|

市场调查报告书

商品编码

1689931

聚乙烯丁醛(PVB):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Polyvinyl Butyral (PVB) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

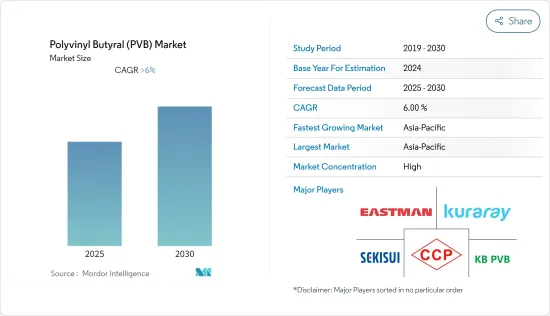

预计预测期内聚乙烯丁醛(PVB) 市场复合年增长率将超过 6%。

市场受到了 COVID-19 的负面影响。鑑于疫情情势,汽车製造厂暂时关闭以防止感染蔓延,限制了用于生产安全、抗衝击的汽车挡风玻璃的 PVB 材料的需求。然而,自 2021 年以来,该行业已恢復发展势头,预计市场在预测期内将遵循类似的轨迹。

主要亮点

- 短期内,全球夹层玻璃使用量的增加以及建筑和基础设施活动的活性化可能会推动市场成长。

- 然而,市场上替代品的存在预计会阻碍市场成长。此外,新兴经济体中大量的聚乙烯丁醛回收可能会损害市场,因为它会带来环境问题。

- 由于太阳能产业的需求不断增长以及购买电动车的人数不断增加,预计未来几年市场将会成长。

- 预计亚太地区将引领这一趋势,在预测期内实现最高的复合年增长率。

聚乙烯丁醛(PVB) 市场趋势

汽车领域占据市场主导地位

- 聚乙烯丁醛是一种机械性质优异的聚合物,常用作夹层玻璃的中间层材料。 PVB 片材附着在两层玻璃上,即使受到撞击也不会破裂。 PVB 片材和玻璃之间的黏合是化学黏合,因此不会轻易剥落。

- PVB 主要用于汽车挡风玻璃的夹层安全玻璃。由于 PVB 能为汽车挡风玻璃提供安全保障,因此作为夹层玻璃中间层的材料需求正在迅速增加。此外,隔音、防紫外线也是PVB的重要优点,增加了PVB在汽车产业的应用。

- 国际汽车製造商协会(OICA)预测,2021年全球汽车产量将达到8,000万辆,比2020年的7,800万辆成长约3%。

- 知名汽车公司丰田汽车2022年11月的汽车销售量和产量与前一年同期比较成长了约4%。丰田2022年1-11月汽车总销量约950万辆,产量约970万辆。虽然销售量与上年基本持平,但产量与前一年同期比较增加了约7%。

- 欧洲汽车工业协会在最新报告中称,美国总合194家汽车製造厂。此外,预计2021年欧洲汽车产量将达总合万辆左右。

- ACEA 也观察到,2022 年 12 月的乘用车註册量与 2021 年 12 月相比环比增长了约 13%。註册量成长率最高的是德国(+38%),其次是义大利(+21.0%)。随着乘用车註册量的增加,产业的生产需求也在增加,这对PVB市场产生了重大影响。

- 受以上因素影响,未来聚乙烯丁醛市场可望保持强劲。

亚太地区占市场主导地位

- 亚太地区有望成为全球最大的市场,因为中国、印度、日本和新加坡正在建造更多的建筑物、销售和製造更多的汽车,而且该地区正在进行投资以帮助生产太阳能。

- 根据中国工业协会预测,2022年中国汽车产量预计将年增与前一年同期比较%左右。 2014年美国汽车销量约2,686万辆。中国预计2022与前一年同期比较的汽车产量也将年增2.1%左右。 2021年汽车销量为2627万辆,而2022年销量约2686万辆。

- 根据印度品牌股权基金会预测,到2026年,印度汽车产业规模将达到3,000亿美元左右。此外,2022财年国内乘用车销量达约300万辆。

- 2000年4月至2022年6月期间,汽车产业累计获得直接股权投资约335.3亿美元。印度政府预计到2023年印度和其他国家将向汽车业额外投资80亿至100亿美元。

- 随着该展会在日本举办,日本的建设产业也有望蓬勃发展。例如,大阪将于2025年举办世博会。建设将主要由重建和自然灾害后的恢復所推动。东京车站有两栋高层建筑:一栋 37 层楼、230 公尺高的办公大楼,原计划于 2021 年竣工;一栋 61 层楼、390 公尺高的办公大楼,计划于 2027 年竣工。

- 据日本国土交通省称,2022年建筑业总投资预计约为66.99兆日圆(5,081.6亿美元),与前一年同期比较增长0.6%。

- 由于汽车、建筑和其他行业的投资不断增加,聚乙烯丁醛(PVB) 的需求预计会增加,这将为这些行业提供服务。这对未来几年的市场来说似乎是件好事。

聚乙烯丁醛(PVB) 产业概览

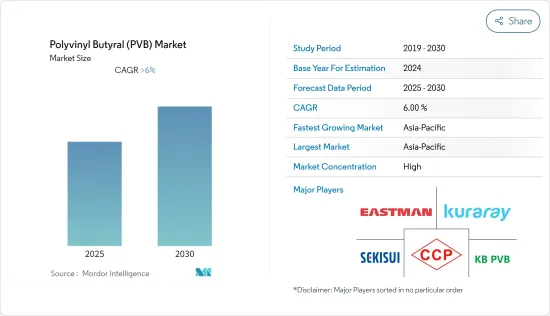

聚乙烯丁醛(PVB) 市场部分合併,少数大公司控制很大一部分市场。市场的主要企业包括(不分先后顺序):伊士曼化学公司、可乐丽、积水化学、建滔(佛冈)特种树脂(KB PVB)、长春集团等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 不断扩大的全球建筑和基础设施活动

- 扩大夹层玻璃的应用范围

- 限制因素

- 市场上存在替代品

- 新兴经济体聚乙烯丁醛回收率高

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 黏合膜

- 油漆和涂料(包括耐洗底漆)

- 印刷油墨和清漆

- 其他类型(陶瓷黏合剂、复合纤维黏合剂)

- 最终用户产业

- 车

- 建造

- 发电

- 其他终端用户产业(航太和国防)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Chang Chun Group

- Everlam

- Genau Manufacturing Company LLP

- Huakai plastic(Chongqing)Co., Ltd.

- Kingboard FoGang Specialty Resins Co. Ltd

- KURARAY CO. LTD

- Eastman Chemical Company

- Sekisui Chemical Co. Ltd.

- WMC GLASS

第七章 市场机会与未来趋势

- 太阳能发电产业的需求不断成长

- 扩大电动车的使用

The Polyvinyl Butyral Market is expected to register a CAGR of greater than 6% during the forecast period.

The market was negatively impacted by COVID-19. Given the pandemic situation, car manufacturing plants were temporarily halted to prevent the spread, limiting demand for PVB materials used to manufacture safe, impact-resistant automotive windscreens. However, the industry has picked up speed since 2021, and the market is expected to follow a similar trajectory throughout the projection period as well.

Key Highlights

- Over the short term, the growing number of laminated glass applications and the ever-increasing construction and infrastructure activities across the world are likely to boost market growth.

- On the flip side, the availability of product substitutes in the market is expected to hinder the market's growth. The high amount of polyvinyl butyral recycling in developed economies could also hurt the market because it would cause environmental problems.

- In the coming years, the market is likely to grow thanks to growing demand from the photovoltaic industry and more people buying electric cars.

- During the period of the forecast, the Asia-Pacific region is expected to lead and have the highest CAGR.

Polyvinyl Butyral (PVB) Market Trends

The Automotive Segment to Dominate the Market

- Polyvinyl butyral is a polymer with good mechanical properties that are commonly used as an interlayer material in laminated glass. The PVB sheet adheres to both layers of glass, keeping them unbroken even after impact. Because the bond between the PVB sheet and the glass is chemical, it does not delaminate easily.

- PVB is mostly found in laminated safety glass for car windshields. Because of the safety and security it provides in automotive windscreens, the demand for PVB as an interlayer in sandwich laminated glass has skyrocketed. Furthermore, acoustic insulation and UV protection are important advantages of PVB that increase its use in the automotive industry.

- The Organization Internationale des Constructeurs d'Automobiles (OICA) predicts that 80 million vehicles will be made around the world in 2021, which is about 3% more than the 78 million vehicles that will be made in 2020.

- Toyota, a renowned automobile company, increased vehicle sales and manufacturing by around 4% in November 2022 compared to the previous year. Toyota's total vehicle sales and production from January to November 2022 were around 9.5 million and 9.7 million, respectively. Even though sales didn't change much from the year before, production did go up by about 7% compared to the year before.

- The European Automobile Manufacturers' Association stated in its latest report that a total of 194 automobile manufacturing units operate on European Union soil. Also, a total of about 12 million vehicles will be made in Europe in 2021.

- The ACEA also saw an increase in passenger automobile registrations in December 2022, which grew by roughly 13% month over month compared to December 2021. Germany gained the highest percentage of registrations (+38%), followed by Italy (+21.0%). With the increased registration of passenger vehicles, demand for production is also increasing in the industry, significantly impacting the PVB market.

- So, the above factors are likely to keep the polyvinyl butyral market going in the years to come.

The Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the biggest market in the world because China, India, Japan, and Singapore are building more buildings and selling and making more cars, and because investments are being made in the region to help solar energy production.

- According to the China Association of Automobile Manufacturers, China has also seen an increase in automotive production in the country of around 2.1% in the year 2022, compared to the previous year. About 26.86 million units of automobiles were sold in the United States in 2014. China has also seen an increase in automotive production in the country of around 2.1% in the year 2022, compared to the previous year. About 26.86 million units of automobiles were sold in 2022, as compared to 26.27 million units sold in 2021.

- According to the Indian Brand Equity Foundation, the Indian automotive industry is expected to reach around USD 300 billion by 2026. Moreover, in FY 2022, passenger vehicle sales in the country reached about 3 million.

- Between April 2000 and June 2022, the automobile industry received approximately USD 33.53 billion in cumulative equity FDI inflows. The Indian government thought that between USD 8 billion and USD 10 billion more would be invested in the car business from India and other countries by 2023.

- The Japanese construction industry is also expected to bloom due to the events expected to be hosted in the country. For instance, Osaka will host the World Expo in 2025. The construction is mostly driven by redevelopment and recovery from natural disasters. Two high-rise towers for Tokyo Stations, a 37-story, 230-meter-tall office tower initially planned to be completed in 2021, and a 61-story, 390-meter-tall office tower, are due for completion in 2027.

- According to Japan's Ministry of Land, Infrastructure, Transport, and Tourism (MLIT), total investment in the construction sector in 2022 is expected to be around 66,990 billion yen (USD 508.16 billion), which is a 0.6% increase over the previous year.

- Growing investments in the auto, construction, and other industries would lead to a rise in demand for polyvinyl butyral (PVB) because it serves those industries. This would be good for the market over the next few years.

Polyvinyl Butyral (PVB) Industry Overview

The polyvinyl butyral (PVB) market is partially consolidated, with a few major players dominating a significant portion of the market. Some of the key players in the market include (in no particular order): Eastman Chemical Company, Kuraray Co. Ltd., Sekisui Chemical Co. Ltd., Kingboard (Fogang) Specialty Resins Co. Ltd. (KB PVB), and Chang Chun Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction and Infrastructure Activities Across the World

- 4.1.2 Growing Applications for Laminated Glass

- 4.2 Restraints

- 4.2.1 Availability of Product Substitutes in the Market

- 4.2.2 High Recycling Activities of Polyvinyl Butyral in Developed Economies

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Adhesive Films

- 5.1.2 Paints and Coatings (including Wash Primers)

- 5.1.3 Printing Inks and Lacquers

- 5.1.4 Other Types (Binders for Ceramics and Composite Fibers)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Construction

- 5.2.3 Power Generation

- 5.2.4 Other End-user Industries (Aerospace, Defense)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chang Chun Group

- 6.4.2 Everlam

- 6.4.3 Genau Manufacturing Company LLP

- 6.4.4 Huakai plastic(Chongqing) Co., Ltd.

- 6.4.5 Kingboard FoGang Specialty Resins Co. Ltd

- 6.4.6 KURARAY CO. LTD

- 6.4.7 Eastman Chemical Company

- 6.4.8 Sekisui Chemical Co. Ltd.

- 6.4.9 WMC GLASS

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Photovoltaic Industry

- 7.2 Increasing Adoption of EVs