|

市场调查报告书

商品编码

1798381

全球 Wi-Fi 晶片组市场(按 IEEE 标准、频段、MIMO 配置、最终用途和行业)- 预测至 2030 年Wi-Fi Chipset Market by IEEE Standard (802.11be, 802.11ax, 802.11ac), Band (Single & Dual Band, Triband), MIMO Configuration (SU-MIMO, MU-MIMO), End-use Application (Consumer, Smart Home, AR/VR, Networking Devices) and Vertical - Global Forecast to 2030 |

||||||

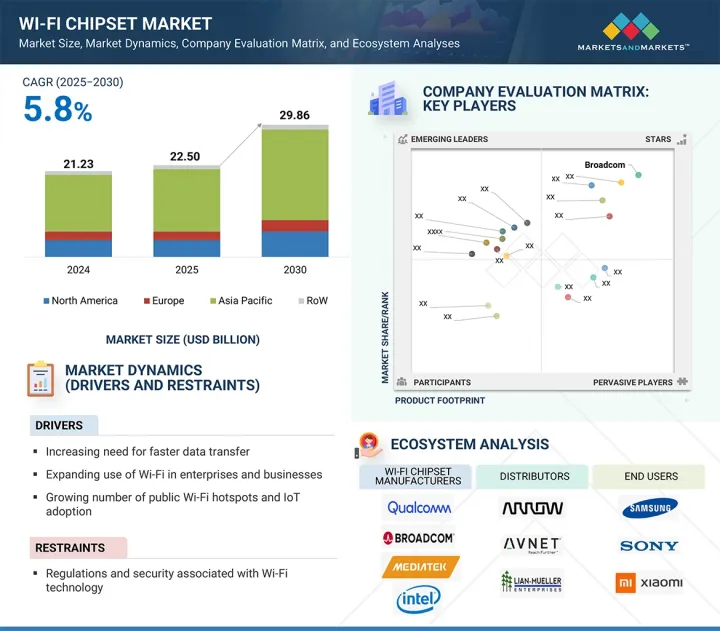

预计到 2025 年全球 Wi-Fi 晶片组市场规模将达到 225 亿美元,到 2030 年将达到 298.6 亿美元,预测期内复合年增长率为 5.8%。

市场的主要驱动力之一是消费者、企业和工业应用对高速网路连线的需求不断增长。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | IEEE 标准、频段、MIMO 配置、产业、最终用途、地区 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

智慧型设备、串流媒体服务、远端办公和线上游戏的普及,推动了对可靠高速无线通讯的需求日益增长。 Wi-Fi 晶片组可实现无缝资料传输、低延迟和高网路效率。此外,Wi-Fi 6、6E 和 7 等先进标准的推出正在加速晶片组的升级。这些趋势正推动原始设备製造商 (OEM) 和服务供应商采用下一代 Wi-Fi 解决方案,推动市场成长。

“预计在预测期内,三频部分将在 Wi-Fi 晶片组市场中实现最高的复合年增长率。”

Wi-Fi 晶片组市场中三频部分的发展得益于高密度环境中对更高频宽和减少网路拥塞日益增长的需求。三频晶片组工作在 2.4 GHz、5 GHz 和 6 GHz(Wi-Fi 6E/7)频率,可提高网路效率并支援更多设备同时连接。这使其成为智慧家庭、企业网路和游戏应用的理想选择。随着数据消费和连网型设备的日益普及,三频 Wi-Fi 晶片组的需求预计将激增,从而推动该领域的强劲成长。

“预计到 2030 年,消费设备终端用途领域将占据最大的市场占有率。”

由于Wi-Fi技术在智慧型手机、笔记型电脑、平板电脑、智慧型电视和家庭自动化产品的广泛应用,预计到2030年,消费性设备领域将占据Wi-Fi晶片组市场的最大份额。全球对高速互联网、视讯串流、线上游戏和智慧家庭生态系统的需求日益增长,持续推动可靠无线连接的需求。随着消费者越来越多地采用Wi-Fi 6和Wi-Fi 7等先进技术,晶片组製造商正在扩大生产规模,以满足不断发展的性能标准。随着消费性电子产品出货量的持续成长,该领域将继续对整体市场需求做出重大贡献。

“到2030年,中国将占据亚太地区Wi-Fi晶片组市场的最大份额。”

中国Wi-Fi晶片市场的发展得益于其强大的消费性电子製造生态系统和强劲的国内智慧型装置需求。中国拥有许多主要的OEM厂商和ODM厂商,他们将Wi-Fi晶片整合到各种智慧型手机、智慧电视、笔记型电脑和物联网设备中。政府支持数位转型的倡议、5G-Advanced网路的广泛部署以及智慧城市的发展,进一步加速了Wi-Fi的普及。此外,中国正在投资Wi-Fi 6和Wi-Fi 7技术,以用于企业、工业和住宅应用,从而巩固其市场地位。本土晶片设计商的不断壮大以及研发支出的不断增加,正在促进供应链能力和技术创新的提升。高产量、良好的政策环境以及不断增长的终端用户需求,使中国在该地区Wi-Fi晶片市场占据主导地位。

本报告对全球 Wi-Fi 晶片组市场进行了分析,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- Wi-Fi晶片组市场为企业带来诱人机会

- Wi-Fi 晶片组市场(以最终用途划分)

- IEEE 标准的 Wi-Fi 晶片组市场

- Wi-Fi晶片组市场(依频段)

- 亚太地区 Wi-Fi 晶片组市场(按最终用途和国家划分)

- Wi-Fi晶片组市场(按区域)

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 价值链分析

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 波特五力分析

- 案例研究分析

- ARUBA Wi-Fi 6 网路和 HPE Edgeline 伺服器为企业提供超低延迟云端连接

- SOUTHSTAR DRUG 利用华为 Wi-Fi 6 网路加强业务运营

- 杜拜国际金融中心与华为合作部署Wi-Fi 6,提升使用者体验

- ATRIA CONVERGENCE TECHNOLOGIES 利用华为 Wi-Fi 6 为商业企业和居民提供增强的连接

- 西门子马来西亚大学采用 AIRENGINE 的 Wi-Fi 6 提供高速网路覆盖

- 定价分析

- 主要企业Wi-Fi 晶片组价格分布(依最终用途划分)(2024 年)

- 各地区搭载Wi-Fi晶片组的消费性设备平均售价趋势(2021-2024)

- 专利分析

- 贸易分析

- 进口情形(HS 编码 851762)

- 出口情形(HS 编码 851762)

- 大型会议和活动(2025-2026年)

- 规定

- 人工智慧/生成式人工智慧对Wi-Fi晶片组市场的影响

- 2025年美国关税对Wi-Fi晶片组市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对产业的影响

第 6 章:以 IEEE 标准分類的 Wi-Fi 晶片组市场

- 介绍

- IEEE 802.11BE(Wi-Fi 7)

- IEEE 802.11AX(Wi-Fi 6/6E)

- IEEE 802.11AC

- IEEE 802.11AD

- IEEE 802.11B/G/N

第七章 Wi-Fi 晶片组市场(按频段)

- 介绍

- 单频段/双波段

- 三频

第 8 章:以 MIMO 配置分類的 Wi-Fi 晶片组市场

- 介绍

- SU-MIMO

- MU-MIMO

- 1x1

- 2x2

- 3x3

- 4x4

- 8x8

第九章 Wi-Fi 晶片组市场(依垂直产业)

- 介绍

- 消费性电子产品

- 公司

- 医疗保健

- BFSI

- 零售

- 车

- 工业

- 其他行业

第 10 章:Wi-Fi 晶片组市场(依最终用途)

- 介绍

- 消费性设备

- 智慧型手机

- 药片

- 笔记型电脑/PC

- 相机

- 智慧家庭设备

- 智慧音箱

- 智慧电视

- 其他家电

- 游戏机

- AR/VR设备

- 移动机器人

- 无人机

- 网路装置

- 闸道路由器

- 网路基地台

- MPOS

- 车载资讯娱乐

- 其他最终用途

第 11 章:Wi-Fi 晶片组市场(按区域)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 德国

- 法国

- 英国

- 义大利

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 其他地区的宏观经济展望

- 中东和非洲

- 南美洲

第十二章竞争格局

- 概述

- 主要参与企业的策略/优势(2021-2025)

- 收益分析(2022-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 比较品牌

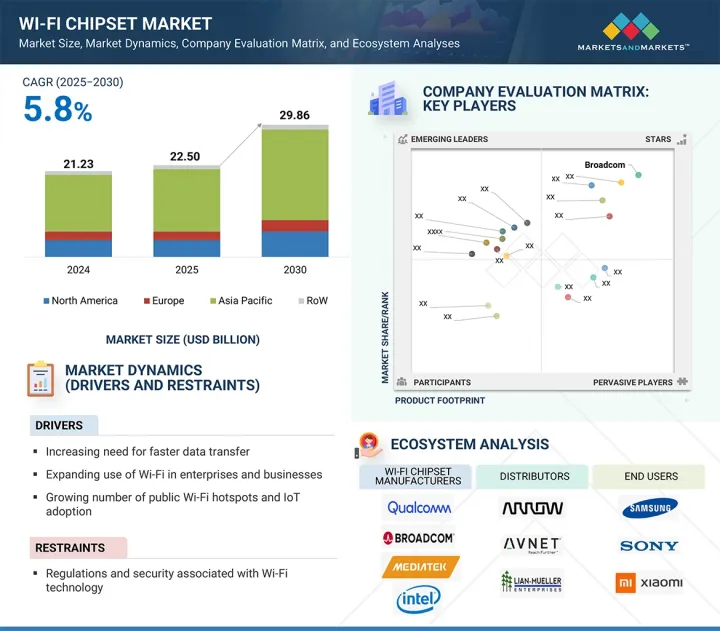

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十三章:公司简介

- 主要企业

- QUALCOMM TECHNOLOGIES, INC.

- BROADCOM

- MEDIATEK

- INTEL CORPORATION

- REALTEK SEMICONDUCTOR CORP.

- INFINEON TECHNOLOGIES AG

- NXP SEMICONDUCTORS

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- RENESAS ELECTRONICS CORPORATION

- ESPRESSIF SYSTEMS

- 其他公司

- MORSE MICRO

- SENSCOMM SEMICONDUCTOR CO., LTD

- PHARROWTECH

- EDGEWATER WIRELESS INC.

- PERASO TECHNOLOGIES INC.

- KORE WIRELESS

- U-BLOX

- QUECTEL

- TENSORCOM, INC.

- TEXAS INSTRUMENTS INCORPORATED

- SILEX TECHNOLOGY AMERICA, INC.

- NEWRACOM

- BEKEN CORPORATION

- BLUETRUM TECHNOLOGY CO., LTD.

- BESTECHNIC

第十四章 附录

The global Wi-Fi chipset market is projected to reach USD 22.50 billion in 2025 and USD 29.86 billion by 2030, registering a CAGR of 5.8% during the forecast period. One key factor driving the Wi-Fi chipset market is the rising demand for high-speed internet connectivity across consumer, enterprise, and industrial applications.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By IEEE Standard, by Band, By MIMO-Configuration, Vertical, End-use Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

With the proliferation of smart devices, streaming services, remote work, and online gaming, there is an increasing need for reliable and faster wireless communication. Wi-Fi chipsets enable seamless data transfer, lower latency, and higher network efficiency. Moreover, the rollout of advanced standards, such as Wi-Fi 6, 6E, and 7, accelerates chipset upgrades. These trends compel OEMs and service providers to adopt next-generation Wi-Fi solutions, boosting market growth.

"Triband segment is expected to witness the highest CAGR in the Wi-Fi chipset market during the forecast period"

The tri-band segment in the Wi-Fi chipset market is driven by the increasing need for higher bandwidth and reduced network congestion in high-density environments. Tri-band chipsets operate across 2.4 GHz, 5 GHz, and 6 GHz (with Wi-Fi 6E and 7), improving network efficiency and supporting more simultaneous device connections. This makes them ideal for smart homes, enterprise networks, and gaming applications. As data consumption and connected device adoption continue to rise, the demand for tri-band Wi-Fi chipsets is expected to surge, fuelling robust growth in this segment.

"Consumer devices end-use application segment is projected to account for the largest market share in 2030"

The consumer devices segment is expected to capture the largest share of the Wi-Fi chipset market in 2030, due to the widespread integration of Wi-Fi technology in smartphones, laptops, tablets, smart TVs, and home automation products. Rising global demand for high-speed internet, video streaming, online gaming, and smart home ecosystems continues to drive the need for reliable wireless connectivity. As consumers increasingly adopt advanced technologies such as Wi-Fi 6 and Wi-Fi 7, chipset manufacturers are scaling production to meet evolving performance standards. The consistent growth in consumer electronics shipments ensures the segment remains the dominant contributor to overall market demand.

"China to account for largest share of Asia Pacific Wi-Fi chipset market in 2030"

The Wi-Fi chipset market in China is driven by its robust consumer electronics manufacturing ecosystem and strong domestic demand for smart devices. The country is home to leading OEMs and ODMs that integrate Wi-Fi chipsets extensively across smartphones, smart TVs, laptops, and IoT devices. Government initiatives supporting digital transformation, widespread 5G advanced networks deployment, and smart city development further accelerate adoption. Moreover, China's investment in Wi-Fi 6 and Wi-Fi 7 technologies for enterprise, industrial, and residential applications strengthens its position. The growing presence of local chipset designers and increased R&D expenditure contribute to enhanced supply chain capabilities and technological innovation. This combination of high-volume production, favorable policy environment, and expanding end users' demand positions China as the dominant contributor to the region's Wi-Fi chipset market.

Extensive primary interviews were conducted with key industry experts in the Wi-Fi chipset market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 55%, and Tier 3 - 25%

- By Designation: C-level Executives - 50%, Directors - 25%, and Managers - 25%

- By Region: North America - 60%, Europe - 20%, Asia Pacific - 10%, and RoW - 10%

Note: RoW includes the Middle East, Africa, and South America. Other designations include product managers, sales managers, and marketing managers. The 3 tiers of the companies have been defined based on their total/segmental revenue as of 2020: Tier 1 = >USD 1,000 million, Tier 2 = USD 100 million to USD 1,000 million, and Tier 3 = <USD 100 million.

Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), Realtek Semiconductor Corp. (Taiwan), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Semiconductor Components Industries, LLC (US), Renesas Electronics Corporation (Japan), and Espressif Systems (China) are some key players in the Wi-Fi chipset market.

The study includes an in-depth competitive analysis of these key players in the Wi-Fi chipset market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the Wi-Fi chipset market based on IEEE standard (IEEE 802.11BE (Wifi 7), IEEE 802.11AX (Wifi 6 and 6E), IEEE 802.11AC, IEEE 802.11AD, IEEE 802.11), band (single & dual band, triband), MIMO configuration (SU-MIMO, MU-MIMO), vertical (consumer electronics, enterprise, healthcare, BFSI, retail, automotive, industrial, and other verticals), end-use application (consumer devices, cameras, smart home devices, gaming devices, AR/VR devices mobile robots, drones, networking devices, MPOS (Mobile Point of Sale), in-vehicle infotainment, and other applications), and region [North America (US, Canada, Mexico), Europe (Germany France, UK, Italy, Rest of Europe), Asia Pacific (China Japan, South Korea, Rest of Asia Pacific), and RoW (Middel East & Africa, South America)]. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the Wi-Fi chipset market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all the companies included in the Wi-Fi chipset ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall Wi-Fi chipset market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (growing number of public Wi-Fi hotspots and adoption of IoT, expanding use of Wi-Fi in enterprises and businesses, and mounting need for faster data transfer), restraints (regulations and security associated with Wi-Fi technology), opportunities (use of Wi-Fi technology in indoor and outdoor location systems and advancements in AR and VR), and challenges (overcrowding of unlicensed wireless frequency spectrum, coexistence issues with use of GHz 5 GHz band Wi-Fi with LTE in LTE-U) influencing the growth of the Wi-Fi chipset market

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the Wi-Fi chipset market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the Wi-Fi chipset market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Wi-Fi chipset market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Qualcomm Technologies, Inc. (US), Broadcom (US), MediaTek (Taiwan), Intel Corporation (US), and Realtek Semiconductor Corp. (Taiwan), in the Wi-Fi chipset market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN WI-FI CHIPSET MARKET

- 4.2 WI-FI CHIPSET MARKET, BY END-USE APPLICATION

- 4.3 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 4.4 WI-FI CHIPSET MARKET, BY BAND

- 4.5 WI-FI CHIPSET MARKET IN ASIA PACIFIC, BY END-USE APPLICATION AND COUNTRY

- 4.6 WI-FI CHIPSET MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for connected devices with advent of IoT

- 5.2.1.2 Growing focus on improving business and enterprise customer engagement

- 5.2.1.3 Mounting need for faster data transfer

- 5.2.1.4 Increasing internet penetration in developed regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Identity theft, hacking, and jamming threats

- 5.2.2.2 High power consumption by advanced Wi-Fi technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improved location capabilities of Wi-Fi chipsets

- 5.2.3.2 Rising integration of AR and VR technologies into consumer electronics and enterprise solutions

- 5.2.3.3 Emergence of 802.11be standard

- 5.2.4 CHALLENGES

- 5.2.4.1 Overcrowding of unlicensed wireless frequency spectrums

- 5.2.4.2 Coexistence issues related to use of 5 GHz Wi-Fi band

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TECHNOLOGY ANALYSIS

- 5.5.1 KEY TECHNOLOGIES

- 5.5.1.1 Radio frequency (RF) front-end design

- 5.5.1.2 System-on-Chip (SoC)

- 5.5.1.3 Complementary metal-oxide semiconductors

- 5.5.2 COMPLEMENTARY TECHNOLOGIES

- 5.5.2.1 Bluetooth and Bluetooth Low Energy (BLE)

- 5.5.2.2 Power management integrated circuits (PMICs)

- 5.5.3 ADJACENT TECHNOLOGIES

- 5.5.3.1 Cellular connectivity (4G/5G/6G)

- 5.5.3.2 Zigbee/Thread/LoRa/Z-Wave

- 5.5.3.3 Ultra-wideband (UWB)

- 5.5.1 KEY TECHNOLOGIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 ARUBA WI-FI 6 NETWORK AND HPE EDGELINE SERVERS HELP ENTERPRISE CONNECT TO CLOUD WITH ULTRA-LOW LATENCY

- 5.7.2 SOUTHSTAR DRUG LEVERAGES HUAWEI'S WI-FI 6 NETWORK TO ENHANCE BUSINESS OPERATIONS

- 5.7.3 DUBAI INTERNATIONAL FINANCIAL CENTRE PARTNERS WITH HUAWEI TO LAUNCH WI-FI 6 TO IMPROVE USER EXPERIENCE

- 5.7.4 ATRIA CONVERGENCE TECHNOLOGIES USES HUAWEI'S WI-FI 6 TO PROVIDE ENHANCED CONNECTIONS ACROSS COMMERCIAL ENTERPRISES AND RESIDENTS

- 5.7.5 XIAMEN UNIVERSITY MALAYSIA ADOPTS AIRENGINE WI-FI 6 TO PROVIDE HIGH-SPEED NETWORK COVERAGE

- 5.8 PRICING ANALYSIS

- 5.8.1 PRICING RANGE OF WI-FI CHIPSETS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO (HS CODE 851762)

- 5.10.2 EXPORT SCENARIO (HS CODE 851762)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATIONS

- 5.13 IMPACT OF AI/GEN AI ON WI-FI CHIPSET MARKET

- 5.13.1 INTRODUCTION

- 5.14 IMPACT OF 2025 US TARIFF ON WI-FI CHIPSET MARKET

- 5.14.1 INTRODUCTION

- 5.14.2 KEY TARIFF RATES

- 5.14.3 PRICE IMPACT ANALYSIS

- 5.14.4 IMPACT ON COUNTRIES/REGIONS

- 5.14.4.1 US

- 5.14.4.2 Europe

- 5.14.4.3 Asia Pacific

- 5.14.5 IMPACT ON VERTICALS

6 WI-FI CHIPSET MARKET, BY IEEE STANDARD

- 6.1 INTRODUCTION

- 6.2 IEEE 802.11BE (WI-FI 7)

- 6.2.1 MOUNTING DEMAND FOR ULTRA-HIGH-SPEED, LOW-LATENCY CONNECTIVITY TO BOOST SEGMENTAL GROWTH

- 6.3 IEEE 802.11AX (WI-FI 6 & 6E)

- 6.3.1 INCREASING USE TO EXPAND SPECTRAL EFFICIENCY AND ACHIEVE POWER EFFICIENCY TO AUGMENT SEGMENTAL GROWTH

- 6.4 IEEE 802.11AC

- 6.4.1 ABILITY TO OFFER PERFORMANCE AND DENSITY GAIN IN MODERN SMARTPHONES, TABLETS, AND PCS TO BOOST SEGMENTAL GROWTH

- 6.5 IEEE 802.11AD

- 6.5.1 ABILITY TO INCREASE POSSIBILITY OF FREQUENCY RE-USE AND SECURITY DUE TO LIMITED RANGE TO FUEL SEGMENTAL GROWTH

- 6.6 IEEE 802.11B/G/N

- 6.6.1 HIGH THROUGHPUT, RANGE, AND COVERAGE OF WI-FI NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

7 WI-FI CHIPSET MARKET, BY BAND

- 7.1 INTRODUCTION

- 7.2 SINGLE & DUAL-BAND

- 7.2.1 INCREASING USE IN ENTRY-LEVEL AND MID-TIER CONSUMER ELECTRONICS APPLICATIONS TO ACCELERATE SEGMENTAL GROWTH

- 7.3 TRI-BAND

- 7.3.1 RISING NETWORK CONGESTION TO CONTRIBUTE TO SEGMENTAL GROWTH

8 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION

- 8.1 INTRODUCTION

- 8.2 SU-MIMO

- 8.2.1 INCREASING THROUGHPUT AND COST TRADE-OFFS TO DRIVE MARKET

- 8.3 MU-MIMO

- 8.3.1 1X1

- 8.3.1.1 Rising deployment in budget smartphones and tablets to augment segmental growth

- 8.3.2 2X2

- 8.3.2.1 High data transfer rate and use in smartphones to contribute to segmental growth

- 8.3.3 3X3

- 8.3.3.1 Growing incorporation in high-end laptops to bolster segmental growth

- 8.3.4 4X4

- 8.3.4.1 Increasing use in premium in-vehicle infotainment systems, enterprise-grade access points, and high-end consumer devices to drive market

- 8.3.5 8X8

- 8.3.5.1 Support for simultaneous spatial streams and low power consumption to fuel segmental growth

- 8.3.1 1X1

9 WI-FI CHIPSET MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 HIGH ADOPTION OF SMART APPLIANCES, SMARTPHONES, AND LAPTOPS TO BOOST SEGMENTAL GROWTH

- 9.3 ENTERPRISE

- 9.3.1 GROWING EMPHASIS ON OPERATIONAL EFFICIENCY, WORKPLACE FLEXIBILITY, AND CENTRALIZED DATA MANAGEMENT TO DRIVE MARKET

- 9.4 HEALTHCARE

- 9.4.1 RAPID DIGITALIZATION TO ENHANCE CARE DELIVERY TO AUGMENT MARKET GROWTH

- 9.5 BFSI

- 9.5.1 RISING IMPORTANCE OF SHARING CRITICAL INFORMATION ACROSS DEPARTMENTS TO FUEL SEGMENTAL GROWTH

- 9.6 RETAIL

- 9.6.1 GROWING FOCUS ON IMPROVING CUSTOMER EXPERIENCE AND OPERATIONAL EFFICIENCY TO FOSTER SEGMENTAL GROWTH

- 9.7 AUTOMOTIVE

- 9.7.1 INCREASING IOT DEPLOYMENT TO MODERNIZE VEHICLE INFRASTRUCTURE TO EXPEDITE SEGMENTAL GROWTH

- 9.8 INDUSTRIAL

- 9.8.1 RISING ADOPTION OF INNOVATIVE TECHNOLOGIES TO TACKLE CONNECTIVITY PROBLEMS TO ACCELERATE SEGMENTAL GROWTH

- 9.9 OTHER VERTICALS

10 W-FI CHIPSET MARKET, BY END-USE APPLICATION

- 10.1 INTRODUCTION

- 10.2 CONSUMER DEVICES

- 10.2.1 SMARTPHONES

- 10.2.1.1 Rising internet connectivity for personal and business purposes to augment segmental growth

- 10.2.2 TABLETS

- 10.2.2.1 Growing popularity of wireless technologies to contribute to segmental growth

- 10.2.3 LAPTOPS & PCS

- 10.2.3.1 Increasing preference for ultrabooks to accelerate segmental growth

- 10.2.1 SMARTPHONES

- 10.3 CAMERAS

- 10.3.1 RISING GOVERNMENT SPENDING ON SECURITY SYSTEMS IN DEVELOPING COUNTRIES TO FUEL SEGMENTAL GROWTH

- 10.4 SMART HOME DEVICES

- 10.4.1 SMART SPEAKERS

- 10.4.1.1 Improvement in form factors and innovations to bolster segmental growth

- 10.4.2 SMART TVS

- 10.4.2.1 Rapid advances in wireless connectivity technology and price optimization to expedite segmental growth

- 10.4.3 OTHER APPLIANCES

- 10.4.1 SMART SPEAKERS

- 10.5 GAMING DEVICES

- 10.5.1 REQUIREMENT FOR HIGH-SPEED INTERNET CONNECTION TO FOSTER SEGMENTAL GROWTH

- 10.6 AR/VR DEVICES

- 10.6.1 DEPLOYMENT OF ADVANCED TECHNOLOGIES IN RETAIL SECTOR TO ENHANCE CONSUMER EXPERIENCE TO FUEL SEGMENTAL GROWTH

- 10.7 MOBILE ROBOTS

- 10.7.1 EMPHASIS ON IMPROVING EFFICIENCY AND ENERGY CONSUMPTION IN INDUSTRIES TO BOOST SEGMENTAL GROWTH

- 10.8 DRONES

- 10.8.1 GROWING FOCUS ON IMPROVING STABILITY AND ANTENNA CONNECTION TO ACCELERATE SEGMENTAL GROWTH

- 10.9 NETWORKING DEVICES

- 10.9.1 GATEWAYS & ROUTERS

- 10.9.1.1 Burgeoning demand for faster internet connectivity to augment segmental growth

- 10.9.2 ACCESS POINTS

- 10.9.2.1 Ability to establish connections between various devices to boost segmental growth

- 10.9.1 GATEWAYS & ROUTERS

- 10.10 MPOS

- 10.10.1 RISE IN CASELESS TRANSACTIONS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.11 IN-VEHICLE INFOTAINMENT

- 10.11.1 EVOLVING CONSUMER PREFERENCES FOR CONNECTED MOBILITY TO DRIVE MARKET

- 10.12 OTHER END-USE APPLICATIONS

11 WI-FI CHIPSET MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing R&D of low-power, high-throughput wireless technologies to accelerate market growth

- 11.2.3 CANADA

- 11.2.3.1 Early rollout of Wi-Fi 7 technologies across residential and enterprise sectors to fuel market growth

- 11.2.4 MEXICO

- 11.2.4.1 Mounting demand for networking equipment and embedded systems to boost market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Rapid digitalization to upgrade industrial, residential, and public infrastructure to foster market growth

- 11.3.3 FRANCE

- 11.3.3.1 Mounting demand for high-speed connectivity across consumer, industrial, and enterprise sectors to drive market

- 11.3.4 UK

- 11.3.4.1 Growing focus on bringing gigabit-capable broadband to underserved and hard-to-reach areas to augment market growth

- 11.3.5 ITALY

- 11.3.5.1 Accelerated broadband and rural connectivity initiatives to bolster market growth

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Rise in semiconductor manufacturing, smart infrastructure development, and digital economy expansion to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Strong focus on high-performance connectivity in enterprises to contribute to market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Mounting adoption of Wi-Fi 7 technology and robust telecom infrastructure to fuel market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Rising smartphone adoption and e-learning programs to contribute to market growth

- 11.5.2.2 GCC

- 11.5.2.3 Africa & Rest of Middle East

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Surging remote work and online education to expedite market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 IEEE standard footprint

- 12.7.5.4 Vertical footprint

- 12.7.5.5 End-use application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BROADCOM

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 MEDIATEK

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 INTEL CORPORATION

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 REALTEK SEMICONDUCTOR CORP.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.2.1 Deals

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 INFINEON TECHNOLOGIES AG

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 NXP SEMICONDUCTORS

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.8 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 RENESAS ELECTRONICS CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.10 ESPRESSIF SYSTEMS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 QUALCOMM TECHNOLOGIES, INC.

- 13.2 OTHER PLAYERS

- 13.2.1 MORSE MICRO

- 13.2.2 SENSCOMM SEMICONDUCTOR CO.,LTD

- 13.2.3 PHARROWTECH

- 13.2.4 EDGEWATER WIRELESS INC.

- 13.2.5 PERASO TECHNOLOGIES INC.

- 13.2.6 KORE WIRELESS

- 13.2.7 U-BLOX

- 13.2.8 QUECTEL

- 13.2.9 TENSORCOM, INC.

- 13.2.10 TEXAS INSTRUMENTS INCORPORATED

- 13.2.11 SILEX TECHNOLOGY AMERICA, INC.

- 13.2.12 NEWRACOM

- 13.2.13 BEKEN CORPORATION

- 13.2.14 BLUETRUM TECHNOLOGY CO., LTD.

- 13.2.15 BESTECHNIC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 WI-FI CHIPSET MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN WI-FI CHIPSET ECOSYSTEM

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES

- TABLE 6 PRICING RANGE OF WI-FI CHIPSETS OFFERED BY KEY PLAYERS, BY END-USE APPLICATION, 2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024 (USD)

- TABLE 8 LIST OF MAJOR PATENTS, 2024-2025

- TABLE 9 IMPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 WI-FI CHIPSET MARKET, BY IEEE STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 14 WI-FI CHIPSET MARKET, BY IEEE STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 15 IEEE 802.11BE (WI-FI 7): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 16 IEEE 802.11BE (WI-FI 7): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 17 IEEE 802.11AX (WI-FI 6 & 6E): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 18 IEEE 802.11AX (WI-FI 6 & 6E): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 19 IEEE 802.11AC (WI-FI 5): WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 20 IEEE 802.11AC (WI-FI 5): WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 21 IEEE 802.11AD: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 22 IEEE 802.11AD: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 23 IEEE 802.11B/G/N: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 24 IEEE 802.11B/G/N: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 25 WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 26 WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 27 SINGLE & DUAL-BAND: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 28 SINGLE & DUAL-BAND: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 29 TRI-BAND: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 30 TRI-BAND: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 31 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 32 WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 33 COMPARISON BETWEEN SU-MIMO AND MU-MIMO CONFIGURATIONS

- TABLE 34 SU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 35 SU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 36 MU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 37 MU-MIMO: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 38 MU-MIMO: WI-FI CHIPSET MARKET, BY ANTENNA CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 39 MU-MIMO: WI-FI CHIPSET MARKET, BY ANTENNA CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 40 WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 41 WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 42 CONSUMER ELECTRONICS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 43 CONSUMER ELECTRONICS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 44 ENTERPRISE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 45 ENTERPRISE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 46 HEALTHCARE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 47 HEALTHCARE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 48 BFSI: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 49 BFSI: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 50 RETAIL: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 51 RETAIL: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 52 AUTOMOTIVE: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 53 AUTOMOTIVE: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 54 INDUSTRIAL: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 55 INDUSTRIAL: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 56 OTHER VERTICALS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 57 OTHER VERTICALS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 58 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (USD MILLION)

- TABLE 59 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 61 WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 62 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 63 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 64 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 65 CONSUMER DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 66 CAMERAS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 67 CAMERAS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 68 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 69 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 70 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 71 SMART HOME DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 72 GAMING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 73 GAMING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 74 AR/VR DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 75 AR/VR DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 76 MOBILE ROBOTS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 77 MOBILE ROBOTS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 78 DRONES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 79 DRONES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 80 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 81 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 82 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 83 NETWORKING DEVICES: WI-FI CHIPSET MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 84 MPOS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 85 MPOS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 86 IN-VEHICLE INFOTAINMENT: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 87 IN-VEHICLE INFOTAINMENT: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 88 OTHER END-USE APPLICATIONS: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 89 OTHER END-USE APPLICATIONS: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 90 WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 91 WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 92 NORTH AMERICA: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 93 NORTH AMERICA: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 94 NORTH AMERICA: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 95 NORTH AMERICA: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 96 NORTH AMERICA: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 97 NORTH AMERICA: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 98 NORTH AMERICA: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 99 NORTH AMERICA: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 100 NORTH AMERICA: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 101 NORTH AMERICA: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 102 NORTH AMERICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 103 NORTH AMERICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 104 EUROPE: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 105 EUROPE: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 106 EUROPE: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 107 EUROPE: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 108 EUROPE: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 109 EUROPE: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 110 EUROPE: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 111 EUROPE: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 112 EUROPE: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 113 EUROPE: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 114 EUROPE: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 115 EUROPE: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 116 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 117 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 118 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 119 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 120 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 121 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 122 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 123 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 124 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 125 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 126 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 127 ASIA PACIFIC: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 128 ROW: WI-FI CHIPSET MARKET, BY STANDARD, 2021-2024 (MILLION UNITS)

- TABLE 129 ROW: WI-FI CHIPSET MARKET, BY STANDARD, 2025-2030 (MILLION UNITS)

- TABLE 130 ROW: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2021-2024 (MILLION UNITS)

- TABLE 131 ROW: WI-FI CHIPSET MARKET, BY MIMO CONFIGURATION, 2025-2030 (MILLION UNITS)

- TABLE 132 ROW: WI-FI CHIPSET MARKET, BY BAND, 2021-2024 (MILLION UNITS)

- TABLE 133 ROW: WI-FI CHIPSET MARKET, BY BAND, 2025-2030 (MILLION UNITS)

- TABLE 134 ROW: WI-FI CHIPSET MARKET, BY VERTICAL, 2021-2024 (MILLION UNITS)

- TABLE 135 ROW: WI-FI CHIPSET MARKET, BY VERTICAL, 2025-2030 (MILLION UNITS)

- TABLE 136 ROW: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2021-2024 (MILLION UNITS)

- TABLE 137 ROW: WI-FI CHIPSET MARKET, BY END-USE APPLICATION, 2025-2030 (MILLION UNITS)

- TABLE 138 ROW: WI-FI CHIPSET MARKET, BY REGION, 2021-2024 (MILLION UNITS)

- TABLE 139 ROW: WI-FI CHIPSET MARKET, BY REGION, 2025-2030 (MILLION UNITS)

- TABLE 140 MIDDLE EAST & AFRICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2021-2024 (MILLION UNITS)

- TABLE 141 MIDDLE EAST & AFRICA: WI-FI CHIPSET MARKET, BY COUNTRY, 2025-2030 (MILLION UNITS)

- TABLE 142 WI-FI CHIPSET MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-JULY 2025

- TABLE 143 WI-FI CHIPSET MARKET: DEGREE OF COMPETITION, 2024

- TABLE 144 WI-FI CHIPSET MARKET: REGION FOOTPRINT

- TABLE 145 WI-FI CHIPSET MARKET: IEEE STANDARD FOOTPRINT

- TABLE 146 WI-FI CHIPSET MARKET: VERTICAL FOOTPRINT

- TABLE 147 WI-FI CHIPSET MARKET: END-USE APPLICATION FOOTPRINT

- TABLE 148 WI-FI CHIPSET MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 149 WI-FI CHIPSET MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 150 WI-FI CHIPSET MARKET: PRODUCT LAUNCHES, JANUARY 2021-JULY 2025

- TABLE 151 WI-FI CHIPSET MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 152 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 153 QUALCOMM TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 QUALCOMM TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 155 QUALCOMM TECHNOLOGIES, INC.: DEALS

- TABLE 156 BROADCOM: COMPANY OVERVIEW

- TABLE 157 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 BROADCOM: PRODUCT LAUNCHES

- TABLE 159 BROADCOM: DEALS

- TABLE 160 MEDIATEK: COMPANY OVERVIEW

- TABLE 161 MEDIATEK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MEDIATEK: PRODUCT LAUNCHES

- TABLE 163 MEDIATEK: DEALS

- TABLE 164 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 165 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 REALTEK SEMICONDUCTOR CORP.: COMPANY OVERVIEW

- TABLE 167 REALTEK SEMICONDUCTOR CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 REALTEK SEMICONDUCTOR CORP.: DEALS

- TABLE 169 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 170 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 172 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 173 NXP SEMICONDUCTORS: COMPANY OVERVIEW

- TABLE 174 NXP SEMICONDUCTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 NXP SEMICONDUCTORS: PRODUCT LAUNCHES

- TABLE 176 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY OVERVIEW

- TABLE 177 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 179 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 180 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 181 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 182 ESPRESSIF SYSTEMS: COMPANY OVERVIEW

- TABLE 183 ESPRESSIF SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 ESPRESSIF SYSTEMS: PRODUCT LAUNCHES

- TABLE 185 ESPRESSIF SYSTEMS: DEALS

- TABLE 186 MORSE MICRO: COMPANY OVERVIEW

- TABLE 187 SENSCOMM SEMICONDUCTOR CO.,LTD: COMPANY OVERVIEW

- TABLE 188 PHARROWTECH: COMPANY OVERVIEW

- TABLE 189 EDGEWATER WIRELESS INC.: COMPANY OVERVIEW

- TABLE 190 PERASO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 191 KORE WIRELESS: COMPANY OVERVIEW

- TABLE 192 U-BLOX: COMPANY OVERVIEW

- TABLE 193 QUECTEL: COMPANY OVERVIEW

- TABLE 194 TENSORCOM, INC.: COMPANY OVERVIEW

- TABLE 195 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 196 SILEX TECHNOLOGY AMERICA, INC.: COMPANY OVERVIEW

- TABLE 197 NEWRACOM: COMPANY OVERVIEW

- TABLE 198 BEKEN CORPORATION: COMPANY OVERVIEW

- TABLE 199 BLUETRUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 200 BESTECHNIC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 WI-FI CHIPSET MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DURATION CONSIDERED

- FIGURE 3 WI-FI CHIPSET MARKET: RESEARCH DESIGN

- FIGURE 4 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 5 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 8 WI-FI CHIPSET MARKET: RESEARCH APPROACH

- FIGURE 9 WI-FI CHIPSET SIZE ESTIMATION METHODOLOGY

- FIGURE 10 WI-FI CHIPSET MARKET: BOTTOM-UP APPROACH

- FIGURE 11 WI-FI CHIPSET MARKET: TOP-DOWN APPROACH

- FIGURE 12 WI-FI CHIPSET MARKET: DATA TRIANGULATION

- FIGURE 13 WI-FI CHIPSET MARKET: RESEARCH ASSUMPTIONS

- FIGURE 14 MU-MIMO SEGMENT TO DOMINATE WI-FI CHIPSET MARKET, IN TERMS OF VOLUME, DURING FORECAST PERIOD

- FIGURE 15 TRI-BAND SEGMENT TO EXHIBIT HIGHEST CAGR IN WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 16 802.11BE (WI-FI 7) SEGMENT TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2030

- FIGURE 17 CONSUMER DEVICES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 18 ASIA PACIFIC TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2030

- FIGURE 19 INCREASING NEED FOR FAST DATA TRANSFER TO CREATE LUCRATIVE OPPORTUNITIES FOR PLAYERS IN WI-FI CHIPSET MARKET BETWEEN 2025 AND 2030

- FIGURE 20 CONSUMER DEVICES APPLICATION TO DOMINATE WI-FI CHIPSET MARKET BETWEEN 2025 AND 2030

- FIGURE 21 802.11BE (WI-FI 7) SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 22 SINGLE & DUAL-BAND SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 23 CONSUMER DEVICES SEGMENT AND CHINA TO CAPTURE LARGEST SHARES OF WI-FI CHIPSET MARKET IN ASIA PACIFIC, IN TERMS OF VOLUME, IN 2025

- FIGURE 24 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN WI-FI CHIPSET MARKET DURING FORECAST PERIOD

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 IMPACT ANALYSIS: DRIVERS

- FIGURE 27 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 28 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 29 IMPACT ANALYSIS: CHALLENGES

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 WIFI CHIPSET ECOSYSTEM

- FIGURE 32 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 AVERAGE SELLING PRICE TREND OF CONSUMER DEVICES POWERED BY WI-FI CHIPSETS, BY REGION, 2021-2024

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 35 IMPORT DATA FOR HS CODE 851762-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 851762-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 37 IMPACT OF AI/GEN AI ON WI-FI CHIPSET MARKET

- FIGURE 38 802.11AX (WI-FI 6 & 6E) SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 39 TRI-BAND SEGMENT TO REGISTER HIGHER CAGR IN WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 40 MU-MIMO-ENABLED WI-FI ACCESS POINT EQUIPMENT SERVES MULTIPLE CLIENTS SIMULTANEOUSLY

- FIGURE 41 MU-MIMO SEGMENT TO DOMINATE WI-FI CHIPSET MARKET DURING FORECAST PERIOD

- FIGURE 42 WI-FI CHIPSET MARKET, BY VERTICAL

- FIGURE 43 CONSUMER ELECTRONICS SEGMENT TO DOMINATE WI-FI CHIPSET MARKET FROM 2025 TO 2030

- FIGURE 44 CONSUMER DEVICES SEGMENT TO HOLD LARGEST SHARE OF WI-FI CHIPSET MARKET IN 2025

- FIGURE 45 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 NORTH AMERICA: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 47 EUROPE: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: WI-FI CHIPSET MARKET SNAPSHOT

- FIGURE 49 WI-FI CHIPSET MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2022-2024

- FIGURE 50 MARKET SHARE ANALYSIS OF COMPANIES OFFERING WI-FI CHIPSETS, 2024

- FIGURE 51 COMPANY VALUATION

- FIGURE 52 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 53 BRAND COMPARISON

- FIGURE 54 WI-FI CHIPSET MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 55 WI-FI CHIPSET MARKET: COMPANY FOOTPRINT

- FIGURE 56 WI-FI CHIPSET MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 57 QUALCOMM TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 58 BROADCOM: COMPANY SNAPSHOT

- FIGURE 59 MEDIATEK: COMPANY SNAPSHOT

- FIGURE 60 INTEL CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 REALTEK SEMICONDUCTOR CORP.: COMPANY SNAPSHOT

- FIGURE 62 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 63 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- FIGURE 64 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC: COMPANY SNAPSHOT

- FIGURE 65 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 ESPRESSIF SYSTEMS: COMPANY SNAPSHOT