|

市场调查报告书

商品编码

1859658

全球夹层玻璃市场按应用、玻璃类型、中阶类型、终端用户产业和地区划分-预测至2030年Laminated Glass Market by Glass Type (Heat-strengthened, Tempered, Triple, Reflective, Others), End-use Industry (Automotive, Electronics, Building & Construction, Energy, Other End-use Industries), and Region - Global Forecast to 2030 |

||||||

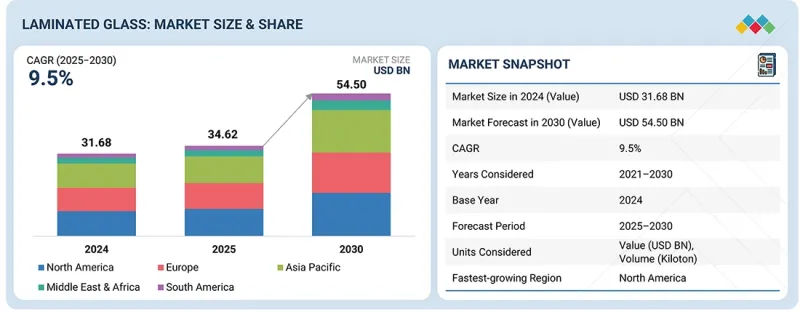

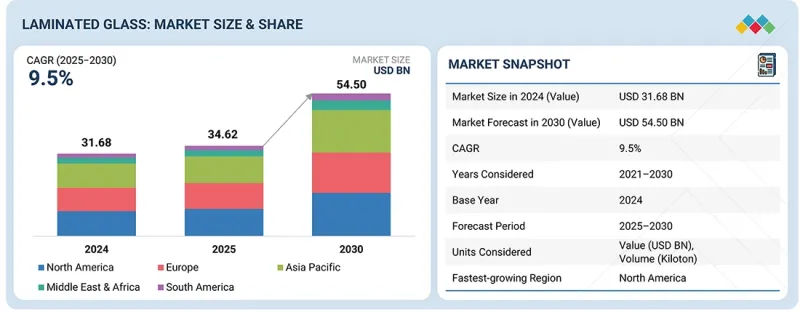

预计夹层玻璃市场将从 2024 年的 316.8 亿美元成长到 2030 年的 545 亿美元,预测期内复合年增长率为 9.5%。

| 调查范围 | |

|---|---|

| 调查年度 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 考虑单位 | 金额(百万美元),数量(千吨) |

| 按细分市场 | 按应用、玻璃类型、中阶类型、最终用途行业和地区划分 |

| 目标区域 | 欧洲、北美、亚太地区、南美洲、中东、非洲 |

在众多应用领域中,光伏/建筑一体化光伏(BIPV)组件是夹层玻璃快速增长的细分市场,这主要得益于可再生能源的普及、建筑技术的进步以及永续性倡议的推动。夹层玻璃在这一领域扮演着关键角色,它既能提供结构完整性,又能实现太阳能电池的功能集成,因此成为太阳能电池板、建筑幕墙、天窗和其他能源生产建筑构件的首选玻璃。推动这一成长的关键因素是全球脱碳进程和净零排放建筑的建设,BIPV组件正日益取代传统的建筑材料,例如屋顶瓦片、帷幕墙和窗户。夹层玻璃在确保耐久性和安全性的同时,也能保持透明度和半透明度,使建筑师和设计师能够兼顾美观和功能性需求。

都市化和智慧城市计划的推进进一步推动了建筑光伏一体化(BIPV)组件的需求成长,因为它们既能产生可再生能源,又能提高建筑基础设施的能源效率。政府对太阳能部署的激励措施、更严格的建筑法规以及不断上涨的能源成本,都使得BIPV解决方案更具经济效益。夹层玻璃具有优异的抗衝击性、耐候性和劣化防护性能,确保了系统的长期性能,并保护了太阳能电池,最终降低了维护成本,延长了系统的使用寿命。

离子聚合物夹层是夹层玻璃市场中价值成长最快的以金额为准,其性能优于PVB等传统材料,可用于高端应用,且价格更高。据报导,离子聚合物夹层玻璃的刚度是PVB的100倍,韧性约为PVB的5倍,它不仅是安全玻璃,更是真正的结构元件。这使得建筑师和工程师能够製造更薄、更轻、更大的玻璃面板,用于建筑幕墙、栏桿、天窗和顶棚嵌装玻璃,而无需笨重的框架,从而在更高的每平方公尺价格下实现系统级成本节约。其卓越的边缘稳定性和防潮性降低了分层和泛黄的风险,并保持了长期的光学清晰度——这对于高端计划至关重要。离子聚合物夹层玻璃即使在破损后高温下仍能保持其承载能力,这在PVB强度降低的温暖气候和其他安全关键环境中提供了显着的安全优势。此外,离子塑胶薄膜通常以特定厚度(如 0.89 毫米和 1.52 毫米)提供,并且具有非常低的黄度指数,进一步证实了它们适用于高端建筑和结构玻璃应用。

三层夹胶玻璃是目前以金额为准成长最快的玻璃,满足了现代基础设施和特殊应用对安全性、耐久性和多功能性的日益增长的需求。与标准双层夹胶玻璃不同,三层夹胶玻璃采用三层玻璃与两层中间层黏合而成,结构更坚固耐用。这种结构使其具有卓越的抗衝击性,是应对爆炸、弹道威胁、飓风和地震等恶劣环境的理想选择。它常用于安全保障至关重要的场所,例如国防、大使馆、高安全级别设施以及机场和政府大楼等关键公共基础设施。三层夹胶玻璃还具有出色的隔音和隔热性能,满足了高层办公大楼、豪华住宅和城市开发项目对节能和隔音日益增长的需求。额外的夹胶层使其能够整合可切换防窥膜、太阳能控制涂层和光伏组件等先进功能,进一步提升了其价值。虽然由于玻璃更厚、中间层更厚、高压釜製程更复杂,三层夹胶玻璃的製造成本更高,但客户愿意支付溢价,因为它能降低长期风险、维护需求和责任问题。

「预计在预测期内,电子产业对夹层玻璃的终端应用市场将成长最快。

在先进显示技术与消费和工业设备对耐用性日益增长的需求共同推动下,电子产业已成为夹层玻璃以金额为准成长最快的终端应用市场。与建筑和汽车行业不同,电子终端应用领域对夹层玻璃的要求不仅在于强度和安全性,还在于其光学清晰度、抗刮性以及与感测器、触控系统和柔性组件的功能整合。智慧型手机、平板电脑、笔记型电脑、智慧型手錶和AR/ VR头戴装置显越来越多地采用夹层玻璃来保护精密显示屏,同时保持高亮度和高精度。在高阶家电领域,夹层玻璃能够实现全面屏设计、超薄厚度和流畅的触控反应,进而直接提升产品价值。除了消费性电子产品外,夹层玻璃在工业电子、医疗设备和汽车萤幕等领域也越来越受欢迎,这些领域对抗衝击性、耐温差性和环境因素的耐受性要求极高。在夹层玻璃中加入离子增强层或化学增强层可以提高其抗跌落、抗弯曲和抗频繁使用的耐用性,从而减少保固索赔并增强客户信心。此外,夹层玻璃还可以嵌入防眩光、防反射、紫外线防护和光伏涂层等功能性薄膜,使显示器成为多功能组件。

北美预计将成为夹层玻璃的主要区域市场,这主要得益于其强大的工业基础、严格的法规环境以及在高价值应用领域的广泛使用。建筑业发挥着至关重要的作用,尤其是在佛罗里达州和墨西哥湾沿岸等沿海地区,为了符合严格的建筑法规,夹层玻璃在商业建筑、机场、教育机构和住宅开发项目中日益普及,以满足安全、防火和抗飓风的要求。绿色认证和节能建筑的兴起进一步扩大了具有太阳能控制涂层和隔音功能的夹层玻璃的应用,这些产品符合LEED和其他永续性标准。在汽车产业,北美受惠于高保有量和严格的法律规范,包括来自美国公路交通安全运输部(NHTSA)的监管,该机构尤其重视碰撞安全和乘员保护。除了传统的挡风玻璃外,夹层玻璃还被用于侧窗、全景天窗和先进的抬头显示器(HUD)挡风玻璃,这反映了消费者对安全性、舒适性和高端设计的偏好。北美也正经历显着的技术进步,夹层玻璃在电子产品、智慧玻璃和建筑一体化光伏(BIPV)领域的应用日益广泛。航太和国防领域对夹层玻璃的需求,例如用于驾驶座、座舱罩和防爆玻璃,进一步提升了其市场价值。此外,美国和加拿大拥有许多主要的夹层玻璃製造商、研发中心和加工设施,确保了灵活的供给能力,并促进了新型夹层、涂层和功能性夹层材料的高效商业化。

本报告对全球夹层玻璃市场进行了分析,并按应用、玻璃类型、中阶类型、最终用途行业、区域趋势以及参与市场的公司的概况进行了细分。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 介绍

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 2024年价格分析

- 2024年主要企业按终端用户产业分類的夹层玻璃平均售价

- 各地区平均销售价格趋势(2021-2024 年)

- 宏观经济展望

- 供应链分析

- 价值链分析

- 贸易分析

- 生态系分析

- 技术分析

- 专利分析

- 监管状态

- 2025-2026 年主要会议和活动

- 案例研究分析

- 影响客户业务的趋势/干扰因素

- 生成式人工智慧/人工智慧对夹层玻璃市场的影响

- 投资和资金筹措方案

- 2025年美国关税对夹层玻璃市场的影响

第六章:夹层玻璃市场(依应用领域划分)

- 介绍

- 门窗、建筑幕墙

- 汽车护罩

- 铁路和船舶玻璃

- 太阳能/光电建筑一体化组件

- 电子产品和智慧型设备

- 安全与国防玻璃

第七章:夹层玻璃市场(依玻璃类型划分)

- 介绍

- 热增强

- 加强

- 三层复合板

- 反光的

- 其他的

第八章:夹层玻璃市场(依中阶类型划分)

- 介绍

- 聚乙烯丁醛

- 乙烯-醋酸乙烯酯

- 离子塑胶聚合物

- 热塑性聚氨酯

- 其他的

第九章 夹层玻璃市场(依终端用户产业划分)

- 介绍

- 建筑/施工

- 车

- 活力

- 电子学

- 其他的

第十章:夹层玻璃市场(依地区划分)

- 介绍

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第十一章 竞争格局

- 概述

- 市占率分析

- 品牌对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 估值和财务指标

- 竞争场景

第十二章:公司简介

- 主要参与企业

- TAIWAN GLASS IND. CORP.

- CSG HOLDING CO. LTD.

- FUYAO GROUP

- NIPPON SHEET GLASS CO., LTD.

- SAINT-GOBAIN

- SISECAM

- CENTRAL GLASS CO., LTD.

- AGC INC.

- TRULITE

- SCHOTT

- VITRO

- FLAT GLASS GROUP CO., LTD.

- XINYI GLASS HOLDINGS LIMITED

- GUARDIAN INDUSTRIES

- CEVITAL

- 其他公司

- BEHRENBERG GLASS CO.

- APOGEE ENTERPRISES, INC.

- PHOENICIA

- CARDINAL GLASS INDUSTRIES, INC

- UNITED PLATE GLASS COMPANY

- INDEPENDENT GLASS CO.

- GSC GLASS PVT LTD

- FISHFA GROUP

- TECNOGLASS

- SCHEUTEN GLASS

第十三章附录

The laminated glass market is anticipated to expand from USD 31.68 billion in 2024 to USD 54.50 billion by 2030, reflecting a compound annual growth rate (CAGR) of 9.5% over the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | By Interlayer Type, By Glass Type, By Application, By End-use Industry |

| Regions covered | Europe, North America, Asia Pacific, South America, Middle East, and Africa |

Among the various applications, the Solar/BIPV Modules segment represents the fastest-growing sector for laminated glass, propelled by the adoption of renewable energy, architectural advancements, and sustainability initiatives. Laminated glass plays a crucial role in this field by providing both structural integrity and functional integration for photovoltaic cells, thereby making it the preferred choice for solar panels, facades, skylights, and other energy-generating architectural elements. A significant factor driving this growth is the global movement towards decarbonization and the development of net-zero buildings, with BIPV modules increasingly replacing traditional building materials such as roofing tiles, curtain walls, and windows. Laminated glass ensures durability and safety while maintaining transparency or semi-transparency, enabling architects and designers to balance aesthetic appeal with functional requirements.

The rising demand is further supported by urbanization and the development of smart city projects, as BIPV modules offer dual benefits: generating renewable energy and improving energy efficiency in building infrastructures. Government incentives for solar energy implementation, stricter building regulations, and rising energy costs have enhanced the economic viability of BIPV solutions. Laminated glass is renowned for its impact resistance, weather resistance, and UV deterioration protection, ensuring long-term performance and safeguarding photovoltaic cells, which ultimately reduces maintenance costs and prolongs system lifespan.

''In terms of value, ionoplast polymer, by Interlayer type, is projected to be the fastest-growing segment of the overall laminated glass market.''

Ionoplast polymer by interlayer type is the fastest-growing segment in the laminated glass market in terms of value because it offers performance that exceeds traditional materials like PVB. This enables high-end applications that can command premium prices. With stiffness reported to be up to 100 times greater and toughness about five times higher than PVB, ionoplast laminates act as true structural elements rather than just safety glass. This allows architects and engineers to create thinner, lighter, and larger glass panels for facades, balustrades, skylights, and overhead glazing without needing bulky frames, leading to system-level cost savings, though with a higher price per square meter. Their excellent edge stability and resistance to moisture reduce the risk of delamination and yellowing, ensuring long-lasting optical clarity, which is important for upscale projects. Notably, ionoplast maintains its load-bearing capacity after breaking even at high temperatures, offering a significant safety advantage in warm climates or safety-critical settings where PVB weakens. Additionally, ionoplast films are typically available in specific thicknesses such as 0.89 mm and 1.52 mm, and feature a very low yellowness index, further confirming their suitability for high-end architectural and structural glass.

''In terms of value, triple laminated, by glass type is projected to be the fastest-growing segment in the overall laminated glass market.''

Triple-laminated glass is the fastest-growing segment based on value, driven by its ability to meet the increasing demand for enhanced safety, durability, and multifunctionality in modern infrastructure and specialized applications. Unlike standard double laminates, triple laminates feature three layers of glass bonded with two interlayers, creating a much stronger and more durable structure. This configuration offers outstanding impact resistance, making it the top choice for environments that face tough conditions such as blasts, ballistic threats, hurricanes, or earthquakes. For instance, it is frequently used in defense, embassies, high-security facilities, and critical public infrastructure like airports and government buildings, where safety and security are priorities. Besides security benefits, triple laminated glass also provides better acoustic insulation and thermal performance, meeting the rising demand for energy-efficient and soundproof spaces in high-rise offices, luxury homes, and urban developments. The additional layer enables the integration of advanced features such as switchable privacy films, solar control coatings, or photovoltaic cells, further adding to its value. Although manufacturing triple laminates involves higher costs due to the thicker glass, extra interlayers, and more complex autoclave processes, customers are willing to pay the premium because it reduces long-term risks, maintenance needs, and liability issues.

"During the forecast period, the laminated glass market in the electronics end-use industry is projected to be the fastest-growing."

The electronics industry is emerging as the fastest-growing end-use market for laminated glass in terms of value, owing to the confluence of advanced display technologies, and consumer and industrial device durability requirements. Unlike the construction or automotive industry, the electronics end-use sector demands laminated glass that not only provides strength and safety but also optical clarity, scratch resistance, and functional integration with sensors, touch systems, and flexible components. Smartphones, tablets, laptops, smartwatches, and AR/VR headsets are increasingly utilizing laminated glass to safeguard sensitive displays while maintaining high brightness and color accuracy. In the luxury consumer electronics segment, laminated glass facilitates edge-to-edge designs, ultra-thin profiles, and smooth touch response, all of which directly augment product value. Beyond consumer devices, laminated glass is gaining popularity within industrial electronics, medical equipment, and automotive screens, where resistance to impacts, temperature variations, and environmental factors is crucial. The incorporation of ionoplast or chemically strengthened layers within laminates ensures long-lasting durability against drops, bending, or frequent usage, thereby reducing warranty claims and fostering customer confidence. Furthermore, laminated glass can embed functional films such as anti-glare, anti-reflective, UV-blocking, or photovoltaic coatings, transforming displays into multifunctional components.

"During the forecast period, the laminated glass market in North America is projected to be the largest."

North America is anticipated to be the leading regional market for laminated glass, primarily owing to its robust industrial foundation, rigorous regulatory environment, and advanced utilization of high-value applications. The construction industry plays a pivotal role, as laminated glass is increasingly mandated in commercial towers, airports, educational institutions, and residential developments to comply with stringent building regulations pertaining to safety, fire protection, and hurricane impact resistance, particularly in coastal regions such as Florida and the Gulf Coast. The growth of green-certified and energy-efficient buildings has further amplified the use of laminated glass with solar control coatings and sound insulation features, in accordance with LEED and other sustainability standards. In the automotive sector, North America benefits from both high vehicle ownership rates and strict regulatory oversight by agencies such as the National Highway Traffic Safety Administration (NHTSA), which emphasize crash safety and occupant protection. Beyond conventional windshields, laminated glass is being employed for side windows, panoramic roofs, and advanced head-up display (HUD) windshields, reflecting consumer preferences for safety, comfort, and premium design. North America also demonstrates excellence in technological advancements, with laminated glass being increasingly integrated into electronics, smart glass, and building-integrated photovoltaics (BIPV). The demand from aerospace and defense sectors, where laminated glass is utilized in cockpits, canopies, and blast-resistant glazing, further enhances the market value. Additionally, the presence of major laminated glass manufacturers, research & development centers, and processing facilities in the United States and Canada ensures a resilient supply capability and efficient commercialization of new interlayers, coatings, and functional laminates.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1- 45%, Tier 2- 35%, and Tier 3- 20%

- By Designation - Managers- 50%, Directors- 30% and Others - 20%

- By Region - North America- 40%, Europe- 35%, Asia Pacific- 20%, RoW- 5%

The report provides a comprehensive analysis of company profiles:

Prominent companies include TAIWAN GLASS IND. CORP. (Taiwan), CSG HOLDING CO., LTD. (China), Fuyao Group (China), Nippon Sheet Glass Co., Ltd. (Japan), Saint-Gobain (France), Sisecam (Turkey), Central Glass Co., Ltd. (Japan), AGC Inc. (Japan), Trulite (Georgia), SCHOTT (Germany), Vitro (Mexico), and others.

Research Coverage

This research report categorizes the laminated glass market by interlayer type (polyvinyl butyral, ethyl-vinyl acetate, ionoplast polymer, thermoplastic polyurethane, other interlayer types), glass type (heat-strengthened, tempered, triple, reflective, other glass types), application (windows, doors, and facades; automotive shields; railway & marine glazing; solar/BIPV modules; electronics & smart devices; security & defense glazing), end-use industry (automotive, electronics, building & construction, energy, other end-use industries), and region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America).

The scope of the report covers detailed information about the main factors influencing the growth of the laminated glass market, such as drivers, restraints, challenges, and opportunities. A thorough analysis of key industry players has been performed to provide insights into their business overview, solutions, services, key strategies, contracts, partnerships, and agreements. The report also discusses service launches, mergers and acquisitions, and recent developments in the laminated glass market. Additionally, it includes a competitive analysis of upcoming startups within the laminated glass market ecosystem.

Reasons to buy this report:

The report will assist market leaders and new entrants by providing approximate revenue figures for the overall laminated glass market and its subsegments. It will help stakeholders understand the competitive landscape and gather insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report offers stakeholders an understanding of the market's current dynamics and key information on drivers, restraints, challenges, and opportunities.

The report provides insights on the following:

- Analysis of key drivers (rising adoption of laminated glass in construction for safety and energy efficiency), restraints (capital-intensive production processes), opportunities (push for sustainable and green-certified buildings), and challenges (high emission in glass production)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the laminated glass market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the laminated glass market across varied regions

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the laminated glass market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players like TAIWAN GLASS IND. CORP. (Taiwan), CSG HOLDING CO., LTD. (China), Fuyao Group (China), Nippon Sheet Glass Co., Ltd (Japan), Saint-Gobain (France), Sisecam (Turkey), Central Glass Co., Ltd. (Japan), AGC Inc. (Japan), Trulite (Georgia), SCHOTT (Germany), Vitro (Mexico), among others in the laminated glass market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAMINATED GLASS MARKET

- 4.2 LAMIANTED GLASS MARKET, BY GLASS TYPE

- 4.3 LAMINATED GLASS MARKET, BY APPLICATION

- 4.4 LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 4.5 LAMINATED GLASS MARKET, BY GLASS TYPE

- 4.6 LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 4.7 LAMINATED GLASS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption in construction for safety and energy efficiency

- 5.2.1.2 Growing use in automotive windshields and sunroofs

- 5.2.1.3 Advances in acoustic, UV control, and solar-integrated glass

- 5.2.2 RESTRAINTS

- 5.2.2.1 Capital-intensive production processes

- 5.2.2.2 Higher cost of glass bonding adhesives than conventional adhesives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Push for sustainable & green certified buildings

- 5.2.3.2 Security and defense demand for bullet-resistant glass

- 5.2.4 CHALLENGES

- 5.2.4.1 High emissions in glass production

- 5.2.4.2 Competition from alternative lightweight materials

- 5.2.4.3 Fluctuating price of raw materials

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 PRICING ANALYSIS, 2024

- 5.5.1 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.6 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.8 MACROECONOMIC OUTLOOK

- 5.8.1 INTRODUCTION

- 5.8.2 GDP TRENDS AND FORECAST

- 5.8.3 TRENDS IN LAMINATED GLASS MARKET

- 5.9 SUPPLY CHAIN ANALYSIS

- 5.9.1 RAW MATERIAL ANALYSIS

- 5.9.2 FABRICATIORS AND INTERMEDIATES

- 5.9.3 FINAL PRODUCT ANALYSIS

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 EXPORT SCENARIO FOR HS CODE 700721

- 5.11.2 IMPORT SCENARIO FOR HS CODE 700721

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 KEY TECHNOLOGIES

- 5.13.1.1 Autoclave processing

- 5.13.1.2 Vacuum heat processing

- 5.13.2 COMPLEMENTARY TECHNOLOGIES

- 5.13.2.1 Cold press

- 5.13.2.2 Nip-roll processing

- 5.13.1 KEY TECHNOLOGIES

- 5.14 PATENT ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 METHODOLOGY

- 5.14.3 DOCUMENT TYPES

- 5.14.4 INSIGHTS

- 5.14.5 LEGAL STATUS

- 5.14.6 JURISDICTION ANALYSIS

- 5.14.7 TOP APPLICANTS

- 5.14.8 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES & EVENTS, 2025-2026

- 5.17 CASE STUDY ANALYSIS

- 5.17.1 USE OF LAMINATED SAFETY GLASS IN HIGH-RISE BUILDINGS BY NIPPON SHEET GLASS

- 5.17.2 DEPLOYMENT OF BULLET-RESISTANT LAMINATED GLASS IN SECURITY INFRASTRUCTURE BY SCHOTT

- 5.17.3 LAMINATED ACOUSTIC GLASS FOR TRANSPORTATION HUBS BY SAINT-GOBAIN

- 5.18 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.19 IMPACT OF GEN AI/AI ON LAMINATED GLASS MARKET

- 5.19.1 TOP USE CASES AND MARKET POTENTIAL

- 5.19.2 CASE STUDIES OF AI IMPLEMENTATION IN LAMINATED GLASS MARKET

- 5.20 INVESTMENT AND FUNDING SCENARIO

- 5.21 IMPACT OF 2025 US TARIFF - LAMINATED GLASS MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 LAMINATED GLASS MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 WINDOWS & DOORS, FACADES

- 6.2.1 GROWING DEMAND FOR ENERGY-EFFICIENT AND SAFETY-ENHANCED BUILDING MATERIALS IN MODERN CONSTRUCTION

- 6.3 AUTOMOTIVE SHIELDS

- 6.3.1 GROWING FOCUS ON VEHICLE SAFETY AND COMFORT

- 6.4 RAILWAY & MARINE GLAZING

- 6.4.1 INCREASING DEMAND FOR ENHANCED PASSENGER SAFETY AND DURABILITY IN TRANSPORT INFRASTRUCTURE

- 6.5 SOLAR/BIPV MODULE

- 6.5.1 RAPIDLY GROWING DEMAND FOR SUSTAINABLE AND ENERGY-EFFICIENT BUILDING SOLUTIONS

- 6.6 ELECTRONICS & SMART DEVICES

- 6.6.1 GROWING DEMAND FOR DURABLE, HIGH-PERFORMANCE TOUCHSCREENS AND DISPLAY PANELS

- 6.7 SECURITY & DEFENSE GLAZING

- 6.7.1 INCREASING NEED FOR ENHANCED PROTECTION AGAINST BALLISTIC THREATS, EXPLOSIONS, AND FORCED ENTRY

7 LAMINATED GLASS MARKET, BY GLASS TYPE

- 7.1 INTRODUCTION

- 7.2 HEAT STRENGTHENED

- 7.2.1 GROWING DEMAND FOR ENHANCED SAFETY AND STRUCTURAL PERFORMANCE IN ARCHITECTURAL APPLICATIONS

- 7.3 TEMPERED

- 7.3.1 RISING DEMAND FOR HIGH-SAFETY, HIGH-STRENGTH GLASS SOLUTIONS IN CONSTRUCTION AND AUTOMOTIVE APPLICATIONS

- 7.4 TRIPLE LAMINATED

- 7.4.1 GROWING DEMAND FOR ENHANCED SAFETY, ACOUSTIC INSULATION, AND STRUCTURAL PERFORMANCE

- 7.5 REFLECTIVE

- 7.5.1 INCREASING DEMAND FOR ENERGY-EFFICIENT AND AESTHETICALLY APPEALING BUILDING DESIGNS

- 7.6 OTHER GLASS TYPES

8 LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 8.1 INTRODUCTION

- 8.2 POLYVINYL BUTYRAL

- 8.2.1 RISING DEMAND FOR COST-EFFECTIVE SAFETY AND ACOUSTIC SOLUTIONS IN AUTOMOTIVE AND CONSTRUCTION APPLICATIONS

- 8.3 ETHYL-VINYL ACETATE

- 8.3.1 RISING ADOPTION IN PHOTOVOLTAICS AND DECORATIVE APPLICATIONS DUE TO SUPERIOR ADHESION AND UV RESISTANCE

- 8.4 IONOPLAST POLYMER

- 8.4.1 GROWING DEMAND FOR HIGH-PERFORMANCE, STRUCTURAL, AND SAFETY GLASS IN PREMIUM ARCHITECTURAL AND SPECIALIZED APPLICATIONS

- 8.5 THERMOPLASTIC POLYURETHANE

- 8.5.1 GROWING ADOPTION IN HIGH-SAFETY AND SPECIALTY APPLICATIONS REQUIRING ENHANCED DURABILITY AND VERSATILITY

- 8.6 OTHER INTERLAYER TYPES

9 LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 BUILDING & CONSTRUCTION

- 9.2.1 RISING DEMAND FOR ENHANCED SECURITY AND ACOUSTIC COMFORT IN URBAN INFRASTRUCTURE

- 9.3 AUTOMOTIVE

- 9.3.1 RISING DEMAND FOR SAFETY, COMFORT, AND ADVANCED GLAZING SOLUTIONS IN VEHICLES

- 9.4 ENERGY

- 9.4.1 GROWING ADOPTION IN SOLAR PHOTOVOLTAICS AND RENEWABLE ENERGY APPLICATIONS

- 9.5 ELECTRONICS

- 9.5.1 RISING INTEGRATION OF LAMINATED GLASS IN SMART DEVICES AND CONSUMER ELECTRONICS

- 9.6 OTHER END-USE INDUSTRIES

10 LAMINATED GLASS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.2.2 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.2.3 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.2.4 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.2.5 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.2.5.1 US

- 10.2.5.1.1 Strong demand for energy-efficient and safety-compliant building materials in construction sector

- 10.2.5.2 Canada

- 10.2.5.2.1 Rapid growth of advanced consumer electronics and smart device adoption

- 10.2.5.3 Mexico

- 10.2.5.3.1 Growing construction and infrastructure sector to drive market

- 10.2.5.1 US

- 10.3 EUROPE

- 10.3.1 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION

- 10.3.2 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.3.3 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.3.4 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.3.5 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY

- 10.3.5.1 Germany

- 10.3.5.1.1 Strong emphasis on energy-efficient and sustainable building solutions

- 10.3.5.2 France

- 10.3.5.2.1 Country's strong emphasis on modern urban development and sustainable architecture

- 10.3.5.3 UK

- 10.3.5.3.1 Rising demand for safety and security glazing in modern construction

- 10.3.5.4 Italy

- 10.3.5.4.1 Strong automotive and electronics manufacturing driving demand for advanced laminated glass

- 10.3.5.5 Rest of Europe

- 10.3.5.1 Germany

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION

- 10.4.2 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.4.3 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.4.4 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.4.5 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY

- 10.4.5.1 China

- 10.4.5.1.1 Rapid urbanization and infrastructure development driving demand for safety, durability, and energy-efficient glazing

- 10.4.5.2 Japan

- 10.4.5.2.1 Technological advancements and strong presence of leading laminated glass manufacturers

- 10.4.5.3 India

- 10.4.5.3.1 Rapid urbanization and growing demand for sustainable and safe construction solutions

- 10.4.5.4 South Korea

- 10.4.5.4.1 Strong automotive and electronics manufacturing driving demand for advanced laminated glass

- 10.4.5.5 Rest of Asia Pacific

- 10.4.5.1 China

- 10.5 SOUTH AMERICA

- 10.5.1 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.5.2 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.5.3 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.5.4 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.5.5 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.5.5.1 Brazil

- 10.5.5.1.1 Rapid growth of the automotive industry to drive market

- 10.5.5.2 Argentina

- 10.5.5.2.1 Expanding construction and infrastructure development

- 10.5.5.3 Rest of South America

- 10.5.5.1 Brazil

- 10.6 MIDDLE EAST AND AFRICA

- 10.6.1 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION

- 10.6.2 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE

- 10.6.3 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY

- 10.6.4 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE

- 10.6.5 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY

- 10.6.5.1 GCC Countires

- 10.6.5.1.1 UAE

- 10.6.5.1.1.1 Rapid growth of large-scale construction and infrastructure projects

- 10.6.5.1.2 Saudi Arabia

- 10.6.5.1.2.1 Large-scale investment in infrastructure and construction projects under Vision 2030

- 10.6.5.1.3 Rest of GCC countries

- 10.6.5.1.1 UAE

- 10.6.5.1 GCC Countires

- 10.6.6 SOUTH AFRICA

- 10.6.6.1 Expanding automotive industry to drive market

- 10.6.7 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.4 MARKET SHARE ANALYSIS

- 11.5 BRAND COMPARISON

- 11.5.1 NIPPON SHEET GLASS CO., LTD.

- 11.5.2 SAINT-GOBAIN

- 11.5.3 SCHOTT

- 11.5.4 CHINA GLASS HOLDINGS LIMITED

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Glass type footprint

- 11.6.5.4 Interlayer footprint

- 11.6.5.5 End-use industry footprint

- 11.6.5.6 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 TAIWAN GLASS IND. CORP.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Key strengths

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 CSG HOLDING CO. LTD.

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 FUYAO GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 NIPPON SHEET GLASS CO., LTD.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.3.3 Others

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 SAINT-GOBAIN

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Expansions

- 12.1.5.3.3 Deals

- 12.1.5.3.4 Others

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 SISECAM

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.3.2 Others

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 CENTRAL GLASS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 AGC INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.3.2 Product launches

- 12.1.8.3.3 Deals

- 12.1.8.3.4 Others

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 TRULITE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.4 MnM view

- 12.1.9.4.1 Right to win

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 SCHOTT

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Expansions

- 12.1.10.4 MnM view

- 12.1.10.4.1 Key strengths

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses and competitive threats

- 12.1.11 VITRO

- 12.1.11.1 Business overviews

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Expansions

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Others

- 12.1.11.4 MnM view

- 12.1.11.4.1 Key strengths

- 12.1.11.4.2 Strategic choices

- 12.1.11.4.3 Weaknesses and competitive threats

- 12.1.12 FLAT GLASS GROUP CO., LTD.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 MnM view

- 12.1.12.3.1 Key strengths

- 12.1.12.3.2 Strategic choices

- 12.1.12.3.3 Weaknesses and competitive threats

- 12.1.13 XINYI GLASS HOLDINGS LIMITED

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.13.4 MnM view

- 12.1.13.4.1 Key sterngths/Right to win

- 12.1.13.4.2 Strategic choices

- 12.1.13.4.3 Weaknesses and competitive threats

- 12.1.14 GUARDIAN INDUSTRIES

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Expansions

- 12.1.14.3.4 Others

- 12.1.14.4 MnM view

- 12.1.14.4.1 Key strengths

- 12.1.14.4.2 Strategic choices

- 12.1.14.4.3 Weaknesses and competitive threats

- 12.1.15 CEVITAL

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 MnM view

- 12.1.15.3.1 Key strengths

- 12.1.15.3.2 Strategic choices

- 12.1.15.3.3 Weaknesses and competitive threats

- 12.1.1 TAIWAN GLASS IND. CORP.

- 12.2 OTHER PLAYERS

- 12.2.1 BEHRENBERG GLASS CO.

- 12.2.2 APOGEE ENTERPRISES, INC.

- 12.2.3 PHOENICIA

- 12.2.4 CARDINAL GLASS INDUSTRIES, INC

- 12.2.5 UNITED PLATE GLASS COMPANY

- 12.2.6 INDEPENDENT GLASS CO.

- 12.2.7 GSC GLASS PVT LTD

- 12.2.8 FISHFA GROUP

- 12.2.9 TECNOGLASS

- 12.2.10 SCHEUTEN GLASS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LAMINATED GLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 4 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 5 AVERAGE SELLING PRICE TREND OF LAMINATED GLASS, BY REGION, 2021-2024

- TABLE 6 GDP PERCENTAGE (%) CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 7 EXPORT SCENARIO FOR HS CODE 700721-COMPLIANT PRODUCTS, BY COUNTRY, 2024 (USD THOUSAND)

- TABLE 8 IMPORT SCENARIO FOR HS CODE 7005-COMPLIANT PRODUCTS, 2024 (USD THOUSAND)

- TABLE 9 LAMINATED GLASS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 10 LAMINATED GLASS MARKET: TOTAL NUMBER OF PATENTS

- TABLE 11 LIST OF PATENTS BY SEKISUI CHEMICAL CO LTD

- TABLE 12 LIST OF PATENTS BY CORNING INC

- TABLE 13 LIST OF PATENTS BY SAINT GOBAIN

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 LAMINATED GLASS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 19 TOP USE CASES AND MARKET POTENTIAL

- TABLE 20 CASE STUDIES OF AI IMPLEMENTATION IN LAMINATED GLASS MARKET

- TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 22 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR LAMINATED GLASS

- TABLE 23 ANTICIPATED CHANGES IN PRICES AND POTENTIAL IMPACT ON END-USE MARKET

- TABLE 24 LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 26 LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 28 WINDOWS & DOORS, FACADES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 WINDOWS & DOORS, FACADES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 30 WINDOWS & DOORS, FACADES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 WINDOWS & DOORS, FACADES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 32 AUTOMOTIVE SHIELDS: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 AUTOMOTIVE SHIELDS: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 34 AUTOMOTIVE SHIELDS: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 AUTOMOTIVE SHIELDS: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 36 RAILWAY & MARINE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 RAILWAY & MARINE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 38 RAILWAY & MARINE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 RAILWAY & MARINE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 40 SOLAR/BIPV MODULE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 SOLAR/BIPV MODULE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 42 SOLAR/BIPV MODULE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SOLAR/BIPV MODULE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 44 ELECTRONICS & SMART DEVICES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 ELECTRONICS & SMART DEVICES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 46 ELECTRONICS & SMART DEVICES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 ELECTRONICS & SMART DEVICES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 48 SECURITY & DEFENSE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 SECURITY & DEFENSE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 50 SECURITY & DEFENSE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 SECURITY & DEFENSE GLAZING: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 52 LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 53 LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 54 LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 55 LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 56 HEAT STRENGTHENED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 HEAT STRENGTHENED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 58 HEAT STRENGTHENED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 HEAT STRENGTHENED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 60 TEMPERED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 TEMPERED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 62 TEMPERED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 TEMPERED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 64 TRIPLE LAMINATED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 TRIPLE LAMINATED: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 66 TRIPLE LAMINATED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 TRIPLE LAMINATED: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 68 REFLECTIVE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 REFLECTIVE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 70 REFLECTIVE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 REFLECTIVE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 72 OTHER GLASS TYPES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 OTHER GLASS TYPES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 74 OTHER GLASS TYPES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 OTHER GLASS TYPES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 76 LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 77 LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 78 LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 79 LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 80 POLYVINYL BUTYRAL: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 POLYVINYL BUTYRAL: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 82 POLYVINYL BUTYRAL: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 POLYVINYL BUTYRAL: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 84 ETHYL-VINYL ACETATE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 ETHYL-VINYL ACETATE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 86 ETHYL-VINYL ACETATE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 ETHYL-VINYL ACETATE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 88 IONOPLAST POLYMER: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 IONOPLAST POLYMER: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 90 IONOPLAST POLYMER: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 IONOPLAST POLYMER: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 92 THERMOPLASTIC POLYURETHANE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 93 THERMOPLASTIC POLYURETHANE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 94 THERMOPLASTIC POLYURETHANE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 THERMOPLASTIC POLYURETHANE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 96 OTHER INTERLAYER TYPES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 97 OTHER INTERLAYER TYPES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 98 OTHER INTERLAYER TYPES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 OTHER INTERLAYER TYPES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 100 LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 101 LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 102 LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 104 BUILDING & CONSTRUCTION: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 105 BUILDING & CONSTRUCTION: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 106 BUILDING & CONSTRUCTION: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 BUILDING & CONSTRUCTION: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 108 AUTOMOTIVE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 109 AUTOMOTIVE: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 110 AUTOMOTIVE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 AUTOMOTIVE: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 112 ENERGY: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 113 ENERGY: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 114 ENERGY: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 115 ENERGY: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 116 ELECTRONICS : LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 ELECTRONICS: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 118 ELECTRONICS: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 ELECTRONICS: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 120 OTHER END-USE INDUSTRIES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 121 OTHER END-USE INDUSTRIES: LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 122 OTHER END-USE INDUSTRIES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 OTHER END-USE INDUSTRIES: LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 124 LAMINATED GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 125 LAMINATED GLASS MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 126 LAMINATED GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 LAMINATED GLASS MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 128 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 130 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 132 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 133 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 134 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 136 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 137 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 138 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 140 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 141 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 142 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 144 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 146 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 NORTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 148 US: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 149 US: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 150 US: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 151 US: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 152 CANADA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 153 CANADA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 154 CANADA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 CANADA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 156 MEXICO: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 157 MEXICO: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 158 MEXICO: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 MEXICO: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 160 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 162 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 163 EUROPE: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 164 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 165 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 166 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 167 EUROPE: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 168 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 169 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 170 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 172 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 173 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 174 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 175 EUROPE: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 176 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 177 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 178 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 179 EUROPE: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 180 GERMANY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 181 GERMANY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 182 GERMANY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 183 GERMANY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 184 FRANCE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 185 FRANCE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 186 FRANCE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 187 FRANCE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 188 UK: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 189 UK: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 190 UK: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 191 UK: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 192 ITALY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 193 ITALY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 194 ITALY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 195 ITALY: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 196 REST OF EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 197 REST OF EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 198 REST OF EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 199 REST OF EUROPE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 200 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 202 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 204 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 205 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 206 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 208 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 209 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 210 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 212 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 213 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 214 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 216 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 217 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 218 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 219 ASIA PACIFIC: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 220 CHINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 221 CHINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 222 CHINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 223 CHINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 224 JAPAN: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 225 JAPAN: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 226 JAPAN: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 227 JAPAN: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 228 INDIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 229 INDIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 230 INDIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 231 INDIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 232 SOUTH KOREA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 233 SOUTH KOREA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 234 SOUTH KOREA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 235 SOUTH KOREA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 236 REST OF ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 237 REST OF ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 238 REST OF ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 240 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 241 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 242 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 243 SOUTH AMERICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 244 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 245 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 246 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 247 SOUTH AMERICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 248 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 249 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 250 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 251 SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 252 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 253 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 254 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 255 SOUTH AMERICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 256 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 257 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 258 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 259 SOUTH AMERICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 260 BRAZIL: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 261 BRAZIL: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 262 BRAZIL: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 263 BRAZIL: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 264 ARGENTINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 265 ARGENTINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 266 ARGENTINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 267 ARGENTINA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 268 REST OF SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 269 REST OF SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 270 REST OF SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 271 REST OF SOUTH AMERICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 274 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 275 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 276 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2021-2024 (KILOTON)

- TABLE 278 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (USD MILLION)

- TABLE 279 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY INTERLAYER TYPE, 2025-2030 (KILOTON)

- TABLE 280 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 282 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 283 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 284 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2021-2024 (KILOTON)

- TABLE 286 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY GLASS TYPE, 2025-2030 (KILOTON)

- TABLE 288 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 289 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 290 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 291 MIDDLE EAST AND AFRICA: LAMINATED GLASS MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 292 UAE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 293 UAE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 294 UAE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 295 UAE: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 296 SAUDI ARABIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 297 SAUDI ARABIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 298 SAUDI ARABIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 299 SAUDI ARABIA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 300 REST OF GCC COUNTRIES: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 301 REST OF GCC COUNTRIES: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 302 REST OF GCC COUNTRIES: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 303 REST OF GCC COUNTRIES: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 304 SOUTH AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 305 SOUTH AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 306 SOUTH AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 307 SOUTH AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 308 REST OF MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 309 REST OF MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 310 REST OF MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 311 REST OF MIDDLE EAST & AFRICA: LAMINATED GLASS MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 312 LAMINATED GLASS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 313 LAMINATED GLASS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 314 LAMINATED GLASS MARKET: REGION FOOTPRINT

- TABLE 315 LAMINATED GLASS MARKET: GLASS TYPE FOOTPRINT

- TABLE 316 LAMINATED GLASS MARKET: INTERLAYER FOOTPRINT

- TABLE 317 LAMINATED GLASS MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 318 LAMINATED GLASS MARKET: APPLICATION FOOTPRINT

- TABLE 319 LAMINATED GLASS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 320 LAMINATED GLASS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 321 LAMINATED GLASS MARKET: PRODUCT LAUNCHES, JANUARY 2020- FEBRUARY 2025

- TABLE 322 LAMINATED GLASS MARKET: DEALS, JANUARY 2020-FEBRUARY 2025

- TABLE 323 LAMINATED GLASS MARKET: EXPANSIONS, JANUARY 2020-FEBRUARY 2025

- TABLE 324 LAMINATED GLASS MARKET: OTHERS, JANUARY 2020-FEBRUARY 2025

- TABLE 325 TAIWAN GLASS IND. CORP.: COMPANY OVERVIEW

- TABLE 326 TAIWAN GLASS IND. CORP.: PRODUCTS OFFERED

- TABLE 327 CSG HOLDING CO. LTD.: COMPANY OVERVIEW

- TABLE 328 CSG HOLDING CO. LTD.: PRODUCTS OFFERED

- TABLE 329 FUYAO GROUP: COMPANY OVERVIEW

- TABLE 330 FUYAO GROUP: PRODUCTS OFFERED

- TABLE 331 FUYAO GROUP: DEALS

- TABLE 332 FUYAO GROUP: EXPANSIONS

- TABLE 333 NIPPON SHEET GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 334 NIPPON SHEET GLASS CO., LTD.: PRODUCTS OFFERED

- TABLE 335 NIPPON SHEET GLASS CO., LTD.: DEALS

- TABLE 336 NIPPON SHEET GLASS CO., LTD.: EXPANSIONS

- TABLE 337 NIPPON SHEET GLASS CO., LTD.: OTHERS

- TABLE 338 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 339 SAINT-GOBAIN: PRODUCTS OFFERED

- TABLE 340 SAINT-GOBAIN: PRODUCT LAUNCHES

- TABLE 341 SAINT-GOBAIN: EXPANSIONS

- TABLE 342 SAINT-GOBAIN: DEALS

- TABLE 343 SAINT-GOBAIN: OTHERS

- TABLE 344 SISECAM: COMPANY OVERVIEW

- TABLE 345 SISECAM: PRODUCTS OFFERED

- TABLE 346 SISECAM: EXPANSIONS

- TABLE 347 SISECAM: OTHERS

- TABLE 348 CENTRAL GLASS CO., LTD.: COMPANY OVERVIEW

- TABLE 349 CENTRAL GLASS CO., LTD.: PRODUCTS OFFERED

- TABLE 350 AGC INC.: COMPANY OVERVIEW

- TABLE 351 AGC INC.: PRODUCTS OFFERED

- TABLE 352 AGC INC.: EXPANSIONS

- TABLE 353 AGC INC.: PRODUCT LAUNCHES

- TABLE 354 AGC INC.: DEALS

- TABLE 355 AGC.: OTHERS

- TABLE 356 TRULITE: COMPANY OVERVIEW

- TABLE 357 TRULITE: PRODUCTS OFFERED

- TABLE 358 TRULITE: DEALS

- TABLE 359 SCHOTT: COMPANY OVERVIEW

- TABLE 360 SCHOTT: PRODUCTS OFFERED

- TABLE 361 SCHOTT: EXPANSIONS

- TABLE 362 VITRO: COMPANY OVERVIEW

- TABLE 363 VITRO: PRODUCTS OFFERED

- TABLE 364 VITRO: DEALS

- TABLE 365 VITR0: OTHERS

- TABLE 366 FLAT GLASS GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 367 FLAT GLASS GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 368 XINYI GLASS HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 369 XINYI GLASS HOLDINGS LIMITED: PRODUCTS OFFERED

- TABLE 370 XINYI GLASS HOLDINGS LIMITED: EXPANSIONS

- TABLE 371 GUARDIAN INDUSTRIES: COMPANY OVERVIEW

- TABLE 372 GUARDIAN INDUSTRIES: PRODUCTS OFFERED

- TABLE 373 GUARDIAN INDUSTRIES: PRODUCT LAUNCHES

- TABLE 374 GUARDIAN INDUSTRIES: DEALS

- TABLE 375 GUARDIAN INDUSTRIES: EXPANSIONS

- TABLE 376 GUARDIAN INDUSTRIES: OTHERS

- TABLE 377 CEVITAL: COMPANY OVERVIEW

- TABLE 378 CEVITAL: PRODUCTS OFFERED

- TABLE 379 BEHRENBERG GLASS CO.: COMPANY OVERVIEW

- TABLE 380 APOGEE ENTERPRISES, INC.: COMPANY OVERVIEW

- TABLE 381 PHOENICIA: COMPANY OVERVIEW

- TABLE 382 CARDINAL GLASS INDUSTRIES, INC: COMPANY OVERVIEW

- TABLE 383 UNITED PLATE GLASS COMPANY: COMPANY OVERVIEW

- TABLE 384 INDEPENDENT GLASS CO.: COMPANY OVERVIEW

- TABLE 385 GSC GLASS PVT LTD: COMPANY OVERVIEW

- TABLE 386 FISHFA GROUP: COMPANY OVERVIEW

- TABLE 387 TECNOGLASS: COMPANY OVERVIEW

- TABLE 388 SCHEUTEN GLASS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 LAMINATED GLASS: MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 LAMINATED GLASS MARKET: RESEARCH DESIGN

- FIGURE 3 LAMINATED GLASS MARKET: BOTTOM-UP APPROACH

- FIGURE 4 LAMINATED GLASS MARKET: TOP-DOWN APPROACH

- FIGURE 5 LAMINATED GLASS MARKET: DATA TRIANGULATION

- FIGURE 6 FACTOR ANALYSIS

- FIGURE 7 WINDOWS, DOORS & FACADES SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- FIGURE 8 IONOPLAST POLYMER SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

- FIGURE 9 TRIPLE LAMINATED SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 BUILDING & CONSTRUCTION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD IN LAMIANTED GLASS MARKET

- FIGURE 12 INCREASING DEMAND FROM BUIDLING & CONSTRUCTION SECTOR TO DRIVE MARKET BETWEEN 2025 AND 2030

- FIGURE 13 TRIPLE LAMINATED TO BE THE FASTEST GROWING GLASS TYPE INDUSTRY OF LAMIANTED GLASS DURING THE FORECAST PERIOD

- FIGURE 14 SOLAR/BIPV MODULES TO REGISTER HIGHEST CAGR DURING FORECASTED PERIOD

- FIGURE 15 IONOPLAST POLYMER TO REGISTER HIGHEST CAGR DURING FORECASTED PERIOD

- FIGURE 16 TRIPLE LAMINATED TO REGISTER HIGHEST CAGR DURING FORECASTED PERIOD

- FIGURE 17 ELECTRONICS TO REGISTER HIGHEST CAGR DURING FORECASTED PERIOD

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, & CHALLENGES IN LAMINATED GLASS MARKET

- FIGURE 20 LAMINATED GLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 22 BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 23 AVERAGE SELLING PRICE OF LAMINATED GLASS OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- FIGURE 24 AVERAGE SELLING PRICE TREND OF LAMINATED GLASS, BY REGION, 2021-2024 (USD/KG)

- FIGURE 25 LAMINATED GLASS MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 LAMINATED GLASS VALUE CHAIN ANALYSIS

- FIGURE 27 EXPORT DATA FOR HS CODE 700721-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 28 IMPORT DATA FOR HS CODE 7005-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD THOUSAND)

- FIGURE 29 LAMINATED GLASS MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 30 PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 31 PATENT PUBLICATION TRENDS, 2015-2025

- FIGURE 32 LEGAL STATUS OF PATENTS

- FIGURE 33 CHINESE JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2014 AND 2024

- FIGURE 34 SEKISUI CHEMICAL CO LTD REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 36 DEALS AND FUNDING IN LAMINATED GLASS MARKET SOARED IN 2024

- FIGURE 37 SOLAR/BIPV MODULES SEGMENT TO REGISTER FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 38 TRIPLE LAMINATED GLASS TO RECORD FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 39 IONOPLAST POLYMER SEGMENT TO WITNESS FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 40 ELECTRONICS END-USE INDUSTRY TO RECORD FASTEST CAGR DURING FORECAST PERIOD

- FIGURE 41 CHINA TO BE FASTEST-GROWING LAMINATED GLASS MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: LAMINATED GLASS MARKET SNAPSHOT

- FIGURE 43 EUROPE: LAMINATED GLASS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: LAMINATED GLASS MARKET SNAPSHOT

- FIGURE 45 LAMINATED GLASS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 46 LAMINATED GLASS MARKET SHARE ANALYSIS, 2024

- FIGURE 47 LAMINATED GLASS MARKET: BRAND COMPARISON

- FIGURE 48 LAMINATED GLASS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 49 LAMINATED GLASS MARKET: COMPANY FOOTPRINT

- FIGURE 50 LAMINATED GLASS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 51 LAMINATED GLASS MARKET: ENTERPRISE VALUE/EBITDA OF KEY PLAYERS

- FIGURE 52 LAMINATED GLASS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 53 LAMINATED GLASS MARKET: COMPANY VALUATION, 2024 (USD BILLION)

- FIGURE 54 TAIWAN GLASS IND. CORP.: COMPANY SNAPSHOT

- FIGURE 55 CSG HOLDING CO. LTD.: COMPANY SNAPSHOT

- FIGURE 56 FUYAO GROUP: COMPANY SNAPSHOT

- FIGURE 57 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 58 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 59 SISECAM: COMPANY SNAPSHOT

- FIGURE 60 CENTRAL GLASS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 AGC INC.: COMPANY SNAPSHOT

- FIGURE 62 SCHOTT: COMPANY SNAPSHOT

- FIGURE 63 VITRO: COMPANY SNAPSHOT

- FIGURE 64 FLAT GLASS GROUP CO., LTD.: COMPANY SNAPSHOT

- FIGURE 65 XINYI GLASS HOLDINGS LIMITED: COMPANY SNAPSHOT