,更好地洞察业务定位,并制定合适的市场进入策略。它还能帮助相关人员掌握市场脉搏,并提供有关市场驱动因素和挑战的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

- 聚乳酸市场机会诱人

- 聚乳酸市场(依等级)

- 聚乳酸市场(按原始材料)

- 聚乳酸市场(按应用)

- 聚乳酸市场(按最终用途行业)

- 聚乳酸市场(按国家)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 波特五力分析

- 价值链分析

- 专利分析

- 定价分析

- 2022-2030年各地区聚乳酸平均销售价格

- 聚乳酸各等级平均售价(2022-2030年)

- 聚乳酸平均售价(以最终用途产业划分,2024年)

- 2024年市场排名前三的公司的平均销售价格

- 聚乳酸的製作方法

- 原料分析

- 生态系/市场製图

- 案例研究

- 监管状况

- 贸易分析

- 影响客户业务的趋势/中断

- 2025-2026年主要会议和活动

- 影响购买决策的关键因素

- 技术分析

第六章 聚乳酸市场(依等级)

- 介绍

- 热成型

- 射出成型

- 挤压

- 吹塑成型

- 其他的

第七章聚乳酸市场(按原始材料)

- 介绍

- 甘蔗

- 玉米粉

- 木薯

- 甜菜

- 其他的

第八章聚乳酸市场(按应用)

- 介绍

- 硬质热成型产品

- 薄膜和片材

- 瓶子

- 其他的

第九章聚乳酸市场(依最终用途产业)

- 介绍

- 包装

- 消费品

- 农业

- 纤维

- 生物医学

- 其他的

第 10 章 聚乳酸市场(按区域)

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他的

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他的

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他的

第十一章竞争格局

- 概述

- 主要参与企业的策略

- 市场占有率分析

- 收益分析

- 估值和财务指标

- 产品/品牌比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- NATUREWORKS LLC

- TOTALENERGIES CORBION

- BASF SE

- COFCO

- FUTERRO

- DANIMER SCIENTIFIC

- TORAY INDUSTRIES, INC.

- EVONIK INDUSTRIES

- MITSUBISHI CHEMICAL GROUP CORPORATION

- UNITIKA LTD.

- 其他公司

- BIOWORKS CORPORATION

- ADBIOPLASTICS

- MUSASHINO CHEMICAL LABORATORY, LTD.

- HANGZHOU PEIJIN CHEMICAL CO.,LTD.

- AKRO-PLASTIC GMBH

- FUJIAN GREENJOY BIOMATERIAL CO., LTD.

- PLAMFG

- FKUR

- OTTO CHEMIE PVT. LTD.

- RAGHAV POLYMERS

- VAISHNAVI BIO TECH

- HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

- EMNANDI BIOPLASTICS

- UNILONG INDUSTRY CO., LTD.

- PRAJ INDUSTRIES

第十三章 附录

The global PLA market is expected to increase from USD 2.01 billion in 2025 to USD 4.51 billion by 2030, translating into a CAGR of 17.5% over the forecast period. Much of this growth can be attributed to increasing demand for compostable packaging in the food and beverage sector, along with the rise of new large-scale industrial PLA production plants, particularly in the Asia Pacific, Europe, and North America regions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million / Billion) Volume (KT) |

| Segments | Application, Grade, End-use Industry, Raw Material, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

Additionally, ongoing developments of PLA that are heat-resistant or can be chemically recycled are opening up broader market opportunities for applications in automotive, electronics, and durable goods. The market outlook remains positive, supported by investments in bio-refineries, diversification of feedstocks, and commitments by brands to develop sustainable packaging. Emerging applications in the biomedical device market, composites, and low-carbon manufacturing systems will also present long-term growth opportunities perspective.

"Films & Sheets to Be Second Fastest-Growing Segment in the PLA Market"

The films and sheets application area is expected to be the second-fastest growing segment in the PLA market. PLA films are used in various applications, including flexible food packaging, agricultural mulch films, personal care wrappers, and different labeling uses due to their excellent transparency, sealability, and, for some applications, biodegradability. Within this market segment, it has become easier to adopt PLA-based film as a replacement because of the global shift away from traditional multilayer plastic films and the increasing demand for certified compostable packaging products. Projects that have supported global initiatives in compostable packaging show a rising use of PLA-based films in waiting-to-laminate, thermo-sealing, coating applications, and other segments actively pursuing sustainability products.

"Extrusion grade to be second fastest-growing segment in PLA market"

The extrusion grade PLA segment was the second fastest-growing segment in the PLA market in 2024, due to the increased demand for bio-based sheets, films, and profiles in packaging, construction, and consumer applications. PLA is considered a viable alternative to conventional polymers, in both rigid and flexible approaches, given that PLA can utilize standard extrusion equipment, improvements in thermal resistance, and mechanical stability. The extrusion segment is further advancing due to its increased use as a viable alternative for clamshell containers, blister packs, laminated materials, and other packaging products, especially where formability, clarity, and compostability are necessary. As the food packaging and industrial sheets market shifted toward more sustainable materials, the extrusion grade PLA segment offers inexpensive alternatives, while also offering large-scale, efficient processing, and reducing the overall impact on the environment. Other innovations, such as co-extrusion and multilayer PLA structures, will help increase the segment's footprint internationally.

"The corn starch segment was the second fastest-growing segment of PLA market in 2024."

The corn starch segment was the second-fastest growing source of PLA raw material in 2024, following sugarcane. Corn starch remains the most prominent and readily available feedstock for the fermentation of lactic acid, especially in North America, Europe, and China. It benefits from a strong supply chain, competitive prices, and high fermentable sugar content, making it attractive for large-scale PLA production. Growth in corn-based PLA is supported by increasing consumer and regulatory demand for biodegradable packaging and agricultural films, particularly in developed markets with well-established corn processing infrastructure. Additionally, ongoing research into fermenting non-GMO field corn and developing more carbon-efficient production methods will likely enhance perceptions of sustainability and improve marketing prospects for corn starch.

"Middle East & Africa to be second fastest-growing regional market for PLA"

The Middle East & Africa is anticipated to be the second fastest-growing regional PLA market in 2024. Growth is being driven by increasing awareness of plastic pollution, adoption of bio-based packaging alternatives, and the region's push toward sustainable development goals (SDGs). Governments in the Middle East & Africa are introducing legislation to reduce single-use plastics, and multinational FMCG companies operating in the region are shifting to PLA-based materials for their sustainability pledges. Additionally, the expansion of food packaging, consumer goods, and agriculture sectors across Gulf nations, South Africa, and North African countries provides a promising foundation for PLA adoption. The region also offers cost-competitive access to biomass resources and is attracting foreign direct investment in green technology and bio-based industries, further fueling its PLA market growth.

By Company Type: Tier 1: 23%, Tier 2: 42%, and Tier 3: 35%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: NatureWorks LLC (US), TotalEnergies Corbion (Netherlands), BASF SE (Germany), COFCO (China), Futerro (Belgium), Danimer Scientific (US), TORAY INDUSTRIES, INC. (Japan), Evonik Industries (Germany), Mitsubishi Chemical Group Corporation (Japan), and UNITIKA LTD. (Japan) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the PLA market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the PLA market based on grade (thermoforming grade, injection molding grade, extrusion grade, blow molding grade), application (rigid thermoforms, films & sheets, bottles), end-use industry (packaging, consumer goods, agricultural, textile, bio-medical), raw material (sugarcane, corn starch, cassava, sugarbeet), and region (Asia Pacific, North America, Europe, South America, Middle East & Africa). The report's scope includes detailed information on the drivers, restraints, challenges, and opportunities impacting the growth of the PLA market. A comprehensive analysis of key industry players provides insights into their business overview, products offered, and key strategies such as partnerships, agreements, product launches, expansions, and acquisitions related to the PLA market. Additionally, this report features a competitive analysis of emerging startups in the PLA industry ecosystem.

Reasons to Buy the Report

The report will provide market leaders and new entrants with estimates of revenue figures for the overall PLA market and its subsegments. This report will help stakeholders understand the competitive landscape, gain better insights into positioning their businesses, and develop appropriate go-to-market strategies. It will also help stakeholders understand the market's pulse and offer information on key drivers, restraints, and challenges opportunities.

The report provides insights into the following points:

- Assessment of primary drivers (changing consumer preference toward eco-friendly plastic products, Increasing use in packaging and compostable bag applications, government focus on green procurement policies and regulations, technological advancements in fermentation and polymerization techniques for PLA production) restraints (higher prices of PLA than conventional plastics and limited performance in high-temperature and high-impact applications), opportunities (development of new end-use applications, High growth potential in emerging economies of Asia Pacific, versatility of PLA in multiple sectors such as 3D printing, agriculture, and textiles), and challenges (lower thermal stability and mechanical performance compared to traditional plastics, competition from other biodegradable or recycled plastics and High production costs and complexity in scaling up).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the PLA market.

- Market Development: Comprehensive information about profitable markets-the report analyzes the PLA market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the PLA market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as NatureWorks LLC (US), TotalEnergies Corbion (Netherlands) , BASF SE (Germany), COFCO (China), Futerro (Belgium), Danimer Scientific (US), TORAY INDUSTRIES, INC. (Japan), Evonik Industries (Germany), Mitsubishi Chemical Group Corporation (Japan), and UNITIKA LTD. (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYLACTIC ACID MARKET

- 4.2 POLYLACTIC ACID MARKET, BY GRADE

- 4.3 POLYLACTIC ACID MARKET, BY RAW MATERIAL

- 4.4 POLYLACTIC ACID MARKET, BY APPLICATION

- 4.5 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY

- 4.6 POLYLACTIC ACID MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Changing consumer preference toward eco-friendly plastic products

- 5.2.1.2 Increasing use in packaging and compostable bag applications

- 5.2.1.3 Government focus on green procurement policies and regulations

- 5.2.1.4 Technological advancements in fermentation and polymerization processes of PLA

- 5.2.2 RESTRAINTS

- 5.2.2.1 Higher prices of PLA compared to conventional plastics

- 5.2.2.2 Limited performance in high-temperature and high-impact applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of new end-use applications

- 5.2.3.2 High growth potential in emerging countries of Asia Pacific

- 5.2.3.3 Versatility of PLA in 3D printing, agriculture, and textile sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Lower thermal stability and mechanical performance compared to traditional plastics

- 5.2.4.2 Competition from other biodegradable or recycled plastics

- 5.2.4.3 Expensive and complex production process

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 THREAT OF NEW ENTRANTS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS

- 5.4.3 DISTRIBUTORS

- 5.4.4 END-CONSUMERS

- 5.4.5 SUPPLIERS OF POLYLACTIC ACID MANUFACTURING EQUIPMENT

- 5.5 PATENT ANALYSIS

- 5.5.1 METHODOLOGY

- 5.5.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 5.5.3 PATENT PUBLICATION TRENDS

- 5.5.4 INSIGHTS

- 5.5.5 LEGAL STATUS OF PATENTS

- 5.5.6 JURISDICTION-WISE PATENT ANALYSIS

- 5.5.7 TOP COMPANIES/APPLICANTS

- 5.5.8 TOP 10 PATENT OWNERS (US) DURING LAST 10 YEARS

- 5.6 PRICE ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF POLYLACTIC ACID, BY REGION, 2022-2030

- 5.6.2 AVERAGE SELLING PRICE OF POLYLACTIC ACID, BY GRADE, 2022-2030

- 5.6.3 AVERAGE SELLING PRICE OF POLYLACTIC ACID, BY END-USE INDUSTRY, 2024

- 5.6.4 AVERAGE SELLING PRICE, BY TOP THREE MARKET PLAYERS, 2024

- 5.7 MANUFACTURING PROCESS OF POLYLACTIC ACID

- 5.7.1 RAW MATERIAL PREPARATION

- 5.7.2 LACTIDE PRODUCTION

- 5.7.3 LACTIDE PURIFICATION

- 5.7.4 LACTIDE DEPOLYMERIZATION

- 5.7.5 POLYMERIZATION CONTROL

- 5.7.6 POLYMER PURIFICATION AND PROCESSING

- 5.7.7 POST-PROCESSING AND FINISHING

- 5.7.8 PRODUCT MANUFACTURING

- 5.8 RAW MATERIAL ANALYSIS

- 5.8.1 STARCH

- 5.8.2 TAPIOCA ROOT

- 5.8.3 WOOD CHIPS

- 5.8.4 SUGARCANE

- 5.9 ECOSYSTEM/MARKET MAPPING

- 5.10 CASE STUDIES

- 5.10.1 TOTALENERGIES CORBION IMPROVES ENVIRONMENTAL FOOTPRINT WITH LUMINY RECYCLED PLAOVERVIEW

- 5.10.2 NATUREWOKS LLC HELPS SHANGHAI TUOZHUO IN IMPROVING PERFORMANCE AND REDUCING COST AND MAINTENANCE OF WOOD MOLDS FOR METAL CASTING

- 5.10.3 NATUREWORKS LLC PROVIDES INGEO POLYLACTIC ACID FILAMENT TO EARL E. BAKKEN MEDICAL DEVICE CENTER TO STREAMLINE ITS 3D PROTOTYPING

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 NORTH AMERICA

- 5.11.1.1 US

- 5.11.1.2 Canada

- 5.11.2 ASIA PACIFIC

- 5.11.3 EUROPE

- 5.11.1 NORTH AMERICA

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT-EXPORT SCENARIO OF POLYLACTIC ACID MARKET (HS CODE 390770)

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.15.1 PRICE

- 5.15.2 SUSTAINABILITY

- 5.15.3 PERFORMANCE

- 5.15.4 AVAILABILITY

- 5.15.5 REGULATIONS

- 5.15.6 BRAND REPUTATION

- 5.15.7 MARKET TRENDS

- 5.15.8 APPLICATION

- 5.16 TECHNOLOGY ANALYSIS

- 5.16.1 NANOCELLULOSE-PLA NANOCOMPOSITES

- 5.16.2 DEVELOPMENT OF STEREO-COMPLEX PLA FOR HEAT-RESISTANT APPLICATIONS

- 5.16.3 GRAPHENE-REINFORCED PLA FOR HIGH-STRENGTH AND CONDUCTIVE APPLICATIONS

6 POLYLACTIC ACID MARKET, BY GRADE

- 6.1 INTRODUCTION

- 6.2 THERMOFORMING

- 6.2.1 PROCESSING CHARACTERISTICS COMPARABLE TO CONVENTIONAL PLASTICS TO BOOST MARKET

- 6.3 INJECTION MOLDING

- 6.3.1 EXCELLENT MELT FLOW AND SUITABILITY FOR COMPLEX AND DETAILED MOLD DESIGNS TO PROPEL MARKET

- 6.4 EXTRUSION

- 6.4.1 GOOD PROCESSIBILITY, MECHANICAL STRENGTH, THERMAL STABILITY, AND LOW ENVIRONMENTAL IMPACT TO DRIVE MARKET

- 6.5 BLOW MOLDING

- 6.5.1 DEMAND FOR HIGH PRODUCTION VOLUMES AND LOW UNIT COST TO BOOST GROWTH

- 6.6 OTHER GRADES

7 POLYLACTIC ACID MARKET, BY RAW MATERIAL

- 7.1 INTRODUCTION

- 7.2 SUGARCANE

- 7.2.1 HIGH SUCROSE CONTENT, AVAILABILITY, AND SUSTAINABILITY TO BOOST MARKET

- 7.3 CORN STARCH

- 7.3.1 WIDE AVAILABILITY AS MOST CULTIVATED CROP GLOBALLY TO FUEL GROWTH

- 7.4 CASSAVA

- 7.4.1 RESILIENCE AND LESS REQUIREMENT OF WATER AND AGRICULTURAL INPUTS TO PROPEL GROWTH

- 7.5 SUGAR BEET

- 7.5.1 CARBON SEQUESTRATION, REDUCED WATER USAGE, , AND POTENTIAL FOR CROP ROTATION, ENHANCING SOIL FERTILITY TO DRIVE MARKET

- 7.6 OTHER RAW MATERIALS

8 POLYLACTIC ACID MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 RIGID THERMOFORMS

- 8.2.1 HIGH-VOLUME PRODUCTION OF PLASTIC PARTS TO DRIVE GROWTH

- 8.3 FILMS & SHEETS

- 8.3.1 DEMAND FOR PRODUCTION OF SPECIAL LINERS, WASTE MANAGEMENT SHEETS, AGRICULTURAL APPLICATIONS, AND RETAIL AND CONVENIENCE BAGS TO BOOST GROWTH

- 8.4 BOTTLES

- 8.4.1 FEWER FOSSIL FUEL RESOURCES AND PLANT-BASED CHEMICAL SYNTHESIS PROCESS TO DRIVE MARKET

- 8.5 OTHER APPLICATIONS

9 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 PACKAGING

- 9.2.1 HIGH DURABILITY AND IMPERMEABILITY OF WATER TO BOOST GROWTH

- 9.2.2 FOOD PACKAGING

- 9.2.3 NON-FOOD PACKAGING

- 9.3 CONSUMER GOODS

- 9.3.1 VERSATILITY AND COST-EFFECTIVENESS TO SUPPORT MARKET GROWTH

- 9.3.2 ELECTRICAL APPLIANCES

- 9.3.3 DOMESTIC APPLIANCES

- 9.4 AGRICULTURAL

- 9.4.1 REGENERATIVE AGRICULTURAL PRACTICES AND REDUCED SOIL POLLUTION TO PROPEL MARKET

- 9.4.2 PLANTER BOXES

- 9.4.3 TAPES & MULCH FILMS

- 9.4.4 NETTING

- 9.5 TEXTILE

- 9.5.1 GROWING DEMAND FOR APPAREL, HOME TEXTILES, AND NONWOVEN FABRICS TO BOOST MARKET

- 9.5.2 DIAPERS AND WIPES

- 9.5.3 FEMALE HYGIENE

- 9.5.4 PERSONAL CARE, CLOTHES, DISPOSABLE GARMENTS, MEDICAL & HEALTHCARE, AND OTHER TEXTILES

- 9.6 BIO-MEDICAL

- 9.6.1 BIODEGRADABILITY, BIOCOMPATIBILITY, AND SAFE ABSORPTION BY HUMAN BODY TO DRIVE GROWTH

- 9.6.2 MEDICAL PLATES AND SCREWS

- 9.6.3 IMPLANTS

- 9.7 OTHER END-USE INDUSTRIES

10 POLYLACTIC ACID MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Rising industrial investments and strong government mandates to boost market

- 10.2.2 INDIA

- 10.2.2.1 Stricter plastic waste laws, domestic push for bioplastics, and NGO engagement to boost market

- 10.2.3 JAPAN

- 10.2.3.1 Research on development of better polylactic acid grades to drive market

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Government policies to support market growth

- 10.2.5 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Ban on conventional plastics to drive market

- 10.3.2 UK

- 10.3.2.1 Stringent regulations on single-use plastics and rising domestic production capacity to drive market growth

- 10.3.3 FRANCE

- 10.3.3.1 Government initiatives to promote use of bioplastics to drive demand

- 10.3.4 ITALY

- 10.3.4.1 Demand from food packaging industry to drive demand

- 10.3.5 SPAIN

- 10.3.5.1 Rising public awareness and regulatory measures to boost market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Shift toward sustainable packaging to drive market growth

- 10.4.2 CANADA

- 10.4.2.1 Stringent environmental regulations and circular economy initiatives to propel growth

- 10.4.3 MEXICO

- 10.4.3.1 Strategic manufacturing and export hub to support market growth

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Abundance of raw materials to fuel market

- 10.5.2 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

- 10.6.1.1 Stringent anti-plastic regulations and circular economy efforts to fuel market

- 10.6.2 UAE

- 10.6.2.1 Focus on medical innovation, circular economy, and healthcare expansion to boost market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 SAUDI ARABIA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 PRODUCT/BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 NATUREWORKS LLC

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 TOTALENERGIES CORBION

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 BASF SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 COFCO

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 FUTERRO

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 DANIMER SCIENTIFIC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.3.2 Expansions

- 12.1.6.4 MnM view

- 12.1.7 TORAY INDUSTRIES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.4 MnM view

- 12.1.8 EVONIK INDUSTRIES

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.4 MnM view

- 12.1.9 MITSUBISHI CHEMICAL GROUP CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 UNITIKA LTD.

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 NATUREWORKS LLC

- 12.2 OTHER PLAYERS

- 12.2.1 BIOWORKS CORPORATION

- 12.2.2 ADBIOPLASTICS

- 12.2.3 MUSASHINO CHEMICAL LABORATORY, LTD.

- 12.2.4 HANGZHOU PEIJIN CHEMICAL CO.,LTD.

- 12.2.5 AKRO-PLASTIC GMBH

- 12.2.6 FUJIAN GREENJOY BIOMATERIAL CO., LTD.

- 12.2.7 PLAMFG

- 12.2.8 FKUR

- 12.2.9 OTTO CHEMIE PVT. LTD.

- 12.2.10 RAGHAV POLYMERS

- 12.2.11 VAISHNAVI BIO TECH

- 12.2.12 HENAN SINOWIN CHEMICAL INDUSTRY CO., LTD.

- 12.2.13 EMNANDI BIOPLASTICS

- 12.2.14 UNILONG INDUSTRY CO., LTD.

- 12.2.15 PRAJ INDUSTRIES

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 POLYLACTIC ACID MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 ADVERSE HEALTH EFFECTS DUE TO USE OF CONVENTIONAL PLASTICS

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 TOTAL NUMBER OF PATENTS

- TABLE 5 TOP TEN PATENT OWNERS

- TABLE 6 ECOSYSTEM

- TABLE 7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 IMPORT DATA FOR HS CODE 390770-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 9 EXPORT DATA FOR HS CODE 390770-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- TABLE 10 DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 12 POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 13 POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 14 POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 15 POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 16 POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 17 POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 18 POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 19 POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 20 POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 21 POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 22 POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 23 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 24 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 25 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 26 POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 27 POLYLACTIC ACID MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 POLYLACTIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 POLYLACTIC ACID MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 30 POLYLACTIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 31 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 34 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 35 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 36 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 38 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 39 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 40 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 41 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 42 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 43 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 44 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 46 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 47 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 50 ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 51 CHINA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 52 CHINA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 53 CHINA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 54 CHINA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 55 INDIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 INDIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 INDIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 58 INDIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 59 JAPAN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 60 JAPAN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 61 JAPAN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 62 JAPAN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 63 SOUTH KOREA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 64 SOUTH KOREA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 SOUTH KOREA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 66 SOUTH KOREA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 67 REST OF ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 70 REST OF ASIA PACIFIC: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 71 EUROPE: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 72 EUROPE: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 74 EUROPE: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 75 EUROPE: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 EUROPE: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 EUROPE: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 78 EUROPE: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 79 EUROPE: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 80 EUROPE: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 81 EUROPE: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 82 EUROPE: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 83 EUROPE: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 84 EUROPE: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 85 EUROPE: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 86 EUROPE: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 87 EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 88 EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 90 EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 91 GERMANY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 92 GERMANY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 93 GERMANY POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 94 GERMANY POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 95 UK: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 96 UK: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 UK: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 98 UK: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 99 FRANCE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 100 FRANCE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 101 FRANCE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 102 FRANCE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 103 ITALY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 104 ITALY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 105 ITALY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 106 ITALY: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 107 SPAIN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 108 SPAIN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 SPAIN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 110 SPAIN: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 111 REST OF EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 114 REST OF EUROPE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 115 NORTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 118 NORTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 119 NORTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 122 NORTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 123 NORTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 124 NORTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 126 NORTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 127 NORTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 128 NORTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 130 NORTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 131 NORTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 134 NORTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 135 US: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 136 US: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 137 US: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 138 US: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 139 CANADA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 140 CANADA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 141 CANADA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 142 CANADA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 143 MEXICO: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 144 MEXICO: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 MEXICO: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 146 MEXICO: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 147 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 148 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 150 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 151 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 154 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 155 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 156 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 158 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 159 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 160 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 162 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 163 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 164 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 166 SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 167 BRAZIL: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 168 BRAZIL: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 BRAZIL: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 170 BRAZIL: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 171 REST OF SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 174 REST OF SOUTH AMERICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY GRADE, 2022-2024 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2022-2024 (KILOTON)

- TABLE 190 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 195 SAUDI ARABIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 196 SAUDI ARABIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 SAUDI ARABIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 198 SAUDI ARABIA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 199 UAE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 200 UAE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 201 UAE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 202 UAE: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 203 REST OF MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2022-2024 (KILOTON)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: POLYLACTIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 207 POLYLACTIC ACID MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-JUNE 2025

- TABLE 208 POLYLACTIC ACID MARKET: DEGREE OF COMPETITION, 2024

- TABLE 209 POLYLACTIC ACID MARKET: REGION FOOTPRINT

- TABLE 210 POLYLACTIC ACID MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 211 POLYLACTIC ACID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 212 POLYLACTIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 213 POLYLACTIC ACID MARKET: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 214 POLYLACTIC ACID MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 215 POLYLACTIC ACID MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 216 NATUREWORKS LLC : COMPANY OVERVIEW

- TABLE 217 NATUREWORKS LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 NATUREWORKS LLC: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 219 NATUREWORKS LLC: DEALS, JANUARY 2020-JUNE 2025

- TABLE 220 NATUREWORKS LLC: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 221 TOTALENERGIES CORBION: COMPANY OVERVIEW

- TABLE 222 TOTALENERGIES CORBION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 TOTALENERGIES CORBION: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 224 TOTALENERGIES CORBION: DEALS, JANUARY 2020-JUNE 2025

- TABLE 225 TOTALENERGIES CORBION: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 226 BASF SE: COMPANY OVERVIEW

- TABLE 227 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 BASF SE: DEALS, JANUARY 2020-JUNE 2025

- TABLE 229 BASF SE: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 230 COFCO: COMPANY OVERVIEW

- TABLE 231 COFCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 FUTERRO: COMPANY OVERVIEW

- TABLE 233 FUTERRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 FUTERRO: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 235 DANIMER SCIENTIFIC: COMPANY OVERVIEW

- TABLE 236 DANIMER SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 DANIMER SCIENTIFIC: DEALS, JANUARY 2020-JUNE 2025

- TABLE 238 DANIMER SCIENTIFIC: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 239 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 240 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 DANIMER SCIENTIFIC: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 242 EVONIK INDUSTRIES: COMPANY OVERVIEW

- TABLE 243 EVONIK INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 EVONIK INDUSTRIES: PRODUCT LAUNCHES, JANUARY 2020-JUNE 2025

- TABLE 245 EVONIK INDUSTRIES: DEALS, JANUARY 2020-JUNE 2025

- TABLE 246 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 247 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 UNITIKA LTD.: COMPANY OVERVIEW

- TABLE 249 UNITIKA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 BIOWORKS CORPORATION: COMPANY OVERVIEW

- TABLE 251 ADBIOPLASTICS: COMPANY OVERVIEW

- TABLE 252 MUSASHINO CHEMICAL LABORATORY, LTD. : COMPANY OVERVIEW

- TABLE 253 HANGZHOU PEIJIN CHEMICAL CO.,LTD.: COMPANY OVERVIEW

- TABLE 254 AKRO-PLASTIC GMBH: COMPANY OVERVIEW

- TABLE 255 FUJIAN GREENJOY BIOMATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 256 PLAMFG: COMPANY OVERVIEW

- TABLE 257 FKUR: COMPANY OVERVIEW

- TABLE 258 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

- TABLE 259 RAGHAV POLYMERS: COMPANY OVERVIEW

- TABLE 260 VAISHNAVI BIO TECH: COMPANY OVERVIEW

- TABLE 261 HENAN SINOWIN CHEMICAL INDUSTRY CO.,LTD.: COMPANY OVERVIEW

- TABLE 262 EMNANDI BIOPLASTICS: COMPANY OVERVIEW

- TABLE 263 UNILONG INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 264 PRAJ INDUSTRIES: COMPANY OVERVIEW

List of Figures

- FIGURE 1 POLYLACTIC ACID MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 POLYLACTIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 POLYLACTIC ACID MARKET: BOTTOM-UP APPROACH

- FIGURE 4 POLYLACTIC ACID MARKET: TOP-DOWN APPROACH

- FIGURE 5 POLYLACTIC ACID MARKET: DATA TRIANGULATION

- FIGURE 6 THERMOFORMING GRADE TO LEAD POLYLACTIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 7 SUGARCANE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 RIGID THERMOFORMS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 PACKAGING INDUSTRY TO DOMINATE OVERALL POLYLACTIC ACID MARKET BETWEEN 2025 AND 2030

- FIGURE 10 EUROPE LED POLYLACTIC ACID MARKET IN 2024

- FIGURE 11 ASIA PACIFIC OFFERS ATTRACTIVE OPPORTUNITIES IN POLYLACTIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 12 THERMOFORMING GRADE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 13 SUGARCANE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 14 RIGID THERMOFORMS APPLICATION TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 PACKAGING SEGMENT TO LEAD MARKET BY 2030

- FIGURE 16 MARKET IN JAPAN TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYLACTIC ACID MARKET

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 OVERVIEW OF POLYLACTIC ACID MARKET VALUE CHAIN

- FIGURE 20 TOTAL NUMBER OF PATENTS DURING LAST 10 YEARS

- FIGURE 21 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 22 TOP JURISDICTIONS FOR POLYLACTIC ACID PATENTS

- FIGURE 23 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 24 AVERAGE SELLING PRICE, BY REGION, 2022-2030 (USD/KG)

- FIGURE 25 AVERAGE SELLING PRICE, BY GRADE, 2022-2030 (USD/KG)

- FIGURE 26 AVERAGE SELLING PRICE, BY END-USE INDUSTRY, 2024 (USD/KG)

- FIGURE 27 AVERAGE SELLING PRICE, BY TOP THREE MARKET PLAYERS, 2024 (USD/KG)

- FIGURE 28 ECOSYSTEM MAPPING

- FIGURE 29 TRENDS IN POLYLACTIC ACID MARKET

- FIGURE 30 THERMOFORMING GRADE TO BE LARGEST SEGMENT OF POLYLACTIC ACID MARKET

- FIGURE 31 SUGARCANE TO BE LEADING RAW MATERIAL SEGMENT OF POLYLACTIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 32 RIGID THERMOFORMS TO BE LARGEST SEGMENT OF POLYLACTIC ACID MARKET

- FIGURE 33 PACKAGING END-USE INDUSTRY TO LEAD OVERALL POLYLACTIC ACID MARKET

- FIGURE 34 ASIA PACIFIC: POLYLACTIC ACID MARKET SNAPSHOT

- FIGURE 35 EUROPE: POLYLACTIC ACID MARKET SNAPSHOT

- FIGURE 36 POLYLACTIC ACID MARKET SHARE ANALYSIS, 2024

- FIGURE 37 POLYLACTIC ACID MARKET: REVENUE ANALYSIS OF KEY COMPANIES IN LAST FOUR YEARS, 2020-2023 (USD BILLION)

- FIGURE 38 POLYLACTIC ACID MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 39 POLYLACTIC ACID MARKET: FINANCIAL MATRIX: EV/EBITDA RATIO, 2024

- FIGURE 40 POLYLACTIC ACID MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA, 2024

- FIGURE 41 POLYLACTIC ACID MARKET: PRODUCT/BRAND COMPARISON

- FIGURE 42 POLYLACTIC ACID MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 43 POLYLACTIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 44 POLYLACTIC ACID MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 45 BASF SE: COMPANY SNAPSHOT

- FIGURE 46 DANIMER SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 47 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 48 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 UNITIKA LTD.: COMPANY SNAPSHOT