|

市场调查报告书

商品编码

1840078

全球硅胶黏合剂市场(按类型、技术、最终用途产业和地区划分)-预测至2030年Silicone Adhesives Market by Type (One-Component, Two-Component), Technology (Non-PSA, PSA), End-use Industry (Building & Construction, Electrical & Electronics, Transportation, Medical, Other End-use Industries), and Region - Global Forecast to 2030 |

||||||

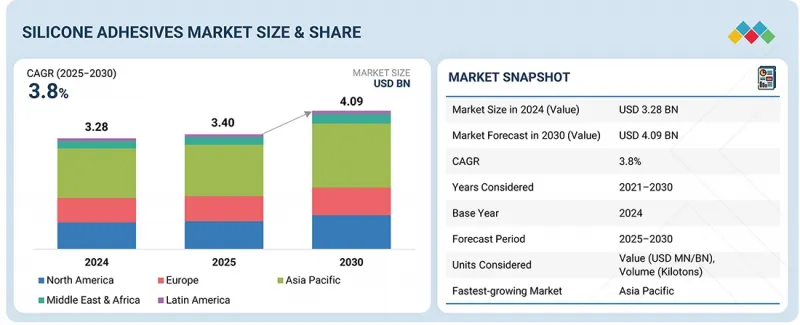

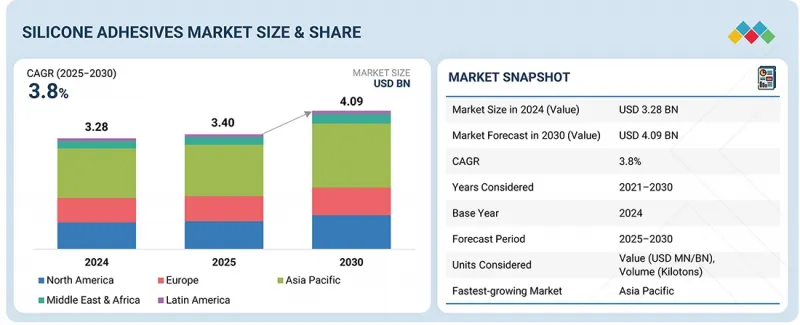

预计全球硅胶黏合剂市场规模到 2025 年将达到 34 亿美元,到 2030 年将达到 40.9 亿美元,2025 年至 2030 年的复合年增长率为 3.8%。

电动车的普及、永续建筑需求的不断增长以及医疗保健成本的上升预计将推动硅胶黏合剂市场的发展。

| 调查范围 | |

|---|---|

| 调查年份 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万美元/十亿美元,千吨 |

| 部分 | 类型、技术、最终用途产业、地区 |

| 目标区域 | 北美、亚太地区、欧洲、中东和非洲、南美 |

然而,市场面临高价格和原物料价格波动带来的限制。与聚氨酯、丙烯酸和环氧树脂等其他胶粘剂相比,有机硅胶黏剂价格相对较高。对于大型计划和大量生产而言,这种成本障碍更加明显,即使是单位成本的微小差异也会对整体预算产生重大影响。

“预计单组分部分将在 2025 年至 2030 年间呈现最高的复合年增长率。”

预计单组分胶黏剂市场将在预测期内实现最高的复合年增长率,因为它在便利性、成本效益和性能方面具有显着优势。与双组分体係不同,单组分体系无需混合、固化剂或复杂的应用设备,从而减少了应用工作工作量和错误。单组分体系能够在室温和潮湿环境下固化,这使得它们在许多需要快速组装和黏合的行业中非常有用,例如汽车、建筑和电子产业。

“预计到 2030 年,非 PSA 领域将占据最大的市场份额。”

按类型划分,有机硅黏合剂市场中最大的产品是非压敏胶(PSA)。这是因为它们广泛应用于汽车、航太、电子和建筑等行业,这些行业不仅需要高性能,还需要牢固持久的黏合力。与仅限于需要黏合力和剥离强度的压敏胶相比,非压敏胶有机硅具有卓越的耐热性、耐化学性、柔韧性和长期耐用性。它们也适用于结构性和高应力应用。电动车、小型化和高功率电子设备的兴起,以及节能和永续建筑的兴起,正在催生对能够承受恶劣条件的黏合剂的需求。

“预计亚太地区硅胶黏合剂市场在预测期内将以最高的复合年增长率增长。”

由于工业化程度高、汽车和电子产品製造基地不断扩张以及基础设施建设投资不断增加,亚太地区的有机硅黏合剂市场正经历高速成长。中国、印度、韩国和日本等国家是电动车和消费性电子产品的主要出口目的地。此外,人口老化和医疗成本上涨带来的医疗保健产业的蓬勃发展,也推动了有机硅黏合剂在医疗设备中的应用。

本报告对全球硅胶黏合剂市场进行了分析,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 硅胶黏合剂製造商的诱人机会

- 硅胶黏合剂:依类型

- 硅胶黏合剂:依技术分类

- 有机硅黏合剂的最终用途产业

- 亚太地区硅胶黏合剂市场类型和地区分布(2024年)

- 各国硅胶黏合剂市场

第五章 市场概况

- 介绍

- 市场动态

- 驱动程式

- 抑制因素

- 机会

- 任务

- 产业趋势

- 定价分析

- 价值链分析

- 生态系分析

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 人工智慧对硅胶黏合剂市场的影响

- 专利分析

- 介绍

- 调查方法

- 贸易分析

- 出口情形(HS 编码 350691)

- 进口情形(HS 编码 350691)

- 大型会议和活动(2025-2026)

- 监管格局和框架

- 监管机构、政府机构和其他组织

- 法规结构

- 波特五力分析

- 主要相关利益者和采购标准

- 案例研究分析

- 宏观经济分析

- 介绍

- GDP趋势与预测

- 投资金筹措场景

- 2025年美国关税对有机硅黏合剂市场的影响

- 介绍

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端产业的影响

6. 硅胶黏合剂市场(按技术)

- 介绍

- 非PSA

- PSA

7. 硅胶黏合剂市场类型

- 介绍

- 1种液体类型

- 2液体型

8. 有机硅黏合剂市场(依最终用途产业)

- 介绍

- 建筑/施工

- 医疗保健

- 运输

- 电气和电子

- 其他终端用途产业

9. 有机硅黏合剂市场(按地区)

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 台湾

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 海湾合作委员会国家

- 南非

- 其他中东和非洲地区

第十章 竞争格局

- 概述

- 主要参与企业的策略/优势

- 收益分析

- 市占率分析

- 公司估值及财务指标

- 产品比较

- 企业评估矩阵:主要企业(2024年)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 竞争场景

第十一章 公司简介

- 主要企业

- HENKEL AG & CO. KGAA

- HB FULLER COMPANY

- WACKER CHEMIE AG

- 3M

- KCC SILICONE CORPORATION

- ELKEM ASA

- SHIN-ETSU CHEMICAL CO., LTD.

- SIKA AG

- DOW

- AVERY DENNISON CORPORATION

- ILLINOIS TOOL WORKS INC.

- 其他公司

- DELO INDUSTRIAL ADHESIVES

- JIANGSU ZHIXIN NEW MATERIALS CO., LTD.

- SHENZHEN DEEPMATERIAL TECHNOLOGIES CO., LTD

- MASTER BOND

- ADHESIVES RESEARCH, INC.

- GERGONNE GROUP

- CHT GROUP

- HERNON MANUFACTURING

- JIANGXI NEW JIAYI NEW MATERIALS CO., LTD.

- 3 SIGMA

- SHENZHEN KANGLIBANG SCIENCE & TECHNOLOGY CO., LTD

- GUANGDONG HENGDA NEW MATERIAL TECHNOLOGY CO., LTD.

- CSL SILICONES INC.

- SILICONE SOLUTIONS

- CONNECT PRODUCTS BV

第十二章:相邻市场与相关市场

- 介绍

- 限制

- 硅胶市场

- 市场定义

- 硅胶市场类型

- 有机硅市场(按最终用途行业划分)

- 硅胶市场(按地区)

第十三章 附录

The silicone adhesives market size is projected to be USD 3.40 billion in 2025 and USD 4.09 billion by 2030, at a CAGR of 3.8% from 2025 to 2030. The rising adoption of electric vehicles, the growing demand for sustainable building, and increased healthcare spending are expected to drive the silicone adhesives market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) Volume (Kiloton) |

| Segments | Type, Technology, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

However, the market encounters limitations concerning its high prices and raw material price fluctuations. Silicone adhesives are relatively expensive compared with other adhesive types, such as polyurethane, acrylic, and epoxy. This cost barrier becomes even more significant in large-scale projects or high-volume production, where small differences in per-unit cost can substantially impact overall budgets.

"One-component segment is projected to exhibit the highest CAGR from 2025 to 2030"

The one-component segment is expected to record the highest CAGR in the silicone adhesives market during the forecast period since it can provide a major advantage in terms of ease, cost-efficiency, and performance. They do not need mixing, curing agents, and complicated application equipment as in the case of two-component systems, and this saves labor time and mistakes during application. They are convenient in many industries that require quick assembly and bonding, such as the automotive, construction, and electronics industries, as they can cure at room temperature and in the presence of moisture.

"Non-PSAs segment is projected to capture the largest market share in 2030"

The largest product in the silicone adhesives market based on type is non-PSA (non-pressure-sensitive) silicone adhesives due to their application in industries with a high need for strong and durable bonding, as well as high performance, such as automotive, aerospace, electronics, and construction. Compared with PSAs, which are restricted to uses that necessitate tackiness and peel strength, non-PSA silicones possess better heat resistance, chemical resistance, flexibility, and long-term durability. They are useful in structural applications and high-stress applications. Their use is increasing due to the growing use of electric vehicles, miniaturization and high-power electronics, and energy-efficient and sustainable buildings demanding adhesives that can survive in extreme conditions.

"Asia Pacific silicone adhesives market is projected to grow at the highest CAGR during the forecast period"

Asia Pacific is experiencing high growth in the silicone adhesives market due to the high industrialization level, the expanding automotive and electronics manufacturing base, and the increasing investment in infrastructure development. Major destinations of electric vehicles, consumer electronics, and countries such as China, India, South Korea, and Japan are major powerhouses in the high-performance bonding solutions. Moreover, the healthcare industry, which is also expanding due to ageing processes and the cost of healthcare, also boosts the adoption of silicone adhesives in medical devices and equipment.

By Company Type: Tier 1 - 25%, Tier 2 - 42%, and Tier 3 - 33%

By Designation: C-level Executives - 20%, Directors - 30%, and Others - 50%

By Region: North America - 20%, Europe - 10%, Asia Pacific - 40%, South America - 10%, and Middle East & Africa - 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Wacker Chemie AG (Germany), 3M (US), and KCC SILICONE CORPORATION (South Korea), Elkem ASA (Norway), Shin-Etsu Chemical Co., Ltd. (Japan), Sika AG (Switzerland), Dow (US), and Avery Dennison Corporation (US), among other companiess are covered in the report.

The study includes an in-depth competitive analysis of these key players in the silicone adhesives market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the silicone adhesives market based on type (one-component, two-component), technology (PSA, non-PSA), end-use industry (building & construction, medical transportation, electrical & electronics, others), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the silicone adhesives market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, mergers, product launches, expansions, and acquisitions, associated with the silicone adhesives market. This report covers a competitive analysis of upcoming startups in the silicone adhesives market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall silicone adhesives market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising electric vehicle adoption, aging populations and higher healthcare spending, mounting demand for energy-efficient and sustainable buildings), restraints (fluctuations in raw material prices, high cost compared with alternatives), opportunities (increasing demand from emerging markets, rise of flexible and wearable electronics), and challenges (intense competition and price pressure, customer awareness & adoption barriers)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the silicone adhesives market

- Market Development: Comprehensive information about profitable markets-the report analyzes the silicone adhesives market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the silicone adhesives market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Henkel AG & Co. KGaA (Germany), H.B. Fuller Company (US), Wacker Chemie AG (Germany), 3M (US), and KCC SILICONE CORPORATION (South Korea), Elkem ASA (Norway), Shin-Etsu Chemical Co., Ltd. (Japan), Sika AG (Switzerland), Dow (US), and Avery Dennison Corporation (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 GROWTH RATE ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR SILICONE ADHESIVE MANUFACTURERS

- 4.2 SILICONE ADHESIVES, BY TYPE

- 4.3 SILICONE ADHESIVES, BY TECHNOLOGY

- 4.4 SILICONE ADHESIVES, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE AND REGION, 2024

- 4.6 SILICONE ADHESIVES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising electric vehicle adoption

- 5.2.1.2 Aging populations and higher healthcare spending

- 5.2.1.3 Rising demand for energy-efficient and sustainable buildings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in raw material prices

- 5.2.2.2 High cost compared to alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand from emerging markets

- 5.2.3.2 Rise of flexible and wearable electronics

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense competition and price pressure

- 5.2.4.2 Customer awareness & adoption barriers

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING ANALYSIS BASED ON REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 RTV (Room Temperature Vulcanizing) curing

- 5.7.1.2 Silicone Pressure-Sensitive Adhesives (PSA)

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Hybrid sealants

- 5.7.2.2 Silicone primers

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Silicone coatings

- 5.7.3.2 Surface coating technologies

- 5.7.1 KEY TECHNOLOGIES

- 5.8 IMPACT OF GEN AI ON SILICONE ADHESIVES MARKET

- 5.8.1 INTRODUCTION

- 5.9 PATENT ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 METHODOLOGY

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO (HS CODE 350691)

- 5.10.2 IMPORT SCENARIO (HS CODE 350691)

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE & FRAMEWORK

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATORY FRAMEWORK

- 5.12.2.1 ASTM F2468

- 5.12.2.2 ASTM D6411

- 5.12.2.3 ISO 10993-1:2018

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 THREAT OF NEW ENTRANTS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.16 MACROECONOMIC ANALYSIS

- 5.16.1 INTRODUCTION

- 5.16.2 GDP TRENDS AND FORECASTS

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON SILICON ADHESIVES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 END-USE INDUSTRY IMPACT

- 5.18.5.1 Medical

- 5.18.5.2 Building & Construction

- 5.18.5.3 Transportation

- 5.18.5.4 Electronics

6 SILICONE ADHESIVES MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 NON-PSA

- 6.2.1 RISE IN USE IN STRUCTURAL BONDING TO DRIVE MARKET GROWTH

- 6.3 PSA

- 6.3.1 INCREASING USE IN MEDICAL APPLICATIONS TO DRIVE MARKET DEMAND

7 SILICONE ADHESIVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 ONE-COMPONENT

- 7.2.1 SIMPLICITY OF APPLICATION PROCESS TO DRIVE MARKET GROWTH

- 7.3 TWO-COMPONENT

- 7.3.1 INNOVATIONS IN FAST CURING TO DRIVE MARKET GROWTH

8 SILICONE ADHESIVE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BUILDING & CONSTRUCTION

- 8.2.1 RISING HOUSING DEMAND AND AGING INFRASTRUCTURE TO DRIVE MARKET

- 8.3 MEDICAL

- 8.3.1 RISING PREVALENCE OF CHRONIC WOUNDS AND EXPANSION OF REMOTE HEALTHCARE AND WEARABLE MEDICAL DEVICES TO PROPEL MARKET

- 8.4 TRANSPORTATION

- 8.4.1 RISING ELECTRIC VEHICLE ADOPTION AND BATTERY APPLICATIONS TO PROPEL MARKET

- 8.5 ELECTRICAL & ELECTRONICS

- 8.5.1 5G EXPANSION AND IOT PROLIFERATION TO PROPEL MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 SILICONE ADHESIVES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Sustainable construction and urban renewal initiatives to drive market

- 9.2.2 INDIA

- 9.2.2.1 Rapid expansion of real estate and construction sector to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Government-supported smart city initiatives and urban infrastructure to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Government-supported semiconductor industry expansion to drive market

- 9.2.5 TAIWAN

- 9.2.5.1 Global leadership in semiconductor and electronics manufacturing to drive market

- 9.2.6 INDONESIA

- 9.2.6.1 Government push toward electric vehicle adoption and carbon reduction to drive market

- 9.2.7 VIETNAM

- 9.2.7.1 Rapid growth of passenger vehicles and electric vehicle adoption to drive market

- 9.2.8 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 NORTH AMERICA

- 9.3.1 US

- 9.3.1.1 Rapid increase in EV sales to propel market

- 9.3.2 CANADA

- 9.3.2.1 Strong electronics and electrical equipment trade with US to drive market

- 9.3.3 MEXICO

- 9.3.3.1 Expanding automotive and EV manufacturing base to drive market

- 9.3.1 US

- 9.4 EUROPE

- 9.4.1 GERMANY

- 9.4.1.1 Medical industry to drive market growth

- 9.4.2 FRANCE

- 9.4.2.1 Medical and automotive sectors to help growth

- 9.4.3 UK

- 9.4.3.1 Automotive industry and government plans to boost market growth

- 9.4.4 ITALY

- 9.4.4.1 Transportation sector to drive market

- 9.4.5 RUSSIA

- 9.4.5.1 Government support for industrial growth to drive market

- 9.4.6 REST OF EUROPE

- 9.4.1 GERMANY

- 9.5 SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.5.1.1 Growing construction, transportation, and electronics industries to drive market

- 9.5.2 ARGENTINA

- 9.5.2.1 Government focus on automotive industry to drive growth

- 9.5.3 REST OF SOUTH AMERICA

- 9.5.1 BRAZIL

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

- 9.6.1.1 Saudi Arabia

- 9.6.1.1.1 Saudi Arabia's Vision 2030 to drive market

- 9.6.1.2 UAE

- 9.6.1.2.1 Government initiatives supporting homeownership and infrastructure to drive market

- 9.6.1.3 Rest of GCC countries

- 9.6.1.1 Saudi Arabia

- 9.6.2 SOUTH AFRICA

- 9.6.2.1 Rising adoption of new-energy vehicles (NEVs) and EVs to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

- 9.6.1 GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.5.1 COMPANY VALUATION

- 10.5.2 FINANCIAL METRICS

- 10.6 PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 End-use industry footprint

- 10.7.5.4 Type footprint

- 10.7.5.5 Technology footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs, 2024

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 HENKEL AG & CO. KGAA

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 H.B. FULLER COMPANY

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 WACKER CHEMIE AG

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product Launches

- 11.1.3.3.2 Expansions

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 3M

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 KCC SILICONE CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 ELKEM ASA

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.6.3.1 Key strengths

- 11.1.6.3.2 Strategic choices

- 11.1.6.3.3 Weaknesses and competitive threats

- 11.1.7 SHIN-ETSU CHEMICAL CO., LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.7.4 MnM view

- 11.1.8 SIKA AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.8.3.2 Expansions

- 11.1.8.4 MnM view

- 11.1.9 DOW

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches

- 11.1.9.4 MnM view

- 11.1.10 AVERY DENNISON CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches

- 11.1.10.4 MnM view

- 11.1.11 ILLINOIS TOOL WORKS INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.11.4 MnM view

- 11.1.1 HENKEL AG & CO. KGAA

- 11.2 OTHER PLAYERS

- 11.2.1 DELO INDUSTRIAL ADHESIVES

- 11.2.2 JIANGSU ZHIXIN NEW MATERIALS CO., LTD.

- 11.2.3 SHENZHEN DEEPMATERIAL TECHNOLOGIES CO., LTD

- 11.2.4 MASTER BOND

- 11.2.5 ADHESIVES RESEARCH, INC.

- 11.2.6 GERGONNE GROUP

- 11.2.7 CHT GROUP

- 11.2.8 HERNON MANUFACTURING

- 11.2.9 JIANGXI NEW JIAYI NEW MATERIALS CO., LTD.

- 11.2.10 3 SIGMA

- 11.2.11 SHENZHEN KANGLIBANG SCIENCE &TECHNOLOGY CO., LTD

- 11.2.12 GUANGDONG HENGDA NEW MATERIAL TECHNOLOGY CO., LTD.

- 11.2.13 CSL SILICONES INC.

- 11.2.14 SILICONE SOLUTIONS

- 11.2.15 CONNECT PRODUCTS B.V.

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.3 SILICONE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 SILICONE MARKET, BY TYPE

- 12.3.3 SILICONE MARKET, BY END-USE INDUSTRY

- 12.3.4 SILICONE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 AVERAGE SELLING PRICE OF SILICONE ADHESIVES BY TYPE, BY KEY PLAYERS, 2024 (USD/KG)

- TABLE 2 AVERAGE SELLING PRICE OF SILICONE ADHESIVES, BY REGION, 2021-2024 (USD/KG)

- TABLE 3 SILICONE ADHESIVES MARKET: ECOSYSTEM

- TABLE 4 LIST OF KEY PATENTS, 2022-2024

- TABLE 5 EXPORT DATA FOR HS CODE 350691-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 6 IMPORT DATA FOR HS CODE 350691-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 7 LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SILICONE ADHESIVES MARKET

- TABLE 15 KEY BUYING CRITERIA FOR END-USE SECTORS

- TABLE 16 SIKASIL SG-500 STRUCTURAL SILICONE'S TRANSFORMATION OF THE LONDON BRIDGE STATION FACADES

- TABLE 17 SILICONE ADHESIVES IN SCAR MANAGEMENT

- TABLE 18 3M'S HI-TACK SILICONE ADHESIVE ELEVATES WEARABLE MEDICAL DEVICES

- TABLE 19 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES, 2024-2026

- TABLE 20 WORLD GDP ANNUAL PERCENTAGE CHANGE OF EMERGING MARKET AND DEVELOPING ECONOMIES, 2024-2026

- TABLE 21 KEY TARIFF RATES ON SILICONE IMPORTS INTO THE US, SEPTEMBER 2025

- TABLE 22 SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 23 SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 24 SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 25 SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 26 PSA VS NON-PSA

- TABLE 27 SILICONE NON-PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 28 SILICONE NON-PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 29 SILICONE NON-PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 30 SILICONE NON-PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 31 SILICONE PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 32 SILICONE PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 33 SILICONE PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 34 SILICONE PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 35 SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 36 SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 37 SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 38 SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 39 SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 40 SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 41 SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 42 SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 43 SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 44 SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 45 SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 46 SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 47 SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 48 SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 49 SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 50 SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 51 SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 52 SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 53 SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 54 SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 55 SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 56 SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 57 SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 58 SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 59 SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 60 SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 61 SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 62 SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 63 SILICONE ADHESIVES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 64 SILICONE ADHESIVES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 SILICONE ADHESIVES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 66 SILICONE ADHESIVES MARKET, BY REGION, 2024-2030 (KILOTON)

- TABLE 67 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 68 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 70 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 71 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 72 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 74 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 75 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 78 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 79 ASIA PACIFIC: NON-PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 80 ASIA PACIFIC: NON-PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: NON-PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 82 ASIA PACIFIC: NON-PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 83 ASIA PACIFIC: PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 84 ASIA PACIFIC: PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: PSA MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 86 ASIA PACIFIC: PSA MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 87 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 88 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 89 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 90 ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 91 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 92 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 93 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 94 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 95 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 98 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 99 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 102 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 103 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 106 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 107 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 110 ASIA PACIFIC: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 111 CHINA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 112 CHINA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 113 CHINA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 114 CHINA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 115 CHINA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 116 CHINA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 117 CHINA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 118 CHINA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 119 INDIA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 120 INDIA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 121 INDIA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 122 INDIA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 123 INDIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 124 INDIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 125 INDIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 126 INDIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 127 JAPAN: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 128 JAPAN: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 129 JAPAN: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 130 JAPAN: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 131 JAPAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 132 JAPAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 133 JAPAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 134 JAPAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 135 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 136 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 137 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 138 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 139 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 140 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 141 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 142 SOUTH KOREA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 143 TAIWAN: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 144 TAIWAN: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 TAIWAN: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 146 TAIWAN: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 147 TAIWAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 148 TAIWAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 149 TAIWAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 150 TAIWAN: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 151 INDONESIA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 152 INDONESIA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 153 INDONESIA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 154 INDONESIA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 155 INDONESIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 156 INDONESIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 157 INDONESIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 158 INDONESIA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 159 VIETNAM: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 160 VIETNAM: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 161 VIETNAM: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 162 VIETNAM: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 163 VIETNAM: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 164 VIETNAM: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 165 VIETNAM: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 166 VIETNAM: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 167 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 170 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 171 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 174 REST OF ASIA PACIFIC: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 175 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 176 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 177 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 178 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY COUNTRY, 2024-2030 (KILOTON)

- TABLE 179 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 180 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 182 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 183 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 184 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 185 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 186 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 187 NORTH AMERICA: NON-PSA MARKET BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 188 NORTH AMERICA: NON-PSA MARKET BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 189 NORTH AMERICA: NON-PSA MARKET BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 190 NORTH AMERICA: NON-PSA MARKET BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 191 NORTH AMERICA: PSA MARKET BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 192 NORTH AMERICA: PSA MARKET BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 193 NORTH AMERICA: PSA MARKET BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 194 NORTH AMERICA: PSA MARKET BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 195 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 196 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (USD MILLION)

- TABLE 197 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 198 NORTH AMERICA: SILICONE ADHESIVES MARKET, BY END-USE INDUSTRY, 2024-2030 (KILOTON)

- TABLE 199 NORTH AMERICA: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 200 NORTH AMERICA: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 201 NORTH AMERICA: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 202 NORTH AMERICA: SILICONE ADHESIVES MARKET IN BUILDING & CONSTRUCTION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 203 NORTH AMERICA: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 204 NORTH AMERICA: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 205 NORTH AMERICA: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 206 NORTH AMERICA: SILICONE ADHESIVES MARKET IN MEDICAL, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 207 NORTH AMERICA: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 208 NORTH AMERICA: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 209 NORTH AMERICA: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 210 NORTH AMERICA: SILICONE ADHESIVES MARKET IN TRANSPORTATION, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 211 NORTH AMERICA: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 212 NORTH AMERICA: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 213 NORTH AMERICA: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 214 NORTH AMERICA: SILICONE ADHESIVES MARKET IN ELECTRICAL & ELECTRONICS, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 215 NORTH AMERICA: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 216 NORTH AMERICA: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 217 NORTH AMERICA: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 218 NORTH AMERICA: SILICONE ADHESIVES MARKET IN OTHER END-USE INDUSTRIES, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 219 US: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 220 US: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 221 US: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 222 US: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 223 US: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 224 US: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 225 US: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 226 US: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 227 CANADA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 228 CANADA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 229 CANADA: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 230 CANADA: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 231 CANADA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 232 CANADA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 233 CANADA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 234 CANADA: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

- TABLE 235 MEXICO: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (USD MILLION)

- TABLE 236 MEXICO: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 237 MEXICO: SILICONE ADHESIVES MARKET, BY TYPE, 2021-2023 (KILOTON)

- TABLE 238 MEXICO: SILICONE ADHESIVES MARKET, BY TYPE, 2024-2030 (KILOTON)

- TABLE 239 MEXICO: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (USD MILLION)

- TABLE 240 MEXICO: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 241 MEXICO: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2021-2023 (KILOTON)

- TABLE 242 MEXICO: SILICONE ADHESIVES MARKET, BY TECHNOLOGY, 2024-2030 (KILOTON)

List of Figures

- FIGURE 1 SILICONE ADHESIVES MARKET: RESEARCH DESIGN

- FIGURE 2 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 6 SILICONE ADHESIVES: DATA TRIANGULATION

- FIGURE 7 ASIA PACIFIC TO LEAD SILICONE ADHESIVES MARKET BETWEEN 2025 AND 2030

- FIGURE 8 ONE-COMPONENT TO BE LARGER TYPE OF SILICONE ADHESIVES BETWEEN 2025 AND 2030

- FIGURE 9 NON-PSA TO BE LARGER TECHNOLOGY OF SILICONE ADHESIVES BETWEEN 2025 AND 2030

- FIGURE 10 TRANSPORTATION TO BE FASTEST-GROWING END-USE INDUSTRY OF SILICONE ADHESIVES BETWEEN 2025 AND 2030

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING SILICONE ADHESIVES MARKET BETWEEN 2025 AND 2030

- FIGURE 12 INCREASING DEMAND FROM TRANSPORTATION INDUSTRY TO DRIVE SILICONE ADHESIVES MARKET

- FIGURE 13 ONE-COMPONENT TO LEAD SILICONE ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 14 NON-PSA TO LEAD SILICONE ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 15 BUILDING & CONSTRUCTION SEGMENT TO LEAD SILICONE ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 16 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC IN 2024

- FIGURE 17 VIETNAM TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 SILICONE ADHESIVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 GLOBAL ELECTRIC CAR SALES, 2020-2024 (MILLION UNITS)

- FIGURE 20 GOVERNMENT HEALTH SPENDING AS A SHARE OF GDP, 2024

- FIGURE 21 CO2 EMISSIONS IN CONSTRUCTION INDUSTRY, 2015-2024

- FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE OF SILICONE ADHESIVES BY TYPE OFFERED BY KEY PLAYERS, 2024

- FIGURE 24 AVERAGE SELLING PRICE TREND OF SILICONE ADHESIVES, BY REGION, 2021-2024

- FIGURE 25 SILICONE ADHESIVES: VALUE CHAIN ANALYSIS

- FIGURE 26 ECOSYSTEM MAP

- FIGURE 27 LIST OF MAJOR PATENTS, 2014-2024

- FIGURE 28 MAJOR PATENTS, BY REGION, 2014-2024

- FIGURE 29 EXPORT DATA FOR HS CODE 350691-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 30 IMPORT DATA FOR HS CODE 350691COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 31 SILICONE ADHESIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USE SECTOR

- FIGURE 33 KEY BUYING CRITERIA FOR END-USE SECTORS

- FIGURE 34 INVESTOR DEALS AND FUNDING SCENARIO, 2020-2024

- FIGURE 35 NON-PSA TO BE LARGER TECHNOLOGY OF SILICONE ADHESIVES DURING FORECAST PERIOD

- FIGURE 36 ONE-COMPONENT TO BE LARGEST TYPE OF SILICONE ADHESIVES DURING FORECAST PERIOD

- FIGURE 37 BUILDING & CONSTRUCTION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 VIETNAM TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF SILICONE ADHESIVES MARKET DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: SILICONE ADHESIVES MARKET SNAPSHOT

- FIGURE 41 NORTH AMERICA: SILICONE ADHESIVES MARKET SNAPSHOT

- FIGURE 42 SILICONE ADHESIVES MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 43 SILICONE ADHESIVES MARKET SHARE ANALYSIS, 2024

- FIGURE 44 SILICONE ADHESIVES MARKET: COMPANY VALUATION

- FIGURE 45 SILICONE ADHESIVES MARKET: FINANCIAL MATRIX (EV/EBITDA RATIO)

- FIGURE 46 SILICONE ADHESIVES MARKET: YEAR-TO-DATE PRICE AND FIVE-YEAR STOCK BETA

- FIGURE 47 SILICONE ADHESIVES MARKET: PRODUCT COMPARISON

- FIGURE 48 SILICONE ADHESIVES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 SILICONE ADHESIVES MARKET: COMPANY FOOTPRINT

- FIGURE 50 SILICONE ADHESIVES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 52 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- FIGURE 53 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 54 3M: COMPANY SNAPSHOT

- FIGURE 55 KCC SILICONE CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 ELKEM ASA: COMPANY SNAPSHOT

- FIGURE 57 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 SIKA AG: COMPANY SNAPSHOT

- FIGURE 59 DOW: COMPANY SNAPSHOT

- FIGURE 60 AVERY DENNISON CORPORATION: COMPANY SNAPSHOT

- FIGURE 61 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT