|

市场调查报告书

商品编码

1829989

全球抗辐射电子元件市场(按元件、製造技术、产品类型、应用和地区划分)- 预测至2030年Radiation Hardened Electronics Market by Component (Mixed Signal ICs, Processors & Controllers, Memory, Power Management), Manufacturing Technique (RHBD, RHBP), Product Type (COTS, Custom), Application and Region - Global Forecast to 2030 |

||||||

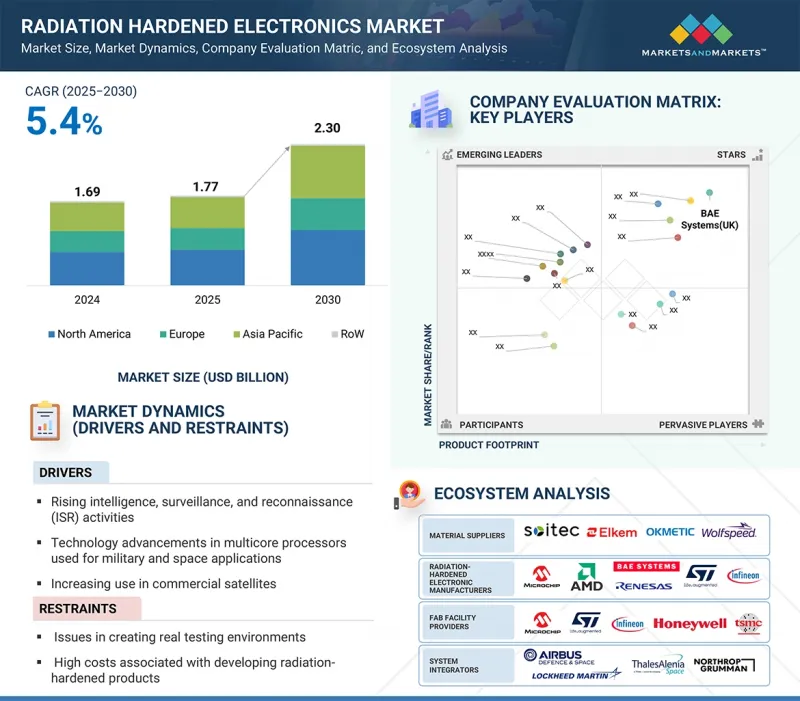

全球抗辐射电子产品市场预计将从 2025 年的 17.7 亿美元成长到 2030 年的 23 亿美元,预测期内的复合年增长率为 5.4%。

随着卫星、无人机和防御系统等情报、监视和侦察 (ISR) 平台越来越依赖抗辐射处理器、控制器、储存设备和混合讯号 IC 来确保在恶劣环境下的关键任务效能,市场呈现稳步成长。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 10亿美元 |

| 部分 | 零件、製造技术、产品类型、应用、地区 |

| 目标区域 | 北美、欧洲、亚太地区和其他地区 |

国防和航太机构正在大力投资情报、监视与侦察(ISR)能力,以增强情境察觉和安全通讯,这推动了对可靠、抗辐射组件的需求。然而,高昂的开发成本以及复製真实测试环境的挑战仍然是该行业发展的主要限制。同时,儘管全球航太飞行的增加以及卫星采用商用现货 (COTS) 组件带来了机会,但高端客户的客製化需求等挑战仍在持续塑造竞争格局。

“预计 2025 年至 2030 年间,内存领域的复合年增长率将达到最高。”

在组件领域,预计内存在预测期内的复合年增长率最高。记忆体设备是储存资料、实现通讯和功能的硬体元件。用于太空船和核武等关键应用的记忆体产品需要进行辐射加固,以减少半导体组件接收的总电离剂量 (TID)。航太航太领域的运算密集型应用越来越需要高密度、高效能、抗辐射的记忆体解决方案来处理来自各种处理器节点和感测器的大量资料。

“预计到2025年,太空应用将占据最大的市场份额。”

抗辐射电子元件专为应对各种太空应用挑战并确保其可靠运作而设计。从管理卫星的机载电脑的核心到控制火箭的导引系统,这些坚固耐用的元件为一系列令人惊嘆的任务提供动力:通讯、燃油效率、科学数据收集以及在遥远行星表面的复杂机器人操控。它们对于太空船导航系统、有效载荷性能监控以及确保在宇宙辐射环境下持续飞行也至关重要。随着卫星星系、载人航太和深空探勘计画的快速发展,抗辐射电子元件正成为商业和政府太空工作中不可或缺的一部分。

“北美很可能在 2030 年占据抗辐射电子产品市场的最大份额。”

到 2030 年,北美将占据抗辐射电子产品市场的最大份额。该领域的持续技术进步、各个政府航太机构的存在以及该地区大多数主要市场参与者等因素正在推动该地区抗辐射电子产品的成长潜力。美国政府正在不断努力提高其抗辐射电子产品的製造能力。此外,强大的国防预算、对卫星星系的持续投资以及 NASA 等政府机构与 SpaceX 和 Northrop Grumman 等私人航太公司之间的合作也在推动该技术的采用。该地区还受益于成熟的半导体生态系统、广泛的研发基础设施以及对下一代 ISR 和飞弹防御系统的强劲需求。

本报告分析了全球抗辐射电子元件市场,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 抗辐射电子产品市场中的诱人机会

- 抗辐射电子元件市场(依产品类型)

- 抗辐射电子元件市场:依製造技术

- 抗辐射电子元件市场:依元件分类

- 耐辐射电子元件市场:按地区

第五章 市场概况

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 影响客户业务的趋势/中断

- 定价分析

- 主要企业按组件类型分類的电源管理产品平均售价(2024 年)

- 各主要製造商 A/D 和 D/A 转换器平均售价(2024 年)

- 主要企业处理器控制器平均售价(2024年)

- 主要企业记忆体产品平均售价(2024年)

- 价值链分析

- 生态系分析

- 投资金筹措场景

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 波特五力分析

- 主要相关利益者和采购标准

- 案例研究分析

- 贸易分析

- 进口情形(HS 代码 8541)

- 出口情况(HS 代码 8541)

- 专利分析

- 大型会议和活动(2025-2026)

- 监管格局

- 监管机构、政府机构和其他组织

- 标准和法规

- 人工智慧对抗辐射电子元件市场的影响

- 介绍

- 主要用例和市场潜力

- 2025年美国关税对抗辐射电子产品市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对使用的影响

第 6 章 抗辐射电子元件的材料与封装类型

- 介绍

- 材料

- 硅

- 碳化硅(SiC)

- 氮化镓(GaN)

- 砷化镓(GaAs)

- 包装类型

- 覆晶

- 陶瓷封装

第七章 抗辐射电子元件市场:依元件分类

- 介绍

- 混合讯号积体电路

- 处理器控制器

- 记忆

- 电源管理

- 其他部分(定性)

第八章 抗辐射电子元件市场:依製造技术

- 介绍

- 抗辐射设计 (RHBD)

- 辐射加固製程(RHBP)

- 辐射强化软体(RHBS)(定性)

9. 抗辐射电子元件市场(依产品类型)

- 介绍

- 商业现货

- 客製化

第十章 抗辐射电子元件市场:依应用

- 介绍

- 卫星)

- 航太/国防

- 核能发电厂

- 医疗保健

- 其他用途

第 11 章耐辐射电子元件市场:按地区

- 介绍

- 北美洲

- 北美宏观经济展望

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 欧洲宏观经济展望

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 亚太宏观经济展望

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 其他地区

- 中东

- 南美洲

- 非洲

第十二章 竞争格局

- 概述

- 主要参与企业的策略/优势(2019-2025)

- 收益分析(2021-2024)

- 市占率分析(2024年)

- 公司估值及财务指标

- 比较品牌

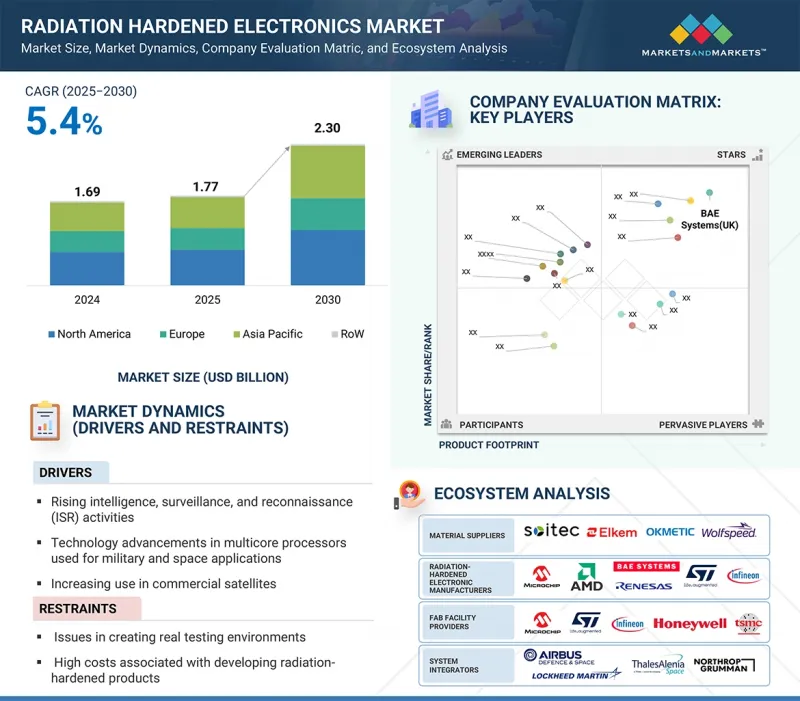

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十三章:公司简介

- 主要企业

- MICROCHIP TECHNOLOGY INC.

- BAE SYSTEMS

- RENESAS ELECTRONICS CORPORATION

- INFINEON TECHNOLOGIES AG

- STMICROELECTRONICS

- ADVANCED MICRO DEVICES, INC.

- TEXAS INSTRUMENTS INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- TELEDYNE TECHNOLOGIES INCORPORATED

- TTM TECHNOLOGIES INC.

- 其他公司

- THALES

- ANALOG DEVICES, INC.

- DATA DEVICE CORPORATION

- 3D PLUS

- MERCURY SYSTEMS, INC.

- PCB PIEZOTRONICS, INC.

- VORAGO TECHNOLOGIES

- GSI TECHNOLOGY, INC.

- EVERSPIN TECHNOLOGIES INC

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- AITECH

- MICROELECTRONICS RESEARCH DEVELOPMENT CORPORATION

- TRIAD SEMICONDUCTOR

- ZERO ERROR SYSTEMS

- RESILIENT COMPUTING

第十四章 附录

The global CST hardened electronics market is anticipated to grow from USD 1.77 billion in 2025 to USD 2.30 billion by 2030, at a CAGR of 5.4% during the forecast period. The market is experiencing steady growth as intelligence, surveillance, and reconnaissance (ISR) platforms, such as satellites, drones, and defense systems, increasingly rely on radiation-tolerant processors, controllers, memory devices, and mixed-signal ICs to ensure mission-critical performance in harsh environments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, Manufacturing Technique, Product Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Defense agencies and space organizations invest heavily in ISR capabilities to enhance situational awareness and secure communications, fueling the demand for reliable rad-hard components. However, high development costs and challenges in replicating real testing environments remain key restraints for the industry. At the same time, opportunities are emerging with the rise in global space missions and the adoption of commercial-off-the-shelf (COTS) components in satellites, while challenges such as customized requirements from high-end consumers continue to shape the competitive landscape.

"Memory segment is expected to grow at highest CAGR from 2025 to 2030"

Memory in the component segment is expected to grow at the fastest CAGR during the forecast period. A memory device is a hardware component that retains data, enabling communication or functionality. The memory products used for critical applications, such as spacecraft and nuclear weapons, need to be radiation-hardened to reduce the total ionizing dose (TID) received by the semiconductor components. Compute-intensive applications in the aerospace & space sector increasingly demand radiation-hardened memory solutions with high density and performance to handle large quantities of data obtained from various processor nodes and sensors.

"Space application is expected to record the largest market share in 2025"

Radiation-hardened electronics are specifically designed to weather the storm and ensure reliable operation across diverse space applications. From the beating heart of onboard computers managing satellites to the guidance systems steering rockets, these robust components power a remarkable range of tasks. They handle communication, fuel efficiency, scientific data collection, and complex robotic maneuvers on distant planetary surfaces. In addition, they are essential for navigation systems in spacecraft, monitoring payload performance, and ensuring mission continuity during exposure to cosmic radiation. With the rapid increase in satellite constellations, crewed missions, and deep-space exploration programs, radiation-hardened electronics are becoming indispensable for commercial and government space initiatives.

"North America is likely to register largest share of radiation hardened electronics market in 2030"

North America accounted for the largest share of the radiation hardened electronics market in 2030. Factors such as continuous technological advancements in this field, the presence of various government-owned space organizations, and a majority of the key market players in the region are driving the growth potential for radiation-hardened electronics in the region. The US government is continuously working on capabilities in manufacturing radiation hardened electronics. In addition, strong defense budgets, rising investments in satellite constellations, and collaborations between government agencies, such as NASA, and private aerospace companies, including SpaceX and Northrop Grumman, boost the adoption. The region also benefits from a well-established semiconductor ecosystem, extensive R&D infrastructure, and robust demand for next-generation ISR and missile defense systems.

Extensive primary interviews were conducted with key industry experts in the radiation hardened electronics market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 25%, and Tier 3 - 55%

- By Designation: C-level Executives - 30%, Directors - 30%, and Others - 40%

- By Region: Asia Pacific - 30%, Europe - 20%, North America - 40%, and RoW - 10%

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of companies are based on their total revenues as of 2024: Tier : >USD 1 billion, Tier 2: USD 500 million to 1 billion, and Tier 3: <USD 500 million.

The study includes an in-depth competitive analysis of these key players in the radiation hardened electronics market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report describes detailed information regarding the key factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the radiation hardened electronics market. It also includes information like technology trends, trade data, and patent analysis. This research report categorizes the radiation hardened electronics market based on components, manufacturing techniques, product type, and region. A detailed analysis of the major industry players was carried out to provide insights into their business overviews, products offered, major strategies adopted that include new product launches, deals (acquisitions, partnerships, agreements, and contracts), and others (expansions), and AI/Gen AI impact on the radiation hardened electronics market.

Key Benefits of Buying the Report:

- Analysis of key drivers (Increasing use of radiation-hardened electronics in space applications), restraints (Issues in creating real testing environment), opportunities (Favorable government initiatives and increasing space missions), and challenges (Customization required for high-end consumers)

- Product development /Innovation: Detailed insights on growing technologies, research and development activities, and new product and service launches in the radiation hardened electronics market

- Market Development: Comprehensive information about adjacent markets; the report analyses the radiation hardened electronics market across various geographies

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the radiation hardened electronics market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players, such as Microchip Technology Inc.(US), BAE Systems (UK), Renesas Electronics Corporation (Japan), Infineon Technologies AG (Germany), and STMicroelectronics (Switzerland), in the radiation hardened electronics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.2.2 YEARS CONSIDERED

- 1.2.3 INCLUSIONS AND EXCLUSIONS

- 1.3 CURRENCY CONSIDERED

- 1.4 UNIT CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RADIATION HARDENED ELECTRONICS MARKET

- 4.2 RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE

- 4.3 RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE

- 4.4 RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT

- 4.5 RADIATION HARDENED ELECTRONICS MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising intelligence, surveillance, and reconnaissance (ISR) activities

- 5.2.1.2 Mounting demand for bandwidth, data processing, and memory components

- 5.2.1.3 Growing emphasis on affordable satellite communication

- 5.2.1.4 Increasing power generation from nuclear energy

- 5.2.2 RESTRAINTS

- 5.2.2.1 Issues in creating testing environments

- 5.2.2.2 High costs associated with developing radiation-hardened products

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing global space missions

- 5.2.3.2 Rising demand for reconfigurable radiation-hardened electronics

- 5.2.3.3 Increasing use of commercial-off-the-shelf components in space satellites

- 5.2.4 CHALLENGES

- 5.2.4.1 Customization requirements from high-end consumers

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF POWER MANAGEMENT PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT TYPE, 2024

- 5.4.2 AVERAGE SELLING PRICE OF A/D & D/A CONVERTERS, BY KEY PLAYER, 2024

- 5.4.3 AVERAGE SELLING PRICE OF PROCESSORS & CONTROLLERS, BY KEY PLAYER, 2024

- 5.4.4 AVERAGE SELLING PRICE OF MEMORY PRODUCTS, BY KEY PLAYER, 2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Radiation-hardened semiconductors

- 5.8.1.2 Rad-hard design techniques

- 5.8.1.3 Rad-hard packaging

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Radiation testing and simulation tools

- 5.8.2.2 Thermal management solutions

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Satellite and space systems

- 5.8.3.2 Defense electronics and avionics

- 5.8.3.3 Quantum and cryogenic electronics

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 US DOD INVESTS IN SKYWATER TECHNOLOGY TO ADVANCE RADIATION-HARDENED TECHNOLOGY TO 90 MM PROCESS HARDENING TECHNIQUE

- 5.11.2 AAC MICROTEC AND TOHOKU UNIVERSITY INTEGRATE 4MBIT MRAM DEVICE FOR SATELLITES

- 5.11.3 ARMY CONTRACTING COMMAND INVESTS IN BAE SYSTEMS TO EXPEDITE DEVELOPMENT OF RHBD MICROELECTRONICS

- 5.11.4 NASA AND AIR FORCE RESEARCH LABORATORY CHOSE VORAGO TO PARTICIPATE IN RADIATION-HARDENED ELECTRONIC MEMORY EXPERIMENT

- 5.11.5 MERCURY SYSTEMS, INC. DEVELOPS 3U TRRUST-STOR VPX RT FOR TWO PROMINENT SUPPLIERS OF LOW EARTH ORBIT SATELLITES

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 8541)

- 5.12.2 EXPORT SCENARIO (HS CODE 8541)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS AND REGULATIONS

- 5.16 IMPACT OF AI ON RADIATION HARDENED ELECTRONICS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 TOP USE CASES AND MARKET POTENTIAL

- 5.17 IMPACT OF 2025 US TARIFF ON RADIATION HARDENED ELECTRONICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 RADIATION HARDENED ELECTRONIC MATERIALS AND PACKAGING TYPES

- 6.1 INTRODUCTION

- 6.2 MATERIALS

- 6.2.1 SILICON

- 6.2.2 SILICON CARBIDE (SIC)

- 6.2.3 GALLIUM NITRIDE (GAN)

- 6.2.4 GALLIUM ARSENIDE (GAAS)

- 6.3 PACKAGING TYPES

- 6.3.1 FLIP-CHIP

- 6.3.2 CERAMIC PACKAGES

7 RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 MIXED-SIGNAL ICS

- 7.2.1 A/D & D/A CONVERTERS

- 7.2.1.1 Increasing usage in space applications to bolster segmental growth

- 7.2.2 MULTIPLEXERS & RESISTORS

- 7.2.2.1 Rising need for data acquisition systems in space flights to augment segmental growth

- 7.2.1 A/D & D/A CONVERTERS

- 7.3 PROCESSORS & CONTROLLERS

- 7.3.1 MPU

- 7.3.1.1 Mounting development of multicore processors for space & defense applications to fuel segmental growth

- 7.3.2 MCU

- 7.3.2.1 Widespread use in spacecraft subsystems to accelerate segmental growth

- 7.3.3 ASIC

- 7.3.3.1 Ability to address highly customized design requirements to contribute to segmental growth

- 7.3.4 FPGA

- 7.3.4.1 Use to eliminate costs related to electronic re-designing or manual updating to boost segmental growth

- 7.3.1 MPU

- 7.4 MEMORY

- 7.4.1 VOLATILE

- 7.4.1.1 DRAM

- 7.4.1.1.1 Low retention time and increased bandwidth to augment segmental growth

- 7.4.1.2 SRAM

- 7.4.1.2.1 High adoption in image processing applications in satellites to fuel segmental growth

- 7.4.1.1 DRAM

- 7.4.2 NON-VOLATILE

- 7.4.2.1 MRAM

- 7.4.2.1.1 Ability to withstand effects of radiation and ionizing radiation in space to bolster segmental growth

- 7.4.2.2 Flash

- 7.4.2.2.1 Use to withstand extreme radiation to contribute to segmental growth

- 7.4.2.3 Other memory components

- 7.4.2.1 MRAM

- 7.4.1 VOLATILE

- 7.5 POWER MANAGEMENT

- 7.5.1 MOSFETS

- 7.5.1.1 Increasing adoption in outer space applications to foster segmental growth

- 7.5.2 DIODES

- 7.5.2.1 High voltage and improved electrical radiation performance to fuel segmental growth

- 7.5.3 THYRISTORS

- 7.5.3.1 Adoption in electronic converters for aerospace power systems to drive market

- 7.5.4 IGBTS

- 7.5.4.1 High current density and low power dissipation attributes to accelerate segmental growth

- 7.5.1 MOSFETS

- 7.6 OTHER COMPONENTS (QUALITATIVE)

8 RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE

- 8.1 INTRODUCTION

- 8.2 RADIATION HARDENED BY DESIGN (RHBD)

- 8.2.1 ABILITY TO IMPROVE RELIABILITY OF ELECTRONIC COMPONENTS IN EXTREME ENVIRONMENTS TO FOSTER SEGMENTAL GROWTH

- 8.2.2 TOTAL IONIZING DOSE (TID)

- 8.2.3 SINGLE EVENT EFFECT (SEE)

- 8.3 RADIATION HARDENED BY PROCESS (RHBP)

- 8.3.1 LESS SENSITIVITY TO DEGRADING EFFECTS CAUSED BY RADIATION TO BOOST SEGMENTAL GROWTH

- 8.3.2 SILICON ON INSULATOR (SOI)

- 8.3.3 SILICON ON SAPPHIRE (SOS)

- 8.4 RADIATION HARDENED BY SOFTWARE (RHBS) (QUALITATIVE)

9 RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE

- 9.1 INTRODUCTION

- 9.2 COMMERCIAL-OFF-THE-SHELF

- 9.2.1 INCREASING ADOPTION IN COMMERCIAL AND MILITARY SATELLITES DUE TO LOW-COST BENEFITS TO DRIVE MARKET

- 9.3 CUSTOM-MADE

- 9.3.1 HIGH PREFERENCE IN DEFENSE MISSION-CRITICAL APPLICATIONS TO EXPEDITE SEGMENTAL GROWTH

10 RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 SPACE (SATELLITES)

- 10.2.1 COMMERCIAL

- 10.2.1.1 Widespread use of global positioning systems and navigation systems to contribute to segmental growth

- 10.2.1.2 Small satellites

- 10.2.1.3 New space

- 10.2.1.4 Nanosatellites

- 10.2.2 MILITARY

- 10.2.2.1 Requirement for high-quality components that withstand high levels of radiation to foster segmental growth

- 10.2.1 COMMERCIAL

- 10.3 AEROSPACE & DEFENSE

- 10.3.1 WEAPONS & MISSILES

- 10.3.1.1 Deployment of reliable electronic components in defense applications to accelerate segmental growth

- 10.3.2 VEHICLES/AVIONICS

- 10.3.2.1 Focus on withstanding extreme radiation and temperature to contribute to segmental growth

- 10.3.1 WEAPONS & MISSILES

- 10.4 NUCLEAR POWER PLANTS

- 10.4.1 EMPHASIS ON INCREASING POWER GENERATION TO AUGMENT SEGMENTAL GROWTH

- 10.5 MEDICAL

- 10.5.1 IMPLANTABLE MEDICAL DEVICES

- 10.5.1.1 Rapid technological advances to accelerate segmental growth

- 10.5.2 RADIOLOGY

- 10.5.2.1 Reliance of imaging techniques on ionizing radiation to fuel segmental growth

- 10.5.1 IMPLANTABLE MEDICAL DEVICES

- 10.6 OTHER APPLICATIONS

11 RADIATION HARDENED ELECTRONICS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing space missions supported by government and private agencies to drive market

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives related to space exploration to foster market growth

- 11.2.4 MEXICO

- 11.2.4.1 Expanding economy and commercial space satellite business to augment segmental growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 UK

- 11.3.2.1 Increasing government initiatives to support space sector to fuel market growth

- 11.3.3 GERMANY

- 11.3.3.1 Proliferation of national space programs to boost demand for radiation-hardened electronics

- 11.3.4 FRANCE

- 11.3.4.1 Rising partnerships in space industry to contribute to market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Increasing investment in military operations and technologies to accelerate market growth

- 11.4.3 INDIA

- 11.4.3.1 Growing focus on Earth observation, communication, and navigation satellites to drive market

- 11.4.4 JAPAN

- 11.4.4.1 Rise in funding for space programs to contribute to market growth

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Increasing production of rockets to augment market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MIDDLE EAST

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Ambitious space and defense initiatives to contribute to market growth

- 11.5.1.2 UAE

- 11.5.1.2.1 Expanding space program and strong focus on defense modernization to drive market

- 11.5.1.3 Rest of Middle East

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Growing support from foreign space agencies to fuel market growth

- 11.5.3 AFRICA

- 11.5.3.1 Increasing investment in satellite programs to accelerate market growth

- 11.5.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2019-2025

- 12.3 REVENUE ANALYSIS, 2021-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Component footprint

- 12.7.5.4 Manufacturing technique footprint

- 12.7.5.5 Product type footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MICROCHIP TECHNOLOGY INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BAE SYSTEMS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 RENESAS ELECTRONICS CORPORATION

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 INFINEON TECHNOLOGIES AG

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 STMICROELECTRONICS

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 ADVANCED MICRO DEVICES, INC.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Product launches

- 13.1.6.3.2 Deals

- 13.1.7 TEXAS INSTRUMENTS INCORPORATED

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Other developments

- 13.1.8 HONEYWELL INTERNATIONAL INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.3.2 Deals

- 13.1.8.3.3 Other developments

- 13.1.9 TELEDYNE TECHNOLOGIES INCORPORATED

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Other developments

- 13.1.10 TTM TECHNOLOGIES INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Expansions

- 13.1.1 MICROCHIP TECHNOLOGY INC.

- 13.2 OTHER PLAYERS

- 13.2.1 THALES

- 13.2.2 ANALOG DEVICES, INC.

- 13.2.3 DATA DEVICE CORPORATION

- 13.2.4 3D PLUS

- 13.2.5 MERCURY SYSTEMS, INC.

- 13.2.6 PCB PIEZOTRONICS, INC.

- 13.2.7 VORAGO TECHNOLOGIES

- 13.2.8 GSI TECHNOLOGY, INC.

- 13.2.9 EVERSPIN TECHNOLOGIES INC

- 13.2.10 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 13.2.11 AITECH

- 13.2.12 MICROELECTRONICS RESEARCH DEVELOPMENT CORPORATION

- 13.2.13 TRIAD SEMICONDUCTOR

- 13.2.14 ZERO ERROR SYSTEMS

- 13.2.15 RESILIENT COMPUTING

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

List of Tables

- TABLE 1 RADIATION HARDENED ELECTRONICS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 MAJOR SECONDARY SOURCES

- TABLE 3 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 4 RADIATION HARDENED ELECTRONICS MARKET: RISK ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF POWER MANAGEMENT PRODUCTS OFFERED BY KEY PLAYERS, BY COMPONENT TYPE, 2024

- TABLE 6 AVERAGE SELLING PRICE OF A/D & D/A CONVERTERS OFFERED BY KEY PLAYERS, 2024

- TABLE 7 AVERAGE SELLING PRICE OF PROCESSORS & CONTROLLERS OFFERED BY KEY PLAYERS, 2024

- TABLE 8 AVERAGE SELLING PRICE OF MEMORY PRODUCTS OFFERED BY KEY PLAYERS, 2024

- TABLE 9 ROLE OF COMPANIES IN RADIATION HARDENED ELECTRONICS ECOSYSTEM

- TABLE 10 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 13 IMPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 EXPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 15 LIST OF KEY PATENTS, 2021-2025

- TABLE 16 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 23 RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 24 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 25 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 26 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 27 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 28 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 29 MIXED-SIGNAL ICS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 30 A/D & D/A CONVERTERS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 31 A/D & D/A CONVERTERS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 32 A/D & D/A CONVERTERS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 33 A/D & D/A CONVERTERS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 34 MULTIPLEXERS & RESISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 35 MULTIPLEXERS & RESISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 36 MULTIPLEXERS & RESISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 37 MULTIPLEXERS & RESISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 38 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 41 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 42 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 43 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 44 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 45 PROCESSORS & CONTROLLERS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 46 MPU: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 47 MPU: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 48 MPU: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 49 MPU: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 50 MCU: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 51 MCU: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 52 MCU: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 53 MCU: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 54 ASIC: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 55 ASIC: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 56 ASIC: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 57 ASIC: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 58 FPGA: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 59 FPGA: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 60 FPGA: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 61 FPGA: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 62 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 63 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 64 RADIATION HARDENED ELECTRONICS MARKET, BY MEMORY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 65 RADIATION HARDENED ELECTRONICS MARKET, BY MEMORY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 66 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 67 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 68 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 69 MEMORY: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 70 VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 71 VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 72 VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 73 VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 74 NON-VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 75 NON-VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 76 NON-VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 77 NON-VOLATILE: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 78 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 79 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 80 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 81 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 82 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 83 POWER MANAGEMENT: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 84 MOSFETS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 85 MOSFETS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 86 MOSFETS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 87 MOSFETS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 88 DIODES: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 89 DIODES: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 90 DIODES: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 91 DIODES: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 92 THYRISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 93 THYRISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 94 THYRISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 95 THYRISTORS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 96 IGBTS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 97 IGBTS: RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 98 IGBTS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 99 IGBTS: RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 100 RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2021-2024 (USD MILLION)

- TABLE 101 RADIATION HARDENED ELECTRONICS MARKET, BY MANUFACTURING TECHNIQUE, 2025-2030 (USD MILLION)

- TABLE 102 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 103 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 104 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 105 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 106 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 107 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 108 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 109 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 110 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 111 RADIATION HARDENED BY DESIGN (RHBD): RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 112 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 113 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 114 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 115 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 116 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 117 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 118 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 119 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 120 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 121 RADIATION HARDENED BY PROCESS (RHBP): RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 122 RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2021-2024 (USD MILLION)

- TABLE 123 RADIATION HARDENED ELECTRONICS MARKET, BY PRODUCT TYPE, 2025-2030 (USD MILLION)

- TABLE 124 COMMERCIAL OFF-THE-SHELF (COTS) PRODUCTS OFFER THE FOLLOWING BENEFITS:

- TABLE 125 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 126 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 127 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 128 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 129 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 130 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 131 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 132 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 134 COMMERCIAL OFF-THE-SHELF: RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 135 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 136 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 137 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 138 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR MIXED-SIGNAL ICS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 139 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 140 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR PROCESSORS & CONTROLLERS, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 142 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR MEMORY, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 143 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2021-2024 (USD MILLION)

- TABLE 144 CUSTOM-MADE: RADIATION HARDENED ELECTRONICS MARKET FOR POWER MANAGEMENT, BY COMPONENT TYPE, 2025-2030 (USD MILLION)

- TABLE 145 RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 146 RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 147 SPACE (SATELLITES): RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 148 SPACE (SATELLITES): RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 149 SPACE (SATELLITES): RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 150 SPACE (SATELLITES): RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 151 AEROSPACE & DEFENSE: RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 152 AEROSPACE & DEFENSE: RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 153 AEROSPACE & DEFENSE: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 AEROSPACE & DEFENSE: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 155 NUCLEAR POWER PLANTS: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 NUCLEAR POWER PLANTS: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 157 MEDICAL: RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2021-2024 (USD MILLION)

- TABLE 158 MEDICAL: RADIATION HARDENED ELECTRONICS MARKET, BY APPLICATION TYPE, 2025-2030 (USD MILLION)

- TABLE 159 MEDICAL: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 MEDICAL: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 161 OTHER APPLICATIONS: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 162 OTHER APPLICATIONS: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 163 RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 165 NORTH AMERICA: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 166 NORTH AMERICA: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 EUROPE: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 ROW: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 172 ROW: RADIATION HARDENED ELECTRONICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: RADIATION HARDENED ELECTRONICS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 RADIATION HARDENED ELECTRONICS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2019-JUNE 2025

- TABLE 176 RADIATION HARDENED ELECTRONICS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 177 RADIATION HARDENED ELECTRONICS MARKET: REGION FOOTPRINT

- TABLE 178 RADIATION HARDENED ELECTRONICS MARKET: COMPONENT FOOTPRINT

- TABLE 179 RADIATION HARDENED ELECTRONICS MARKET: MANUFACTURING TECHNIQUE FOOTPRINT

- TABLE 180 RADIATION HARDENED ELECTRONICS MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 181 RADIATION HARDENED ELECTRONICS MARKET: APPLICATION FOOTPRINT

- TABLE 182 RADIATION HARDENED ELECTRONICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 183 RADIATION HARDENED ELECTRONICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 184 RADIATION HARDENED ELECTRONICS MARKET: PRODUCT LAUNCHES, JANUARY 2019-JUNE 2025

- TABLE 185 RADIATION HARDENED ELECTRONICS MARKET: DEALS, JANUARY 2019-JUNE 2025

- TABLE 186 RADIATION HARDENED ELECTRONICS MARKET: EXPANSIONS, JANUARY 2019-JUNE 2025

- TABLE 187 MICROCHIP TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 188 MICROCHIP TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 MICROCHIP TECHNOLOGY INC.: PRODUCT LAUNCHES

- TABLE 190 MICROCHIP TECHNOLOGY INC.: DEALS

- TABLE 191 MICROCHIP TECHNOLOGY INC.: EXPANSIONS

- TABLE 192 BAE SYSTEMS: COMPANY OVERVIEW

- TABLE 193 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 BAE SYSTEMS: PRODUCT LAUNCHES

- TABLE 195 BAE SYSTEMS: DEALS

- TABLE 196 BAE SYSTEMS: OTHER DEVELOPMENTS

- TABLE 197 RENESAS ELECTRONICS CORPORATION: COMPANY OVERVIEW

- TABLE 198 RENESAS ELECTRONICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 RENESAS ELECTRONICS CORPORATION: PRODUCT LAUNCHES

- TABLE 200 RENESAS ELECTRONICS CORPORATION: DEALS

- TABLE 201 RENESAS ELECTRONICS CORPORATION: OTHER DEVELOPMENTS

- TABLE 202 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW

- TABLE 203 INFINEON TECHNOLOGIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 INFINEON TECHNOLOGIES AG: PRODUCT LAUNCHES

- TABLE 205 INFINEON TECHNOLOGIES AG: DEALS

- TABLE 206 INFINEON TECHNOLOGIES AG: OTHER DEVELOPMENTS

- TABLE 207 STMICROELECTRONICS: COMPANY OVERVIEW

- TABLE 208 STMICROELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 STMICROELECTRONICS: PRODUCT LAUNCHES

- TABLE 210 STMICROELECTRONICS: DEALS

- TABLE 211 ADVANCED MICRO DEVICES, INC.: COMPANY OVERVIEW

- TABLE 212 ADVANCED MICRO DEVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 ADVANCED MICRO DEVICES, INC.: PRODUCT LAUNCHES

- TABLE 214 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 215 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW

- TABLE 216 TEXAS INSTRUMENTS INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 TEXAS INSTRUMENTS INCORPORATED: PRODUCT LAUNCHES

- TABLE 218 TEXAS INSTRUMENTS INCORPORATED: DEALS

- TABLE 219 TEXAS INSTRUMENTS INCORPORATED: OTHER DEVELOPMENTS

- TABLE 220 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 221 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 223 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 224 HONEYWELL INTERNATIONAL INC.: OTHER DEVELOPMENTS

- TABLE 225 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 226 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES

- TABLE 228 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 229 TELEDYNE TECHNOLOGIES INCORPORATED: OTHER DEVELOPMENTS

- TABLE 230 TTM TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 231 TTM TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 TTM TECHNOLOGIES INC.: PRODUCT LAUNCHES

- TABLE 233 TTM TECHNOLOGIES INC.: OTHER DEVELOPMENTS

List of Figures

- FIGURE 1 RADIATION HARDENED ELECTRONICS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RADIATION HARDENED ELECTRONICS MARKET: DURATION CONSIDERED

- FIGURE 3 RADIATION HARDENED ELECTRONICS MARKET: RESEARCH FLOW

- FIGURE 4 RADIATION HARDENED ELECTRONICS MARKET: RESEARCH DESIGN

- FIGURE 5 RADIATION HARDENED ELECTRONICS MARKET: RESEARCH APPROACH

- FIGURE 6 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 7 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 8 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 9 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 10 RADIATION HARDENED ELECTRONICS MARKET ESTIMATION

- FIGURE 11 RADIATION HARDENED ELECTRONICS MARKET: BOTTOM-UP APPROACH

- FIGURE 12 RADIATION HARDENED ELECTRONICS MARKET: TOP-DOWN APPROACH

- FIGURE 13 RADIATION HARDENED ELECTRONICS MARKET: DATA TRIANGULATION

- FIGURE 14 RADIATION HARDENED ELECTRONICS MARKET: RESEARCH ASSUMPTIONS

- FIGURE 15 POWER MANAGEMENT SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 16 RADIATION HARDENED BY DESIGN (RHBD) TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 17 SPACE (SATELLITES) SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 18 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 19 INCREASING NUMBER OF COMMUNICATION SATELLITES TO PROPEL RADIATION HARDENED ELECTRONICS MARKET

- FIGURE 20 COMMERCIAL-OFF-THE-SHELF SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 21 RADIATION HARDENED BY DESIGN (RHBD) SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 22 MEMORY SEGMENT TO COMMAND HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 23 CHINA TO RECORD HIGHEST CAGR IN GLOBAL RADIATION HARDENED ELECTRONICS MARKET FROM 2025 TO 2030

- FIGURE 24 EVOLUTION OF RADIATION-HARDENED ELECTRONICS TECHNOLOGY

- FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 26 DRIVERS: IMPACT ANALYSIS

- FIGURE 27 RESTRAINTS: IMPACT ANALYSIS

- FIGURE 28 OPPORTUNITIES: IMPACT ANALYSIS

- FIGURE 29 CHALLENGES: IMPACT ANALYSIS

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 AVERAGE SELLING PRICE OF POWER MANAGEMENT COMPONENTS OFFERED BY KEY PLAYERS, 2024

- FIGURE 32 VALUE CHAIN ANALYSIS

- FIGURE 33 RADIATION HARDENED ELECTRONICS ECOSYSTEM

- FIGURE 34 INVESTMENT AND FUNDING SCENARIO, 2019-2024

- FIGURE 35 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 37 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 38 IMPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 EXPORT DATA FOR HS CODE 8541-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 41 KEY AI USE CASES IN RADIATION HARDENED ELECTRONICS MARKET

- FIGURE 42 POWER MANAGEMENT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 43 RADIATION HARDENED BY DESIGN (RHBD) SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 COMMERCIAL-OFF-THE-SHELF SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 45 SPACE (SATELLITES) SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 46 CHINA TO GROW AT HIGHEST CAGR IN GLOBAL RADIATION HARDENED ELECTRONICS MARKET FROM 2025 TO 2030

- FIGURE 47 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 48 NORTH AMERICA: RADIATION HARDENED ELECTRONICS MARKET SNAPSHOT

- FIGURE 49 EUROPE: RADIATION HARDENED ELECTRONICS MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: RADIATION HARDENED ELECTRONICS MARKET SNAPSHOT

- FIGURE 51 RADIATION HARDENED ELECTRONICS MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2021-2024

- FIGURE 52 MARKET SHARE ANALYSIS OF COMPANIES OFFERING RADIATION HARDENED ELECTRONICS, 2024

- FIGURE 53 COMPANY VALUATION

- FIGURE 54 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 55 BRAND COMPARISON

- FIGURE 56 RADIATION HARDENED ELECTRONICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 57 RADIATION HARDENED ELECTRONICS MARKET: COMPANY FOOTPRINT

- FIGURE 58 RADIATION HARDENED ELECTRONICS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 59 MICROCHIP TECHNOLOGY INC.: COMPANY SNAPSHOT

- FIGURE 60 BAE SYSTEMS: COMPANY SNAPSHOT

- FIGURE 61 RENESAS ELECTRONICS CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 INFINEON TECHNOLOGIES AG: COMPANY SNAPSHOT

- FIGURE 63 STMICROELECTRONICS: COMPANY SNAPSHOT

- FIGURE 64 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT

- FIGURE 65 TEXAS INSTRUMENTS INCORPORATED: COMPANY SNAPSHOT

- FIGURE 66 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 67 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 68 TTM TECHNOLOGIES INC.: COMPANY SNAPSHOT