|

市场调查报告书

商品编码

1895143

全球汽车酰胺纤维市场按类型、应用和地区划分-预测至2030年Automotive Aramid Fiber Market By Type (Para-Aramid, Meta-Aramid), Application (Brake Pads & Clutch Facings, Reinforced Tires, Hoses, Belts, & Gaskets, Racing Vehicle Components, Heat Shields & Insulation), and Region - Global Forecast to 2030 |

||||||

汽车酰胺纤维的市场规模预计将受到以下因素的推动:为提高燃油效率和减少排放气体而加大力度减轻车辆重量,以及全球电动车 (EV) 产量的快速增长。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2030 |

| 基准年 | 2024 |

| 预测期 | 2025-2030 |

| 目标单元 | 价值(百万美元) 数量(千吨) |

| 部分 | 按类型、用途和区域 |

| 目标区域 | 北美洲、欧洲、亚太地区、南美洲、中东和非洲 |

由于对具有优异强度重量比、热稳定性和耐久性的高性能材料的需求不断增长,酰胺纤维在关键汽车零件中的应用日益广泛。

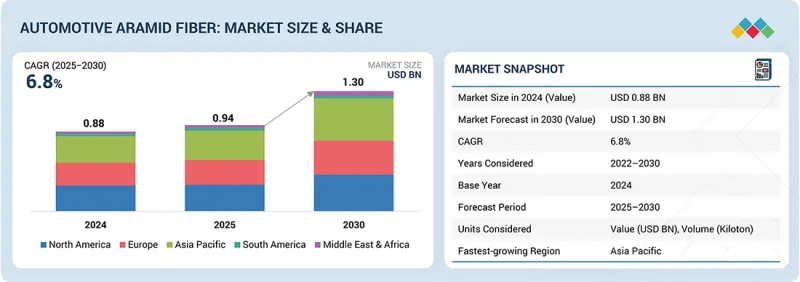

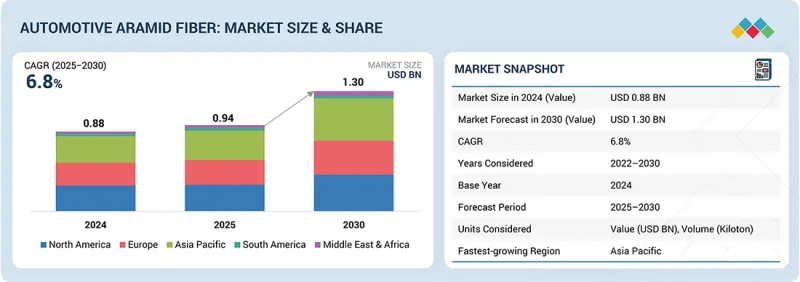

预计汽车酰胺纤维市场将从2025年的9.4亿美元成长至2025年至2030年的13亿美元,复合年增长率(CAGR)为6.8%。这一增长主要得益于以下因素:为提高燃油效率和减少排放气体,汽车轻量化趋势的日益增长;电动汽车(EV)在全球范围内的快速普及;酰胺纤维在汽车应用领域(例如煞车皮、轮胎、垫片和发动机舱部件)中优异的强度重量比、热稳定性、耐磨性和抗衝击性。 2024年1月,杜邦公司与美国合作,推出了一款采用其汽车用酰胺纤维品牌克维拉 EXO的执法机关防弹背心。这款创新纤维具有卓越的防护性能、轻盈性和柔软性,能够打造舒适贴身的背心。此举进一步巩固了杜邦在防护解决方案领域的领先地位和市场影响力。

由于其优异的耐热性、尺寸稳定性和阻燃性,间位芳香聚酰胺纤维是汽车酰胺纤维市场中成长速度第二快的细分市场。这些纤维广泛应用于汽车行业,例如隔热材料、汽车製造中的个人防护衣以及暴露于高温环境的引擎室零件。随着对高效温度控管性能和防火安全性的需求不断增长,间位芳香聚酰胺作为电动车电池系统和电气元件的隔热材料也越来越受欢迎。为汽车应用提供间位芳香聚酰胺纤维品牌的主要企业包括 Nomex(杜邦公司)、Heraklon Meta(科隆工业公司)和 X-FIPER Meta(X-FIPER 新材料公司)。

汽车酰胺纤维市场目前在聚氨酯、橡胶和热塑性塑胶应用领域呈现成长态势。对能够承受极端机械应力、宽温范围和化学相容性的零件的需求不断增长,推动了酰胺纤维在软管、皮带和垫片等产品中的应用。日益精密的汽车,尤其是电动和混合动力汽车,对更小巧、更轻且耐热的系统提出了更高的要求,从而促进了芳香聚酰胺增强材料在软管、橡胶正时皮带和密封垫片中的应用。材料成分和零件设计的进步不断提升酰胺纤维的性能,增强了产品的整体多功能性,并进一步推动了该细分市场的成长。

中东和非洲地区预计将成为全球汽车酰胺纤维市场成长第二快的区域市场。这一成长主要得益于快速的工业化进程、汽车製造地的扩张以及对基础设施和出行解决方案投资的增加。沙乌地阿拉伯的「2030愿景」和阿联酋的「工业战略」等政府主导的倡议,正在推动对高性能材料的需求,这些材料能够提升汽车应用的安全性、效率和耐久性。随着各国政府致力于永续、推广电动车和发展在地化製造业,对酰胺纤维等轻质耐热材料的整体需求将持续成长。我们进行了大量的初步访谈,以确认和检验透过二手研究确定的各个细分市场和子细分市场的规模。

报告涵盖的公司:本报告涵盖杜邦(美国)、帝人株式会社(东京)、科隆工业株式会社(韩国)、晓星(韩国)、烟台泰和先进材料有限公司(中国)、东丽株式会社(日本)、X-FIPER 新材料(中国)、Huvis 公司(韩国)和 SRF 有限公司(印度)。

本研究对汽车酰胺纤维市场的主要企业进行了详细的竞争分析,包括公司简介、近期发展和关键市场策略。

调查范围

本研究报告按类型(对位芳香聚酰胺和间位芳香聚酰胺)、应用(煞车皮和离合器摩擦酰胺纤维、增强轮胎、软管、皮带和垫片、赛车部件、隔热罩和隔热材料、轻质结构复合复合材料)以及地区(亚太地区、北美、欧洲、南美、中东和非洲)对汽车芳纶纤维市场进行细分。报告详细资讯阐述了影响汽车酰胺纤维纤维市场成长的驱动因素、阻碍因素、挑战和机会。酰胺纤维。报告中还对汽车酰胺纤维市场生态系统中的新兴Start-Ups进行了竞争分析。

购买本报告的好处

本报告为市场领导和新参与企业提供汽车酰胺纤维市场及其细分市场最准确的收入估计值。它帮助相关人员了解竞争格局,获得更深入的洞察以巩固自身市场地位,并制定合适的打入市场策略。报告深入分析市场趋势,并提供关键市场驱动因素、限制因素、挑战和机会的资讯。

本报告深入分析了以下内容:

- 该报告分析了关键驱动因素(车辆轻量化倡议、电动车的成长、安全法规、性能要求、温度控管需求和製造技术的进步)、限制因素(来自替代材料的竞争、缺乏回收基础设施、供应链脆弱性、对技术专长的需求、材料创新、高昂的材料成本和加工复杂性)、机会(电动车应用、混合动力和复合材料解决方案、高级驾驶辅助系统、以永续性为中心的解决方案、区域製造扩张和增材製造技术的整合)以及挑战(供应链韧性、由于缺乏通用标准而导致芳香聚酰胺采用的障碍、劳动力技能差距以及适应快速变化的汽车製造方法)。

- 产品开发/创新:深入分析汽车酰胺纤维市场即将出现的技术趋势、研发活动以及产品和服务发布。

- 市场发展:关于盈利的市场的全面资讯—该报告分析了各个地区的汽车酰胺纤维市场。

市场多元化:全面介绍汽车酰胺纤维市场的新产品和服务、未开发的地区、近期趋势和投资情况。

- 竞争评估:主要企业(美国- 杜邦,东京 - 帝人株式会社,韩国 - 科隆工业株式会社,韩国 - 晓星,中国 - 烟台泰和先进材料,日本 - 东丽株式会社,中国 - X-FIPER 新材料,韩国 - Huvis 公司,印度 - SRF 有限公司)的市场份额详细评估。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章重要考察

第五章 市场概览

- 市场动态

- 波特五力分析

- 主要相关人员和采购标准

- 总体经济指标

- 价值链分析

- 监管状态

- 贸易分析

- 生态系分析

- 影响客户业务的趋势/干扰因素

- 案例研究分析

- 技术分析

- 定价分析

- 2025-2026 年主要会议和活动

- 专利分析

- 人工智慧/生成式人工智慧对汽车酰胺纤维市场的影响

- 投资和资金筹措方案

- 2025年美国关税对汽车酰胺纤维市场的影响

第六章 汽车酰胺纤维市场(依型别)

- 对位芳香聚酰胺

- 间位芳香聚酰胺

第七章 汽车酰胺纤维市场(依应用领域划分)

- 煞车皮和离合器摩擦片

- 加强型轮胎

- 软管、皮带、垫圈

- 隔热罩和隔热材料

- 轻质结构复合材料

- 赛车零件等。

第八章 汽车酰胺纤维市场(依地区分)

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 其他的

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 其他的

- 中东和非洲

- 海湾合作委员会国家

- 其他的

- 南美洲

- 巴西

- 阿根廷

- 其他的

第九章 竞争情势

- 概述

- 主要参与企业的策略

- 收入分析

- 2024年市占率分析

- 估值和财务指标

- 品牌/产品比较分析

- 公司估值矩阵:主要参与企业,2024 年

- 公司估值矩阵:Start-Ups/中小企业,2024 年

- 竞争场景

第十章:公司简介

- 主要参与企业

- DUPONT

- TEIJIN LIMITED

- KOLON INDUSTRIES, INC.

- YANTAI TAYHO ADVANCED MATERIALS CO., LTD.

- HYOSUNG

- TORAY INDUSTRIES, INC.

- X-FIPER NEW MATERIAL CO., LTD

- HUVIS CORP.

- CHINA NATIONAL BLUESTAR(GROUP)CO, LTD.

- AFCHINA

- 其他公司

- SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- TAEKWANG INDUSTRIAL CO., LTD

- ARAMID HPM, LLC

- SHANGHAI J&S NEW MATERIALS CO., LTD

- YF INTERNATIONAL BV

- SUZHOU ZHAODA SPECIALLY FIBER TECHNICAL CO., LTD.

- ZHANGJIAGANG GANGYING INDUSTRY

- VEPLAS DD

- PRO-SYSTEMS SPA

- WUXI GDE TECHNOLOGY CO., LTD.

- BARNET

- ZHEJIANG SURETEX COMPOSITE CO., LTD

- HEBEI SILICON VALLEY CHEMICAL CO., LTD.

- BEAVER MANUFACTURING COMPANY

- BALLY RIBBON MILLS

第十一章附录

The automotive aramid fiber market is expected to be driven by increasing vehicle lightweighting initiatives aimed at improving fuel efficiency and reducing emissions, as well as the rapid expansion of electric vehicle (EV) production globally.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Kiloton) |

| Segments | Fibre Type, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The demand for high-performance materials with superior strength-to-weight ratios, thermal stability, and durability is accelerating the adoption of aramid fibers in critical automotive components.

The automotive aramid fiber market is anticipated to grow from USD 0.94 billion in 2025 to USD 1.30 billion during the period of 2025-2030, with a CAGR of 6.8%. This expected growth is driven by an increase in vehicle lightweighting to improve fuel efficiency and reduce emissions, the rapid global adoption of electric vehicles (EVs), and aramid's enhanced strength-to-weight ratio, thermal stability, and resistance to abrasion and impact in automotive applications such as brake pads, tires, gaskets, and under-the-hood components. In January 2024, DuPont partnered with Point Blank Enterprises (US) to launch law-enforcement body armor using the automotive aramid fiber brand, Kevlar EXO. The revolutionary fiber offers superior protection, lighter weight, and enhanced flexibility, resulting in comfortable, form-fitting vests that strengthen DuPont's leadership and market reach in protective solutions.

"Meta-Aramid to be second fastest-growing type segment in automotive aramid fiber market "

Meta-aramid fibers represent the second fastest-growing segment of the automotive aramid fiber market due to their excellent thermal resistance, dimensional stability, and flame resistance. These fibers are widely used in the automotive industry, including applications such as thermal insulation, personal protective clothing for automotive manufacturing, and under-the-hood components subjected to high temperatures. Meta-aramids are increasingly popular as insulation materials in electric vehicle battery systems and electrical components, driven by a greater need for effective thermal management properties and fire resistance safety. Key companies offering meta-aramid fiber brands for automotive applications include Nomex (DuPont), Heracron meta (Kolon Industries), and X-FIPER meta (X-FIPER New Material Co., Ltd).

"Hoses, belts, and gaskets to be the second fastest-growing application segment in the automotive aramid fiber market "

The automotive aramid fiber market is currently experiencing growth in the polyurethane, rubber, and thermoplastics application segments. The demand for components that can withstand extreme levels of mechanical stress, a broad range of temperatures, and chemical compatibility has led to increasing use of aramid fiber in hoses, belts, and gaskets. As vehicles, particularly electric and hybrid models, become more advanced and require smaller, lighter, yet heat-tolerant systems, there is a growing amount of aramid-reinforced material utilized in hoses, rubber timing belts, and sealing gaskets. Advancements in material compositions and component engineering continue to enhance the performance of aramid fibers, which in turn boosts overall product versatility and further promotes growth in this market segment.

"Middle East & Africa to be the second fastest-growing regional market for automotive aramid filter"

The Middle East and Africa are expected to be the second-fastest-growing regional market in the global automotive aramid fiber market. This growth is primarily driven by rapid industrialization, expanding automotive manufacturing bases, and an increasing emphasis on investing in infrastructure and mobility solutions. Government-led initiatives such as Saudi Arabia's Vision 2030 and the United Arab Emirates' (UAE) industrial strategy will boost demand for high-performing materials that enhance safety, efficiency, and longevity in motor vehicle applications. As governments focus on sustainable development, electric vehicle adoption, and local manufacturing, the overall demand for lightweight, heat-resistant materials like aramid fibers will continue to rise. To determine and verify the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: DuPont (US), Teijin Limited (Tokyo), Kolon Industries, Inc. (South Korea), HYOSUNG (South Korea), Yantai Tayho Advanced Materials Co., Ltd. (China), TORAY INDUSTRIES, INC.(Japan), X-FIPER NEW MATERIAL CO., LTD (China), Huvis Corp. (South Korea), and SRF Limited (India) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the automotive aramid fiber market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the automotive aramid fiber market based on type (para-aramid and meta-aramid), application (brake pads and clutch facings, reinforced tires, hoses, belts, and gaskets, racing vehicle components, heat shields and insulation, and lightweight structural composites), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the automotive aramid fiber market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, agreements, product launches, expansions, and acquisitions, associated with the automotive aramid fiber market. This report covers a competitive analysis of upcoming startups in the automotive aramid fiber market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall automotive aramid fiber market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Vehicle Lightweighting Initiatives, Electric Vehicle Growth, Safety Regulations, Performance Requirements, Thermal Management Needs, and Manufacturing Technology Advances), restraints (Competition from Alternative Materials, Limited Recycling Infrastructure, Supply Chain Vulnerabilities, Technical Expertise Requirements, Material Innovation, High Material Cost, and Processing Complexities), opportunities (Electric Vehicle Applications, Hybrid and Multi-Material Solutions, Advanced Driver Assistance Systems, Sustainability-Focused Solutions, Regional Manufacturing Expansion, and Additive Manufacturing Integration), and challenges (Supply Chain Resilience, The lack of universal standards creates challenges for broader aramid adoption, Workforce Skills Gap, and Adapting to rapidly changing automotive manufacturing approaches ).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the automotive aramid fiber market .

- Market Development: Comprehensive information about profitable markets - the report analyzes the automotive aramid fiber market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive aramid fiber market .

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as DuPont (US), Teijin Limited (Tokyo), Kolon Industries, Inc. (South Korea), HYOSUNG (South Korea), Yantai Tayho Advanced Materials Co., Ltd. (China), TORAY INDUSTRIES, INC. (Japan), X-FIPER NEW MATERIAL CO., LTD (China), Huvis Corp. (South Korea), and SRF Limited (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 AUTOMOTIVE ARAMID FIBER MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE ARAMID FIBER MARKET

- 4.2 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE

- 4.3 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION

- 4.4 AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising need for lightweight materials enabling significant emission reductions in vehicles

- 5.2.1.2 Rapid expansion of electric vehicles

- 5.2.1.3 Advancements in composite manufacturing technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High production cost

- 5.2.2.2 Processing and machining complexities

- 5.2.2.3 Competition from alternative materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Research and development in bio-based and recyclable aramid fibers

- 5.2.3.2 Stringent safety and emission regulations

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions

- 5.2.4.2 Worker safety concerns

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATIONS

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Asia Pacific

- 5.7.1.3 Europe

- 5.7.1.4 Middle East & Africa

- 5.7.1.5 South America

- 5.7.1.1 North America

- 5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 REGULATIONS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 550311)

- 5.8.2 EXPORT SCENARIO (HS CODE 550311)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 DUPONT OFFERS F200 BARRIER HOSE MADE FROM KEVLAR ARAMID FIBER REINFORCEMENT FOR AUTOMOBILES

- 5.11.2 TEIJIN ARAMID AND OMP RACING PUSH LIMITS OF SAFETY AND COMFORT IN MOTORSPORTS WITH ADVANCED ARAMID INNOVATION

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Polymer synthesis and spinning

- 5.12.1.2 Advanced composite manufacturing

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Nanotechnology in surface treatments

- 5.12.2.2 Recycling and sustainability technologies

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.13.2 AVERAGE SELLING PRICES OF AUTOMOTIVE ARAMID FIBERS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PATENT ANALYSIS

- 5.15.1 METHODOLOGY

- 5.15.2 DOCUMENT TYPES

- 5.15.3 PUBLICATION TRENDS

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP APPLICANTS

- 5.16 IMPACT OF AI/GEN AI ON AUTOMOTIVE ARAMID FIBER MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFFS ON AUTOMOTIVE ARAMID FIBER MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 PARA-ARAMID

- 6.2.1 PROTECTION AGAINST HEAT, CHEMICALS, AND ABRASION TO DRIVE MARKET

- 6.3 META-ARAMID

- 6.3.1 PROPERTIES LIKE LIGHTWEIGHT, RESISTANT TO DEGRADATION, AND DURABILITY TO FUEL MARKET GROWTH

7 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BRAKE PADS & CLUTCH FACINGS

- 7.2.1 DEMAND FOR HIGH-PERFORMANCE, HEAT-RESISTANT, AND DURABLE FRICTION MATERIALS TO FUEL MARKET

- 7.3 REINFORCED TIRES

- 7.3.1 PUNCTURE AND CUT RESISTANT PROPERTIES TO ENHANCE SAFETY AND TIRE LIFE

- 7.4 HOSES, BELTS, AND GASKETS

- 7.4.1 ENHANCED VEHICLE RELIABILITY, REDUCED MAINTENANCE EXPENSES, AND INCREASED OPERATIONAL SAFETY TO DRIVE MARKET

- 7.5 HEAT SHIELDS & INSULATION

- 7.5.1 ENHANCED THERMAL MANAGEMENT, DURABILITY, AND PROTECTION OF OCCUPANTS TO DRIVE MARKET

- 7.6 LIGHTWEIGHT STRUCTURAL COMPOSITES

- 7.6.1 BETTER EFFICIENCY AND PERFORMANCE IN ELECTRIC VEHICLES TO DRIVE MARKET

- 7.7 RACING VEHICLE COMPONENTS AND OTHERS

- 7.7.1 IMPROVED SPEED AND FUEL EFFICIENCY TO DRIVE MARKET

8 AUTOMOTIVE ARAMID FIBER MARKET, BY REGION

- 8.1 INTRODUCTION

- 8.2 NORTH AMERICA

- 8.2.1 US

- 8.2.1.1 Growing electric vehicle industry to boost use of aramid fibers

- 8.2.2 CANADA

- 8.2.2.1 Government initiatives to favor growth of automotive aramid fiber market

- 8.2.3 MEXICO

- 8.2.3.1 Favorable trade tariffs from US to support growth of automotive industry

- 8.2.1 US

- 8.3 EUROPE

- 8.3.1 GERMANY

- 8.3.1.1 Robust automotive industry to drive market

- 8.3.2 FRANCE

- 8.3.2.1 Plan for electric vehicle battery gigafactory to drive market

- 8.3.3 UK

- 8.3.3.1 Government initiatives and electric vehicle plans to drive market

- 8.3.4 SPAIN

- 8.3.4.1 Expanding automotive industry to drive market

- 8.3.5 REST OF EUROPE

- 8.3.1 GERMANY

- 8.4 ASIA PACIFIC

- 8.4.1 CHINA

- 8.4.1.1 Growing population, industrialization, and urbanization to support market

- 8.4.2 JAPAN

- 8.4.2.1 Growing electric vehicle industry to drive automotive aramid fiber market

- 8.4.3 INDIA

- 8.4.3.1 Growing FDI in manufacturing industry to support market growth

- 8.4.4 SOUTH KOREA

- 8.4.4.1 Government and automakers' initiatives to drive market

- 8.4.5 REST OF ASIA PACIFIC

- 8.4.1 CHINA

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.5.1.1 Saudi Arabia

- 8.5.1.1.1 Government initiatives to support growth of market

- 8.5.1.2 UAE

- 8.5.1.2.1 Potential foreign investors to positively influence market

- 8.5.1.3 Rest of GCC countries

- 8.5.1.1 Saudi Arabia

- 8.5.2 REST OF MIDDLE EAST & AFRICA

- 8.5.1 GCC COUNTRIES

- 8.6 SOUTH AMERICA

- 8.6.1 BRAZIL

- 8.6.1.1 Growing EV initiatives to drive demand

- 8.6.2 ARGENTINA

- 8.6.2.1 Liberal trade policies and increasing chemical production to drive market

- 8.6.3 REST OF SOUTH AMERICA

- 8.6.1 BRAZIL

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES

- 9.3 REVENUE ANALYSIS

- 9.4 MARKET SHARE ANALYSIS, 2024

- 9.5 COMPANY VALUATION AND FINANCIAL METRICS

- 9.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 9.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 9.7.1 STARS

- 9.7.2 EMERGING LEADERS

- 9.7.3 PERVASIVE PLAYERS

- 9.7.4 PARTICIPANTS

- 9.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 9.7.5.1 Company footprint

- 9.7.5.2 Region footprint

- 9.7.5.3 Type footprint

- 9.7.5.4 Application footprint

- 9.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 9.8.1 PROGRESSIVE COMPANIES

- 9.8.2 RESPONSIVE COMPANIES

- 9.8.3 DYNAMIC COMPANIES

- 9.8.4 STARTING BLOCKS

- 9.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 9.8.5.1 Detailed list of key startups/SMEs

- 9.8.5.2 Competitive benchmarking of key startups/SMEs

- 9.9 COMPETITIVE SCENARIO

- 9.9.1 PRODUCT LAUNCHES

- 9.9.2 DEALS

- 9.9.3 EXPANSIONS

10 COMPANY PROFILES

- 10.1 KEY PLAYERS

- 10.1.1 DUPONT

- 10.1.1.1 Business overview

- 10.1.1.2 Products offered

- 10.1.1.3 Recent developments

- 10.1.1.3.1 Product launches

- 10.1.1.3.2 Deals

- 10.1.1.4 MnM view

- 10.1.1.4.1 Right to win

- 10.1.1.4.2 Strategic choices

- 10.1.1.4.3 Weaknesses and competitive threats

- 10.1.2 TEIJIN LIMITED

- 10.1.2.1 Business overview

- 10.1.2.2 Products offered

- 10.1.2.3 Recent developments

- 10.1.2.3.1 Expansions

- 10.1.2.4 MnM view

- 10.1.2.4.1 Right to win

- 10.1.2.4.2 Strategic choices

- 10.1.2.4.3 Weaknesses and competitive threats

- 10.1.3 KOLON INDUSTRIES, INC.

- 10.1.3.1 Business overview

- 10.1.3.2 Products offered

- 10.1.3.3 Recent developments

- 10.1.3.3.1 Deals

- 10.1.3.3.2 Expansions

- 10.1.3.4 MnM view

- 10.1.3.4.1 Right to win

- 10.1.3.4.2 Strategic choices

- 10.1.3.4.3 Weaknesses and competitive threats

- 10.1.4 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.

- 10.1.4.1 Business overview

- 10.1.4.2 Products offered

- 10.1.4.3 MnM view

- 10.1.4.3.1 Right to win

- 10.1.4.3.2 Strategic choices

- 10.1.4.3.3 Weaknesses and competitive threats

- 10.1.5 HYOSUNG

- 10.1.5.1 Business overview

- 10.1.5.2 Products offered

- 10.1.5.3 MnM view

- 10.1.5.3.1 Right to win

- 10.1.5.3.2 Strategic choices

- 10.1.5.3.3 Weaknesses and competitive threats

- 10.1.6 TORAY INDUSTRIES, INC.

- 10.1.6.1 Business overview

- 10.1.6.2 Products offered

- 10.1.6.3 MnM view

- 10.1.7 X-FIPER NEW MATERIAL CO., LTD

- 10.1.7.1 Business overview

- 10.1.7.2 Products offered

- 10.1.7.3 MnM view

- 10.1.8 HUVIS CORP.

- 10.1.8.1 Business overview

- 10.1.8.2 Products offered

- 10.1.9 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.

- 10.1.9.1 Business overview

- 10.1.9.2 Products offered

- 10.1.10 AFCHINA

- 10.1.10.1 Business overview

- 10.1.10.2 Products offered

- 10.1.10.3 MnM view

- 10.1.1 DUPONT

- 10.2 OTHER PLAYERS

- 10.2.1 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY

- 10.2.2 TAEKWANG INDUSTRIAL CO., LTD

- 10.2.3 ARAMID HPM, LLC

- 10.2.4 SHANGHAI J&S NEW MATERIALS CO., LTD

- 10.2.5 YF INTERNATIONAL BV

- 10.2.6 SUZHOU ZHAODA SPECIALLY FIBER TECHNICAL CO., LTD.

- 10.2.7 ZHANGJIAGANG GANGYING INDUSTRY

- 10.2.8 VEPLAS D.D.

- 10.2.9 PRO-SYSTEMS SPA

- 10.2.10 WUXI GDE TECHNOLOGY CO., LTD.

- 10.2.11 BARNET

- 10.2.12 ZHEJIANG SURETEX COMPOSITE CO., LTD

- 10.2.13 HEBEI SILICON VALLEY CHEMICAL CO., LTD.

- 10.2.14 BEAVER MANUFACTURING COMPANY

- 10.2.15 BALLY RIBBON MILLS

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 AUTOMOTIVE ARAMID FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021-2030 (%)

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INDIA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 IMPORT SCENARIO FOR HS CODE 550311-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXPORT SCENARIO FOR HS CODE 550311-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 11 ROLE OF COMPANIES IN AUTOMOTIVE ARAMID FIBER ECOSYSTEM

- TABLE 12 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE ARAMID FIBERS, BY REGION, (USD/KG), 2022-2024 (USD/KG)

- TABLE 13 AVERAGE SELLING PRICES OF AUTOMOTIVE ARAMID FIBERS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG)

- TABLE 14 AUTOMOTIVE ARAMID FIBER MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 TOP 10 PATENT OWNERS, 2015-2024

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE 2022-2024 (TON)

- TABLE 18 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 19 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE 2022-2024 (USD MILLION)

- TABLE 20 AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 22 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 23 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 24 AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 AUTOMOTIVE ARAMID FIBER MARKET, BY REGION, 2022-2024 (TON)

- TABLE 26 AUTOMOTIVE ARAMID FIBER MARKET, BY REGION, 2025-2030 (TON)

- TABLE 27 AUTOMOTIVE ARAMID FIBER MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 28 AUTOMOTIVE ARAMID FIBER MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 30 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 31 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 32 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 34 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 35 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 36 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 38 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 39 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 40 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 US: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 42 US: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 43 US: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 44 US: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 US: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 46 US: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 47 US: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 48 US: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 50 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 51 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 52 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 53 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 54 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 55 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 56 CANADA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 57 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 58 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 59 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 60 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 61 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 62 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 63 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 64 MEXICO: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 65 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 66 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 67 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 68 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 70 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 71 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 72 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 74 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 75 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 76 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 77 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 78 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 79 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 80 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 81 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 82 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 83 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 84 GERMANY: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 85 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 86 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 87 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 88 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 89 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 90 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 91 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 92 FRANCE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 93 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 94 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 95 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 96 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 97 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 98 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 99 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 100 UK: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 101 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 102 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 103 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 104 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 105 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 106 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 107 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 108 SPAIN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 109 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 110 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 111 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 112 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 113 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 114 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 115 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 116 REST OF EUROPE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 118 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 119 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 120 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 122 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 123 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 124 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 125 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 126 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 127 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 128 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 129 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 130 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 131 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 132 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 133 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 134 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 135 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 136 CHINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 137 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 138 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 139 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 140 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 141 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 142 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 143 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 144 JAPAN: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 145 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 146 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 147 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 148 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 149 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 150 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 151 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 152 INDIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 153 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 154 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 155 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 156 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 157 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 158 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 159 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 160 SOUTH KOREA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 162 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 163 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 164 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 166 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 167 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 170 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 171 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 174 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 175 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 178 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 179 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 181 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 182 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 183 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 184 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 185 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 186 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 187 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 188 SAUDI ARABIA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 189 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 190 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 191 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 192 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 193 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 194 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 195 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 196 UAE: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 197 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 198 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 199 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 200 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 201 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 202 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 203 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 204 REST OF GCC COUNTRIES: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 206 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 207 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 213 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (TON)

- TABLE 214 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (TON)

- TABLE 215 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 216 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 217 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 218 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 219 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 220 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 221 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 222 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 223 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 224 SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 225 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 226 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 227 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 228 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 229 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 230 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 231 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 232 BRAZIL: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 233 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 234 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 235 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 236 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 237 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 238 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 239 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 240 ARGENTINA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 241 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (TON)

- TABLE 242 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (TON)

- TABLE 243 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2022-2024 (USD MILLION)

- TABLE 244 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (TON)

- TABLE 246 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (TON)

- TABLE 247 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 248 REST OF SOUTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 249 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE ARAMID FIBER MARKET BETWEEN 2023 AND 2025

- TABLE 250 AUTOMOTIVE ARAMID FIBER MARKET: DEGREE OF COMPETITION

- TABLE 251 AUTOMOTIVE ARAMID FIBER MARKET: REGION FOOTPRINT

- TABLE 252 AUTOMOTIVE ARAMID FIBER MARKET: TYPE FOOTPRINT

- TABLE 253 AUTOMOTIVE ARAMID FIBER MARKET: APPLICATION FOOTPRINT

- TABLE 254 AUTOMOTIVE ARAMID FIBER MARKET: KEY STARTUPS/SMES

- TABLE 255 AUTOMOTIVE ARAMID FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 256 AUTOMOTIVE ARAMID FIBER MARKET: PRODUCT LAUNCHES, JANUARY 2023-JUNE 2025

- TABLE 257 AUTOMOTIVE ARAMID FIBER MARKET: DEALS, JANUARY 2023-JUNE 2025

- TABLE 258 AUTOMOTIVE ARAMID FIBER MARKET: EXPANSIONS, JANUARY 2023-JUNE 2025

- TABLE 259 DUPONT: COMPANY OVERVIEW

- TABLE 260 DUPONT: PRODUCTS OFFERED

- TABLE 261 DUPONT: PRODUCT LAUNCHES, JANUARY 2023- JUNE 2025

- TABLE 262 DUPONT: DEALS, JANUARY 2023-JUNE 2025

- TABLE 263 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 264 TEIJIN LIMITED: PRODUCTS OFFERED

- TABLE 265 TEIJIN LIMITED: EXPANSIONS, JANUARY 2023-JUNE 2025

- TABLE 266 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 267 KOLON INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 268 KOLON INDUSTRIES, INC.: DEALS, JANUARY 2023-JUNE 2025

- TABLE 269 KOLON INDUSTRIES, INC.: EXPANSIONS, JANUARY 2023-JUNE 2025

- TABLE 270 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 271 YANTAI TAYHO ADVANCED MATERIALS CO., LTD.: PRODUCTS OFFERED

- TABLE 272 HYOSUNG: COMPANY OVERVIEW

- TABLE 273 HYOSUNG: PRODUCTS OFFERED

- TABLE 274 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 275 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 276 X-FIPER NEW MATERIAL CO., LTD: COMPANY OVERVIEW

- TABLE 277 X-FIPER NEW MATERIAL CO., LTD: PRODUCTS OFFERED

- TABLE 278 HUVIS CORP.: COMPANY OVERVIEW

- TABLE 279 HUVIS CORP.: PRODUCTS OFFERED

- TABLE 280 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.: COMPANY OVERVIEW

- TABLE 281 CHINA NATIONAL BLUESTAR (GROUP) CO, LTD.: PRODUCTS OFFERED

- TABLE 282 AFCHINA: COMPANY OVERVIEW

- TABLE 283 AFCHINA: PRODUCTS OFFERED

- TABLE 284 SINOPEC YIZHENG CHEMICAL FIBRE LIMITED LIABILITY COMPANY: COMPANY OVERVIEW

- TABLE 285 TAEKWANG INDUSTRIAL CO., LTD: COMPANY OVERVIEW

- TABLE 286 ARAMID HPM, LLC: COMPANY OVERVIEW

- TABLE 287 SHANGHAI J&S NEW MATERIALS CO., LTD: COMPANY OVERVIEW

- TABLE 288 YF INTERNATIONAL BV: COMPANY OVERVIEW

- TABLE 289 SUZHOU ZHAODA SPECIALLY FIBER TECHNICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 290 ZHANGJIAGANG GANGYING INDUSTRY: COMPANY OVERVIEW

- TABLE 291 VEPLAS D.D.: COMPANY OVERVIEW

- TABLE 292 PRO-SYSTEMS SPA: COMPANY OVERVIEW

- TABLE 293 WUXI GDE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 294 BARNET: COMPANY OVERVIEW

- TABLE 295 ZHEJIANG SURETEX COMPOSITE CO., LTD: COMPANY OVERVIEW

- TABLE 296 HEBEI SILICON VALLEY CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 297 BEAVER MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 298 BALLY RIBBON MILLS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE ARAMID FIBER MARKET: RESEARCH DESIGN

- FIGURE 2 AUTOMOTIVE ARAMID FIBER MARKET: BOTTOM-UP APPROACH

- FIGURE 3 AUTOMOTIVE ARAMID FIBER MARKET: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: AUTOMOTIVE ARAMID FIBER MARKET TOP-DOWN APPROACH

- FIGURE 5 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 6 AUTOMOTIVE ARAMID FIBER MARKET: DATA TRIANGULATION

- FIGURE 7 PARA-ARAMID TYPE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 BREAKING PADS & CLUTCH FACINGS APPLICATION TO LEAD AUTOMOTIVE ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 10 INCREASE IN AUTOMOTIVE PRODUCTION IN ASIA PACIFIC TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 PARA-ARAMID TYPE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 REINFORCED TIRES APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 AUTOMOTIVE ARAMID FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 19 IMPORT DATA FOR HS CODE 550311-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 20 EXPORT DATA FOR HS CODE 550311-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 21 AUTOMOTIVE ARAMID FIBER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 AUTOMOTIVE ARAMID FIBER MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE ARAMID FIBERS, BY REGION, 2022-2024 (USD/KG)

- FIGURE 24 AVERAGE SELLING PRICES OF AUTOMOTIVE ARAMID FIBERS OFFERED BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG)

- FIGURE 25 AUTOMOTIVE ARAMID FIBER MARKET: PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 26 NUMBER OF PATENTS PER YEAR, 2015-2024

- FIGURE 27 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD MILLION)

- FIGURE 31 PARA-ARAMID TO BE LARGER TYPE OF AUTOMOTIVE ARAMID FIBER DURING FORECAST PERIOD

- FIGURE 32 BRAKE PADS & CLUTCH FACINGS APPLICATION TO LEAD AUTOMOTIVE ARAMID FIBER MARKET DURING FORECAST PERIOD

- FIGURE 33 INDIA TO BE FASTEST-GROWING MARKET FOR AUTOMOTIVE ARAMID FIBER DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: AUTOMOTIVE ARAMID FIBER MARKET SNAPSHOT

- FIGURE 35 EUROPE: AUTOMOTIVE ARAMID FIBER MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: AUTOMOTIVE ARAMID FIBER MARKET SNAPSHOT

- FIGURE 37 REVENUE ANALYSIS OF KEY COMPANIES IN AUTOMOTIVE ARAMID FIBER MARKET, 2022-2024

- FIGURE 38 SHARES OF TOP FIVE COMPANIES IN AUTOMOTIVE ARAMID FIBER MARKET, 2024

- FIGURE 39 VALUATION OF KEY COMPANIES IN AUTOMOTIVE ARAMID FIBER MARKET, 2024

- FIGURE 40 FINANCIAL METRICS OF KEY COMPANIES IN AUTOMOTIVE ARAMID FIBER MARKET, 2024

- FIGURE 41 AUTOMOTIVE ARAMID FIBER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 42 AUTOMOTIVE ARAMID FIBER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 43 AUTOMOTIVE ARAMID FIBER MARKET: COMPANY FOOTPRINT

- FIGURE 44 AUTOMOTIVE ARAMID FIBER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 45 DUPONT: COMPANY SNAPSHOT

- FIGURE 46 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 47 KOLON INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 48 HYOSUNG: COMPANY SNAPSHOT

- FIGURE 49 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT