|

市场调查报告书

商品编码

1822294

全球低温运输监控市场(按温度类型、产品、物流、应用和地区划分)- 预测至 2030 年Cold Chain Monitoring Market by Sensors and Data Loggers, RFID Devices, Telematics & Telemetry Devices, Networking Devices, Logistics (Storage, Transportation), Application (Pharmaceuticals & Healthcare, Food & Beverages) - Global Forecast to 2030 |

||||||

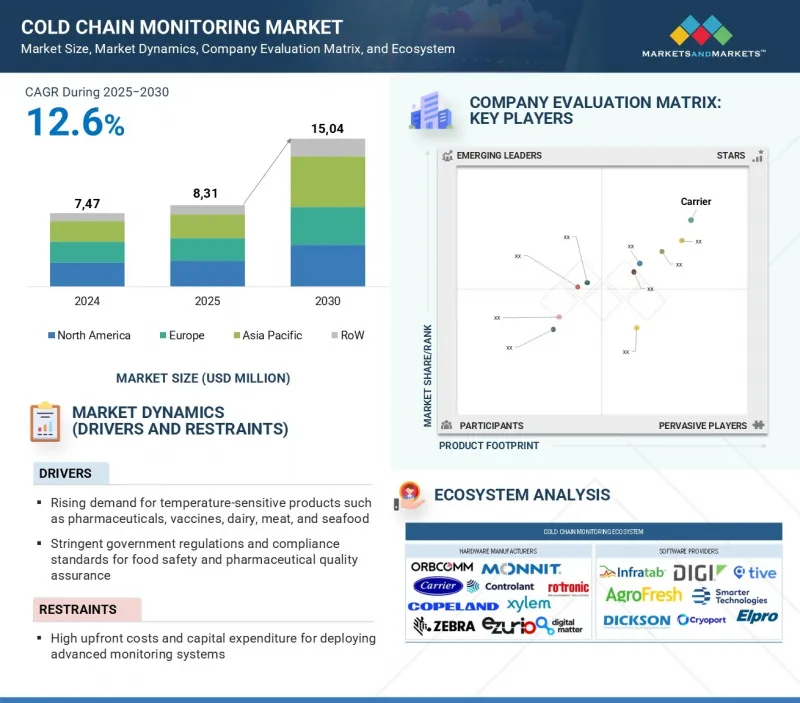

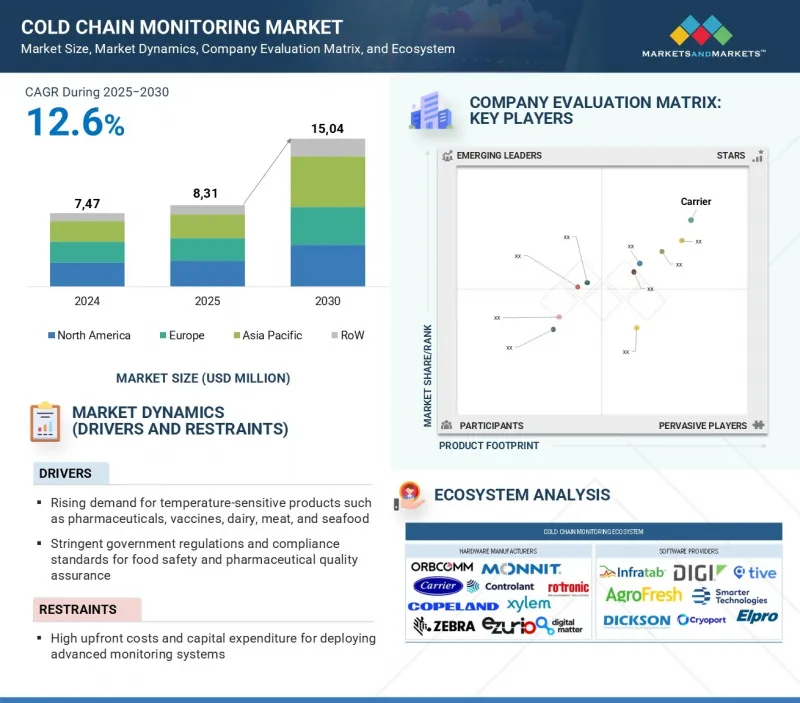

全球低温运输监控市场预计将从 2025 年的 83.1 亿美元成长到 2030 年的 150.4 亿美元,复合年增长率为 12.6%。

由于消费者对便利性和生鲜食品宅配的偏好不断变化,电子商务和线上杂货平台的快速成长极大地推动了对先进低温运输监控解决方案的需求。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 对价单位 | 金额(十亿美元) |

| 按细分市场 | 按温度类型、按产品、按物流、按应用、按地区 |

| 目标区域 | 北美、欧洲、亚太地区和其他地区 |

随着承诺闪电般快速配送的快速商务模式的兴起,在物流的最后一英里保持温度的完整性对于确保食品安全和品质至关重要。零售商和物流供应商正在增加对物联网感测器、即时追踪和预测分析的投资,以增强对整个配送週期的可视性和控制力。这种转变使低温运输监控成为在快速发展的数位零售生态系统中建立消费者信任、减少损耗和确保合规性的策略推动因素。

预计硬体领域将在2024年占据最大的市场份额,这反映出人们对物联网感测器、RFID标籤、GPS追踪器和数据记录器的强烈依赖,这些构成了低温运输监控基础设施的支柱。食品、药品和疫苗分销领域对精确温湿度追踪的需求日益增长,这加速了仓库、运输车队和零售网路对硬体的大规模采用。对先进感测器技术和无线连接解决方案的投资进一步提高了即时可视性和可靠性。此外,品质合规性的监管要求使得硬体对于确保整个供应链的完整性至关重要。

预计在预测期内,製药和医疗保健领域将实现最高的复合年增长率。这得归功于全球对疫苗、生技药品和温度敏感药物日益增长的需求,这些药物需要严格的储存和分销条件。 COVID-19 疫苗的推出凸显了低温运输监控的关键作用,并促使人们增加对先进的物联网解决方案和医学物流预测分析的投资。 FDA 和 EMA 等机构日益严格的监管规定进一步推动了合规监控系统的采用,以确保产品完整性和病患安全。此外,生物製药和个人化医疗的成长正在创造对可靠、透明的低温运输解决方案的持续需求。

预计在预测期内,中国将引领亚太地区低温运输监控市场,这得益于製药、生物技术和电子商务产业的快速扩张,这些产业对先进的温控物流的需求。中国政府的「健康中国2030」倡议和严格的食品安全法规正在加速对数位监控解决方案的投资,以保障整个食品和医疗保健供应链的品质。顺丰速运和京东物流等领先的物流公司已经部署了基于物联网的追踪和人工智慧主导的低温运输平台,以提高效率和合规性。此外,生鲜食品、水产品和疫苗的跨境贸易日益增长,巩固了中国作为该地区低温运输监控技术成长引擎的地位。

本报告研究了全球低温运输监控市场,并按温度类型、产品、物流、应用和地区对市场进行了细分,并提供了参与市场的公司概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 介绍

- 市场动态

- 影响客户的趋势和中断

- 定价分析

- 价值链分析

- 生态系分析

- 技术分析

- 专利分析

- 贸易分析

- 大型会议及活动

- 案例研究分析

- 投资金筹措场景

- 关税和监管状况

- 波特五力分析

- 主要相关人员和采购标准

- 人工智慧对低温运输监控市场的影响

- 2025年美国关税对低温运输监控市场的影响

第六章低温运输监控市场(依温度类型)

- 介绍

- 冷冻

- 冷藏

第七章低温运输监控市场(依产品分类)

- 介绍

- 硬体

- 软体

第八章低温运输监控市场(按物流)

- 介绍

- 贮存

- 运输

第九章低温运输监控市场(按应用)

- 介绍

- 製药和医疗保健

- 食品/饮料

- 化学品

- 其他的

第 10 章低温运输监控市场(按地区)

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 波兰

- 北欧国家

- 其他的

- 亚太地区

- 亚太宏观经济展望

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他的

- 其他地区

- 世界其他地区宏观经济展望

- 中东

- 非洲

- 南美洲

第十一章 竞争格局

- 概述

- 主要参与企业的策略/优势,2021-2025

- 2022-2024年收益分析

- 2024年市占率分析

- 估值和财务指标

- 产品比较

- 公司估值矩阵:2024 年关键参与企业

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十二章:公司简介

- 介绍

- 主要参与企业

- ORBCOMM

- CARRIER

- MONNIT CORPORATION

- CONTROLANT HF.

- ELPRO-BUCHS AG

- INFRATAB, INC.

- COPELAND LP

- TIVE, INC.

- CRYOPORT INC.

- DIGI INTERNATIONAL INC.

- 其他公司

- AGROFRESH(VERIGO)

- ZEBRA TECHNOLOGIES CORP.

- IOBOT TECHNOLOGIES INDIA PRIVATE LIMITED

- DIGITAL MATTER

- SMARTER TECHNOLOGIES GROUP

- EZURIO

- DICKSON

- ROTRONIC AG

- XYLEM

- INSIGHTGEEKS SOLUTIONS PVT. LTD.

- CAPTEMP

- SPOTSEE

- ACCENT ADVANCED SYSTEMS, SLU

- TESTO SE & CO. KGAA

- RFID4U

第十三章 附录

The global cold chain monitoring market is expected to grow from USD 8.31 billion in 2025 to USD 15.04 billion by 2030, at a CAGR of 12.6%. The rapid growth of e-commerce and online grocery platforms, fueled by changing consumer preferences for convenience and fresh food delivery, is significantly driving the demand for advanced cold chain monitoring solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By temperature type, logistics, application, offering, and region |

| Regions covered | North America, Europe, APAC, RoW |

With the rise of quick-commerce models promising ultra-fast deliveries, maintaining temperature integrity across last-mile logistics has become critical to ensure food safety and quality. Retailers and logistics providers are increasingly investing in IoT-enabled sensors, real-time tracking, and predictive analytics to enhance visibility and control throughout the delivery cycle. This shift is positioning cold chain monitoring as a strategic enabler for building consumer trust, reducing spoilage, and ensuring regulatory compliance in the fast-evolving digital retail ecosystem.

"Hardware segment accounted for largest market share in 2024"

The hardware segment accounted for the largest market share in 2024, reflecting the strong reliance on IoT-enabled sensors, RFID tags, GPS trackers, and data loggers that form the backbone of cold chain monitoring infrastructure. The growing demand for precise temperature and humidity tracking in food, pharmaceutical, and vaccine distribution has accelerated the adoption of large-scale hardware across warehouses, transport fleets, and retail networks. Investments in advanced sensor technologies and wireless connectivity solutions are further enhancing real-time visibility and reliability. Additionally, regulatory mandates for quality compliance continue to make hardware indispensable for ensuring integrity throughout the supply chain.

"Pharmaceuticals & healthcare application projected to register highest CAGR during forecast period"

The pharmaceuticals & healthcare segment is projected to register the highest CAGR during the forecast period. This is driven by the rising global demand for vaccines, biologics, and temperature-sensitive drugs that require strict storage and distribution conditions. The COVID-19 vaccine rollout underscored the crucial role of cold chain monitoring, prompting increased investments in advanced, IoT-enabled solutions and predictive analytics for pharmaceutical logistics. Increasing regulatory enforcement by agencies such as the FDA and EMA is further pushing the adoption of compliant monitoring systems to ensure product integrity and patient safety. Moreover, the growth of biopharmaceuticals and personalized medicines is creating sustained demand for highly reliable and transparent cold chain solutions.

"China to lead growth in Asia Pacific cold chain monitoring market during forecast period"

China is estimated to lead the Asia Pacific cold chain monitoring market during the forecast period, supported by its rapidly expanding pharmaceutical, biotechnology, and e-commerce sectors that demand advanced temperature-controlled logistics. The government's "Healthy China 2030" initiative and strict food safety regulations are accelerating investments in digital monitoring solutions to safeguard quality across food and healthcare supply chains. Major logistics players such as SF Express and JD Logistics are deploying IoT-based tracking and AI-driven cold chain platforms to enhance efficiency and compliance. Additionally, rising cross-border trade in fresh produce, seafood, and vaccines is reinforcing China's position as the region's growth engine for cold chain monitoring technologies.

Breakdown of Primaries

Various executives from key organizations operating in the cold chain monitoring market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3-30%

- By Designation: C-level Executives-40%, Directors-40%, and Others-20%

- By Region: North America-40%, Asia Pacific-30%, Europe-20%, and RoW-10%

The cold chain monitoring market is dominated by globally established players such as ORBCOMM (US), Carrier (US), Monnit Corporation (US), Controlant hf. (Iceland), ELPRO-BUCHS AG (Switzerland), Infratab, Inc. (US), Copeland LP (US), Tive, Inc. (US), Cryoport Inc. (US), Digi International Inc. (US), AgroFresh (Verigo) (US), Zebra Technologies Corp. (US), IOBOT TECHNOLOGIES INDIA PRIVATE LIMITED (India), Digital Matter (Australia), Smarter Technologies Group (UK), Ezurio (US), Dickson (US), Rotronic AG (Switzerland), Xylem (US), InsightGeeks Solutions Pvt. Ltd. (India), CapTemp (Portugal), SpotSee (US), Accent Advanced Systems, SLU. (Spain), Testo SE & Co. KGaA (Germany), and RFID4U (US). The study includes an in-depth competitive analysis of these key players in the cold chain monitoring market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the cold chain monitoring market and forecasts its size by temperature type, offering, logistics, application, and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. A value chain analysis has been included in the report, along with the key players and their competitive analysis of the cold chain monitoring ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising demand for perishable food, pharmaceuticals, and biologics requiring temperature-controlled logistics), restraints (High implementation and maintenance costs of advanced cold chain monitoring systems), opportunities (Rapid growth of online grocery and food delivery fueling last-mile cold chain visibility solutions), and challenges (Limited skilled workforce to manage advanced cold chain monitoring technologies) influencing the growth of the cold chain monitoring market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the cold chain monitoring market

- Market Development: Comprehensive information about lucrative markets-the report analyses the cold chain monitoring market across varied regions.

- Market Diversification: Exhaustive information about new hardware/software, untapped geographies, recent developments, and investments in the cold chain monitoring market

- Competitive Assessment: In-depth assessment of market shares and growth strategies and offerings of leading players, such as Carrier (US), Testo SE & Co. KGaA (Germany), Cryoport Inc. (US), ORBCOMM (US), and Controlant hf. (Iceland), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Key data from primary sources

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to derive market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COLD CHAIN MONITORING MARKET

- 4.2 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE

- 4.3 COLD CHAIN MONITORING MARKET, BY OFFERING

- 4.4 COLD CHAIN MONITORING MARKET, BY LOGISTICS

- 4.5 COLD CHAIN MONITORING MARKET, BY APPLICATION

- 4.6 COLD CHAIN MONITORING MARKET, BY REGION

- 4.7 COLD CHAIN MONITORING MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion of e-commerce and direct-to-consumer pharma and food delivery

- 5.2.1.2 End-to-end pharma monitoring accelerates time-to-value

- 5.2.1.3 Reducing global food waste unlocks value in cold chain ecosystems

- 5.2.1.4 Generic drug affordability and access pivot to growth

- 5.2.1.5 Regulatory alignment in pharma logistics reimagine value chain

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive cold chain monitoring rationalize CapEx allocation

- 5.2.2.2 Sustainability challenges and emissions-intensive cold chain operations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Smart warehousing and digital cold chain solutions

- 5.2.3.2 Emerging market penetration through expanding cold chain ecosystems in developing regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising complexity in installation and monitoring of cold chain systems

- 5.2.4.2 Infrastructure gaps and connectivity barriers in emerging markets

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 AVERAGE SELLING PRICE OF TEMPERATURE DATA LOGGERS, BY KEY PLAYER

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 IoT sensors

- 5.7.1.2 Data loggers

- 5.7.1.3 GPS and GNSS

- 5.7.1.4 RFID

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Edge computing

- 5.7.2.2 Digital twins

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Automated guided vehicles (AGVs)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO

- 5.9.2 IMPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PHARMACEUTICALS & HEALTHCARE

- 5.11.2 FOOD & BEVERAGES

- 5.11.3 CHEMICALS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.1.1 Regulatory bodies, government agencies, and other organizations

- 5.13.1.2 Key regulations

- 5.13.1 TARIFF ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 BARGAINING POWER OF SUPPLIERS

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF ARTIFICIAL INTELLIGENCE ON COLD CHAIN MONITORING MARKET

- 5.17 IMPACT OF 2025 US TARIFFS ON COLD CHAIN MONITORING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT OF COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATION

6 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE

- 6.1 INTRODUCTION

- 6.2 FROZEN

- 6.2.1 RISE IN CONSUMER DEMAND FOR FROZEN AND CONVENIENCE FOODS, WITH INTRODUCTION OF STRICTER REGULATORY STANDARDS

- 6.3 CHILLED

- 6.3.1 CHILLED COLD CHAIN MONITORING TO HELP PRESERVE FRESHNESS AND SHELF-LIFE

7 COLD CHAIN MONITORING MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 SENSORS & DATA LOGGERS

- 7.2.1.1 Rise in need for real-time monitoring to fuel growth of sensors and data loggers in cold chain

- 7.2.1.2 Temperature sensors/data loggers

- 7.2.1.3 Humidity sensors

- 7.2.1.4 Shock/Tilt/Accelerometer sensors

- 7.2.1.5 Door-open/contact sensors

- 7.2.1.6 Other sensors & data loggers

- 7.2.2 RFID DEVICES

- 7.2.2.1 RFID to offer end-to-end cold chain reliability through RFID-based environmental sensing and monitoring

- 7.2.3 TELEMATICS & TELEMETRY DEVICES

- 7.2.3.1 Fleet-level temperature control and route optimization to transform cold chain telematics devices

- 7.2.4 NETWORKING DEVICES

- 7.2.4.1 Advanced networking devices to enable predictive analytics and real-time decisions in cold chain operations

- 7.2.1 SENSORS & DATA LOGGERS

- 7.3 SOFTWARE

- 7.3.1 ON-PREMISES

- 7.3.1.1 On-premise software to enhance data control and operational efficiency in cold chains

- 7.3.2 CLOUD-BASED

- 7.3.2.1 Cloud-based cold chain software to improve visibility, analytics, and operational efficiency

- 7.3.1 ON-PREMISES

8 COLD CHAIN MONITORING MARKET, BY LOGISTICS

- 8.1 INTRODUCTION

- 8.2 STORAGE

- 8.2.1 WAREHOUSES

- 8.2.1.1 Smart warehousing and IoT-driven monitoring to power cold chain efficiency

- 8.2.2 COLD CONTAINERS

- 8.2.2.1 Thermal stress resilience and GPS-enabled monitoring to drive cold chain container adoption

- 8.2.3 BLAST FREEZERS

- 8.2.3.1 Blast freezers to increase cold chain efficiency with rapid freezing and quality retention

- 8.2.1 WAREHOUSES

- 8.3 TRANSPORTATION

- 8.3.1 AIRWAYS

- 8.3.1.1 Time-critical air transport to optimize cold chain reliability and shelf-life

- 8.3.2 WATERWAYS

- 8.3.2.1 Cost-effective waterway transport to boost cold chain reliability

- 8.3.3 ROADWAYS

- 8.3.3.1 IoT-enabled roadway cold chain transportation to help maximize reach and compliance

- 8.3.4 RAILWAYS

- 8.3.4.1 Cost-efficient and sustainable rail transport to transform cold chain logistics, despite challenges in terms of reach

- 8.3.1 AIRWAYS

9 COLD CHAIN MONITORING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 PHARMACEUTICALS & HEALTHCARE

- 9.2.1 VACCINES

- 9.2.1.1 Strategic cold chain monitoring to ensure immunization integrity by forming backbone of vaccine production and distribution

- 9.2.2 BIOBANKS

- 9.2.2.1 Requirement of strictly regulated temperature levels in biobanks to boost growth of cold chain monitoring market

- 9.2.3 MEDICINES & DRUGS

- 9.2.3.1 Cold chain monitoring devices to enhance therapeutic efficacy and optimize resource utilization by minimizing pharmaceutical wastage

- 9.2.1 VACCINES

- 9.3 FOOD & BEVERAGES

- 9.3.1 FRUITS & VEGETABLES

- 9.3.1.1 Cold chain monitoring devices to help reduce wastage and improve quality of fruits and vegetables

- 9.3.2 MEAT & SEAFOOD

- 9.3.2.1 Cold chain monitoring to help increase durability and prevent any infection during storage and transportation of meat and seafood

- 9.3.3 POULTRY & DAIRY PRODUCTS

- 9.3.3.1 Cold chain monitoring to help prolong shelf life and prevent contamination of poultry and dairy products

- 9.3.4 PROCESSED FOODS

- 9.3.4.1 Processed foods need cold chain monitoring to increase durability and prevent spoilage

- 9.3.1 FRUITS & VEGETABLES

- 9.4 CHEMICALS

- 9.4.1 NEED FOR STRINGENT REGULATORY COMPLIANCE FOR HANDLING TEMPERATURE-SENSITIVE AND HAZARDOUS CHEMICALS

- 9.5 OTHER APPLICATIONS

- 9.5.1 AGRICULTURE

- 9.5.2 MANUFACTURING

10 COLD CHAIN MONITORING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Rising complexity of biopharma logistics to position cold chain monitoring as critical enabler of market growth in US

- 10.2.3 CANADA

- 10.2.3.1 Rising export-led food & beverage expansion to catalyze cold chain monitoring investment in Canada

- 10.2.4 MEXICO

- 10.2.4.1 Growing fresh produce exports requiring stringent cold chain monitoring to drive market in Mexico

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Escalating biologics and clinical trial shipments, coupled with Germany's strong pharmaceutical logistics sector, to fuel growth

- 10.3.3 UK

- 10.3.3.1 Rise in specialty medicines and clinical trial dependencies, supported by UK's advanced life sciences ecosystem, to drive market

- 10.3.4 FRANCE

- 10.3.4.1 High-value pharmaceutical exports to fuel cold chain monitoring growth in France

- 10.3.5 SPAIN

- 10.3.5.1 High-volume fresh produce exports and demand for perishable logistics to drive cold chain monitoring expansion in Spain

- 10.3.6 ITALY

- 10.3.6.1 Premium food exports and expanding biopharma distribution networks to strengthen cold chain monitoring adoption in Italy

- 10.3.7 POLAND

- 10.3.7.1 Increase in pharma manufacturing capacity and frozen food exports to accelerate demand in Poland

- 10.3.8 NORDIC COUNTRIES

- 10.3.8.1 Sustainability-driven investments and high-value biopharma exports to redefine market in Nordic Countries

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Pharmaceutical exports and E-grocery logistics, anchoring next-gen IoT-driven compliance ecosystem, to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Pharma & biopharma logistics surge to drive growth in Japan, supported by compliance-grade IoT and real-time analytics

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Advanced manufacturing of biologics and high-value seafood exports to propel market in South Korea

- 10.4.5 INDIA

- 10.4.5.1 Rise in vaccine manufacturing and agri-food exports to position India's cold chain monitoring market for hyper-scale growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Agricultural exports and expanding biopharma distribution to catalyze adoption of cold chain monitoring

- 10.4.7 INDONESIA

- 10.4.7.1 Increase in seafood and horticulture exports, combined with rising vaccine distribution, to fuel market

- 10.4.8 MALAYSIA

- 10.4.8.1 High-value seafood and tropical fruit exports, coupled with growing biopharma logistics, to drive Malaysia's market

- 10.4.9 THAILAND

- 10.4.9.1 Thailand's cold chain monitoring market poised for growth, driven by food exports, vaccines, and smart IoT logistics

- 10.4.10 VIETNAM

- 10.4.10.1 Rise in seafood exports, pharma distribution, and adoption of cost-effective IoT solutions to drive market in Vietnam

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 REST OF THE WORLD (ROW)

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Bahrain

- 10.5.2.1.1 Market to gain traction through pharma re-exports, halal food distribution, and strategic GCC trade connectivity

- 10.5.2.2 Kuwait

- 10.5.2.2.1 Rise in pharma imports, frozen food demand, and investments in smart logistics infrastructure to fuel growth

- 10.5.2.3 Oman

- 10.5.2.3.1 Pharma reliance, fisheries exports, and smart port investments to position Oman as strategic growth node

- 10.5.2.4 Qatar

- 10.5.2.4.1 Qatar leveraged healthcare modernization, high-end food imports, and smart warehousing to drive next-phase growth

- 10.5.2.5 Saudi Arabia

- 10.5.2.5.1 Vision 2030 investments, expanding pharma manufacturing, and rising demand for processed food logistics to drive Saudi market

- 10.5.2.6 United Arab Emirates (UAE)

- 10.5.2.6.1 Global re-export hub for pharma and perishables, powering demand for digitized and AI-enabled cold chain monitoring solutions

- 10.5.2.7 Rest of Middle East

- 10.5.2.1 Bahrain

- 10.5.3 AFRICA

- 10.5.3.1 South Africa

- 10.5.3.1.1 Pharma export scalability, food security demands, and AI-driven logistics to reshape supply resilience

- 10.5.3.2 Rest of Africa

- 10.5.3.1 South Africa

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Export-oriented agribusiness and food value chains act as strategic catalyst for cold chain monitoring presence in South America

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.5.1 COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- 11.6 PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Regional footprint

- 11.7.5.3 Offering footprint

- 11.7.5.4 Temperature type footprint

- 11.7.5.5 Logistics footprint

- 11.7.5.6 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 ORBCOMM

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 CARRIER

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 MONNIT CORPORATION

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 CONTROLANT HF.

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 ELPRO-BUCHS AG

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths/Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 INFRATAB, INC.

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.7 COPELAND LP

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.8 TIVE, INC.

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches

- 12.2.8.3.2 Deals

- 12.2.9 CRYOPORT INC.

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Deals

- 12.2.10 DIGI INTERNATIONAL INC.

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent development

- 12.2.10.3.1 Product launches

- 12.2.1 ORBCOMM

- 12.3 OTHER PLAYERS

- 12.3.1 AGROFRESH (VERIGO)

- 12.3.2 ZEBRA TECHNOLOGIES CORP.

- 12.3.3 IOBOT TECHNOLOGIES INDIA PRIVATE LIMITED

- 12.3.4 DIGITAL MATTER

- 12.3.5 SMARTER TECHNOLOGIES GROUP

- 12.3.6 EZURIO

- 12.3.7 DICKSON

- 12.3.8 ROTRONIC AG

- 12.3.9 XYLEM

- 12.3.10 INSIGHTGEEKS SOLUTIONS PVT. LTD.

- 12.3.11 CAPTEMP

- 12.3.12 SPOTSEE

- 12.3.13 ACCENT ADVANCED SYSTEMS, SLU

- 12.3.14 TESTO SE & CO. KGAA

- 12.3.15 RFID4U

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 KEY DATA FROM PRIMARY SOURCES

- TABLE 3 COLD CHAIN MONITORING MARKET: RESEARCH ASSUMPTIONS

- TABLE 4 COLD CHAIN MONITORING MARKET: RISK ASSESSMENT

- TABLE 5 AVERAGE SELLING PRICE TREND OF COLD CHAIN MONITORING TEMPERATURE DATA LOGGERS, BY REGION, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE OF TEMPERATURE DATA LOGGERS, BY KEY PLAYERS, 2020-2024 (USD)

- TABLE 7 ROLE OF KEY PLAYERS IN COLD CHAIN MONITORING ECOSYSTEM

- TABLE 8 LIST OF KEY PATENTS IN COLD CHAIN MONITORING MARKET, 2023-2025

- TABLE 9 COUNTRY-WISE EXPORT DATA FOR REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT UNDER HS CODE: 8418, 2020-2024 (USD MILLION)

- TABLE 10 COUNTRY-WISE IMPORT DATA FOR REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT UNDER HS CODE: 8418, 2020-2024 (USD MILLION)

- TABLE 11 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 MFN TARIFF FOR HS CODE 8418-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2025

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 COLD CHAIN MONITORING MARKET: REGULATORY LANDSCAPE

- TABLE 18 COLD CHAIN MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 21 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE, 2021-2024 (USD MILLION)

- TABLE 23 COLD CHAIN MONITORING MARKET, BY TEMPERATURE TYPE, 2025-2030 (USD MILLION)

- TABLE 24 COLD CHAIN MONITORING MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 25 COLD CHAIN MONITORING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 26 COLD CHAIN MONITORING HARDWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 COLD CHAIN MONITORING HARDWARE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 COLD CHAIN MONITORING HARDWARE MARKET, BY TYPE, 2021-2024 (MILLION UNITS)

- TABLE 29 COLD CHAIN MONITORING HARDWARE MARKET, BY TYPE, 2025-2030 (MILLION UNITS)

- TABLE 30 COLD CHAIN SENSORS & DATA LOGGERS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 31 COLD CHAIN SENSORS & DATA LOGGERS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 32 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 33 COLD CHAIN MONITORING MARKET FOR RFID DEVICES, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 34 COLD CHAIN TELEMATICS & TELEMETRY DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 35 COLD CHAIN TELEMATICS & TELEMETRY DEVICES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 36 COLD CHAIN NETWORKING DEVICES MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 37 COLD CHAIN NETWORKING DEVICES MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 38 COLD CHAIN MONITORING SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 COLD CHAIN MONITORING SOFTWARE MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 ON-PREMISE COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 41 ON-PREMISE COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 42 CLOUD-BASED COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 CLOUD-BASED COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 COLD CHAIN MONITORING MARKET, BY LOGISTICS, 2021-2024 (USD MILLION)

- TABLE 45 COLD CHAIN MONITORING MARKET, BY LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 46 COLD CHAIN STORAGE MONITORING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 COLD CHAIN STORAGE MONITORING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 COLD CHAIN TRANSPORTATION MONITORING MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 49 COLD CHAIN TRANSPORTATION MONITORING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 50 COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 53 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 54 COLD CHAIN MONITORING HARDWARE MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 55 COLD CHAIN MONITORING HARDWARE MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 56 COLD CHAIN MONITORING SOFTWARE MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 57 COLD CHAIN MONITORING SOFTWARE MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 58 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 61 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 62 EUROPE: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 63 EUROPE: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 64 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 ROW: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 ROW: COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 69 COLD CHAIN MONITORING MARKET FOR PHARMACEUTICALS & HEALTHCARE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 70 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 71 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 72 COLD CHAIN MONITORING HARDWARE MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 73 COLD CHAIN MONITORING HARDWARE MARKET FOR FOOD & BEVERAGES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 74 COLD CHAIN MONITORING SOFTWARE MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 COLD CHAIN MONITORING SOFTWARE MARKET FOR FOOD & BEVERAGES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 79 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 80 EUROPE: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 EUROPE: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 82 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 83 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 84 ROW: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 ROW: COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 87 COLD CHAIN MONITORING MARKET FOR FOOD & BEVERAGES, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 88 COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 89 COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 90 COLD CHAIN MONITORING HARDWARE MARKET FOR CHEMICALS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 91 COLD CHAIN MONITORING HARDWARE MARKET FOR CHEMICALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 92 COLD CHAIN MONITORING SOFTWARE MARKET FOR CHEMICALS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 93 COLD CHAIN MONITORING SOFTWARE MARKET FOR CHEMICALS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 94 COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 95 COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 EUROPE: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 EUROPE: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 100 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 101 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 102 ROW: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 103 ROW: COLD CHAIN MONITORING MARKET FOR CHEMICALS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 105 COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 COLD CHAIN MONITORING HARDWARE MARKET FOR OTHER APPLICATIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 107 COLD CHAIN MONITORING HARDWARE MARKET FOR OTHER APPLICATIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 COLD CHAIN MONITORING SOFTWARE MARKET FOR OTHER APPLICATIONS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 COLD CHAIN MONITORING SOFTWARE MARKET FOR OTHER APPLICATIONS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 111 COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 112 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 115 EUROPE: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 ASIA PACIFIC: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 ROW: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 119 ROW: COLD CHAIN MONITORING MARKET FOR OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 120 COLD CHAIN MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 COLD CHAIN MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 US: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 US: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 CANADA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 CANADA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 MEXICO: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 MEXICO: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 EUROPE: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 132 GERMANY: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 GERMANY: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 UK: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 UK: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 FRANCE: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 FRANCE: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 SPAIN: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 SPAIN: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 ITALY: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 ITALY: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 POLAND: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 POLAND: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 NORDIC COUNTRIES: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 NORDIC COUNTRIES: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 CHINA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 151 CHINA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 JAPAN: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 SOUTH KOREA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 SOUTH KOREA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 INDIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 INDIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 AUSTRALIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 160 INDONESIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 INDONESIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 MALAYSIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 MALAYSIA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 THAILAND: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 THAILAND: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 VIETNAM: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 VIETNAM: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 170 ROW: COLD CHAIN MONITORING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 171 ROW: COLD CHAIN MONITORING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 176 AFRICA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 AFRICA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 AFRICA: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 179 AFRICA: COLD CHAIN MONITORING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 180 SOUTH AMERICA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 SOUTH AMERICA: COLD CHAIN MONITORING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 COLD CHAIN MONITORING MARKET: KEY PLAYER STRATEGIES/RIGHT TO WIN, DECEMBER 2021-AUGUST 2025

- TABLE 183 COLD CHAIN MONITORING MARKET: DEGREE OF COMPETITION

- TABLE 184 COLD CHAIN MONITORING MARKET: REGIONAL FOOTPRINT, 2024

- TABLE 185 COLD CHAIN MONITORING MARKET: OFFERING FOOTPRINT, 2024

- TABLE 186 COLD CHAIN MONITORING MARKET: TEMPERATURE TYPE FOOTPRINT, 2024

- TABLE 187 COLD CHAIN MONITORING MARKET: LOGISTICS FOOTPRINT, 2024

- TABLE 188 COLD CHAIN MONITORING MARKET: APPLICATION FOOTPRINT, 2024

- TABLE 189 COLD CHAIN MONITORING MARKET: DETAILED LIST OF KEY STARTUPS/SMES, 2024

- TABLE 190 COLD CHAIN MONITORING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 191 COLD CHAIN MONITORING MARKET: PRODUCT LAUNCHES, SEPTEMBER 2022-JULY 2025

- TABLE 192 COLD CHAIN MONITORING MARKET: DEALS, SEPTEMBER 2022-JULY 2025

- TABLE 193 ORBCOMM: COMPANY OVERVIEW

- TABLE 194 ORBCOMM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 ORBCOMM: PRODUCT LAUNCHES

- TABLE 196 ORBCOMM: DEALS

- TABLE 197 CARRIER: COMPANY OVERVIEW

- TABLE 198 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CARRIER: PRODUCT LAUNCHES

- TABLE 200 CARRIER: DEALS

- TABLE 201 MONNIT CORPORATION: COMPANY OVERVIEW

- TABLE 202 MONNIT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 MONNIT CORPORATION: PRODUCT LAUNCHES

- TABLE 204 CONTROLANT HF.: COMPANY OVERVIEW

- TABLE 205 CONTROLANT HF.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 CONTROLANT HF.: DEALS

- TABLE 207 ELPRO-BUCHS AG: COMPANY OVERVIEW

- TABLE 208 ELPRO-BUCHS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 ELPRO-BUCHS AG: PRODUCT LAUNCHES

- TABLE 210 ELPRO-BUCHS AG: DEALS

- TABLE 211 INFRATAB, INC.: COMPANY OVERVIEW

- TABLE 212 INFRATAB, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 COPELAND LP: COMPANY OVERVIEW

- TABLE 214 COPELAND LP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 TIVE, INC.: COMPANY OVERVIEW

- TABLE 216 TIVE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 TIVE, INC.: PRODUCT LAUNCHES

- TABLE 218 TIVE, INC.: DEALS

- TABLE 219 CRYOPORT INC.: COMPANY OVERVIEW

- TABLE 220 CRYOPORT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 CRYOPORT INC.: DEALS

- TABLE 222 DIGI INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 223 DIGI INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 DIGI INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 225 AGROFRESH (VERIGO): COMPANY OVERVIEW

- TABLE 226 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 227 IOBOT TECHNOLOGIES INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 228 DIGITAL MATTER: COMPANY OVERVIEW

- TABLE 229 SMARTER TECHNOLOGIES GROUP: COMPANY OVERVIEW

- TABLE 230 EZURIO: COMPANY OVERVIEW

- TABLE 231 DICKSON: COMPANY OVERVIEW

- TABLE 232 ROTRONIC AG: COMPANY OVERVIEW

- TABLE 233 XYLEM: COMPANY OVERVIEW

- TABLE 234 INSIGHTGEEKS SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- TABLE 235 CAPTEMP: COMPANY OVERVIEW

- TABLE 236 SPOTSEE: COMPANY OVERVIEW

- TABLE 237 ACCENT ADVANCED SYSTEMS, SLU: COMPANY OVERVIEW

- TABLE 238 TESTO SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 239 RFID4U: COMPANY OVERVIEW

List of Figures

- FIGURE 1 COLD CHAIN MONITORING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 COLD CHAIN MONITORING MARKET: RESEARCH DESIGN

- FIGURE 4 SECONDARY AND PRIMARY RESEARCH APPROACHES

- FIGURE 5 KEY DATA FROM SECONDARY SOURCES

- FIGURE 6 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 7 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 8 APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY PLAYERS FROM COLD CHAIN MONITORING MARKET

- FIGURE 9 APPROACH 2 (DEMAND SIDE): BOTTOM-UP ESTIMATION OF COLD CHAIN MONITORING MARKET, BY OFFERING

- FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 12 DATA TRIANGULATION: COLD CHAIN MONITORING MARKET

- FIGURE 13 COLD CHAIN MONITORING MARKET SNAPSHOT

- FIGURE 14 FROZEN SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 16 TRANSPORTATION SEGMENT TO WITNESS FASTER GROWTH FROM 2025 TO 2030

- FIGURE 17 FOOD & BEVERAGES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 18 ASIA PACIFIC COLD CHAIN MONITORING MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 GROWING DEMAND FOR IOT-ENABLED SOLUTIONS AND TEMPERATURE-CONTROLLED LOGISTICS TO BOOST COLD CHAIN MONITORING MARKET

- FIGURE 20 CHILLED SEGMENT TO ACCOUNT FOR LARGER SEGMENT IN 2025 AND 2030

- FIGURE 21 HARDWARE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 STORAGE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 23 FOOD & BEVERAGES TO WITNESS LARGEST MARKET SHARE IN 2030

- FIGURE 24 ASIA PACIFIC IS PROJECTED TO LEAD MARKET IN 2025 AND 2030

- FIGURE 25 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 26 COLD CHAIN MONITORING MARKET DYNAMICS

- FIGURE 27 DRIVERS AND THEIR IMPACT ON COLD CHAIN MONITORING MARKET

- FIGURE 28 RESTRAINTS AND THEIR IMPACT ON COLD CHAIN MONITORING MARKET

- FIGURE 29 OPPORTUNITIES AND THEIR IMPACT ON COLD CHAIN MONITORING MARKET

- FIGURE 30 CHALLENGES AND THEIR IMPACT ON COLD CHAIN MONITORING MARKET

- FIGURE 31 SHIFT IN CLIENTS' REVENUES WITH EXTENDED LENS ON FOOD & BEVERAGES, PHARMACEUTICALS & HEALTHCARE, AND CHEMICALS

- FIGURE 32 AVERAGE SELLING PRICE TREND OF COLD CHAIN MONITORING TEMPERATURE DATA LOGGERS, BY REGION, 2021-2024 (USD)

- FIGURE 33 AVERAGE SELLING PRICE OF TEMPERATURE DATA LOGGERS, BY KEY PLAYER, 2024 (USD)

- FIGURE 34 COLD CHAIN MONITORING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 35 KEY PLAYERS IN COLD CHAIN MONITORING ECOSYSTEM

- FIGURE 36 NUMBER OF PATENTS GRANTED IN COLD CHAIN MONITORING MARKET, 2015-2024

- FIGURE 37 COUNTRY-WISE EXPORT DATA FOR REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT UNDER HS CODE: 8418, 2020-2024 (USD MILLION)

- FIGURE 38 COUNTRY-WISE IMPORT DATA FOR REFRIGERATORS, FREEZERS, AND OTHER REFRIGERATING OR FREEZING EQUIPMENT UNDER HS CODE: 8418, 2020-2024 (USD MILLION)

- FIGURE 39 INVESTMENT AND FUNDING SCENARIO, 2021-2025 (USD MILLION)

- FIGURE 40 COLD CHAIN MONITORING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 42 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 43 CHILLED SEGMENT TO DOMINATE COLD CHAIN MONITORING MARKET DURING FORECAST PERIOD

- FIGURE 44 HARDWARE SEGMENT TO EXHIBIT LARGER MARKET SHARE IN 2030

- FIGURE 45 TRANSPORTATION SEGMENT PROJECTED TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 46 PHARMACEUTICALS & HEALTHCARE APPLICATION RECORDED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC SET TO RECORD LARGEST MARKET SHARE FOR PHARMACEUTICAL & HEALTHCARE APPLICATIONS FROM 2025 TO 2030

- FIGURE 48 NORTH AMERICA TO RECORD LARGEST MARKET SHARE FOR FOOD & BEVERAGES APPLICATION IN 2025

- FIGURE 49 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 SNAPSHOT OF COLD CHAIN MONITORING MARKET IN NORTH AMERICA

- FIGURE 51 SNAPSHOT OF COLD CHAIN MONITORING MARKET IN EUROPE

- FIGURE 52 SNAPSHOT OF COLD CHAIN MONITORING MARKET IN ASIA PACIFIC

- FIGURE 53 COLD CHAIN MONITORING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022-2024

- FIGURE 54 MARKET SHARE ANALYSIS OF COMPANIES OFFERING COLD CHAIN MONITORING SOLUTIONS, 2024

- FIGURE 55 COMPANY VALUATION, 2025 (USD BILLION)

- FIGURE 56 FINANCIAL METRICS, 2025

- FIGURE 57 PRODUCT COMPARISON

- FIGURE 58 COLD CHAIN MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 COLD CHAIN MONITORING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 60 COLD CHAIN MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 CARRIER: COMPANY SNAPSHOT

- FIGURE 62 CRYOPORT INC.: COMPANY SNAPSHOT

- FIGURE 63 DIGI INTERNATIONAL INC.: COMPANY SNAPSHOT