|

市场调查报告书

商品编码

1873965

全球黑母粒市场(依载体树脂、终端用途产业、类型及地区划分)-预测至2030年Black Masterbatch Market by Carrier Resin, End-use Industry, by Type, and Region - Global Forecasts to 2030 |

||||||

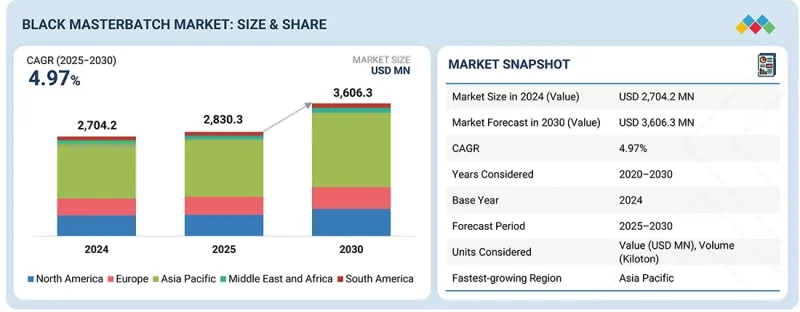

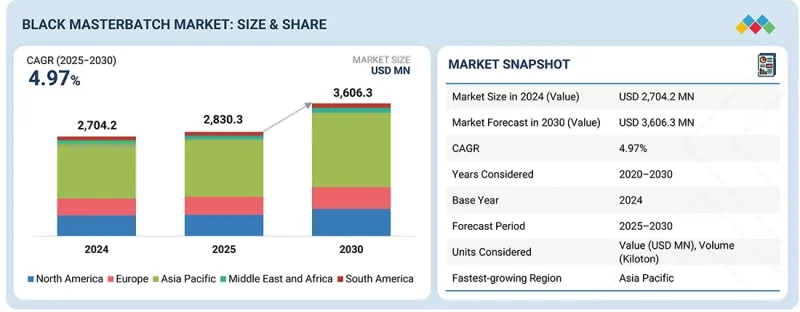

2025 年全球黑母粒市场规模为 28.303 亿美元,预计到 2030 年将达到 36.063 亿美元,2025 年至 2030 年的复合年增长率为 4.97%。

| 调查范围 | |

|---|---|

| 调查期 | 2020-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 单元 | 百万美元每千吨 |

| 部分 | 载体树脂、最终用途产业、类型、地区 |

| 目标区域 | 亚太地区、欧洲、北美、中东和非洲、南美 |

“基础设施建设和都市化正在推动市场发展。”

基础建设和都市化是黑色母粒需求的关键驱动因素,尤其是在世界各国大力投资城市现代化和工业基础建设的情况下。亚太地区以及中东和非洲新兴经济体的快速都市化,催生了对耐用、耐候且美观的建筑材料的强劲需求。根据联合国预测,到2050年,全球约68%的人口居住在都市区,这将刺激住房、交通网络、公共产业和智慧基础设施的巨额投资。

黑母粒在这一转型过程中发挥关键作用,为管道、电缆、屋顶板、窗框和建筑薄膜等应用提供抗紫外线性能、增强耐久性和均匀的色彩。在北美和欧洲等已开发地区,诸如美国《基础设施投资与就业法案》(IIJA)和欧盟《绿色基础设施战略》等基础设施更新计划,进一步推动了性能更优、永续性更高的先进聚合物材料的应用。

全球基础设施建设的蓬勃发展凸显了黑母粒在提高现代建筑的耐久性、视觉吸引力和永续性的重要作用,这些应用与全球向具有韧性、环境高效和技术先进的城市发展方向密切相关。

在预测期内,线型低密度聚乙烯(LLDPE) 预计将成为黑母粒市场中成长最快的载体树脂细分市场(按销量计)。

在预测期内,线性低密度聚乙烯(LLDPE)载体树脂细分市场预计将以最快的速度成长。其优异的机械强度、适应性和经济性是推动成长的关键因素,使其成为建筑、包装和农业等众多终端应用产业的热门选择。 LLDPE基黑母粒是薄膜和地工止水膜的理想之选,因为它们能够改善炭黑分散性、增强耐久性和提高抗紫外线性能。受可再生轻质包装材料需求不断增长的推动,LLDPE在吹膜加工和挤出应用中的使用量显着增加。 LLDPE易于加工且与多种聚合物相容,使其成为不断发展的黑母粒市场的主要驱动力。

按终端用户产业划分,纺织业预计将成为黑母粒市场销售成长速度第三快的细分市场。

在全球黑母粒市场中,纺织业是销售成长速度第三快的终端用户领域。地毯、汽车内装、纺织品和工业应用领域对合成纤维的需求不断增长,推动了这一增长,而黑母粒则提供了均匀显色、紫外线稳定性和更佳耐久性等优势。此外,高性能纤维(尤其是运动服、地工织物和家具领域)在功能性和美观性方面的提升需求不断增长,也促进了黑色母粒消费量的增长。同时,聚酯纤维和聚丙烯纤维在机织和不织布应用中的日益普及也支撑了稳定的需求。随着纺织服装行业向永续、色牢度高的材料转型,製造商正在采用先进的黑母粒配方,以实现均匀的颜色分散和更佳的耐候性,从而进一步推动市场扩张。

“2024年,欧洲是全球第三大黑色母粒市场(按销量计)。”

预计到2024年,欧洲强劲的汽车、包装和建筑业将成为该地区黑母粒市场的主要驱动力。严格的环境法规和品质标准促进了高性能、可回收和色牢度高的塑胶材料的使用,从而支撑了市场需求。欧洲製造商越来越多地使用黑母粒来提高消费品、建筑构件和汽车内饰产品的耐用性、抗紫外线性能和视觉吸引力。此外,该地区向循环经济原则的转变以及再生塑胶使用量的增加,也推动了对复杂母粒母粒的需求。德国、义大利和法国等国家由于高度重视创新驱动生产和永续製造标准,继续为市场做出重大贡献。

本报告对全球黑母粒市场进行了分析,提供了关键驱动因素和限制因素、竞争格局和未来趋势的资讯。

目录

第一章 引言

第二章执行摘要

第三章 主要发现

- 黑母粒市场蕴藏着巨大的商机

- 黑母粒市场:依最终用途产业和地区划分

- 载体树脂黑母粒市场

- 按国家/地区分類的黑胶母粒市场

第四章 市场概览

- 介绍

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 相互关联的市场与跨产业机会

- 互联市场

- 跨职能机会

- 新的经营模式和生态系统变化

- 新的经营模式

- 生态系变化

- 一级/二级/三级公司的策略性倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 介绍

- 主要经济体的GDP趋势与预测

- 全球汽车产业趋势

- 供应链分析

- 原物料供应商

- 黑母粒製造商

- 分销网络

- 最终用户产业

- 生态系分析

- 定价分析

- 主要企业在终端用户产业的平均售价(2024 年)

- 2022-2024年各地区黑色母粒平均售价趋势

- 贸易分析

- 出口方案(HS编码320649)

- 进口方案(HS编码320649)

- 重大会议和活动(2025-2026)

- 影响客户业务的趋势/颠覆性因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税的影响-黑母粒市场

- 介绍

- 主要关税

- 价格影响分析

- 对国家的影响

- 对终端用户产业的影响

第六章:技术进步、人工智慧的影响与专利

- 主要新技术

- 双螺桿挤出

- 超分散式技术

- 互补技术

- 母粒添加剂系统

- 导电聚合物化合物

- 技术/产品蓝图

- 短期(2025-2027)

- 中期规划(2027-2030 年)| 扩张与标准化

- 长期(2030-2035年及以后)

- 专利分析

- 方法

- 文件类型

- 主要申请人

- 管辖权分析

- 人工智慧/生成式人工智慧对黑母粒市场的影响

- 加速研发和创新配方

- 提高生产效率和製程控制

- 预测性维护和营运连续性

- 优化供应链和成本管理

第七章永续性与监管环境

- 地方法规和合规性

- 监管机构、政府机构和其他组织

- 业界标准

- 监理政策倡议

- 安全通讯协定

- 永续

- 标准化

- 循环经济

- 认证、标籤和环境标准

第八章:顾客状况与购买行为

- 决策流程

- 主要相关利益者和采购标准

- 招募障碍和内部挑战

- 各个终端用户产业尚未满足的需求

9. 依载体树脂分類的黑母粒市场

- 介绍

- 聚丙烯

- 线型低密度聚乙烯

- 低密度聚乙烯

- 高密度聚苯乙烯

- 聚对苯二甲酸乙二酯

- 聚氯乙烯

- 聚苯乙烯

- 聚酰胺

- 其他载体树脂

第十章 以最终用途产业分類的黑母粒市场

- 介绍

- 车

- 包装

- 基础设施

- 电气和电子

- 消费品

- 农业

- 纤维

- 其他终端用户产业

第十一章 黑母粒市场类型

- 介绍

- 标准黑母粒

- 高纯度黑母粒

- 抗紫外线黑母粒

- 导电黑母粒

- 用于再生聚合物的黑母粒

第十二章 各地区的黑胶母粒市场

- 介绍

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 泰国

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 中东和非洲

- 伊朗

- 南非

- 土耳其

- 南美洲

- 巴西

- 阿根廷

第十三章 竞争格局

- 介绍

- 主要参与企业的策略/优势

- 市占率分析(2024 年)

- 收入分析(2020-2024)

- 企业评估矩阵:主要企业(2024)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 比较产品

- 公司估值和财务指标

- 竞争场景

第十四章:公司简介

- 主要企业

- AVIENT CORPORATION

- AMPACET CORPORATION

- LYONDELLBASELL INDUSTRIES HOLDINGS BV

- CABOT CORPORATION

- PLASTIBLENDS

- HUBRON INTERNATIONAL

- TOSAF

- BLEND COLOURS PRIVATE LIMITED

- RTP COMPANY

- PLASTIKA KRITIS SA

- Start-Ups/中小企业

- VIBRANT COLOR TECH PVT LTD.

- US MASTERBATCH JOINT STOCK COMPANY

- GABRIEL-CHEMIE GMBH

- ASTRA POLYMERS

- PERFECT COLOURANTS & PLASTICS PVT. LTD.

- KOTHARI POLYMERS

- DELTA TECNIC

- ABBEY VIETNAM

- ALOK

- JKP MASTERBATCH

- PURE POLYMERS

- MASKOM PLASTIC INDUSTRY AND TRADE JOINT STOCK COMPANY

- MALION NEW MATERIALS CO., LTD.

- EUP GROUP

- REPIN MASTERBATCHES

第十五章调查方法

第十六章:邻近及相关市场

- 介绍

- 限制

- 母粒市场

- 市场定义

- 市场概览

- 按地区母粒市场

- 亚太地区

- 欧洲

- 北美洲

- 中东和非洲

- 南美洲

第十七章附录

The black masterbatch market size was USD 2,830.3 million in 2025 and is projected to reach USD 3,606.3 million by 2030, at a CAGR of 4.97%, between 2025 and 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Carrier Resin, End-use Industries, Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Infrastructure development and urbanization are driving the market."

Infrastructure development and urbanization are pivotal drivers propelling the demand for black masterbatches, particularly as nations worldwide invest heavily in modernizing their cities and industrial bases. Rapid urbanization in emerging economies across Asia Pacific, the Middle East, and Africa is generating strong demand for durable, weather-resistant, and aesthetically appealing construction materials. According to the United Nations, nearly 68% of the world's population is projected to live in urban areas by 2050, driving large-scale investments in housing, transportation networks, utilities, and smart infrastructure.

Black masterbatches play a vital role in this transformation, offering UV resistance, enhanced durability, and consistent coloration for applications such as pipes, cables, roofing sheets, window profiles, and construction films. In developed regions such as North America and Europe, infrastructure renewal initiatives like the U.S. Infrastructure Investment and Jobs Act (IIJA) and the EU's Green Infrastructure Strategy are further boosting the use of advanced polymer materials with improved performance and sustainability attributes.

This global surge in infrastructure development underscores the critical role of black masterbatches in enhancing the durability, visual appeal, and sustainability of modern construction. Their application aligns closely with the worldwide push toward resilient, eco-efficient, and technologically advanced urban development.

The linear low-density polyethylene is estimated to be the fastest-growing carrier resin segment of the black masterbatch market, in terms of volume, during the forecast period.

In terms of volume, the LLDPE carrier resin segment is expected to expand at the fastest pace during the forecast period. Its superior mechanical strength, adaptability, and affordability are the primary factors driving this growth, as they make it a popular option for various end-use industries, including construction, packaging, and agriculture. LLDPE-based black masterbatches are perfect for films and geomembranes because they provide better carbon black dispersion, increased durability, and improved UV resistance. The use of LLDPE in blown film and extrusion applications has increased dramatically due to the growing demand for recyclable and lightweight packaging materials. LLDPE is positioned as a major growth driver in the changing black masterbatch landscape due to the resin's ease of processing and compatibility with a broad range of polymers.

The fibers industry segment is projected to be the third fastest-growing segment by end-use industry in the black masterbatch market, in terms of volume.

Within the global black masterbatch market, the Fibers industry is the third fastest-growing end-use segment in terms of volume. The increasing use of synthetic fibers in carpets, automotive interiors, textiles, and industrial applications-where black masterbatches offer uniform coloration, UV stability, and improved durability-is what is driving this growth. Consumption has also increased due to the growing need for high-performance fibers with better functional and aesthetic qualities, particularly in sportswear, geotextiles, and home furnishings. Furthermore, steady adoption is supported by the increasing preference for polyester and polypropylene fibers in both woven and nonwoven applications. Manufacturers are using sophisticated black masterbatch formulations to achieve uniform color dispersion and improved weatherability as the textile and apparel industries transition to sustainable and color-stable materials, which is propelling market expansion.

"Europe was the third-largest black masterbatch market, in terms of volume, in 2024."

Europe's robust automotive, packaging, and construction sectors are the main drivers of its black masterbatch market in 2024. Strict environmental and product quality regulations, which promote the use of high-performance, recyclable, and color-stable plastic materials, support the demand. Black masterbatches are being used more and more by European manufacturers to improve the longevity, UV resistance, and visual appeal of their products in consumer goods, building components, and automobile interiors. Furthermore, the market for sophisticated masterbatch formulations has been bolstered by the region's ongoing transition to circular economy principles and the growing use of recycled plastics. With the help of innovation-driven production and a strong focus on sustainable manufacturing standards, nations such as Germany, Italy, and France continue to make significant contributions.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 18%, and Rest of the World - 7%

The key players profiled in the report include Avient Corporation (US), LyondellBasell Industries Holdings B.V. (US), Ampacet Corporation (US), Cabot Corporation (US), Plastiblends (India), Hubron International (UK), Tosaf (Israel), Blend Colours Private Limited (India), RTP Company (US), Plastika Kritis S.A. (Greece), and other players (15).

Study Coverage

This report segments the market for black masterbatches based on carrier resin, end-use industry, type, and region, and provides estimations of the overall market size (in USD million) across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the black masterbatch market.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the black masterbatch market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on black masterbatch offered by top players in the global market

- Analysis of key drivers (Government regulations and policies promoting sustainable materials, infrastructure development and urbanization, advancements in automotive manufacturing, rising demand for packaging applications), restraints (Volitality in raw material prices and supply chain disruptions, stringent environmental and regulatory compliance burdens), opportunities (Expansion in semiconductor and electronics industries, rising demand in 3D printing and additive manufacturing), challenges (Intense price based competition).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the black masterbatch market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for black masterbatch across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global black masterbatch market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the black masterbatch market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY CARRIER RESIN

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS SHAPING MARKET

- 2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 2.5 SNAPSHOT: ASIA PACIFIC MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BLACK MASTERBATCH MARKET

- 3.2 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY AND REGION

- 3.3 BLACK MASTERBATCH MARKET, BY CARRIER RESIN

- 3.4 BLACK MASTERBATCH MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Government regulations and policies promoting sustainable materials

- 4.2.1.2 Infrastructure development and urbanization

- 4.2.1.3 Advancements in automotive manufacturing

- 4.2.1.4 Rising demand for packaging applications

- 4.2.2 RESTRAINTS

- 4.2.2.1 Volatility in raw material prices and supply chain disruptions

- 4.2.2.2 Rising environmental and regulatory compliance burdens

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Expansion in semiconductor and electronics industries

- 4.2.3.2 Rising demand in 3D printing and additive manufacturing

- 4.2.4 CHALLENGES

- 4.2.4.1 Intense price-based competition in global market

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.3.1 INTERCONNECTED MARKETS

- 4.3.2 CROSS-SECTOR OPPORTUNITIES

- 4.4 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS

- 4.4.1 EMERGING BUSINESS MODELS

- 4.4.2 ECOSYSTEM SHIFTS

- 4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.5.1 KEY MOVES AND STRATEGIC FOCUS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 THREAT OF SUBSTITUTES

- 5.1.2 THREAT OF NEW ENTRANTS

- 5.1.3 BARGAINING POWER OF SUPPLIERS

- 5.1.4 BARGAINING POWER OF BUYERS

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 BLACK MASTERBATCH MANUFACTURERS

- 5.3.3 DISTRIBUTION NETWORK

- 5.3.4 END-USE INDUSTRIES

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE OF END-USE INDUSTRY, BY KEY PLAYERS, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF BLACK MASTERBATCH, BY REGION, 2022-2024

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT SCENARIO (HS CODE-320649)

- 5.6.2 IMPORT SCENARIO (HS CODE-320649)

- 5.7 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 VALVES FOR CHALK IN BLACK MASTERBATCH PRODUCTION

- 5.10.2 ADDRESSING DISPERSION ISSUES IN BLACK MASTERBATCH PRODUCTION

- 5.10.3 LAUNCH OF REPLASBLAK UNIVERSAL CIRCULAR BLACK MASTERBATCHES BY CABOT CORPORATION

- 5.11 IMPACT OF 2025 US TARIFF - BLACK MASTERBATCH MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFFS

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRY/REGION

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT AND PATENTS

- 6.1 KEY EMERGING TECHNOLOGIES

- 6.1.1 TWIN-SCREW EXTRUSION

- 6.1.2 HYPER DISPERSION TECHNOLOGY

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 MASTERBATCH ADDITIVE SYSTEMS

- 6.2.2 CONDUCTIVE POLYMER COMPOUNDS

- 6.3 TECHNOLOGY/PRODUCT ROADMAP

- 6.3.1 SHORT-TERM (2025-2027)

- 6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION

- 6.3.3 LONG-TERM (2030-2035+)

- 6.4 PATENT ANALYSIS

- 6.4.1 APPROACH

- 6.4.2 DOCUMENT TYPE

- 6.4.3 TOP APPLICANTS

- 6.4.4 JURISDICTION ANALYSIS

- 6.5 IMPACT OF AI/GEN AI ON BLACK MASTERBATCH MARKET

- 6.5.1 ACCELERATED R&D AND FORMULATION INNOVATION

- 6.5.2 ENHANCED PRODUCTION EFFICIENCY AND PROCESS CONTROL

- 6.5.3 PREDICTIVE MAINTENANCE AND OPERATIONAL CONTINUITY

- 6.5.4 OPTIMIZED SUPPLY CHAIN AND COST MANAGEMENT

7 SUSTAINABILITY AND REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

- 7.2 REGULATORY POLICY INITIATIVES

- 7.2.1 SAFETY PROTOCOLS

- 7.2.2 SUSTAINABLE DEVELOPMENT

- 7.2.3 STANDARDIZATION

- 7.2.4 CIRCULAR ECONOMY

- 7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES

9 BLACK MASTERBATCH MARKET, BY CARRIER RESIN

- 9.1 INTRODUCTION

- 9.2 POLYPROPYLENE

- 9.2.1 EXTENSIVE USE OF POLYPROPYLENE IN PACKAGING AND AUTOMOTIVE APPLICATIONS

- 9.3 LINEAR LOW-DENSITY POLYETHYLENE

- 9.3.1 RISING DEMAND FOR FLEXIBLE AND DURABLE FILMS IN PACKAGING AND AGRICULTURE

- 9.4 LOW-DENSITY POLYETHYLENE

- 9.4.1 INCREASING USE OF LDPE IN FILM APPLICATIONS REQUIRING FLEXIBILITY AND OPTICAL CLARITY

- 9.5 HIGH-DENSITY POLYETHYLENE

- 9.5.1 GROWING DEMAND FOR RIGID AND UV-RESISTANT PLASTIC PRODUCTS IN INDUSTRIAL APPLICATIONS

- 9.6 POLYETHYLENE TEREPHTHALATE

- 9.6.1 RISING DEMAND FOR HIGH-PERFORMANCE AND AESTHETIC PACKAGING SOLUTIONS

- 9.7 POLYVINYL CHLORIDE

- 9.7.1 EXPANDING USE OF POLYVINYL CHLORIDE IN CONSTRUCTION AND ELECTRICAL APPLICATIONS

- 9.8 POLYSTYRENE

- 9.8.1 RISING DEMAND FOR HIGH-GLOSS AND RIGID PLASTIC COMPONENTS IN PACKAGING AND CONSUMER GOODS

- 9.9 POLYAMIDE

- 9.9.1 GROWING ADOPTION OF HIGH-PERFORMANCE PLASTICS IN AUTOMOTIVE AND ELECTRICAL APPLICATIONS

- 9.10 OTHER CARRIER RESINS

10 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 AUTOMOTIVE

- 10.2.1 INCREASING USE OF LIGHTWEIGHT AND AESTHETIC PLASTIC COMPONENTS IN AUTOMOTIVE DESIGN

- 10.3 PACKAGING

- 10.3.1 RISING DEMAND FOR VISUALLY APPEALING, UV-STABLE, AND RECYCLABLE PACKAGING SOLUTIONS

- 10.4 INFRASTRUCTURE

- 10.4.1 EXPANDING CONSTRUCTION ACTIVITIES AND DEMAND FOR DURABLE PLASTIC INFRASTRUCTURE COMPONENTS

- 10.5 ELECTRICAL & ELECTRONICS

- 10.5.1 GROWING DEMAND FOR ELECTRICALLY INSULATIVE AND AESTHETIC PLASTIC COMPONENTS IN ELECTRONICS

- 10.6 CONSUMER GOODS

- 10.6.1 INCREASING USE OF AESTHETIC AND DURABLE PLASTICS IN CONSUMER GOODS MANUFACTURING

- 10.7 AGRICULTURE

- 10.7.1 RISING ADOPTION OF UV-STABLE AND WEATHER-RESISTANT PLASTICS IN MODERN AGRICULTURE

- 10.8 FIBERS

- 10.8.1 GROWING DEMAND FOR DEEP-COLORED AND UV-STABLE SYNTHETIC FIBERS IN TEXTILES AND INDUSTRIAL APPLICATIONS

- 10.9 OTHER END-USE INDUSTRIES

11 BLACK MASTERBATCH MARKET, BY TYPE

- 11.1 INTRODUCTION

- 11.2 STANDARD BLACK MASTERBATCH

- 11.2.1 EXPANDING PLASTIC CONSUMPTION IN PACKAGING AND CONSUMER GOODS

- 11.3 HIGH JETNESS BLACK MASTERBATCH

- 11.3.1 RISING DEMAND FOR AESTHETIC AND PREMIUM-QUALITY PLASTIC COMPONENTS

- 11.4 UV-RESISTANT BLACK MASTERBATCH

- 11.4.1 GROWING USE OF PLASTICS IN OUTDOOR AND INFRASTRUCTURE APPLICATIONS

- 11.5 CONDUCTIVE BLACK MASTERBATCH

- 11.5.1 RISING DEMAND FOR ELECTRICALLY SAFE AND STATIC-CONTROL MATERIALS

- 11.6 RECYCLED POLYMER COMPATIBLE BLACK MASTERBATCH

- 11.6.1 INCREASING FOCUS ON CIRCULAR ECONOMY AND SUSTAINABLE PLASTICS

12 BLACK MASTERBATCH MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Dominant manufacturing base and strong downstream demand

- 12.2.2 JAPAN

- 12.2.2.1 Technological advancements and high-quality manufacturing standards to drive market

- 12.2.3 INDIA

- 12.2.3.1 Expanding manufacturing base and rapid growth in packaging and construction sectors

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Strong electronics and automotive manufacturing base driving specialty black masterbatch demand

- 12.2.5 THAILAND

- 12.2.5.1 Rising consumer goods production and growing demand for aesthetic, durable plastic products

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Expanding use of black masterbatches in automotive and packaging sectors

- 12.3.2 CANADA

- 12.3.2.1 Growing adoption of high-performance black masterbatches in sustainable and durable applications

- 12.3.3 MEXICO

- 12.3.3.1 Expanding manufacturing base and increasing foreign investments in plastic processing

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Strong automotive manufacturing driving black masterbatch demand

- 12.4.2 UK

- 12.4.2.1 Expanding packaging sector enhancing market growth

- 12.4.3 FRANCE

- 12.4.3.1 Green building and infrastructure upgrades bolster black masterbatch applications

- 12.4.4 RUSSIA

- 12.4.4.1 Agriculture and packaging growth fuel masterbatch usage in film and pipe applications

- 12.4.5 SPAIN

- 12.4.5.1 Consumer goods & electronics manufacturing spur masterbatch uptake in Spain

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 IRAN

- 12.5.1.1 Surging automotive production amid polymer demand growth

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Packaging Industry Growth Underpins Masterbatch Demand

- 12.5.3 TURKEY

- 12.5.3.1 Construction Sector Boom Elevates Masterbatch Usage in Plastics

- 12.5.1 IRAN

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Expanding plastic processing and packaging industries supported by local manufacturing strength

- 12.6.2 ARGENTINA

- 12.6.2.1 Growing industrial output and rising adoption of polymer-based packaging solutions

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Carrier resin footprint

- 13.5.5.4 End-use industry footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 PRODUCT COMPARISON

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 EXPANSIONS

- 13.9.3 DEALS

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- 14.1.1 AVIENT CORPORATION

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM View

- 14.1.1.4.1 Right to Win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 AMPACET CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM View

- 14.1.2.4.1 Right to Win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Other developments

- 14.1.3.4 MnM View

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 CABOT CORPORATION

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.4 MnM View

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 PLASTIBLENDS

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM View

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 HUBRON INTERNATIONAL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.2.1 Deals

- 14.1.7 TOSAF

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 BLEND COLOURS PRIVATE LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Expansions

- 14.1.9 RTP COMPANY

- 14.1.9.1 Business Overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 PLASTIKA KRITIS S.A.

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 AVIENT CORPORATION

- 14.2 START-UP/SMES PLAYERS

- 14.2.1 VIBRANT COLOR TECH PVT LTD.

- 14.2.2 US MASTERBATCH JOINT STOCK COMPANY

- 14.2.3 GABRIEL-CHEMIE GMBH

- 14.2.4 ASTRA POLYMERS

- 14.2.5 PERFECT COLOURANTS & PLASTICS PVT. LTD.

- 14.2.6 KOTHARI POLYMERS

- 14.2.7 DELTA TECNIC

- 14.2.8 ABBEY VIETNAM

- 14.2.9 ALOK

- 14.2.10 JKP MASTERBATCH

- 14.2.11 PURE POLYMERS

- 14.2.12 MASKOM PLASTIC INDUSTRY AND TRADE JOINT STOCK COMPANY

- 14.2.13 MALION NEW MATERIALS CO., LTD.

- 14.2.14 EUP GROUP

- 14.2.15 REPIN MASTERBATCHES

15 RESEARCH METHODOLOGY

- 15.1 RESEARCH DATA

- 15.1.1 SECONDARY DATA

- 15.1.1.1 Key data from secondary sources

- 15.1.2 PRIMARY DATA

- 15.1.2.1 Key data from primary sources

- 15.1.2.2 Primary interview - demand side and supply side

- 15.1.2.3 Breakdown of primary interviews

- 15.1.2.4 Key industry insights

- 15.1.1 SECONDARY DATA

- 15.2 MARKET SIZE ESTIMATION

- 15.2.1 BOTTOM-UP APPROACH

- 15.2.2 TOP-DOWN APPROACH

- 15.3 DATA TRIANGULATION

- 15.4 GROWTH FORECAST

- 15.4.1 SUPPLY SIDE

- 15.4.2 DEMAND SIDE

- 15.5 RESEARCH ASSUMPTIONS

- 15.6 RESEARCH LIMITATIONS

- 15.7 RISK ASSESSMENT

16 ADJACENT & RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATION

- 16.3 MASTERBATCH MARKETMARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.4 MASTERBATCH MARKET, BY REGION

- 16.4.1 ASIA PACIFIC

- 16.4.2 EUROPE

- 16.4.3 NORTH AMERICA

- 16.4.4 MIDDLE EAST & AFRICA

- 16.4.5 SOUTH AMERICA

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS

List of Tables

- TABLE 1 BLACK MASTERBATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021-2030 (USD BILLION)

- TABLE 3 PRODUCTION TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 4 BLACK MASTERBATCH MARKET: ROLE IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF BLACK MASTERBATCH OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024 (USD/KG)

- TABLE 6 AVERAGE SELLING PRICE TREND OF BLACK MASTERBATCH, BY REGION, 2022-2024 (USD/KG)

- TABLE 7 EXPORT OF BLACK MASTERBATCH, BY REGION, 2020-2024 (USD MILLION)

- TABLE 8 IMPORT OF BLACK MASTERBATCH, BY REGION, 2020-2024 (USD MILLION)

- TABLE 9 BLACK MASTERBATCH MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 10 TARIFF RATES

- TABLE 11 PATENT STATUS: PATENT APPLICATIONS AND GRANTED PATENTS

- TABLE 12 MAJOR PATENTS FOR BLACK MASTERBATCH

- TABLE 13 PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

- TABLE 14 PATENTS BY BOREALIS AG

- TABLE 15 TOP 10 PATENT OWNERS IN US, 2014-2024

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 GLOBAL STANDARDS IN BLACK MASTERBATCH MARKET

- TABLE 22 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN BLACK MASTERBATCH MARKET

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 24 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 25 BLACK MASTERBATCH MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES

- TABLE 26 BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 27 BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 28 BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 29 BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 30 BLACK MASTERBATCH MARKET IN POLYPROPYLENE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 BLACK MASTERBATCH MARKET IN POLYPROPYLENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 BLACK MASTERBATCH MARKET IN POLYPROPYLENE, BY REGION, 2020-2024 (KILOTON)

- TABLE 33 BLACK MASTERBATCH MARKET IN POLYPROPYLENE, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 BLACK MASTERBATCH MARKET IN LINEAR LOW-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 BLACK MASTERBATCH MARKET IN LINEAR LOW-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 BLACK MASTERBATCH MARKET IN LINEAR LOW-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (KILOTON)

- TABLE 37 BLACK MASTERBATCH MARKET IN LINEAR LOW-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 BLACK MASTERBATCH MARKET IN LOW-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 39 BLACK MASTERBATCH MARKET IN LOW-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 40 BLACK MASTERBATCH MARKET IN LOW-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (KILOTON)

- TABLE 41 BLACK MASTERBATCH MARKET IN LOW-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 BLACK MASTERBATCH MARKET IN HIGH-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 BLACK MASTERBATCH MARKET IN HIGH-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 BLACK MASTERBATCH MARKET IN HIGH-DENSITY POLYETHYLENE, BY REGION, 2020-2024 (KILOTON)

- TABLE 45 BLACK MASTERBATCH MARKET IN HIGH-DENSITY POLYETHYLENE, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 BLACK MASTERBATCH MARKET IN POLYETHYLENE TEREPHTHALATE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 BLACK MASTERBATCH MARKET IN POLYETHYLENE TEREPHTHALATE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 BLACK MASTERBATCH MARKET IN POLYETHYLENE TEREPHTHALATE, BY REGION, 2020-2024 (KILOTON)

- TABLE 49 BLACK MASTERBATCH MARKET IN POLYETHYLENE TEREPHTHALATE, BY REGION, 2025-2030 (KILOTON)

- TABLE 50 BLACK MASTERBATCH MARKET IN POLYVINYL CHLORIDE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 BLACK MASTERBATCH MARKET IN POLYVINYL CHLORIDE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 BLACK MASTERBATCH MARKET IN POLYVINYL CHLORIDE, BY REGION, 2020-2024 (KILOTON)

- TABLE 53 BLACK MASTERBATCH MARKET IN POLYVINYL CHLORIDE, BY REGION, 2025-2030 (KILOTON)

- TABLE 54 BLACK MASTERBATCH MARKET IN POLYSTYRENE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 BLACK MASTERBATCH MARKET IN POLYSTYRENE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 BLACK MASTERBATCH MARKET IN POLYSTYRENE, BY REGION, 2020-2024 (KILOTON)

- TABLE 57 BLACK MASTERBATCH MARKET IN POLYSTYRENE, BY REGION, 2025-2030 (KILOTON)

- TABLE 58 BLACK MASTERBATCH MARKET IN POLYAMIDE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 BLACK MASTERBATCH MARKET IN POLYAMIDE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 BLACK MASTERBATCH MARKET IN POLYAMIDE, BY REGION, 2020-2024 (KILOTON)

- TABLE 61 BLACK MASTERBATCH MARKET IN POLYAMIDE, BY REGION, 2025-2030 (KILOTON)

- TABLE 62 BLACK MASTERBATCH MARKET IN OTHER CARRIER RESINS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 BLACK MASTERBATCH MARKET IN OTHER CARRIER RESINS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 BLACK MASTERBATCH MARKET IN OTHER CARRIER RESINS, BY REGION, 2020-2024 (KILOTON)

- TABLE 65 BLACK MASTERBATCH MARKET IN OTHER CARRIER RESINS, BY REGION, 2025-2030 (KILOTON)

- TABLE 66 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 67 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 68 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 69 BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 70 BLACK MASTERBATCH MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 71 BLACK MASTERBATCH MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 72 BLACK MASTERBATCH MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 73 BLACK MASTERBATCH MARKET IN AUTOMOTIVE INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 74 BLACK MASTERBATCH MARKET IN PACKAGING INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 BLACK MASTERBATCH MARKET IN PACKAGING INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 BLACK MASTERBATCH MARKET IN PACKAGING INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 77 BLACK MASTERBATCH MARKET IN PACKAGING INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 BLACK MASTERBATCH MARKET IN INFRASTRUCTURE INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 BLACK MASTERBATCH MARKET IN INFRASTRUCTURE INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 BLACK MASTERBATCH MARKET IN INFRASTRUCTURE INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 81 BLACK MASTERBATCH MARKET IN INFRASTRUCTURE INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 BLACK MASTERBATCH MARKET IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 BLACK MASTERBATCH MARKET IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 BLACK MASTERBATCH MARKET IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 85 BLACK MASTERBATCH MARKET IN ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 86 BLACK MASTERBATCH MARKET IN CONSUMER GOODS INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 BLACK MASTERBATCH MARKET IN CONSUMER GOODS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 BLACK MASTERBATCH MARKET IN CONSUMER GOODS INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 89 BLACK MASTERBATCH MARKET IN CONSUMER GOODS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 90 BLACK MASTERBATCH MARKET IN AGRICULTURE INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 91 BLACK MASTERBATCH MARKET IN AGRICULTURE INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 BLACK MASTERBATCH MARKET IN AGRICULTURE INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 93 BLACK MASTERBATCH MARKET IN AGRICULTURE INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 94 BLACK MASTERBATCH MARKET IN FIBERS INDUSTRY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 95 BLACK MASTERBATCH MARKET IN FIBERS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 96 BLACK MASTERBATCH MARKET IN FIBERS INDUSTRY, BY REGION, 2020-2024 (KILOTON)

- TABLE 97 BLACK MASTERBATCH MARKET IN FIBERS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 98 BLACK MASTERBATCH MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 99 BLACK MASTERBATCH MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 100 BLACK MASTERBATCH MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2020-2024 (KILOTON)

- TABLE 101 BLACK MASTERBATCH MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 102 BLACK MASTERBATCH MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 103 BLACK MASTERBATCH MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 104 BLACK MASTERBATCH MARKET, BY REGION, 2020-2024 (KILOTON)

- TABLE 105 BLACK MASTERBATCH MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 106 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 107 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 108 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 109 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 110 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 111 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 112 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 113 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 114 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 115 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 116 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 117 ASIA PACIFIC: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 118 CHINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 119 CHINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 120 CHINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 121 CHINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 122 JAPAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 123 JAPAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 124 JAPAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 125 JAPAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 126 INDIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 127 INDIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 128 INDIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 129 INDIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 130 SOUTH KOREA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 131 SOUTH KOREA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 132 SOUTH KOREA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 133 SOUTH KOREA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 THAILAND: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 135 THAILAND: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 136 THAILAND: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 137 THAILAND: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 138 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 139 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 140 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 141 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 142 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 144 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 145 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 146 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 147 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 148 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 149 NORTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 150 US: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 151 US: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 152 US: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 153 US: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 CANADA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 155 CANADA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 156 CANADA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 157 CANADA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 158 MEXICO: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 159 MEXICO: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 160 MEXICO: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 161 MEXICO: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 EUROPE: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 163 EUROPE: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 164 EUROPE: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 165 EUROPE: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 166 EUROPE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 167 EUROPE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 168 EUROPE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 169 EUROPE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 170 EUROPE: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 171 EUROPE: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 EUROPE: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 173 EUROPE: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 174 GERMANY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 175 GERMANY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 176 GERMANY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 177 GERMANY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 178 UK: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 179 UK: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 180 UK: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 181 UK: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 182 FRANCE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 183 FRANCE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 184 FRANCE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 185 FRANCE: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 186 RUSSIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 187 RUSSIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 188 RUSSIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 189 RUSSIA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 190 SPAIN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 191 SPAIN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 192 SPAIN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 193 SPAIN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 197 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 201 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 205 MIDDLE EAST & AFRICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 206 IRAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 207 IRAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 208 IRAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 209 IRAN: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 210 SOUTH AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 211 SOUTH AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 212 SOUTH AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 213 SOUTH AFRICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 214 TURKEY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 215 TURKEY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 216 TURKEY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 217 TURKEY: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 218 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (USD MILLION)

- TABLE 219 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (USD MILLION)

- TABLE 220 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2020-2024 (KILOTON)

- TABLE 221 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY CARRIER RESIN, 2025-2030 (KILOTON)

- TABLE 222 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 223 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 224 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 225 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 226 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 227 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 228 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2020-2024 (KILOTON)

- TABLE 229 SOUTH AMERICA: BLACK MASTERBATCH MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 230 BRAZIL: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 231 BRAZIL: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 232 BRAZIL: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 233 BRAZIL: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 234 ARGENTINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (USD MILLION)

- TABLE 235 ARGENTINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 236 ARGENTINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2020-2024 (KILOTON)

- TABLE 237 ARGENTINA: BLACK MASTERBATCH MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 238 BLACK MASTERBATCH MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-OCTOBER 2025

- TABLE 239 BLACK MASTERBATCH MARKET: DEGREE OF COMPETITION, 2024

- TABLE 240 BLACK MASTERBATCH MARKET: REGION FOOTPRINT

- TABLE 241 BLACK MASTERBATCH MARKET: CARRIER RESIN FOOTPRINT

- TABLE 242 BLACK MASTERBATCH MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 243 BLACK MASTERBATCH MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 244 BLACK MASTERBATCH MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 245 BLACK MASTERBATCH MARKET: PRODUCT LAUNCHES, JANUARY 2020-OCTOBER 2025

- TABLE 246 BLACK MASTERBATCH MARKET: EXPANSIONS, JANUARY 2020-OCTOBER 2025

- TABLE 247 BLACK MASTERBATCH MARKET: DEALS, JANUARY 2020-OCTOBER 2025

- TABLE 248 AVIENT CORPORATION: COMPANY OVERVIEW

- TABLE 249 AVIENT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 AVIENT CORPORATION: PRODUCT LAUNCHES

- TABLE 251 AVIENT CORPORATION: EXPANSIONS

- TABLE 252 AMPACET CORPORATION: COMPANY OVERVIEW

- TABLE 253 AMPACET CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 AMPACET CORPORATION: PRODUCT LAUNCHES

- TABLE 255 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY OVERVIEW

- TABLE 256 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 257 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: OTHER DEVELOPMENTS

- TABLE 258 CABOT CORPORATION: COMPANY OVERVIEW

- TABLE 259 CABOT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 CABOT CORPORATION: PRODUCT LAUNCHES

- TABLE 261 PLASTIBLENDS: COMPANY OVERVIEW

- TABLE 262 PLASTIBLENDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 HUBRON INTERNATIONAL: COMPANY OVERVIEW

- TABLE 264 HUBRON INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 HUBRON INTERNATIONAL: DEALS

- TABLE 266 TOSAF: COMPANY OVERVIEW

- TABLE 267 TOSAF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 BLEND COLOURS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 269 BLEND COLOURS PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 BLEND COLOURS PRIVATE LIMITED: PRODUCT LAUNCHES

- TABLE 271 BLEND COLOURS PRIVATE LIMITED: EXPANSIONS

- TABLE 272 RTP COMPANY: COMPANY OVERVIEW

- TABLE 273 RTP COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 RTP COMPANY: PRODUCT LAUNCHES

- TABLE 275 PLASTIKA KRITIS S.A.: COMPANY OVERVIEW

- TABLE 276 PLASTIKA KRITIS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 VIBRANT COLOR TECH PVT LTD.: COMPANY OVERVIEW

- TABLE 278 US MASTERBATCH JOINT STOCK COMPANY: COMPANY OVERVIEW

- TABLE 279 GABRIEL-CHEMIE GMBH: COMPANY OVERVIEW

- TABLE 280 ASTRA POLYMERS: COMPANY OVERVIEW

- TABLE 281 PERFECT COLOURANTS & PLASTICS PVT. LTD.: COMPANY OVERVIEW

- TABLE 282 KOTHARI POLYMERS: COMPANY OVERVIEW

- TABLE 283 DELTA TECNIC: COMPANY OVERVIEW

- TABLE 284 ABBEY VIETNAM: COMPANY OVERVIEW

- TABLE 285 ALOK: COMPANY OVERVIEW

- TABLE 286 JKP MASTERBATCH: COMPANY OVERVIEW

- TABLE 287 PURE POLYMERS: COMPANY OVERVIEW

- TABLE 288 MASKOM PLASTIC INDUSTRY AND TRADE JOINT STOCK COMPANY: COMPANY OVERVIEW

- TABLE 289 MALION NEW MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 290 EUP GROUP: COMPANY OVERVIEW

- TABLE 291 REPIN MASTERBATCHES: COMPANY OVERVIEW

- TABLE 292 BLACK MASTERBATCH MARKET: RISK ASSESSMENT

- TABLE 293 ASIA PACIFIC: MASTERBATCH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 294 EUROPE: MASTERBATCH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 295 NORTH AMERICA: MASTERBATCH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 296 MIDDLE EAST & AFRICA: MASTERBATCH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 297 SOUTH AMERICA: MASTERBATCH MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 BLACK MASTERBATCH MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS

- FIGURE 3 GLOBAL BLACK MASTERBATCH MARKET, 2025-2030

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN BLACK MASTERBATCH MARKET (2020-2025)

- FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF BLACK MASTERBATCH MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN BLACK MASTERBATCH MARKET, 2024

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 HIGH DEMAND IN AUTOMOTIVE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 9 AUTOMOTIVE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 POLYPROPYLENE (PP) SEGMENT DOMINATED BLACK MASTERBATCH MARKET IN 2024

- FIGURE 11 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 BLACK MASTERBATCH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 13 BLACK MASTERBATCH MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 14 BLACK MASTERBATCH MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 15 BLACK MASTERBATCH MARKET: KEY PARTICIPANTS IN ECOSYSTEM

- FIGURE 16 BLACK MASTERBATCH MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 AVERAGE SELLING PRICE OF BLACK MASTERBATCH OFFERED BY KEY PLAYERS, BY END-USE INDUSTRY, 2024

- FIGURE 18 AVERAGE SELLING PRICE TREND OF BLACK MASTERBATCH, BY REGION, 2022-2024

- FIGURE 19 EXPORT DATA FOR HS CODE- 320649-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024

- FIGURE 20 IMPORT DATA FOR HS CODE - 320649-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024

- FIGURE 21 TREND/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 PATENTS REGISTERED FOR BLACK MASTERBATCH, 2014-2024

- FIGURE 23 LIST OF MAJOR PATENTS FOR BLACK MASTERBATCH

- FIGURE 24 LEGAL STATUS OF PATENTS FILED IN BLACK MASTERBATCH

- FIGURE 25 MAXIMUM PATENTS FILED IN JURISDICTION OF US

- FIGURE 26 IMPACT OF AI/GEN AI ON BLACK MASTERBATCH MARKET

- FIGURE 27 BLACK MASTERBATCH MARKET: DECISION-MAKING FACTORS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 29 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 30 ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 31 POLYPROPYLENE RESIN ESTIMATED TO LEAD BLACK MASTERBATCH MARKET IN 2025

- FIGURE 32 AUTOMOTIVE SEGMENT ESTIMATED TO LEAD BLACK MASTERBATCH MARKET IN 2025

- FIGURE 33 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN BLACK MASTERBATCH MARKET BETWEEN 2025 AND 2030

- FIGURE 34 ASIA PACIFIC: BLACK MASTERBATCH MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: BLACK MASTERBATCH MARKET SNAPSHOT

- FIGURE 36 EUROPE: BLACK MASTERBATCH MARKET SNAPSHOT

- FIGURE 37 BLACK MASTERBATCH MARKET, SHARE OF KEY MARKET PLAYERS, 2024

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 39 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 40 BLACK MASTERBATCH MARKET: COMPANY FOOTPRINT

- FIGURE 41 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 42 BLACK MASTERBATCH MARKET: PRODUCT COMPARISON

- FIGURE 43 BLACK MASTERBATCH MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 44 BLACK MASTERBATCH MARKET: ENTERPRISE VALUATION OF KEY PLAYERS

- FIGURE 45 AVIENT CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.: COMPANY SNAPSHOT

- FIGURE 47 CABOT CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 PLASTIBLENDS: COMPANY SNAPSHOT

- FIGURE 49 PLASTIKA KRITIS S.A.: COMPANY SNAPSHOT

- FIGURE 50 BLACK MASTERBATCH MARKET: RESEARCH DESIGN

- FIGURE 51 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): COLLECTIVE REVENUE AND SHARE OF MAJOR PLAYERS

- FIGURE 52 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL CARRIER RESIN PRODUCTS

- FIGURE 53 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3 - BOTTOM-UP (DEMAND-SIDE)

- FIGURE 54 BLACK MASTERBATCH MARKET: TOP-DOWN APPROACH

- FIGURE 55 BLACK MASTERBATCH MARKET: DATA TRIANGULATION

- FIGURE 56 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- FIGURE 57 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES