|

市场调查报告书

商品编码

1811731

全球人工智慧检测器市场(按产品、检测方式、应用、最终用户和地区划分)- 预测至 2030 年AI Detector Market by Offering (Platform, API/SDKs), Detection Modality (AI Generated Text, Image, Video, Voice, Code), Application (Academic Integrity, Plagiarism Detection, Deepfake Detection, Content Authenticity Assessment) - Global Forecast to 2030 |

||||||

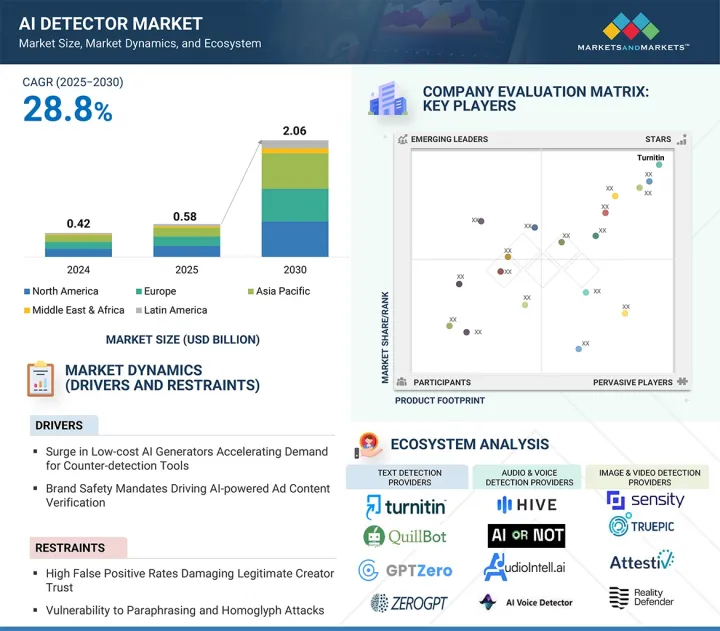

AI检测器市场规模预计将从2025年的约5.8亿美元成长到2030年的20.6亿美元,预测期间的年复合成长率(CAGR)为28.8%。

生成式人工智慧在教育、媒体和企业领域的广泛应用是人工智慧检测器市场的主要驱动力,机构和企业越来越需要工具来确保其数位输出的原创性、保持真实性和完整性。

| 调查范围 | |

|---|---|

| 调查年份 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 美元(百万美元) |

| 部分 | 按产品、按检测方式、按应用、按最终用户、按地区 |

| 目标区域 | 北美、欧洲、亚太地区、中东和非洲、拉丁美洲 |

同时,深度造假、虚假资讯和合成诈骗的风险日益增加,迫切需要可靠的检测技术来维护通讯信任、维护品牌声誉并支持遵守日益严格的法规。然而,儘管发展势头强劲,市场仍面临一个重大限制:检测供应商之间的基准测试标准有限。缺乏普遍认可的绩效指标和评估框架,使得买家难以比较解决方案、评估准确性并衡量长期可靠性,从而减缓了企业范围内的采用速度,并为采购决策带来了不确定性。

在产品细分市场中,平台子细分市场预计将在 2025 年占据最大的市场占有率,这得益于人们越来越偏好将多种检测功能整合到单一介面的端到端解决方案。与独立的 API 和 SDK 相比,平台使企业、教育机构和报导机构能够更有效地管理大规模检测工作流程,而独立的 API 和 SDK 通常需要额外的整合和客製化。许多供应商正在透过多模态检测、效能追踪和报告仪表板等功能增强其平台,使其对寻求解决合规性和简化管治的组织更具吸引力。平台能够支援各种使用案例,从学术诚信到品牌安全和错误讯息监控,这使它们成为大规模部署的核心产品。随着受监管行业和大容量内容生态系统中平台的采用率不断提高,平台为相关人员提供了更大的营运控制权、更轻鬆的审核和更快的实施,从而加强了他们在该领域的领导地位。

在应用领域中,学术诚信子领域预计将在 2025 年占据最大的市场占有率,这得益于学校、大学和线上学习平台中人工智慧检测工具的日益整合。随着学生产生的人工智慧的迅速普及,教育机构正在优先考虑能够识别人工智慧辅助挑战、维护评估公平性和保护证书完整性的解决方案。学习管理系统和数位评估平台正在整合检测功能,以大规模解决这些问题,大学也在正式製定学术政策,强制使用此类工具。供应商也越来越多地提供与机构要求直接相关的功能,例如抄袭检测、风格分析和即时内容检验。远距和混合学习的持续扩展进一步刺激了需求,越来越依赖可靠的检验方法来维护对数位教育生态系统的信任。这种强劲而持续的需求使学术诚信成为人工智慧检测器市场的关键应用领域。

全球人工智慧检测器市场发展势头强劲,预计到 2025 年北美将占据最大市场占有率,而 2030 年亚太地区预计将实现最快成长。北美的领先地位得益于成熟的数位基础设施、早期采用的人工智慧管治框架,以及在教育、媒体和金融服务等领域提供企业级解决方案的知名供应商。美国和加拿大的大学和企业用户越来越多地将人工智慧检测工具纳入其学术、编辑和合规工作流程中,从而形成了可持续的需求基础。同时,随着中国、印度、日本和韩国等国家加速数位转型并加强对人工智慧使用的法律规范,亚太地区正成为一个快速成长的市场。该地区教育科技生态系统的兴起,加上对虚假资讯、合成媒体和选举安全日益增长的担忧,正促使机构和企业寻求可扩展的检测平台。此外,中国和日本政府主导的人工智慧内容监管倡议,以及印度和东南亚地区新兴企业的快速扩张,为新的发展创造了肥沃的土壤。这些动态共同凸显了北美作为全球市场收益中心的地位,以及亚太地区作为未来成长潜力最大的地区的地位,使得这两个地区在塑造供应商的竞争策略方面都至关重要。

本报告研究了全球人工智慧检测器市场,并根据产品、检测方式、应用、最终用户、区域趋势和参与市场的公司概况对其进行细分。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章市场概况及产业趋势

- 介绍

- 市场动态

- AI检测器市场的演变

- 供应链分析

- 生态系分析

- 投资状况及资金筹措情景

- 案例研究分析

- 技术分析

- 监管状况

- 专利分析

- 定价分析

- 大型会议及活动

- 波特五力分析

- 主要相关人员和采购标准

- 影响客户业务的趋势/中断

6. 人工智慧检测器市场(依产品分类)

- 介绍

- 平台

- API/SDK

7. AI检测器市场(依检测方式)

- 介绍

- 人工智慧生成的文本

- 人工智慧生成的图像和影片

- 人工智慧生成的音讯和语音

- AI产生的程式码

- 多模态

第 8 章:AI检测器市场(按应用)

- 介绍

- 学术诚信

- 内容可信度评估

- 抄袭检测

- 深度造假和合成媒体侦测

- 程式码真实性检查

- 检测错误讯息和虚假讯息

- 其他的

第 9 章 AI检测器市场(按最终用户划分)

- 介绍

- BFSI

- 医疗保健和生命科学

- 媒体与娱乐

- 教育

- 法律

- 软体和技术供应商

- 政府和国防

- 消费者

- 其他的

第十章 AI检测器市场(按地区)

- 介绍

- 北美洲

- 北美:人工智慧检测器市场驱动因素

- 北美:宏观经济展望

- 美国

- 加拿大

- 欧洲

- 欧洲:人工智慧检测器市场驱动因素

- 欧洲:宏观经济展望

- 英国

- 德国

- 法国

- 其他的

- 亚太地区

- 亚太地区:人工智慧检测器市场驱动因素

- 亚太地区:宏观经济展望

- 中国

- 印度

- 日本

- 其他的

- 中东和非洲

- 中东和非洲:人工智慧检测器市场驱动因素

- 中东与非洲:宏观经济展望

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他的

- 拉丁美洲

- 拉丁美洲:人工智慧检测器市场驱动因素

- 拉丁美洲:宏观经济展望

- 巴西

- 墨西哥

- 其他的

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势,2022-2025

- 2024年市场占有率分析

- 产品比较分析

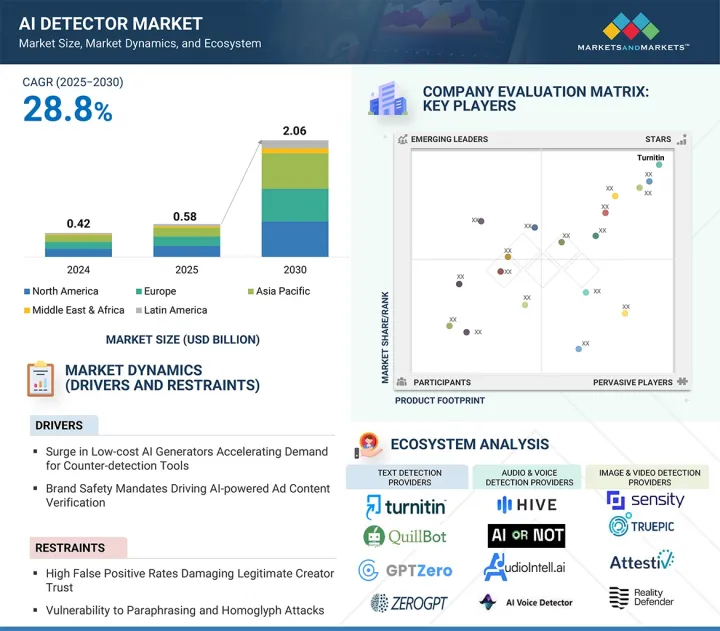

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:其他公司,2024 年

- 竞争场景

第十二章:公司简介

- 介绍

- 主要参与企业

- TURNITIN

- GRAMMARLY

- HIVE MODERATION

- COPYLEAKS

- QUILLBOT

- REALITY DEFENDER

- ATTESTIV

- GPTZERO

- TRUEPIC

- BRANDWELL AI

- COMPILATIO

- QUETEXT

- SENSITY

- DUCKDUCKGOOSE

- PINDROP

- SCRIBBR

- RESEMBLE AI

- BLACKBIRD.AI

- 其他公司

- ORIGINALITY.AI

- SIGHTENGINE

- WRITER.COM

- PERFIOS

- AI OR NOT

- AI DETECTOR PRO(AIDP)

- SMODIN

- SURFER

- SCALENUT

- WINSTON AI

- ILLUMINARTY

- CROSSPLAG

- ZEROGPT

- SAPLING.AI

- PANGRAM LABS

- TRACEGPT(PLAGIARISMCHECKER)

- FACIA.AI

第十三章:相邻市场与相关市场

第十四章 附录

The AI detector market is anticipated to grow at a compound annual growth rate (CAGR) of 28.8% during the forecast period, from an estimated USD 0.58 billion in 2025 to USD 2.06 billion by 2030. The proliferation of generative AI across education, media, and enterprise sectors is a key driver of the AI detector market, as institutions and businesses increasingly require tools to ensure originality, maintain credibility, and uphold integrity in digital outputs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Detection Modality, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

At the same time, the escalating risk of deepfakes, disinformation, and synthetic fraud is creating urgent demand for reliable detection technologies to safeguard trust in communication, protect brand reputation, and support compliance with tightening regulations. However, despite this strong momentum, the market faces a significant restraint in the form of limited benchmark standards across detection vendors. The absence of universally accepted performance metrics and evaluation frameworks makes it difficult for buyers to compare solutions, assess accuracy, and measure long-term reliability, slowing down enterprise-scale adoption and creating uncertainty in procurement decisions.

"Platforms segment leads growth in 2025"

Within the offering segment, the platform subsegment is expected to hold the largest market share in 2025, driven by the rising preference for end-to-end solutions that consolidate multiple detection capabilities in a single interface. Platforms allow enterprises, educational institutions, and media organizations to manage large-scale detection workflows more efficiently compared to standalone APIs or SDKs, which often require additional integration and customization. Many vendors are enhancing their platforms with features such as multimodal detection, provenance tracking, and reporting dashboards, making them more attractive for organizations seeking compliance readiness and streamlined governance. The ability of platforms to support varied use cases, from academic integrity to brand safety and misinformation monitoring, positions them as the core offering for large-scale deployments. As adoption expands across regulated industries and high-volume content ecosystems, platforms provide stakeholders with greater operational control, easier auditability, and faster implementation, reinforcing their leadership within the offering segment.

"Academic integrity becomes the anchor of AI detector demand"

Within the application segment, the academic integrity subsegment is projected to hold the largest market share in 2025, supported by the growing integration of AI detection tools across schools, universities, and online learning platforms. With the rapid adoption of generative AI by students, institutions are prioritizing solutions that can identify AI-assisted assignments, maintain fairness in assessments, and protect the credibility of qualifications. Learning management systems and digital assessment platforms are embedding detection capabilities to address these concerns at scale, while universities are formalizing academic policies that mandate the use of such tools. Vendors are also tailoring their offerings with plagiarism detection, writing style analysis, and real-time content verification, which align directly with institutional requirements. The continued expansion of remote and hybrid learning further amplifies demand, as academic environments increasingly depend on reliable verification methods to uphold trust in digital education ecosystems. This strong and recurring demand positions academic integrity as the leading application area in the AI detector market.

"Asia Pacific to witness rapid AI detector growth fueled by innovation and emerging technologies, while North America leads in market size"

The AI detector market is experiencing strong global momentum, with North America expected to hold the largest market share in 2025, while Asia Pacific is projected to register the fastest growth through 2030. North America's lead is supported by a combination of mature digital infrastructure, early adoption of AI governance frameworks, and the presence of established vendors offering enterprise-grade solutions across sectors such as education, media, and financial services. Universities and corporate users across the US and Canada are increasingly embedding AI detection tools into academic, editorial, and compliance workflows, creating a sustained demand base. Meanwhile, Asia Pacific is emerging as the fastest-growing market as countries including China, India, Japan, and South Korea accelerate digital transformation initiatives and tighten regulatory oversight on AI usage. The rise of edtech ecosystems in the region, coupled with growing concerns around disinformation, synthetic media, and election security, is driving institutions and enterprises to seek scalable detection platforms. Additionally, government-backed initiatives in China and Japan to regulate AI-generated content and the rapid expansion of start-ups across India and Southeast Asia are creating fertile ground for new deployments. Together, these dynamics highlight North America as the anchor for global market revenues and Asia Pacific as the most promising region for future expansion, making both regions critical in shaping competitive strategies for vendors.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI detector market.

- By Company: Tier I - 30%, Tier II - 45%, and Tier III - 25%

- By Designation: C Level - 32%, Director Level - 25%, and others - 43%

- By Region: North America - 40%, Europe - 21%, Asia Pacific - 26%, Middle East & Africa - 8%, and Latin America - 5%

The report includes the study of key players offering AI detector solutions. It profiles major vendors in the AI detector market. The major players in the AI detector market include GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India).

Research coverage

This research report covers the AI detector market, which has been segmented based on Offering (Platforms, API/SDKs). The Detection Modality segment consists of AI-generated Text, AI-generated Image & video, AI-generated Audio & voice, AI-generated Code, and Multimodal. The application segment includes Academic Integrity, Content Authenticity Assessment, Plagiarism Detection, Deepfake and Synthetic Media Detection, Code Authenticity Checking, Misinformation and Disinformation Detection, and Other Applications. The End User segment consists of BFSI, Healthcare & Life Sciences, Media & Entertainment, Education, Legal, Software & Technology Providers, Government & Defense, Consumers, and Other End Users. The regional analysis of the AI detector market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI detector market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption, Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools, Brand Safety Mandates Driving AI-powered Ad Content Verification, and Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment), restraints (High False Positive Rates Damaging Legitimate Creator Trust, and Vulnerability to Paraphrasing and Homoglyph Attacks), opportunities (Expansion into Real-time API Integrations for Chatbots and Collaboration Tools, Radioactive Data Tracing for Enhanced AI Output Attribution, and Integration with Blockchain-based Content Authenticity Ledgers), and challenges (Limited Explainability of Content Flagging Decisions, and Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the AI detector market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the AI detector market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI detector market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India) among others in the AI detector market. The report also helps stakeholders understand the pulse of the AI detector market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI DETECTOR MARKET

- 4.2 AI DETECTOR MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING AND DETECTION MODALITY

- 4.4 AI DETECTOR MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption

- 5.2.1.2 Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools

- 5.2.1.3 Brand Safety Mandates Driving AI-powered Ad Content Verification

- 5.2.1.4 Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High False Positive Rates Damaging Legitimate Creator Trust

- 5.2.2.2 Vulnerability to Paraphrasing and Homoglyph Attacks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion into Real-time API Integrations for Chatbots and Collaboration Tools

- 5.2.3.2 Radioactive Data Tracing for Enhanced AI Output Attribution

- 5.2.3.3 Integration with Blockchain-based Content Authenticity Ledgers

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited Explainability of Content Flagging Decisions

- 5.2.4.2 Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI DETECTOR MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 TEXT DETECTION PROVIDERS

- 5.5.2 AUDIO AND VOICE DETECTION PROVIDERS

- 5.5.3 CODE DETECTION PROVIDERS

- 5.5.4 IMAGE AND VIDEO DETECTION PROVIDERS

- 5.5.5 MULTIMODAL DETECTION PROVIDERS

- 5.6 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 IZZ2IZZ'S CONTENT PROTECTION UPGRADED TO ENTERPRISE LEVEL THROUGH COPYLEAKS

- 5.7.2 VERIFIEDHUMAN PARTNERED WITH ORIGINALITY.AI TO EMPOWER EDUCATORS IN AUTHENTICITY VERIFICATION

- 5.7.3 HIGHRISE PARTNERED WITH HIVE MODERATION TO SAFEGUARD AND SCALE ITS VIRTUAL COMMUNITY

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Natural Language Processing (NLP)

- 5.8.1.2 Computer Vision

- 5.8.1.3 Machine Learning

- 5.8.1.4 Neural Text & Image Embeddings

- 5.8.1.5 Perplexity & Entropy Calculation Engines

- 5.8.1.6 Sequence Modeling

- 5.8.1.7 Audio Forensics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Metadata Extraction & Forensics

- 5.8.2.2 Cloud Computing

- 5.8.2.3 Digital Watermarking

- 5.8.2.4 Data Labeling & Annotation Systems

- 5.8.2.5 Blockchain

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Generative AI

- 5.8.3.2 Synthetic Media Generation

- 5.8.3.3 Plagiarism Detection Engines

- 5.8.3.4 Digital Identity Verification

- 5.8.3.5 Content Moderation Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 TAKE IT DOWN Act (2025)

- 5.9.2.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.9.2.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.9.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.9.2.2 Europe

- 5.9.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.9.2.2.2 General Data Protection Regulation (Europe)

- 5.9.2.2.3 Online Safety Act 2023

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 Provisions on Deep Synthesis Internet Information Services (2023)

- 5.9.2.3.2 Act on the Protection of Personal Information (APPI)

- 5.9.2.3.3 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.9.2.3.4 National AI Strategy (Singapore)

- 5.9.2.3.5 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Federal Decree-Law No. 45 of 2021 (UAE PDPL)

- 5.9.2.4.2 National Strategy for Artificial Intelligence (UAE)

- 5.9.2.4.3 National Artificial Intelligence Strategy (Qatar)

- 5.9.2.4.4 AI Ethics Principles and Guidelines (Dubai)

- 5.9.2.5 Latin America

- 5.9.2.5.1 Santiago Declaration (Chile)

- 5.9.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.10.3 INNOVATIONS AND PATENT APPLICATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.11.2 AVERAGE SELLING PRICE, BY DETECTION MODALITY, 2025

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

6 AI DETECTOR MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AI DETECTOR MARKET, BY OFFERING

- 6.2 PLATFORMS

- 6.2.1 UNIFIED HUBS FOR END-TO-END AI DETECTION

- 6.3 API/SDKS

- 6.3.1 AGILE DETECTION EMBEDDED INTO DIGITAL ECOSYSTEMS

7 AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.2 AI-GENERATED TEXT

- 7.2.1 SAFEGUARDING WRITTEN INTEGRITY TO PRESERVE TRUST, AUTHENTICITY, AND ACCOUNTABILITY

- 7.3 AI-GENERATED IMAGE & VIDEO

- 7.3.1 PRESERVING VISUAL TRUTH TO COMBAT MANIPULATED IMAGERY AND DEEPFAKES

- 7.4 AI-GENERATED AUDIO & VOICE

- 7.4.1 DEFENDING SONIC AUTHENTICITY AGAINST VOICE CLONING, IMPERSONATION, AND AUDIO-DRIVEN MISINFORMATION

- 7.5 AI-GENERATED CODE

- 7.5.1 SECURING SOFTWARE SUPPLY CHAIN BY DETECTING AI-GENERATED CODE RISKS

- 7.6 MULTIMODAL

- 7.6.1 TRUST ASSURANCE THROUGH MULTIMODAL DETECTION ACROSS TEXT, VISUALS, AUDIO, VIDEO, AND CODE

8 AI DETECTOR MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AI DETECTOR MARKET, BY APPLICATION

- 8.2 ACADEMIC INTEGRITY

- 8.2.1 SAFEGUARDING ACADEMIC INTEGRITY IN AGE OF AI

- 8.3 CONTENT AUTHENTICITY ASSESSMENT

- 8.3.1 ESTABLISHING CONTENT AUTHENTICITY AS NEW TRUST CURRENCY

- 8.4 PLAGIARISM DETECTION

- 8.4.1 REDEFINING PLAGIARISM DETECTION FOR AI ERA

- 8.5 DEEPFAKE AND SYNTHETIC MEDIA DETECTION

- 8.5.1 COMBATING SYNTHETIC MEDIA WITH PRECISION DEEPFAKE DETECTION

- 8.6 CODE AUTHENTICITY CHECKING

- 8.6.1 ENSURING TRUST IN SOFTWARE THROUGH CODE AUTHENTICITY CHECKING

- 8.7 MISINFORMATION AND DISINFORMATION DETECTION

- 8.7.1 COUNTERING FALSE NARRATIVES WITH MISINFORMATION AND DISINFORMATION DETECTION

- 8.8 OTHER APPLICATIONS

9 AI DETECTOR MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AI DETECTOR MARKET, BY END USER

- 9.2 BFSI

- 9.2.1 SAFEGUARDING TRUST IN FINANCIAL COMMUNICATION

- 9.3 HEALTHCARE & LIFE SCIENCES

- 9.3.1 PROTECTING PATIENT DATA AND CLINICAL ACCURACY

- 9.4 MEDIA & ENTERTAINMENT

- 9.4.1 MAINTAINING BRAND INTEGRITY IN DIGITAL STORYTELLING

- 9.5 EDUCATION

- 9.5.1 REINFORCING ETHICAL STANDARDS IN ACADEMIA

- 9.6 LEGAL

- 9.6.1 STRENGTHENING EVIDENCE AND DOCUMENTATION IN LEGAL PRACTICE

- 9.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 9.7.1 ENHANCING PRODUCT INTEGRITY FOR SOFTWARE INNOVATORS

- 9.8 GOVERNMENT & DEFENSE

- 9.8.1 SAFEGUARDING PUBLIC TRUST IN GOVERNANCE AND DEFENSE

- 9.9 CONSUMERS

- 9.9.1 EMPOWERING INDIVIDUAL USERS WITH DIGITAL CONFIDENCE

- 9.10 OTHER END USERS

10 AI DETECTOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI DETECTOR MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AI DETECTOR MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI DETECTOR MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI DETECTOR MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 SOUTH AFRICA

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI DETECTOR MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.3.1 MARKET RANKING ANALYSIS

- 11.4 PRODUCT COMPARATIVE ANALYSIS

- 11.4.1 PRODUCT COMPARATIVE ANALYSIS, BY AI CONTENT DETECTOR PROVIDER

- 11.4.2 PRODUCT COMPARATIVE ANALYSIS, BY DEEPFAKE DETECTION PROVIDER

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company Footprint

- 11.5.5.2 Regional Footprint

- 11.5.5.3 Detection Modality Footprint

- 11.5.5.4 Application Footprint

- 11.5.5.5 End User Footprint

- 11.6 COMPANY EVALUATION MATRIX: OTHER PLAYERS, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: OTHER PLAYERS, 2024

- 11.6.5.1 Detailed List of Other Players

- 11.6.5.2 Competitive Benchmarking of Other Players

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 TURNITIN

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 GRAMMARLY

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 HIVE MODERATION

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 COPYLEAKS

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 QUILLBOT

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 REALITY DEFENDER

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Deals

- 12.2.7 ATTESTIV

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.8 GPTZERO

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.9 TRUEPIC

- 12.2.10 BRANDWELL AI

- 12.2.11 COMPILATIO

- 12.2.12 QUETEXT

- 12.2.13 SENSITY

- 12.2.14 DUCKDUCKGOOSE

- 12.2.15 PINDROP

- 12.2.16 SCRIBBR

- 12.2.17 RESEMBLE AI

- 12.2.18 BLACKBIRD.AI

- 12.2.1 TURNITIN

- 12.3 OTHER PLAYERS

- 12.3.1 ORIGINALITY.AI

- 12.3.1.1 Business overview

- 12.3.1.2 Products/Solutions/Services offered

- 12.3.1.3 Recent developments

- 12.3.2 SIGHTENGINE

- 12.3.2.1 Business overview

- 12.3.2.2 Products/Solutions/Services offered

- 12.3.2.3 Recent developments

- 12.3.3 WRITER.COM

- 12.3.4 PERFIOS

- 12.3.5 AI OR NOT

- 12.3.6 AI DETECTOR PRO (AIDP)

- 12.3.7 SMODIN

- 12.3.8 SURFER

- 12.3.9 SCALENUT

- 12.3.10 WINSTON AI

- 12.3.11 ILLUMINARTY

- 12.3.12 CROSSPLAG

- 12.3.13 ZEROGPT

- 12.3.14 SAPLING.AI

- 12.3.15 PANGRAM LABS

- 12.3.16 TRACEGPT (PLAGIARISMCHECKER)

- 12.3.17 FACIA.AI

- 12.3.1 ORIGINALITY.AI

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DEEPFAKE AI MARKET - GLOBAL FORECAST TO 2031

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Deepfake AI market, by offering

- 13.2.2.2 Deepfake AI market, by technology

- 13.2.2.3 Deepfake AI market, by vertical

- 13.2.2.4 Deepfake AI market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by end user

- 13.3.2.2 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 GLOBAL AI DETECTOR MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL AI DETECTOR MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 AI DETECTOR MARKET: ECOSYSTEM

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 PATENTS FILED, 2016-2025

- TABLE 12 LIST OF FEW PATENTS IN AI DETECTOR MARKET, 2024-2025

- TABLE 13 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- TABLE 14 AVERAGE SELLING PRICE, BY DETECTION MODALITY, 2025

- TABLE 15 AI DETECTOR MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 PORTER'S FIVE FORCES' IMPACT ON AI DETECTOR MARKET

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 19 AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 20 AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 PLATFORMS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 22 PLATFORMS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 23 API/SDKS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 24 API/SDKS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 26 AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 27 AI-GENERATED TEXT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 28 AI-GENERATED TEXT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 AI-GENERATED IMAGE & VIDEO: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 30 AI-GENERATED IMAGE & VIDEO: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 AI-GENERATED AUDIO & VOICE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 AI-GENERATED AUDIO & VOICE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 AI-GENERATED CODE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 AI-GENERATED CODE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 MULTIMODAL: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 MULTIMODAL: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 38 AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 39 ACADEMIC INTEGRITY: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 ACADEMIC INTEGRITY: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 CONTENT AUTHENTICITY ASSESSMENT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 CONTENT AUTHENTICITY ASSESSMENT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 PLAGIARISM DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 44 PLAGIARISM DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 DEEPFAKE AND SYNTHETIC MEDIA DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 DEEPFAKE AND SYNTHETIC MEDIA DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 CODE AUTHENTICITY CHECKING: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 48 CODE AUTHENTICITY CHECKING: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 MISINFORMATION AND DISINFORMATION DETECTION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 MISINFORMATION AND DISINFORMATION DETECTION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 OTHER APPLICATIONS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 OTHER APPLICATIONS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 54 AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 55 BFSI: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 BFSI: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 HEALTHCARE & LIFE SCIENCES: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 HEALTHCARE & LIFE SCIENCES: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 60 MEDIA & ENTERTAINMENT: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 EDUCATION: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 EDUCATION: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 LEGAL: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 LEGAL: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 SOFTWARE & TECHNOLOGY PROVIDERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 SOFTWARE & TECHNOLOGY PROVIDERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 GOVERNMENT & DEFENSE: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 GOVERNMENT & DEFENSE: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 CONSUMERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 CONSUMERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 OTHER END USERS: AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 72 OTHER END USERS: AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 AI DETECTOR MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 AI DETECTOR MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 76 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 77 NORTH AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 80 NORTH AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 81 NORTH AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 84 NORTH AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 85 US: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 86 US: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 87 US: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 88 US: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 89 US: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 90 US: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 91 US: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 92 US: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 93 CANADA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 94 CANADA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 95 CANADA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 96 CANADA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 97 CANADA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 98 CANADA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 99 CANADA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 100 CANADA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 101 EUROPE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 102 EUROPE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 103 EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 104 EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 105 EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 106 EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 108 EUROPE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 109 EUROPE: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 110 EUROPE: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 UK: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 112 UK: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 113 UK: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 114 UK: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 115 UK: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 116 UK: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 117 UK: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 118 UK: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 119 GERMANY: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 120 GERMANY: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 121 GERMANY: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 122 GERMANY: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 123 GERMANY: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 124 GERMANY: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 125 GERMANY: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 126 GERMANY: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 127 FRANCE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 128 FRANCE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 129 FRANCE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 130 FRANCE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 131 FRANCE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 132 FRANCE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 133 FRANCE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 134 FRANCE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 135 REST OF EUROPE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 136 REST OF EUROPE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 137 REST OF EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 138 REST OF EUROPE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 139 REST OF EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 140 REST OF EUROPE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 141 REST OF EUROPE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 142 REST OF EUROPE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 143 ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 148 ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 151 ASIA PACIFIC: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 152 ASIA PACIFIC: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 CHINA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 154 CHINA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 155 CHINA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 156 CHINA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 157 CHINA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 158 CHINA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 159 CHINA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 160 CHINA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 161 INDIA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 162 INDIA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 163 INDIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 164 INDIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 165 INDIA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 166 INDIA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 167 INDIA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 168 INDIA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 169 JAPAN: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 170 JAPAN: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 171 JAPAN: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 172 JAPAN: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 173 JAPAN: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 174 JAPAN: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 175 JAPAN: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 176 JAPAN: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 177 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 178 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 179 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 180 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 181 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 182 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 183 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 184 REST OF ASIA PACIFIC: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 185 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 195 SAUDI ARABIA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 196 SAUDI ARABIA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 197 SAUDI ARABIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 198 SAUDI ARABIA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 199 SAUDI ARABIA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 200 SAUDI ARABIA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 201 SAUDI ARABIA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 202 SAUDI ARABIA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 203 UAE: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 204 UAE: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 205 UAE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 206 UAE: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 207 UAE: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 208 UAE: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 209 UAE: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 210 UAE: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 211 SOUTH AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 212 SOUTH AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 213 SOUTH AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 214 SOUTH AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 215 SOUTH AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 216 SOUTH AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 217 SOUTH AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 218 SOUTH AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 221 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 222 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 223 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 224 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 225 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 226 REST OF MIDDLE EAST & AFRICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 227 LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 228 LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 229 LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD MILLION)

- TABLE 230 LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD MILLION)

- TABLE 231 LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 232 LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 234 LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 235 LATIN AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 236 LATIN AMERICA: AI DETECTOR MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 237 BRAZIL: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 238 BRAZIL: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 239 BRAZIL: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 240 BRAZIL: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 241 BRAZIL: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 242 BRAZIL: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 243 BRAZIL: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 244 BRAZIL: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 245 MEXICO: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 246 MEXICO: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 247 MEXICO: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 248 MEXICO: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 249 MEXICO: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 250 MEXICO: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 251 MEXICO: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 252 MEXICO: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 253 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2020-2024 (USD THOUSAND)

- TABLE 254 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY OFFERING, 2025-2030 (USD THOUSAND)

- TABLE 255 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2020-2024 (USD THOUSAND)

- TABLE 256 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY DETECTION MODALITY, 2025-2030 (USD THOUSAND)

- TABLE 257 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2020-2024 (USD THOUSAND)

- TABLE 258 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY APPLICATION, 2025-2030 (USD THOUSAND)

- TABLE 259 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2020-2024 (USD THOUSAND)

- TABLE 260 REST OF LATIN AMERICA: AI DETECTOR MARKET, BY END USER, 2025-2030 (USD THOUSAND)

- TABLE 261 OVERVIEW OF STRATEGIES ADOPTED BY KEY AI DETECTOR VENDORS, 2022-2025

- TABLE 262 AI DETECTOR MARKET: DEGREE OF COMPETITION

- TABLE 263 REGIONAL FOOTPRINT (18 COMPANIES), 2024

- TABLE 264 DETECTION MODALITY FOOTPRINT (18 COMPANIES), 2024

- TABLE 265 APPLICATION FOOTPRINT (18 COMPANIES), 2024

- TABLE 266 END USER FOOTPRINT (18 COMPANIES), 2024

- TABLE 267 AI DETECTOR MARKET: OTHER PLAYERS, 2024

- TABLE 268 AI DETECTOR MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- TABLE 269 AI DETECTOR MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2022-2025

- TABLE 270 AI DETECTOR MARKET: DEALS, 2022-2025

- TABLE 271 TURNITIN: COMPANY OVERVIEW

- TABLE 272 TURNITIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 TURNITIN: PRODUCT LAUNCHES

- TABLE 274 TURNITIN: DEALS

- TABLE 275 GRAMMARLY: COMPANY OVERVIEW

- TABLE 276 GRAMMARLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 GRAMMARLY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 GRAMMARLY: DEALS

- TABLE 279 HIVE MODERATION: COMPANY OVERVIEW

- TABLE 280 HIVE MODERATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 HIVE MODERATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 HIVE MODERATION: DEALS

- TABLE 283 COPYLEAKS: COMPANY OVERVIEW

- TABLE 284 COPYLEAKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 COPYLEAKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 286 COPYLEAKS: DEALS

- TABLE 287 QUILLBOT: COMPANY OVERVIEW

- TABLE 288 QUILLBOT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 QUILLBOT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 REALITY DEFENDER: COMPANY OVERVIEW

- TABLE 291 REALITY DEFENDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 292 REALITY DEFENDER: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 293 REALITY DEFENDER: DEALS

- TABLE 294 ATTESTIV: COMPANY OVERVIEW

- TABLE 295 ATTESTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 ATTESTIV: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 297 ATTESTIV: DEALS

- TABLE 298 GPTZERO: COMPANY OVERVIEW

- TABLE 299 GPTZERO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 GPTZERO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 301 GPTZERO: DEALS

- TABLE 302 ORIGINALITY.AI: COMPANY OVERVIEW

- TABLE 303 ORIGINALITY.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 ORIGINALITY.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 305 ORIGINALITY.AI: DEALS

- TABLE 306 SIGHTENGINE: COMPANY OVERVIEW

- TABLE 307 SIGHTENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 SIGHTENGINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 309 SIGHTENGINE: DEALS

- TABLE 310 DEEPFAKE AI MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 311 DEEPFAKE AI MARKET, BY OFFERING, 2025-2031 (USD MILLION)

- TABLE 312 DEEPFAKE AI MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 313 DEEPFAKE AI MARKET, BY TECHNOLOGY, 2025-2031 (USD MILLION)

- TABLE 314 DEEPFAKE AI MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 315 DEEPFAKE AI MARKET, BY VERTICAL, 2025-2031 (USD MILLION)

- TABLE 316 DEEPFAKE AI MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 317 DEEPFAKE AI MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 318 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2020-2024 (USD BILLION)

- TABLE 319 ARTIFICIAL INTELLIGENCE MARKET, BY END USER, 2025-2032 (USD BILLION)

- TABLE 320 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 321 ARTIFICIAL INTELLIGENCE MARKET, BY REGION, 2025-2032 (USD BILLION)

List of Figures

- FIGURE 1 AI DETECTOR MARKET: RESEARCH DESIGN

- FIGURE 2 AI DETECTOR MARKET: DATA TRIANGULATION

- FIGURE 3 AI DETECTOR MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM PLATFORMS AND API/SDKS IN AI DETECTOR MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM KEY COMPANIES IN AI DETECTOR MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM BUSINESS UNITS (BU) OF KEY VENDORS IN AI DETECTOR MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF AI DETECTOR THROUGH OVERALL IT SPENDING ON AI DETECTOR SOLUTIONS

- FIGURE 8 PLATFORMS SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 9 AI-GENERATED TEXT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 10 ACADEMIC INTEGRITY SEGMENT TO HOLD LARGEST MARKET SIZE IN 2025

- FIGURE 11 HEALTHCARE & LIFE SCIENCES TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 13 RAPID AI & COMPUTER-VISION ADVANCEMENTS AND EXPANSIVE DEPLOYMENT ACROSS INDUSTRIES IN ASIA PACIFIC TO DRIVE AI DETECTOR MARKET GROWTH

- FIGURE 14 DEEPFAKE AND SYNTHETIC MEDIA DETECTION SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 15 PLATFORMS AND AI-GENERATED TEXT TO BE LARGEST SHAREHOLDERS IN NORTH AMERICAN AI DETECTOR MARKET IN 2025

- FIGURE 16 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 17 AI DETECTOR MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 EVOLUTION OF AI DETECTORS

- FIGURE 19 AI DETECTOR MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 KEY PLAYERS IN AI DETECTOR MARKET ECOSYSTEM

- FIGURE 21 AI DETECTOR MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO (USD MILLION AND NUMBER OF FUNDING ROUNDS)

- FIGURE 22 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2016-2025

- FIGURE 23 REGIONAL ANALYSIS OF PATENTS GRANTED, 2016-2025

- FIGURE 24 AI DETECTOR MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 API/SDKS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 AI-GENERATED AUDIO & VOICE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 DEEPFAKE AND SYNTHETIC MEDIA DETECTION SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 31 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 INDIA TO REGISTER HIGHEST GROWTH RATE IN AI DETECTOR MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: AI DETECTOR MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: AI DETECTOR MARKET SNAPSHOT

- FIGURE 36 SHARE OF LEADING COMPANIES IN AI DETECTOR MARKET, 2024

- FIGURE 37 PRODUCT COMPARATIVE ANALYSIS, BY AI CONTENT DETECTOR PROVIDER

- FIGURE 38 PRODUCT COMPARATIVE ANALYSIS, BY DEEPFAKE DETECTION ASSISTANT PROVIDER

- FIGURE 39 AI DETECTOR MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 40 COMPANY FOOTPRINT (18 COMPANIES), 2024

- FIGURE 41 AI DETECTOR MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2024