|

市场调查报告书

商品编码

1810324

全球热交换器市场(按类型、材料、最终用途产业和地区划分)-预测至2030年Heat Exchanger Market by Type (Shell & Tube, Plate & Frame, Air Cooled), Material (Metals, Alloys, Brazing Clad Materials), End-use Industry (Chemical, Energy, HVACR, Food & Beverage, Power, Pulp & Paper), and Region - Global Forecast to 2030 |

||||||

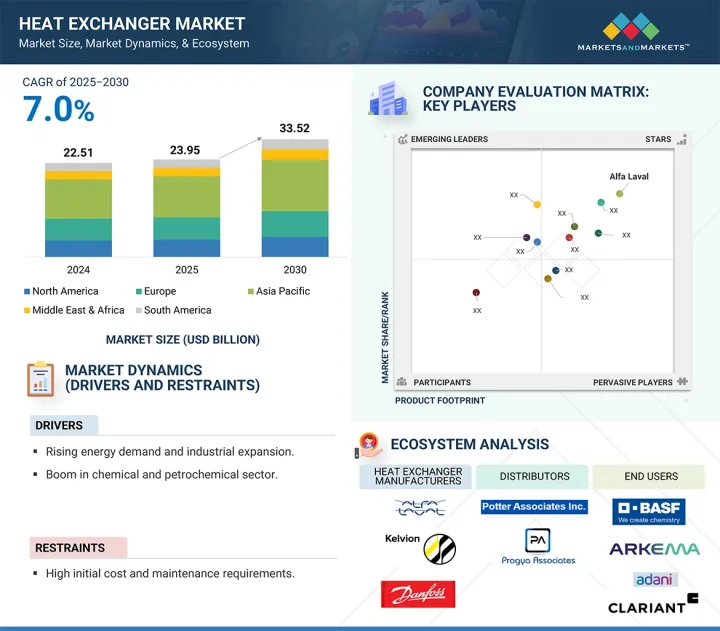

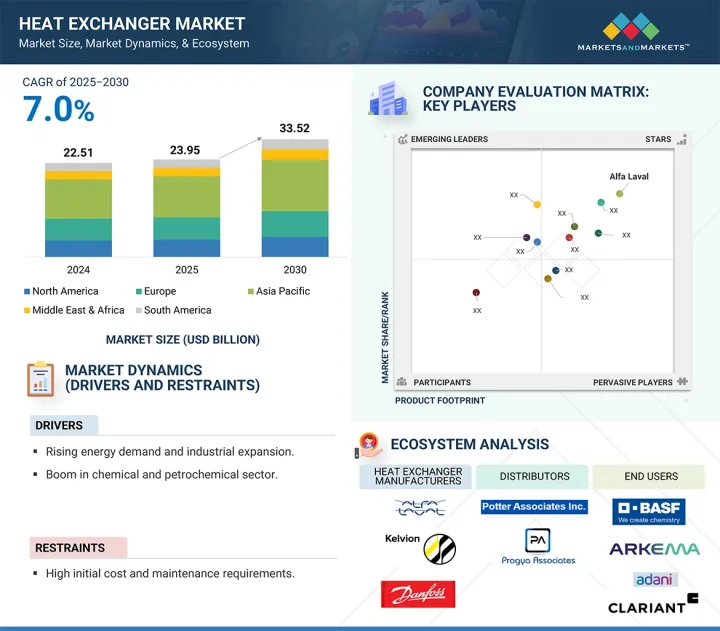

预计热交换器市场规模将从 2025 年的 239.5 亿美元成长到 2030 年的 335.2 亿美元,预测期间的复合年增长率为 7.0%。

热交换器市场主要受到快速工业化、全球能源需求上升以及发电、石油和天然气、化学、暖通空调、食品加工、製药等行业对节能係统日益增长的需求的推动。随着各行各业旨在透过改善温度控管来减少排放和营运成本,更严格的环境法规和对废热回收日益增长的兴趣进一步加速了热交换器的采用。

| 调查范围 | |

|---|---|

| 调查年份 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(百万美元) 数量(单位) |

| 部分 | 按类型、材料、最终用途行业和地区 |

| 目标区域 | 北美、欧洲、亚太地区、南美、中东和非洲 |

此外,亚太、拉丁美洲和中东地区的新兴经济体正在大力投资基础设施、製造业和能源计划,对新装机和替换设备的需求强劲。然而,市场成长面临许多限制因素,例如高昂的初始投资成本(尤其是先进和专业的热交换器),以及在高污染和腐蚀环境中的维护挑战。

风冷式热交换器 (ACHE) 是一种利用环境空气(而非水)作为冷却介质来散发製程流体热的热系统。它由翅片管或盘管组成,热的製程流体流经这些管或盘管,风扇将环境空气吹过表面以促进传热。与管壳式和板式热交换器不同,ACHE 不需要大量冷却水,因此特别适用于水资源短缺或水处理成本高的地区。 ACHE 广泛应用于石油天然气、石化、发电、化学加工以及其他需要在户外环境中可靠、持续冷却的产业。其模组化和灵活的设计使其可扩充性以适应各种容量需求,并且无需冷却水系统,从而降低了维护和操作的复杂性。日益增长的环境问题、日益严格的用水法规以及水冷系统不断增长的营运成本推动了风冷式热交换器的日益普及。随着各行各业寻求永续的冷却解决方案以减少对水的依赖,风冷式热交换器越来越受欢迎,尤其是在干旱地区和海上设施。在水资源有限或无法进入冷却塔进行维护的偏远或危险地区,风冷式热交换器也是首选。

化学工业是热交换器最重要的终端应用领域之一。这些系统对于精确的温度控制、高效的热回收以及在加热、冷却、冷凝和蒸发等製程中安全处理腐蚀性或高黏度流体至关重要。在亚太地区,需求主要来自中国庞大的石化和特种化学品生产、印度快速扩张的超过 2,200 亿美元的化学工业,以及日本先进的特种製造业,这些产业需要高品质的耐腐蚀设计。北美受益于低成本的页岩气原料,推动了美国的产能扩张和维修。在欧洲,尤其是在德国、法国和荷兰,严格的能源效率和环境法规正在刺激先进、永续的热交换系统的应用。中东和非洲,主要是沙乌地阿拉伯、阿拉伯联合大公国和卡达,对需要大型耐用设备的大型石化大型企划的需求强劲。拉丁美洲(主要是巴西)的聚合物、农业化学品和炼油计划相关的化学製造业正在稳步增长。在这些地区,能源成本的上升、减少二氧化碳排放的动力以及对可靠、高性能设备的需求,正在强化化学工业作为全球热交换器市场关键驱动力的作用。

欧洲占据全球热交换器市场的最大份额,这得益于成熟的工业基础、严格的能源效率法规以及对永续技术的高度重视。该地区拥有成熟的工业,包括化学品、发电、石油和天然气、暖通空调、食品和饮料以及製药,对高性能热交换系统的需求稳定。欧盟关于能源效率、排放和废热回收的指令正在加速采用先进设计,例如板框式和紧凑式热交换器,以优化热性能并降低营业成本。德国、法国和义大利等国家在製造业和工业创新方面处于领先地位,其中德国是化学加工和工程专业知识的中心,法国在核能发电雄厚,义大利则因食品加工产业强劲而推动需求。英国的可再生能源计划,加上其供热和製冷基础设施的现代化,正在进一步推动市场成长。此外,在欧洲绿色交易的支持下,欧洲的脱碳运动正在刺激对区域供热和製冷网路以及製造工厂废热回收的投资。

本报告研究了全球热交换器市场,按类型、材料、最终用途行业和地区进行细分,并提供了参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

第六章 产业趋势

- 介绍

- 价值链分析

- 监管状况

- 贸易分析

- 定价分析

- 投资金筹措场景

- 生态系统

- 影响客户业务的趋势/中断

- 技术分析

- 案例研究分析

- 2025-2026年主要会议和活动

- 专利分析

第七章热交换器市场(按类型)

- 介绍

- 管壳式热交换器

- 板框式热交换器

- 空气冷却热交换器

- 其他的

第八章 热交换器市场(依材质)

- 介绍

- 金属

- 合金

- 硬焊复合材料

9. 热交换器市场(依最终用途产业)

- 介绍

- 化学品

- 活力

- 暖通空调和製冷

- 食品/饮料

- 电力

- 纸浆和造纸

- 其他的

第 10 章热交换器市场(按地区)

- 介绍

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 土耳其

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 其他的

第十一章 竞争格局

- 概述

- 主要参与企业的策略

- 收益分析

- 市场占有率分析

- 估值和财务指标

- 品牌比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争情境和趋势

第十二章:公司简介

- 主要参与企业

- ALFA LAVAL

- KELVION HOLDING GMBH

- DANFOSS

- EXCHANGER INDUSTRIES LIMITED

- MERSEN

- API HEAT TRANSFER

- BOYD

- JOHNSON CONTROLS

- XYLEM

- WABTEC CORPORATION

- SPX FLOW

- LU-VE GROUP

- LENNOX INTERNATIONAL INC.

- MODINE MANUFACTURING COMPANY

- WIELAND

- 其他公司

- AIR PRODUCTS AND CHEMICALS, INC.

- BARRIQUAND HEAT EXCHANGERS

- BRASK, INC.

- CATARACT STEEL

- CHART INDUSTRIES

- DOOSAN CORPORATION

- FUNKEWARMETAUSCHER APPARATEBAU GMBH

- HISAKA WORKS, LTD.

- HINDUSTAN DORR-OLIVER LTD.

- KOCH HEAT TRANSFER COMPANY

- RADIANT HEAT EXCHANGER PVT. LTD.

- SWEP INTERNATIONAL AB

- THERMAX LIMITED

- SIERRA SPA

- VAHTERUS OY

第十三章 附录

The heat exchanger market is projected to reach USD 33.52 billion by 2030 from USD 23.95 billion in 2025, at a CAGR of 7.0% during the forecast period. The heat exchanger market is primarily driven by rapid industrialization, rising global energy demand, and the increasing need for energy-efficient systems across industries such as power generation, oil and gas, chemicals, HVAC, food processing, and pharmaceuticals. Stricter environmental regulations and a growing focus on waste heat recovery further accelerate adoption, as industries seek to reduce emissions and operational costs through improved thermal management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Unit) |

| Segments | Type, Material, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

Additionally, emerging economies in the Asia Pacific, Latin America, and the Middle East are investing heavily in infrastructure, manufacturing, and energy projects, creating significant demand for both new installations and replacement units. However, market growth faces restraints such as high initial investment costs, especially for advanced and specialized heat exchangers, along with maintenance challenges in high-fouling or corrosive environments.

"Air cooled heat exchanger type is projected to be the second fastest-growing segment in the heat exchanger market during the forecast period"

Air cooled heat exchangers (ACHEs) are thermal systems that use ambient air, rather than water, as the cooling medium to dissipate heat from process fluids. They consist of finned tubes or coils through which hot process fluid flows, with fans blowing atmospheric air over the surface to facilitate heat transfer. Unlike shell-and-tube or plate heat exchangers, ACHEs do not require large quantities of cooling water, making them particularly suitable for regions facing water scarcity or where water treatment costs are high. They are widely used in oil and gas, petrochemicals, power generation, chemical processing, and other industries where reliable, continuous cooling is required in outdoor environments. Their modular and flexible design allows easy scalability for different capacity requirements, while the absence of cooling water systems reduces maintenance and operational complexity. The growing adoption of air-cooled heat exchangers is fueled by rising environmental concerns, tightening water usage regulations, and the increasing operational costs of water-based cooling systems. With industries seeking sustainable cooling solutions that reduce water dependency, ACHEs are gaining prominence, especially in arid regions and offshore installations. They are also favored in remote or hazardous locations where water supply is limited or where maintenance access to cooling towers is impractical.

"The chemical segment is projected to be the largest segment in the heat exchanger market during the forecast period"

The chemical industry is one of the most critical end-use sectors for heat exchangers, as these systems are essential for precise temperature regulation, efficient heat recovery, and safe handling of corrosive or high-viscosity fluids across processes such as heating, cooling, condensation, and evaporation. In the Asia Pacific, demand is fueled by China's massive petrochemical and specialty chemical output, India's rapidly expanding USD 220+ billion chemical sector, and Japan's advanced specialty manufacturing requiring high-quality, corrosion-resistant designs. North America benefits from low-cost shale gas feedstock, driving capacity expansions and retrofits in the US, while Europe's stringent energy-efficiency and environmental regulations-especially in Germany, France, and the Netherlands-spur adoption of advanced, sustainable heat transfer systems. The Middle East & Africa, led by Saudi Arabia, the UAE, and Qatar, sees heavy demand from petrochemical megaprojects requiring large, durable units, and Latin America, particularly Brazil, is experiencing steady growth in chemical manufacturing linked to polymer, agrochemical, and refining projects. Across these regions, rising energy costs, the push for carbon reduction, and the need for reliable, high-performance equipment are reinforcing the chemical industry's role as a key growth driver for the global heat exchanger market.

"The Europe market is projected to largest for heat exchangers during the forecast period"

Europe holds the largest share of the global heat exchanger market, driven by its mature industrial base, stringent energy-efficiency regulations, and strong focus on sustainable technologies. The region's well-established industries-including chemicals, power generation, oil and gas, HVAC, food and beverage, and pharmaceuticals-create consistent demand for high-performance heat transfer systems. EU directives on energy efficiency, emission reduction, and waste heat recovery have accelerated the adoption of advanced designs, such as plate-and-frame and compact heat exchangers, to optimize thermal performance while reducing operational costs. Countries like Germany, France, and Italy lead in manufacturing and industrial innovation, with Germany being a hub for chemical processing and engineering expertise, France excelling in nuclear power generation, and Italy driving demand from its robust food processing sector. The UK's growing renewable energy initiatives, coupled with modernization in its heating and cooling infrastructure, further support market growth. Additionally, Europe's push toward decarbonization-supported by the European Green Deal-has spurred investments in district heating and cooling networks, as well as waste heat recovery in manufacturing plants.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of interviews with experts is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Alfa Laval (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), BOYD (US), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US) ,SPX Flow (US), Lennox International Inc. (US), Modine Manufacturing Company (US), Wieland (Germany), and Air Products & Chemicals, Inc. (US), among others are some of the key players in the heat exchanger market.

The study includes an in-depth competitive analysis of these key players in the heat exchanger market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the heat exchanger market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, material, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their positions in the heat exchanger market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall heat exchanger market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the positions of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Increasing industrialization in emerging economies, rising energy efficiency regulations and stringent emission standards, Growing demand for HVAC & refrigeration equipment), restraints (Fluctuation in raw material prices, Lack awareness in energy efficiency), opportunities (Growth number of nuclear power plants), challenges (Regulations concerning fluorinated greenhouse gases, Capital intensive market)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the heat exchanger market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the heat exchanger market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Alfa Laval (Sweden), Kelvion Holding GmbH (Germany), Danfoss (Denmark), Exchanger Industries Limited (Canada), Mersen (France), API Heat Transfer (US), BOYD (US), Johnson Controls (Ireland), Xylem (US), Wabtec Corporation (US), SPX Flow (US), Lennox International Inc. (US), Modine Manufacturing Company (US), Wieland (Germany), and Air Products & Chemicals, Inc. (US), among others are the top manufacturers covered in the heat exchanger market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SPREAD

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HEAT EXCHANGER MARKET

- 4.2 HEAT EXCHANGER MARKET, BY TYPE

- 4.3 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY

- 4.4 HEAT EXCHANGER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing industrialization in emerging economies

- 5.2.1.2 Rising energy efficiency regulations and stringent emission standards

- 5.2.1.3 Growing demand for HVAC & refrigeration equipment

- 5.2.1.4 Growing demand for heat pumps

- 5.2.1.5 Rising demand for sustainable, low energy consumption, and cost-effective heat exchangers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuation in raw material prices

- 5.2.2.2 Lack of awareness of energy efficiency

- 5.2.2.3 Growing demand for battery electric vehicles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing number of nuclear power plants

- 5.2.3.2 Growing aftermarket of heat exchangers

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulations concerning fluorinated greenhouse gases

- 5.2.4.2 Capital-intensive market

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.5.2 OIL & GAS STATISTICS

- 5.5.3 POWER GENERATION STATISTICS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Europe

- 6.3.1.3 Asia Pacific

- 6.3.2 STANDARDS

- 6.3.2.1 ISO 27.060.30

- 6.3.2.2 BS EN 308:2022

- 6.3.2.3 ASME Boiler and Pressure Vessel Code (BPVC)

- 6.3.2.4 Tubular Exchanger Manufacturers Association (TEMA) Standards

- 6.3.2.5 API (American Petroleum Institute) Standards

- 6.3.2.6 PD500 Standards

- 6.3.2.7 EN 13445 Standards

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 841950)

- 6.4.2 EXPORT SCENARIO (HS CODE 841950)

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.5.2 AVERAGE SELLING PRICE TREND, BY TYPE, 2024-2030

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.6 INVESTMENT AND FUNDING SCENARIO

- 6.7 ECOSYSTEM

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Multi-functional heat exchangers

- 6.9.1.2 Nanotechnology-enhanced heat exchangers

- 6.9.2 COMPLEMENTARY TECHNOLOGIES

- 6.9.2.1 3D-printed heat exchangers

- 6.9.2.2 Compact and microgroove heat exchangers

- 6.9.1 KEY TECHNOLOGIES

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 API HEAT TRANSFER

- 6.10.2 BOYD

- 6.10.3 API HEAT TRANSFER

- 6.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.12 PATENT ANALYSIS

- 6.12.1 METHODOLOGY

- 6.12.2 PATENT TYPES

- 6.12.3 PUBLICATION TRENDS

- 6.12.4 INSIGHTS

- 6.12.5 JURISDICTION ANALYSIS

- 6.12.6 TOP APPLICANTS

7 HEAT EXCHANGER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 SHELL & TUBE HEAT EXCHANGERS

- 7.2.1 INCREASING DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

- 7.2.2 TUBULAR HEAT EXCHANGERS

- 7.2.3 FIXED TUBE HEAT EXCHANGERS

- 7.2.4 U-TUBE HEAT EXCHANGERS

- 7.2.5 FLOATING HEAD HEAT EXCHANGERS

- 7.3 PLATE & FRAME HEAT EXCHANGERS

- 7.3.1 COST-EFFECTIVENESS AND DURABILITY TO DRIVE MARKET

- 7.3.2 GASKETED PLATE & FRAME HEAT EXCHANGERS

- 7.3.3 WELDED PLATE & FRAME HEAT EXCHANGERS

- 7.3.4 BRAZED HEAT EXCHANGERS

- 7.4 AIR COOLED HEAT EXCHANGERS

- 7.4.1 INCREASING USE IN CHEMICAL AND ENERGY INDUSTRIES TO DRIVE MARKET

- 7.4.2 FORCED DRAFT HEAT EXCHANGERS

- 7.4.3 INDUCED DRAFT HEAT EXCHANGERS

- 7.5 OTHER TYPES

- 7.5.1 EXTENDED SURFACE HEAT EXCHANGERS

- 7.5.2 REGENERATIVE HEAT EXCHANGERS

8 HEAT EXCHANGER MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.1.1 METALS

- 8.1.1.1 High thermal conductivity and durability to drive market

- 8.1.1.2 Steel

- 8.1.1.2.1 Carbon steel

- 8.1.1.2.2 Stainless steel

- 8.1.1.3 Copper

- 8.1.1.4 Aluminum

- 8.1.1.5 Titanium

- 8.1.1.6 Nickel

- 8.1.1.7 Other metals

- 8.1.2 ALLOYS

- 8.1.2.1 Extreme environmentally friendly nature to drive market

- 8.1.2.2 Nickel alloys

- 8.1.2.2.1 Hastelloy alloys

- 8.1.2.2.2 Inconel alloys

- 8.1.2.2.3 Monel alloys

- 8.1.2.2.4 Other nickel alloys

- 8.1.2.3 Copper alloys

- 8.1.2.4 Titanium alloys

- 8.1.2.5 Other alloys

- 8.1.3 BRAZING CLAD MATERIALS

- 8.1.3.1 Enhanced corrosion resistance and thermal conductivity to drive market

- 8.1.3.2 Copper brazing

- 8.1.3.3 Ni clad brazing

- 8.1.3.4 Phosphor copper brazing

- 8.1.3.5 Silver brazing

- 8.1.3.6 Other brazing clad materials

- 8.1.1 METALS

9 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 CHEMICALS

- 9.2.1 GROWING CHEMICAL INDUSTRY TO DRIVE MARKET

- 9.2.2 BASE CHEMICALS

- 9.2.3 INTERMEDIATE CHEMICALS

- 9.2.4 SPECIALTY CHEMICALS

- 9.3 ENERGY

- 9.3.1 INCREASING USE FOR HEAT RECOVERY TO DRIVE MARKET

- 9.3.2 PETROCHEMICALS

- 9.3.3 OIL & GAS

- 9.4 HVAC & REFRIGERATION

- 9.4.1 POPULATION GROWTH, URBANIZATION, AND RISING INCOME TO DRIVE MARKET

- 9.4.2 DISTRICT HEATING & COOLING

- 9.4.3 COMMERCIAL REFRIGERATION

- 9.4.4 AIR CONDITIONING

- 9.4.5 INDUSTRIAL REFRIGERATION

- 9.5 FOOD & BEVERAGES

- 9.5.1 NEED FOR ENERGY EFFICIENCY AND STRINGENT ENVIRONMENTAL REGULATIONS TO DRIVE MARKET

- 9.5.2 PROCESS FOOD

- 9.5.3 DAIRY

- 9.5.4 SUGAR & ETHANOL PRODUCTION

- 9.5.5 OTHER FOOD & BEVERAGES

- 9.6 POWER

- 9.6.1 ENHANCEMENT IN THERMAL MANAGEMENT TO DRIVE MARKET

- 9.6.2 RENEWABLE

- 9.6.3 NON-RENEWABLE

- 9.7 PULP & PAPER

- 9.7.1 REDUCED FUEL CONSUMPTION AND LOWER OPERATING COSTS TO DRIVE MARKET

- 9.8 OTHER END-USE INDUSTRIES

- 9.8.1 METALLURGICAL

- 9.8.2 WASTEWATER TREATMENT

- 9.8.3 MINING

10 HEAT EXCHANGER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Change in efficiency standards by DOE to drive market

- 10.2.2 CANADA

- 10.2.2.1 Availability of vast natural resources & diversified economy to contribute to market growth

- 10.2.3 MEXICO

- 10.2.3.1 Rising population to drive demand for power generation

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Strong economy, substantial investments in end-use industries to drive market

- 10.3.2 FRANCE

- 10.3.2.1 Carbon neutrality initiative and strong chemical industry to influence market growth

- 10.3.3 UK

- 10.3.3.1 Strong end-use industry and favorable business environment to boost market

- 10.3.4 ITALY

- 10.3.4.1 Need for sustainability to drive market

- 10.3.5 RUSSIA

- 10.3.5.1 Oil & gas sector to boost demand for heat exchangers

- 10.3.6 TURKEY

- 10.3.6.1 Urbanization and improving living standards to boost demand

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Rapid industrialization and thriving end-use industries to grow market

- 10.4.2 JAPAN

- 10.4.2.1 Growth in end-use industries to drive market

- 10.4.3 INDIA

- 10.4.3.1 Rapid industrialization in energy and power generation end-use industries to boost demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Strong chemical industry and favorable government policies to boost market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Strong end-use industry to influence market

- 10.5.2 ARGENTINA

- 10.5.2.1 Focus on non-hydro renewable sources to boost demand

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Strong oil & gas industry to drive market

- 10.6.1.2 Qatar

- 10.6.1.2.1 Oil & gas industry contribute to rise in demand for heat exchangers

- 10.6.1.3 Other GCC Countries

- 10.6.1.3.1 Adoption of district cooling systems and rising industrialization to drive market

- 10.6.1.1 Saudi Arabia

- 10.6.2 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Material footprint

- 11.7.5.5 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ALFA LAVAL

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 KELVION HOLDING GMBH

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DANFOSS

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 EXCHANGER INDUSTRIES LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MERSEN

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 API HEAT TRANSFER

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.7 BOYD

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.8 JOHNSON CONTROLS

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.4 MnM view

- 12.1.9 XYLEM

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.4 MnM view

- 12.1.10 WABTEC CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Expansions

- 12.1.10.4 MnM view

- 12.1.11 SPX FLOW

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.2.1 Expansions

- 12.1.11.3 MnM view

- 12.1.12 LU-VE GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Deals

- 12.1.12.3.2 Expansions

- 12.1.12.4 MnM view

- 12.1.13 LENNOX INTERNATIONAL INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.13.4 MnM view

- 12.1.14 MODINE MANUFACTURING COMPANY

- 12.1.14.1 Business overview

- 12.1.14.2 Products/Solutions/Services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.14.4 MnM view

- 12.1.15 WIELAND

- 12.1.15.1 Business overview

- 12.1.15.2 Products/Solutions/Services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.15.3.2 Other developments

- 12.1.15.4 MnM view

- 12.1.1 ALFA LAVAL

- 12.2 OTHER PLAYERS

- 12.2.1 AIR PRODUCTS AND CHEMICALS, INC.

- 12.2.2 BARRIQUAND HEAT EXCHANGERS

- 12.2.3 BRASK, INC.

- 12.2.4 CATARACT STEEL

- 12.2.5 CHART INDUSTRIES

- 12.2.6 DOOSAN CORPORATION

- 12.2.7 FUNKEWARMETAUSCHER APPARATEBAU GMBH

- 12.2.8 HISAKA WORKS, LTD.

- 12.2.9 HINDUSTAN DORR-OLIVER LTD.

- 12.2.10 KOCH HEAT TRANSFER COMPANY

- 12.2.11 RADIANT HEAT EXCHANGER PVT. LTD.

- 12.2.12 SWEP INTERNATIONAL AB

- 12.2.13 THERMAX LIMITED

- 12.2.14 SIERRA S.P.A.

- 12.2.15 VAHTERUS OY

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 REGULATIONS

- TABLE 2 HEAT EXCHANGER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA, BY KEY END-USE INDUSTRY

- TABLE 5 TRENDS OF PER CAPITA GDP, BY COUNTRY, 2020-2023 (USD)

- TABLE 6 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2024-2027

- TABLE 7 OIL PRODUCTION, BY COUNTRY, 2023-2024 (MILLION BARRELS PER DAY)

- TABLE 8 POWER GENERATED IN KEY COUNTRIES, 2022 -2024 (TERAWATT HOUR (TWH))

- TABLE 9 ROLES OF STAKEHOLDERS IN HEAT EXCHANGER VALUE CHAIN

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 HEAT EXCHANGER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 TOP 10 PATENT OWNERS DURING LAST 10 YEARS

- TABLE 15 HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 16 HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 17 HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 18 HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 19 HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 20 HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 21 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 22 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 23 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 24 HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 25 HEAT EXCHANGER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 26 HEAT EXCHANGER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 HEAT EXCHANGER MARKET, BY REGION, 2022-2024 (UNIT)

- TABLE 28 HEAT EXCHANGER MARKET, BY REGION, 2025-2030 (UNIT)

- TABLE 29 NORTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 30 NORTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 31 NORTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 32 NORTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 33 NORTH AMERICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 34 NORTH AMERICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 38 NORTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 39 NORTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 42 NORTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 43 US: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 44 US: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 US: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 46 US: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 47 US: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 48 US: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 49 US: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 50 US: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 51 CANADA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 52 CANADA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 CANADA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 54 CANADA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 55 CANADA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 56 CANADA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 CANADA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 58 CANADA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 59 MEXICO: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 60 MEXICO: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 MEXICO: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 62 MEXICO: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 63 MEXICO: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 64 MEXICO: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 65 MEXICO: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 66 MEXICO: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 67 EUROPE: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 70 EUROPE: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 71 EUROPE: HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 72 EUROPE: HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 74 EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 75 EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 76 EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 77 EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 78 EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 79 EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 80 EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 81 GERMANY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 82 GERMANY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 83 GERMANY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 84 GERMANY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 85 GERMANY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 86 GERMANY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 87 GERMANY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 88 GERMANY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 89 FRANCE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 90 FRANCE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 91 FRANCE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 92 FRANCE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 93 FRANCE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 94 FRANCE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 FRANCE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 96 FRANCE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 97 UK: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 98 UK: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 99 UK: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 100 UK: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 101 UK: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 102 UK: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 UK: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 104 UK: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 105 ITALY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 106 ITALY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 107 ITALY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 108 ITALY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 109 ITALY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 110 ITALY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 111 ITALY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 112 ITALY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 113 RUSSIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 114 RUSSIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 115 RUSSIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 116 RUSSIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 117 RUSSIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 118 RUSSIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 RUSSIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 120 RUSSIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 121 TURKEY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 122 TURKEY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 123 TURKEY: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 124 TURKEY: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 125 TURKEY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 126 TURKEY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 TURKEY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 128 TURKEY: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 129 REST OF EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 130 REST OF EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 REST OF EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 132 REST OF EUROPE: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 133 REST OF EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 134 REST OF EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 136 REST OF EUROPE: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 137 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 140 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 141 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 146 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 147 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 150 ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 151 CHINA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 152 CHINA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 154 CHINA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 155 CHINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 156 CHINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 157 CHINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 158 CHINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 159 JAPAN: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 160 JAPAN: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 161 JAPAN: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 162 JAPAN: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 163 JAPAN: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 164 JAPAN: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 165 JAPAN: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 166 JAPAN: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 167 INDIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 168 INDIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 169 INDIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 170 INDIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 171 INDIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 172 INDIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 173 INDIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 174 INDIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 175 SOUTH KOREA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 176 SOUTH KOREA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 SOUTH KOREA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 178 SOUTH KOREA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 179 SOUTH KOREA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 180 SOUTH KOREA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH KOREA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 182 SOUTH KOREA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 183 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 184 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 186 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 187 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 190 REST OF ASIA PACIFIC: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 191 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 192 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 193 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 194 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 195 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 196 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 197 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 198 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 199 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 200 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 201 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 202 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 203 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 204 SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 205 BRAZIL: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 206 BRAZIL: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 207 BRAZIL: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 208 BRAZIL: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 209 BRAZIL: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 210 BRAZIL: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 BRAZIL: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 212 BRAZIL: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 213 ARGENTINA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 214 ARGENTINA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 215 ARGENTINA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 216 ARGENTINA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 217 ARGENTINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 218 ARGENTINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 219 ARGENTINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 220 ARGENTINA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 221 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 222 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 223 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 224 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 225 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 226 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 227 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 228 REST OF SOUTH AMERICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 229 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2022-2024 (UNIT)

- TABLE 232 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY COUNTRY, 2025-2030 (UNIT)

- TABLE 233 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2022-2024 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 238 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 239 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 242 MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 243 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 244 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 245 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 246 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 247 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 248 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 249 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 250 SAUDI ARABIA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 251 QATAR: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 252 QATAR: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 253 QATAR: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 254 QATAR: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 255 QATAR: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 256 QATAR: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 257 QATAR: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 258 QATAR: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 259 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 260 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 261 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 262 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 263 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 264 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 265 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 266 OTHER GCC COUNTRIES: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2022-2024 (UNIT)

- TABLE 270 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY TYPE, 2025-2030 (UNIT)

- TABLE 271 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (USD MILLION)

- TABLE 272 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 273 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2022-2024 (UNIT)

- TABLE 274 REST OF MIDDLE EAST & AFRICA: HEAT EXCHANGER MARKET, BY END-USE INDUSTRY, 2025-2030 (UNIT)

- TABLE 275 HEAT EXCHANGER MARKET: DEGREE OF COMPETITION

- TABLE 276 HEAT EXCHANGER MARKET: COMPANY FOOTPRINT

- TABLE 277 HEAT EXCHANGER MARKET: REGION FOOTPRINT

- TABLE 278 HEAT EXCHANGER MARKET: TYPE FOOTPRINT

- TABLE 279 HEAT EXCHANGER MARKET: MATERIAL FOOTPRINT

- TABLE 280 HEAT EXCHANGER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 281 HEAT EXCHANGER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 282 HEAT EXCHANGER MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 283 HEAT EXCHANGER MARKET: PRODUCT LAUNCHES, JANUARY 2019-AUGUST 2025

- TABLE 284 HEAT EXCHANGER MARKET: DEALS, JANUARY 2019 - AUGUST 2025

- TABLE 285 HEAT EXCHANGER MARKET: EXPANSIONS, JANUARY 2019-AUGUST 2025

- TABLE 286 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 287 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 ALFA LAVAL: PRODUCT LAUNCHES

- TABLE 289 ALFA LAVAL: DEALS

- TABLE 290 ALFA LAVAL: EXPANSIONS

- TABLE 291 KELVION HOLDING GMBH: COMPANY OVERVIEW

- TABLE 292 KELVION HOLDING GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 KELVION HOLDING GMBH: PRODUCT LAUNCHES

- TABLE 294 KELVION HOLDING GMBH: EXPANSIONS

- TABLE 295 DANFOSS: COMPANY OVERVIEW

- TABLE 296 DANFOSS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 DANFOSS: PRODUCT LAUNCHES

- TABLE 298 DANFOSS: DEALS

- TABLE 299 DANFOSS: EXPANSIONS

- TABLE 300 EXCHANGER INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 301 EXCHANGER INDUSTRIES LIMITED: PRODUCT OFFERINGS

- TABLE 302 EXCHANGER INDUSTRIES LIMITED: PRODUCT LAUNCHES

- TABLE 303 EXCHANGER INDUSTRIES LIMITED: DEALS

- TABLE 304 MERSEN: COMPANY OVERVIEW

- TABLE 305 MERSEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 MERSEN: PRODUCT LAUNCHES

- TABLE 307 MERSEN: DEALS

- TABLE 308 API HEAT TRANSFER: COMPANY OVERVIEW

- TABLE 309 API HEAT TRANSFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 BOYD: COMPANY OVERVIEW

- TABLE 311 BOYD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 BOYD: DEALS

- TABLE 313 BOYD: EXPANSIONS

- TABLE 314 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 315 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 JOHNSON CONTROLS: PRODUCT LAUNCHES

- TABLE 317 XYLEM: COMPANY OVERVIEW

- TABLE 318 XYLEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 XYLEM: PRODUCT LAUNCHES

- TABLE 320 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 321 WABTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 WABTEC CORPORATION: DEALS

- TABLE 323 WABTEC CORPORATION: EXPANSIONS

- TABLE 324 SPX FLOW: COMPANY OVERVIEW

- TABLE 325 SPX FLOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SPX FLOW: EXPANSIONS

- TABLE 327 LU-VE GROUP: COMPANY OVERVIEW

- TABLE 328 LU-VE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 LU-VE GROUP: DEALS

- TABLE 330 LU-VE GROUP: EXPANSIONS

- TABLE 331 LENNOX INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 332 LENNOX INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 LENNOX INTERNATIONAL INC.: EXPANSIONS

- TABLE 334 MODINE MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 335 MODINE MANUFACTURING COMPANY: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 336 MODINE MANUFACTURING COMPANY: DEALS

- TABLE 337 WIELAND: COMPANY OVERVIEW

- TABLE 338 WIELAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 339 WIELAND: DEALS

- TABLE 340 WIELAND: OTHER DEVELOPMENTS

- TABLE 341 HISAKA WORKS, LTD.: COMPANY OVERVIEW

- TABLE 342 HINDUSTAN DORR-OLIVER LTD.: COMPANY OVERVIEW

- TABLE 343 KOCH HEAT TRANSFER COMPANY: COMPANY OVERVIEW

- TABLE 344 RADIANT HEAT EXCHANGER PVT. LTD.: COMPANY OVERVIEW

- TABLE 345 SWEP INTERNATIONAL AB: COMPANY OVERVIEW

- TABLE 346 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 347 SIERRA S.P.A.: COMPANY OVERVIEW

- TABLE 348 VAHTERUS OY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HEAT EXCHANGER MARKET: SEGMENTATION

- FIGURE 2 HEAT EXCHANGER MARKET: RESEARCH DESIGN

- FIGURE 3 HEAT EXCHANGER MARKET: BOTTOM-UP APPROACH

- FIGURE 4 HEAT EXCHANGER MARKET: TOP-DOWN APPROACH

- FIGURE 5 HEAT EXCHANGER MARKET: DATA TRIANGULATION

- FIGURE 6 SHELL & TUBE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HEAT EXCHANGER MARKET IN 2030

- FIGURE 7 METALS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HEAT EXCHANGER MARKET IN 2030

- FIGURE 8 CHEMICAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HEAT EXCHANGER MARKET IN 2030

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR HEAT EXCHANGERS DURING FORECAST PERIOD

- FIGURE 10 EMERGING ECONOMIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS DURING FORECAST PERIOD

- FIGURE 11 PLATE & FRAME SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 HVAC & REFRIGERATION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INDIA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 HEAT EXCHANGER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 HEAT EXCHANGER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY END-USE INDUSTRY

- FIGURE 17 KEY BUYING CRITERIA, BY KEY END-USE INDUSTRY

- FIGURE 18 HEAT EXCHANGER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 19 IMPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 20 EXPORT DATA FOR HS CODE 841950-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 21 AVERAGE SELLING PRICE TREND OF HEAT EXCHANGERS, BY REGION, 2022-2030 (USD/UNIT)

- FIGURE 22 AVERAGE SELLING PRICE TREND OF HEAT EXCHANGERS, BY TYPE, 2024-2030 (USD/UNIT)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF HEAT EXCHANGERS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/UNIT)

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2019-2023 (USD MILLION)

- FIGURE 25 HEAT EXCHANGER MARKET: ECOSYSTEM

- FIGURE 26 TREND/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 27 HEAT EXCHANGER MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 28 NUMBER OF PATENTS YEAR-WISE, 2015-2024

- FIGURE 29 US JURISDICTION REGISTERED HIGHEST PERCENTAGE OF PATENTS, 2015-2024

- FIGURE 30 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 31 PLATE & FRAME HEAT EXCHANGERS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 METALS SEGMENT TO DOMINATE HEAT EXCHANGER MARKET DURING FORECAST PERIOD

- FIGURE 33 HVAC & REFRIGERATION INDUSTRY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 35 NORTH AMERICA: HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 36 EUROPE: HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: HEAT EXCHANGER MARKET SNAPSHOT

- FIGURE 38 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HEAT EXCHANGER MARKET BETWEEN 2019 AND 2025

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES IN HEAT EXCHANGER MARKET, 2022-2024 (USD BILLION)

- FIGURE 40 HEAT EXCHANGER MARKET SHARE ANALYSIS, 2024

- FIGURE 41 COMPANY VALUATION OF LEADING COMPANIES IN HEAT EXCHANGER MARKET, 2024

- FIGURE 42 FINANCIAL METRICS OF LEADING COMPANIES IN HEAT EXCHANGER MARKET, 2024

- FIGURE 43 HEAT EXCHANGER MARKET: BRAND COMPARISON

- FIGURE 44 HEAT EXCHANGER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 45 HEAT EXCHANGER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 46 ALFA LAVAL: COMPANY SNAPSHOT

- FIGURE 47 DANFOSS: COMPANY SNAPSHOT

- FIGURE 48 MERSEN: COMPANY SNAPSHOT

- FIGURE 49 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 50 XYLEM: COMPANY SNAPSHOT

- FIGURE 51 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 52 LU-VE GROUP: COMPANY SNAPSHOT

- FIGURE 53 LENNOX INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 54 MODINE MANUFACTURING COMPANY: COMPANY SNAPSHOT