|

市场调查报告书

商品编码

1808088

装饰箔市场(按产品类型、应用、最终用户和地区划分)- 预测至 2030 年Decorative Foils Market by Product Type, Application, End User, and Region - Global Forecast to 2030 |

||||||

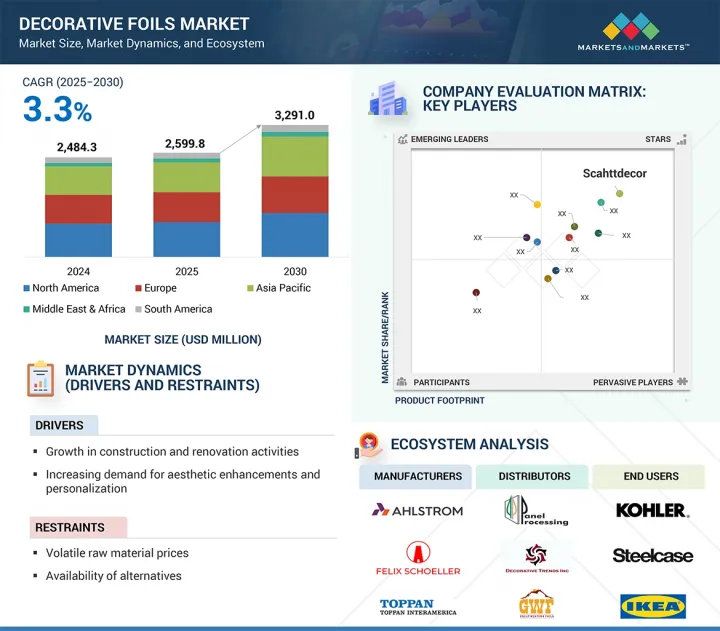

装饰箔市场预计将从 2025 年的 25.998 亿美元成长到 2030 年的 32.91 亿美元,复合年增长率为 4.8%。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

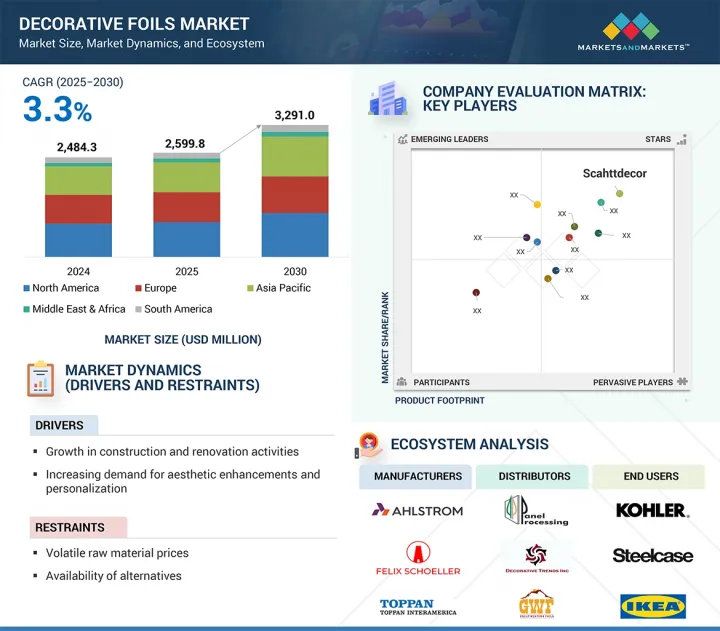

| 预测期 | 2025-2030 |

| 对价单位 | 数量(平方公尺)及价值(百万美元) |

| 部分 | 按产品类型、应用程式、最终用户和地区 |

| 目标区域 | 亚太地区、北美、欧洲、中东和非洲、南美 |

装饰箔的需求受到建筑和製冷行业活动、快速都市化、可支配收入的提高、印刷技术的不断进步以及对可持续、永续且价格合理的室内装饰解决方案的需求的推动。然而,市场也面临原材料价格波动和製造成本上升等挑战,这些挑战可能会影响装饰铝箔业的成长和盈利。

在预测期内,聚酯箔将成为装饰箔市场中以金额为准成长最快的产品类型,这得益于其卓越的耐用性、柔韧性和出色的印刷适性,能够实现鲜艳的设计和高品质的影像。聚酯箔还具有强大的耐化学性、防潮性和抗紫外线性能,使其在汽车、建筑和家具等高要求应用中的应用范围不断扩大。製造和印刷技术的创新,包括新型数位印刷方法,进一步提升了聚酯箔的吸引力,为客製化和成本节约创造了新的机会。此外,住宅和商业建筑重建对高端表面处理的需求不断增长,预计将继续推动聚酯箔的销售额以金额为准。

按应用划分,预计非住宅领域将在预测期内成为装饰箔市场的第二大细分市场,这得益于商业和机构建筑的持续成长。对办公室和酒店建设、零售计划和公共基础设施的投资不断增加,这推动了对装饰箔的需求,装饰箔可以为耐用、易于维护的建筑和维修增添美学价值。各种装饰箔类别的技术进步为非住宅表面(特别是适合高人流量区域的表面)提供了灵活的设计选择和功能性涂层。非住宅领域的都市化和商业空间维修的上升都在推动对装饰表面的需求,而装饰表面的需求通常超过对住宅表面的需求。非住宅类别对装饰箔的需求也与现代商业建筑设计中对节能表面处理、风格和保护的日益重视相吻合。

预计亚太地区将在装饰箔市场中占据最大份额,主要原因是快速的都市化、可支配收入的增加以及中国、印度、印尼和菲律宾等新兴市场建筑和维修活动的扩大。其他因素包括以金额为准的政府基础设施计划,重点关注永续建筑材料以及数位印刷和製造技术的进步,这些都为产品客製化和效率带来了机会。该地区不断壮大的中等收入阶层要求为住宅和商业空间提供更实惠、更时尚的室内解决方案。此外,本地製造商和全球技术供应商之间的伙伴关係正在推动新产品开发和上市机会,进一步巩固亚太地区在装饰箔市场的主导地位。

本报告研究了全球装饰箔市场,提供了按产品类型、应用、最终用户和地区分類的趋势信息,以及参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概述

- 介绍

- 市场动态

第六章 产业趋势

- 价值链分析

- 生态系分析

- 波特五力分析

- 主要相关人员和采购标准

- 贸易分析

- 影响客户业务的趋势/中断

- 技术分析

- 总体经济指标

- 定价分析

- 人工智慧/生成式人工智慧的影响

- 2025-2026年主要会议和活动

- 案例研究分析

- 投资金筹措场景

- 专利分析

- 2025年美国关税对装饰箔市场的影响

7. 装饰箔市场(依产品类型)

- 介绍

- PVC箔

- 聚酯箔

- 铝箔纸

- 其他的

第八章装饰箔市场(按应用)

- 介绍

- 家具

- 内阁

- 地板

- 墙板

- 檯面

- 其他的

第九章装饰箔市场(按最终用户)

- 介绍

- 住房

- 非住宅

- 运输

第十章 装饰箔市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第十一章竞争格局

- 概述

- 主要参与企业的策略/优势

- 收益分析

- 市场占有率分析

- 估值和财务指标

- 品牌/产品比较分析

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 主要参与企业

- TOPPAN HOLDINGS INC.(TOPPAN INTERAMERICA)

- SCHATTDECOR

- SURTECO GMBH

- TAGHLEEF INDUSTRIES

- KRONOPLUS LIMITED

- AHLSTROM

- FELIX SCHOELLER

- INTERPRINT GMBH

- IMPRESS DECOR INC

- OLON INDUSTRIES, INC

- 其他公司

- LAMIGRAF

- YODEAN DECOR

- KOEHLER PAPER

- LAMIDECOR

- KONRAD HORNSCHUCH AG

- IMAWELL GMBH

- TURKUAZ DECOR

- MOBELFOLIEN GMBH BIESENTHAL

- LIKORA DEKORFOLIEN GMBH

- FINE DECOR GMBH

- PURA GROUP

- DECOR DRUCK LEIPZIG GMBH

- NEODECORTECH SPA

- RENOLIT SE

- UPCO SRL

第十三章 附录

The decorative foils market is expected to reach USD 3,291.0 million by 2030, up from USD 2,599.8 million in 2025, growing at a CAGR of 4.8%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Volume (Square Meters) and Value (USD Million) |

| Segments | Product Type, Application, and End User |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The demand for decorative foils is driven by construction and refrigeration activities, rapid urbanization, increasing disposable income, numerous technological advancements in printing, and the demand for sustainable, customizable, and affordable interior solutions. However, the market also faces challenges, such as the volatility of raw material prices and high manufacturing costs, which are likely to affect growth and profitability in the decorative foils industry.

"Based on product type, polyester to be fastest-growing segment in decorative foils market during forecast period"

During the forecast period, polyester foils are the fastest-growing product type in the decorative foils market by value, due to their superior durability, flexibility, and excellent printability for high-quality images with bright designs. Polyester foils will also have strong resistance to chemicals, moisture, and UV rays, expanding their use in demanding applications like automotive, architecture, and furniture. The appeal of polyester foils is further boosted by innovations in manufacturing and printing technologies, including new digital printing methods, which have created new opportunities for customization and reduced costs. Additionally, the increasing demand for premium surface finishes in renovations of residential and commercial buildings will continue to drive polyester foil sales based on dollar value.

"Based on application, non-residential to be second-largest segment in decorative foils market during the forecast period"

Based on application, non-residential is projected to be the second-largest segment of the decorative foils market during the forecast period, as commercial and institutional construction continues to grow. Increased investment in office and hotel construction, retail projects, and public infrastructure has raised demand for decorative foils, which can create aesthetic results for building and refurbishment that are durable and easy to maintain. Technological advancements across different decorative foil categories enable flexible design options and functional coatings for non-residential surfaces, which are especially suitable for high-traffic areas. Both urbanization in the non-residential sector and rising renovation rates in commercial spaces have driven demand for decorative surfaces, which generally outpaces demand for residential surfaces. The demand for decorative foils in the non-residential category also aligns with considerations for energy-efficient surface finishes, style, and protection in modern commercial building design.

"Based on region, Asia Pacific to account for largest share of decorative foils market during forecast period"

In terms of value, Asia Pacific is expected to hold the largest share of the decorative foils market, mainly driven by rapid urbanization, rising disposable incomes, and growing construction and renovation activities across emerging markets like China, India, Indonesia, and the Philippines. There are also strong government infrastructure programs focused on sustainable building materials and advancements in technology for digital printing and manufacturing that boost opportunities for product customization and efficiency. The region's expanding middle class demands more affordable, stylish interior solutions for residential and commercial spaces. Additionally, partnerships between local manufacturers and global technology providers foster new product development and market opportunities, further cementing Asia Pacific's dominance in the decorative foils market.

During the process of estimating and confirming the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

Key players in this market include Toppan Holdings Inc (Toppan Interamerica) (US), Schattdecor (Germany), SURTECO GmbH (Germany), Taghleef Industries (UAE), Kronoplus Limited (UK), Ahlstrom (Finland), Felix Schoeller (Germany), INTERPRINT GmbH (Germany), Impress Decor Inc (US), and Olon Industries Inc (Malta).

Research Coverage

This report segments the decorative foils market by product type, application, end-user, and region, and offers estimates of the market's overall value across different regions. A comprehensive analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions related to the decorative foils market.

Key benefits of buying this report

This research report examines different levels of analysis, including industry trends, market ranking of top players, and company profiles, all of which provide a comprehensive view of the competitive landscape. It highlights emerging and high-growth segments of the decorative foils market, key growth regions, and the market's drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Growth in construction and renovation activities, increasing demand for aesthetic enhancements and personalization, sustainability and eco-friendly trends), restraints (Volatility in raw material prices, availability of alternative solutions), opportunities (Advancements in printing and surface customization technologies, growing applications in automotive and consumer electronics sectors), and challenges (Durability and performance in challenging environments, difficulty replicating natural textures and achieving premium visual quality).

- Market Penetration: Comprehensive information on the decorative foils market offered by top players in the global decorative foils market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the decorative foils market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for decorative foils across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global decorative foils market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the decorative foils market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DECORATIVE FOILS MARKET

- 4.2 DECORATIVE FOILS MARKET, BY PRODUCT TYPE

- 4.3 DECORATIVE FOILS MARKET, BY APPLICATION

- 4.4 DECORATIVE FOILS MARKET, BY END USER

- 4.5 DECORATIVE FOILS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in construction and renovation activities

- 5.2.1.2 Increasing demand for aesthetic enhancements and personalization

- 5.2.1.3 Sustainability and ecofriendly trends

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility in raw material prices

- 5.2.2.2 Availability of alternative solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in printing and surface customization technologies

- 5.2.3.2 Growing applications in automotive and consumer electronics sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Durability and performance in challenging environments

- 5.2.4.2 Difficulty replicating natural textures and achieving premium visual quality

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 QUALITY

- 6.4.3 SERVICE

- 6.4.4 BUYING CRITERIA

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 392190)

- 6.5.2 IMPORT SCENARIO (HS CODE 392190)

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 High resolution digital printing

- 6.7.1.2 Smart foils

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Plasma pretreatment and advanced adhesive systems

- 6.7.2.2 Hot stamping

- 6.7.1 KEY TECHNOLOGIES

- 6.8 MACROECONOMIC INDICATORS

- 6.8.1 GDP TRENDS AND FORECASTS

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2022-2024

- 6.9.2 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024

- 6.9.3 AVERAGE SELLING PRICE TREND, BY END USER, 2022-2024

- 6.9.4 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.9.5 REGULATORY LANDSCAPE

- 6.9.5.1 North America

- 6.9.5.2 Asia Pacific

- 6.9.5.3 Europe

- 6.9.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 IMPACT OF AI/GEN AI

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 CASE STUDY ANALYSIS

- 6.12.1 FANTONI ENHANCED ITS OFFICE DESK LINE BY USING REALISTIC WOODGRAIN DECORATIVE FOILS

- 6.12.2 SKAI TRANSFORMED KITCHEN CABINETRY BY OFFERING CUSTOMIZABLE, THERMOFORMABLE FURNITURE FOILS

- 6.12.3 LEONHARD KURZ REVOLUTIONIZED AUTOMOTIVE INTERIOR DESIGN WITH MULTIFUNCTIONAL TRANSFER FOILS THAT INTEGRATE TOUCH SENSITIVITY

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 PATENT ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 LEGAL STATUS OF PATENTS

- 6.14.3 JURISDICTION ANALYSIS

- 6.15 IMPACT OF 2025 US TARIFF-DECORATIVE FOILS MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICING IMPACT ANALYSIS

- 6.15.4 IMPACT ON COUNTRY/REGION

- 6.15.4.1 US

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.5 IMPACT ON END-USE INDUSTRIES

7 DECORATIVE FOILS MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 PVC FOILS

- 7.2.1 USED FOR SEAMLESS, DURABLE, AND CUSTOMIZABLE SURFACES FOR INTERIOR FURNITURE

- 7.3 POLYESTER FOILS

- 7.3.1 EXCELLENT SURFACE QUALITY AND LONG-LASTING, LOW-MAINTENANCE PERFORMANCE

- 7.4 PAPER-BASED FOILS

- 7.4.1 AFFORDABLE, VERSATILE, AND SUSTAINABLE SOLUTIONS FOR STYLISH INTERIORS

- 7.5 OTHER PRODUCT TYPES

8 DECORATIVE FOILS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FURNITURE

- 8.2.1 ENABLING AFFORDABLE LUXURY IN FURNITURE WITH HIGH-PERFORMANCE DECORATIVE LAMINATES AND FOILS

- 8.3 CABINETS

- 8.3.1 EMPOWER CABINETS WITH EXCEPTIONAL DURABILITY, CUSTOMIZATION, AND EFFORTLESS MAINTENANCE

- 8.4 FLOORING

- 8.4.1 ENHANCE WEAR RESISTANCE AND AESTHETIC APPEAL IN MODERN FLOORING SOLUTIONS

- 8.5 WALL PANELS

- 8.5.1 HELP IN TRANSFORMING VERTICAL SPACES WITH LIGHTWEIGHT AND CUSTOMIZABLE WALL PANEL SOLUTIONS

- 8.6 COUNTER TOPS

- 8.6.1 COST-EFFECTIVE, DURABLE, AND EXCELLENT STYLE OFFERED BY DECORATIVE FOILS

- 8.7 OTHER APPLICATIONS

9 DECORATIVE FOILS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 RESIDENTIAL

- 9.2.1 ECOFRIENDLY ESTHETICS AND HIGH-PERFORMANCE SURFACES

- 9.3 NON-RESIDENTIAL

- 9.3.1 SCALABLE DESIGN CONSISTENCY IN HIGH-TRAFFIC COMMERCIAL INTERIOR

- 9.4 TRANSPORTATION

- 9.4.1 REDUCED WEIGHT WHILE ENHANCING AESTHETICS IN TRANSPORTATION INTERIORS

10 DECORATIVE FOILS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Customization and home furnishing boom fueling demand

- 10.2.2 CANADA

- 10.2.2.1 Surge in sustainable design driving market

- 10.2.3 MEXICO

- 10.2.3.1 Booming export-oriented furniture industry driving market

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Massive manufacturing and export surging market growth

- 10.3.2 JAPAN

- 10.3.2.1 Advanced technological innovation driving market

- 10.3.3 INDIA

- 10.3.3.1 Affordable interior solutions to drive market

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Advanced technology adoption and rapid furniture sector boosting market

- 10.3.5 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Green policies and precision automation enhancing market growth

- 10.4.2 UK

- 10.4.2.1 Emphasis on sustainability and customization propelling market

- 10.4.3 FRANCE

- 10.4.3.1 Focus on eco-friendly and customizable interior solutions accelerating market

- 10.4.4 ITALY

- 10.4.4.1 Design-driven luxury furniture sector elevating market

- 10.4.5 SPAIN

- 10.4.5.1 Tourism-driven hospitality sector boosting market

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Mega construction projects of Vision 2030 driving market

- 10.5.1.2 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Infrastructure growth and rising demand for stylish, durable interiors propelling market

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Robust furniture export industry fueling foils market growth

- 10.6.2 ARGENTINA

- 10.6.2.1 Thriving agricultural and retail sectors to boost market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Product type footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 EXPANSIONS

- 11.9.3 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TOPPAN HOLDINGS INC. (TOPPAN INTERAMERICA)

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 SCHATTDECOR

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 SURTECO GMBH

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 TAGHLEEF INDUSTRIES

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 KRONOPLUS LIMITED

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 AHLSTROM

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Key strengths

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 FELIX SCHOELLER

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Expansions

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 INTERPRINT GMBH

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 IMPRESS DECOR INC

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 OLON INDUSTRIES, INC

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 TOPPAN HOLDINGS INC. (TOPPAN INTERAMERICA)

- 12.2 OTHER PLAYERS

- 12.2.1 LAMIGRAF

- 12.2.2 YODEAN DECOR

- 12.2.3 KOEHLER PAPER

- 12.2.4 LAMIDECOR

- 12.2.5 KONRAD HORNSCHUCH AG

- 12.2.6 IMAWELL GMBH

- 12.2.7 TURKUAZ DECOR

- 12.2.8 MOBELFOLIEN GMBH BIESENTHAL

- 12.2.9 LIKORA DEKORFOLIEN GMBH

- 12.2.10 FINE DECOR GMBH

- 12.2.11 PURA GROUP

- 12.2.12 DECOR DRUCK LEIPZIG GMBH

- 12.2.13 NEODECORTECH S.P.A

- 12.2.14 RENOLIT SE

- 12.2.15 UPCO SRL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 DECORATIVE FOILS MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 3 DECORATIVE FOILS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 6 EXPORT SCENARIO FOR HS CODE 392190 -COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 392190 -COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 8 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2019-2023

- TABLE 9 ANNUAL GDP PERCENTAGE CHANGE AND PROJECTION OF KEY COUNTRIES, 2024-2029

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 DECORATIVE FOILS MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 15 DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 16 DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 17 DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 18 DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 19 DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 20 DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 21 DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 22 DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 23 DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 24 DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 25 DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 26 DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 27 DECORATIVE FOILS MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 DECORATIVE FOILS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 DECORATIVE FOILS MARKET, BY REGION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 30 DECORATIVE FOILS MARKET, BY REGION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 31 NORTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 NORTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METERS)

- TABLE 34 NORTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METERS)

- TABLE 35 NORTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 38 NORTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 39 NORTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 42 NORTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 43 NORTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 44 NORTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 46 NORTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 47 US: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 48 US: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 49 US: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 50 US: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 51 CANADA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 52 CANADA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 53 CANADA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 54 CANADA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 55 MEXICO: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 56 MEXICO: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 57 MEXICO: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 58 MEXICO: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 59 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 60 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METERS)

- TABLE 62 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METERS)

- TABLE 63 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 64 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 66 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 67 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 70 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 71 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 72 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 74 ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 75 CHINA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 76 CHINA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 77 CHINA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 78 CHINA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 79 JAPAN: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 80 JAPAN: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 81 JAPAN: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 82 JAPAN: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 83 INDIA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 84 INDIA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 85 INDIA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 86 INDIA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 87 SOUTH KOREA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 88 SOUTH KOREA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 89 SOUTH KOREA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 90 SOUTH KOREA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 91 REST OF ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 94 REST OF ASIA PACIFIC: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 95 EUROPE: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 96 EUROPE: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METERS)

- TABLE 98 EUROPE: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METERS)

- TABLE 99 EUROPE: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 100 EUROPE: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 102 EUROPE: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 103 EUROPE: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 104 EUROPE: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 106 EUROPE: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 107 EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 108 EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 110 EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 111 GERMANY: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 112 GERMANY: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 113 GERMANY: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 114 GERMANY: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 115 UK: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 116 UK: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 117 UK: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 118 UK: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 119 FRANCE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 120 FRANCE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 121 FRANCE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 122 FRANCE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 123 ITALY: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 124 ITALY: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 125 ITALY: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 126 ITALY: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 127 SPAIN: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 128 SPAIN: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 129 SPAIN: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 130 SPAIN: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 131 REST OF EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 132 REST OF EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 133 REST OF EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 134 REST OF EUROPE: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 135 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METERS)

- TABLE 138 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METERS)

- TABLE 139 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 142 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 143 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 146 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 147 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 150 MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 151 SAUDI ARABIA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 152 SAUDI ARABIA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 153 SAUDI ARABIA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 154 SAUDI ARABIA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 155 REST OF GCC COUNTRIES: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 156 REST OF GCC COUNTRIES: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 157 REST OF GCC COUNTRIES: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 158 REST OF GCC COUNTRIES: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 159 SOUTH AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 160 SOUTH AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 162 SOUTH AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 167 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 168 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2022-2024 (MILLION SQUARE METERS)

- TABLE 170 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY COUNTRY, 2025-2030 (MILLION SQUARE METERS)

- TABLE 171 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (USD MILLION)

- TABLE 172 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 173 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2022-2024 (MILLION SQUARE METERS)

- TABLE 174 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY PRODUCT TYPE, 2025-2030 (MILLION SQUARE METERS)

- TABLE 175 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 176 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2022-2024 (MILLION SQUARE METERS)

- TABLE 178 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY APPLICATION, 2025-2030 (MILLION SQUARE METERS)

- TABLE 179 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 182 SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 183 BRAZIL: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 184 BRAZIL: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 185 BRAZIL: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 186 BRAZIL: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 187 ARGENTINA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 188 ARGENTINA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 189 ARGENTINA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 190 ARGENTINA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 191 REST OF SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (USD MILLION)

- TABLE 192 REST OF SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2022-2024 (MILLION SQUARE METERS)

- TABLE 194 REST OF SOUTH AMERICA: DECORATIVE FOILS MARKET, BY END USER, 2025-2030 (MILLION SQUARE METERS)

- TABLE 195 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN DECORATIVE FOILS MARKET BETWEEN JANUARY 2020 AND JUNE 2025

- TABLE 196 DECORATIVE FOILS MARKET: DEGREE OF COMPETITION

- TABLE 197 DECORATIVE FOILS MARKET: REGION FOOTPRINT

- TABLE 198 DECORATIVE FOILS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 199 DECORATIVE FOILS MARKET: APPLICATION FOOTPRINT

- TABLE 200 DECORATIVE FOILS MARKET: END USER FOOTPRINT

- TABLE 201 DECORATIVE FOILS MARKET: KEY STARTUPS/SMES

- TABLE 202 DECORATIVE FOILS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 203 DECORATIVE FOILS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 204 DECORATIVE FOILS MARKET: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 205 DECORATIVE FOILS MARKET: EXPANSIONS, JANUARY 2020-MAY 2025

- TABLE 206 DECORATIVE FOILS MARKET: DEALS, JANUARY 2020-MAY 2025

- TABLE 207 TOPPAN HOLDINGS INC. (TOPPAN INTERAMERICA): COMPANY OVERVIEW

- TABLE 208 TOPPAN INTERAMERICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 SCHATTDECOR: COMPANY OVERVIEW

- TABLE 210 SCHATTDECOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 SURTECO GMBH: COMPANY OVERVIEW

- TABLE 212 SURTECO GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 SURTECO GMBH: DEALS, JANUARY 2020-JUNE 2025

- TABLE 214 TAGHLEEF INDUSTRIES: COMPANY OVERVIEW

- TABLE 215 TAGHLEEF INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 TAGHLEEF INDUSTRIES: PRODUCT LAUNCHES, JANUARY 2020-MAY 2025

- TABLE 217 KRONOPLUS LIMITED: COMPANY OVERVIEW

- TABLE 218 KRONOPLUS LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 AHLSTROM: COMPANY OVERVIEW

- TABLE 220 AHLSTROM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 FELIX SCHOELLER: COMPANY OVERVIEW

- TABLE 222 FELIX SCHOELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 FELIX SCHOELLER: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 224 INTERPRINT GMBH: COMPANY OVERVIEW

- TABLE 225 INTERPRINT GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 INTERPRINT GMBH: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 227 IMPRESS DECOR INC: COMPANY OVERVIEW

- TABLE 228 IMPRESS DECOR INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 OLON INDUSTRIES INC: COMPANY OVERVIEW

- TABLE 230 OLON INDUSTRIES INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 LAMIGRAF: COMPANY OVERVIEW

- TABLE 232 YODEAN DECOR: COMPANY OVERVIEW

- TABLE 233 KOEHLER PAPER: COMPANY OVERVIEW

- TABLE 234 LAMIDECOR: COMPANY OVERVIEW

- TABLE 235 KONRAD HORNSCHUCH AG: COMPANY OVERVIEW

- TABLE 236 IMAWELL GMBH: COMPANY OVERVIEW

- TABLE 237 TURKUAZ DECOR: COMPANY OVERVIEW

- TABLE 238 MOBELFOLIEN GMBH BIESENTHAL: COMPANY OVERVIEW

- TABLE 239 LIKORA DEKORFOLIEN GMBH: COMPANY OVERVIEW

- TABLE 240 FINE DECOR GMBH: COMPANY OVERVIEW

- TABLE 241 PURA GROUP: COMPANY OVERVIEW

- TABLE 242 DECOR DRUCK LEIPZIG GMBH: COMPANY OVERVIEW

- TABLE 243 NEODECORTECH S.P.A: COMPANY OVERVIEW

- TABLE 244 RENOLIT SE: COMPANY OVERVIEW

- TABLE 245 UPCO SRL: COMPANY OVERVIEW

List of Figures

- FIGURE 1 DECORATIVE FOILS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 DECORATIVE FOILS MARKET: RESEARCH DESIGN

- FIGURE 3 DECORATIVE FOILS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 DECORATIVE FOILS MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DECORATIVE FOILS MARKET TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 DECORATIVE FOILS MARKET: DATA TRIANGULATION

- FIGURE 8 PVC FOILS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 FURNITURE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 RESIDENTIAL END USER TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 12 GROWING DEMAND FROM CONSTRUCTION AND RENOVATION ACTIVITIES TO DRIVE MARKET

- FIGURE 13 PVC FOILS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 14 FURNITURE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 RESIDENTIAL TO BE LARGEST END USER OF DECORATIVE FOILS

- FIGURE 16 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DECORATIVE FOILS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 DECORATIVE FOILS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 DECORATIVE FOILS MARKET: ECOSYSTEM

- FIGURE 20 DECORATIVE FOILS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 23 EXPORT DATA FOR HS CODE 392190 -COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 24 IMPORT DATA FOR HS CODE 392190 -COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- FIGURE 25 DECORATIVE FOILS MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 AVERAGE SELLING PRICE TREND, 2022-2024 (USD/SQUARE METERS)

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 28 PATENTS APPLIED AND GRANTED, 2014-2024

- FIGURE 29 LEGAL STATUS OF PATENTS (2014-2024)

- FIGURE 30 TOP JURISDICTIONS

- FIGURE 31 PVC FOILS TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 32 FURNITURE TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 33 RESIDENTIAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 34 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: DECORATIVE FOILS MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: DECORATIVE FOILS MARKET SNAPSHOT

- FIGURE 37 EUROPE: DECORATIVE FOILS MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF TOP PLAYERS IN DECORATIVE FOILS MARKET, 2022-2024

- FIGURE 39 DECORATIVE FOILS MARKET SHARE ANALYSIS, 2024

- FIGURE 40 VALUATION OF LEADING COMPANIES IN DECORATIVE FOILS MARKET, 2024

- FIGURE 41 FINANCIAL METRICS OF LEADING COMPANIES IN DECORATIVE FOILS MARKET, 2024

- FIGURE 42 DECORATIVE FOILS MARKET: BRAND/PRODUCT COMPARISON ANALYSIS

- FIGURE 43 DECORATIVE FOILS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 44 DECORATIVE FOILS MARKET: COMPANY FOOTPRINT

- FIGURE 45 DECORATIVE FOILS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 TOPPAN HOLDINGS INC. (TOPPAN INTERAMERICA): COMPANY SNAPSHOT

- FIGURE 47 SCHATTDECOR: COMPANY SNAPSHOT

- FIGURE 48 SURTECO GMBH: COMPANY SNAPSHOT

- FIGURE 49 AHLSTROM: COMPANY SNAPSHOT