|

市场调查报告书

商品编码

1881230

苯甲酸钠市场按应用和地区划分-预测至2030年Sodium Benzoate Market by Application (Food & Beverages, Pharma, Cosmetics, Home Care) and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2030 |

||||||

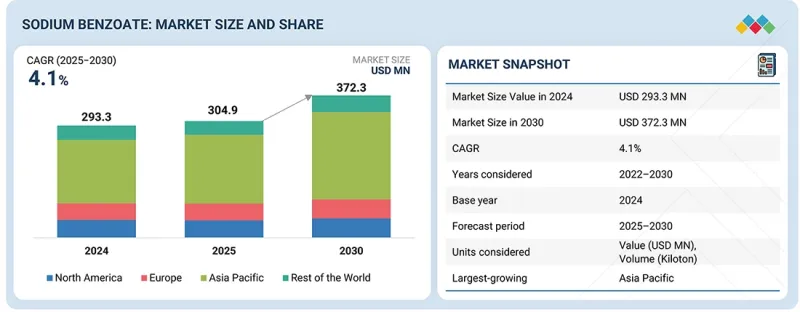

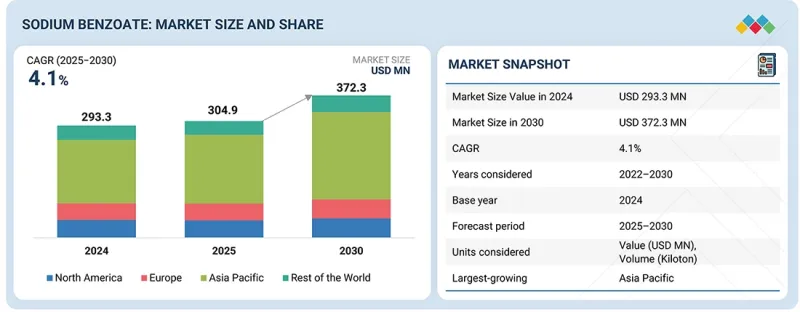

全球苯甲酸钠市场预计将从 2025 年的 3.049 亿美元成长到 2030 年的 3.723 亿美元,预测期内复合年增长率为 4.1%。

市场成长的主要驱动力是其作为食品和饮料防腐剂的广泛应用,这得益于包装食品和简便食品需求的不断增长。此外,消费者对食品安全和保质期的日益关注也进一步推动了市场成长。

| 调查范围 | |

|---|---|

| 调查期 | 2022-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 价值(百亿美元),数量(千吨) |

| 部分 | 用途和麵积 |

| 目标区域 | 亚太地区、欧洲、北美和世界其他地区 |

此外,製药业的扩张也推动了需求成长。苯甲酸钠因其抗菌和稳定特性而被广泛应用于医药领域。化妆品和个人护理行业也促进了市场成长,苯甲酸钠被用作乳霜、乳液、洗髮精等产品中的安全防腐剂。此外,苯甲酸钠在油漆、涂料和润滑剂等工业领域的应用日益广泛,也因其防腐蚀性能而推动了市场扩张。美国食品药物管理局(FDA)和欧洲食品安全局(EFSA)等机构核准苯甲酸钠用于食品和化妆品,也刺激了全球需求。

预计在预测期内,化妆品产业将占据苯甲酸钠市场第二大份额。这一增长主要得益于全球个人护理和美容产品需求的不断增长,尤其是在新兴经济体,这些地区的消费者可支配收入和护肤意识正在不断提高。苯甲酸钠广泛用作化妆品和个人保健产品中的防腐剂,以防止微生物污染并延长产品保质期,从而确保乳霜、乳液、洗髮精和彩妆产品的安全性和稳定性。美国食品药物管理局(FDA) 和欧盟委员会等监管机构核准其用于冲洗型和免冲洗型产品,进一步促进了其应用。此外,消费者转向不含对羟基苯甲酸酯和天然来源的配方,也推动了苯甲酸钠作为一种更安全、更环保的替代品的使用。全球化妆品和个人护理行业的持续扩张,在都市化、社交媒体的影响以及产品配方创新等因素的推动下,预计将在预测期内支撑该行业对苯甲酸钠的强劲需求。

北美预计将占据苯甲酸钠市场第二大份额,这主要得益于食品饮料、化妆品和製药业的强劲需求。该地区成熟的包装食品产业正大幅增加苯甲酸钠作为防腐剂的使用量,这主要受消费者对便利性和长保质期产品的偏好所驱动。此外,美国和加拿大蓬勃发展的製药业也促进了市场成长,因为苯甲酸钠因其抗菌和稳定特性而被广泛用于配方中。个人护理和化妆品市场的不断扩张,以及对产品安全性和合规性的重视,也推动了对苯甲酸钠的需求,使其成为对羟基苯甲酸酯类防腐剂的可靠替代品。此外,美国食品药物管理局(FDA) 和环境保护署 (EPA) 等机构的严格监管确保了苯甲酸钠的安全使用,并增强了消费者的信任和产业的信心。主要生产商的存在以及食品保鲜和化妆品配方领域的持续技术创新,预计将进一步巩固北美在全球苯甲酸钠市场中的领先地位。

本报告分析了全球苯甲酸钠市场,概述了按应用和地区分類的趋势,并介绍了参与该市场的公司的概况。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 介绍

- 市场动态

- 宏观经济展望

- 价值链分析

- 生态系分析

- 波特五力分析

- 2025-2026 年主要会议和活动

- 定价分析

- 专利分析

6. 苯甲酸钠市场(依应用领域划分)

- 介绍

- 食品/饮料

- 製药

- 化妆品

- 居家照护

- 其他的

7. 苯甲酸钠市场(依地区划分)

- 介绍

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他的

- 欧洲

- 德国

- 法国

- 西班牙

- 英国

- 义大利

- 其他的

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他地区

第八章 竞争情势

- 介绍

- 主要参与企业的策略/优势

- 收入分析

- 2024年市占率分析

- 竞争场景

- 估值和财务指标

第九章:公司简介

- 主要参与企业

- LANXESS

- WUHAN YOUJI HOLDINGS LTD.

- TIANJIN DONGDA CHEMICAL GROUP CO., LTD

- EASTMAN CHEMICAL COMPANY

- TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD.

第十章:邻近及相关市场

第十一章附录

The global sodium benzoate market is projected to grow from USD 304.9 million in 2025 to USD 372.3 million by 2030 at a CAGR of 4.1% during the forecast period. The growth of the market is primarily driven by its widespread use as a preservative in food and beverages due to the rising demand for packaged and convenience foods. Increasing consumer awareness about food safety and extended shelf life is further enhancing market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments | Application and Region |

| Regions covered | Asia Pacific, Europe, North America, and Rest of the World |

Additionally, the expanding pharmaceuticals industry is fueling demand, as sodium benzoate is used in medicines for its antimicrobial and stabilizing properties. The cosmetics and personal care industry also contributes to market growth, utilizing sodium benzoate as a safe preservative in creams, lotions, and shampoos. Moreover, the growing application of sodium benzoate in industrial sectors such as paints, coatings, and lubricants due to its corrosion-inhibiting characteristics supports market expansion. Regulatory approvals from agencies like the FDA and EFSA for the use of sodium benzoate in food and cosmetics also stimulate global demand.

"The cosmetics segment of the sodium benzoate market, by application, is projected to account for the second-largest share during the forecast period".

The cosmetics segment is projected to account for the second-largest share of the sodium benzoate market during the forecast period. This growth is primarily driven by the increasing demand for personal care and beauty products worldwide, particularly in emerging economies where disposable incomes and consumer awareness of hygiene and skincare are on the rise. Sodium benzoate is widely used in cosmetics and personal care formulations as a preservative to prevent microbial contamination and extend product shelf life, ensuring safety and stability in creams, lotions, shampoos, and makeup products. Its approval by regulatory bodies such as the US Food and Drug Administration (FDA) and the European Commission for use in rinse-off and leave-on products has further strengthened its adoption. Additionally, the growing shift toward paraben-free and naturally derived formulations has led to an increase in the use of sodium benzoate as a safer and more environmentally friendly alternative. The continuous expansion of the global cosmetics and personal care industry, supported by urbanization, social media influence, and innovation in product formulations, is expected to sustain strong demand for sodium benzoate in this segment during the forecast period.

"North America is projected to account for the second-largest share of the sodium benzoate market".

North America is projected to account for the second-largest share of the sodium benzoate market, driven by strong demand from the food & beverage, cosmetics, and pharmaceuticals industries. The region's well-established packaged food sector, supported by high consumer preference for convenient and long-shelf-life products, has significantly boosted the consumption of sodium benzoate as a preservative. In addition, the robust pharmaceuticals industry in the US and Canada contributes to market growth, as sodium benzoate is commonly used in formulations for its antimicrobial and stabilizing properties. The growing personal care & cosmetics market, emphasizing product safety and regulatory compliance, also drives sodium benzoate demand as a reliable preservative alternative to parabens. Moreover, stringent regulations by authorities such as the US Food and Drug Administration (FDA) and the Environmental Protection Agency (EPA) ensure the safe use of sodium benzoate, fostering consumer trust and industry confidence. The presence of key manufacturers and ongoing innovations in food preservation and cosmetic formulations are further expected to sustain North America's strong position in the global sodium benzoate market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 25%, and Tier 3 - 10%

- By Designation: C-level - 25%, Director Level - 30%, and Others - 45%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, and Rest of the World - 10%

LANXESS (Germany), Wuhan Youji Holdings Ltd. (China), Tianjin Dongda Chemical Group Co., Ltd (China), Eastman Chemical Company (US), and Tengzhou Tenglong Food Technology Development Co., Ltd. (China) are the major players in the sodium benzoate market. These players have adopted partnerships and expansions to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the sodium benzoate market based on application and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles sodium benzoate manufacturers, comprehensively analyzes their market shares and core competencies, and tracks and analyzes competitive developments, such as expansions and partnerships, adopted by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the sodium benzoate market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It may also enable stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising demand for food and beverage preservatives, expanding use of sodium benzoate in pharmaceuticals, growing demand for cosmetics and home care products), restraints (growing shift toward natural preservatives), opportunities (growth prospects in animal feed segment of livestock industry, growing industrial applications), and challenges (regulatory restrictions) influencing the growth of the sodium benzoate market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the sodium benzoate market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the sodium benzoate market across varied regions)

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as LANXESS (Germany), Wuhan Youji Holdings Ltd. (China), Tianjin Dongda Chemical Group Co., Ltd (China), Eastman Chemical Company (US), and Tengzhou Tenglong Food Technology Development Co., Ltd. (China) in the sodium benzoate market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 CALCULATION FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SODIUM BENZOATE MARKET

- 4.2 SODIUM BENZOATE MARKET, BY APPLICATION

- 4.3 SODIUM BENZOATE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for food and beverage preservatives

- 5.2.1.2 Expanding use of sodium benzoate in pharmaceuticals

- 5.2.1.3 Growing demand for cosmetics and home care products

- 5.2.2 RESTRAINTS

- 5.2.2.1 Growing shift toward natural preservatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth prospects in animal feed segment of livestock industry

- 5.2.3.2 Growing industrial applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory restrictions

- 5.2.1 DRIVERS

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 GDP

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 BARGAINING POWER OF SUPPLIERS

- 5.6.2 BARGAINING POWER OF BUYERS

- 5.6.3 THREAT OF SUBSTITUTES

- 5.6.4 THREAT OF NEW ENTRANTS

- 5.6.5 DEGREE OF COMPETITION

- 5.7 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE, BY REGION

- 5.8.2 AVERAGE SELLING PRICE, BY APPLICATION

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.9.2 PATENT PUBLICATION TRENDS

- 5.9.3 INSIGHTS

- 5.9.3.1 LIST OF MAJOR PATENTS

6 SODIUM BENZOATE MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 FOOD & BEVERAGES

- 6.2.1 DOMINANT APPLICATION OF SODIUM BENZOATE

- 6.3 PHARMA

- 6.3.1 FASTEST-GROWING APPLICATION OF SODIUM BENZOATE

- 6.4 COSMETICS

- 6.4.1 GROWING DEMAND FOR PRESERVATIVES IN BEAUTY INDUSTRY TO DRIVE MARKET

- 6.5 HOME CARE

- 6.5.1 EXTENSIVE USE IN HOUSEHOLD CLEANING AND MAINTENANCE PRODUCTS TO DRIVE MARKET

- 6.6 OTHERS

7 SODIUM BENZOATE MARKET, BY REGION

- 7.1 INTRODUCTION

- 7.2 ASIA PACIFIC

- 7.2.1 CHINA

- 7.2.1.1 Increasing private-label food manufacturing to drive growth

- 7.2.2 INDIA

- 7.2.2.1 Expanding food and beverage production to drive market

- 7.2.3 JAPAN

- 7.2.3.1 Growth in food processing sector to drive demand

- 7.2.4 SOUTH KOREA

- 7.2.4.1 Rising demand for cosmetic products to drive growth

- 7.2.5 REST OF ASIA PACIFIC

- 7.2.1 CHINA

- 7.3 EUROPE

- 7.3.1 GERMANY

- 7.3.1.1 Strong cosmetics market to drive demand

- 7.3.2 FRANCE

- 7.3.2.1 Increase in premium beauty exports to drive market

- 7.3.3 SPAIN

- 7.3.3.1 Large-scale export of packaged food products to drive market

- 7.3.4 UK

- 7.3.4.1 Consistent preservative demand across low- and no-calorie beverages to drive market

- 7.3.5 ITALY

- 7.3.5.1 Strong pharmaceutical manufacturing base and extensive food processing industry to drive market

- 7.3.6 REST OF EUROPE

- 7.3.1 GERMANY

- 7.4 NORTH AMERICA

- 7.4.1 US

- 7.4.1.1 Increased pharmaceutical spending and high cosmetics export to drive demand

- 7.4.2 CANADA

- 7.4.2.1 Growing processed food & beverages industry to drive market

- 7.4.3 MEXICO

- 7.4.3.1 High soft drink consumption to drive demand

- 7.4.1 US

- 7.5 REST OF THE WORLD

8 COMPETITIVE LANDSCAPE

- 8.1 INTRODUCTION

- 8.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 8.3 REVENUE ANALYSIS

- 8.3.1 REVENUE ANALYSIS OF TOP 3 PLAYERS, 2021-2024

- 8.4 MARKET SHARE ANALYSIS, 2024

- 8.4.1 MARKET SHARE ANALYSIS

- 8.4.2 RANKING OF KEY MARKET PLAYERS

- 8.4.2.1 LANXESS

- 8.4.2.2 Wuhan Youji Holdings Ltd.

- 8.4.2.3 Eastman Chemical Company

- 8.4.2.4 Tianjin Dongda Chemical Group Co., Ltd.

- 8.4.2.5 Tengzhou Tenglong Food Technology Development Co., Ltd.

- 8.4.3 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 8.4.3.1 Company footprint

- 8.4.3.2 Region footprint

- 8.4.3.3 Application footprint

- 8.5 COMPETITIVE SCENARIO

- 8.5.1 PRODUCT LAUNCHES

- 8.5.2 DEALS

- 8.6 COMPANY VALUATION AND FINANCIAL METRICS

9 COMPANY PROFILES

- 9.1 KEY PLAYERS

- 9.1.1 LANXESS

- 9.1.1.1 Business overview

- 9.1.1.2 Products offered

- 9.1.1.3 Recent developments

- 9.1.1.3.1 Product launches

- 9.1.1.3.2 Deals

- 9.1.1.4 MnM view

- 9.1.1.4.1 Key strengths

- 9.1.1.4.2 Strategic choices

- 9.1.1.4.3 Weaknesses and competitive threats

- 9.1.2 WUHAN YOUJI HOLDINGS LTD.

- 9.1.2.1 Business overview

- 9.1.2.2 Products offered

- 9.1.2.3 Recent developments

- 9.1.2.3.1 Deals

- 9.1.2.3.2 Expansions

- 9.1.2.4 MnM view

- 9.1.2.4.1 Key strengths

- 9.1.2.4.2 Strategic choices

- 9.1.2.4.3 Weaknesses and competitive threats

- 9.1.3 TIANJIN DONGDA CHEMICAL GROUP CO., LTD

- 9.1.3.1 Business overview

- 9.1.3.2 Products offered

- 9.1.3.3 MnM View

- 9.1.3.3.1 Key strengths

- 9.1.3.3.2 Strategic choices

- 9.1.3.3.3 Weaknesses and competitive threats

- 9.1.4 EASTMAN CHEMICAL COMPANY

- 9.1.4.1 Business overview

- 9.1.4.2 Products offered

- 9.1.4.3 Recent developments

- 9.1.4.3.1 Deals

- 9.1.4.4 MnM view

- 9.1.4.4.1 Key strengths

- 9.1.4.4.2 Strategic choices

- 9.1.4.4.3 Weaknesses and competitive threats

- 9.1.5 TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD.

- 9.1.5.1 Business overview

- 9.1.5.2 Products offered

- 9.1.5.3 MnM view

- 9.1.5.3.1 Key strengths

- 9.1.5.3.2 Strategic choices

- 9.1.5.3.3 Weaknesses and competitive threats

- 9.1.1 LANXESS

10 ADJACENT AND RELATED MARKETS

- 10.1 INTRODUCTION

- 10.2 LIMITATIONS

- 10.3 SODIUM BENZOATE MARKET: INTERCONNECTED MARKET/S

- 10.4 BENZOATES MARKET: GLOBAL FORECAST TO 2027

- 10.4.1 MARKET DEFINITION

- 10.4.2 MARKET OVERVIEW

- 10.4.2.1 Potassium benzoate

- 10.4.2.2 Sodium benzoate

- 10.4.2.3 Ammonium benzoate

- 10.4.2.4 Others

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

List of Tables

- TABLE 1 SODIUM BENZOATE MARKET SNAPSHOT, 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 3 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024 (%)

- TABLE 4 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, 2023 VS. 2024 (USD BILLION)

- TABLE 6 SODIUM BENZOATE MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 SODIUM BENZOATE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 SODIUM BENZOATE MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 9 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY REGION, 2022-2025 (USD/KG)

- TABLE 10 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY APPLICATION, 2022-2025 (USD/KG)

- TABLE 11 SODIUM BENZOATE MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 12 SODIUM BENZOATE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 13 SODIUM BENZOATE MARKET, BY APPLICATION, 2022-2024 (KILOTON)

- TABLE 14 SODIUM BENZOATE MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 15 SODIUM BENZOATE MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 16 SODIUM BENZOATE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 17 SODIUM BENZOATE MARKET, BY REGION, 2022-2024 (KILOTON)

- TABLE 18 SODIUM BENZOATE MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 19 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 20 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 21 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 22 ASIA PACIFIC: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 23 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 24 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 25 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 26 EUROPE: SODIUM BENZOATE MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 27 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 28 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2022-2024 (KILOTON)

- TABLE 30 NORTH AMERICA: SODIUM BENZOATE MARKET BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 31 SODIUM BENZOATE: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 32 SODIUM BENZOATE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 33 SODIUM BENZOATE MARKET: REGION FOOTPRINT (5 COMPANIES)

- TABLE 34 SODIUM BENZOATE MARKET: APPLICATION FOOTPRINT (5 COMPANIES)

- TABLE 35 SODIUM BENZOATE MARKET: PRODUCT LAUNCHES, JANUARY 2020-AUGUST 2025

- TABLE 36 SODIUM BENZOATE MARKET: DEALS, JANUARY 2020-AUGUST 2025

- TABLE 37 LANXESS: COMPANY OVERVIEW

- TABLE 38 LANXESS: PRODUCTS OFFERED

- TABLE 39 LANXESS: PRODUCT LAUNCHES

- TABLE 40 LANXESS: DEALS

- TABLE 41 WUHAN YOUJI HOLDINGS LTD.: COMPANY OVERVIEW

- TABLE 42 WUHAN YOUJI HOLDINGS LTD.: PRODUCTS OFFERED

- TABLE 43 WUHAN YOUJI HOLDINGS LTD.: DEALS

- TABLE 44 WUHAN YOUJI HOLDINGS LTD.: EXPANSIONS

- TABLE 45 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 46 TIANJIN DONGDA CHEMICAL GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 47 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 48 EASTMAN CHEMICAL COMPANY: PRODUCTS OFFERED

- TABLE 49 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 50 TENGZHOU TENGLONG FOOD TECHNOLOGY DEVELOPMENT CO., LTD: PRODUCTS OFFERED

- TABLE 51 BENZOATES MARKET SIZE, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 52 BENZOATES MARKET SIZE, BY TYPE, 2022-2027 (USD MILLION)

List of Figures

- FIGURE 1 SODIUM BENZOATE MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 SODIUM BENZOATE MARKET: RESEARCH DESIGN

- FIGURE 3 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR SODIUM BENZOATE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SODIUM BENZOATE MARKET (1/2)

- FIGURE 7 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SODIUM BENZOATE MARKET (2/2)

- FIGURE 8 SODIUM BENZOATE MARKET: DATA TRIANGULATION

- FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 10 RISING DEMAND FOR TOPICAL DRUGS AND LIQUID ORAL SYRUPS TO DRIVE SODIUM BENZOATE MARKET

- FIGURE 11 PHARMA SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD (2025-2030)

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SODIUM BENZOATE MARKET

- FIGURE 14 PAINT AND VARNISH EXPORTS (HS CODE 3209), 2020-2024

- FIGURE 15 VALUE CHAIN ANALYSIS OF SODIUM BENZOATE MARKET

- FIGURE 16 SODIUM BENZOATE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: SODIUM BENZOATE MARKET

- FIGURE 18 AVERAGE SELLING PRICE OF SODIUM BENZOATE, BY REGION, 2022-2025 (USD/KG)

- FIGURE 19 AVERAGE SELLING PRICE, BY APPLICATION, 2022-2025 (USD/KG)

- FIGURE 20 NUMBER OF PATENTS YEAR-WISE, 2014-2024

- FIGURE 21 FOOD & BEVERAGES TO BE LARGEST APPLICATION OF SODIUM BENZOATE IN 2025

- FIGURE 22 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 23 ASIA PACIFIC: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 24 EUROPE: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 25 NORTH AMERICA: SODIUM BENZOATE MARKET SNAPSHOT

- FIGURE 26 SODIUM BENZOATE MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2021-2024 (USD BILLION)

- FIGURE 27 SODIUM BENZOATE MARKET SHARE ANALYSIS, 2024

- FIGURE 28 RANKING OF KEY PLAYERS IN SODIUM BENZOATE MARKET, 2024

- FIGURE 29 SODIUM BENZOATE MARKET: COMPANY FOOTPRINT

- FIGURE 30 SODIUM BENZOATE MARKET: EV/EBITDA, 2025

- FIGURE 31 SODIUM BENZOATE MARKET: ENTERPRISE VALUE, 2025 (USD BILLION)

- FIGURE 32 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 33 LANXESS: COMPANY SNAPSHOT

- FIGURE 34 WUHAN YOUJI HOLDINGS LTD.: COMPANY SNAPSHOT

- FIGURE 35 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT