|

市场调查报告书

商品编码

1808089

全球网路 API 市场(按 API 类型、应用程式和产业划分)- 预测至 2030 年Network API Market by API Type (Device Status, Identity, Location, Network Performance), Application (IoT, Priority Communication, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Autonomous Vehicles), Vertical - Global Forecast to 2030 |

||||||

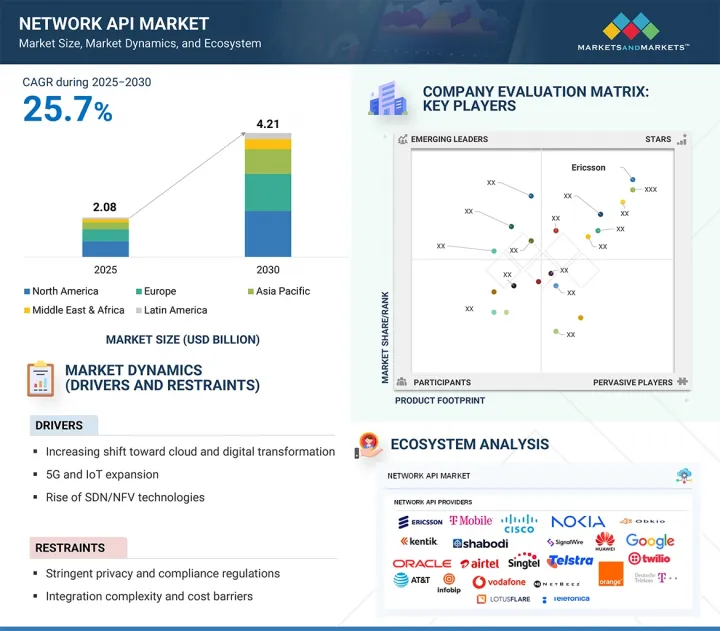

预计 2025 年全球网路 API 市值将达到 19.6 亿美元,到 2030 年将达到 61.3 亿美元,2025 年至 2030 年的复合年增长率为 25.7%。

在可程式化、随选连线的推动下,市场正迅速从实验阶段走向商业化。与传统的整合模式不同,网路 API 以标准化、开发者友善的格式提供设备状态、位置、边缘运算和策略控制等即时功能。这种转变使企业能够像使用云端基础设施一样轻鬆地使用网路服务,从而降低复杂性,并解锁物联网、自主移动旅行、扩展现实 (XR) 和安全数位交易等新用例。

| 调查范围 | |

|---|---|

| 调查年份 | 2025-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万/十亿美元 |

| 部分 | API类型、应用程式、产业、地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

CAMARA 和开放式网关等计画的兴起确保了营运商之间的互通性,使企业能够实现全球可程式性,而不是孤立的部署。随着网路日益软体定义化,API 正在从可选的附加元件演变为必不可少的业务赋能器。未来五年的成长将由企业对敏捷性的需求、新的营运商收益模式以及人工智慧驱动的自动化与网路可程式化的融合所推动。

儘管网路 API 市场成长潜力巨大,但它仍面临着许多限制因素,例如整合复杂度、营运商标准化程度有限以及高昂的实施成本。企业往往难以应对难以轻鬆使用 API 的旧有系统,而对 API 安全性、延迟保证和收益模式的担忧也阻碍了 API 的广泛应用。

根据应用,预计物联网领域将在预测期内占据最大的市场规模。

物联网是网路 API 市场最大的应用,企业需要为数十亿台设备提供可扩展、安全、即时的连接。用于设备状态、策略控制和分析的 API 使公司能够以无与伦比的精度管理其物联网生态系统。 2024 年 11 月,NTT Docomo 将符合 CAMARA 标准的 API 整合到其位于日本的 5G 物联网平台中,取得了突破性进展,使企业能够动态监控设备效能并在大规模物联网部署中实施网路策略。这对于智慧製造、物流和公共产业等行业至关重要,因为这些行业的延迟和可靠性会直接影响营运。透过将 API 整合到物联网解决方案中,营运商正在开闢新的收益途径,企业也正在获得大规模的控制力和可视性。

根据 API 类型,边缘部分预计在预测期内实现最快的成长率。

边缘 API 正在成为网路 API 市场的关键战场,使企业能够提供需要超低延迟和本地运算能力的体验。边缘 API 使开发人员能够无缝利用分散式基础架构、编配工作负载并优化效能,而无需深厚的通讯专业知识。 2024 年 10 月,新加坡电信 (Singtel) 和 Bridge Alliance 合作,在亚太地区扩展 API Exchange,为企业和开发人员提供标准化的边缘 API。此次扩展使智慧城市和物流应用供应商能够直接存取边缘基础架构,以实现对延迟敏感的用例,例如自主无人机和交通管理。透过抽象网路资源的复杂性,此部署使边缘功能可编程且可扩展。随着企业将工作负载推向边缘,API 将成为从交通到娱乐等各个领域实现收益、效率和创新的关键。

本报告研究了全球网路 API 市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 网路 API 市场为企业带来诱人机会

- 北美网路 API 市场(按 API 类型和国家划分)

- 按 API 类型分類的网路 API 市场

- 按行业分類的网路 API 市场

- 网路 API 市场(按应用)

第五章市场概况与产业趋势(具有定量意义的策略驱动因素)

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 价值链分析

- 生态系分析

- 案例研究

- 诺基亚和德国电信 (DT) 利用 NETWORK AS CODE 的 5G 功能突破无人机操作的界限

- 中国电信透过QOD API和CNOS架构赋能企业

- ORANGE 透过 CAMARA API 消除对 DIDIT 的 OTP 依赖并增强数位身分安全

- 波特五力分析

- 主要相关利益者和采购标准

- 专利分析

- 影响客户业务的趋势/中断

- 定价分析

- 各 API 类型主要企业平均销售价格(2024 年)

- 主要企业参考价格分析(2024年)

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 监管格局

- 监管机构、政府机构和其他组织

- 主要法规

- 大型会议和活动(2025-2026年)

- 网路API市场技术蓝图

- 短期蓝图(2025-2026)

- 中期蓝图(2027-2028)

- 长期蓝图(2028-2030)

- 网路 API 市场的最佳实践

- 采用 JSON 进行资料交换

- 不要在 URL 中使用动词

- 实作 API 版本控制

- 安全身份验证和核准实施

- 所有资料传输均经过加密

- 速率限制和节流

- 日誌记录、监控和审核

- 定期进行安全测试

- GSMA开放网关和CAMARA计划

- 当前和新兴的经营模式经营模式

- 网路 API 市场中使用的工具、框架和技术

- 投资金筹措场景

- 人工智慧/生成式人工智慧对网路 API 市场的影响

- 2025年美国关税的影响 - 网路API市场

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

第六章:按 API 类型分類的网路 API 市场(市场规模与预测,到 2030 年)

- 介绍

- 设备状态

- 边缘

- 鑑别

- 位置

- 网路效能

- 其他 API 类型

第七章 网路 API 市场应用(市场规模与预测,到 2030 年)

- 介绍

- IoT

- 优先通讯

- 自动驾驶汽车

- 预防诈欺

- 娱乐和内容传送

- 企业IT

- 其他用途

第 8 章 按行业分類的网路 API 市场(市场规模和预测,到 2030 年)

- 介绍

- BFSI

- 资讯科技/资讯科技服务

- 通讯

- 政府/公共部门

- 製造业

- 医学与生命科学

- 零售与电子商务

- 媒体与娱乐

- 其他行业

第九章 网路 API 市场(按地区划分) (市场规模和预测,到 2030 年)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲宏观经济展望

- 英国

- 德国

- 法国

- 西班牙

- 俄罗斯

- 义大利

- 北欧国家

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 韩国

- 东南亚

- 其他亚太地区

- 中东和非洲

- 中东和非洲的宏观经济展望

- 中东

- 非洲

- 拉丁美洲

- 拉丁美洲宏观经济展望

- 巴西

- 墨西哥

- 其他拉丁美洲

第十章 竞争格局

- 介绍

- 主要参与企业的策略/优势(2023-2025)

- 市场占有率分析(2024年)

- 收益分析(2024年)

- 品牌/产品比较

- 公司估值及财务指标

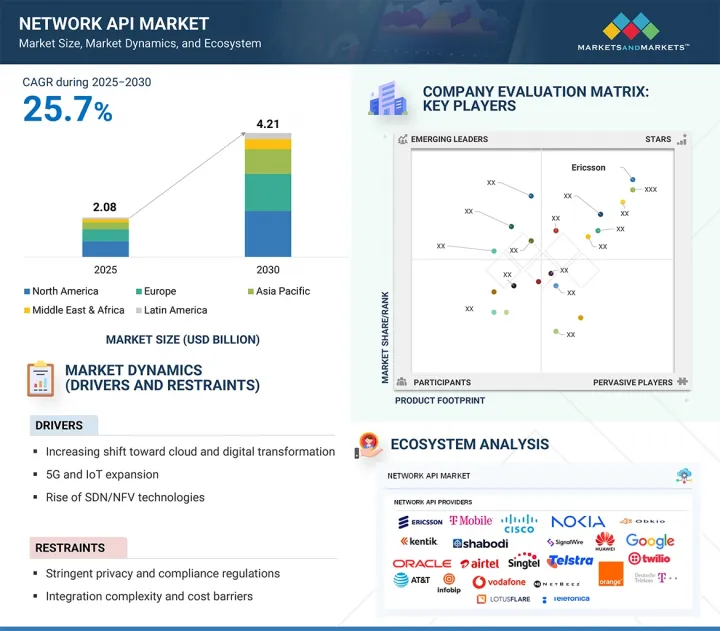

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十一章:公司简介

- 主要企业

- ERICSSON

- CISCO

- NOKIA

- MICROSOFT

- T-MOBILE

- AT&T

- ORANGE

- DEUTSCHE TELEKOM

- VODAFONE

- TELEFONICA

- 其他公司

- SINGTEL

- TELSTRA

- BHARTI AIRTEL

- HUAWEI

- ORACLE

- INFOBIP

- Start-Ups/中小型企业

- KENTIK

- OBKIO

- NETBEEZ

- GRAPHIANT

- ALKIRA

- SHABODI

- LOTUSFLARE

- PHOENIXNAP

第 12 章:相邻/相关市场

- 介绍

- API管理市场

- 市场定义

- 市场概览

- API 管理市场:按产品

- API 管理市场(按平台)

- API 管理市场:依组织规模

- 按开发类型分類的 API 管理市场

- API 管理市场:按行业

- API 管理市场:按地区

- iPaaS(整合平台即服务)市场

- 市场定义

- 市场概览

- iPaaS(整合平台即服务)市场(依服务类型)

- iPaaS(整合平台即服务)市场(依部署模式)

- iPaaS(整合平台即服务)市场:依组织规模

- iPaaS(整合平台即服务)市场(按行业)

- iPaaS(整合平台即服务)市场(按地区)

第十三章 附录

The network API market is estimated to be USD 1.96 billion in 2025 and is projected to reach USD 6.13 billion by 2030, at a CAGR of 25.7% from 2025 to 2030. The market is rapidly moving from experimentation to commercialization, driven by the push for programmable, on-demand connectivity across industries. Unlike traditional integration models, network APIs expose real-time capabilities such as device status, location, edge computing, and policy control in a standardized, developer-friendly format. This shift is enabling enterprises to consume network services as easily as cloud infrastructure, reducing complexity while unlocking new applications in IoT, autonomous mobility, extended reality, and secure digital transactions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | API type, application, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The rise of initiatives like CAMARA and Open Gateway is ensuring interoperability across operators, giving enterprises global-scale programmability instead of siloed deployments. As networks become increasingly software-defined, APIs are evolving from optional add-ons to essential business enablers. Over the next five years, growth will be fueled by enterprise demand for agility, new monetization models for operators, and the convergence of AI-driven automation with network programmability.

Despite strong growth potential, the network API market faces constraints such as integration complexity, limited standardization across operators, and high implementation costs. Enterprises often struggle with legacy systems that cannot easily consume APIs, while concerns around API security, latency guarantees, and monetization models slow adoption at scale.

By application, the IoT segment is estimated to account for the largest market size during the forecast period

The Internet of Things (IoT) is the largest application of the network API market, as enterprises demand scalable, secure, and real-time connectivity for billions of devices. APIs for device status, policy control, and analytics are enabling enterprises to manage IoT ecosystems with unmatched precision. A breakthrough came in November 2024, when NTT Docomo integrated CAMARA-compliant APIs into its 5G IoT platform in Japan, allowing enterprises to dynamically monitor device performance and enforce network policies across massive IoT deployments. This is critical for industries like smart manufacturing, logistics, and utilities, where latency and reliability directly impact operations. By embedding APIs into IoT solutions, operators are unlocking new monetization pathways while enterprises gain control and visibility at scale.

By API type, the edge segment is expected to register the fastest growth rate during the forecast period

The edge API is emerging as a critical battleground in the network API market, enabling enterprises to deliver experiences that demand ultra-low latency and local compute power. Edge APIs allow developers to seamlessly tap into distributed infrastructure, orchestrate workloads, and optimize performance without needing deep telecom expertise. In October 2024, Singtel and Bridge Alliance partnered to expand their API Exchange across the Asia Pacific, providing standardized edge APIs to enterprises and developers. This expansion gave application providers in smart cities and logistics direct access to edge infrastructure for latency-sensitive use cases such as autonomous drones and traffic management. By abstracting the complexity of network resources, this rollout makes edge capabilities programmable and consumable at scale. As enterprises push workloads to the edge, APIs will be the key to unlocking monetization, efficiency, and innovation across sectors from transportation to entertainment.

North America leads in market share, while Asia Pacific is expected to be the fastest-growing regional market during the forecast period

The Network API market in North America and the Asia Pacific is dynamically shaping the global digital landscape through rapid adoption, innovation, and infrastructure advancements. North America, with its mature telecommunications ecosystem and extensive 5G rollout, spearheads enterprise adoption of programmable networks, enabling scalable IoT, edge computing, and secure API integration across industries such as healthcare, finance, and smart cities. At the same time, Asia Pacific stands out as the fastest-growing market, driven by aggressive government initiatives, massive 5G deployments, and expanding private network ecosystems. The Asia Pacific region leverages network APIs extensively across manufacturing, autonomous vehicles, and smart urban infrastructure, fueling digital transformation at an unprecedented pace. Together, these regions exemplify a complementary growth narrative: North America leads in technological maturity and use case diversity, while Asia Pacific delivers scale and acceleration through innovative, large-scale deployments. This synergistic growth positions both markets as critical pillars in the worldwide expansion of network API ecosystems, setting a robust foundation for next-generation connectivity and digital services.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 39%, Tier 2 - 26%, and Tier 3 - 35%

- By Designation: C-level - 27%, Directors - 39%, and Others - 34%

- By Region: North America - 39%, Europe - 25%, Asia Pacific - 19%, Rest of the World - 17%

The major players in the network API market are Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia). These players have adopted various growth strategies, such as partnerships, agreements, collaborations, product launches, product enhancements, and acquisitions, to expand their footprint in the network API market.

Research Coverage

The market study covers the network API market size and the growth potential across different segments, including API Type (Device Status, Edge, Identity, Location, Network Performance, Other API Types), Application (IoT, Priority Communication, Autonomous Vehicles, Anti-fraud, Entertainment & Content Distribution, Enterprise IT, Other Applications), Vertical (BFSI, IT & ITeS, Telecom, Government & Public Sector, Manufacturing, Healthcare & Life Sciences, Retail & E-commerce, Media & Entertainment, Other Verticals), and Region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global network API market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increasing shift toward cloud and digital transformation, 5G and IoT expansion, rise of SDN/NFV technologies), restraints (stringent privacy and compliance regulations, integration complexity and cost barriers), opportunities (growing demand for real-time data and services, monetization of network-as-a-service), challenges (scalability and SLA assurance, rising complexity of API security and cyber threats).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the network API market

- Market Development: Comprehensive information about lucrative markets - analyzing the network API market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the network API market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Ericsson (Sweden), Nokia (Finland), Cisco (US), Microsoft (US), T-Mobile (US), AT&T (US), Orange (France), Deutsche Telekom (Germany), Vodafone (UK), Telefonica (Spain), Singtel (Singapore), Telstra (Australia), Huawei (China), Oracle (US), Bharti Airtel (India), and Infobip (Croatia).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Primary sources

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NETWORK API MARKET

- 4.2 NORTH AMERICA: NETWORK API MARKET, BY API TYPE AND COUNTRY

- 4.3 NETWORK API MARKET, BY API TYPE

- 4.4 NETWORK API MARKET, BY VERTICAL

- 4.5 NETWORK API MARKET, BY APPLICATION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

Unpacking the Forces Shaping network API Adoption & Future Growth Opportunities

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing shift toward cloud and digital transformation

- 5.2.1.2 5G and IoT expansion

- 5.2.1.3 Rise of SDN/NFV technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent privacy and compliance regulations

- 5.2.2.2 Integration complexity and cost barriers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for real-time data and services

- 5.2.3.2 Monetization of Network-as-a-Service

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalability & SLA assurance

- 5.2.4.2 Rising complexity of API security and cyber threats

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDIES

- 5.5.1 NOKIA AND DEUTSCHE TELEKOM (DT) PUSH BOUNDARIES OF DRONE OPERATIONS USING NETWORK AS CODE'S 5G CAPABILITIES

- 5.5.2 CHINA TELECOM EMPOWERS ENTERPRISES WITH QOD APIS AND CNOS ARCHITECTURE

- 5.5.3 ORANGE ENABLES DIDIT ELIMINATE OTP DEPENDENCY AND STRENGTHEN DIGITAL IDENTITY SECURITY VIA CAMARA APIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 BARGAINING POWER OF SUPPLIERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.7.2 BUYING CRITERIA

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, 2024

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 OpenAPI/Swagger

- 5.11.1.2 gRPC with Protocol Buffers

- 5.11.1.3 NETCONF/RESTCONF

- 5.11.1.4 YANG data models

- 5.11.1.5 gNMI (gRPC network management interface)

- 5.11.1.6 API gateways (e.g., Kong, Apigee Edge)

- 5.11.1.7 OAuth 2.0/OpenID Connect

- 5.11.1.8 Event-driven Webhooks/Kafka Topics

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Service mesh (Istio, Linkerd)

- 5.11.2.2 API lifecycle management platforms

- 5.11.2.3 Network function virtualization (NFV) orchestration

- 5.11.2.4 SDN controllers (OpenDaylight, ONOS)

- 5.11.2.5 Telemetry analytics engines (Prometheus, InfluxDB)

- 5.11.2.6 Policy-control engines (PCRF/PCF)

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 OSS/BSS integration platforms

- 5.11.3.2 Edge orchestration frameworks (KubeEdge, OpenNESS)

- 5.11.3.3 IoT device management platforms

- 5.11.3.4 Zero-trust network access (ZTNA) gateways

- 5.11.3.5 Intent-based networking engines

- 5.11.3.6 Network assurance & digital twin tools

- 5.11.1 KEY TECHNOLOGIES

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.12.2.1 North America

- 5.12.2.1.1 US

- 5.12.2.2 Europe

- 5.12.2.3 Asia Pacific

- 5.12.2.3.1 India

- 5.12.2.4 Middle East & Africa

- 5.12.2.4.1 UAE

- 5.12.2.5 Latin America

- 5.12.2.5.1 Brazil

- 5.12.2.5.2 Mexico

- 5.12.2.1 North America

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 TECHNOLOGY ROADMAP FOR NETWORK API MARKET

- 5.14.1 SHORT-TERM ROADMAP (2025-2026)

- 5.14.2 MID-TERM ROADMAP (2027-2028)

- 5.14.3 LONG-TERM ROADMAP (2028-2030)

- 5.15 BEST PRACTICES IN NETWORK API MARKET

- 5.15.1 ADOPT JSON FOR DATA EXCHANGE

- 5.15.2 AVOID VERBS IN URLS

- 5.15.3 IMPLEMENT API VERSIONING

- 5.15.4 ENFORCE SECURE AUTHENTICATION AND AUTHORIZATION

- 5.15.5 ENCRYPT ALL DATA TRANSMISSION

- 5.15.6 RATE LIMITING AND THROTTLING

- 5.15.7 LOGGING, MONITORING, AND AUDITING

- 5.15.8 CONDUCT REGULAR SECURITY TESTING

- 5.16 GSMA OPEN GATEWAY AND CAMARA INITIATIVES

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN NETWORK API MARKET

- 5.19 INVESTMENT AND FUNDING SCENARIO

- 5.20 IMPACT OF AI/GENERATIVE AI ON NETWORK API MARKET

- 5.20.1 IMPACT OF GENERATIVE AI IN NETWORK API

- 5.21 IMPACT OF 2025 US TARIFF - NETWORK API MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 NETWORK API MARKET, BY API TYPE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API device status, edge, identity, location, network performance, other API types

- 6.1 INTRODUCTION

- 6.1.1 API TYPE: MARKET DRIVERS

- 6.2 DEVICE STATUS

- 6.2.1 NEED FOR REAL-TIME VISIBILITY AND MANAGEMENT CAPABILITIES TO DRIVE DEMAND

- 6.3 EDGE

- 6.3.1 ULTRA-LOW LATENCY WORKFLOWS TO SPUR EDGE API ADOPTION

- 6.4 IDENTITY

- 6.4.1 INTEGRATION OF REAL-TIME NUMBER VERIFICATION TO DRIVE DEMAND FOR IDENTITY APIS

- 6.5 LOCATION

- 6.5.1 NETWORK-BASED GEOFENCING TO DRIVE DEMAND

- 6.6 NETWORK PERFORMANCE

- 6.6.1 ON-DEMAND QUALITY OF SERVICE TO INCREASE ADOPTION

- 6.7 OTHER API TYPES

7 NETWORK API MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API applications

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: MARKET DRIVERS

- 7.2 IOT

- 7.2.1 AUTOMATING SIM ACTIVATION AND CONFIGURATION VIA SINGLE API ACCELERATES LARGE-SCALE IOT ROLLOUTS

- 7.3 PRIORITY COMMUNICATION

- 7.3.1 EMBEDDING AUTOMATED PRIORITY-CHANNEL RESERVATION TO DRIVE DEMAND FOR PRIORITY COMMUNICATION

- 7.4 AUTONOMOUS VEHICLES

- 7.4.1 ON-THE-FLY ALLOCATION OF DEDICATED NETWORK SLICES VIA API ENABLES RELIABLE TELEOPERATION AND REMOTE CONTROL

- 7.5 ANTI-FRAUD

- 7.5.1 INCORPORATING NETWORK-SIDE IDENTITY VALIDATION INTO TRANSACTION FLOWS VIA API DRAMATICALLY CUTS FRAUD RATES

- 7.6 ENTERTAINMENT & CONTENT DISTRIBUTION

- 7.6.1 EDGE-POWERED ADAPTIVE STREAMING TO DRIVE MARKET

- 7.7 ENTERPRISE IT

- 7.7.1 SINGLE API GATEWAY TO UNIFY MULTI-NETWORK CONNECTIVITY

- 7.8 OTHER APPLICATIONS

8 NETWORK API MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Detailed breakdown of market share and growth across network API vertical

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: MARKET DRIVERS

- 8.2 BFSI

- 8.2.1 MANDATORY API-DRIVEN TRANSACTION AUTHENTICATION TO DRIVE MARKET

- 8.3 IT & ITES

- 8.3.1 ACCELERATION OF APP-TO-NETWORK INTEGRATION TO DRIVE DEMAND

- 8.4 TELECOM

- 8.4.1 MONETIZED NETWORK SLICES THROUGH SELF-SERVICE APIS TO SPUR MARKET

- 8.5 GOVERNMENT & PUBLIC SECTOR

- 8.5.1 STANDARDIZATION OF APIS TO DRIVE MARKET

- 8.6 MANUFACTURING

- 8.6.1 INTEGRATION OF PRECISION INDOOR POSITIONING APIS TO DRIVE SEGMENT

- 8.7 HEALTHCARE & LIFESCIENCES

- 8.7.1 DEMAND FOR NETWORK PERFORMANCE APIS IN TELEHEALTH APPLICATIONS TO DRIVE MARKET

- 8.8 RETAIL & E-COMMERCE

- 8.8.1 DEMAND FOR REAL-TIME LOCATION-BASED PERSONALIZATION TO DRIVE MARKET

- 8.9 MEDIA & ENTERTAINMENT

- 8.9.1 NEED FOR SEAMLESS STREAMING EXPERIENCES TO INCREASE NETWORK API ADOPTION

- 8.10 OTHER VERTICALS

9 NETWORK API MARKET, BY REGION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD))

Regional market sizing, forecasts, and regulatory landscapes

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing focus on 5G-driven API innovation to drive market

- 9.2.3 CANADA

- 9.2.3.1 Accelerating IoT and digital transformation to drive market

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Focus on network API leadership with developer-centric innovation to drive market

- 9.3.3 GERMANY

- 9.3.3.1 Open Gateway to fuel market with identity & QoS APIs

- 9.3.4 FRANCE

- 9.3.4.1 GSMA Open Gateway initiative and Aduna alliance to expand network API ecosystem

- 9.3.5 SPAIN

- 9.3.5.1 Focus on smart city innovations via API integration to drive market

- 9.3.6 RUSSIA

- 9.3.6.1 Emergence of network API landscape with gradual 5G expansion to drive market

- 9.3.7 ITALY

- 9.3.7.1 Advancements in 5G infrastructure and government-led digitization programs to drive market

- 9.3.8 NORDIC COUNTRIES

- 9.3.8.1 Maturing 5G infrastructure to enable API-driven smart applications

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Focus on OTP API commercialization for digital security to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Accelerating network API revolution with Aduna partnerships

- 9.4.4 INDIA

- 9.4.4.1 Widespread 4G/5G adoption and initiatives by Reliance Jio and Bharti Airtel to drive market

- 9.4.5 AUSTRALIA AND NEW ZEALAND

- 9.4.5.1 High smartphone penetration and thriving digital economy to fuel market

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Proactive involvement in global collaborations for unified open API framework to drive market

- 9.4.7 SOUTHEAST ASIA

- 9.4.7.1 Advancements in digital infrastructure to accelerate network API integration

- 9.4.8 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 MIDDLE EAST

- 9.5.2.1 KSA

- 9.5.2.1.1 Vision 2030 to spur leadership in network API innovation

- 9.5.2.2 UAE

- 9.5.2.2.1 Global standards adoption to fuel API-driven innovation

- 9.5.2.3 KUWAIT

- 9.5.2.3.1 Expanding digital services to accelerate API adoption

- 9.5.2.4 BAHRAIN

- 9.5.2.4.1 Progressive digital agenda and rising demand for enterprise-grade connectivity to drive market

- 9.5.2.5 Rest of Middle East

- 9.5.2.1 KSA

- 9.5.3 AFRICA

- 9.5.3.1 Increasing focus on fintech and e-health to drive market

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Strong market momentum to drive network API innovations

- 9.6.3 MEXICO

- 9.6.3.1 Growing digital economy and global collaborations to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

Strategic Profiles of Leading Players & Their Playbooks for Market Dominance

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023-2025

- 10.3 MARKET SHARE ANALYSIS, 2024

- 10.4 REVENUE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 API type footprint

- 10.7.5.4 Application footprint

- 10.7.5.5 Vertical footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILES

In-depth look at their Strengths, Weaknesses, Product Portfolios, Recent Developments, and Strategic Moves

- 11.1 KEY PLAYERS

- 11.1.1 ERICSSON

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 CISCO

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and enhancements

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 NOKIA

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches and enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 MICROSOFT

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 T-MOBILE

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 AT&T

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.7 ORANGE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches and enhancements

- 11.1.7.3.2 Deals

- 11.1.8 DEUTSCHE TELEKOM

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 VODAFONE

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 TELEFONICA

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.1 ERICSSON

- 11.2 OTHER PLAYERS

- 11.2.1 SINGTEL

- 11.2.2 TELSTRA

- 11.2.3 BHARTI AIRTEL

- 11.2.4 HUAWEI

- 11.2.5 ORACLE

- 11.2.6 INFOBIP

- 11.3 STARTUPS/SMES

- 11.3.1 KENTIK

- 11.3.2 OBKIO

- 11.3.3 NETBEEZ

- 11.3.4 GRAPHIANT

- 11.3.5 ALKIRA

- 11.3.6 SHABODI

- 11.3.7 LOTUSFLARE

- 11.3.8 PHOENIXNAP

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 API MANAGEMENT MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 API MANAGEMENT MARKET, BY OFFERING

- 12.2.4 API MANAGEMENT MARKET, BY PLATFORM

- 12.2.5 API MANAGEMENT MARKET, BY ORGANIZATION SIZE

- 12.2.6 API MANAGEMENT MARKET, BY DEVELOPMENT TYPE

- 12.2.7 API MANAGEMENT MARKET, BY VERTICAL

- 12.2.8 API MANAGEMENT MARKET, BY REGION

- 12.3 INTEGRATION PLATFORM AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE

- 12.3.4 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL

- 12.3.5 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.6 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL

- 12.3.7 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 NETWORK API MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON NETWORK API MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 7 LIST OF PATENTS IN NETWORK API MARKET, 2023-2025

- TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- TABLE 9 INDICATIVE PRICING ANALYSIS, BY API TYPE, 2024

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NETWORK API MARKET: KEY CONFERENCES AND EVENTS, 2025

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKETS DUE TO TARIFF IMPACT

- TABLE 17 NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 18 DEVICE STATUS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 19 EDGE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 20 IDENTITY: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 21 LOCATION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 22 NETWORK PERFORMANCE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 OTHER API TYPES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 24 NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 IOT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 26 PRIORITY COMMUNICATION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 AUTONOMOUS VEHICLES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 ANTI-FRAUD: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 ENTERTAINMENT & CONTENT DISTRIBUTION: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ENTERPRISE IT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 OTHER APPLICATIONS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 33 BFSI: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 IT & ITES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 TELECOM: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 GOVERNMENT & PUBLIC SECTOR: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 MANUFACTURING: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 HEALTHCARE & LIFESCIENCES: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 RETAIL & E-COMMERCE: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 MEDIA & ENTERTAINMENT: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 OTHER VERTICALS: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 NORTH AMERICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 44 NORTH AMERICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 46 NORTH AMERICA: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 US: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 48 US: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 49 US: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 50 EUROPE: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 51 EUROPE: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 52 EUROPE: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 53 EUROPE: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 54 UK: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 55 UK: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 56 UK: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 GERMANY: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 58 GERMANY: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 59 GERMANY: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 60 FRANCE: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 61 FRANCE: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 62 FRANCE: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 63 SPAIN: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 64 SPAIN: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 65 SPAIN: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 66 RUSSIA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 67 RUSSIA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 68 RUSSIA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 71 ASIA PACIFIC: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 CHINA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 74 CHINA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 75 CHINA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 JAPAN: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 77 JAPAN: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 78 JAPAN: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 79 INDIA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 80 INDIA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 81 INDIA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 MIDDLE EAST & AFRICA: NETWORK API MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 MIDDLE EAST: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 87 MIDDLE EAST: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 88 MIDDLE EAST: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 MIDDLE EAST: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 90 LATIN AMERICA: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 91 LATIN AMERICA: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 92 LATIN AMERICA: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 LATIN AMERICA: NETWORK API MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 94 BRAZIL: NETWORK API MARKET, BY API TYPE, 2025-2030 (USD MILLION)

- TABLE 95 BRAZIL: NETWORK API MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 96 BRAZIL: NETWORK API MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 97 OVERVIEW OF STRATEGIES DEPLOYED BY KEY NETWORK API MARKET PLAYERS, 2023-APRIL 2025

- TABLE 98 NETWORK API MARKET: DEGREE OF COMPETITION

- TABLE 99 NETWORK API MARKET: REGION FOOTPRINT

- TABLE 100 NETWORK API MARKET: API TYPE FOOTPRINT

- TABLE 101 NETWORK API MARKET: APPLICATION FOOTPRINT

- TABLE 102 NETWORK API MARKET: VERTICAL FOOTPRINT

- TABLE 103 NETWORK API MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 104 NETWORK API MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 105 NETWORK API MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, FEBRUAY 2023-JULY 2025

- TABLE 106 NETWORK API MARKET: DEALS, 2023-JULY 2025

- TABLE 107 ERICSSON: COMPANY OVERVIEW

- TABLE 108 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 110 ERICSSON: DEALS

- TABLE 111 CISCO: COMPANY OVERVIEW

- TABLE 112 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 113 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 114 NOKIA: COMPANY OVERVIEW

- TABLE 115 NOKIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 NOKIA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 117 NOKIA: DEALS

- TABLE 118 MICROSOFT: COMPANY OVERVIEW

- TABLE 119 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 121 T-MOBILE: COMPANY OVERVIEW

- TABLE 122 T-MOBILE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 123 T-MOBILE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 124 AT&T: COMPANY OVERVIEW

- TABLE 125 AT&T: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 127 ORANGE: COMPANY OVERVIEW

- TABLE 128 ORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 ORANGE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 130 ORANGE: DEALS

- TABLE 131 DEUTSCHE TELEKOM: COMPANY OVERVIEW

- TABLE 132 DEUTSCHE TELEKOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 DEUTSCHE TELEKOM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 134 DEUTSCHE TELEKOM: DEALS

- TABLE 135 VODAFONE: COMPANY OVERVIEW

- TABLE 136 VODAFONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 VODAFONE: DEALS

- TABLE 138 TELEFONICA: COMPANY OVERVIEW

- TABLE 139 TELEFONICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 API MANAGEMENT MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 141 API MANAGEMENT MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 142 API MANAGEMENT PLATFORMS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 143 API MANAGEMENT PLATFORMS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 145 API MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 146 API MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 147 API MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 148 API MANAGEMENT MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 149 API MANAGEMENT MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 150 API MANAGEMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 151 API MANAGEMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 152 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2016-2020 (USD MILLION)

- TABLE 153 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE, 2021-2026 (USD MILLION)

- TABLE 154 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2016-2020 (USD MILLION)

- TABLE 155 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL, 2021-2026 (USD MILLION)

- TABLE 156 INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2016-2020 (USD MILLION)

- TABLE 157 INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- TABLE 158 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2016-2020 (USD MILLION)

- TABLE 159 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 160 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2016-2020 (USD MILLION)

- TABLE 161 INTEGRATION PLATFORM AS A SERVICE MARKET, BY REGION, 2021-2026 (USD MILLION)

List of Figures

- FIGURE 1 NETWORK API MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): NETWORK API MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (DEMAND-SIDE): NETWORK API MARKET

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 NETWORK API MARKET, 2025-2030 (USD MILLION)

- FIGURE 8 NETWORK API MARKET, REGIONAL SHARE, 2025

- FIGURE 9 RISE OF SDN/NFV TECHNOLOGIES TO DRIVE MARKET

- FIGURE 10 IDENTITY SEGMENT AND US TO LEAD MARKET IN NORTH AMERICA IN 2025

- FIGURE 11 IDENTITY SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 IOT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 NETWORK API MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 NETWORK API MARKET: VALUE CHAIN ANALYSIS

- FIGURE 16 NETWORK API MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 NETWORK API MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 20 MAJOR PATENTS APPLIED AND GRANTED FOR NETWORK API, 2015-2024

- FIGURE 21 NETWORK API MARKET: TREND/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 22 AVERAGE SELLING PRICE OF KEY PLAYERS, BY API TYPE, 2024

- FIGURE 23 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN NETWORK API MARKET

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO

- FIGURE 25 IMPACT OF GENERATIVE AI IN NETWORK API

- FIGURE 26 EDGE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 AUTONOMOUS VEHICLES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 MEDIA & ENTERTAINMENT SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 SHARES OF LEADING COMPANIES IN NETWORK API MARKET, 2024

- FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN NETWORK API MARKET, 2024 (USD MILLION)

- FIGURE 33 NETWORK API MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 34 COMPANY VALUATION, 2025

- FIGURE 35 FINANCIAL METRICS OF KEY VENDORS, 2025

- FIGURE 36 NETWORK API MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 37 NETWORK API MARKET: COMPANY FOOTPRINT

- FIGURE 38 NETWORK API MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 39 ERICSSON: COMPANY SNAPSHOT

- FIGURE 40 CISCO: COMPANY SNAPSHOT

- FIGURE 41 NOKIA: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 T-MOBILE: COMPANY SNAPSHOT

- FIGURE 44 AT&T: COMPANY SNAPSHOT

- FIGURE 45 ORANGE: COMPANY SNAPSHOT

- FIGURE 46 DEUTSCHE TELEKOM: COMPANY SNAPSHOT

- FIGURE 47 VODAFONE: COMPANY SNAPSHOT

- FIGURE 48 TELEFONICA: COMPANY SNAPSHOT