|

市场调查报告书

商品编码

1834229

全球自动驾驶高清地图市场(至 2032 年):按服务类型(地图绘製与本地化、更新与维护)、车辆类型(PC 与 CV)、解决方案类型(嵌入式与云端)、用途、自动化程度(L2、L3、L4、L5)和地区划分HD Maps for Autonomous Driving Market by Service Type (Mapping & Localization, Update & Maintenance), Vehicle Type (PC & CV), Solution Type (Embedded & Cloud), Usage Type, Level of Automation (L2, L3, L4, L5), and Region - Global Forecast to 2032 |

||||||

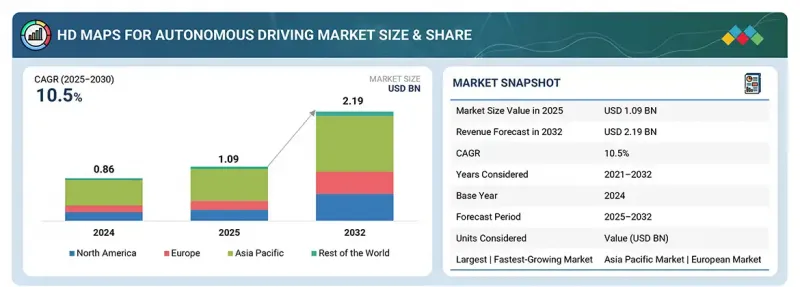

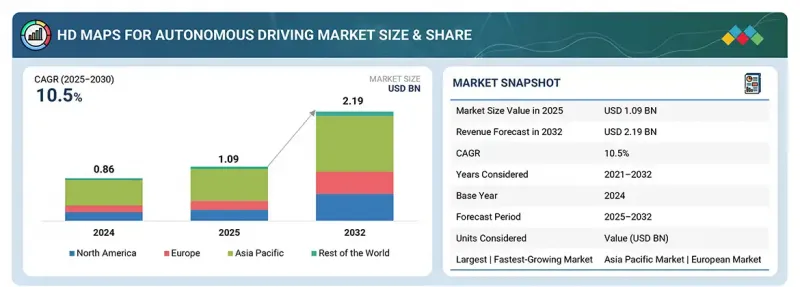

自动驾驶高清地图市场规模预计将从 2025 年的 10.9 亿美元增长到 2032 年的 21.9 亿美元,预测期内的复合年增长率为 10.5%。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 单元 | 金额(美元) |

| 按细分市场 | 依服务类型、自动化程度、解决方案类型、使用模式、车辆类型和地区 |

| 目标区域 | 亚太地区、北美、欧洲和世界其他地区 |

由于语意地图技术的进步,自动驾驶高清地图市场正在迅速扩张。这种地图不仅能辨识道路,还能辨识交通号誌、行人穿越道和车道标记等物体,并理解週边交通状况。此外,区块链技术和安全资料共用框架正日益应用,以确保所有车队都能可靠且透明地更新地图。节能地图生成技术也日益受到关注,它们能够在保持高精度的同时降低自动驾驶汽车的计算负荷。高清地图资料通常由配备光达、摄影机、GPS 和雷达等感测器的车队收集。这些车辆在行驶过程中不断获取和更新道路及週边环境的详细信息,并透过众包和感测器融合技术,确保地图始终保持准确和最新。这些因素正在强力推动自动驾驶高清地图市场的成长。

按解决方案类型划分,嵌入式细分市场预计将在预测期内占据较大份额

嵌入式解决方案可直接在车辆内提供即时、高精度的定位和导航,透过本地处理减少通讯延迟,并在动态、安全关键的通讯环境中实现更快的回应时间。这些系统无需依赖云端连线即可运行,即使在连线受限的区域也能确保可靠性和弹性。整合来自 V2X 和车载感测器的即时数据还能使高清地图持续更新,支援自动驾驶所需的持续更新。日益复杂的城市基础设施以及对详细环境理解的需求,推动了对能够处理精确道路几何形状和交通场景的高性能嵌入式地图系统的需求。此外,半导体技术和感测器融合演算法的进步正在提高这些系统的效率并降低成本。

从自动化程度来看,自动驾驶汽车领域预计将在预测期内显着成长

这一增长得益于人工智慧、高清地图、雷射雷达和感测器融合技术的快速发展,这些技术正在实现无需人工干预的完全自动驾驶(4 级和 5 级)。此外,对自动驾驶计程车、无人驾驶巴士和物流车辆的投资正在增加,政府推动智慧运输的政策也在推动市场扩张。 Waymo、Uber 和百度阿波罗等公司在城市推出的商用自动驾驶计程车服务也推动了对高清地图的需求。这些公司正在利用高清地图实现厘米级定位精度、详细的道路理解和即时导航,从而提高安全性、舒适性和营运可靠性。

“预计欧洲将在预测期内实现最高增长率”

欧洲对高清地图的需求受到以下因素的推动:欧盟严格的安全法规、2+级和3级自动驾驶功能向豪华车的扩展,以及政府对智慧运输和互联基础设施的支持。都市区自动驾驶试验的增加也加速了高清地图的普及。

本报告调查了全球自动驾驶高清地图市场,并提供了市场概况、影响市场成长的各种因素分析、技术和专利趋势、法律制度、案例研究、市场规模趋势和预测、各个细分市场、地区/主要国家的详细分析、竞争格局和主要企业的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概况

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

第六章 产业趋势

- 总体经济指标

- 生态系分析

- 供应链分析

- 定价分析

- 主要相关利益者和采购标准

- 案例研究分析

- 投资金筹措场景

- 策略展望与成长机会

- 贸易分析

- 2025-2026年重要会议和活动

- 影响客户业务的趋势/中断

- 监管状况

- 专利分析

- 生成式人工智慧对自动驾驶市场高画质地图的影响

- 混合地图策略协助 ADAS 开发

- 无地图自动驾驶概念对高清地图的影响

- 自动驾驶汽车高清地图经营模式的演变

- MNM 对在地化领先产业解决方案的洞察

- 高清地图资料格式及标准化现状

- 自动驾驶生态系中高清地图的分阶段采用策略

- 关键新兴技术

- 互补技术

- 技术/产品蓝图

- 高画质地图服务供应商:竞争格局

- OEM高清地图解决方案的比较分析

- 高清地图的未来应用

- 成功案例和实际应用

7. 自动驾驶高清地图市场(依自动化程度)

- 半自动驾驶汽车

- 2级

- 3级

- 自动驾驶汽车

- 4级

- 5级

- 关键见解

第 8 章:按服务类型分類的自动驾驶高清地图市场

- 地图绘製与本地化

- 更新和维护

- 广告

- 关键见解

9. 自动驾驶高清地图市场(依解决方案类型)

- 嵌入式

- 云端基础

- 关键见解

第 10 章:按使用类型分類的自动驾驶高清地图市场

- 个人出行

- 商业移动性

- 关键见解

第 11 章。按车辆类型分類的自动驾驶高清地图市场

- 搭乘用车

- 商用车

- 关键见解

第 12 章:按地区分類的自动驾驶高清地图市场

- 亚太地区

- 宏观经济展望

- 中国

- 印度

- 日本

- 韩国

- 欧洲

- 宏观经济展望

- 德国

- 法国

- 义大利

- 西班牙

- 英国

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 其他地区

- 宏观经济展望

- 巴西

- 南非

- 俄罗斯

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

第十三章竞争格局

- 概述

- 主要参与企业的策略/优势

- 市占率分析

- 前5家公司收益分析

- 估值和财务指标

- 品牌/产品比较

- 公司评估矩阵:主要企业

- 公司估值矩阵:Start-Ups/中小型企业

- 竞争场景

第十四章:公司简介

- 主要企业

- HERE

- BAIDU INC.

- TOMTOM INTERNATIONAL BV

- NVIDIA CORPORATION

- MOBILEYE

- WAYMO LLC

- DYNAMIC MAP PLATFORM CO., LTD.

- NAVINFO CO., LTD.

- LUMINAR TECHNOLOGIES, INC.

- THE SANBORN MAP COMPANY, INC.

- MOMENTA

- MAPBOX

- 其他公司

- CE INFO SYSTEMS LTD.

- NAVMII

- RMSI

- ZENRIN CO., LTD.

- WOVEN BY TOYOTA, INC.

- SWIFT NAVIGATION, INC.

- IMERIT

- VOXELMAPS

- HYUNDAI AUTOEVER CORP.

- GENESYS INTERNATIONAL CORPORATION LTD

- GEOMATE

- INTELLIAS

- MORAI INC.

第十五章 附录

The HD maps for autonomous driving market is projected to grow from USD 1.09 billion in 2025 to USD 2.19 billion by 2032, at a CAGR of 10.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By service type, level of automation, solution type, usage type, vehicle type, and region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The HD maps for autonomous driving market is growing with the rise of semantic mapping, where maps show roads and interpret objects, such as traffic lights, crosswalks, and lane markings for contextual awareness. Another emerging trend is the use of blockchain and secure data-sharing frameworks to ensure reliability and trust in map updates across fleets. In addition, energy-efficient mapping techniques are gaining attention to reduce the computational load on autonomous vehicles while maintaining accuracy. Data for HD maps is typically collected through fleets of sensor-equipped vehicles using LiDAR, cameras, GPS, and radar, which continuously capture and update detailed road and environment information. This crowdsourced and sensor-fusion approach ensures maps remain precise and up to date for autonomous driving. All these factors are boosting the growth of the HD maps for autonomous driving market.

The embedded segment is projected to account for a significant share during the forecast period.

By solution type, the embedded segment is projected to account for a significant share during the forecast period. Embedded solutions offer real-time, high-precision localization and navigation directly within a vehicle's onboard systems, processing mapping data locally to reduce latency and enable faster response times critical for safety in dynamic driving environments. These systems operate independently of cloud connectivity, providing enhanced reliability and resilience, especially in areas with limited or no network coverage. By seamlessly integrating real-time data from sensors and vehicle-to-everything (V2X) communication, embedded solutions ensure that HD maps remain current and accurate, supporting the continuous updates required by autonomous vehicles. The growing complexity of urban infrastructure and the need for detailed environmental understanding further drive the demand for sophisticated embedded mapping systems capable of handling intricate road geometries and traffic scenarios. With advancements in semiconductor technology and sensor fusion algorithms, these systems are becoming increasingly cost-effective and efficient.

Companies such as HERE (Netherlands), Baidu Inc. (China), Hyundai Autoever Corporation (South Korea), and Mapbox (US) offer embedded HD Map solutions. The Volvo EX90 and Polestar 3 were among the first to feature Google's embedded HD maps to improve driver assistance. NIO also provides an offline mode for its HD maps in the Navigation on Pilot system of the NIO ET7, allowing use in areas with weak or no internet connection. Similarly, BMW's Personal Pilot Level 2+ system uses HERE Technologies' embedded HD maps to enable "on-map" driving.

The autonomous vehicles segment is projected to grow at a significant rate during the forecast period.

By level of automation, the autonomous vehicles segment is projected to grow at a significant rate during the forecast period. The growth of HD maps in autonomous vehicles, including Level 4 and Level 5 autonomy, is driven by major advancements in AI, HD mapping, LiDAR, and sensor fusion, making fully autonomous driving possible without human input. Increasing investments in robotaxis, autonomous shuttles, and logistics fleets, supported by government smart mobility programs, are speeding up large-scale adoption. The launch of commercial robotaxi services by companies such as Waymo, Uber, and Baidu Apollo in selected urban areas further boosts the market. These players use HD maps to provide centimeter-level localization, detailed road understanding, and real-time navigation for safe autonomous driving. This helps them improve ride reliability, enhance passenger safety, and ensure smooth operation in complex urban environments.

In September 2025, Uber Technologies (China) and Momenta (China) plan to begin testing Level 4 autonomous robotaxi services in Munich, Germany. Similarly, in August 2025, Kia partnered with Autonomous A2Z to develop Level 4 self-driving cars using Kia's PBV (Platform Beyond Vehicle) system, with plans to showcase these vehicles at the 2025 Asia Pacific Economic Cooperation summit in Gyeongju, South Korea. In addition, the use of autonomous driving in freight and delivery operations helps lower costs and tackle driver shortages, creating more opportunities for HD maps.

"Europe is projected to grow at the highest rate during the forecast period."

Europe is projected to grow at the highest rate in the HD maps for autonomous driving market during the forecast period. The demand for HD maps in Europe will be driven by stringent EU safety regulations, the expansion of Level 2+ and Level 3 semi-autonomous driving features in premium vehicles, and strong government backing for smart mobility and connected infrastructure. Growing autonomous trials in urban mobility further accelerate adoption.

Companies such as HERE (Netherlands), TomTom International BV (Netherlands), and Navmii (UK) provide HD maps for autonomous driving vehicles in Europe. In August 2025, HERE partnered with DAF Trucks N.V. in the EU co-funded MODI Project to advance and test Level 4 automated freight transport across Europe. In this project, DAF contributes its expertise in commercial vehicles. At the same time, HERE provides its High-Definition Live Map (HDLM), which functions as an external sensor, with data collected from DAF's sensor-equipped automated trucks feeding into HERE's platform to keep the maps continuously updated for safe and reliable operations. Likewise, in April 2025, HERE signed an MoU with Lotus Robotics, the intelligent driving division of Lotus Technology, to develop an advanced Highway Navigation Pilot that delivers Level 2+ (L2+) automated driving functions. The partnership combined Lotus's sensor perception stack with HERE's high-precision maps to enable safer, more advanced driving features, including hands-off driving in certain conditions. The solution, planned for European approval in 2025, will be used in future Lotus vehicles and offered to other automakers.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEM - 8%, Tier I - 74%, and Tier 2/3 - 8%

- By Designation: CXOs - 36%, Managers - 51%, and Executives - 13%

- By Region: North America - 24%, Europe - 30%, Asia Pacific - 38%, and ROW - 8%

The HD maps for autonomous driving market is dominated by major players, including HERE (Netherlands), Baidu, Inc. (China), TomTom International BV (Netherlands), NVIDIA Corporation (US), and Mobileye (Israel). These companies offer highly detailed, lane-level HD maps with real-time updates to support autonomous driving and ADAS. They also provide value-added services, such as dynamic map layers (traffic, road conditions, and weather), cloud-based map delivery platforms, crowdsourced data integration, sensor fusion solutions, and software tools for path planning, localization, and navigation.

Research Coverage

The report covers the HD maps for autonomous driving market by service type (mapping & localization, update & maintenance, and advertisement), vehicle type (passenger car and commercial vehicle), solution type (embedded and cloud-based), usage type, level of automation, and region. It covers the major HD maps' competitive landscape and company profiles for autonomous driving market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall HD maps for autonomous driving market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The Report Provides Insight into the Following Pointers:

- Analysis of key drivers (Rising penetration of autonomous vehicles in the global mobility ecosystem, focus on leveraging next-gen mapping and data collection for enhanced navigation, emergence of autonomous urban mobility applications, increasing adoption of L2 and L3 ADAS-equipped vehicles), restraints (lack of global standardization, less reliability in untested environments), opportunities (integration with traffic and infrastructure systems for optimized urban navigation, map-as-a-service enabling scalable and flexible adoption, adoption in emerging markets with 5G expansion), and challenges (high cost of development and maintenance, complex real-time merging of multi-sensor data, dependence on high-bandwidth networks and advanced edge computing infrastructure).

- Product Development/Innovation: Detailed insights into upcoming technologies and research & development activities in the HD maps for autonomous driving market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the HD maps for autonomous driving market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as HERE (Netherlands), Baidu, Inc. (China), TomTom International BV (Netherlands), NVIDIA Corporation (US), and Mobileye (Israel) in the HD maps for autonomous driving market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF STRATEGIC CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.2.5 Primary interviewees

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BASE NUMBER CALCULATION

- 2.2.3 MARKET FORECAST APPROACH

- 2.2.3.1 Supply side

- 2.2.3.2 Demand side

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS

- 3.3 DISRUPTIVE TRENDS SHAPING MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HD MAPS FOR AUTONOMOUS DRIVING MARKET

- 4.2 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE

- 4.3 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE

- 4.4 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE

- 4.5 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION

- 4.6 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE

- 4.7 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising penetration of autonomous vehicles into global mobility ecosystem

- 5.2.1.2 Focus on leveraging next-gen mapping and data collection for enhanced navigation

- 5.2.1.3 Emergence of autonomous urban mobility applications

- 5.2.1.4 Increasing adoption of L2 and L3 ADAS-equipped vehicles

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of global standardization

- 5.2.2.2 Less reliability in untested environments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration with traffic and infrastructure systems for optimized urban navigation

- 5.2.3.2 Map-as-a-service enabling scalable and flexible adoption

- 5.2.3.3 Adoption in emerging markets with 5G expansion

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of development and maintenance

- 5.2.4.2 Complex real-time merging of multi-sensor data

- 5.2.4.3 Dependence on high-bandwidth networks and advanced edge computing infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 MACROECONOMIC INDICATORS

- 6.1.1 INTRODUCTION

- 6.1.2 GDP TRENDS AND FORECAST

- 6.1.3 TRENDS IN GLOBAL AUTONOMOUS DRIVING INDUSTRY

- 6.1.4 TRENDS IN GLOBAL AUTOMOTIVE & TRANSPORTATION INDUSTRY

- 6.2 ECOSYSTEM ANALYSIS

- 6.2.1 HD MAP PROVIDERS

- 6.2.2 AUTONOMOUS DRIVING SOFTWARE/PLATFORM PROVIDERS

- 6.2.3 CLOUD INFRASTRUCTURE PROVIDERS

- 6.2.4 SENSOR PROVIDERS

- 6.2.5 TELEMATICS & CONNECTIVITY PROVIDERS

- 6.2.6 OEMS

- 6.2.7 FLEET OPERATORS/MOBILITY PROVIDERS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 INDICATIVE PRICING OF AUTONOMOUS DRIVING SOFTWARE SUITE OFFERED BY KEY PLAYERS

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.5.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 6.5.4 MARKET PROFITABILITY

- 6.5.4.1 Revenue potential

- 6.5.4.2 Cost dynamics

- 6.5.4.3 Margin opportunities, by application

- 6.5.5 DECISION-MAKING PROCESS

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 MERCEDES-BENZ INTEGRATED HERE'S HD LIVE MAP INTO ITS DRIVE PILOT SYSTEM

- 6.6.2 INTELLIAS CONCEPTUALIZED, DEVELOPED, AND SCALED CLOUD-BASED HD MAPPING AND LOCATION DATA PLATFORM FOR AUTONOMOUS DRIVING

- 6.6.3 MAGNASOFT DEPLOYED AI-DRIVEN CONTINUOUS IMPROVEMENT PROCESSES THAT ENABLED REAL-TIME DETECTION OF CHANGES IN TRAFFIC PATTERNS AND ROAD CONDITIONS

- 6.6.4 INFOSYS DEPLOYED MULTI-SOURCE HD MAPPING SOLUTION SPECIFICALLY DESIGNED FOR ADAS IN URBAN ENVIRONMENTS

- 6.7 INVESTMENT & FUNDING SCENARIO

- 6.8 STRATEGIC OUTLOOK AND GROWTH OPPORTUNITIES

- 6.8.1 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 6.8.1.1 Interconnected markets

- 6.8.1.2 Cross-sector opportunities

- 6.8.2 STRATEGIC MOVES BY OEMS AND TIER-1 & TIER-2/3 PLAYERS

- 6.8.1 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 852691)

- 6.9.2 EXPORT SCENARIO (HS CODE 852691)

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.12 REGULATORY LANDSCAPE

- 6.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12.2 KEY REGULATIONS

- 6.12.3 REGULATIONS GOVERNING AUTONOMOUS VEHICLE USAGE, BY COUNTRY

- 6.13 PATENT ANALYSIS

- 6.13.1 INTRODUCTION

- 6.13.2 METHODOLOGY

- 6.13.3 DOCUMENT TYPE

- 6.13.4 INSIGHTS

- 6.13.5 LEGAL STATUS OF PATENTS

- 6.13.6 JURISDICTION ANALYSIS

- 6.13.7 TOP PATENT APPLICANTS

- 6.13.8 LIST OF PATENTS

- 6.14 IMPACT OF GENERATIVE AI ON HD MAPS FOR AUTONOMOUS DRIVING MARKET

- 6.14.1 ACCELERATED MAP CREATION AND UPDATES

- 6.14.2 ENHANCED LOCALIZATION ACCURACY

- 6.14.3 COST REDUCTION THROUGH SYNTHETIC DATA

- 6.14.4 DYNAMIC MAP PERSONALIZATION

- 6.15 HYBRID MAPPING STRATEGIES FOR ENHANCING ADAS DEVELOPMENT

- 6.16 IMPACT OF MAPLESS AUTONOMY CONCEPT ON HD MAPS

- 6.17 EVOLVING BUSINESS MODELS FOR HD MAPPING IN AUTONOMOUS MOBILITY

- 6.17.1 LICENSING AND SUBSCRIPTION-BASED MODEL

- 6.17.2 CROWDSOURCED MAPPING AND DATA-AS-A-SERVICE (DAAS)

- 6.17.3 PAY-PER-USE MODEL

- 6.18 MNM INSIGHTS ON KEY INDUSTRY SOLUTIONS FOR LOCALIZATION

- 6.18.1 GNSS AND AUGMENTED POSITIONING

- 6.18.2 HD MAP-BASED LOCALIZATION

- 6.18.3 LIDAR AND CAMERA-BASED LOCALIZATION

- 6.18.4 SENSOR FUSION

- 6.18.5 V2X-ENABLED COOPERATIVE LOCALIZATION

- 6.19 HD MAP DATA FORMATS AND STANDARDIZATION LANDSCAPE

- 6.19.1 CORE COMPONENTS OF HD MAP DATA

- 6.19.1.1 Geometric layer

- 6.19.1.2 Semantic layer

- 6.19.1.3 Localization layer

- 6.19.1.4 Dynamic/Update layer

- 6.19.2 KEY STANDARDS AND FORMATS

- 6.19.1 CORE COMPONENTS OF HD MAP DATA

- 6.20 PHASED ADOPTION STRATEGY OF HD MAPS IN AV ECOSYSTEM

- 6.20.1 ASSISTED DRIVING & PILOT DEPLOYMENTS

- 6.20.2 LIMITED AUTONOMY IN CONTROLLED ENVIRONMENTS

- 6.20.3 EXPANDED COVERAGE & REAL-TIME UPDATES

- 6.20.4 FULL AUTONOMY & ECOSYSTEM INTEGRATION

- 6.21 KEY EMERGING TECHNOLOGIES

- 6.21.1 INTRODUCTION

- 6.21.2 MULTI-SENSOR FUSION FOR HIGH PRECISION HD MAPPING WITH LIDAR, RADAR, AND CAMERAS

- 6.21.3 SLAM (SIMULTANEOUS LOCALIZATION AND MAPPING) IN HD MAPS FOR AUTONOMOUS DRIVING

- 6.21.4 5G CONNECTIVITY AND VEHICLE-TO-EVERYTHING (V2X) TECHNOLOGY FOR AUTONOMOUS DRIVING

- 6.22 COMPLEMENTARY TECHNOLOGIES

- 6.22.1 SECURING AND VALIDATING HD MAPS WITH BLOCKCHAIN

- 6.22.2 ENHANCING HD MAPS WITH MACHINE LEARNING (ML)-POWERED ANALYTICS

- 6.23 TECHNOLOGY/PRODUCT ROADMAP

- 6.23.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION

- 6.23.2 MID-TERM (2028-2030) | EXPANSION & STANDARDIZATION

- 6.23.3 LONG-TERM (2031-2035+) | MASS COMMERCIALIZATION & DISRUPTION

- 6.24 HD MAPPING SERVICE PROVIDERS: COMPETITIVE LANDSCAPE

- 6.25 COMPARATIVE ANALYSIS OF OEM HD MAPPING SOLUTIONS

- 6.26 FUTURE APPLICATIONS OF HD MAPS

- 6.27 SUCCESS STORIES AND REAL-WORLD APPLICATIONS

- 6.27.1 WAYMO'S COMMERCIAL ROBOTAXI OPERATIONS IN US

- 6.27.2 MOBILEYE REM: CROWDSOURCED HD MAPPING ACROSS EUROPE

- 6.27.3 BAIDU APOLLO GO: CHINA'S ROBOTAXI EXPANSION

7 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION

- 7.1 INTRODUCTION

- 7.2 SEMI-AUTONOMOUS VEHICLE

- 7.2.1 GROWING DEMAND FOR ADVANCED ADAS-EQUIPPED VEHICLES TO DRIVE MARKET

- 7.2.2 LEVEL 2

- 7.2.3 LEVEL 3

- 7.3 AUTONOMOUS VEHICLE

- 7.3.1 RISING USE OF AUTONOMOUS DRIVING VEHICLES IN URBAN MOBILITY OPERATIONS TO DRIVE DEMAND

- 7.3.2 LEVEL 4

- 7.3.3 LEVEL 5

- 7.4 KEY PRIMARY INSIGHTS

8 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE

- 8.1 INTRODUCTION

- 8.2 MAPPING & LOCALIZATION

- 8.2.1 INTEGRATION OF AI, 5G, AND CROWDSOURCED DATA IN HD MAPS TO DRIVE MARKET

- 8.3 UPDATE & MAINTENANCE

- 8.3.1 RISING NEED FOR REAL-TIME HD MAP UPDATES AND PREDICTIVE MAINTENANCE TO DRIVE MARKET

- 8.4 ADVERTISEMENT

- 8.5 KEY PRIMARY INSIGHTS

9 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE

- 9.1 INTRODUCTION

- 9.2 EMBEDDED

- 9.2.1 DEMAND FOR ONBOARD MAPPING AND SENSOR FUSION TECHNOLOGIES TO DRIVE MARKET

- 9.3 CLOUD-BASED

- 9.3.1 FOCUS ON ADOPTING SCALABLE CLOUD PLATFORMS FOR AUTONOMOUS NAVIGATION TO DRIVE MARKET

- 9.4 KEY PRIMARY INSIGHTS

10 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE

- 10.1 INTRODUCTION

- 10.2 PERSONAL MOBILITY

- 10.2.1 RISING DEMAND FOR ADAS-EQUIPPED PASSENGER CARS TO DRIVE MARKET

- 10.3 COMMERCIAL MOBILITY

- 10.3.1 GROWING REGULATORY EMPHASIS ON APPROVALS FOR AUTONOMOUS VEHICLE TESTING TO DRIVE MARKET

- 10.4 KEY PRIMARY INSIGHTS

11 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE

- 11.1 INTRODUCTION

- 11.2 PASSENGER CAR

- 11.2.1 POPULARITY OF CONNECTED-CAR ECOSYSTEMS EQUIPPED WITH REAL-TIME MAPPING TO DRIVE MARKET

- 11.3 COMMERCIAL VEHICLE

- 11.3.1 AUTONOMOUS FLEET NAVIGATION AND PREDICTIVE ROUTING TO DRIVE MARKET

- 11.4 KEY PRIMARY INSIGHTS

12 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 MACROECONOMIC OUTLOOK

- 12.2.2 CHINA

- 12.2.2.1 High production of vehicles and favourable investment norms to drive growth

- 12.2.3 INDIA

- 12.2.3.1 Increased focus on emission-friendly vehicles and vehicle safety regulations to drive market

- 12.2.4 JAPAN

- 12.2.4.1 Increased sales of mid-range cars to drive market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Rapid integration of HD maps into autonomous vehicle technologies to boost growth

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK

- 12.3.2 GERMANY

- 12.3.2.1 Increased production of passenger cars to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Need for improving road safety through advanced ADAS features to drive market

- 12.3.4 ITALY

- 12.3.4.1 Presence of major OEMs to drive advancements in HD map technology

- 12.3.5 SPAIN

- 12.3.5.1 Rise in government initiatives for advanced automotive systems to drive market

- 12.3.6 UK

- 12.3.6.1 Rising automotive output in country to spur demand for HD maps

- 12.4 NORTH AMERICA

- 12.4.1 MACROECONOMIC OUTLOOK

- 12.4.2 US

- 12.4.2.1 Rising investments by OEMs in emerging megatrends to drive market

- 12.4.3 CANADA

- 12.4.3.1 Heightened awareness of consumers regarding vehicle safety to drive adoption of HD maps

- 12.5 REST OF THE WORLD (ROW)

- 12.5.1 MACROECONOMIC OUTLOOK

- 12.5.2 BRAZIL

- 12.5.2.1 Collaboration between autonomous driving companies and other tech companies to boost growth

- 12.5.3 SOUTH AFRICA

- 12.5.3.1 Rapid growth of automotive sector and rising number of vehicle manufacturers to drive demand

- 12.5.4 RUSSIA

- 12.5.4.1 Changing market dynamics aligned with rising production of autonomous vehicles to drive growth

- 12.5.5 SAUDI ARABIA

- 12.5.5.1 Rising domestic demand for vehicles and support of government-backed initiatives to boost growth

- 12.5.6 UAE

- 12.5.6.1 Rapid investments in electric and autonomous vehicle infrastructure to boost growth

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Usage type footprint

- 13.7.5.4 Vehicle type footprint

- 13.7.5.5 Level of automation footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSION

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 HERE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Other developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BAIDU INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 TOMTOM INTERNATIONAL BV

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product/Service launches/developments

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 NVIDIA CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 MOBILEYE

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Deals

- 14.1.5.3.2 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 WAYMO LLC

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 DYNAMIC MAP PLATFORM CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product/Service launches/developments

- 14.1.7.3.2 Deals

- 14.1.7.3.3 Expansion

- 14.1.7.3.4 Other developments

- 14.1.8 NAVINFO CO., LTD.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Other developments

- 14.1.9 LUMINAR TECHNOLOGIES, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 THE SANBORN MAP COMPANY, INC.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 MOMENTA

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 MAPBOX

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product/Service launches/developments

- 14.1.12.3.2 Deals

- 14.1.1 HERE

- 14.2 OTHER PLAYERS

- 14.2.1 CE INFO SYSTEMS LTD.

- 14.2.2 NAVMII

- 14.2.3 RMSI

- 14.2.4 ZENRIN CO., LTD.

- 14.2.5 WOVEN BY TOYOTA, INC.

- 14.2.6 SWIFT NAVIGATION, INC.

- 14.2.7 IMERIT

- 14.2.8 VOXELMAPS

- 14.2.9 HYUNDAI AUTOEVER CORP.

- 14.2.10 GENESYS INTERNATIONAL CORPORATION LTD

- 14.2.11 GEOMATE

- 14.2.12 INTELLIAS

- 14.2.13 MORAI INC.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.3.1 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 15.3.2 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, AT COUNTRY LEVEL

- 15.3.3 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, AT COUNTRY LEVEL

- 15.3.4 COMPANY INFORMATION

- 15.3.4.1 Profiling of additional market players (up to five)

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

List of Tables

- TABLE 1 HD MAPS FOR AUTONOMOUS DRIVING MARKET DEFINITION, BY SERVICE TYPE

- TABLE 2 HD MAPS FOR AUTONOMOUS DRIVING MARKET DEFINITION, BY LEVEL OF AUTOMATION

- TABLE 3 HD MAPS FOR AUTONOMOUS DRIVING MARKET DEFINITION, BY SOLUTION TYPE

- TABLE 4 HD MAPS FOR AUTONOMOUS DRIVING MARKET DEFINITION, BY VEHICLE TYPE

- TABLE 5 HD MAPS FOR AUTONOMOUS DRIVING MARKET DEFINITION, BY USAGE TYPE

- TABLE 6 INCLUSIONS & EXCLUSIONS

- TABLE 7 CURRENCY EXCHANGE RATES, 2019-2024

- TABLE 8 OEMS OFFERING HD MAPS IN L2/L3 VEHICLES

- TABLE 9 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021-2030

- TABLE 10 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 11 INDICATIVE PRICING OF L2+/L3 AUTONOMOUS DRIVING SOFTWARE SUITE OFFERED BY KEY PLAYERS, 2024 (USD)

- TABLE 12 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L2+ AUTONOMY, BY REGION, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L3 AUTONOMY, BY REGION, 2022-2024 (USD)

- TABLE 14 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L4 AUTONOMY, BY REGION, 2022-2024 (USD)

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VEHICLE TYPES

- TABLE 16 KEY BUYING CRITERIA, BY VEHICLE TYPE

- TABLE 17 FUNDING DETAILS, 2022-2025

- TABLE 18 STRATEGIC MOVES BY OEMS AND TIER-1 & TIER-2/3 PLAYERS

- TABLE 19 IMPORT DATA FOR HS CODE 852691-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 20 EXPORT DATA FOR HS CODE 852691-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 21 KEY CONFERENCES & EVENTS, 2025-2026

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 REGULATIONS FOR HD MAPS, BY COUNTRY

- TABLE 26 REGULATIONS AND INITIATIVES FOR ADAS

- TABLE 27 NCAP REGULATIONS

- TABLE 28 PATENTS GRANTED, JANUARY 2015-DECEMBER 2024

- TABLE 29 PATENT REGISTRATIONS, 2022-2024

- TABLE 30 STANDARDS AND FORMATS OF HD MAPS

- TABLE 31 COMPARISON BETWEEN LIDAR, CAMERA, AND RADAR SENSORS

- TABLE 32 LOCATION ACCURACY BY 3GPP RELEASE

- TABLE 33 HD MAPPING SERVICE PROVIDERS: COMPETITIVE LANDSCAPE (1/2)

- TABLE 34 HD MAPPING SERVICE PROVIDERS: COMPETITIVE LANDSCAPE (2/2)

- TABLE 35 COMPARATIVE ANALYSIS OF HD MAPPING SOLUTIONS, BY KEY OEM (1/2)

- TABLE 36 COMPARATIVE ANALYSIS OF HD MAPPING SOLUTIONS, BY KEY OEM (2/2)

- TABLE 37 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2021-2024 (USD MILLION)

- TABLE 38 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025-2032 (USD MILLION)

- TABLE 39 SEMI-AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY AUTOMATION LEVEL, 2021-2024 (USD MILLION)

- TABLE 40 SEMI-AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY AUTOMATION LEVEL, 2025-2032 (USD MILLION)

- TABLE 41 SEMI-AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 SEMI-AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 43 AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY AUTOMATION LEVEL, 2021-2024 (USD MILLION)

- TABLE 44 AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY AUTOMATION LEVEL, 2025-2032 (USD MILLION)

- TABLE 45 AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 AUTONOMOUS VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 47 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 48 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 49 MAPPING & LOCALIZATION: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 MAPPING & LOCALIZATION: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 51 UPDATE & MAINTENANCE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 52 UPDATE & MAINTENANCE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 53 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2021-2024 (USD MILLION)

- TABLE 54 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025-2032 (USD MILLION)

- TABLE 55 EMBEDDED: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 EMBEDDED: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 57 CLOUD-BASED: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 CLOUD-BASED: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 59 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 60 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 61 PERSONAL MOBILITY: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 PERSONAL MOBILITY: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 63 COMMERCIAL MOBILITY: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 64 COMMERCIAL MOBILITY: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 65 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 66 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 67 OEMS PROVIDING HD MAPS IN PASSENGER CARS

- TABLE 68 PASSENGER CAR: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 PASSENGER CAR: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 COMMERCIAL VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 COMMERCIAL VEHICLE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 74 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 75 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 76 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2021-2024 (USD MILLION)

- TABLE 77 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025-2032 (USD MILLION)

- TABLE 78 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 79 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 80 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2021-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025-2032 (USD MILLION)

- TABLE 82 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 83 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 84 KEY COMPANIES IN AUTONOMOUS VEHICLE TECHNOLOGY AND THEIR PARTNERS IN CHINA

- TABLE 85 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 86 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 87 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025-2032 (USD MILLION)

- TABLE 89 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 90 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 91 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2021-2024 (USD MILLION)

- TABLE 92 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025-2032 (USD MILLION)

- TABLE 93 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 94 EUROPE: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 95 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 96 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 97 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025-2032 (USD MILLION)

- TABLE 99 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 101 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2021-2024 (USD MILLION)

- TABLE 102 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025-2032 (USD MILLION)

- TABLE 103 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 105 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2021-2024 (USD MILLION)

- TABLE 106 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025-2032 (USD MILLION)

- TABLE 107 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2021-2024 (USD MILLION)

- TABLE 108 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025-2032 (USD MILLION)

- TABLE 109 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2021-2024 (USD MILLION)

- TABLE 110 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025-2032 (USD MILLION)

- TABLE 111 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2021-2024 (USD MILLION)

- TABLE 112 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025-2032 (USD MILLION)

- TABLE 113 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2021-2024 (USD MILLION)

- TABLE 114 ROW: HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025-2032 (USD MILLION)

- TABLE 115 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- TABLE 116 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2024

- TABLE 117 HD MAPS FOR AUTONOMOUS DRIVING MARKET: REGION FOOTPRINT, 2024

- TABLE 118 HD MAPS FOR AUTONOMOUS DRIVING MARKET: USAGE TYPE FOOTPRINT, 2024

- TABLE 119 HD MAPS FOR AUTONOMOUS DRIVING MARKET: VEHICLE TYPE FOOTPRINT, 2024

- TABLE 120 HD MAPS FOR AUTONOMOUS DRIVING MARKET: LEVEL OF AUTOMATION FOOTPRINT, 2024

- TABLE 121 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 122 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 123 HD MAPS FOR AUTONOMOUS DRIVING MARKET: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 124 HD MAPS FOR AUTONOMOUS DRIVING MARKET: DEALS, JANUARY 2021-AUGUST 2025

- TABLE 125 HD MAPS FOR AUTONOMOUS DRIVING MARKET: EXPANSION, JANUARY 2021-AUGUST 2025

- TABLE 126 HD MAPS FOR AUTONOMOUS DRIVING MARKET: OTHER DEVELOPMENTS, JANUARY 2021-AUGUST 2025

- TABLE 127 HERE: COMPANY OVERVIEW

- TABLE 128 HERE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 HERE: DEALS

- TABLE 130 HERE: OTHER DEVELOPMENTS

- TABLE 131 BAIDU INC.: COMPANY OVERVIEW

- TABLE 132 BAIDU INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 BAIDU INC.: DEALS

- TABLE 134 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 135 TOMTOM INTERNATIONAL BV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 TOMTOM INTERNATIONAL BV: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 137 TOMTOM INTERNATIONAL BV: DEALS

- TABLE 138 NVIDIA CORPORATION: COMPANY OVERVIEW

- TABLE 139 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 MOBILEYE: COMPANY OVERVIEW

- TABLE 141 MOBILEYE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 MOBILEYE: DEALS

- TABLE 143 MOBILEYE: OTHER DEVELOPMENTS

- TABLE 144 WAYMO LLC: COMPANY OVERVIEW

- TABLE 145 WAYMO LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 WAYMO LLC: DEALS

- TABLE 147 DYNAMIC MAP PLATFORM CO., LTD.: COMPANY OVERVIEW

- TABLE 148 DYNAMIC MAP PLATFORM CO., LTD.: GROUP COMPANIES

- TABLE 149 DYNAMIC MAP PLATFORM CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 DYNAMIC MAP PLATFORM CO., LTD.: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 151 DYNAMIC MAP PLATFORM CO., LTD.: DEALS

- TABLE 152 DYNAMIC MAP PLATFORM CO., LTD.: EXPANSION

- TABLE 153 DYNAMIC MAP PLATFORM CO., LTD.: OTHER DEVELOPMENTS

- TABLE 154 NAVINFO CO., LTD.: COMPANY OVERVIEW

- TABLE 155 NAVINFO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 NAVINFO CO., LTD.: DEALS

- TABLE 157 NAVINFO CO., LTD.: OTHER DEVELOPMENTS

- TABLE 158 LUMINAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 159 LUMINAR TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 THE SANBORN MAP COMPANY, INC.: COMPANY OVERVIEW

- TABLE 161 THE SANBORN MAP COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 162 MOMENTA: COMPANY OVERVIEW

- TABLE 163 MOMENTA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 MAPBOX: COMPANY OVERVIEW

- TABLE 165 MAPBOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 MAPBOX: PRODUCT/SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 167 MAPBOX: DEALS

- TABLE 168 CE INFO SYSTEMS LTD.: COMPANY OVERVIEW

- TABLE 169 NAVMII: COMPANY OVERVIEW

- TABLE 170 RMSI: COMPANY OVERVIEW

- TABLE 171 ZENRIN CO., LTD.: COMPANY OVERVIEW

- TABLE 172 WOVEN BY TOYOTA, INC.: COMPANY OVERVIEW

- TABLE 173 SWIFT NAVIGATION, INC.: COMPANY OVERVIEW

- TABLE 174 IMERIT: COMPANY OVERVIEW

- TABLE 175 VOXELMAPS: COMPANY OVERVIEW

- TABLE 176 HYUNDAI AUTOEVER CORP.: COMPANY OVERVIEW

- TABLE 177 GENESYS INTERNATIONAL CORPORATION LTD: COMPANY OVERVIEW

- TABLE 178 GEOMATE: COMPANY OVERVIEW

- TABLE 179 INTELLIAS: COMPANY OVERVIEW

- TABLE 180 MORAI INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HD MAPS FOR AUTONOMOUS DRIVING MARKET: RESEARCH DESIGN

- FIGURE 2 HD MAPS FOR AUTONOMOUS DRIVING MARKET: TOP-DOWN APPROACH

- FIGURE 3 APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 4 HD MAPS FOR AUTONOMOUS DRIVING MARKET: DATA TRIANGULATION

- FIGURE 5 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 6 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN HD MAPS FOR AUTONOMOUS DRIVING MARKET

- FIGURE 7 DISRUPTIVE TRENDS IMPACTING GROWTH OF HD MAPS FOR AUTONOMOUS DRIVING MARKET DURING FORECAST PERIOD

- FIGURE 8 PASSENGER CAR SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 9 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 ADVANCEMENTS IN AUTONOMOUS DRIVING TECHNOLOGY AND SUPPORTIVE GOVERNMENT INITIATIVES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 11 MAPPING & LOCALIZATION SEGMENT TO LEAD MARKET IN 2032

- FIGURE 12 PASSENGER CAR SEGMENT TO DOMINATE MARKET IN 2032

- FIGURE 13 CLOUD-BASED SEGMENT TO LEAD MARKET IN 2032

- FIGURE 14 SEMI-AUTONOMOUS VEHICLE TO LEAD THE MARKET DURING FORECAST PERIOD

- FIGURE 15 COMMERCIAL MOBILITY SEGMENT TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 17 FUNCTIONS OF HD MAPS IN AUTONOMOUS DRIVING VEHICLES

- FIGURE 18 HD MAPS FOR AUTONOMOUS DRIVING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 MOBILEYE'S APPROACH TO MAKING HD MAPS

- FIGURE 20 5G-ENABLED AUTONOMOUS DRIVING

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 SUPPLY CHAIN ANALYSIS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L2+ AUTONOMY, BY REGION, 2022-2024 (USD)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L3 AUTONOMY, BY REGION, 2022-2024 (USD)

- FIGURE 25 AVERAGE SELLING PRICE TREND OF AUTONOMOUS DRIVING SOFTWARE SUITE FOR L4 AUTONOMY, BY REGION, 2022-2024 (USD)

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VEHICLE TYPES

- FIGURE 27 KEY BUYING CRITERIA, BY VEHICLE TYPE

- FIGURE 28 INVESTMENT & FUNDING SCENARIO, 2022-2025

- FIGURE 29 IMPORT DATA FOR HS CODE 852691-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR HS CODE 852691-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD MILLION)

- FIGURE 31 NEW REVENUE SOURCES AND REVENUE POCKETS IN HD MAPS FOR AUTONOMOUS DRIVING MARKET

- FIGURE 32 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015-2024

- FIGURE 33 PATENT PUBLICATION TRENDS, 2015-2024

- FIGURE 34 HD MAPS FOR AUTONOMOUS DRIVING MARKET: LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 35 JURISDICTION OF HIGHEST PERCENTAGE OF US-REGISTERED PATENTS, 2015-2024

- FIGURE 36 TOP PATENT APPLICANTS, 2015-2024

- FIGURE 37 BUSINESS MODELS FOR HD MAPPING IN AUTONOMOUS MOBILITY

- FIGURE 38 VEHICLE LOCALIZATION

- FIGURE 39 SLAM SYSTEM FRAMEWORK

- FIGURE 40 FUTURE APPLICATIONS OF HD MAPS

- FIGURE 41 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY LEVEL OF AUTOMATION, 2025 VS. 2032 (USD MILLION)

- FIGURE 42 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SERVICE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 43 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY SOLUTION TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 44 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY USAGE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 45 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY VEHICLE TYPE, 2025 VS. 2032 (USD MILLION)

- FIGURE 46 HD MAPS FOR AUTONOMOUS DRIVING MARKET, BY REGION, 2025 VS. 2032 (USD MILLION)

- FIGURE 47 ASIA PACIFIC: HD MAPS FOR AUTONOMOUS DRIVING MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 49 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 50 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 51 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 52 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 53 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 54 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 55 EUROPE: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 56 NORTH AMERICA: HD MAPS FOR AUTONOMOUS DRIVING MARKET SNAPSHOT

- FIGURE 57 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 58 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 59 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 60 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 61 ROW: REAL GDP GROWTH RATE, 2024-2026

- FIGURE 62 ROW: GDP PER CAPITA, 2024-2026

- FIGURE 63 ROW: INFLATION RATE AVERAGE CONSUMER PRICES, 2024-2026

- FIGURE 64 ROW: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024 (USD TRILLION)

- FIGURE 65 MARKET SHARE ANALYSIS, 2024

- FIGURE 66 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD BILLION)

- FIGURE 67 COMPANY VALUATION OF KEY PLAYERS, 2025 (USD BILLION)

- FIGURE 68 FINANCIAL METRICS OF KEY PLAYERS, 2025

- FIGURE 69 BRAND/PRODUCT COMPARISON FOR TOP FIVE PLAYERS

- FIGURE 70 HD MAPS FOR AUTONOMOUS DRIVING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 71 HD MAPS FOR AUTONOMOUS DRIVING MARKET: COMPANY FOOTPRINT, 2024

- FIGURE 72 HD MAPS FOR AUTONOMOUS DRIVING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 73 HERE: COMPANY SNAPSHOT

- FIGURE 74 HERE: PRODUCT SPECIFICATIONS

- FIGURE 75 BAIDU INC.: COMPANY SNAPSHOT

- FIGURE 76 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT

- FIGURE 77 NVIDIA CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 MOBILEYE: COMPANY SNAPSHOT

- FIGURE 79 MOBILEYE: COMMON INDUSTRY APPROACH VS. THE MOBILEYE APPROACH

- FIGURE 80 MOBILEYE: REM SOLUTION FOR AUTONOMOUS VEHICLE MAPPING

- FIGURE 81 WAYMO LLC: COMPANY SNAPSHOT

- FIGURE 82 DYNAMIC MAP PLATFORM CO., LTD.: COMPANY SNAPSHOT

- FIGURE 83 NAVINFO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 84 LUMINAR TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 85 THE SANBORN MAP COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 86 MAPBOX: COMPANY SNAPSHOT