|

市场调查报告书

商品编码

1802916

全球聚乙烯丁醛市场(按应用、最终用途行业、产品类型、树脂类型、厚度和地区划分)- 预测至2030年Polyvinyl Butyral Market by Application, Thickness, Resin Type, Product Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

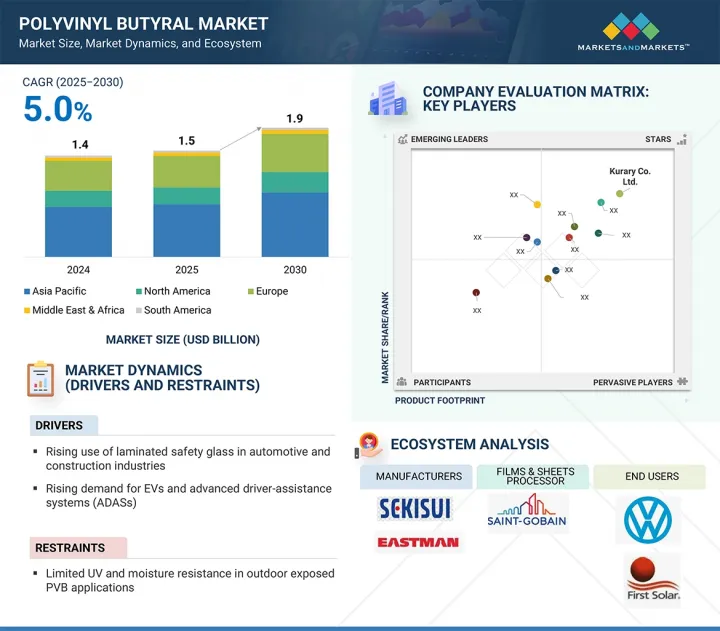

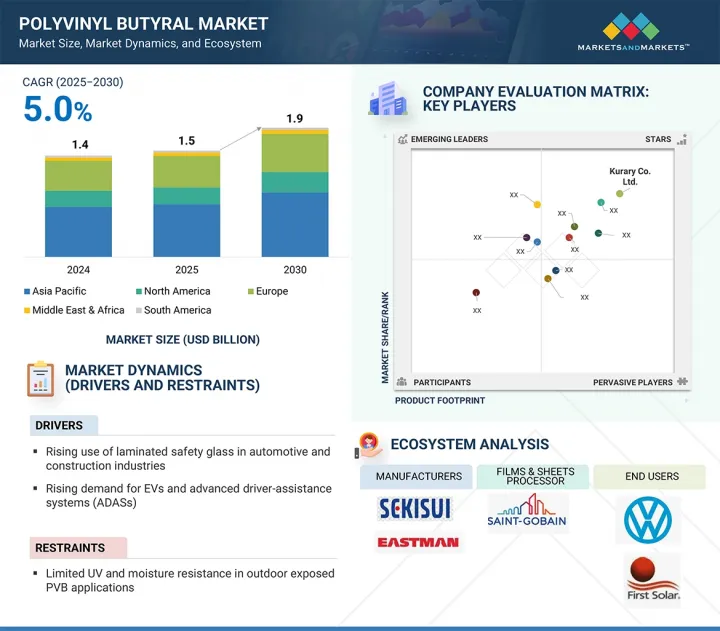

聚乙烯丁醛市场规模预计将从 2025 年的 15 亿美元成长到 2030 年的 19 亿美元,预测期内复合年增长率为 5.0%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 数量(百万美元/十亿美元)和千吨 |

| 部分 | 依应用、依最终用途产业、依产品类型、按树脂类型、厚度、按地区 |

| 目标区域 | 北美、亚太地区、欧洲、中东和非洲、南美 |

PVB 产业正在经历显着成长,其应用领域涵盖汽车、建筑和可再生能源等关键产业。推动这一成长的关键因素之一是 PVB 在夹层安全玻璃中的应用日益广泛。 PVB 可作为中间膜,在撞击过程中将玻璃黏合在一起,从而提高安全性并降低受伤风险。在汽车领域,随着汽车产量(尤其是在亚太地区)的不断增长以及监管要求的不断提高,PVB 夹层玻璃已成为新车挡风玻璃、侧窗和天窗的标准配置。此外,消费者的偏好也推动了对隔音、日光控制玻璃以及节能解决方案的需求。

在建筑领域,都市化和基础建设推动着夹层玻璃在商业和住宅建筑的应用不断增加,以提高安全性、隔音效果和紫外线防护性能。此外,在可再生能源产业,尤其是在光伏组件领域,PVB 可以保护太阳能电池免受潮湿和机械应力的影响。此外,PVB 技术的持续创新,例如 PVB 中间膜中的生物基选择和再生材料,符合永续性趋势,并持续受到欢迎,吸引更广泛的人群。这些应用以及全球市场所需的必需产品,支撑着日常生活中 PVB 需求的稳定持续成长。

聚乙烯丁醛(PVB) 市场预计将稳定成长,这得益于其在汽车、建筑和可再生能源等许多主要工业和商业领域的成功应用。汽车产业继续扩大生产,主要是在亚太地区,而全球范围内的安全玻璃法规也日益严格。汽车产量的增加推动了对夹层安全玻璃的需求,而 PVB 是其中的关键成分。印度、中国和巴西等国家的快速都市化和现代化,以及欧洲日益严格的能源效率和环境标准推动了建筑业的发展。在可再生能源发电领域,PVB 通常用于保护产生可再生能源的太阳能板中的太阳能电池,这也导致了 PVB消费量的增加。由于各种回收流程和挑战,公司必须投资新的回收方法,并投入资源使 PVB 生产更具永续,才能在严格的法规和原材料成本上涨的环境中保持竞争力。

聚乙烯丁醛(PVB) 市场预计将在标准薄膜领域快速成长,该领域在大多数主要终端用户领域(包括汽车和建筑应用)提供性能、成本和法规遵循的最佳平衡。典型的 PVB 薄膜厚度为 0.76 毫米,被认为是夹层安全玻璃的行业标准。包括KURARAY CO. LTD.(Trosifol) 和酵母(Saflex) 在内的业内相关人员表示,这个厚度范围为嵌装玻璃应用提供了必要的特性,包括优异的抗衝击性、光学清晰度、隔音性和紫外线防护性。在汽车产业,标准薄膜广泛用于挡风玻璃和车窗,以满足全球碰撞测试标准和声学舒适度法规。电动车也建议更多使用标准厚度的声学 PVB,以降低内部噪音并改善驾驶体验。在建筑业,PVB 薄膜用于从学校到办公大楼的所有类型建筑的建筑幕墙和窗户,需要快速应用、自动化生产线、能源效率和抗衝击等安全标准。与超薄和厚夹层不同,标准膜提供了实用的中间地带,满足了更多的功能需求,同时实现了更具成本效益和可扩展性的生产,使标准膜成为成长最快的细分市场。

无机污染物是聚乙烯丁醛(EO) 市场成长最快的应用领域,这得益于处理重金属、硝酸盐和其他无机污染物的需求。 EO 透过直接电子转移或活性物质的生成来氧化或还原去除无机物,这使得无机处理在传统方法无法满足去除需求时变得非常有效。由于工业实务的改变和法规的日益严格,EO 正逐渐成为亚太地区首选的处理技术。在该地区,采矿、化学和电子行业必须满足严格的污染物排放标准,尤其是重金属排放标准,例如中国的工业污水和采矿试点项目以及印度,采矿作业的污水排放标准中规定了零排放。在北美,有关硝酸盐污染的农业法规已发生变化,涵盖了农业径流和地下水,这导致使用二氧化铅和钛电极进行高效硝酸盐处理的 EO 试点计画越来越多。在欧洲, 《都市废水处理指令》及其关于防止工业废水中污染(包括无机污染物)的要求,引发了人们对 EO 在化工厂中应用的兴趣。在世界银行的支持下,非洲、南美和拉丁美洲国家采矿活动的成长也推动了对环氧乙烷处理的需求,这种处理方法可以处理含有重金属的酸性矿井废水。

以树脂类型分類的聚乙烯丁醛(PVB) 市场以高分子量 PVB 树脂为主,预计此类树脂的成长速度最快。高分子量 PVB 树脂的成功源于其先进的性能特征,为其在交通、建筑、施工和电子行业的应用提供了额外的障碍。与低分子量和中分子量 PVB 树脂相比,高分子量 PVB 树脂具有更优异的机械强度、弹性、附着力和热稳定性。这些独特的性能对于夹层安全玻璃的应用至关重要,而夹层安全玻璃的市场需求日益增长,也促使住宅和商业领域多个组织制定了日益严格的安全、卫生、环境和产品责任标准。

据业内资讯来源(包括技术出版物)称,高分子量树脂用于夹层安全玻璃时,声学性能更佳,抗分层性更强。随着电动车的兴起以及领先设计公司对建筑设计的精益求精,这一趋势仍在持续。未来的发展方向包括安全玻璃规格和多功能嵌装玻璃,其先进设计包括隔音、防紫外线和节能。树脂配方技术的最新创新使製造商能够生产更高分子量的PVB树脂,并提高其加工性能并与现有的夹层设备相容。随着全球建筑、汽车和电子产业对高性能、长寿命材料的需求不断增长,「高分子量」PVB树脂的前景仍然光明。

本报告研究了全球聚乙烯丁醛市场,并按应用、最终用途行业、产品类型、树脂类型、厚度、区域趋势和公司概况对市场进行了概述。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

- 生成式人工智慧效果

- 人工智慧对聚乙烯丁醛市场的影响

第六章 产业趋势

- 介绍

- 影响客户业务的趋势/中断

- 价值链分析

- 定价分析

- 投资状况及资金筹措情景

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 2024-2025年重要会议和活动

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 宏观经济展望

- 案例研究

第七章聚乙烯丁醛市场(依应用)

- 介绍

- 薄膜和片材

- 油漆和涂料

- 胶水

- 其他的

第八章聚乙烯丁醛市场(依最终用途产业)

- 介绍

- 车

- 建造

- 电机与电子工程

- 其他的

第九章聚乙烯丁醛市场(依产品类型)

- 介绍

- 粉末/颗粒

- 其他的

第十章聚乙烯丁醛市场(依树脂类型)

- 介绍

- 高分子量级PVB树脂

- 中分子量级PVB树脂

- 低分子量级PVB树脂

- 改质PVB树脂

第11章聚乙烯丁醛市场(依厚度)

- 介绍

- 超薄膜

- 标准胶片

- 中阶电影

- 厚实的复合中阶

第十二章聚乙烯丁醛市场(按地区)

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 义大利

- 法国

- 英国

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十三章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 2024年市场占有率分析

- 收益分析

- 品牌/产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 2024 年估值与财务指标

- 竞争场景

第十四章:公司简介

- 主要参与企业

- KURARAY CO., LTD.

- EASTMAN CHEMICAL COMPANY

- SEKISUI CHEMICAL CO., LTD.

- HUBERGROUP

- CHANG CHUN GROUP

- VIZAGCHEMICAL

- KINGBOARD(FOGANG)SPECIALITY RESINS LIMITED

- EVERLAM

- HUAKAI PLASTIC(CHONGQING)CO., LTD.

- TRIDEV GROUP

- 其他公司

- QINGDAO JIAHUA PLASTICS CO., LTD

- SIVA CHEMICAL INDUSTRIES

- TANYUN JUNRONG(LIAONING)CHEMICAL RESEARCH INSTITUTE NEW MATERIALS INCUBATOR CO., LTD.

- SYNPOL PRODUCTS PVT LTD.

- UNIFORM SYNTHETICS PRIVATE LIMITED

- DR COATS INK & RESINS PVT. LTD

- HUZHOU XINFU NEW MATERIALS CO., LTD.

- QINGDAO HAOCHENG INDUSTRIAL COMPANY LIMITED

- ZHEJIANG PULIJIN PLASTIC CO., LTD.

- TIANTAI KANGLAI INDUSTRIAL CO., LTD

- PERSTORP

- ATAMAN KIMYA AS

- WEGO CHEMICAL GROUP

- JAINISH INDUSTRIES

- SINOEVER INTERNATIONAL CO., LTD.

第十五章 附录

The polyvinyl butyral market is projected to grow from USD 1.5 billion in 2025 to USD 1.9 billion by 2030, registering a CAGR of 5.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) and Kiloton |

| Segments | Resin Type, Product Type, Thickness, Application, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

The PVB industry is experiencing significant growth with many applications across major industries such as automotive, construction, and renewable energy. A key driver of this growth is the rising use of PVB in laminated safety glass, where PVB acts as an interlayer to hold glass together upon impact, enhancing safety and reducing injury risk. In the automotive sector, increased vehicle production-especially in the Asia Pacific region-and regulatory requirements mean PVB laminated glass is now standard in new vehicles for windshields, side windows, and sunroofs. Additionally, there is growing demand for acoustic and solar-control glazing and energy-efficient solutions, driven by consumer preferences.

In construction, urbanization and infrastructure development are boosting the use of laminated glass in both commercial and residential buildings to improve safety, noise insulation, and UV protection. The use of PVB in laminated glass is also an important factor in the renewable energy industry, especially in photovoltaic modules, where PVB protects solar cells from moisture and mechanical stress. Additionally, ongoing innovation of PVB, including bio-based options and recycled content for laminated PVB interlayers, aligns with sustainability trends and continues to grow in popularity to appeal to a broader demographic. These applications and essential products needed in the global market support steady and consistent growth in demand for PVB in our daily lives.

"Powder & granules segment to be fastest-growing product type segment of polyvinyl butyral market during forecast period"

The polyvinyl butyral (PVB) market is poised for steady growth due to its successful use in many major industrial and private sector applications across automotive, construction, and renewable energy. The automotive industry has continued to increase production, especially in the Asia Pacific region, while also becoming subject to stricter safety glass regulations worldwide. As vehicle manufacturing rises, the need for laminated safety glass will grow, with PVB being a key component. The construction sector also drives PVB demand due to rapid urbanization and modernization in countries like India, China, and Brazil, along with stricter energy efficiency and environmental standards in many European nations. The renewable energy sector contributes to increased PVB consumption since it is often used to protect photovoltaic cells in solar panels that generate renewable energy. Due to different recycling processes and challenges, companies must invest in new recycling methods and commit resources to making PVB production more sustainable to stay competitive amid strict regulations and rising raw material costs.

"Standard films to be fastest-growing segment of polyvinyl butyral market in terms of value"

The standard film segment is projected to witness fast growth in the polyvinyl butyral (PVB) market due to its optimal balance of performance, cost, and regulation compliance across most major end-user sectors, such as automotive and construction. Standard PVB films typically have a nominal thickness of 0.76 mm and are regarded as the industry standard for laminated safety glass. Industry sources like Kuraray (Trosifol) and Eastman (Saflex) have stated that this nominal thickness range provides good impact resistance, optical clarity, sound insulation, and UV protection-all essential characteristics for glazing applications. In the automotive industry, standard films are widely used in windshields and windows to ensure they pass global crash test standards and meet (acoustic) comfort regulations. They also suggest that the use of acoustic PVBs, within standard thicknesses, is increasing in electric vehicles to reduce cabin noise and enhance the driving experience. In the architecture industry, all types of buildings, from schools to office towers, utilize PVB films in facades and windows where quick adherence, automated production lines, energy efficiency compliance, and safety standards like impact resistance are required. Unlike ultra-thin or thick interlayers, standard films provide a practical middle ground, meeting more functional needs while enabling more cost-effective and scalable production; thus, standard films have become the fastest-growing sub-segment.

"Inorganic pollutants treatment to be fastest-growing in electrode material segment of polyvinyl butyral market in terms of value"

Inorganic pollutants are the fastest-growing application segment in the Polyvinyl butyral (EO) market due to the need to treat heavy metals, nitrates, and other inorganic contaminants. EO removes inorganics through oxidation or reduction by direct electron transfer or reactive species generation, and treatment of inorganics can be highly effective when traditional methods cannot meet removal needs. Due to changes in industrial practices and stricter regulations, EO is mainly emerging as the best treatment technology in the Asia-Pacific region, where industries in mining, chemicals, and electronics must meet stringent discharge standards for pollutants, especially heavy metals, as seen in pilots in China's industrial wastewater and mining industries, and in India, where mining operations have a zero-liquid discharge component to wastewater discharge standards. Changes in North America's agricultural regulations for nitrate contamination, which now target agricultural runoff and groundwater, have increased the use of EO pilots using lead dioxide or titanium electrodes for effective and efficient nitrate treatment. In Europe, the Urban Waste Water Treatment Directive and its requirements for pollution prevention, including inorganic contaminants in industrial discharges, have generated interest in EO applications in chemical plants. The growth of mining activities in countries across Africa, South America, and Latin America has also driven demand for EO treatment, as it can treat acidic mine drainage with heavy metals, with support from the World Bank.

"Higher molecular weight PVB resin to be fastest-growing resin type segment of polyvinyl butyral market in terms of value"

The leading materials in the polyvinyl butyral (PVB) market, classified by resin type, are the higher molecular weight PVB resins, which are the fastest-growing based on expected resin growth rates. The success of businesses in the higher molecular weight PVB resin segment is due to their advanced performance features, offering extra barriers for use in transportation, building, construction, and electronics industries. Compared to low or medium molecular weight PVB resins, higher molecular weight variants deliver superior mechanical strength, elasticity, adhesion, and thermal stability. These unique qualities are essential when used in laminated safety glass, as there are increased demands for interlayer strength and durability, along with a trend toward stricter safety, health, environmental, and product liability standards set by multiple organizations in the residential and commercial sectors.

Sources across the industry, including technical publications, indicate that higher molecular weight resin choices have better acoustic dampening characteristics when used in laminated safety glass and are more resistant to delamination. This is recommended for electric vehicles and as the trend continues among leading design firms for exquisite architectural design. There is even a developing trend toward multi-functional glazing that will have future specifications for safety glass and advanced designs that include sound insulation, ultraviolet shielding, and energy efficiency. Recent innovations in resin formulation technologies have enabled manufacturers to produce higher molecular weight PVBs with improved processability and compatibility with existing laminated glass equipment. With the increasing global demand for materials that deliver high performance and longer service life across the construction, automotive, and electronics industries, the outlook for "high molecular weight" PVB resin remains promising.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the polyvinyl butyral market. Additionally, information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East & Africa - 10%, South America - 5%.

Key players in the polyvinyl butyral market include Sekisui Chemical Co. Ltd. (Japan), Kuraray Co. Ltd. (Japan), Eastman Chemical Company (US), Hubergroup (US), Chang Chun Group (China), Anhui WanWei Bisheng New Material Co., Ltd. (China), Kingboard Fogang Specialty Resin Co., Ltd (China), Qingdao Jinuo New Materials Co., Ltd. (China), Huakai Plastic Co. Ltd. (China), and Everlam (Belgium). The study provides an in-depth competitive analysis of these key players in the Polyvinyl Butyral market, including their company profiles, recent developments, and main market strategies.

Research Coverage

This report segments the market for polyvinyl butyral based on resin type, thickness, product type, end-use industry, application, and region, and provides estimates for the overall market value across different regions. A detailed analysis of key industry players is included to offer insights into their business overviews, products and services, key strategies, and expansions related to the polyvinyl butyral market.

Key benefits of buying this report

This research report focuses on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the polyvinyl butyral market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of drivers rising demand of EVs and advanced driver-assistant systems (ADAS) driving high-performance PVB adoption), restraints (Limited UV and moisture resistance in outdoor exposed PVB applications), opportunities (expanding recycled PVB (rPVB) adoption in industrial and infrastructure materials), and challenges (regulatory pressure on plasticizer formulations and VOC emission in PVB manufacturing).

- Market Penetration: Comprehensive information on the polyvinyl butyral market offered by top players.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, partnerships, agreements, joint ventures, collaborations, announcements, awards, and expansions in the market.

- Market Development: Comprehensive information about lucrative emerging markets across regions.

- Market Capacity: Wherever possible, the production capacities of companies producing polyvinyl butyral are provided, along with upcoming capacities for the polyvinyl butyral market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polyvinyl butyral market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants in primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 GROWTH FORECAST

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYVINYL BUTYRAL MARKET

- 4.2 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE

- 4.3 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE

- 4.4 POLYVINYL BUTYRAL MARKET, BY THICKNESS

- 4.5 POLYVINYL BUTYRAL MARKET, BY APPLICATION

- 4.6 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY

- 4.7 POLYVINYL BUTYRAL MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Mandatory use of laminated safety glass in architectural and automotive applications

- 5.2.1.2 Rise in demand for EVs and advanced driver-assistance systems (ADAS)

- 5.2.1.3 Shift toward building-integrated photovoltaics (BIPV) using PVB-encapsulated laminated glass

- 5.2.1.4 Growth in acoustic and decorative glass installations in high-end construction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited UV and moisture resistance in outdoor-exposed PVB applications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of recycled PVB (rPVB) adoption in industrial and infrastructure materials

- 5.2.3.2 Smart glass & dynamic glazing integration

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory pressure on plasticizer formulations and VoC emissions in PVB manufacturing

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.4 IMPACT OF GENERATIVE AI ON POLYVINYL BUTYRAL MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 PVB RESIN PRODUCTION

- 6.3.3 FILM/CAST SHEET PROCESSING

- 6.3.4 END USERS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY RESIN TYPE, 2021-2024

- 6.4.3 AVERAGE SELLING PRICE TREND AMONG POLYVINYL BUTYRAL KEY PLAYERS, BY RESIN TYPE, 2021-2024

- 6.5 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.8.3 PATENT PUBLICATION TRENDS

- 6.8.4 INSIGHTS

- 6.8.5 LEGAL STATUS OF PATENTS

- 6.8.6 JURISDICTION ANALYSIS

- 6.8.7 TOP APPLICANTS

- 6.8.8 LIST OF MAJOR PATENTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 392091)

- 6.9.2 EXPORT SCENARIO (HS CODE 392091)

- 6.10 KEY CONFERENCES AND EVENTS, 2024-2025

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF AND REGULATIONS RELATED TO POLYVINYL BUTYRAL MARKET

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 REGULATIONS RELATED TO POLYVINYL BUTYRAL MARKET

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY

- 6.15.1 ECO-FRIENDLY INNOVATION IN TEXTILE COATINGS: MODIFIED RECYCLED POLYVINYL BUTYRAL (RPVB) FOR TRADEMARK RIBBON APPLICATIONS

- 6.15.2 INVESTIGATING BUBBLE FORMATION MECHANISMS IN LAMINATED SAFETY GLASS (LSG)

- 6.15.3 BIOCOMPATIBLE COMPOSITES OF RECYCLED PVB AND HDPE: SAFETY EVALUATION FOR HUMAN CELL COMPATIBILITY

7 POLYVINYL BUTYRAL MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FILMS & SHEETS

- 7.2.1 RISING GROWTH OF PVB IS SUPPORTED BY URBANIZATION AND INFRASTRUCTURE PROJECTS IN DEVELOPING COUNTRIES

- 7.3 PAINTS & COATINGS

- 7.3.1 INDIA'S SMART CITY PROJECTS UNDERSCORE POTENTIAL FOR PVB-BASED COATINGS IN PROTECTIVE APPLICATIONS

- 7.4 ADHESIVES

- 7.4.1 GROWING EMPHASIS ON LIGHTWEIGHT VEHICLES AND RENEWABLE ENERGY INFRASTRUCTURE TO DRIVE DEMAND

- 7.5 OTHER END-USE INDUSTRIES

- 7.5.1 WASH PRIMERS

- 7.5.1.1 Rising demand for advanced metal protection solutions to influence demand

- 7.5.2 CERAMIC BINDERS

- 7.5.2.1 Rising demand for high-performance ceramics across electronics, renewable energy, and industrial sectors to drive market

- 7.5.3 COMPOSITE FIBERS

- 7.5.3.1 Shift towards lightweight and high performance materials to drive demand for PVB materials

- 7.5.1 WASH PRIMERS

8 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 AUTOMOTIVE

- 8.2.1 RISING DEMAND FOR ADVANCED SAFETY GLASS IN EVS AND AUTONOMOUS VEHICLES

- 8.3 CONSTRUCTION

- 8.3.1 MANDATORY REGULATORY COMPLIANCE FOR GREEN BUILDING CODES AND ENERGY-EFFICIENT INFRASTRUCTURE

- 8.4 ELECTRICAL & ELECTRONICS

- 8.4.1 ADVANCING SHIFT TO SOLAR ENERGY AND CLEAN ELECTRONICS

- 8.5 OTHER END-USE INDUSTRIES

- 8.5.1 MILITARY & DEFENSE

- 8.5.1.1 Advancements in lightweight armor technology and composite glazing systems

- 8.5.2 RAIL & MASS TRANSIT

- 8.5.2.1 Expansion of metro networks, high-speed trains, and light rail systems

- 8.5.3 CONSUMER GOODS & WEARABLES

- 8.5.3.1 Lenses laminated with PVB in designer sunglasses improve visual clarity and extend product durability

- 8.5.4 CONSUMER ELECTRONICS

- 8.5.4.1 Demand for sustainable, durable, and visually appealing components

- 8.5.1 MILITARY & DEFENSE

9 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 POWDER & GRANULES

- 9.2.1 VERSATILITY AND DIVERSE APPLICATIONS OF POWDER & GRANULATED PVB RESIN TO DRIVE DEMAND

- 9.3 OTHER PRODUCT TYPES

- 9.3.1 AQUEOUS DISPERSIONS

- 9.3.1.1 Increase in demand for green and sustainable coatings to drive market

- 9.3.2 RESIN SOLUTIONS

- 9.3.2.1 Resin solutions of PVB resin enable precision in electronics and optical applications

- 9.3.1 AQUEOUS DISPERSIONS

10 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE

- 10.1 INTRODUCTION

- 10.2 HIGHER MOLECULAR WEIGHT GRADE PVB RESIN

- 10.2.1 UTMOST STRENGTH AND RESISTANCE AT BREAK

- 10.3 MEDIUM MOLECULAR WEIGHT GRADE PVB RESIN

- 10.3.1 SPECIALLY USED IN SAFETY GLAZING APPLICATIONS, WHICH OFFER LOW-COST SOLUTIONS

- 10.4 LOWER MOLECULAR WEIGHT GRADE PVB RESIN

- 10.4.1 VERSATILE USE OF LOW MOLECULAR WEIGHT GRADE PVB RESIN IN MULTIPLE APPLICATIONS

- 10.5 MODIFIED PVB RESIN

- 10.5.1 GROWING INTEREST IN VALUE-ADDED GLASS PRODUCTS IN RENEWABLE ENERGY SECTOR

11 POLYVINYL BUTYRAL MARKET, BY THICKNESS

- 11.1 INTRODUCTION

- 11.2 ULTRA-THIN FILMS

- 11.2.1 INCREASED USE IN DECORATIVE GLASS MARKET TO DRIVE DEMAND

- 11.3 STANDARD FILMS

- 11.3.1 RISING URBANIZATION, GROWING AUTOMOTIVE MANUFACTURING, AND STRENGTHENED REGULATORY ENFORCEMENT OF SAFETY STANDARDS TO DRIVE MARKET

- 11.4 MID-RANGE FILMS

- 11.4.1 ONGOING INNOVATION WITHIN MODERN GLAZING SYSTEMS TO INCREASE DEMAND

- 11.5 THICK & COMPOSITE INTERLAYERS

- 11.5.1 INCREASE IN DEMAND AT PREMIUM END OF PVB MARKET TO DRIVE GROWTH

12 POLYVINYL BUTYRAL MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Regulatory push for sustainability to drive polyvinyl butyral adoption

- 12.2.2 JAPAN

- 12.2.2.1 Harnessing technological advancements to propel polyvinyl butyral market growth

- 12.2.3 INDIA

- 12.2.3.1 Capitalizing on sustainability focus to boost polyvinyl butyral market growth

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Utilizing technological innovation in electronics market to accelerate polyvinyl butyral market growth

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Capitalizing on stringent regulatory frameworks to drive polyvinyl butyral market growth

- 12.3.2 CANADA

- 12.3.2.1 Sustainability focus to propel polyvinyl butyral market growth

- 12.3.3 MEXICO

- 12.3.3.1 Regulatory alignment to drive polyvinyl butyral market growth

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Leveraging sustainable plastic solutions to drive demand for polyvinyl butyral

- 12.4.2 ITALY

- 12.4.2.1 Sustainability commitment to boost polyvinyl butyral market growth

- 12.4.3 FRANCE

- 12.4.3.1 Growing demand for polyvinyl butyral packaging, textile, and automotive industries to propel market growth

- 12.4.4 UK

- 12.4.4.1 Growing focus on renewable energy and alignment with stringent European regulatory standards to drive polyvinyl butyral market

- 12.4.5 SPAIN

- 12.4.5.1 Favorable climate and adherence to stringent European regulations to drive demand of polyvinyl butyral

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Sustainability initiative to drive polyvinyl butyral market growth

- 12.5.1.2 UAE

- 12.5.1.2.1 Strong incentives and policies supporting sustainability initiatives to drive market

- 12.5.1.3 Rest of GCC countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Rapid expansion of utility-scale solar farms increases need for high-quality materials

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Growing housing initiative and infrastructure program to drive market for PVB

- 12.6.2 ARGENTINA

- 12.6.2.1 Growing wind and solar projects to drive market for PVB

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Product type footprint

- 13.6.5.3 Application footprint

- 13.6.5.4 End-use industry footprint

- 13.6.5.5 Region footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 DEALS

- 13.9.2 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 KURARAY CO., LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.3.4 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 EASTMAN CHEMICAL COMPANY

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SEKISUI CHEMICAL CO., LTD.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 HUBERGROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 CHANG CHUN GROUP

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 VIZAGCHEMICAL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.7 KINGBOARD (FOGANG) SPECIALITY RESINS LIMITED

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 EVERLAM

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.9 HUAKAI PLASTIC (CHONGQING) CO., LTD.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.10 TRIDEV GROUP

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 KURARAY CO., LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 QINGDAO JIAHUA PLASTICS CO., LTD

- 14.2.2 SIVA CHEMICAL INDUSTRIES

- 14.2.3 TANYUN JUNRONG (LIAONING) CHEMICAL RESEARCH INSTITUTE NEW MATERIALS INCUBATOR CO., LTD.

- 14.2.4 SYNPOL PRODUCTS PVT LTD.

- 14.2.5 UNIFORM SYNTHETICS PRIVATE LIMITED

- 14.2.6 D.R. COATS INK & RESINS PVT. LTD

- 14.2.7 HUZHOU XINFU NEW MATERIALS CO., LTD.

- 14.2.8 QINGDAO HAOCHENG INDUSTRIAL COMPANY LIMITED

- 14.2.9 ZHEJIANG PULIJIN PLASTIC CO., LTD.

- 14.2.10 TIANTAI KANGLAI INDUSTRIAL CO., LTD

- 14.2.11 PERSTORP

- 14.2.12 ATAMAN KIMYA A.S.

- 14.2.13 WEGO CHEMICAL GROUP

- 14.2.14 JAINISH INDUSTRIES

- 14.2.15 SINOEVER INTERNATIONAL CO., LTD.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF POLYVINYL BUTYRAL, BY REGION, 2021-2024 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND, BY RESIN TYPE, 2021-2024 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND AMONG POLYVINYL BUTYRAL KEY PLAYERS, BY RESIN TYPE, 2021-2024 (USD/KILOTON)

- TABLE 4 POLYVINYL BUTYRAL MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES IN POLYVINYL BUTYRAL MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES IN POLYVINYL BUTYRAL MARKET

- TABLE 7 ADJACENT TECHNOLOGIES IN POLYVINYL BUTYRAL MARKET

- TABLE 8 POLYVINYL BUTYRAL MARKET: TOTAL NUMBER OF PATENTS

- TABLE 9 POLYVINYL BUTYRAL MARKET: LIST OF MAJOR PATENT OWNERS

- TABLE 10 POLYVINYL BUTYRAL MARKET: LIST OF MAJOR PATENTS, 2016-2024

- TABLE 11 POLYVINYL BUTYRAL MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 TARIFF-RELATED TO POLYVINYL BUTYRAL MARKET

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 REGULATIONS FOR PLAYERS IN POLYVINYL BUTYRAL MARKET

- TABLE 19 POLYVINYL BUTYRAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 22 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 23 POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 24 POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 26 POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 27 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 29 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 30 POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 31 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 32 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 33 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 34 POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 35 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 36 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 37 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 38 POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 39 POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 40 POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 41 POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 42 POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 43 POLYVINYL BUTYRAL MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 44 POLYVINYL BUTYRAL MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 POLYVINYL BUTYRAL MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 46 POLYVINYL BUTYRAL MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 47 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 50 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 51 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 52 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 53 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 54 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 55 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 56 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 57 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 58 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 59 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 62 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 63 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 66 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 67 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 70 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 71 CHINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 72 CHINA POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 73 CHINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 74 CHINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 75 JAPAN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 76 JAPAN POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 JAPAN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 78 JAPAN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 79 INDIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 80 INDIA POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 81 INDIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 82 INDIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 83 SOUTH KOREA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 84 SOUTH KOREA POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 85 SOUTH KOREA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 86 SOUTH KOREA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 87 REST OF ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 90 REST OF ASIA PACIFIC: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 91 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 94 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 95 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 98 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 99 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 102 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 103 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 106 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 107 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 110 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 111 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 114 NORTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 115 US: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 116 US POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 US: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 118 US: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 119 CANADA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 CANADA POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 121 CANADA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 122 CANADA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 123 MEXICO: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 124 MEXICO POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 126 MEXICO: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 127 EUROPE: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 EUROPE: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 130 EUROPE: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 131 EUROPE: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 132 EUROPE: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 134 EUROPE: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 135 EUROPE: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 138 EUROPE: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 139 EUROPE: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 140 EUROPE: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 142 EUROPE: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 143 EUROPE: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 144 EUROPE: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 146 EUROPE: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 147 EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 148 EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 150 EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 151 GERMANY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 152 GERMANY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 GERMANY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 154 GERMANY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 155 ITALY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 156 ITALY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 ITALY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 158 ITALY: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 159 FRANCE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 160 FRANCE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 FRANCE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 162 FRANCE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 163 UK: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 164 UK: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 UK: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 166 UK: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 167 SPAIN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 SPAIN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 SPAIN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 170 SPAIN: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 171 REST OF EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 REST OF EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 REST OF EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 174 REST OF EUROPE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 175 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST AND AFRICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST AND AFRICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 178 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 179 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 182 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 183 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 186 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 187 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 190 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 191 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA : POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 199 SAUDI ARABIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 200 SAUDI ARABIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 201 SAUDI ARABIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 202 SAUDI ARABIA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 203 UAE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 204 UAE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 UAE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 206 UAE: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 207 REST OF GCC COUNTRIES: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 208 REST OF GCC COUNTRIES: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 209 REST OF GCC COUNTRIES: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 210 REST OF GCC COUNTRIES: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 211 SOUTH AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 212 SOUTH AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 214 SOUTH AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 215 REST OF MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 216 REST OF MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 217 REST OF MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 219 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 220 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 221 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 222 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 223 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 224 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 225 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2021-2024 (KILOTON)

- TABLE 226 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY PRODUCT TYPE, 2025-2030 (KILOTON)

- TABLE 227 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (USD MILLION)

- TABLE 228 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (USD MILLION)

- TABLE 229 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2021-2024 (KILOTON)

- TABLE 230 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY RESIN TYPE, 2025-2030 (KILOTON)

- TABLE 231 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (USD MILLION)

- TABLE 232 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (USD MILLION)

- TABLE 233 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2021-2024 (KILOTON)

- TABLE 234 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY THICKNESS, 2025-2030 (KILOTON)

- TABLE 235 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 236 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 237 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 238 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 239 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 240 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 242 SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 243 BRAZIL: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 244 BRAZIL: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 245 BRAZIL: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 246 BRAZIL: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 247 ARGENTINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 248 ARGENTINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 249 ARGENTINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 250 ARGENTINA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 251 REST OF SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 253 REST OF SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 254 REST OF SOUTH AMERICA: POLYVINYL BUTYRAL MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 255 POLYVINYL BUTYRAL MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-MAY 2025

- TABLE 256 POLYVINYL BUTYRAL MARKET: DEGREE OF COMPETITION, 2024

- TABLE 257 POLYVINYL BUTYRAL MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 258 POLYVINYL BUTYRAL MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 259 POLYVINYL BUTYRAL MARKET: END-USE INDUSTRY FOOTPRINT, 2024

- TABLE 260 POLYVINYL BUTYRAL MARKET: REGION FOOTPRINT, 2024

- TABLE 261 POLYVINYL BUTYRAL MARKET: LIST OF KEY STARTUPS/SMES, 2024

- TABLE 262 POLYVINYL BUTYRAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 (1/2)

- TABLE 263 POLYVINYL BUTYRAL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024 (2/2)

- TABLE 264 POLYVINYL BUTYRAL MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 265 POLYVINYL BUTYRAL MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 266 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 267 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 KURARAY CO., LTD.: PRODUCT LAUNCHES

- TABLE 269 KURARAY CO., LTD.: DEALS

- TABLE 270 KURARAY CO., LTD.: EXPANSIONS

- TABLE 271 KURARAY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 272 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 273 EASTMAN CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 EASTMAN CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 275 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 276 EASTMAN CHEMICAL COMPANY: EXPANSIONS

- TABLE 277 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 278 SEKISUI CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 SEKISUI CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 280 SEKISUI CHEMICAL CO., LTD.: DEALS

- TABLE 281 SEKISUI CHEMICAL CO., LTD.: EXPANSIONS

- TABLE 282 HUBERGROUP: COMPANY OVERVIEW

- TABLE 283 HUBERGROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 284 HUBERGROUP: PRODUCT LAUNCHES

- TABLE 285 HUBERGROUP: DEALS

- TABLE 286 HUBERGROUP: EXPANSIONS

- TABLE 287 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 288 CHANG CHUN GROUP: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 289 VIZAGCHEMICAL: COMPANY OVERVIEW

- TABLE 290 VIZAGCHEMICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 KINGBOARD (FOGANG) SPECIALITY RESINS LIMITED: COMPANY OVERVIEW

- TABLE 292 KINGBOARD (FOGANG) SPECIALITY RESINS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 EVERLAM: COMPANY OVERVIEW

- TABLE 294 EVERLAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 EVERLAM: PRODUCT LAUNCHES

- TABLE 296 HUAKAI PLASTIC (CHONGQING) CO., LTD.: COMPANY OVERVIEW

- TABLE 297 HUAKAI PLASTIC (CHONGQING) CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 HUAKAI PLASTIC (CHONGQING) CO., LTD.: DEALS

- TABLE 299 TRIDEV GROUP: COMPANY OVERVIEW

- TABLE 300 TRIDEV GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 QINGDAO JIAHUA PLASTICS CO., LTD: COMPANY OVERVIEW

- TABLE 302 SIVA CHEMICAL INDUSTRIES: COMPANY OVERVIEW

- TABLE 303 TANYUN JUNRONG (LIAONING) CHEMICAL RESEARCH INSTITUTE NEW MATERIALS INCUBATOR CO., LTD.: COMPANY OVERVIEW

- TABLE 304 SYNPOL PRODUCTS PVT LTD.: COMPANY OVERVIEW

- TABLE 305 UNIFORM SYNTHETIC PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 306 D.R. COATS INK & RESINS PVT. LTD: COMPANY OVERVIEW

- TABLE 307 HUZHOU XINFU NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 308 QINGDAO HAOCHENG INDUSTRIAL COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 309 ZHEJIANG PULIJIN PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 310 TIANTAI KANGLAI INDUSTRIAL CO., LTD: COMPANY OVERVIEW

- TABLE 311 PERSTORP: COMPANY OVERVIEW

- TABLE 312 ATAMAN KIMYA A.S.: COMPANY OVERVIEW

- TABLE 313 WEGO CHEMICAL GROUP: COMPANY OVERVIEW

- TABLE 314 JAINISH INDUSTRIES: COMPANY OVERVIEW

- TABLE 315 SINOEVER INTERNATIONAL CO., LTD.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 POLYVINYL BUTYRAL MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 POLYVINYL BUTYRAL MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2024

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 POLYVINYL BUTYRAL MARKET: DATA TRIANGULATION

- FIGURE 9 HIGHER MOLECULAR WEIGHT PVB RESIN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 POWDER & GRANULES SEGMENT TO BE LARGER PRODUCT TYPE DURING FORECAST PERIOD

- FIGURE 11 STANDARD FILMS TO BE LARGEST THICKNESS SEGMENT DURING FORECAST PERIOD

- FIGURE 12 FILMS & SHEETS TO BE LARGEST APPLICATION DURING FORECAST PERIOD

- FIGURE 13 AUTOMOTIVE TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 15 STRONG INDUSTRIAL EXPANSION, MODERN CONSTRUCTION TRENDS, AND MANUFACTURING ADVANTAGES DRIVE DEMAND FOR POLYVINYL BUTYRAL

- FIGURE 16 POWDER & GRANULES GRADE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 17 HIGHER MOLECULAR WEIGHT PVB RESIN SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 STANDARD FILMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 19 FILM & SHEET AGENTS APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 20 AUTOMOTIVE TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 22 POLYVINYL BUTYRAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 USE OF GENERATIVE AI IN POLYVINYL BUTYRAL MARKET

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 VALUE CHAIN OF POLYVINYL BUTYRAL MARKET

- FIGURE 26 AVERAGE SELLING PRICE TREND OF POLYVINYL BUTYRAL, BY REGION, 2021-2024 (USD/KILOTON)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF POLYVINYL BUTYRAL AMONG KEY PLAYERS, BY RESIN TYPE, 2021-2024

- FIGURE 28 POLYVINYL BUTYRAL MARKET: INVESTMENT AND FUNDING SCENARIO

- FIGURE 29 POLYVINYL BUTYRAL MARKET: ECOSYSTEM

- FIGURE 30 NUMBER OF PATENTS GRANTED (2014-2024)

- FIGURE 31 POLYVINYL BUTYRAL MARKET: LEGAL STATUS OF PATENTS

- FIGURE 32 PATENT ANALYSIS FOR POLYVINYL BUTYRAL, BY JURISDICTION, 2015-2024

- FIGURE 33 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 34 IMPORT OF HS CODE 392091-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 35 EXPORT OF HS CODE 392091-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 36 POLYVINYL BUTYRAL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 38 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 39 FILMS & SHEETS SEGMENT TO DOMINATE POLYVINYL BUTYRAL MARKET DURING FORECAST PERIOD

- FIGURE 40 AUTOMOTIVE SEGMENT TO LEAD POLYVINYL BUTYRAL MARKET DURING FORECAST PERIOD

- FIGURE 41 POWDER & GRANULES SEGMENT TO LEAD POLYVINYL BUTYRAL MARKET DURING FORECAST PERIOD

- FIGURE 42 HIGHER MOLECULAR WEIGHT PVB RESIN SEGMENT TO LEAD POLYVINYL BUTYRAL MARKET DURING FORECAST PERIOD

- FIGURE 43 STANDARD FILMS SEGMENT TO LEAD POLYVINYL BUTYRAL MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 45 ASIA PACIFIC: POLYVINYL BUTYRAL MARKET SNAPSHOT

- FIGURE 46 NORTH AMERICA: POLYVINYL BUTYRAL MARKET SNAPSHOT

- FIGURE 47 EUROPE: POLYVINYL BUTYRAL MARKET SNAPSHOT

- FIGURE 48 POLYVINYL BUTYRAL MARKET SHARE ANALYSIS, 2024

- FIGURE 49 POLYVINYL BUTYRAL MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 50 POLYVINYL BUTYRAL MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 51 POLYVINYL BUTYRAL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 POLYVINYL BUTYRAL MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 53 POLYVINYL BUTYRAL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 POLYVINYL BUTYRAL MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 55 POLYVINYL BUTYRAL MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2020-2024

- FIGURE 56 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 57 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- FIGURE 58 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT