|

市场调查报告书

商品编码

1804842

全球蛋白A树脂市场(按产品、产地、基质类型、应用和最终用户划分)- 预测至2030年Protein A Resin Market by Product (Bulk Resin, Lab-scale Columns), Source (Recombinant Protein A), Matrix Type (Agarose-Based Protein A), Application (Monoclonal Antibody Purification, FC-Fusion Protein Purification) & End User - Global Forecast to 2030 |

||||||

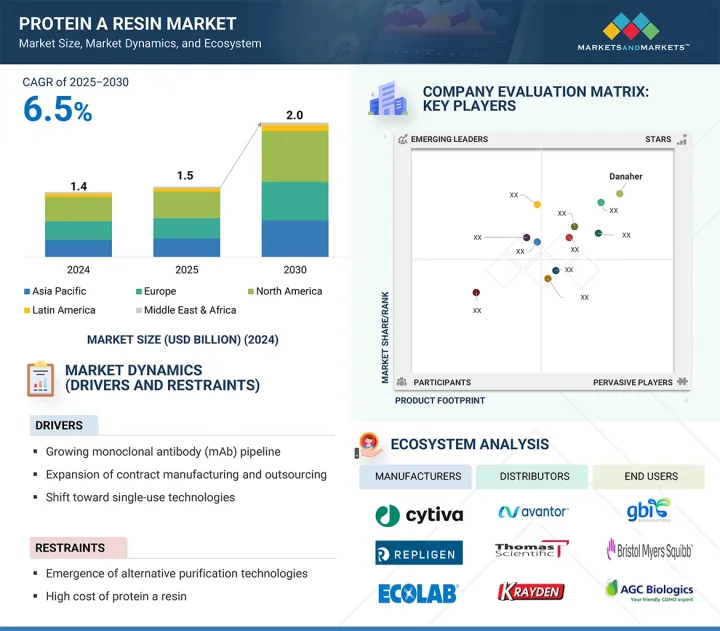

预计全球蛋白质 A 树脂市场将从 2025 年的 15 亿美元成长到 2030 年的 20 亿美元,预测期间的复合年增长率为 6.5%。

| 调查范围 | |

|---|---|

| 调查年份 | 2024-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 产品、产地、矩阵类型、应用、最终用户、地区 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

市场成长的驱动力来自于透过CDMO(合约客製化生产与生产组织)不断增加的外包服务,主要企业正在已开发市场拓展多工厂生物製造能力。随着FDA的核准以及新型双特异性抗体和抗体药物复合体的上市,单株抗体(mAb)产品线正在全球扩张。随着最终用户对纯化需求的不断增长,预计这将推动蛋白A树脂市场的发展。

“按产品划分,2024 年散装树脂占据蛋白质 A 树脂市场的最大份额。”

根据产品类型,蛋白A树脂市场可细分为散装树脂、预注管柱、实验室规模柱和其他类型。与预装形式不同,散装树脂是不銹钢柱装置中大规模纯化製程的业界标准。虽然需要内部填充和验证,但散装树脂的每循环和每克纯化单株抗体的成本要低得多。其可重复使用性使其受到最终用户的欢迎。大多数产品类型的额定循环次数为50至200次以上,从而可以在很少更换树脂的情况下实现长时间生产。这项特性直接提高了商业化生产的经济效率和生产力目标。这些因素使散装树脂成为最终用途行业的首选。

“根据基质类型,琼脂糖基蛋白 A 树脂部分将在预测期内占据最大份额。”

蛋白A树脂市场依基质类型分为:琼脂糖基、玻璃/二氧化硅基和有机聚合物基。其中,琼脂糖基蛋白A树脂占据最大的市场占有率。这些树脂以其更高的耐久性、增强的机械性能以及在适当pH值下较高的金属掺杂剂吸收能力而闻名。琼脂糖基树脂的最新发展包括新一代产品,例如Praesto CH1和DurA Cycle A50,它们具有更高的耐久性、更高的结合能力以及与双特异性抗体和片段等复杂抗体形式的更好的兼容性。这些新产品采用耐碱性增强的配体,可延长重复使用时间并提高成本效益。

“按应用划分,单株抗体纯化领域预计将在 2024 年占据最大份额。”

根据应用,蛋白 A 树脂市场细分为 mAb 纯化、Fc 融合蛋白纯化和其他应用。 mAb 纯化占据 Protein A 树脂市场的最大份额,这主要归功于其在大规模生物製药生产中的既定作用。 mAb 是生产最广泛的生物治疗剂类别,在下游加工的主要捕获步骤中需要大量 Protein A 树脂。 Protein A 树脂因其对 Fc 区具有高结合特异性且符合产品纯度和一致性的监管标准而受到青睐。此外,製药公司和 CMO 的大多数生物製造设施都专用于 mAb 生产,这自然增加了该领域对 Protein A 树脂的需求。

“基于最终用户,製药和生物製药公司部门在 2024 年占据最大份额。”

製药和生物製药公司作为治疗性蛋白质(尤其是单株抗体 (mAb) 和 Fc 融合蛋白)的主要製造商,在 Protein A 树脂市场占有相当大的份额。这些公司经营大型生产设施,其中 Protein A 树脂广泛用于下游纯化工艺,并且需要大量树脂来满足商业供应需求和法规遵循标准。此外,在这些公司内部,一致的供应链和品管是优先事项,这推动了直接采购 Protein A 树脂而不是仅依赖外包合作伙伴的趋势。这种对 Protein A 树脂作为生技药品核心的结构性依赖,使製药和生物製药公司成为市场的主要终端使用者群体。

本报告分析了全球蛋白质 A 树脂市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 蛋白A树脂市场概况

- 亚太地区蛋白A树脂市场(按国家和最终用户划分)

- 蛋白A树脂市场:地理成长机会

第五章市场概述

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 平均销售价格趋势:依主要企业划分

- 各地区平均销售价格趋势

- 价值链分析

- 研究与开发

- 原物料采购及生产製造

- 分销、行销和销售

- 售后服务

- 供应链分析

- 知名公司

- 小型企业

- 最终用户

- 生态系分析

- 投资金筹措场景

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 专利分析

- 贸易分析

- HS 代码 3504 的进口数据

- HS 代码 3504 的出口数据

- 大型会议和活动(2025-2026年)

- 案例研究分析

- 案例研究1:与 PUROLITE (ECOLAB) 合作进行策略产能扩张,以增强蛋白质 A 树脂业务的供应链弹性

- 案例研究2:CYTIVA 製程创新,增强 Protein A 树脂的再利用循环

- 案例研究3:TOSOH的一次性使用策略满足了日益增长的灵活生物加工需求

- 监管分析

- 监管机构、政府机构和其他组织

- 法规结构

- 波特五力分析

- 主要相关利益者和采购标准

- 未满足的需求

- 2025年美国关税的影响 - 蛋白A树脂市场

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家和地区的影响

- 对终端产业的影响

- 人工智慧/生成人工智慧对蛋白A树脂市场的影响

- AI/纯化AI在蛋白A树脂应用的市场潜力

- 人工智慧用例

- 使用人工智慧/生成式人工智慧的主要企业

- 蛋白A树脂生态系中人工智慧/新一代人工智慧的未来

6. 蛋白A树脂市场(依产品)

- 介绍

- 本体树脂

- 预注管柱

- 实验室规模的色谱柱

- 其他产品

7. 蛋白A树脂市场(按产地)

- 介绍

- 重组蛋白A

- 天然蛋白质A

8. 蛋白A树脂市场(依基质类型)

- 介绍

- 琼脂糖基蛋白A

- 基于玻璃/二氧化硅的蛋白质A

- 有机聚合物基蛋白A

9. 蛋白A树脂市场(依应用)

- 介绍

- 单株抗体纯化

- FC融合蛋白纯化

- 其他用途

第 10 章。蛋白质 A 树脂市场(依最终用户)

- 介绍

- 製药和生物製药公司

- 合约研究组织/合约生产组织

- 学术研究机构

- 其他最终用户

第 11 章:蛋白 A 树脂市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 其他亚太地区

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他拉丁美洲

- 中东和非洲

- 中东和非洲的宏观经济展望

- 海湾合作委员会国家

- 其他中东和非洲地区

第十二章竞争格局

- 介绍

- 主要参与企业的策略/优势

- 主要企业收益分析(2020-2024)

- 市场占有率分析(2024年)

- 公司估值及财务指标

- 品牌/产品比较

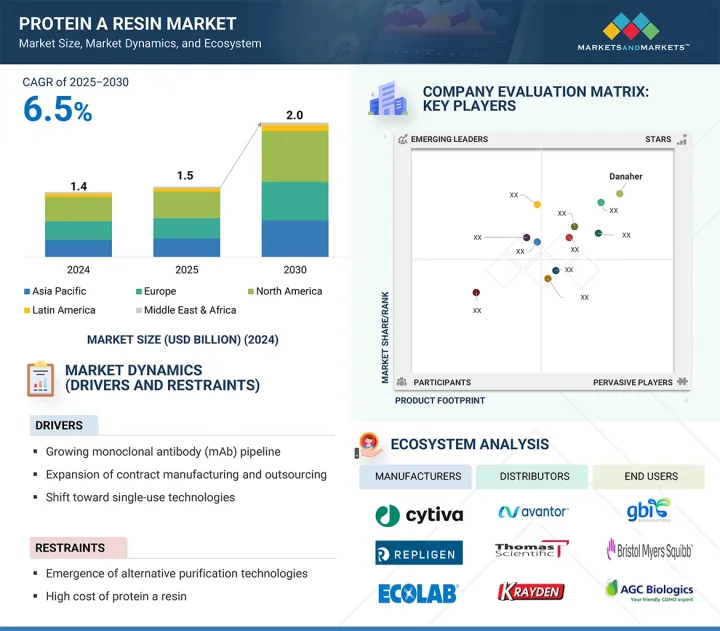

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十三章:公司简介

- 主要企业

- DANAHER

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- BIO-RAD LABORATORIES, INC

- MERCK KGAA

- REPLIGEN CORPORATION

- TOSOH BIOSCIENCE

- ECOLAB INC.

- NOVASEP HOLDING

- AVANTOR, INC.

- OROCHEM TECHNOLOGIES, INC.

- KANEKA CORPORATION

- JSR CORPORATION

- GENSCRIPT

- 其他公司

- BIO-WORKS

- GENO TECHNOLOGY, INC.

- PROMEGA CORPORATION

- SUZHOU NANOMICRO TECHNOLOGY CO., LTD.

- TRANSGEN BIOTECH CO., LTD

- RESYN BIOSCIENCES (PTY) LTD

- BIOTOOLOMICS LTD.

- CALIBRE SCIENTIFIC (PROTEIN ARK)

- SUNRESIN NEW MATERIALS CO., LTD.

- BEAVER

第十四章 附录

The global protein A resin market is projected to reach USD 2.0 billion by 2030 from USD 1.5 billion in 2025, at a CAGR of 6.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Source, Matrix Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Market growth is attributed to increased outsourced services through CDMOs, with major players expanding multi-plant biomanufacturing capacities across developed markets. The global monoclonal antibody (mAb) pipeline is growing, marked by high FDA approvals and new bispecific and antibody-drug conjugate launches. This has helped boost purification requirements among end users, which is expected to increase the market for protein A resin.

"Based on product, bulk resins held the largest share of the protein A resin market in 2024."

Based on products, the protein A resin market is divided into bulk resin, pre-packed columns, lab-scale columns, and others. Unlike pre-packed formats, bulk resin is the industry standard for high-volume purification processes in stainless-steel column setups. While it requires in-house packing and validation, bulk resin provides a much lower cost per cycle and per gram of purified monoclonal antibody. It is the preferred choice among end users because of its reusability. Most types can support 50 to over 200 cycles, enabling long-term production runs with minimal resin replacement. This feature directly enhances the economic efficiency and productivity goals of commercial manufacturing. All these factors make bulk resin the favored choice in the end-use industries.

"Based on matrix type, the agarose-based protein A resin segment accounted for the largest share during the forecast period."

The protein A resin market is categorized by matrix type into agarose-based, glass/silica-based, and organic polymer-based varieties. Among these, agarose-based protein A resins represent the largest market share. They are known for their improved durability, stronger mechanical properties, and higher capacity to absorb metal dopants at suitable pH levels. Recent developments in agarose-based resins include next-generation products such as Praesto CH1 and DurA Cycle A50, which offer better durability, increased binding capacity, and improved compatibility with complex antibody formats like bispecifics and fragments. These new products feature engineered ligands with enhanced alkaline resistance, enabling longer reuse and better cost efficiency.

"Based on applications, the monoclonal antibodies purification segment has acquired the largest share in 2024."

Based on applications, the protein A resin market is divided into mAb purification, Fc-fusion protein purification, and other applications. mAb purification holds the largest share in the protein A resin market mainly because of its established role in large-scale biopharmaceutical manufacturing. mAbs are the most widely produced category of biologic therapeutics, requiring large amounts of protein A resin for the primary capture steps in downstream processing. Protein A resin is preferred due to its Fc region binding specificity and compliance with regulatory standards for product purity and consistency. Moreover, a significant portion of the installed biomanufacturing capacity across pharmaceutical companies and contract manufacturing organizations is dedicated to mAb production, which naturally increases demand for protein A resin in this segment.

"Based on end users, the pharmaceutical and biopharmaceutical companies segment accounted for the largest share in 2024."

Pharmaceutical and biopharmaceutical companies account for the major share in the protein A resin market due to their role as the primary manufacturers of therapeutic proteins, particularly monoclonal antibodies (mAbs) and Fc-fusion proteins. These companies operate large-scale production facilities where protein A resin is extensively used in downstream purification processes, requiring significant resin volumes to meet commercial supply needs and regulatory compliance standards. Additionally, in-house manufacturing setups within these organizations prioritize consistent supply chains and quality control, further reinforcing direct procurement of protein A resins rather than relying solely on outsourced partners. This structural reliance on protein A resin for core biologics manufacturing activities positions pharmaceutical and biopharmaceutical companies as the dominant end-user segment in the market.

"North America is expected to hold a significant market share in the protein A resin market throughout the forecast period."

The protein A resin market includes five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held a significant market share for protein A resin. Its dominant position is due to increased manufacturing capacity, focusing on commercial-scale and clinical trial supply production. Investment trends show that US federal and state support promotes domestic biomanufacturing for pandemic preparedness and reducing reliance on international supply chains. Small- to mid-sized biotech firms are increasingly partnering with CDMOs. These factors have helped North America secure the largest market share in 2024.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (35%), Tier 2 (45%), and Tier 3 (20%)

- By Designation: C-level Executives (35%), Directors (25%), and Others (40%)

- By Region: North America (40%), Europe (30%), Asia Pacific (20%), Latin America (5%), and the Middle East & Africa (5%)

The key players profiled in the protein A resin market are Danaher Corporation (US), Repligen Corporation (US), Merck KGaA (Germany), Thermo Fisher Scientific (US), Agilent Technologies (US), GenScript (China), Bio-Rad Laboratories, Inc. (US), Orochem Technologies Inc. (US), Kaneka Corporation (Japan), Abcam Plc. (UK), Ecolab (US), and Tosoh Biosciences LLC (Japan).

Research Coverage

The research report analyzes the protein A resin market by product, matrix type, source, application, end user, and region. It explores the factors driving market growth, examines the challenges and opportunities faced by various industries, and presents details on the competitive landscape, including market leaders and small to medium-sized enterprises. Additionally, it estimates the revenue generated by different market segments across five regions and includes a micromarket analysis.

Reasons to Buy the Report

The report will help market leaders and new entrants by providing accurate revenue estimates for the protein A resin market and subsegments. It will assist stakeholders in understanding the competitive landscape, enabling them to position their businesses more effectively and develop suitable go-to-market strategies. Additionally, the report offers insights into market dynamics, including key drivers, restraints, challenges, and opportunities.

This report provides insightful data on the following pointers:

- Market Penetration: In-depth coverage of product portfolios offered by the top players in the protein A resin market.

- Product Development/Innovation: In-depth coverage of product portfolios offered by the top players in the protein A resin market.

- Market Development: Insightful data on profitable developing areas.

- Market Diversification: Details about recent developments and advancements in the protein A resin market.

- Competitive Assessment: Extensive assessment of the products, growth tactics, revenue projections, and market categories of the top competitors.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.1.3 Objectives of secondary research

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key supply and demand-side participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Objectives of primary research

- 2.1.2.5 Key primary insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation

- 2.2.1.2 Customer-based market estimation

- 2.2.1.3 Primary interviews

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 GROWTH RATE ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PROTEIN A RESIN MARKET OVERVIEW

- 4.2 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY COUNTRY AND END USER

- 4.3 PROTEIN A RESIN MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strong monoclonal antibody pipeline to drive demand

- 5.2.1.2 Advent of continuous bioprocessing to drive adoption

- 5.2.1.3 Increased utilization due to expansion of bispecific antibodies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High manufacturing cost and pricing pressure

- 5.2.2.2 Issues associated with scaling up resin production

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising outsourcing to CDMOs

- 5.2.3.2 Innovative therapeutic indications

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited resin reusability and fouling concerns

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING

- 5.5.3 DISTRIBUTION AND MARKETING & SALES

- 5.5.4 AFTER-SALES SERVICES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.6.3 END USERS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Recombinant protein A ligand engineering

- 5.9.1.2 Alkaline-stable ligand development

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Automated column packing systems

- 5.9.2.2 In-line monitoring and PAT (process analytical technology) tools

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Continuous chromatography systems

- 5.9.3.2 Affinity membrane technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INNOVATIONS AND PATENT REGISTRATIONS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 3504

- 5.11.2 EXPORT DATA FOR HS CODE 3504

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: STRATEGIC CAPACITY EXPANSION BY PUROLITE (ECOLAB) TO STRENGTHEN SUPPLY CHAIN RESILIENCE IN PROTEIN A RESIN BUSINESS

- 5.13.2 CASE STUDY 2: PROCESS INNOVATION BY CYTIVA TO ENHANCE REUSE CYCLES IN PROTEIN A RESINS

- 5.13.3 CASE STUDY 3: TOSOH'S SINGLE-USE STRATEGY TO TAP INTO GROWING DEMAND FOR FLEXIBLE BIOPROCESSING

- 5.14 REGULATORY ANALYSIS

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 REGULATORY FRAMEWORK

- 5.14.2.1 North America

- 5.14.2.1.1 US

- 5.14.2.1.2 Canada

- 5.14.2.2 Europe

- 5.14.2.2.1 UK

- 5.14.2.2.2 Germany

- 5.14.2.2.3 France

- 5.14.2.2.4 Italy

- 5.14.2.2.5 Spain

- 5.14.2.3 Asia Pacific

- 5.14.2.3.1 Japan

- 5.14.2.3.2 China

- 5.14.2.3.3 India

- 5.14.2.3.4 Australia

- 5.14.2.4 Latin America

- 5.14.2.4.1 Brazil

- 5.14.2.4.2 Mexico

- 5.14.2.5 Middle East & Africa

- 5.14.2.5.1 UAE

- 5.14.2.5.2 South Africa

- 5.14.2.1 North America

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 UNMET NEEDS

- 5.18 IMPACT OF 2025 US TARIFFS-PROTEIN A RESIN MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.1.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.4.1 North America

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.19 IMPACT OF AI/GEN AI ON PROTEIN A RESIN MARKET

- 5.19.1 MARKET POTENTIAL OF AI/GEN AI IN PROTEIN A RESIN APPLICATIONS

- 5.19.2 AI USE CASES

- 5.19.3 KEY COMPANIES IMPLEMENTING AI/GEN AI

- 5.19.4 FUTURE OF AI/GEN AI IN PROTEIN A RESIN ECOSYSTEM

6 PROTEIN A RESIN MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 BULK RESINS

- 6.2.1 BULK RESINS TO HOLD LARGEST MARKET SHARE

- 6.3 PREPACKED COLUMNS

- 6.3.1 CONSISTENCY AND LOW CROSS-CONTAMINATION RISK TO SUPPORT ADOPTION

- 6.4 LAB-SCALE COLUMNS

- 6.4.1 FLEXIBILITY, LOW SAMPLE CONSUMPTION, AND HIGH THROUGHPUT TO DRIVE USAGE

- 6.5 OTHER PRODUCTS

7 PROTEIN A RESIN MARKET, BY SOURCE

- 7.1 INTRODUCTION

- 7.2 RECOMBINANT PROTEIN A

- 7.2.1 COST-EFFICIENCY OF RECOMBINANT PROTEINS TO DRIVE MARKET GROWTH

- 7.3 NATURAL PROTEIN A

- 7.3.1 ADVANTAGES OF RECOMBINANT PROTEIN A TO RESTRICT NATURALLY SOURCED COUNTERPARTS

8 PROTEIN A RESIN MARKET, BY MATRIX TYPE

- 8.1 INTRODUCTION

- 8.2 AGAROSE-BASED PROTEIN A

- 8.2.1 AGAROSE-BASED PROTEIN A TO DOMINATE MARKET

- 8.3 GLASS/SILICA-BASED PROTEIN A

- 8.3.1 LOW PH TOLERANCE OF SILICA-BASED RESINS TO LIMIT MARKET GROWTH

- 8.4 ORGANIC POLYMER-BASED PROTEIN A

- 8.4.1 INCREASING POPULARITY OF ORGANIC POLYMERS TO DRIVE MARKET GROWTH

9 PROTEIN A RESIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MONOCLONAL ANTIBODY PURIFICATION

- 9.2.1 GROWING DEMAND, RAPID EXPANSION OF APPLICATIONS, AND INCREASING APPROVALS TO ENSURE LARGEST SHARE

- 9.3 FC-FUSION PROTEIN PURIFICATION

- 9.3.1 INNOVATION AND PATENTED PUBLICATIONS TO DRIVE MARKET

- 9.4 OTHER APPLICATIONS

10 PROTEIN A RESIN MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES

- 10.2.1 EXTENSIVE USE IN BIOLOGICAL DRUG PRODUCTION TO ENSURE STRONG DEMAND

- 10.3 CROS & CDMOS

- 10.3.1 EXPANSION OF BIOLOGICS AND BIOSIMILARS TO DRIVE MARKET GROWTH

- 10.4 ACADEMIC & RESEARCH INSTITUTES

- 10.4.1 INCREASING R&D IN DRUG DISCOVERY TO DRIVE USE OF PROTEIN A RESINS

- 10.5 OTHER END USERS

11 PROTEIN A RESIN MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Expansion in biomanufacturing and domestic capacity to drive market

- 11.2.3 CANADA

- 11.2.3.1 Policy-led capacity build and CDMO growth to drive the market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increased capital expenditure from manufacturers to drive market

- 11.3.3 UK

- 11.3.3.1 Government policies and public-private partnerships to drive market

- 11.3.4 FRANCE

- 11.3.4.1 CDMO capacity expansion and public programs to drive market growth

- 11.3.5 ITALY

- 11.3.5.1 Increased Cap Ex from major end-user categories to grow the demand for protein A resin

- 11.3.6 SPAIN

- 11.3.6.1 Increased CDMO and CRO likely to grow demand for protein A resin

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 CDMO capacity expansions, policy backing, and CDMO investment to propel market

- 11.4.3 CHINA

- 11.4.3.1 Robust biopharmaceutical expansion to grow demand

- 11.4.4 INDIA

- 11.4.4.1 Growth of pharma and biotech industries to drive demand for protein A resins

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increasing demand for protein-based therapeutics to drive growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Developments in biopharmaceutical sector to drive market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Biomanufacturing emphasis and public-private partnerships to catalyze demand

- 11.5.3 MEXICO

- 11.5.3.1 Supportive government initiatives to grow demand for protein A resin

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Favorable government policies to propel market growth

- 11.6.3 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PROTEIN A RESIN MARKET

- 12.3 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING OF KEY PLAYERS, 2024

- 12.5 COMPANY VALUATION & FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 PERVASIVE PLAYERS

- 12.7.3 EMERGING LEADERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Matrix type footprint

- 12.7.5.5 Application footprint

- 12.7.5.6 End-user footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DANAHER

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 THERMO FISHER SCIENTIFIC INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 AGILENT TECHNOLOGIES, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 BIO-RAD LABORATORIES, INC

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.5 MERCK KGAA

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Expansions

- 13.1.5.3.2 Other developments

- 13.1.6 REPLIGEN CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 TOSOH BIOSCIENCE

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.8 ECOLAB INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses & competitive threats

- 13.1.9 NOVASEP HOLDING

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 AVANTOR, INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 OROCHEM TECHNOLOGIES, INC.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.12 KANEKA CORPORATION

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 JSR CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.14 GENSCRIPT

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.1 DANAHER

- 13.2 OTHER PLAYERS

- 13.2.1 BIO-WORKS

- 13.2.2 GENO TECHNOLOGY, INC.

- 13.2.3 PROMEGA CORPORATION

- 13.2.4 SUZHOU NANOMICRO TECHNOLOGY CO., LTD.

- 13.2.5 TRANSGEN BIOTECH CO., LTD

- 13.2.6 RESYN BIOSCIENCES (PTY) LTD

- 13.2.7 BIOTOOLOMICS LTD.

- 13.2.8 CALIBRE SCIENTIFIC (PROTEIN ARK)

- 13.2.9 SUNRESIN NEW MATERIALS CO., LTD.

- 13.2.10 BEAVER

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 PROTEIN A RESIN MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 PROTEIN A RESIN MARKET: STUDY ASSUMPTIONS

- TABLE 3 PROTEIN A RESIN MARKET: RISK ANALYSIS

- TABLE 4 PROTEIN A RESIN MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS

- TABLE 5 KEY PARAMETERS IMPACTING PRICES FOR PROTEIN A RESIN

- TABLE 6 AVERAGE SELLING PRICE TREND OF PROTEIN A RESIN, BY KEY PLAYER, 2022-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF PROTEIN A RESIN, BY REGION, 2022-2024 (USD)

- TABLE 8 PROTEIN A RESIN MARKET: ROLE IN ECOSYSTEM

- TABLE 9 PROTEIN A RESIN MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2022-2024

- TABLE 10 IMPORT SCENARIO FOR HS CODE 3504, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 11 EXPORT SCENARIO FOR HS CODE 3504, BY COUNTRY, 2020-2024 (USD THOUSAND)

- TABLE 12 PROTEIN A RESIN: LIST OF KEY CONFERENCES & EVENTS, JANUARY 2025-DECEMBER 2026

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANISATIONS

- TABLE 18 PROTEIN A RESIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS OF PROTEIN A RESIN, BY PRODUCT

- TABLE 20 KEY BUYING CRITERIA OF PROTEIN A RESIN, BY END USER

- TABLE 21 PROTEIN A RESIN MARKET: UNMET NEEDS

- TABLE 22 US ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 23 KEY COMPANIES IMPLEMENTING AI/GEN AI IN PROTEIN A RESIN MARKET

- TABLE 24 PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 25 PROTEIN A RESIN MARKET FOR BULK RESINS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 PROTEIN A RESIN MARKET FOR PREPACKED COLUMNS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 PROTEIN A RESIN MARKET FOR LAB-SCALE COLUMNS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 PROTEIN A RESIN MARKET FOR OTHER PRODUCTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 30 RECOMBINANT PROTEIN A MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 NATURAL PROTEIN A MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 33 AGAROSE-BASED PROTEIN A MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 GLASS/SILICA-BASED PROTEIN A MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 ORGANIC POLYMER-BASED PROTEIN A MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 37 PROTEIN A RESIN MARKET FOR MAB PURIFICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PROTEIN A RESIN MARKET FOR FC-FUSION PURIFICATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 39 PROTEIN A RESIN MARKET FOR OTHER APPLICATIONS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 40 PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 41 PROTEIN A RESIN MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 42 PROTEIN A RESIN MARKET FOR CROS & CDMOS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 43 PROTEIN A RESIN MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 44 PROTEIN A RESIN MARKET FOR OTHER END USERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 45 PROTEIN A RESIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: KEY MACROINDICATORS

- TABLE 47 NORTH AMERICA: PROTEIN A RESIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 48 NORTH AMERICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 52 NORTH AMERICA: PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 53 US: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 54 CANADA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 55 EUROPE: KEY MACROINDICATORS

- TABLE 56 EUROPE: PROTEIN A RESIN MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 57 EUROPE: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 58 EUROPE: PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 59 EUROPE: PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 60 EUROPE: PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 61 EUROPE: PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 62 GERMANY: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 63 UK: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 64 FRANCE: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 65 ITALY: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 66 SPAIN: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 67 REST OF EUROPE: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 68 ASIA PACIFIC: KEY MACROINDICATORS

- TABLE 69 ASIA PACIFIC: PROTEIN A RESIN, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 74 ASIA PACIFIC: PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 75 JAPAN: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 76 CHINA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 77 INDIA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 78 AUSTRALIA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 79 SOUTH KOREA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 80 REST OF ASIA PACIFIC: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 81 LATIN AMERICA: KEY MACROINDICATORS

- TABLE 82 LATIN AMERICA: PROTEIN A RESIN, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 83 LATIN AMERICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 84 LATIN AMERICA: PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 85 LATIN AMERICA: PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 86 LATIN AMERICA: PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 87 LATIN AMERICA: PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 88 BRAZIL: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 89 MEXICO: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 90 REST OF LATIN AMERICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 91 MIDDLE EAST & AFRICA: KEY MACROINDICATORS

- TABLE 92 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY SOURCE, 2023-2030 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2023-2030 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 98 GCC COUNTRIES: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 99 REST OF MIDDLE EAST & AFRICA: PROTEIN A RESIN MARKET, BY PRODUCT, 2023-2030 (USD MILLION)

- TABLE 100 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN PROTEIN A RESIN MARKET, 2022-2025

- TABLE 101 PROTEIN A RESIN MARKET: DEGREE OF COMPETITION

- TABLE 102 PROTEIN A RESIN MARKET: REGION FOOTPRINT

- TABLE 103 PROTEIN A RESIN MARKET: PRODUCT FOOTPRINT

- TABLE 104 PROTEIN A RESIN MARKET: MATRIX TYPE FOOTPRINT

- TABLE 105 PROTEIN A RESIN MARKET: APPLICATION FOOTPRINT

- TABLE 106 PROTEIN A RESIN MARKET: END-USER FOOTPRINT

- TABLE 107 PROTEIN A RESIN MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 108 PROTEIN A RESIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY PRODUCT AND REGION

- TABLE 109 PROTEIN A RESIN MARKET: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022-JUNE 2025

- TABLE 110 PROTEIN A RESIN MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 111 PROTEIN A RESIN MARKET: EXPANSIONS, JANUARY 2021-JUNE 2025

- TABLE 112 DANAHER: COMPANY OVERVIEW

- TABLE 113 DANAHER: PRODUCTS OFFERED

- TABLE 114 DANAHER: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 115 DANAHER: DEALS, JANUARY 2022-JULY 2025

- TABLE 116 DANAHER: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 117 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 118 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 119 THERMO FISHER SCIENTIFIC INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 120 THERMO FISHER SCIENTIFIC INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 121 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 122 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 123 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 124 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 125 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 126 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 127 MERCK KGAA: COMPANY OVERVIEW

- TABLE 128 MERCK KGAA: PRODUCTS OFFERED

- TABLE 129 MERCK KGAA: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 130 MERCK KGAA: OTHER DEVELOPMENTS, JANUARY 2022-JULY 2025

- TABLE 131 REPLIGEN CORPORATION: COMPANY OVERVIEW

- TABLE 132 REPLIGEN CORPORATION: PRODUCTS OFFERED

- TABLE 133 REPLIGEN CORPORATION: DEALS, JANUARY 2022-JULY 2025

- TABLE 134 TOSOH BIOSCIENCE: COMPANY OVERVIEW

- TABLE 135 TOSOH BIOSCIENCE: PRODUCTS OFFERED

- TABLE 136 TOSOH BIOSCIENCE: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 137 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 138 ECOLAB INC.: PRODUCTS OFFERED

- TABLE 139 ECOLAB INC.: PRODUCT LAUNCHES, JANUARY 2022-JULY 2025

- TABLE 140 ECOLAB INC.: DEALS, JANUARY 2022-JULY 2025

- TABLE 141 ECOLAB INC.: EXPANSIONS, JANUARY 2022-JULY 2025

- TABLE 142 NOVOSEP HOLDING: COMPANY OVERVIEW

- TABLE 143 NOVOSEP HOLDING: PRODUCTS OFFERED

- TABLE 144 AVANTOR, INC.: COMPANY OVERVIEW

- TABLE 145 AVANTOR, INC.: PRODUCTS OFFERED

- TABLE 146 OROCHEM TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 147 OROCHEM TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 148 KANEKA CORPORATION: COMPANY OVERVIEW

- TABLE 149 KANEKA CORPORATION: PRODUCTS OFFERED

- TABLE 150 JSR CORPORATION: COMPANY OVERVIEW

- TABLE 151 JSR CORPORATION: PRODUCTS OFFERED

- TABLE 152 GENSCRIPT: COMPANY OVERVIEW

- TABLE 153 GENSCRIPT: PRODUCTS OFFERED

- TABLE 154 BIO-WORKS: COMPANY OVERVIEW

- TABLE 155 GENO TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 156 PROMEGA CORPORATION: COMPANY OVERVIEW

- TABLE 157 SUZHOU NANOMICRO TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 158 TRANSGEN BIOTECH CO., LTD: COMPANY OVERVIEW

- TABLE 159 RESYN BIOSCIENCES (PTY) LTD: COMPANY OVERVIEW

- TABLE 160 BIOTOOLOMICS LTD.: COMPANY OVERVIEW

- TABLE 161 CALIBRE SCIENTIFIC (PROTEIN ARK): COMPANY OVERVIEW

- TABLE 162 SUNRESIN NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 163 BEAVER: COMPANY OVERVIEW

List of Figures

- FIGURE 1 PROTEIN A RESIN MARKET SEGMENTATION & REGIONAL SCOPE

- FIGURE 2 PROTEIN A RESIN MARKET: RESEARCH DATA

- FIGURE 3 PROTEIN A RESIN MARKET: RESEARCH DESIGN

- FIGURE 4 PROTEIN A RESIN MARKET: KEY SECONDARY SOURCES

- FIGURE 5 PROTEIN A RESIN MARKET: KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 PROTEIN A RESIN MARKET: KEY PRIMARY SOURCES (DEMAND AND SUPPLY SIDES)

- FIGURE 7 PROTEIN A RESIN MARKET: KEY SUPPLY AND DEMAND-SIDE PARTICIPANTS

- FIGURE 8 PROTEIN A RESIN MARKET: BREAKDOWN OF PRIMARY INTERVIEWS (BY COMPANY TYPE, DESIGNATION, AND REGION)

- FIGURE 9 PROTEIN A RESIN MARKET: KEY INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 10 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 11 PROTEIN A RESIN MARKET: COMPANY REVENUE ESTIMATION

- FIGURE 12 PROTEIN A RESIN MARKET: END-USER AND REVENUE-MAPPING-BASED MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 13 PROTEIN A RESIN MARKET: TOP-DOWN APPROACH

- FIGURE 14 GROWTH PROJECTIONS ON REVENUE IMPACT OF KEY MACROINDICATORS

- FIGURE 15 PROTEIN A RESIN MARKET: DATA TRIANGULATION METHODOLOGY

- FIGURE 16 PROTEIN A RESIN MARKET SHARE, BY PRODUCT, 2025 VS. 2030

- FIGURE 17 PROTEIN A RESIN MARKET, BY SOURCE, 2025 VS. 2030 (USD MILLION)

- FIGURE 18 PROTEIN A RESIN MARKET, BY MATRIX TYPE, 2025 VS. 2030 (USD MILLION)

- FIGURE 19 PROTEIN A RESIN MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- FIGURE 20 PROTEIN A RESIN MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- FIGURE 21 PROTEIN A RESIN MARKET: GEOGRAPHIC SNAPSHOT (2024)

- FIGURE 22 RISING ADOPTION OF PREPACKED DISPOSABLE COLUMNS TO FUEL MARKET GROWTH

- FIGURE 23 CHINA AND JAPAN TO ACQUIRE MAJOR SHARES OF ASIA PACIFIC MARKET IN 2024

- FIGURE 24 CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 25 PROTEIN A RESIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 PROTEIN A RESIN MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PROTEIN A RESIN, BY KEY PLAYER, 2022-2024 (USD)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF PROTEIN A RESIN, BY REGION, 2022-2024 (USD)

- FIGURE 29 PROTEIN A RESIN MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 PROTEIN A RESIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 31 PROTEIN A RESIN MARKET: ECOSYSTEM ANALYSIS

- FIGURE 32 PROTEIN A RESIN MARKET: FUNDING AND NUMBER OF DEALS, 2019-2023 (USD MILLION)

- FIGURE 33 NUMBER OF DEALS IN PROTEIN A RESIN MARKET, BY KEY PLAYER, 2019-2023

- FIGURE 34 VALUE OF DEALS IN PROTEIN A RESIN MARKET, BY KEY PLAYER, 2019-2023 (USD)

- FIGURE 35 PROTEIN A RESIN MARKET: TOP COMPANIES/APPLICANTS FOR PROTEIN A RESIN PATENTS AND NUMBER OF PATENTS GRANTED, 2015-2025

- FIGURE 36 PROTEIN A RESIN MARKET: IMPORT SCENARIO FOR HS CODE 3504, 2020-2024

- FIGURE 37 PROTEIN A RESIN MARKET: EXPORT SCENARIO FOR HS CODE 3504, 2020-2024

- FIGURE 38 PROTEIN A RESIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 39 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR PROTEIN A RESIN, BY PRODUCT

- FIGURE 40 KEY BUYING CRITERIA OF PROTEIN A RESIN, BY END USER

- FIGURE 41 KEY AI USE CASES IN PROTEIN A RESIN MARKET

- FIGURE 42 NORTH AMERICA: PROTEIN A RESIN MARKET SNAPSHOT (2024)

- FIGURE 43 ASIA PACIFIC: PROTEIN A RESIN MARKET SNAPSHOT (2024)

- FIGURE 44 REVENUE ANALYSIS OF KEY PLAYERS IN PROTEIN A RESIN MARKET, 2020-2024 (USD MILLION)

- FIGURE 45 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PROTEIN A RESIN MARKET, 2024

- FIGURE 46 MARKET RANKING OF KEY PLAYERS IN PROTEIN A RESIN MARKET, 2024

- FIGURE 47 EV/EBITDA OF TOP THREE PLAYERS (2025)

- FIGURE 48 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF TOP THREE PLAYERS (2025)

- FIGURE 49 PROTEIN A RESIN MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 50 PROTEIN A RESIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 51 PROTEIN A RESIN MARKET: COMPANY FOOTPRINT

- FIGURE 52 PROTEIN A RESIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 DANAHER: COMPANY SNAPSHOT

- FIGURE 54 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- FIGURE 55 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 56 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 57 MERCK KGAA: COMPANY SNAPSHOT (2024)

- FIGURE 58 REPLIGEN CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 59 TOSOH BIOSCIENCE: COMPANY SNAPSHOT (2024)

- FIGURE 60 ECOLAB INC.: COMPANY SNAPSHOT (2024)

- FIGURE 61 AVANTOR, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 62 KANEKA CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 63 JSR CORPORATION: COMPANY SNAPSHOT (2024)

- FIGURE 64 GENSCRIPT: COMPANY SNAPSHOT (2024)