|

市场调查报告书

商品编码

1693425

硅胶黏合剂和密封剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)Silicone Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

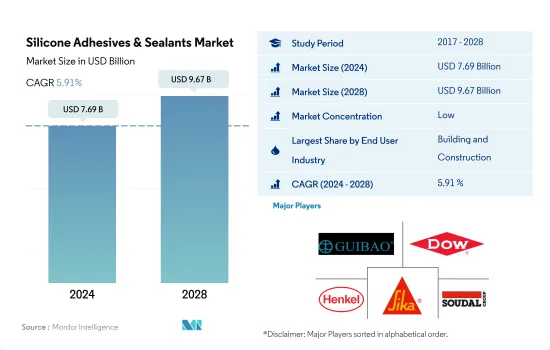

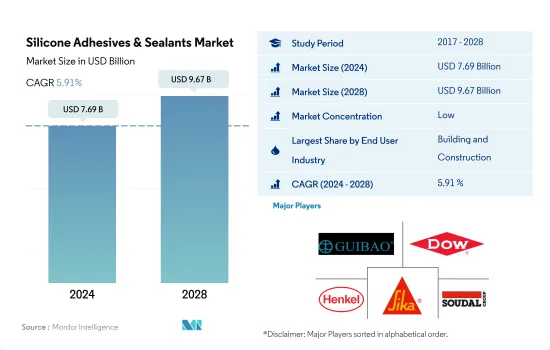

预计 2024 年硅胶黏合剂和密封剂市场规模将达到 76.9 亿美元,到 2028 年将达到 96.7 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.91%。

建筑和包装终端使用行业的成长预计将推动全球硅胶黏合剂和密封剂的消费

- 硅胶黏合剂具有耐低温、良好的电气性能、耐候性和化学稳定性等独特性能。

- 硅胶黏合剂和密封剂用于各种行业,但建筑和施工是这些黏合剂的主要终端用户,因为它们用于多种建筑应用。这些黏合剂和密封剂为建筑製造商提供了紫外线稳定性、-65°C 至 300°C 的耐极端温度性以及三种方法最长 24 小时的短固化时间方面的巨大优势。硅胶密封胶主要用作黏合密封胶,可用于门窗、建筑建筑幕墙、厨房和浴室等应用。

- 硅胶黏合剂在包装产业也有广泛的应用。这些黏合剂本质上非常灵活,这是包装行业的特殊要求。它们主要用于金属、塑胶、纸质基材和食品包装。水性硅胶黏合剂是消费量最大的黏合剂技术,占2021年整个市场的70%。该技术比该行业使用的其他技术成本更低。

- 建筑业对结构性黏着剂和包装行业对柔性胶粘剂的需求不断增长,预计将在未来几年推动对硅胶胶和密封剂的需求。预计到 2030 年,建筑业的复合年增长率将达到 3.5%。预计在 2022-2028 年预测期内,电子产业硅胶密封胶的使用量复合年增长率将达到 2.57%。

亚太地区建筑业需求的不断增长可能会推动全球硅胶黏合剂和密封剂的销售

- 2021 年,硅胶黏合剂和密封剂占全球黏合剂和密封剂需求的 9.25%。它们用于建筑、包装、汽车、航太、医疗和许多其他行业。这些黏合剂和密封剂也使建筑结构更具灵活性,使材料能够吸收风和地震引起的压力和运动。建筑物中的硅胶黏合剂和密封剂还可以防止湿气、热量和冷气通过接缝和缝隙进入,从而节省能源。预计 2022-2028 年预测期内全球硅胶黏合剂和密封剂市场复合年增长率约为 4.39%。

- 亚太地区是全球硅胶黏合剂和密封剂的主要消费地区。该地区建设活动的增加正在产生对硅胶黏合剂和密封剂的需求。该地区的新增占地面积预计将从 2021 年的 179 亿平方英尺增加到 2028 年的 246 亿平方英尺。

- 硅胶黏合剂和密封剂主要用于全球的建筑和包装产业。 2021年,建筑业消耗了近715,000吨硅胶黏合剂和密封剂。硅胶密封胶在建筑应用中得到越来越多的应用,因为它们为製造商提供了在紫外线稳定性、-65°C 至 300°C 的耐极端温度以及三种方法最长 24 小时的短固化时间方面的巨大优势。硅胶黏合剂和密封剂主要用作黏合剂和密封剂,可用于门窗、建筑物建筑幕墙、厨房和浴室以及其他应用。

全球硅胶黏合剂和密封剂市场趋势

住宅基础建设推动建筑业发展

- 建筑业呈现稳定成长,2017 年至 2019 年的复合年增长率为 2.6%。这一成长受到全球经济活动好转和独栋住宅需求成长的推动。 2020年,新冠疫情对全球建筑业产生了重大影响。劳动力供应限制、建筑融资和供应链中断以及经济不确定性对全球 AEC 产业产生了负面影响。

- 虽然2021年呈现正成长,但疫情对供应链的衝击导致原物料价格上涨,仍在困扰产业。不过,由于建筑业对一个国家的经济影响重大,北美和亚太国家都透过提供支持计画来重新启动经济週期。支持计划包括澳大利亚的HomeBuilder计划和欧盟国家的经济復苏计划。

- 亚太地区的建设活动,预计到 2028 年仍将是最大的建筑市场,这得益于其庞大的人口、不断加快的都市化以及中国、印度、日本、印尼和韩国等国家对基础设施建设的投资不断增加。

- 预计在预测期内,对绿色建筑的日益重视和减少全球建设活动排放的努力将带来更永续的营运程序。例如,法国已累计75亿欧元用于建筑业转型为低碳能源经济的。

政府推行的电动车优惠政策将推动汽车产业

- 自2021年起,全球汽车产业预计将稳定成长,但成长速度将有所放缓。预计预测期内全球汽车产业将以每年 2% 的速度成长,总收益增加价值将达到 1.5 兆美元。

- 2020年,受新冠疫情影响,汽车销量下滑,但2021年却迅速回升。汽车市场通常对GDP贡献巨大,因此世界各国政府纷纷推出措施支持经济。汽车销量从2019年的9000万辆下降到2020年的7800万辆。

- 由于电动车能源成本低廉、环保且移动性能高效,其在全球范围内的普及对全球汽车市场的总收益做出了重大贡献。各种政府政策和标准也在推动电动车产量的成长。例如,欧盟二氧化碳排放标准在2021年增加了对电动车的需求。根据国际能源总署的永续发展情景,到2030年将需要2.3亿辆电动车取代燃油汽车。 2021年,最大的电动车製造商特斯拉的电动车产量增加了157%。预计预测期内(2022-2028 年),消费者对电动车的偏好将进一步成长。

硅胶黏合剂和密封剂产业概况

硅胶黏合剂和密封剂市场较为分散,前五大公司占了27.78%的市场。该市场的主要企业包括成都硅宝科技、陶氏化学、汉高股份公司、西卡股份公司、Soudal Holding NV 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 包装

- 木製品和配件

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 中国

- EU

- 印度

- 印尼

- 日本

- 马来西亚

- 墨西哥

- 俄罗斯

- 沙乌地阿拉伯

- 新加坡

- 南非

- 韩国

- 泰国

- 美国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 医疗保健

- 包装

- 木製品和配件

- 其他的

- 科技

- 热熔胶

- 反应性

- 密封剂

- 溶剂型

- 紫外线固化胶合剂

- 水性

- 地区

- 亚太地区

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

- 欧洲

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 北美洲

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地区

- 亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Chengdu Guibao Science and Technology Co., Ltd.

- Dow

- Guangzhou Jointas Chemical Co.,Ltd.

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI SpA

- Momentive

- RPM International Inc.

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92484

The Silicone Adhesives & Sealants Market size is estimated at 7.69 billion USD in 2024, and is expected to reach 9.67 billion USD by 2028, growing at a CAGR of 5.91% during the forecast period (2024-2028).

Emerging construction and packaging end-use sector expected to boost the consumption of silicone adhesives & sealants, globally

- Silicone adhesives are known for their unique properties, such as low-temperature resistance, good electrical properties and weather resistance, and chemical stability.

- Silicone adhesives and sealants are used in various industries, but building and construction is the primary end-user consumer of these adhesives as they are used in several construction applications. These adhesives and sealants are highly advantageous for construction manufacturers in terms of UV stability, extreme temperature resistance, within the range of -65°C to 300°C, and a low curing time of up to 24 hours with three methods. Silicone sealants are mainly used as a bonding sealing agent, which can be used in windows and doors, building facades, kitchens & bathrooms, and other applications.

- Silicone adhesives are also widely used in the packaging industry. These adhesives are highly flexible in nature, which is a particular requirement of the packaging industry. They are primarily used in food packaging with metal, plastic, and paper substrates. Water-borne silicone adhesives are the highest consumed adhesive technology and accounted for 70% of the total market in 2021. This technology is cheaper than other technologies used in this industry.

- The rising demand for structural adhesives from the building and construction industry and flexible adhesives for the packaging industry is expected to drive the demand for silicone adhesives and sealants over the coming years. The construction industry is expected to record a CAGR of 3.5% up to 2030. The electronic industry's usage of silicone sealants is expected to register a CAGR of 2.57% during the forecast period 2022-2028.

Inflating demand from Asia-Pacific's construction sector likely to drive the global sales of silicone adhesive and sealants

- Silicone adhesives and sealants accounted for a 9.25% share of the global adhesives and sealants demand in 2021. They are used in construction, packaging, automotive, aerospace, healthcare, and many other industries. These adhesives and sealants also provide building structures more flexibility, allowing materials to absorb stress and movement produced by wind or earthquakes. Silicone adhesives and sealants in buildings can also save energy by preventing damp and heat or cold air from entering through seams and gaps. The global silicone adhesives and sealants market is expected to record a CAGR of about 4.39% in terms of volume during the forecast period 2022-2028.

- Asia-Pacific is the leading consumer of silicone adhesives and sealants globally. The rising construction activities in the region are generating demand for silicone adhesives and sealants. The new floor area in the region is expected to reach 24.6 billion square feet by 2028 from 17.9 billion square feet in 2021.

- Silicone-based adhesives and sealants are majorly consumed in the construction and packaging industries across the globe. Nearly 715 thousand tons of silicone adhesives and sealants were consumed in the construction industry in 2021. Silicone sealants are used more in construction applications as they are highly advantageous for manufacturers in terms of UV stability, extreme temperature resistance ranging within -65°C and 300°C, and a short curing time of up to 24 hours with three methods. Silicone adhesives and sealants are mainly used as bonding and sealing agents, which can be used in windows and doors, building facades, kitchens and bathrooms, and other applications.

Global Silicone Adhesives & Sealants Market Trends

Growing residential and infrastructural development to thrive the construction sector

- The building and construction industry witnessed steady growth, with a CAGR of 2.6% from 2017 to 2019. This growth was driven by the upswing in global economic activity and increasing demand for single-family homes. In 2020, the COVID-19 pandemic had a major impact on the global building and construction industry. Constraints in labor supply, disruptions in construction finances and the supply chain, and economic uncertainty negatively impacted the global building and construction industry.

- Though the industry showed positive growth in 2021, the pandemic's effect on supply chains, which resulted in a hike in raw material prices, is still plaguing the industry. However, as the construction industry heavily influences a nation's economy, countries in Europe, North America, and Asia-Pacific have used the construction industry to restart their economic cycles by offering support schemes. Some support schemes include the Homebuilder Programme in Australia and the economic recovery plan of EU countries.

- The Asia-Pacific region experiences the highest volume of construction activities, and it is expected to remain the largest construction market till 2028 due to its huge population, increasing urbanization, and increasing investments in infrastructural development in countries like China, India, Japan, Indonesia, and South Korea.

- Increasing emphasis on green buildings and efforts to reduce emissions from global construction activities are expected to result in more sustainable operational procedures during the forecast period. For example, France has sanctioned EUR 7.5 billion for the construction industry to transform itself into a low-carbon energy economy.

Favorable government policies to promote electric vehicles will propel automotive industry

- Since 2021, the global automotive industry has been expected to grow steadily but at a slower pace because of the decline in consumers' preferences for individual ownership of passenger vehicles and their increased preference for shared mobility in transportation. The global automotive industry is expected to experience a growth rate of 2% annually, with an expected value addition of USD 1.5 trillion in total revenue during the forecast period.

- In 2020, due to the impact of the COVID-19 pandemic, vehicle sales declined but recovered rapidly in 2021 because the governments of various countries took measures to support their economies, as automotive markets usually contribute majorly to their GDP. Vehicle sales declined from 90 million units of passenger vehicles in 2019 to 78 million units in 2020.

- The introduction of electric vehicles worldwide has contributed significantly to the overall revenue of the global automotive market because of their cheaper energy costs, environmentally benign nature, and efficient mobility features. Various government policies and standards also work as driving factors to increase EV production. For instance, the EU standards for CO2 emissions increased the demand for electric vehicles in 2021. As per the IEA's Sustainable Scenario, 230 million electric vehicles are required to replace combustion fuel-based vehicles by 2030. In 2021, Tesla, the largest EV manufacturer, recorded a rise of 157% in the number of electric vehicles manufactured. This growing trend of consumers preferring electric vehicles is expected to rise further during the forecast period (2022-2028).

Silicone Adhesives & Sealants Industry Overview

The Silicone Adhesives & Sealants Market is fragmented, with the top five companies occupying 27.78%. The major players in this market are Chengdu Guibao Science and Technology Co., Ltd., Dow, Henkel AG & Co. KGaA, Sika AG and Soudal Holding N.V. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Packaging

- 4.1.5 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 Argentina

- 4.2.2 Australia

- 4.2.3 Brazil

- 4.2.4 Canada

- 4.2.5 China

- 4.2.6 EU

- 4.2.7 India

- 4.2.8 Indonesia

- 4.2.9 Japan

- 4.2.10 Malaysia

- 4.2.11 Mexico

- 4.2.12 Russia

- 4.2.13 Saudi Arabia

- 4.2.14 Singapore

- 4.2.15 South Africa

- 4.2.16 South Korea

- 4.2.17 Thailand

- 4.2.18 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Packaging

- 5.1.6 Woodworking and Joinery

- 5.1.7 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 UV Cured Adhesives

- 5.2.6 Water-borne

- 5.3 Region

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 Singapore

- 5.3.1.8 South Korea

- 5.3.1.9 Thailand

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 France

- 5.3.2.2 Germany

- 5.3.2.3 Italy

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 United Kingdom

- 5.3.2.7 Rest of Europe

- 5.3.3 Middle East & Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 South Africa

- 5.3.3.3 Rest of Middle East & Africa

- 5.3.4 North America

- 5.3.4.1 Canada

- 5.3.4.2 Mexico

- 5.3.4.3 United States

- 5.3.4.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 Argentina

- 5.3.5.2 Brazil

- 5.3.5.3 Rest of South America

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Chengdu Guibao Science and Technology Co., Ltd.

- 6.4.4 Dow

- 6.4.5 Guangzhou Jointas Chemical Co.,Ltd.

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Illinois Tool Works Inc.

- 6.4.9 MAPEI S.p.A.

- 6.4.10 Momentive

- 6.4.11 RPM International Inc.

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Sika AG

- 6.4.14 Soudal Holding N.V.

- 6.4.15 Wacker Chemie AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219