|

市场调查报告书

商品编码

1800742

液体涂膜市场(按应用、最终用途行业、类型、用途和地区划分)- 预测至 2030 年Liquid-applied Membrane Market by Type (Bituminous, Elastomeric, Cementitious), Application (Roofing, Walls, Roadways), Usage (New Construction, Refurbishment), End-use Industry (Commercial, Residential), And Region - Global Forecast to 2030 |

||||||

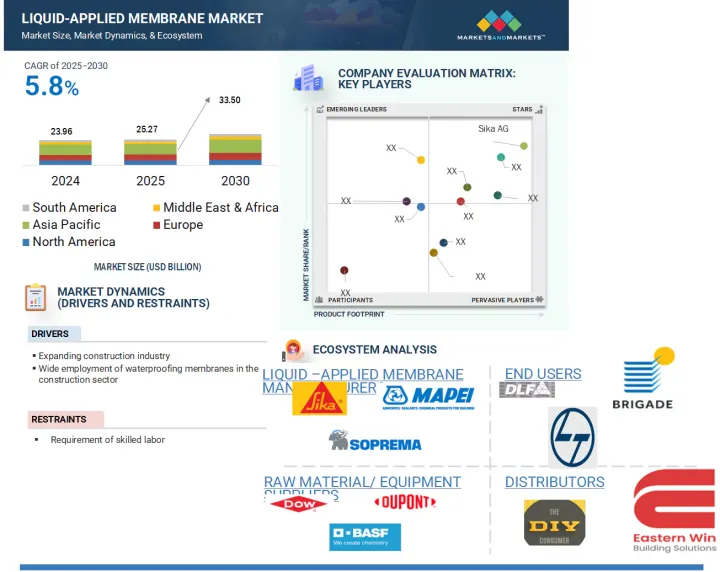

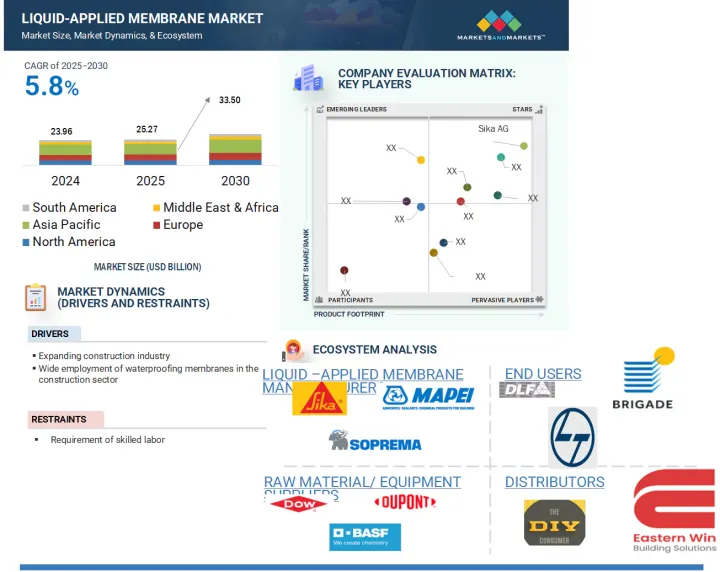

液体应用膜市场预计将从 2025 年的 252.7 亿美元成长到 2030 年的 335 亿美元,预测期内的复合年增长率为 5.8%。

液体施工膜是一种无缝液体施工防水系统,可形成一道灵活耐用的防护屏障。由于其能够贴合复杂表面,并提供持久的防水、防紫外线和防化学物质保护,广泛应用于屋顶、地下室、露台、隧道和其他结构构件。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元) 数量(百万平方公尺) |

| 部分 | 按应用、按最终用途行业、按类型、按用途、按地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

液体应用防水捲材市场受到多种因素驱动,包括对高效低维护防水解决方案的需求不断增长、全球建设产业的成长,以及对节能永续建筑材料的日益关注。此外,液体应用防水卷材因其易于应用、安装快速以及优于传统片材系统的性能而备受青睐。

从区域来看,亚太地区由于中国和印度等国快速的都市化、基础建设以及政府住房建设计划,增长最为显着。北美地区则受到翻新和绿色建筑趋势的推动,而欧洲则受到严格的环境法规和对永续建筑的重视。由于商业基础设施和交通计划投资的增加,中东和非洲也正在成为关键市场。这些区域动态,加上该材料的性能优势,将继续支持液体应用膜市场的全球扩张。

沥青膜是建设产业使用最广泛的防水解决方案之一,以其坚固耐用和在各种应用中经过验证的性能而闻名。沥青膜主要由沥青组成,通常以杂排聚丙烯(APP) 或苯乙烯丁二烯-苯乙烯 (SBS) 等聚合物改质。它们通常以片材或液体形式应用,并用玻璃纤维或聚酯等材料增强,以提高拉伸强度和尺寸稳定性。这些薄膜在提供长期防止水平和垂直表面渗水的保护方面特别有效。它们广泛用于屋顶、地下室、地基、隧道、桥樑和挡土墙。它们对各种基材(包括混凝土、金属和木材)具有出色的附着力,即使在恶劣的环境条件下也能确保一致的性能。沥青膜能够承受紫外线照射、极端温度和机械应力,使其成为暴露和埋地应用的理想选择。受环保意识的驱动,近期改质沥青防水卷材的开发日益兴起,其挥发性有机化合物 (VOC)排放更低,热性能更佳,符合绿建筑标准。製造商也致力于透过推出整合式黏合层和更快固化时间的预製捲材来提高施工效率。随着全球建筑业的持续繁荣,沥青防水卷材的需求依然旺盛,尤其是在基础设施和商业领域,这得益于其在各种计划规模和环境条件下均具有可靠的防水性能。

受全球建筑维修、基础设施升级和老化结构修復热潮的推动,建筑改造领域已成为液体应用膜维修最快的领域之一。随着都市区的成熟,现有建筑的维修和现代化维修已成为公共和私人相关人员关注的重点。老化建筑经常面临漏水、屋顶损坏、地基裂缝和热性能下降等问题,而使用液体应用薄膜可以有效解决这些问题。这些膜特别适合用于改造项目,因为它们维修计划,能够贴合不规则表面,并且与各种基材(包括老化混凝土、砖块和金属)相容。

液体应用防水捲材在维修工程中的一大关键优势在于其易于施工,无需完全拆除现有系统。这不仅降低了人事费用,也最大限度地减少了对住宅、学校、医院和商业建筑等生活空间的干扰。在空间受限且建筑可及性受限的城市环境中,液体应用防水卷材提供了实用的解决方案,只需极少的设备即可垂直或水平安装。其弹性特性使其能够适应结构位移并密封现有裂缝,从而延长建筑围护结构的使用寿命。此外,欧洲、北美和亚洲的许多政府计画都鼓励提高现有建筑的能源效率和防水性能。鼓励永续建筑实践和绿色认证的法规进一步支持在维修项目中使用高性能防水系统,例如液体应用防水卷材。液体应用防水捲材还提供低挥发性有机化合物 (VOC) 和环保配方,符合现代美学和环保标准。

亚太地区是液体应用膜 (LAM) 市场最大的地区,受快速都市化、工业化、基础设施投资增加以及政府对建筑和市场发展计划的大力支持等强大驱动因素的推动。该地区的主导地位主要由中国、印度、日本、韩国和东南亚国家等主要经济体推动,每个经济体都透过大规模的住宅、商业和基础设施建设活动做出贡献。其中一个最关键的驱动因素是印度和中国正在进行的大规模建筑热潮。在印度,建筑业是经济发展的主要驱动力,由住房、交通和城市基础设施领域雄心勃勃的公共和私人计划推动。诸如 Pradhan Mantri Awas Yojana-Urban (PMAY-U)、智慧城市使命等倡议以及对物流、仓储和房地产的资本投资增加,正在显着增加对高性能防水材料(如液体应用膜)的需求。该行业对永续性和绿色建筑的追求进一步推动了符合环境标准的先进液体应用膜系统的使用。

在中国,政府的「十四五」计画强调交通、能源、水系统和绿色都市化等领域的新基础设施。该国也正在推动大规模建筑维修和节能、净零建筑的发展,为液体应用薄膜在新建和维修中的应用创造了重大机会。此外,工业活动的活性化、城市重建和商业扩张继续推动上海、北京和广州等主要城市群对液体应用膜的需求。此外,该地区对能源效率、水资源管理和气候适应能力的认识日益增强,促使开发商和政府采用先进的防水技术。城市中心相对较低的人事费用和不断减少的土地供应正在推动人们强烈转向高效、易于应用的系统,例如液体应用膜,特别是在现有结构的维修。

本报告研究了全球液体涂层膜市场,并对市场的应用、最终用途行业、类型、用途、区域趋势和公司概况进行了全面的分析。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

第六章 产业趋势

- 介绍

- 价值链分析

- 监管状况

- 贸易分析

- 总体经济指标

- 定价分析

- 投资金筹措场景

- 生态系统

- 影响客户业务的趋势/中断

- 技术分析

- 原料分析

- 波特五力分析

- 案例研究分析

- 2025-2026年主要会议和活动

- 专利分析

- 主要相关人员和采购标准

第七章液体涂膜市场(依应用)

- 介绍

- 屋顶

- 墙

- 建筑结构

- 路

- 其他的

8. 液体涂料市场(依最终用途产业)

- 介绍

- 房屋建筑

- 商业建筑

- 公共基础设施

9. 液体涂料市场(按类型)

- 介绍

- 弹性体膜

- 沥青膜

- 水泥膜

第 10 章 液体涂料市场(依用途)

- 介绍

- 新建筑

- 维修

第 11 章液体涂料市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 义大利

- 俄罗斯

- 其他的

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 泰国

- 印尼

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十二章竞争格局

- 概述

- 主要参与企业的策略

- 收益分析

- 市场占有率分析

- 估值和财务指标

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争情境和趋势

第十三章:公司简介

- 主要参与企业

- SIKA AG

- MAPEI SPA

- SOPREMA

- FOSROC, INC.

- SAINT-GOBAIN WEBER

- HB FULLER

- WACKER CHEMIE AG

- JOHNS MANVILLE

- BOSTIK

- GCP APPLIED TECHNOLOGIES INC.

- ARDEX

- 其他公司

- RENOLIT SE

- PAUL BAUDER GMBH CO. KG

- GAF, INC.

- CARLISLE COMPANIES INC.

- PIDILITE

- TREMCO

- KEMPER SYSTEM

- ALCHIMICA

- AMES RESEARCH LABORATORIES, INC.

- CHASE CORPORATION

- CHEMBOND CHEMICALS

- CHEM LINK

- CONCRETE SEALANTS, INC.

- CROMMELIN WATERPROOFING & SEALING

- ESKOLA ROOFING

- EVERBUILD BUILDING PRODUCTS LIMITED

- HENRY COMPANY

- INLAND COATINGS

- KARNAK

- KEY RESIN COMPANY

- PROTECTO WRAP COMPANY

- XYPEX CHEMICAL CORPORATION

第十四章 附录

The liquid-applied membrane market is projected to reach USD 33.50 billion by 2030 from USD 25.27 billion in 2025, at a CAGR of 5.8% during the forecast period. Liquid-applied membranes (LAMs) are fluid-applied, seamless waterproofing systems that create a flexible and durable protective barrier. They are widely used in roofing, basements, terraces, tunnels, and other structural elements due to their ability to conform to complex surfaces and provide long-lasting protection against water ingress, UV radiation, and chemical exposure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Million Square Meter) |

| Segments | Type, Application, Usage, End-Use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The market for LAMs is being propelled by several factors, including the increasing demand for efficient and low-maintenance waterproofing solutions, the growth of the global construction industry, and a rising focus on energy-efficient and sustainable building materials. Additionally, LAMs are favored for their ease of application, rapid installation time, and superior performance over traditional sheet-based systems.

Regionally, growth is most prominent in Asia Pacific due to rapid urbanization, infrastructure development, and government housing initiatives in countries like China and India. North America is seeing strong demand driven by renovation and green building trends, while Europe's market is supported by stringent environmental regulations and emphasis on sustainable construction. The Middle East and Africa are also emerging as key markets due to increased investment in commercial infrastructure and transport projects. These regional dynamics, combined with the material's performance advantages, continue to support the global expansion of the liquid applied membrane market.

"Bituminous membranes segment is the second fastest-growing segment in the liquid-applied membrane market during the forecast period."

Bituminous membranes are one of the most widely used waterproofing solutions in the construction industry, known for their robustness, durability, and proven performance across a wide range of applications. These membranes are primarily composed of bitumen (asphalt), often modified with polymers such as Atactic Polypropylene (APP) or Styrene-Butadiene-Styrene (SBS), which enhance their elasticity, flexibility, and resistance to aging. Bituminous membranes are typically applied in sheet form or as liquid-applied coatings and are reinforced with materials like fiberglass or polyester to improve tensile strength and dimensional stability. These membranes are especially effective in providing long-lasting protection against water ingress in both horizontal and vertical surfaces. They are extensively used in roofing systems, basements, foundations, tunnels, bridges, and retaining walls. Their superior adhesion to a wide range of substrates, such as concrete, metal, and wood, ensures consistent performance even under challenging environmental conditions. The ability of bituminous membranes to withstand UV exposure, temperature extremes, and mechanical stress makes them ideal for exposed as well as buried applications. In recent years, environmental concerns have led to the development of modified bituminous membranes with lower VOC emissions and improved thermal performance, aligning with green building standards. Manufacturers are also focusing on improving installation efficiency by introducing prefabricated rolls with integrated adhesive layers and faster curing times. As construction activities continue to rise globally, especially in infrastructure and commercial sectors, the demand for bituminous membranes remains strong, supported by their ability to deliver reliable waterproofing across diverse project scales and environmental conditions.

"Refurbishment segment is the fastest-growing usage segment in the liquid-applied membrane market during the forecast period."

The refurbishment segment is emerging as one of the fastest-growing segments for liquid-applied membranes (LAMs), driven by a global surge in building renovation, infrastructure upgrades, and retrofitting of aging structures. As urban areas mature, the need to restore and modernize existing buildings has become a key focus for both public and private stakeholders. Older structures often face issues such as water leakage, roof damage, foundation cracks, and poor thermal performance-problems that can be effectively addressed through the application of LAMs. These membranes are especially well-suited for refurbishment projects due to their seamless application, ability to conform to irregular surfaces, and compatibility with various substrates, including aged concrete, brick, and metal.

One of the main advantages of LAMs in refurbishment is their ease of use without requiring the complete removal of the existing system. This not only reduces labor costs but also minimizes disruption in occupied spaces such as residential buildings, schools, hospitals, and commercial establishments. In urban environments where space constraints and building accessibility pose challenges, LAMs provide a practical solution that can be applied vertically or horizontally with minimal equipment. Their elastomeric properties allow them to accommodate structural movement and seal existing cracks, extending the lifespan of the building envelope. Additionally, many government programs in Europe, North America, and Asia are incentivizing energy efficiency and water resistance upgrades in existing buildings. Regulations encouraging sustainable building practices and green certification are further propelling the use of high-performance waterproofing systems like LAMs during renovation. Liquid-applied membranes also align with modern aesthetic and environmental standards, offering low-VOC, environmentally safe formulations.

"Asia Pacific is projected to be the largest market for liquid-applied membrane during the forecast period."

Asia Pacific stands as the largest region in the liquid-applied membrane (LAM) market, driven by a powerful combination of rapid urbanization, industrialization, rising infrastructure investments, and strong governmental support for construction and development projects. The region's dominance is primarily fueled by major economies like China, India, Japan, South Korea, and Southeast Asian countries, each contributing through large-scale residential, commercial, and infrastructure construction activities. One of the most defining growth drivers is the massive construction boom underway in India and China. In India, the construction sector is a cornerstone of economic development, propelled by ambitious public and private sector projects in housing, transportation, and urban infrastructure. Initiatives such as the Pradhan Mantri Awas Yojana-Urban (PMAY-U), Smart Cities Mission, and rising capital expenditure in logistics, warehousing, and real estate are significantly increasing the demand for high-performance waterproofing materials like liquid-applied membranes. The sector's push towards sustainability and green buildings is further encouraging the use of advanced LAM systems that align with environmental standards.

In China, the government's 14th Five-Year Plan emphasizes new infrastructure in areas like transportation, energy, water systems, and green urbanization. The country is also pushing for extensive building retrofits and the development of energy-efficient and net-zero buildings, creating robust opportunities for LAM usage in both new constructions and refurbishments. Additionally, rising industrial activity, urban redevelopment, and commercial expansions continue to add to LAM demand in key urban clusters like Shanghai, Beijing, and Guangzhou. Moreover, the region's growing awareness of energy efficiency, water management, and climate resilience is encouraging developers and governments to adopt advanced waterproofing technologies. With labor costs being comparatively lower and land availability continuing to shrink in urban cores, there is a strong shift toward efficient, easy-to-apply systems like LAMs, especially in retrofitting existing structures.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information was gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US). among others are some of the key players in the liquid-applied membrane market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the liquid-applied membrane market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, usage, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the liquid-applied membrane market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall liquid-applied membrane market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Expanding construction industry, rising renovation and refurbishment activities), restraints (Requirements of skilled labor ), opportunities (Growth in emerging markets), and challenges (Environmental & health concerns related to liquid-applied membranes)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the liquid-applied membrane market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the liquid-applied membrane market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.1.2.4 Key primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET

- 4.2 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 4.3 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 4.4 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 4.5 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 4.6 LIQUID-APPLIED MEMBRANE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Rising renovation and refurbishment activities

- 5.2.1.3 Wide deployment of waterproofing membranes in construction sector

- 5.2.1.4 Stringent building codes and standards in construction projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing demand for sheet membranes as substitutes

- 5.2.2.2 High initial investment required for liquid-applied membranes

- 5.2.2.3 Requirement of skilled labor

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for energy-efficient buildings and green roofs

- 5.2.3.2 Growth in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and health concerns related to liquid-applied membranes

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION

- 6.2.4 END USERS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Europe

- 6.3.1.3 Asia Pacific

- 6.3.2 STANDARDS

- 6.3.2.1 ISO 15824

- 6.3.2.2 ISO 19288

- 6.3.2.3 ASTM D4068

- 6.3.2.4 ASTM D6788

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO

- 6.4.2 EXPORT SCENARIO

- 6.5 MACROECONOMIC INDICATORS

- 6.5.1 GLOBAL GDP TRENDS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 ECOSYSTEM

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGY

- 6.10.1.1 New formulations

- 6.10.1.2 Self-healing & nanotechnology

- 6.10.2 COMPLEMENTARY TECHNOLOGY

- 6.10.2.1 Spray application technique

- 6.10.2.2 Moisture detection and monitoring tools

- 6.10.1 KEY TECHNOLOGY

- 6.11 RAW MATERIAL ANALYSIS

- 6.11.1 BITUMINOUS MEMBRANES

- 6.11.2 ELASTOMERIC MEMBRANES

- 6.11.2.1 Acrylic

- 6.11.2.2 Polyurethane

- 6.11.3 CEMENTITIOUS MEMBRANES

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 AIR GUARD VPA COATING ENHANCES ASPHALT'S FLEXIBILITY AND DURABILITY

- 6.13.2 SIKALASTIC ROOFPRO MEMBRANE SYSTEM PROVIDES FULLY REINFORCED MEMBRANE

- 6.13.3 FOSROC NITOPROOF 600PF PROVIDES EFFECTIVE WATERPROOFING

- 6.13.4 SPECTRUM HOUSE

- 6.13.5 EMPIRE STATE BUILDING

- 6.14 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.15 PATENT ANALYSIS

- 6.15.1 METHODOLOGY

- 6.15.2 DOCUMENT TYPES

- 6.15.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 6.15.4 INSIGHTS

- 6.15.5 JURISDICTION ANALYSIS

- 6.15.6 TOP APPLICANTS

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

7 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ROOFING

- 7.2.1 RISING DEMAND FOR GREEN ROOF SYSTEMS TO DRIVE MARKET

- 7.3 WALLS

- 7.3.1 HIGH EXPOSURE TO MOISTURE, TEMPERATURE FLUCTUATIONS, UV RADIATION, AND AIR POLLUTANTS TO DRIVE DEMAND

- 7.4 BUILDING STRUCTURES

- 7.4.1 STRUCTURAL CRACKING AND BIOLOGICAL DEGRADATION TO FUEL DEMAND FOR POLYURETHANE AND BITUMINOUS MEMBRANES

- 7.5 ROADWAYS

- 7.5.1 RISING INFRASTRUCTURE PROJECTS TO FUEL MARKET

- 7.6 OTHER APPLICATIONS

8 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL CONSTRUCTION

- 8.2.1 STRONG GROWTH IN RESIDENTIAL SECTOR TO FUEL DEMAND

- 8.3 COMMERCIAL CONSTRUCTION

- 8.3.1 INCREASING DEMAND FOR COMMERCIAL INFRASTRUCTURE TO BOOST MARKET

- 8.4 PUBLIC INFRASTRUCTURE

- 8.4.1 RAPID URBANIZATION AND INDUSTRIALIZATION TO DRIVE MARKET

9 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 ELASTOMERIC MEMBRANES

- 9.2.1 NEED FOR MEMBRANES WITH ROBUST PERFORMANCE IN SENSITIVE ENVIRONMENTS TO DRIVE MARKET

- 9.2.2 ACRYLIC MEMBRANES

- 9.2.3 POLYURETHANE WATERPROOFING MEMBRANES

- 9.2.4 PMMA MEMBRANES

- 9.3 BITUMINOUS MEMBRANES

- 9.3.1 RESISTANCE TO UV AND TEMPERATURE FLUCTUATIONS TO DRIVE DEMAND

- 9.3.2 SOLVENT-BASED

- 9.3.3 WATER-BASED

- 9.4 CEMENTITIOUS MEMBRANES

- 9.4.1 WIDE APPLICATIONS IN ROOFS AND TUNNELS TO DRIVE MARKET

- 9.4.2 ONE-COMPONENT (1K)

- 9.4.3 TWO-COMPONENT (2K)

10 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 10.1 INTRODUCTION

- 10.2 NEW CONSTRUCTION

- 10.2.1 STRONG GROWTH IN NEW CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 10.3 REFURBISHMENT

- 10.3.1 RISE IN INFRASTRUCTURAL DEVELOPMENTS TO BOOST MARKET

11 LIQUID-APPLIED MEMBRANE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Strong building & construction industry to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increase in demand due to government measures to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Increased public and private investments in infrastructure projects to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Steady economic growth and rapid urbanization to boost market

- 11.3.2 FRANCE

- 11.3.2.1 Investments in public infrastructure and digitalization to boost market

- 11.3.3 SPAIN

- 11.3.3.1 Growth of construction industry to propel market

- 11.3.4 UK

- 11.3.4.1 Various government activities to drive market

- 11.3.5 ITALY

- 11.3.5.1 Rise in renovation and refurbishment projects to boost market

- 11.3.6 RUSSIA

- 11.3.6.1 Increase in residential construction activities to fuel market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Surge in transportation projects to drive market

- 11.4.2 INDIA

- 11.4.2.1 Government initiatives and increased infrastructure spending to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Surge in redevelopment activities to boost market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Strong construction industry to fuel market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising need for durable waterproofing solutions to boost market

- 11.4.6 THAILAND

- 11.4.6.1 Growth of real estate and tourism industries to drive market

- 11.4.7 INDONESIA

- 11.4.7.1 Rapid urbanization and population growth to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Development of Jeddah Economic City to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Growing emphasis on eco-friendly construction solutions to boost market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing investment in construction sector to boost market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Upcoming international sports events to boost market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growth of construction industry to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Type footprint

- 12.7.5.2 Application footprint

- 12.7.5.3 Region footprint

- 12.7.5.4 Company footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIKA AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MAPEI S.P.A.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SOPREMA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 FOSROC, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SAINT-GOBAIN WEBER

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 H.B. FULLER

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.7 WACKER CHEMIE AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 JOHNS MANVILLE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 BOSTIK

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 GCP APPLIED TECHNOLOGIES INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strengths

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 ARDEX

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.4 MnM view

- 13.1.1 SIKA AG

- 13.2 OTHER PLAYERS

- 13.2.1 RENOLIT SE

- 13.2.2 PAUL BAUDER GMBH CO. KG

- 13.2.3 GAF, INC.

- 13.2.4 CARLISLE COMPANIES INC.

- 13.2.5 PIDILITE

- 13.2.6 TREMCO

- 13.2.7 KEMPER SYSTEM

- 13.2.8 ALCHIMICA

- 13.2.9 AMES RESEARCH LABORATORIES, INC.

- 13.2.10 CHASE CORPORATION

- 13.2.11 CHEMBOND CHEMICALS

- 13.2.12 CHEM LINK

- 13.2.13 CONCRETE SEALANTS, INC.

- 13.2.14 CROMMELIN WATERPROOFING & SEALING

- 13.2.15 ESKOLA ROOFING

- 13.2.16 EVERBUILD BUILDING PRODUCTS LIMITED

- 13.2.17 HENRY COMPANY

- 13.2.18 INLAND COATINGS

- 13.2.19 KARNAK

- 13.2.20 KEY RESIN COMPANY

- 13.2.21 PROTECTO WRAP COMPANY

- 13.2.22 XYPEX CHEMICAL CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 TRENDS PER CAPITA GDP, 2020-2023 (USD)

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2024-2027

- TABLE 6 INDUSTRY (INCLUDING CONSTRUCTION) VALUE-ADDED STATISTICS, BY COUNTRY, 2023 (USD MILLION)

- TABLE 7 ROLE IN ECOSYSTEM: LIQUID-APPLIED MEMBRANE MARKET

- TABLE 8 LIQUID-APPLIED MEMBRANE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 LIQUID-APPLIED MEMBRANE MARKET: KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 10 TOP 10 PATENT OWNERS OVER LAST TEN YEARS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 13 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 14 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 15 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 16 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 17 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 18 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 19 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 20 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 21 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 22 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 23 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 24 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 25 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2022-2024 (USD MILLION)

- TABLE 26 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2025-2030 (USD MILLION)

- TABLE 27 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2022-2024 (MILLION SQUARE METER)

- TABLE 28 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE, 2025-2030 (MILLION SQUARE METER)

- TABLE 29 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 30 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2022-2024 (MILLION SQUARE METER)

- TABLE 32 LIQUID-APPLIED MEMBRANE MARKET, BY REGION, 2025-2030 (MILLION SQUARE METER)

- TABLE 33 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 34 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 36 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 37 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 38 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 39 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 40 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 41 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 42 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 44 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 45 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 46 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 47 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 48 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 49 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 50 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 52 US: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 53 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 54 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 56 CANADA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 57 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 58 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 60 MEXICO: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 61 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 62 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 63 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 64 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 65 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 66 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 68 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 69 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 70 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 71 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 72 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 73 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 74 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 76 EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 77 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 78 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 80 GERMANY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 81 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 82 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 83 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 84 FRANCE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 85 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 88 SPAIN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 89 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 90 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 92 UK: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 93 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 94 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 96 ITALY: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 97 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 98 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 100 RUSSIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 101 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 102 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 104 REST OF EUROPE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 105 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 106 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 108 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 109 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 110 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 112 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 113 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 116 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 117 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 118 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 119 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 120 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 121 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 122 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 124 CHINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 125 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 126 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 128 INDIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 129 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 130 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 132 JAPAN: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 133 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 134 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 136 SOUTH KOREA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 137 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 138 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 140 AUSTRALIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 141 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 142 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 144 THAILAND: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 145 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 146 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 147 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 148 INDONESIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 149 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 152 REST OF ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 153 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 156 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 157 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 160 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 161 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 164 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 165 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 168 MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 169 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 170 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 172 SAUDI ARABIA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 173 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 174 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 175 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 176 UAE: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 177 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 178 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 179 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 180 REST OF GCC: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 181 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 182 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 184 SOUTH AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 185 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 186 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 189 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 190 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 192 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 193 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 194 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 196 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 197 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METER)

- TABLE 200 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METER)

- TABLE 201 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 203 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2022-2024 (MILLION SQUARE METER)

- TABLE 204 SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY TYPE, 2025-2030 (MILLION SQUARE METER)

- TABLE 205 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 206 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 207 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 208 BRAZIL: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 209 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 210 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 212 ARGENTINA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 213 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2022-2024 (MILLION SQUARE METER)

- TABLE 216 REST OF SOUTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY, 2025-2030 (MILLION SQUARE METER)

- TABLE 217 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET BETWEEN 2019 AND 2025

- TABLE 218 LIQUID-APPLIED MEMBRANE MARKET: DEGREE OF COMPETITION

- TABLE 219 LIQUID-APPLIED MEMBRANE MARKET: TYPE FOOTPRINT

- TABLE 220 LIQUID-APPLIED MEMBRANE MARKET: APPLICATION FOOTPRINT

- TABLE 221 LIQUID-APPLIED MEMBRANE MARKET: REGION FOOTPRINT

- TABLE 222 LIQUID-APPLIED MEMBRANE MARKET: KEY STARTUPS/SMES

- TABLE 223 LIQUID-APPLIED MEMBRANE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 224 LIQUID-APPLIED MEMBRANE MARKET: PRODUCT LAUNCHES, MAY 2019-FEBRUARY 2024

- TABLE 225 LIQUID-APPLIED MEMBRANE MARKET: DEALS, MAY 2019-FEBRUARY 2024

- TABLE 226 LIQUID-APPLIED MEMBRANE MARKET: EXPANSIONS, MAY 2019-FEBRUARY 2024

- TABLE 227 SIKA AG: COMPANY OVERVIEW

- TABLE 228 SIKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 SIKA AG: DEALS

- TABLE 230 SIKA AG: EXPANSIONS

- TABLE 231 MAPEI S.P.A.: COMPANY OVERVIEW

- TABLE 232 MAPEI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 MAPEI S.P.A.: DEALS

- TABLE 234 MAPEI S.P.A: EXPANSIONS

- TABLE 235 SOPREMA: COMPANY OVERVIEW

- TABLE 236 SOPREMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 SOPREMA: DEALS

- TABLE 238 SOPREMA: EXPANSIONS

- TABLE 239 FOSROC, INC.: COMPANY OVERVIEW

- TABLE 240 FOSROC, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 FOSROC, INC: DEALS

- TABLE 242 FOSROC, INC.: EXPANSIONS

- TABLE 243 SAINT-GOBAIN WEBER: COMPANY OVERVIEW

- TABLE 244 SAINT-GOBAIN WEBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 H.B. FULLER: COMPANY OVERVIEW

- TABLE 246 H.B. FULLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 H.B. FULLER: DEALS

- TABLE 248 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 249 WACKER CHEMIE AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 JOHNS MANVILLE: COMPANY OVERVIEW

- TABLE 251 JOHNS MANVILLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 JOHNS MANVILLE: PRODUCT LAUNCHES

- TABLE 253 BOSTIK: COMPANY OVERVIEW

- TABLE 254 BOSTIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 GCP APPLIED TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 256 GCP APPLIED TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 GCP APPLIED TECHNOLOGIES INC.: DEALS

- TABLE 258 ARDEX: COMPANY OVERVIEW

- TABLE 259 ARDEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 ARDEX.: DEALS

- TABLE 261 RENOLIT SE: COMPANY OVERVIEW

- TABLE 262 PAUL BAUDER GMBH CO. KG: COMPANY OVERVIEW

- TABLE 263 GAF, INC.: COMPANY OVERVIEW

- TABLE 264 CARLISLE COMPANIES INC.: COMPANY OVERVIEW

- TABLE 265 PIDILITE: COMPANY OVERVIEW

- TABLE 266 TREMCO: COMPANY OVERVIEW

- TABLE 267 KEMPER SYSTEM: COMPANY OVERVIEW

- TABLE 268 ALCHIMICA: COMPANY OVERVIEW

- TABLE 269 AMES RESEARCH LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 270 CHASE CORPORATION: COMPANY OVERVIEW

- TABLE 271 CHEMBOND CHEMICALS: COMPANY OVERVIEW

- TABLE 272 CHEM LINK: COMPANY OVERVIEW

- TABLE 273 CONCRETE SEALANTS, INC.: COMPANY OVERVIEW

- TABLE 274 CROMMELIN WATERPROOFING & SEALING: COMPANY OVERVIEW

- TABLE 275 ESKOLA ROOFING: COMPANY OVERVIEW

- TABLE 276 EVERBUILD BUILDING PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 277 HENRY COMPANY: COMPANY OVERVIEW

- TABLE 278 INLAND COATINGS: COMPANY OVERVIEW

- TABLE 279 KARNAK: COMPANY OVERVIEW

- TABLE 280 KEY RESIN COMPANY: COMPANY OVERVIEW

- TABLE 281 PROTECTO WRAP COMPANY: COMPANY OVERVIEW

- TABLE 282 XYPEX CHEMICAL CORPORATION: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LIQUID-APPLIED MEMBRANE MARKET: RESEARCH DESIGN

- FIGURE 2 LIQUID-APPLIED MEMBRANE MARKET: TOP-DOWN APPROACH

- FIGURE 3 LIQUID-APPLIED MEMBRANE MARKET: BOTTOM-UP APPROACH

- FIGURE 4 LIQUID-APPLIED MEMBRANE MARKET: DATA TRIANGULATION

- FIGURE 5 ELASTOMERIC MEMBRANES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 6 ROOFING TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 7 RESIDENTIAL CONSTRUCTION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 8 NEW CONSTRUCTION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 RISING DEMAND FROM CONSTRUCTION SECTOR TO DRIVE ASIA PACIFIC MARKET

- FIGURE 11 ELASTOMERIC MEMBRANES TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 ROOFING APPLICATION TO LEAD MARKET IN 2030

- FIGURE 13 RESIDENTIAL CONSTRUCTION TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 14 REFURBISHMENT SEGMENT TO RECORD FASTER GROWTH DURING FORECAST PERIOD

- FIGURE 15 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 MARKET DYNAMICS OF LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 17 LIQUID-APPLIED MEMBRANE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 18 ADHESIVE WATERPROOFING MEMBRANES IMPORT, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 19 ADHESIVE WATERPROOFING MEMBRANES EXPORT, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 20 AVERAGE SELLING PRICE TREND, BY REGION (USD/SQUARE METER)

- FIGURE 21 AVERAGE SELLING PRICE TREND, BY KEY MARKET PLAYER, 2024 (USD/SQUARE METER)

- FIGURE 22 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 23 LIQUID-APPLIED MEMBRANE MARKET: ECOSYSTEM

- FIGURE 24 TRENDS IN LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS OF LIQUID-APPLIED MEMBRANE MARKET

- FIGURE 26 LIQUID-APPLIED MEMBRANE MARKET: GRANTED PATENTS

- FIGURE 27 NUMBER OF PATENTS YEAR-WISE FROM 2015 TO 2024

- FIGURE 28 TOP JURISDICTION, BY DOCUMENT

- FIGURE 29 TOP 10 PATENT APPLICANTS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- FIGURE 31 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 32 ROOFING APPLICATION TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 33 RESIDENTIAL CONSTRUCTION INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 34 ELASTOMERIC MEMBRANES TO BE LARGEST TYPE DURING FORECAST PERIOD

- FIGURE 35 NEW CONSTRUCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 36 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: LIQUID-APPLIED MEMBRANE MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: LIQUID-APPLIED MEMBRANE MARKET SNAPSHOT

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2022-2024

- FIGURE 40 SHARES OF LEADING COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 41 COMPANY VALUATION OF LEADING PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 42 FINANCIAL METRICS OF LEADING COMPANIES IN LIQUID-APPLIED MEMBRANE MARKET, 2024

- FIGURE 43 LIQUID-APPLIED MEMBRANE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 44 LIQUID-APPLIED MEMBRANE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 LIQUID-APPLIED MEMBRANE MARKET: COMPANY OVERALL FOOTPRINT

- FIGURE 46 LIQUID-APPLIED MEMBRANE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 47 SIKA AG: COMPANY SNAPSHOT

- FIGURE 48 MAPEI S.P.A.: COMPANY SNAPSHOT

- FIGURE 49 SAINT-GOBAIN WEBER: COMPANY SNAPSHOT

- FIGURE 50 H.B. FULLER: COMPANY SNAPSHOT

- FIGURE 51 WACKER CHEMIE AG: COMPANY SNAPSHOT