|

市场调查报告书

商品编码

1523348

夹层玻璃:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Laminated Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

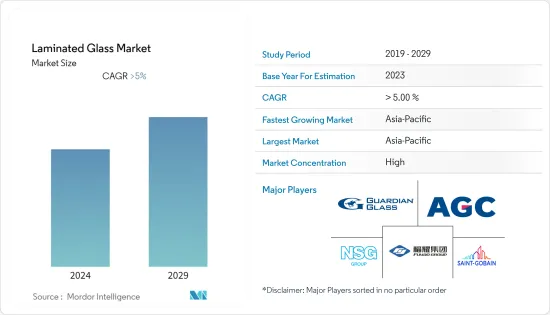

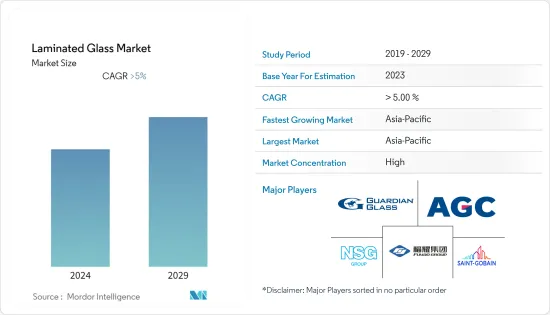

预计2024年夹层玻璃市场规模为206.2亿美元,2029年将达268.3亿美元,预测期间(2024-2029年)复合年增长率将超过5%。

COVID-19 对夹层玻璃市场产生了负面影响。与许多行业一样,夹层玻璃市场在疫情初期也经历了放缓。这是由于供应链中断、劳动力短缺和建设活动减少所造成的。随着封锁措施的放鬆和建设活动的恢復,夹层玻璃的需求有所回升。因疫情而推迟或暂停的建设计划已恢復,对玻璃产品的需求增加,包括用于住宅、商业和基础设施计划的夹层玻璃。

主要亮点

- 在建筑领域越来越多地应用夹层玻璃以结构玻璃代替砖,以及技术进步是推动夹层玻璃市场的主要因素。

- 由于其多个製造步骤,夹层玻璃比其他普通窗玻璃更昂贵,这可能会阻碍市场成长。

- 此外,发展中国家的快速都市化以及汽车行业对夹层玻璃的需求不断增长预计将为市场相关人员提供各种机会。

- 亚太地区呈现高成长率,中国、印度和日本等国家是夹层玻璃的重要消费者。

夹层玻璃市场趋势

主导市场的汽车细分市场

- 夹层玻璃可减少进入机舱的噪音并提高乘客的舒适度。随着消费者越来越重视舒适性和安静的驾驶体验,汽车製造商开始转向夹层玻璃来提高隔音效果。

- 夹层玻璃可以加入具有紫外线防护功能的中间膜,可防止内部装潢建材褪色并保护乘客免受有害紫外线的伤害。此功能在阳光强烈的区域至关重要。

- 电动车 (EV) 的日益普及为夹层玻璃製造商提供了机会。电动车製造商通常会优先考虑先进的功能和技术,使其产品脱颖而出,例如使用夹层玻璃来提高安全性、舒适性和能源效率。

- 根据国际能源总署(IEA)发布的预测,纯电动车销量将从 2021 年的约 460 万辆增加到 2022 年的 730 万辆。消费者对永续交通的兴趣增加以及旨在减少直接空气污染的政府立法等因素导致纯电动车销量增加。

- 此外,根据IEA公布的预计,2022年,全球电动车销量将达到约84.76%,进而带动国内电动车产量的增加。这相当于约 900 万台的销售量,而同年透过国际贸易销售的数量为 160 万台。

- 根据经济分析局(BEA)发布的最新预测,2023年美国乘用车年销量将为312万辆,高于2022年的286万辆。

- 因此,由于上述因素,预计市场将在预测期内出现成长。

亚太地区主导市场

- 亚太地区正在经历快速的人口成长和都市化,推动了建筑和基础设施发展的需求。夹层玻璃广泛应用于亚太地区商业、住宅、机构建筑的建筑幕墙、门窗、天窗等。

- 该地区是世界上成长最快的经济体之一,建设计划投资巨大。夹层玻璃因其安全性和美观性而受到建筑师和建筑商的青睐。上海、北京、新加坡和孟买等城市的高层建筑、购物中心、饭店和多用户住宅的建设正在推动夹层玻璃的需求。

- 此外,根据国家统计局最新发布的计算,2022年中国建筑业产值将超过31兆元。

- 亚太地区是全球最大的汽车市场,在汽车生产和销售方面处于领先地位。夹层玻璃主要用于汽车挡风玻璃,用于安全和降噪。该地区汽车工业的成长进一步推动了夹层玻璃的需求。

- 根据中国工业协会最新测算,截至2022年4月,中国商用车产量约21万辆,乘用车产量约99.6万辆。本月该产业总合生产了 120 万台。

- 根据日本经济产业省(METI)发布的估计,2022年日本汽车工业的汽车产值将约为19.29兆日圆(1,300亿美元),而前一年约为17.65兆日圆。亿美元)。

- 所有这些预计都将对该地区未来几年的市场成长产生重大影响。

夹层玻璃产业概况

夹层玻璃市场部分整合。市场的主要企业包括(排名不分先后)圣戈班、AGC Glass Europe、Guardian Industries Holdings、日本板硝子和福耀玻璃工业集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 用结构玻璃代替砖的应用越来越多

- 技术进步

- 抑制因素

- 製造成本高

- 其他阻碍因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔(以金额为准的市场规模)

- 按类型

- 聚乙烯丁醛(PVB)

- Sentry Glass Plus (新加坡)

- 乙烯醋酸乙烯(EVA)

- 其他(离子塑胶、防火夹层玻璃)

- 按最终用户产业

- 车

- 建筑/施工

- 电子产品

- 其他(安全/国防)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 马来西亚

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)/排名分析

- 主要企业策略

- 公司简介

- AGC Inc.

- Asahi India Glass Limited

- CARDINAL GLASS INDUSTRIES INC.

- Central Glass Co. Ltd

- Fuyao Group

- GSC GLASS LTD

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd

- Saint-Gobain

- Stevenage Glass Company Ltd

- Taiwan Glass Ind. Corp.

第七章 市场机会及未来趋势

The Laminated Glass Market size is estimated at USD 20.62 billion in 2024, and is expected to reach USD 26.83 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

COVID-19 had a detrimental effect on the laminated glass market. Like many industries, the laminated glass market experienced a slowdown in the early stages of the pandemic. This occurred due to disruptions in supply chains, labor shortages, and decreased construction activity. As lockdown measures eased and construction activities resumed, the demand for laminated glass picked up. Construction projects that were delayed or put on hold due to the pandemic restarted, driving demand for glass products, including laminated glass, for use in residential, commercial, and infrastructure projects.

Key Highlights

- The increasing application of laminated glass in replacing bricks with structural glass in the construction sector and the advancement in technology are the key factors that are driving the laminated glass market.

- Laminated glass is more expensive than other regular windows because of the number of steps taken to produce it, which is likely to hamper market growth.

- Also, the rapid urbanization in developing countries and the rising demand for laminated glasses from the automotive sector are expected to provide various opportunities to market players.

- Due to the fact that countries like China, India, and Japan are critical consumers of laminated glass, Asia-Pacific has a high growth rate.

Laminated Glass Market Trends

Automotive Segment to Dominate the Market

- Laminated glass helps reduce noise transmission into the vehicle cabin, enhancing comfort for passengers. As consumers increasingly prioritize comfort and a quieter driving experience, automakers utilize laminated glass to improve acoustic insulation.

- Laminated glass can incorporate interlayers that provide UV protection, reducing the fading of interior materials and protecting occupants from harmful UV radiation. This feature is essential for regions with intense sunlight exposure.

- The increasing popularity of electric vehicles (EVs) offers opportunities for laminated glass manufacturers. EV manufacturers often prioritize advanced features and technologies to differentiate their products, including the use of laminated glass for safety, comfort, and energy efficiency.

- According to the estimate released by the International Energy Agency (IEA), in 2022, sales of battery electric vehicles reached 7.3 million, up from around 4.6 million in 2021. Factors such as increased consumer interest in sustainable transport and governmental legislation that aims to reduce direct air pollution have led to a rise in the sale of BEVs.

- Further, according to the estimate released by the IEA, in 2022, around 84.76% of global electric vehicles were sold, resulting from the domestic production of these vehicles. This represented nearly 9 million sales, compared to 1.6 million units sold from international trade that year.

- According to the latest estimate published by the Bureau of Economic Analysis (BEA), the annual passenger car sales in the United States were 3.12 million units in 2023, which increased from 2.86 million units in 2022.

- Consequently, the market is expected to register growth during the forecast period due to the abovementioned factors.

Asia-Pacific to Dominate the Market

- Asia-Pacific has experienced rapid population growth and urbanization, driving demand for construction and infrastructure development. Laminated glass is widely used in building facades, windows, doors, and skylights in commercial, residential, and institutional buildings across the region.

- It is home to some of the world's fastest-growing economies, leading to significant investments in construction projects. Laminated glass is a preferred choice for architects and builders due to its safety, security, and aesthetic properties. The construction of skyscrapers, shopping malls, hotels, and residential complexes in cities like Shanghai, Beijing, Singapore, and Mumbai fuels the demand for laminated glass.

- Furthermore, according to the latest estimate published by the National Bureau of Statistics of China, in 2022, the construction industry in China generated an output of over CNY 31 trillion.

- Asia-Pacific is the largest automotive market globally, leading in automobile production and sales. Laminated glass is majorly used in automotive windshields for safety and noise reduction. The region's automotive industry's growth further contributes to the demand for laminated glass.

- According to the latest estimate published by the China Association of Automobile Manufacturers (CAAM), China produced approximately 210,000 commercial vehicles and 996,000 passenger cars as of April 2022. The industry produced a total of 1.2 million vehicles during the month.

- According to the estimate released by the Ministry for Economy, Trade, and Industry (Meti), Japan, in 2022, the production value of motor vehicles by the automotive industry in Japan was approximately JPY 19.29 trillion (USD 0.13 trillion), increasing from around JPY 17.65 trillion (USD 0.12 trillion) in the previous year.

- In the coming years, all of this is expected to have a significant impact on the growth of the region's market.

Laminated Glass Industry Overview

The laminated glass market is partially consolidated in nature. Some of the major players in the market (not in any particular order) include Saint-Gobain, AGC Glass Europe, Guardian Industries Holdings, Nippon Sheet Glass Co. Ltd, and Fuyao Glass Industry Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Replacement of Bricks with Structural Glass

- 4.1.2 Advancements in Technology

- 4.2 Restraints

- 4.2.1 High Cost of Manufacturing

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyvinyl Butyral (PVB)

- 5.1.2 Sentryglas Plus (SGP)

- 5.1.3 Ethylene-vinyl Acetate (EVA)

- 5.1.4 Other Types (Ionoplast, Fire-Rated Laminated Glass)

- 5.2 By End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Electronics

- 5.2.4 Other End-user Industries (Security and Defense)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Egypt

- 5.3.5.5 Qatar

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Asahi India Glass Limited

- 6.4.3 CARDINAL GLASS INDUSTRIES INC.

- 6.4.4 Central Glass Co. Ltd

- 6.4.5 Fuyao Group

- 6.4.6 GSC GLASS LTD

- 6.4.7 Guardian Industries Holdings

- 6.4.8 Nippon Sheet Glass Co. Ltd

- 6.4.9 Saint-Gobain

- 6.4.10 Stevenage Glass Company Ltd

- 6.4.11 Taiwan Glass Ind. Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Urbanization in Developing Countries

- 7.2 Rising Demand from the Automotive Sector