|

市场调查报告书

商品编码

1889167

全球AMR/AGV车队管理软体市场按产品、平台类型、车队类型、应用、组织规模、产业和地区划分-预测至2032年Fleet Management Software Market for AMR/AGV By Fleet Type (AGV & AMR), Offering, Fleet Type, Application, Organization Size, Industry - Global Forecast to 2032 |

||||||

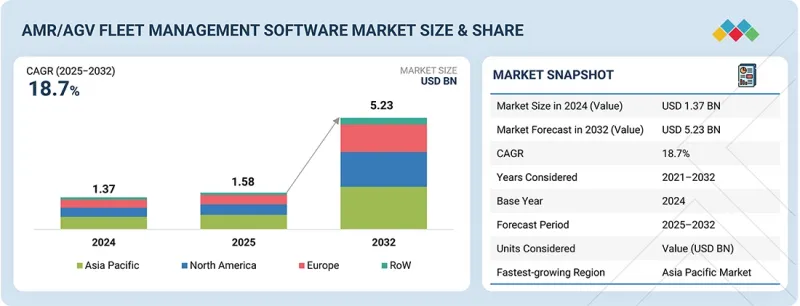

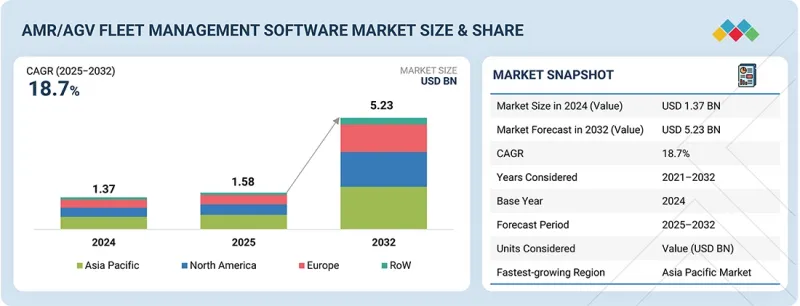

全球 AMR/AGV 车队管理软体市场预计将从 2025 年的 15.8 亿美元成长到 2032 年的 52.3 亿美元,复合年增长率为 18.7%,这主要得益于移动机器人在各种物流和製造设施中的日益普及。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 目标单元 | 金额(十亿美元) |

| 部分 | 透过产品/服务、平台类型、车队类型、应用、组织规模、产业和地区进行分类。 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

随着企业不断扩大机器人车队规模以提高吞吐量并减少营运延误,对集中式平台的需求日益增长,该平台可用于管理路线规划、交通控制、任务分配、充电和安全合规性。与仓库管理系统 (WMS)、製造执行系统 (MES) 和企业资源计划 (ERP) 系统的集成,可实现机器人车队与更广泛的供应链工作流程之间的无缝协作;而人工智慧、云端运算和物联网资料流则为预测性维护和即时优化提供支援。随着企业日益关注效率、准确性和可扩展的自动化,车队管理软体正成为支援持续绩效改善和长期机器人规划的核心营运工具。

随着移动机器人车队在仓库、製造工厂、电商中心和物流营运的应用日益广泛,预计在AMR/AGV车队管理软体市场中,软体细分市场将实现最高的复合年增长率。企业正在投资建立整合路线管理、交通控制、任务分配、车队视觉化、安全工作流程和充电协调等功能的中央平台,以提高效率并减少閒置时间。人工智慧驱动的分析、云端基础的编配和物联网资料流增强了即时优化和预测性维护能力,而与WMS(仓库管理系统)、MES(製造执行系统)和ERP(业务线计划)系统的整合则实现了端到端供应链流程的协调执行。随着企业不断扩展自动化并采用多机器人环境,对灵活高效能软体平台的需求正在加速成长,这将支撑该细分市场在预测期内的强劲成长。

在AMR/AGV车队管理软体市场中,多供应商车队平台细分市场预计将以最高的复合年增长率成长。这是因为随着企业采用混合车队,对来自不同供应商的AMR和AGV进行统一控制的需求日益增长。企业将机器人组合用于托盘搬运、拣选、分类和内部物流运输。集中式管理平台使这些不同的车队能够透过单一介面运作。这实现了协同路径规划、交通控制、任务调度、充电管理和安全监控。随着企业寻求供应商选择的灵活性并减少对单一製造商的依赖,互通性转型正在加速。多供应商车队平台可以与WMS(仓库管理系统)、MES(製造执行系统)和ERP(业务线计划)系统集成,支援云端基础的最佳化、人工智慧驱动的决策和物联网驱动的预测性维护。这提高了车队效率并减少了营运瓶颈。随着自动化专案扩展到多个地点,企业加大对机器人技术的投资,对能够提高吞吐量、保持工作流程连续性并支援长期自动化策略的多供应商平台的需求日益增长。

亚太地区预计将成为AMR/AGV车队管理软体市场复合年增长率最高的地区,主要得益于中国、日本、韩国、印度和东南亚地区仓库和工厂自动化技术的快速普及。製造业、电子商务、零售分销、汽车、电子和第三方物流(3PL)等行业的企业正在部署大规模的AMR和AGV车队,以提高吞吐量并降低对劳动力的依赖,从而推动了对集中式车队编配软体的需求。亚太地区各国政府正透过资助项目、激励措施和国家自动化倡议,大力推动数位转型、智慧製造和机器人技术集成,进而促进先进车队管理平台的普及。亚太地区拥有成本效益高的製造地、强大的机器人生产能力以及快速发展的AMR和AGV供应商生态系统,这些都加速了软体的普及。此外,该地区在人工智慧驱动的自动化、云端基础的车队控制和物联网赋能的营运监控方面的投资也在不断增加,从而提升了物流和生产工作流程的速度、准确性和即时决策能力。随着工业自动化的不断扩展和复杂机器人车队的日益普及,预计亚太地区在预测期内仍将是全球 AMR/AGV 车队管理软体市场成长最快的地区。

主要调查主题细分

我们对在 AMR/AGV 车队管理软体市场中营运的关键组织的高阶主管(例如 CEO、市场总监、创新与技术总监)进行了深入访谈。

本报告主要企业有:KUKA SE &Co. KGaA(德国)、ABB(瑞士)、欧姆龙株式会社(日本)、西门子(德国)、Ocado集团(英国)、三菱物流(日本)、Symbotic公司(美国)、Fives(法国)、极智科技(中国)、行动工业机器人(丹麦)、印度工业机器人)、Addverb Technologies) Robotics(美国)、BlueBotics(瑞士)、SYNAOS(德国)、KINEXON(德国)、WAKU Robotics GmbH(德国)、WEWO Techmotion(荷兰)、KNAPP AG(奥地利)、OTTO by Rockwell Automation(加拿大)、Seegrid(美国)、乔治亚)、乔治亚州(美国)、欧林尼亚) Inc.(美国)、SIGMATEK GmbH &Co KG(奥地利)和Deus Robotics(乌克兰)。这些公司提供广泛的先进车队管理软体功能,包括交通控制、路线规划、任务分配、即时监控、分析以及与企业系统的集成,并在成熟和新兴的自动化市场中建立了强大的影响力。

本研究对 AMR/AGV 车队管理软体市场的主要参与企业进行了详细的竞争分析,介绍了他们的公司简介、近期发展和关键市场策略。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 相互关联的市场与跨产业机会

- 1/2/3级参与企业的策略倡议

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 价值链分析

- 生态系分析

- 定价分析

- 投资和资金筹措方案

- 贸易分析

- 2025-2026 年主要会议和活动

- 影响客户业务的趋势/颠覆性因素

- 案例研究分析

- 美国关税对2025年AMR/AGV车队管理软体市场的影响

第六章:技术进步、人工智慧的影响、专利与创新

- 主要技术

- 互补技术

- 技术蓝图

- 专利分析

- 人工智慧对AMR/AGV车队管理软体市场的影响

第七章 监理环境

- 地方法规和合规性

- 监管机构、政府机构和其他组织

- 业界标准

第八章:顾客状况与购买行为

- 决策流程

- 买方相关人员和采购评估标准

- 招募障碍和内部挑战

- 各行业尚未满足的需求

9. AMR/AGV车队管理软体市场的关键技术和标准

- 人工智慧和机器学习在任务分配中的作用

- 用于舰队模拟的数位双胞胎

- 5G和边缘运算实现即时调整

- 电脑视觉

- 用于车辆追踪的区块链

- 互通性标准

第十章:AMR/AGV车队管理平台的主要特点

- 即时车队监控

- 路线优化

- 交通管理

- 避免碰撞

- 电池管理

- 预测性维护

- 绩效分析

- 多品牌机器人协作

11. AMR/AGV车队管理软体市场(依产品/服务分类)

- 软体

- 服务

12. AMR/AGV车队管理软体市场(依平台类型划分)

- 单一供应商车队平台

- 多供应商车队平台

13. AMR/AGV车队管理软体市场(依车队类型划分)

- 自主移动机器人(AMRS)

- 自动导引运输车(AGVS)

- 混合式(多机器人集群)

第十四章 AMR/AGV车队管理软体市场(依应用领域划分)

- 物流及物料运输管理

- 订单处理和拣货

- 包装、堆迭、流水线供料

- 越库作业和枢纽间运输

- 排序和分配管理

- 车队协调和区域管理

第十五章 AMR/AGV车队管理软体市场(依企业规模划分)

- 大公司

- 小型企业

第十六章:AMR/AGV车队管理软体市场(依产业垂直领域划分)

- 车

- 半导体和电子学

- 航空

- 卫生保健

- 食品/饮料

- 化学品

- 电子商务与零售

- 物流/第三方物流

- 其他的

17. AMR/AGV车队管理软体市场(按地区划分)

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他的

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 其他的

- 其他地区

- 中东

- 南美洲

- 非洲

第十八章 竞争格局

- 概述

- 主要参与企业的策略/优势,2021-2024年

- 2020-2024年收入分析

- 市占率分析

- 估值和财务指标,2024

- 品牌/产品对比

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十九章:公司简介

- 主要参与企业

- KUKA SE & CO. KGAA

- ABB

- OMRON CORPORATION

- GEEKPLUS TECHNOLOGY CO., LTD.

- ADDVERB TECHNOLOGIES LIMITED

- SIEMENS

- FIVES

- GREYORANGE

- OCADO GROUP PLC.

- KNAPP AG

- MITSUBISHI LOGISNEXT CO., LTD

- OTTO BY ROCKWELL AUTOMATION

- MOBILE INDUSTRIAL ROBOTS

- LOCUS ROBOTICS

- SYMBOTIC INC.

- SYNAOS

- 其他公司

- WEWO TECHMOTION

- SEEGRID

- SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- BLUEBOTICS

- KINEXON

- WAKU ROBOTICS GMBH

- NAVITEC SYSTEMS

- FORMANT

- INORBIT, INC.

- SIGMATEK GMBH & CO KG

- DEUS ROBOTICS

第20章调查方法

第21章附录

The global AMR/AGV fleet management software market is projected to increase from USD 1.58 billion in 2025 to USD 5.23 billion by 2032 with a CAGR of 18.7%, driven by the rising deployment of mobile robotics across various logistics and manufacturing facilities.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform Type, Fleet Type, Offering, Application, Organization Size, Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Companies are expanding their robotic fleets to improve throughput and reduce operational delays, which increases demand for centralized platforms that manage routing, traffic control, task allocation, charging, and safety compliance. Integration with WMS, MES, and ERP systems enables seamless coordination between robotic fleets and broader supply chain workflows, while AI, cloud computing, and IoT data streams strengthen predictive maintenance and real-time optimization. As organizations focus on efficiency, accuracy, and scalable automation, fleet management software is becoming a core operational tool that supports continuous performance improvement and long-term robotics planning.

"Software to Grow with the Highest CAGR in the AMR/AGV Fleet Management Software Market"

The software segment is expected to record the highest CAGR in the AMR/AGV Fleet Management Software Market due to the rising deployment of mobile robot fleets across warehouses, manufacturing plants, e-commerce hubs, and logistics operations. Companies are investing in centralized platforms that manage routing, traffic control, task allocation, fleet visibility, safety workflows, and charging coordination to increase efficiency and reduce idle time. AI-driven analytics, cloud-based orchestration, and IoT-enabled data flows are strengthening real-time optimization and predictive maintenance, while integration with WMS, MES, and ERP systems is enabling coordinated execution across end-to-end supply chain processes. As organizations scale automation and adopt multi-robot environments, demand for flexible and high-performance software platforms is accelerating, which is expected to support strong growth for the segment throughout the forecast period.

"Multi-vendor Fleet Platform to Grow with the Highest CAGR in the AMR/AGV Fleet Management Software Market"

The multi-vendor fleet platform segment is expected to grow at the highest CAGR in the AMR/AGV Fleet Management Software Market as companies adopt mixed fleets, which creates a strong need for unified control of AMRs and AGVs from different suppliers. Enterprises are combining robots for pallet handling, picking, sorting, and intralogistics movement, and a centralized platform allows these varied fleets to operate through one interface with coordinated routing, traffic control, task scheduling, charging management, and safety oversight. The shift toward interoperability is gaining momentum as organizations seek flexibility in vendor selection and attempt to reduce dependence on a single manufacturer. Multi-vendor fleet platforms integrate with WMS, MES, and ERP systems and support cloud-based optimization, AI-driven decision making, and IoT-enabled predictive maintenance, which strengthens fleet efficiency and reduces operational bottlenecks. As automation programs expand across multiple sites and businesses scale their robotics investments, demand for multi-vendor platforms is rising due to their ability to improve throughput, maintain workflow continuity, and support long-term automation strategies.

"Asia Pacific to Witness the Highest Growth Driven by Expanding Automation and Rising Deployment of Mobile Robotics"

The Asia Pacific region is expected to record the highest CAGR in the AMR/AGV Fleet Management Software Market due to the rapid adoption of warehouse and factory automation across China, Japan, South Korea, India, and Southeast Asia. Companies in manufacturing, e-commerce, retail distribution, automotive, electronics, and third-party logistics are deploying large fleets of AMRs and AGVs to improve throughput and reduce labour dependency, which increases demand for centralized fleet orchestration software. Governments in the region are promoting digital transformation, smart manufacturing, and robotics integration through funding programs, incentive schemes, and national automation initiatives that strengthen the adoption of advanced fleet management platforms. Asia Pacific offers a cost-efficient manufacturing base, strong robotics production capacity, and a fast-growing ecosystem of AMR and AGV vendors, which accelerates software adoption. The region is experiencing strong investment in AI-driven automation, cloud-based fleet control, and IoT-enabled operational monitoring that improves speed, accuracy, and real-time decision-making across logistics and production workflows. With the continuous expansion of industrial automation and increasing use of mixed robotic fleets, Asia Pacific is expected to remain the fastest-growing region in the global AMR/AGV Fleet Management Software Market during the forecast period.

Breakdown of primaries

A variety of executives from key organizations operating in the AMR/AGV fleet management software market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 40%, C-level - 45%, and Others - 15%

- By Region: Asia Pacific - 41%, North America - 26%, Europe - 28%, and RoW - 5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenue as of 2024: tier 3: revenue less than USD 300 million; tier 2: revenue between USD 300 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Major players profiled in this report are as follows: KUKA SE & Co. KGaA (Germany), ABB (Switzerland), OMRON Corporation (Japan), Siemens (Germany), Ocado Group plc (UK), MITSUBISHI LOGISNEXT CO., LTD. (Japan), Symbotic Inc. (US), Fives (France), Geekplus Technology Co., Ltd. (China), Mobile Industrial Robots (Denmark), Addverb Technologies Limited (India), Locus Robotics (US), BlueBotics (Switzerland), SYNAOS (Germany), KINEXON (Germany), WAKU Robotics GmbH (Germany), WEWO Techmotion (Netherlands), KNAPP AG (Austria), OTTO by Rockwell Automation (Canada), Seegrid (US), Suzhou Casun Intelligent Robot Co., Ltd. (China), GreyOrange (Georgia), Navitec Systems (Finland), Formant (US), InOrbit, Inc. (US), SIGMATEK GmbH & Co KG (Austria) and Deus Robotics(Ukraine). These companies provide a broad suite of advanced fleet management software capabilities, covering traffic control, routing, task allocation, real-time monitoring, analytics, and integration with enterprise systems, establishing a strong presence across both mature and emerging automation markets.

The study provides a detailed competitive analysis of these key players in the AMR/AGV fleet management software market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the AMR/AGV fleet management software market offers a comprehensive analysis, segmented by platform type, fleet type, offering, application, organization size, industry, and region. By offering, the AMR/AGV Fleet Management Software Market is segmented into software and services. By platform type, it includes single-vendor fleet platforms and multi-vendor fleet platforms. By fleet type, the market covers Autonomous Mobile Robots AMRs, Automated Guided Vehicles AGVs, and hybrid fleets that combine mixed robot types. By application, the market is segmented into intralogistics and material transport management, order fulfilment and picking operations, packaging, palletizing and line feeding, cross-docking and dock-to-dock transfers, sorting and allocation management, and fleet coordination and zone management. Organization size segmentation includes large enterprises and small and medium enterprises (SMEs). By industry, the market includes automotive, e-commerce and retail, chemicals, semiconductor and electronics, food and beverages, healthcare, aviation, logistics and 3PL, and other industries such as metal and heavy machinery, pulp and paper. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World. This segmentation supports detailed assessment of growth opportunities, adoption patterns, and technology developments shaping the global AMR/AGV Fleet Management Software Market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the AMR/AGV fleet management software market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rising adoption of warehouse and factory automation supported by rapid deployment of AMRs and AGVs, Growing demand for centralized fleet orchestration, Increasing integration of AI, cloud platforms, and IoT data pipelines that enhance predictive maintenance and autonomous decision making), restraints (High complexity of integrating fleet software with existing WMS, MES, ERP, and OT systems), opportunities (Rising shift toward multi-vendor robotic fleets that require unified and vendor neutral fleet platforms for coordination and real time control, Increasing shift toward Robotics as a Service models which drives demand for subscription based and cloud managed fleet software platforms) and challenges (Difficulty in standardizing communication protocols across robots from different vendors) influencing the growth of the AMR/AGV fleet management software market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the AMR/AGV fleet management software market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AMR/AGV fleet management software market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the AMR/AGV fleet management software market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like KUKA SE & Co. KGaA (Germany), ABB (Switzerland), Omron Corporation (Japan), Geekplus Technology Co., Ltd. (China), Addverb Technologies Limited (India), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 3.2 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

- 3.3 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 3.4 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE

- 3.5 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE

- 3.6 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING

- 3.7 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY

- 3.8 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY

- 3.9 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Rising adoption of warehouses and factory automation supported by rapid deployment of AMRs and AGVs

- 4.2.1.2 Growing demand for centralized fleet orchestration to manage multi-robot operations

- 4.2.1.3 Increasing adoption of data-driven operations and the need for predictive traffic optimization

- 4.2.1.4 Increasing expectations for real-time system-wide synchronization across automation assets

- 4.2.2 RESTRAINTS

- 4.2.2.1 High complexity of integrating fleet software with existing WMS, MES, ERP, and OT systems

- 4.2.2.2 Limited standardization of robot interfaces and operating logic across vendors

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Shift toward multi-vendor robotic fleets that require unified and vendor-neutral fleet platforms for coordination and real-time control

- 4.2.3.2 Robotics-as-a-service models driving demand for subscription-based and cloud-managed fleet software platforms

- 4.2.3.3 Expansion of hybrid cloud and edge deployment models that support real-time control and multi-site visibility

- 4.2.4 CHALLENGES

- 4.2.4.1 Difficulties in standardizing communication protocols across robots from different vendors

- 4.2.4.2 Rising cybersecurity requirements for connected fleet ecosystems

- 4.2.1 DRIVERS

- 4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

5 INDUSTRY TRENDS

- 5.1 PORTER'S FIVE FORCES ANALYSIS

- 5.1.1 BARGAINING POWER OF SUPPLIERS

- 5.1.2 BARGAINING POWER OF BUYERS

- 5.1.3 THREAT OF NEW ENTRANTS

- 5.1.4 THREAT OF SUBSTITUTES

- 5.1.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 INTRODUCTION

- 5.2.2 GDP TRENDS AND FORECAST

- 5.2.3 TRENDS IN GLOBAL E-COMMERCE AND RETAIL INDUSTRY

- 5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER

- 5.5.2 AVERAGE SELLING PRICE, BY TYPE

- 5.5.3 AVERAGE SELLING PRICE, BY REGION

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (842710)

- 5.7.2 EXPORT SCENARIO (842710)

- 5.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 SYMBOTIC DEPLOYS AI-POWERED ROBOTIC AUTOMATION FOR SOUTHERN GLAZER'S DISTRIBUTION CENTERS

- 5.10.2 ASSOCIATED FOOD STORES IMPLEMENTS SYMBOTIC ROBOTIC AUTOMATION IN UTAH DISTRIBUTION CENTER

- 5.10.3 GREYORANGE PARTNERED WITH KENCO TO DEPLOY AI-DRIVEN WAREHOUSE ORCHESTRATION

- 5.10.4 BAILEY EQUIPMENT & INTRALOGISTICS PARTNERS WITH GREYORANGE TO EXPAND AI-ENABLED WAREHOUSE AUTOMATION

- 5.11 IMPACT OF 2025 US TARIFFS-AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 KEY TARIFF RATES

- 5.11.3 PRICE IMPACT ANALYSIS

- 5.11.4 IMPACT ON COUNTRIES/REGIONS

- 5.11.4.1 US

- 5.11.4.2 Europe

- 5.11.4.3 Asia Pacific

- 5.11.5 IMPACT ON END-USE INDUSTRIES

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 KEY TECHNOLOGIES

- 6.1.1 FLEET ORCHESTRATION AND TRAFFIC MANAGEMENT

- 6.1.2 NAVIGATION AND LOCALIZATION SYSTEMS

- 6.1.3 ROBOT CONTROL AND SAFETY INFRASTRUCTURE

- 6.2 COMPLEMENTARY TECHNOLOGIES

- 6.2.1 ENTERPRISE SYSTEM INTEGRATION

- 6.2.2 CONNECTIVITY AND EDGE COMPUTING CAPABILITIES

- 6.3 TECHNOLOGY ROADMAP

- 6.4 PATENT ANALYSIS

- 6.5 IMPACT OF AI ON AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.1 TOP USE CASES AND MARKET POTENTIAL

- 6.5.2 BEST PRACTICES IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.3 CASE STUDIES OF AI IMPLEMENTATION IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 6.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.5.5 CLIENTS' READINESS TO ADOPT AI IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

7 REGULATORY LANDSCAPE

- 7.1 REGIONAL REGULATIONS AND COMPLIANCE

- 7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.1.2 INDUSTRY STANDARDS

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES

- 8.4 UNMET NEEDS FROM VARIOUS VERTICALS

9 KEY TECHNOLOGIES AND STANDARDS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- 9.1 INTRODUCTION

- 9.2 ROLE OF AI & ML IN TASK ALLOCATION

- 9.2.1 ADVANCED TASK ALLOCATION AND ROUTING

- 9.2.2 PREDICTIVE CAPACITY PLANNING

- 9.2.3 AUTONOMOUS TRAFFIC GOVERNANCE

- 9.2.4 FAILURE PREDICTION AND RISK AVOIDANCE

- 9.2.5 EXECUTION QUALITY OPTIMIZATION

- 9.3 DIGITAL TWINS FOR FLEET SIMULATION

- 9.3.1 PURPOSE OF DIGITAL TWIN SYSTEMS

- 9.4 5G AND EDGE COMPUTING FOR REAL-TIME COORDINATION

- 9.5 COMPUTER VISION

- 9.6 BLOCKCHAIN FOR FLEET TRACKING

- 9.7 INTEROPERABILITY STANDARDS

- 9.7.1 VDA 5050

- 9.7.2 OPC UNIFIED ARCHITECTURE UA

- 9.7.3 MQTT

10 KEY FUNCTIONS OF AMR/AGV FLEET MANAGEMENT PLATFORMS

- 10.1 INTRODUCTION

- 10.2 REAL-TIME FLEET MONITORING

- 10.3 ROUTE OPTIMIZATION

- 10.4 TRAFFIC MANAGEMENT

- 10.5 COLLISION AVOIDANCE

- 10.6 BATTERY MANAGEMENT

- 10.7 PREDICTIVE MAINTENANCE

- 10.8 PERFORMANCE ANALYTICS

- 10.9 MULTI-BRAND ROBOT COORDINATION

11 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING

- 11.1 INTRODUCTION

- 11.2 SOFTWARE

- 11.2.1 CLOUD-BASED ORCHESTRATION PLATFORMS

- 11.2.1.1 Cloud orchestration gains momentum as enterprises centralize fleet intelligence across networks

- 11.2.2 ON-PREMISES ORCHESTRATION PLATFORMS

- 11.2.2.1 On-premises control platforms gain traction in latency-critical environments

- 11.2.3 HYBRID PLATFORMS

- 11.2.3.1 Hybrid orchestration expands as enterprises seek unified command across cloud and local systems

- 11.2.1 CLOUD-BASED ORCHESTRATION PLATFORMS

- 11.3 SERVICES

- 11.3.1 CONSULTING & SYSTEM DESIGN

- 11.3.1.1 Strategy-driven automation roadmaps increase demand for consulting and system design

- 11.3.2 IMPLEMENTATION & INTEGRATION

- 11.3.2.1 Complex robotics environments increase need for high-fidelity integration and precise execution

- 11.3.3 TRAINING & SUPPORT

- 11.3.3.1 Software-driven robot operations elevate importance of skilled operators and responsive support

- 11.3.4 MAINTENANCE & UPDATES

- 11.3.4.1 Expansion of large multi-site fleets increases the need for predictive maintenance and continuous software updates

- 11.3.5 MANAGED SERVICES

- 11.3.5.1 Demand for predictable automation outcomes accelerates growth of fully managed fleet operations

- 11.3.1 CONSULTING & SYSTEM DESIGN

12 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE

- 12.1 INTRODUCTION

- 12.2 SINGLE-VENDOR FLEET PLATFORMS

- 12.2.1 GROWING PREFERENCE FOR UNIFIED HARDWARE-SOFTWARE ECOSYSTEMS DRIVES DEMAND FOR SINGLE VENDOR PLATFORMS

- 12.3 MULTI-VENDOR FLEET PLATFORMS

- 12.3.1 RISING DEMAND FOR INTEROPERABILITY AND MIXED ROBOT ECOSYSTEMS ACCELERATES MULTI-VENDOR PLATFORM ADOPTION

13 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE

- 13.1 INTRODUCTION

- 13.2 AUTONOMOUS MOBILE ROBOTS (AMRS)

- 13.2.1 PICKING & SORTING AMRS

- 13.2.1.1 Surging E-commerce volumes drive large-scale adoption of picking and sorting AMRs

- 13.2.2 TRANSPORTATION AMRS

- 13.2.2.1 Increasing need for continuous, touchless material movement fuels demand for transportation AMRs

- 13.2.3 COLLABORATIVE AMRS

- 13.2.3.1 Human-centric workflows increase adoption of collaborative AMRs requiring advanced safety logic

- 13.2.1 PICKING & SORTING AMRS

- 13.3 AUTOMATED GUIDED VEHICLES (AGVS)

- 13.3.1 TOW/TUGGER AGVS

- 13.3.1.1 Expansion of industrial line feeding and batch transport drives demand

- 13.3.2 UNIT LOAD AGVS

- 13.3.2.1 Rising need for automated pallet, rack, and container movement strengthens unit deployment

- 13.3.3 PALLET TRUCK AGVS

- 13.3.3.1 Shift toward automated dock, warehouse, and cold storage handling accelerates pallet truck AGV adoption

- 13.3.4 ASSEMBLY LINE AGVS

- 13.3.4.1 Flexible production layouts and modular manufacturing boost assembly line AGV adoption

- 13.3.1 TOW/TUGGER AGVS

- 13.4 HYBRID (MULTI-ROBOT FLEETS)

- 13.4.1 GROWING NEED FOR MULTI-FUNCTION AND VENDOR-NEUTRAL AUTOMATION ACCELERATES HYBRID FLEET ADOPTION

14 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- 14.1 INTRODUCTION

- 14.2 INTRALOGISTICS & MATERIAL TRANSPORT MANAGEMENT

- 14.2.1 INCREASING DEMAND FOR CONTINUOUS MATERIAL FLOW STRENGTHENS NEED FOR INTELLIGENT TRANSPORT ORCHESTRATION

- 14.3 ORDER FULFILLMENT & PICKING OPERATIONS

- 14.3.1 GROWTH IN HIGH-VELOCITY FULFILLMENT DRIVES ADOPTION OF ADVANCED PICK EXECUTION PLATFORMS

- 14.4 PACKAGING, PALLETIZING, AND LINE FEEDING

- 14.4.1 AUTOMATION OF END-OF-LINE TASKS EXPANDS NEED FOR PRECISE LINE SUPPORT ORCHESTRATION

- 14.5 CROSS-DOCKING & DOCK-TO-DOCK TRANSFERS

- 14.5.1 GROWTH IN HIGH-THROUGHPUT LOGISTICS DRIVES NEED FOR REAL-TIME DOCK TRANSFER ORCHESTRATION

- 14.6 SORTING & ALLOCATION MANAGEMENT

- 14.6.1 RISING SKU COMPLEXITY AND PARCEL VOLUMES ACCELERATE DEMAND FOR INTELLIGENT ALLOCATION ORCHESTRATION

- 14.7 FLEET COORDINATION & ZONE MANAGEMENT

- 14.7.1 GROWING SCALE OF MOBILE ROBOT DEPLOYMENTS REINFORCES NEED FOR UNIFIED ZONE CONTROL

15 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

- 15.1 INTRODUCTION

- 15.2 LARGE ENTERPRISES

- 15.2.1 GROWING EMPHASIS ON MULTI-SITE AUTOMATION AND PROCESS STANDARDIZATION DRIVES ENTERPRISE-LEVEL ADOPTION

- 15.3 SMALL & MEDIUM ENTERPRISES (SMES)

- 15.3.1 SMES ACCELERATE AUTOMATION ADOPTION TO IMPROVE EFFICIENCY AND REDUCE OPERATIONAL BURDEN

16 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY

- 16.1 INTRODUCTION

- 16.2 AUTOMOTIVE

- 16.2.1 RISING PRODUCTION COMPLEXITY AND LINE AUTOMATION STRENGTHEN DEMAND FOR ADVANCED AMR/AGV FLEET SOFTWARE IN AUTOMOTIVE MANUFACTURING

- 16.3 SEMICONDUCTOR & ELECTRONICS

- 16.3.1 RISING DEMAND FOR ULTRA-RELIABLE, CONTAMINATION-FREE TRANSPORT ACCELERATES SOFTWARE-DRIVEN AMR/AGV COORDINATION

- 16.4 AVIATION

- 16.4.1 OPERATIONAL COMPLEXITY AND NEED FOR PRECISION STRENGTHEN ROLE OF SOFTWARE-LED AMR/AGV COORDINATION IN AVIATION

- 16.5 HEALTHCARE

- 16.5.1 GROWING DEMAND FOR SAFE, TRACEABLE, AND ROUND-THE-CLOCK TRANSPORT DRIVES ADOPTION OF SOFTWARE-ORCHESTRATED AMR/AGV WORKFLOWS IN HEALTHCARE FACILITIES

- 16.6 FOOD & BEVERAGES

- 16.6.1 HIGH-SPEED PRODUCTION CYCLES AND PERISHABILITY PRESSURES ACCELERATE NEED FOR SOFTWARE-ORCHESTRATED AMR/AGV OPERATIONS

- 16.7 CHEMICALS

- 16.7.1 SAFETY REQUIREMENTS AND HAZARDOUS MATERIAL HANDLING DRIVE ADOPTION OF AMR/AGV FLEET SOFTWARE IN CHEMICAL MANUFACTURING

- 16.8 E-COMMERCE & RETAIL

- 16.8.1 RAPID ORDER GROWTH AND HIGH-MIX FULFILLMENT INTENSIFY DEMAND FOR ADVANCED AMR/AGV FLEET SOFTWARE IN E-COMMERCE AND RETAIL

- 16.9 LOGISTICS/3PL

- 16.9.1 HIGH-THROUGHPUT, MULTI-CLIENT DISTRIBUTION DEMANDS STRONG SOFTWARE-ORCHESTRATED AMR/AGV COORDINATION

- 16.10 OTHER INDUSTRIES

17 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.2 NORTH AMERICA

- 17.2.1 US

- 17.2.1.1 Automation pressure in fulfillment and manufacturing accelerates fleet software integration

- 17.2.2 CANADA

- 17.2.2.1 Expansion of manufacturing and export-intensive supply chains drives adoption of AMR and AGV fleet management software

- 17.2.3 MEXICO

- 17.2.3.1 Rising robotics orchestration requirements driven by nearshoring and high-volume manufacturing

- 17.2.1 US

- 17.3 EUROPE

- 17.3.1 GERMANY

- 17.3.1.1 Strong industrial automation ecosystem accelerates adoption of AMR and AGV fleet management software

- 17.3.2 UK

- 17.3.2.1 Rising automation across fulfillment and manufacturing boosts demand for scalable fleet orchestration

- 17.3.3 FRANCE

- 17.3.3.1 Expansion of advanced warehousing and manufacturing automation drives software adoption

- 17.3.4 ITALY

- 17.3.4.1 Automation investments and high-mix manufacturing drive strong demand for fleet software

- 17.3.5 REST OF EUROPE

- 17.3.1 GERMANY

- 17.4 ASIA PACIFIC

- 17.4.1 CHINA

- 17.4.1.1 Large-scale manufacturing strength and high-volume fulfillment networks accelerate AMR and AGV fleet software adoption

- 17.4.2 JAPAN

- 17.4.2.1 Digitalization and workforce pressures accelerate robotics coordination needs

- 17.4.3 SOUTH KOREA

- 17.4.3.1 High automation intensity accelerates demand for intelligent fleet orchestration

- 17.4.4 INDIA

- 17.4.4.1 Expanding industrial output and digital supply chains accelerate fleet software adoption

- 17.4.5 AUSTRALIA

- 17.4.5.1 Operational Efficiency and Labor Constraints Strengthen Demand for Mobile Robot Orchestration

- 17.4.6 REST OF ASIA PACIFIC

- 17.4.1 CHINA

- 17.5 REST OF THE WORLD

- 17.5.1 MIDDLE EAST

- 17.5.1.1 Growing focus on smart logistics and manufacturing modernization accelerates software adoption

- 17.5.1.2 GCC Countries

- 17.5.1.3 Rest of Middle East

- 17.5.2 SOUTH AMERICA

- 17.5.2.1 Growing automation in manufacturing and expanding e-commerce networks drive demand for fleet coordination platforms

- 17.5.3 AFRICA

- 17.5.3.1 Industrial park expansion and digital supply chain programs increase the need for coordinated robot operations

- 17.5.1 MIDDLE EAST

18 COMPETITIVE LANDSCAPE

- 18.1 OVERVIEW

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 18.3 REVENUE ANALYSIS, 2020-2024

- 18.4 MARKET SHARE ANALYSIS

- 18.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 18.6 BRAND/PRODUCT COMPARISON

- 18.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 18.7.1 STARS

- 18.7.2 EMERGING LEADERS

- 18.7.3 PERVASIVE PLAYERS

- 18.7.4 PARTICIPANTS

- 18.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 18.7.5.1 Company footprint

- 18.7.5.2 Region footprint

- 18.7.5.3 Fleet type footprint

- 18.7.5.4 Platform type footprint

- 18.7.5.5 Industry footprint

- 18.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 18.8.1 PROGRESSIVE COMPANIES

- 18.8.2 RESPONSIVE COMPANIES

- 18.8.3 DYNAMIC COMPANIES

- 18.8.4 STARTING BLOCKS

- 18.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 18.8.5.1 Detailed list of key startups/SMEs

- 18.9 COMPETITIVE SCENARIO

- 18.9.1 PRODUCT LAUNCHES

- 18.9.2 DEALS

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- 19.1.1 KUKA SE & CO. KGAA

- 19.1.1.1 Business overview

- 19.1.1.2 Products/Solutions/Services offered

- 19.1.1.3 MnM view

- 19.1.1.3.1 Right to win

- 19.1.1.3.2 Strategic choices

- 19.1.1.3.3 Weaknesses/competitive threats

- 19.1.2 ABB

- 19.1.2.1 Business overview

- 19.1.2.2 Products/Solutions/Services offered

- 19.1.2.3 MnM view

- 19.1.2.3.1 Right to win

- 19.1.2.3.2 Strategic choices

- 19.1.2.3.3 Weaknesses/competitive threats

- 19.1.3 OMRON CORPORATION

- 19.1.3.1 Business overview

- 19.1.3.2 Products/Solutions/Services offered

- 19.1.3.3 MnM view

- 19.1.3.3.1 Right to win

- 19.1.3.3.2 Strategic choices

- 19.1.3.3.3 Weaknesses/competitive threats

- 19.1.4 GEEKPLUS TECHNOLOGY CO., LTD.

- 19.1.4.1 Business overview

- 19.1.4.2 Products/Solutions/Services offered

- 19.1.4.3 MnM view

- 19.1.4.3.1 Right to win

- 19.1.4.3.2 Strategic choices

- 19.1.4.3.3 Weaknesses/competitive threats

- 19.1.5 ADDVERB TECHNOLOGIES LIMITED

- 19.1.5.1 Business overview

- 19.1.5.2 Products/Solutions/Services offered

- 19.1.5.3 Recent developments

- 19.1.5.3.1 Deals

- 19.1.5.4 MnM view

- 19.1.5.4.1 Right to win

- 19.1.5.4.2 Strategic choices

- 19.1.5.4.3 Weaknesses/competitive threats

- 19.1.6 SIEMENS

- 19.1.6.1 Business overview

- 19.1.6.2 Products/Solutions/Services offered

- 19.1.7 FIVES

- 19.1.7.1 Business overview

- 19.1.7.2 Products/Solutions/Services offered

- 19.1.8 GREYORANGE

- 19.1.8.1 Business overview

- 19.1.8.2 Products/Solutions/Services offered

- 19.1.8.3 Recent developments

- 19.1.8.3.1 Deals

- 19.1.9 OCADO GROUP PLC.

- 19.1.9.1 Business overview

- 19.1.9.2 Products/Solutions/Services offered

- 19.1.10 KNAPP AG

- 19.1.10.1 Business overview

- 19.1.10.2 Products/Solutions/Services offered

- 19.1.11 MITSUBISHI LOGISNEXT CO., LTD

- 19.1.11.1 Business overview

- 19.1.11.2 Products/Solutions/Services offered

- 19.1.12 OTTO BY ROCKWELL AUTOMATION

- 19.1.12.1 Business overview

- 19.1.12.2 Products/Solutions/Services offered

- 19.1.12.3 Recent developments

- 19.1.12.3.1 Product enhancements

- 19.1.12.3.2 Deals

- 19.1.13 MOBILE INDUSTRIAL ROBOTS

- 19.1.13.1 Business overview

- 19.1.13.2 Products/Solutions/Services offered

- 19.1.13.3 Recent developments

- 19.1.13.3.1 Product launches

- 19.1.13.3.2 Deals

- 19.1.14 LOCUS ROBOTICS

- 19.1.14.1 Business overview

- 19.1.14.2 Products/Solutions/Services offered

- 19.1.14.3 Recent developments

- 19.1.14.3.1 Product launches

- 19.1.14.3.2 Deals

- 19.1.15 SYMBOTIC INC.

- 19.1.15.1 Business overview

- 19.1.15.2 Products/Solutions/Services offered

- 19.1.15.3 Recent developments

- 19.1.15.3.1 Deals

- 19.1.16 SYNAOS

- 19.1.16.1 Business overview

- 19.1.16.2 Products/Solutions/Services offered

- 19.1.16.3 Recent developments

- 19.1.16.3.1 Deals

- 19.1.1 KUKA SE & CO. KGAA

- 19.2 OTHER PLAYERS

- 19.2.1 WEWO TECHMOTION

- 19.2.2 SEEGRID

- 19.2.3 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.

- 19.2.4 BLUEBOTICS

- 19.2.5 KINEXON

- 19.2.6 WAKU ROBOTICS GMBH

- 19.2.7 NAVITEC SYSTEMS

- 19.2.8 FORMANT

- 19.2.9 INORBIT, INC.

- 19.2.10 SIGMATEK GMBH & CO KG

- 19.2.11 DEUS ROBOTICS

20 RESEARCH METHODOLOGY

- 20.1 RESEARCH DATA

- 20.1.1 SECONDARY AND PRIMARY RESEARCH

- 20.1.2 SECONDARY DATA

- 20.1.2.1 List of major secondary sources

- 20.1.2.2 Key data from secondary sources

- 20.1.3 PRIMARY DATA

- 20.1.3.1 Primary interviews with experts

- 20.1.3.2 Key data from primary sources

- 20.1.3.3 Key industry insights

- 20.1.3.4 Breakdown of primaries

- 20.2 MARKET SIZE ESTIMATION

- 20.2.1 TOP-DOWN APPROACH

- 20.2.2 BOTTOM-UP APPROACH

- 20.2.3 BASE NUMBER CALCULATION

- 20.3 MARKET FORECAST APPROACH

- 20.3.1 SUPPLY SIDE

- 20.3.2 DEMAND SIDE

- 20.4 DATA TRIANGULATION

- 20.5 RESEARCH ASSUMPTIONS

- 20.6 RESEARCH LIMITATIONS

- 20.7 RISK ASSESSMENT

21 APPENDIX

- 21.1 DISCUSSION GUIDE

- 21.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 21.3 CUSTOMIZATION OPTIONS

- 21.4 RELATED REPORTS

- 21.5 AUTHOR DETAILS

List of Tables

- TABLE 1 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- TABLE 2 MARKET DYNAMICS

- TABLE 3 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2030

- TABLE 5 ROLE OF COMPANIES IN AMR/AGV FLEET MANAGEMENT SOFTWARE ECOSYSTEM

- TABLE 6 INDICATIVE PRICING OF AMR/AGV FLEET MANAGEMENT SOFTWARE, BY KEY PLAYER (USD)

- TABLE 7 AVERAGE SELLING PRICE OF AMR/AGV FLEET MANAGEMENT SOFTWARE, BY TYPE, 2021-2024 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF AMR/AGV FLEET MANAGEMENT SOFTWARE, BY REGION, 2021-2024 (USD)

- TABLE 9 IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 13 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: TECHNOLOGY ROADMAP

- TABLE 14 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: LIST OF APPLIED/GRANTED PATENTS, 2021-2024

- TABLE 15 TOP USE CASES AND MARKET POTENTIAL

- TABLE 16 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 17 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 18 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: INDUSTRY STANDARDS

- TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 25 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 26 UNMET NEEDS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY END USER

- TABLE 27 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 28 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 29 SOFTWARE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 30 SOFTWARE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 31 SOFTWARE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 32 SOFTWARE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 33 SERVICES: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 34 SERVICES: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 35 SERVICES: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 36 SERVICES: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 37 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE, 2021-2024 (USD MILLION)

- TABLE 38 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE, 2025-2032 (USD MILLION)

- TABLE 39 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 40 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 41 AMR FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 42 AMR FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 43 AMR FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 44 AMR FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 45 AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 46 AGV FLEET MANAGEMENT SOFTWARE MARKET, BY TYPE, 2025-2032 (USD MILLION)

- TABLE 47 AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 48 AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 49 HYBRID FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 HYBRID FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 51 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 52 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION, 2025-2032 (USD MILLION)

- TABLE 53 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2024 (USD MILLION)

- TABLE 54 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE, 2025-2032 (USD MILLION)

- TABLE 55 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 56 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 57 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 58 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 59 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 60 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 61 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 62 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 63 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 65 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 67 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 68 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AUTOMOTIVE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 69 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 70 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 71 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 72 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 73 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 74 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 75 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 77 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 79 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR SEMICONDUCTOR & ELECTRONICS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 81 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 82 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 83 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 85 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 87 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 89 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 91 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR AVIATION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 93 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 94 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 95 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 97 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 99 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 101 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 103 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR HEALTHCARE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 105 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 106 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 107 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 108 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 109 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 111 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 115 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 116 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR FOOD & BEVERAGES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 117 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 118 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 119 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 120 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 121 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 123 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 127 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 128 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR CHEMICALS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 129 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 130 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 131 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 132 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 133 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 135 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 139 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 140 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR E-COMMERCE & RETAIL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 141 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 142 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 143 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 144 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 145 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 147 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 149 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 151 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 152 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR LOGISTICS/3PL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 153 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY FLEET TYPE, 2021-2024 (USD MILLION)

- TABLE 154 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY FLEET TYPE, 2025-2032 (USD MILLION)

- TABLE 155 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 156 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 157 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 158 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 159 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 163 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 164 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET FOR OTHER INDUSTRIES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 165 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 167 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 168 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 169 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 170 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 171 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 172 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 173 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 175 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 176 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 177 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 178 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 179 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 183 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 185 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 186 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 187 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 188 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING, 2025-2032 (USD MILLION)

- TABLE 189 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 190 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 191 MIDDLE EAST: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 192 MIDDLE EAST: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 193 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 194 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: DEGREE OF COMPETITION, 2024

- TABLE 195 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: REGION FOOTPRINT

- TABLE 196 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: FLEET TYPE FOOTPRINT

- TABLE 197 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: PLATFORM TYPE FOOTPRINT

- TABLE 198 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: INDUSTRY TYPE FOOTPRINT

- TABLE 199 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 200 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: PRODUCT LAUNCHES, JUNE 2022 TO OCTOBER 2025

- TABLE 201 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: DEALS, JUNE 2022 TO OCTOBER 2025

- TABLE 202 KUKA SE & CO. KGAA: COMPANY OVERVIEW

- TABLE 203 KUKA SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 ABB: COMPANY OVERVIEW

- TABLE 205 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 207 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 GEEKPLUS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 209 GEEKPLUS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 ADDVERB TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 211 ADDVERB TECHNOLOGIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 ADDVERB TECHNOLOGIES LIMITED: DEALS

- TABLE 213 SIEMENS: COMPANY OVERVIEW

- TABLE 214 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 FIVES: COMPANY OVERVIEW

- TABLE 216 FIVES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 GREYORANGE: COMPANY OVERVIEW

- TABLE 218 GREYORANGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 GREYORANGE: DEALS

- TABLE 220 OCADO GROUP PLC.: COMPANY OVERVIEW

- TABLE 221 OCADO GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 KNAPP AG: COMPANY OVERVIEW

- TABLE 223 KNAPP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW

- TABLE 225 MITSUBISHI LOGISNEXT CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 OTTO BY ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 227 OTTO BY ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 OTTO BY ROCKWELL AUTOMATION: PRODUCT ENHANCEMENTS

- TABLE 229 OTTO BY ROCKWELL AUTOMATION: DEALS

- TABLE 230 MOBILE INDUSTRIAL ROBOTS: COMPANY OVERVIEW

- TABLE 231 MOBILE INDUSTRIAL ROBOTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 MOBILE INDUSTRIAL ROBOTS: PRODUCT LAUNCHES

- TABLE 233 MOBILE INDUSTRIAL ROBOTS: DEALS

- TABLE 234 LOCUS ROBOTICS: COMPANY OVERVIEW

- TABLE 235 LOCUS ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 LOCUS ROBOTICS: PRODUCT LAUNCHES

- TABLE 237 LOCUS ROBOTICS: DEALS

- TABLE 238 SYMBOTIC INC.: COMPANY OVERVIEW

- TABLE 239 SYMBOTIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SYMBOTIC INC.: DEALS

- TABLE 241 SYNAOS: COMPANY OVERVIEW

- TABLE 242 SYNAOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 SYNAOS: DEALS

- TABLE 244 LIST OF MAJOR SECONDARY SOURCES

- TABLE 245 PRIMARY INTERVIEWS WITH EXPERTS

- TABLE 246 KEY DATA FROM PRIMARY SOURCES

- TABLE 247 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: RISK ASSESSMENT

List of Figures

- FIGURE 1 MARKET SEGMENTATION & REGIONS COVERED

- FIGURE 2 MARKET SCENARIO

- FIGURE 3 GLOBAL AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, 2021-2032

- FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, 2021-2025

- FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET

- FIGURE 6 HIGH-GROWTH SEGMENTS IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, 2025-2030

- FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC LEADS GLOBAL GROWTH WITH EXPANDING ROBOTIC AUTOMATION ADOPTION

- FIGURE 9 SMALL & MEDIUM ENTERPRISES (SMES) TO EXHIBIT HIGHEST GROWTH RATE

- FIGURE 10 INTRALOGISTICS & MATERIAL TRANSPORT MANAGEMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 11 AUTONOMOUS MOBILE ROBOTS (AMRS) TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 12 SINGLE-VENDOR FLEET PLATFORMS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 13 SOFTWARE SEGMENT TO EXHIBIT HIGHEST GROWTH RATE

- FIGURE 14 E-COMMERCE & RETAIL TO HOLD THE LARGEST SHARE DURING THE FORECAST PERIOD

- FIGURE 15 SOFTWARE SEGMENT AND INDIA TO HOLD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2032

- FIGURE 16 INDIA TO RECORD HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 17 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE OF AMR/AGV FLEET MANAGEMENT SOFTWARE, BY TYPE, 2021-2024 (USD)

- FIGURE 26 AVERAGE SELLING PRICE OF AMR/AGV FLEET MANAGEMENT SOFTWARE, BY REGION, 2021-2024 (USD)

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2021-2024

- FIGURE 28 IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 29 EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024 (USD MILLION)

- FIGURE 30 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 31 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 32 AMR/AGV FLEET MANAGEMENT SOFTWARE DECISION-MAKING FACTORS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 35 AMR/AGV FLEET MANAGEMENT SOFTWARE: ADOPTION BARRIERS & INTERNAL CHALLENGES

- FIGURE 36 FUNCTIONS OF AMR/AGV FLEET MANAGEMENT PLATFORMS

- FIGURE 37 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY OFFERING

- FIGURE 38 SOFTWARE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY PLATFORM TYPE

- FIGURE 40 MULTI-VENDOR FLEET PLATFORM TO GROW AT HIGHEST CAGR FROM 2025-2032

- FIGURE 41 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY FLEET TYPE

- FIGURE 42 AUTONOMOUS MOBILE ROBOTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY APPLICATION

- FIGURE 44 ORDER FULFILLMENT & PICKING OPERATIONS TO GROW AT HIGHEST CAGR TILL 2032

- FIGURE 45 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY ORGANIZATION SIZE

- FIGURE 46 LARGE ENTERPRISES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 47 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY INDUSTRY

- FIGURE 48 E-COMMERCE & RETAIL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 49 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET, BY REGION

- FIGURE 50 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL MARKET DURING FORECAST PERIOD

- FIGURE 51 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 52 NORTH AMERICA: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 53 EUROPE: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 54 ASIA PACIFIC: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 55 REST OF THE WORLD: AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET SNAPSHOT

- FIGURE 56 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 57 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET SHARE ANALYSIS, 2024

- FIGURE 58 COMPANY VALUATION (USD MILLION)

- FIGURE 59 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 60 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 61 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 62 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: COMPANY FOOTPRINT

- FIGURE 63 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 64 KUKA SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

- FIGURE 66 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 SIEMENS: COMPANY SNAPSHOT

- FIGURE 68 FIVES: COMPANY SNAPSHOT

- FIGURE 69 OCADO GROUP PLC.: COMPANY SNAPSHOT

- FIGURE 70 MITSUBISHI LOGISNEXT CO., LTD: COMPANY SNAPSHOT

- FIGURE 71 SYMBOTIC INC.: COMPANY SNAPSHOT

- FIGURE 72 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: RESEARCH DESIGN

- FIGURE 73 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: RESEARCH APPROACH

- FIGURE 74 KEY DATA FROM SECONDARY SOURCES

- FIGURE 75 KEY INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 76 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 77 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 78 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 79 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 80 AMR/AGV FLEET MANAGEMENT SOFTWARE MARKET: DATA TRIANGULATION

- FIGURE 81 ASSUMPTIONS