|

市场调查报告书

商品编码

1445871

液体应用膜 - 市场占有率分析、产业趋势与统计、成长预测(2024 - 2029 年)Liquid Applied Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

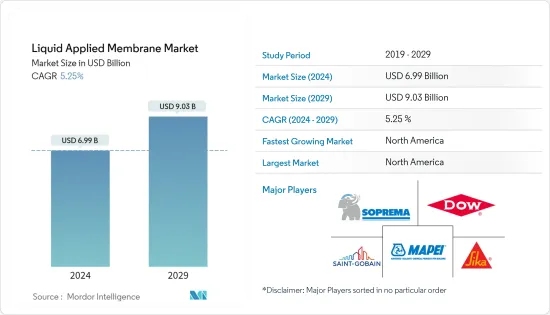

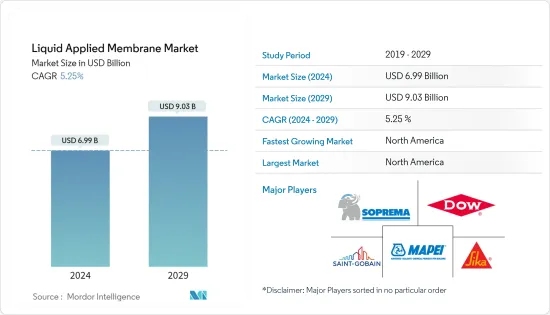

液体应用膜市场规模预计到2024年为69.9亿美元,预计到2029年将达到90.3亿美元,在预测期内(2024-2029年)CAGR为5.25%。

2020年,市场受到COVID-19的严重影响。由于疫情的影响,多个国家被迫进入封锁状态,导致全球几乎所有行业的製造设施在指定时间内关闭;包括建筑业。商业建筑和基础设施产业是液体应用膜的主要消费者,受到疫情的严重影响。这种持续的情况促使许多业主推迟或取消2020 年的建设项目几个月。根据美国总承包商协会的数据,高等教育建筑减少了40%,公共建筑减少了38%,公共建筑减少了27% 。观察学校建设情况。儘管如此,根据全国房地产经纪人协会的数据,预计 2021 年单户住宅将达到 6%,从而带动液体应用膜市场的成长。因此,住宅建筑业和商业建筑的成长将推动液体应用膜市场的发展。 COVID-19 的疫情对基础设施发展和全球经济产生了重大影响。根据世界银行组织的数据,就发展中国家的基础设施项目而言,有 256 个项目被报告取消或延迟。管道中的项目中断在 2020 年 4 月达到顶峰,但此后开始趋于稳定。

主要亮点

- 从长远来看,越来越多地使用防水膜来维持建筑物的寿命,液体应用膜的好处不断增加,从而实现具有成本效益的建筑,以及新兴经济体不断增长的基础设施和商业项目预计将推动预测期内的市场成长。

- 片状膜等替代品的出现预计将阻碍预测期内的市场成长。

- 除其他因素外,对办公空间的需求不断增加可能会成为预测期内研究的市场的机会。

- 预计亚太地区将主导液体应用膜市场;而北美地区预计将在预测期内实现最快的成长。

液体应用膜市场趋势

屋顶应用预计将主导市场

- 混凝土屋顶的防水始终是工程师和涂料规范者面临的巨大挑战。随着结构运动的复杂性增加,人们对混凝土结构渗漏的日益关注,长期需要多样化的防水系统,促进了液体防水卷材在全球市场的成长。

- 有效且耐用的防水系统对于确保混凝土板的长期耐用性并透过避免昂贵的维修来保持较低的维护成本至关重要。

- 固化形成橡胶状弹性体防水膜的液体涂覆膜可以拉伸并恢復到原来的形状而不会损坏。这些薄膜在屋顶市场上得到了广泛接受。

- 这些薄膜透过传统方法应用于屋顶,例如刷子、滚筒或单组分无气喷涂,单层涂层每层厚度约为 450-500 微米,重涂时间为 4 小时。它们具有出色的裂缝桥接能力,可以解决混凝土中的结构运动。它们还具有抗穿刺性能,可以在其上建造景观、花园、道碴或摊舖机,而不会破坏防水层的完整性。

- 屋顶中的液体应用膜进一步提供完全的水密性、较长的预期寿命和最少的维护。这些薄膜的应用无需沥青、明火或溶剂,且不包含接缝或缝线。

- 根据Global Construction Perspectives和Oxford Economics的预测,到2030年,全球建筑产值预计将达到15.5兆美元,其中中国、美国和印度三个国家处于领先地位,占全球总成长的57%。

- 根据抵押贷款银行家协会(MBA)预测,2023年美国单户住宅预计将达到121万套。

- 美国拥有庞大的建筑业,拥有超过 760 万名员工。根据美国人口普查局的数据,2022年建筑价值为17,929亿美元,比2021年的16,264亿美元增加10.2%。

- 此外,根据美国人口普查局的进一步统计,2022年美国新建建筑年价值为16,575.90亿美元,而2021年为14,998.22亿美元。此外,美国住宅建筑年价值为16,575.90亿美元。2022 年国家价值为8,491.64 亿美元,而2021 年为7,406.45 亿美元。2022 年国家非住宅建筑年度价值为8,084.27 亿美元,而2021 年为7,591.77 亿美元。从而减少了市场消费短期内学习。

- 所有这些因素预计将在未来几年推动液体涂覆膜在建筑领域的使用。

北美市场成长最快

- 预计北美地区在未来几年将成长最快。美国是北美最大的液体应用膜市场。这是由于该国住房项目的增加、地下水建设需求的增加以及基础设施建设的不断发展。

- 近年来,佛罗里达州、乔治亚州、北卡罗来纳州、华盛顿州、犹他州、田纳西州、俄亥俄州、加利福尼亚州、爱达荷州和南卡罗来纳州的单身家庭住宅建设稳步增长。这导致该国对液体应用膜的需求显着增加。

- 据加拿大建筑协会称,建筑业是加拿大最大的雇主之一,也是该国经济成功的主要贡献者。该产业贡献了该国国内生产毛额(GDP)的7%。此外,加拿大新建建筑计划(NBCP)和经济适用住房计划(AHI)等各种政府项目正在支持建筑业的成长。

- 此外,2022 年 7 月工业建设投资成长 2.2%,其中 7 个州出现成长。安大略省占本月组件成长的大部分,并在 2021 年 12 月之后继续大幅成长。此外,该国还有超过 1 亿平方英尺的空间,仍在建设中以满足办公需求。

- 因此,考虑到上述因素,预计该国液体膜市场在预测期内将出现高速成长。

液体应用膜产业概述

液体应用膜市场本质上是部分分散的,没有一家公司在全球市场上占据重要地位。这些主要参与者包括 MBCC Group、Saint Gobain Weber、SOPREMA SAS、Sika AG 和 MAPEI, SpA 等(排名不分先后)。

额外的好处:

- Excel 格式的市场估算 (ME) 表

- 3 个月的分析师支持

目录

第 1 章:简介

- 研究假设

- 研究范围

第 2 章:研究方法

第 3 章:执行摘要

第 4 章:市场动态

- 司机

- 越来越多地使用防水膜来维持建筑物的使用寿命

- 液体应用膜的优势不断增加,从而实现具有成本效益的施工

- 新兴经济体不断成长的基础设施和商业项目

- 限制

- 片状膜等替代品的可用性

- 其他限制

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章:市场区隔(市场价值规模)

- 类型

- 聚氨酯

- 水泥质

- 沥青

- 其他类型

- 应用

- 屋顶

- 墙壁

- 地下和隧道

- 其他应用

- 地理

- 亚太

- 中国

- 印度

- 日本

- 韩国

- 东协国家

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 中东和非洲其他地区

- 亚太

第 6 章:竞争格局

- 併购、合资、合作与协议

- 市占率(%)**/排名分析

- 领先企业采取的策略

- 公司简介

- Carlisle Companies Incorporated

- Dow

- Fosroc Inc.

- GAF

- GCP Applied Technologies Inc.

- Henry Company

- Johns Manville (A Berkshire Hathaway Company)

- KEMPER SYSTEM Ltd

- MAPEI SpA

- SOPREMA INC.

- Saint-Gobain Weber

- Sika AG

第 7 章:市场机会与未来趋势

- 生物基液膜系统的开发

- 基于奈米技术的功能性液膜系统的开发

The Liquid Applied Membrane Market size is estimated at USD 6.99 billion in 2024, and is expected to reach USD 9.03 billion by 2029, growing at a CAGR of 5.25% during the forecast period (2024-2029).

The market was significantly impacted by COVID-19 in 2020. Several countries were forced to go into lockdown, owing to the pandemic scenario, which led to the shutdown of manufacturing facilities of almost every industry worldwide for a specified time; including that of the construction industry. The commercial construction and infrastructure industries, which are the major consumers of liquid applied membrane, were significantly impacted due to the pandemic. The ongoing scenario then prompted many owners to delay or cancel construction projects for a few months in 2020. According to the Associated General Contractors of America Organization, a decrease of 40% in higher education construction, 38% in public buildings, and 27% in school construction were observed. Still, according to The National Association of Realtors, single-family home is expected to reach 6% in 2021, thus leading to the growth of liquid applied membrane market. Thus, a rise in the residential construction sector and commercial construction will boost the liquid applied membrane market. The COVID-19 outbreak has significantly impacted infrastructure development and the global economy. As per the World Bank Organization, in terms of developing-country infrastructure projects, 256 have been reported as canceled or delayed. The project disruptions in the pipeline peaked in April 2020, but since then, it started to stabilize.

Key Highlights

- Over the long run, growing usage of waterproofing membranes to maintain the longevity of buildings, increasing benefits of liquid applied membranes resulting in cost-effective construction, and growing infrastructural and commercial projects in emerging economies are expected to drive the market growth in the forecast period.

- Availability of substitutes such as sheet membranes is expected to hinder the market growth during the forecast period.

- Increasing need for office spaces, amongst other factors, is likely to act as an opportunity for the market studied over the forecast period.

- Asia-Pacific is expected to dominate the liquid applied membrane market; while North America is expected to register the fastest growth through the forecast period.

Liquid Applied Membranes Market Trends

Roofing Application is Expected to Dominate the Market

- The waterproofing of concrete roofs is always a great challenge to engineers and coating specifiers. With the increased complexity of structural movements, the growing concern for leakages in concrete structures carved the need for diverse waterproofing systems for a long time, facilitating the growth of liquid-applied membranes in the global market.

- An effective and durable waterproofing system is critical to ensure the long-term durability of the concrete slabs and keep maintenance costs low by avoiding costly repairs.

- Liquid-applied membranes that cure to form rubber-like elastomeric waterproof membranes can stretch and return to their original shape without damage. These membranes found wide acceptance in the roofing market.

- These membranes are applied in roofing by conventional methods, like brush, roller, or single component airless spray, with a single coat yielding around 450-500 microns per coat, with a re-coat window of four hours. They include excellent crack-bridging abilities to tackle the structural movements in the concrete. They also possess puncture resistance quality to build landscaping, gardens, and ballast or pavers over them without undermining the integrity of the waterproof layer.

- The liquid-applied membranes in roofing further offer complete water-tightness, long life expectancy, and minimal maintenance. These membranes are applied without bitumen, open flames, or solvents and do not contain seams or stitches.

- According to Global Construction Perspectives and Oxford Economics, the volume of construction output is expected to reach USD 15.5 trillion worldwide by 2030, with three countries - China, the United States, and India leading the way and accounting for 57% of all global growth.

- According to the Mortgage Bankers Association (MBA) forecasts, single-family housing is expected to be 1.210 million in the United States in 2023.

- The United States boasts a colossal construction sector with over 7.6 million employees. According to the US Census Bureau, in 2022, the construction value was USD 1,792.9 billion, a 10.2% increase over the USD 1,626.4 billion spent in 2021.

- Further, as per further statistics generated by the US Census Bureau, the annual value for new construction in the United States accounted for USD 1,657,590 million in 2022, compared to USD 1,499,822 million in 2021. Moreover, the annual value of residential construction in the United States was valued at USD 849,164 million in 2022, compared to USD 740,645 million in 2021. The country's annual non-residential construction value was USD 808,427 million in 2022, compared to USD 759,177 million in 2021. It is thereby decreasing the consumption of the market studied in the short term.

- All such factors are expected to drive the usage of liquid-applied membranes in the construction sector through the years to come.

North America to Register the Fastest Growth in the Market

- The North American region is expected to grow fastest in the coming years. The United States is the largest market for liquid-applied membranes in North America. It is due to the increase in housing projects, growing underground water construction requirements, and rising infrastructural developments in the country.

- Residential construction for single families witnessed steady growth in recent years in Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina. It led to a significant increase in the demand for liquid-applied membranes in the country.

- According to the Canadian Construction Association, the construction sector is one of Canada's largest employers and a major contributor to the country's economic success. The industry contributes 7% of the country's Gross Domestic Product (GDP). Further, various government projects, such as New Building Canada Plan (NBCP) and Affordable Housing Initiative (AHI), are supporting the construction sector's growth.

- Additionally, investment in industrial construction rose 2.2% in July 2022, with gains in seven states. Ontario accounted for most of this month's component increase and continues to grow significantly beyond December 2021. Furthermore, the country includes more than 100 million sq ft of space, still under construction for office requirements.

- Therefore, considering the factors above, the market for the liquid-applied membrane is expected to witness high growth in the country during the forecast period.

Liquid Applied Membranes Industry Overview

The liquid-applied membrane market is partially fragmented in nature, with no players occupying a significant position in the global market. These major players include MBCC Group, Saint Gobain Weber, SOPREMA SAS, Sika AG, and MAPEI, SpA.among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Usage of Waterproofing Membranes to Maintain Longevity of Buildings

- 4.1.2 Increasing Benefits of Liquid Applied Membranes Resulting in Cost-effective Construction

- 4.1.3 Growing Infrastructural and Commercial Projects in Emerging Economies

- 4.2 Restraints

- 4.2.1 Availability of Substitutes such as Sheet Membranes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyurethane

- 5.1.2 Cementitious

- 5.1.3 Bituminous

- 5.1.4 Other Types

- 5.2 Application

- 5.2.1 Roofing

- 5.2.2 Walls

- 5.2.3 Underground and Tunnels

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Carlisle Companies Incorporated

- 6.4.2 Dow

- 6.4.3 Fosroc Inc.

- 6.4.4 GAF

- 6.4.5 GCP Applied Technologies Inc.

- 6.4.6 Henry Company

- 6.4.7 Johns Manville (A Berkshire Hathaway Company)

- 6.4.8 KEMPER SYSTEM Ltd

- 6.4.9 MAPEI SpA

- 6.4.10 SOPREMA INC.

- 6.4.11 Saint-Gobain Weber

- 6.4.12 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Bio Based Liquid Membrane Systems

- 7.2 Develop of Nanotechnology based Functional Liquid Membrane Systems