|

市场调查报告书

商品编码

1915208

全球儿童血管通路市场按类型、应用和最终用户划分-预测至2030年Pediatric Vascular Access Market by Type (Catheters (CVC, PIVC, PICC), Ports, IV Sets, Infusion Pumps), Application (Drug Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, ASCs) - Global Forecast to 2030 |

||||||

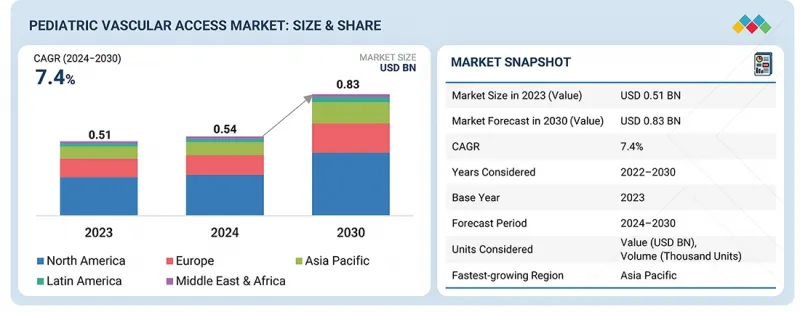

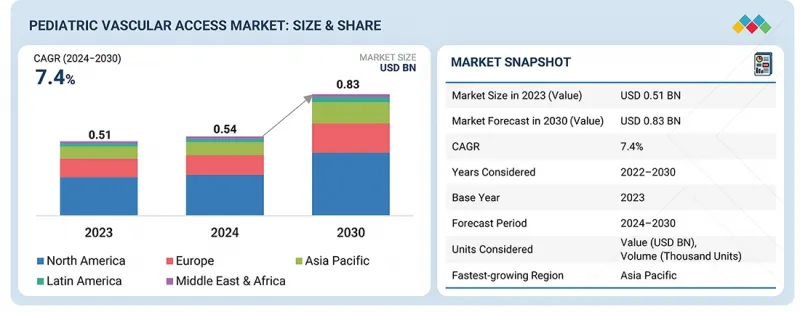

全球儿童血管通路市场预计将从2024年的5.43亿美元成长到2030年的8.331亿美元,预测期内复合年增长率(CAGR)为7.4%。儿科儿童通路市场呈现稳定成长的态势,这主要得益于多种因素,例如早产儿数量的增加、导管材料安全性和舒适性的提升以及新生儿加护病房(NICU)收治患者数量的增长。

| 调查范围 | |

|---|---|

| 调查期 | 2023-2030 |

| 基准年 | 2023 |

| 预测期 | 2024-2030 |

| 单元 | 100万美元 |

| 部分 | 类型、用途、最终用户、区域 |

| 目标区域 | 北美、欧洲、亚太地区、拉丁美洲、中东和非洲 |

此外,智慧血管通路装置的普及也推动了住院患者数量的成长,尤其是在北美、欧洲和亚太地区。总体而言,发展中国家医疗保健成本的不断上涨为市场成长创造了新的机会。

根据导管类型划分,预计在预测期内,儿童血管通路市场的周边静脉导管 (PIVC) 部分将维持最高的复合年增长率。

由于週边静脉导管(PIVC)在为高风险新生儿提供安全有效的血管通路方面发挥着至关重要的作用,预计在预测期内,儿童血管通路市场中的PIVC细分市场将实现最高的复合年增长率。 PIVC设计用于短期使用,通常持续24至96小时。在需要频繁介入的新生儿加护病房(NICU)中,PIVC是输注药物、液体和血液製品的首选。

按最终用户划分,儿童血管通路市场的门诊手术中心 (ASC) 细分市场预计将迎来第二高的成长率。

由于日间手术中心(ASC)具有成本效益高、方便快速以及以患者为中心的护理理念,因此越来越多地被选为传统医院以外的新生儿干预措施的替代方案。日间手术中心通常专注于需要使用先进血管通路装置的手术,例如经外周静脉置入的中心静脉导管(PIVC)、周边置入的中央静脉导管(PICC)和中线导管。这些装置对于在可控制的微创环境下处理先天性异常、早产併发症以及术后恢復等情况至关重要。在大型医院之外进行这些手术能够在降低成本的同时保持高标准的护理,使其成为医护人员和患者都青睐的选择。

预计在预测期内,亚太地区儿童血管通路市场的复合年增长率将最高。

亚太地区儿童血管通路市场正因人口结构、经济和医疗基础设施的动态而快速成长。人口的快速成长和早产儿发病率的上升,尤其是在中国和印度,正推动新生儿专用血管器械需求的激增。该地区各国政府正将改善新生儿护理作为优先事项,投资兴建先进的新生儿加护病房(NICU),并依照国际标准发展医疗设施。例如,中国国家卫生健康委员会已启动一项旨在改善新生儿关键护理(包括血管通路技术)可近性的计画。日本先进的医疗生态系统正越来越多地采用先进技术,例如人工智慧整合监测系统和超小型导管。亚太地区的经济扩张进一步推动了市场成长,因为可支配收入的增加和中产阶级的壮大扩大了人们获得优质医疗解决方案的机会。在韩国和新加坡,由于医疗领域技术融合的文化,智慧血管器材的应用正在激增。

本报告分析了全球儿童血管通路市场,深入探讨了关键驱动因素和限制因素、产品开发和创新以及竞争格局。

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 主要发现

- 儿童血管通路市场中企业面临的诱人机会

- 按地区分類的儿童血管通路市场

第五章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

- 技术分析

- 主要技术

- 互补技术

- 邻近技术

- 产业趋势

- 微创血管通路手术

- 导管材料和涂层的创新

- 价值链分析

- 生态系分析

- 供应链分析

- 贸易分析

- 进口方案(HS编码901839)

- 出口方案(HS编码901839)

- 波特五力分析

- 主要相关利益者和采购标准

- 监管环境

- 法规结构

- 监管机构、政府机构和其他组织

- 专利分析

- 定价分析

- 主要企业平均售价趋势

- 各地区平均销售价格趋势

- 重大会议和活动(2025-2026)

- 邻近市场分析

- 未满足的需求/最终用户期望

- 影响客户业务的趋势与干扰因素

- 投资和资金筹措方案

- 人工智慧/生成式人工智慧的影响

- 美国2025年关税

- 主要关税税率

- 价格影响分析

- 对国家的影响

- 对终端用户产业的影响

第六章儿童血管通路市场(按类型划分)

- 导管

- 导管固定稳定

- 植入式连接埠

- 端口针

- 点滴帮浦

- 静脉输液连接器

- 注射器/针头

- 血管闭合装置

- 点滴器及配件

- 麻醉注射器

- 导向装置

- 导管盖子与封口装置

- 骨内注射装置

- 其他类型

第七章 依应用分類的儿童血管通路市场

- 输液和营养液

- 剂量

- 诊断和检测

- 输血

第八章 以最终用户分類的儿童血管通路市场

- 医院

- 门诊手术中心及诊所

- 居家照护环境

- 其他最终用户

第九章 各地区儿童血管通路市场

- 北美洲

- 宏观经济展望

- 美国

- 加拿大

- 欧洲

- 亚太地区

- 宏观经济展望

- 日本

- 中国

- 亚太其他地区

第十章 竞争格局

- 主要参与企业的策略/优势(2022-2024)

- 收入分析(2022-2024)

- 市占率分析(2024 年)

- 企业评估矩阵:主要企业(2024)

- 公司评估矩阵:Start-Ups/中小企业(2024 年)

- 公司估值和财务指标

- 品牌/产品对比

- 竞争场景

第十一章:公司简介

- 主要企业

- BECTON, DICKINSON AND COMPANY

- TELEFLEX INCORPORATED

- ICU MEDICAL, INC.

- B. BRAUN SE

- TERUMO CORPORATION

- MEDTRONIC

- VYGON

- NIPRO CORPORATION

- ANGIODYNAMICS

- COOK MEDICAL

- 其他公司

- CANADIAN HOSPITAL SPECIALTIES LIMITED

- MERIT MEDICAL SYSTEMS, INC.

- MEDICAL COMPONENTS, INC.

- AMECATH

- ARGON MEDICAL DEVICES

- HEALTH LINE INTERNATIONAL CORPORATION

- DELTA MED

- ACCESS VASCULAR, INC.

- PAKUMEDMEDICAL PRODUCTS GMBH

- GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- PFM MEDICAL

- POLY MEDICURE LTD

- NEWTECH MEDICAL DEVICES PVT. LTD.

- SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- ANGIPLAST PRIVATE LIMITED

第十二章附录

The global pediatric vascular access market is projected to reach USD 833.1 million by 2030 from USD 543.0 million in 2024, at a CAGR of 7.4% during the forecast period. The pediatric vascular access market is witnessing consistent growth due to various factors such as preterm births, advancement in catheter materials in terms of safety and comfort, and growing NICU admissions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific , Latin America, Middle East & Africa |

There has also been a shift towards smart vascular access devices, particularly in North America, Europe, and the Asia Pacific, where there is an increase in hospitalizations. Overall, increased healthcare expenditure in developing markets is bringing new opportunities to market growth.

The Peripheral Intravenous Catheters (PIVC) segment of the pediatric vascular access market, by the type of catheters, is expected to hold the highest CAGR during the forecast period.

The Peripheral Intravenous Catheters (PIVC) segment within the Pediatric Vascular Access market is anticipated to exhibit the highest CAGR during the forecast period due to its critical role in facilitating safe and efficient vascular access for high-risk newborns. PIVCs are designed for short-term use, typically lasting 24-96 hours. They are preferred for administering medications, fluids, and blood products in neonatal intensive care units (NICUs), where frequent interventions are required.

The Ambulatory Surgical Centers (ASCs) segment of the pediatric vascular access market, by end user, is expected to show the second-highest growth.

ASCs are increasingly becoming a preferred alternative to traditional hospital settings for certain neonatal interventions due to their cost-effectiveness, convenience, and focus on patient-centered care. ASCs often specialize in procedures that require advanced vascular access devices, such as peripheral intravenous catheters (PIVCs), peripherally inserted central catheters (PICCs), and midline catheters. These devices are essential for managing conditions such as congenital anomalies, preterm complications, or post-surgical recovery in a controlled, less intensive setting. The ability to perform these procedures outside of a full-scale hospital environment reduces costs while maintaining high standards of care, making ASCs an attractive option for providers and patients.

Asia Pacific is expected to grow at the highest CAGR during the forecast period in the pediatric vascular access market.

The pediatric vascular access market in the Asia Pacific region is growing rapidly due to demographic, economic, and healthcare infrastructure dynamics. With a rapidly growing population and rising incidence of preterm births, particularly in China and India, the demand for specialized vascular devices tailored to neonates is surging. Governments across the region are prioritizing improvements in neonatal care, investing in advanced NICUs, and upgrading healthcare facilities to align with global standards. For instance, China's National Health Commission has launched initiatives to enhance access to critical neonatal interventions, including vascular access technologies. Japan's sophisticated healthcare ecosystem continues to adopt cutting-edge technologies such as AI-integrated monitoring systems and ultra-miniaturized catheters. Economic expansion in the Asia Pacific is further fueling market growth as rising disposable incomes and expanding middle-class populations increase access to premium medical solutions. South Korea and Singapore are witnessing heightened adoption of smart vascular devices, driven by a culture of technological integration in healthcare.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 28%, Tier 2: 34%, and Tier 3: 38%

- By Designation: C-level: 40%, Director Level: 26%, and Others: 34%

- By Region: North America: 25%, Europe: 41%, Asia Pacific: 30%, Latin America: 3%, and Middle East & Africa: 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the Pediatric Vascular Access market include BD (US), Teleflex Incorporated (US), ICU Medical, Inc. (US), B. Braun SE (Germany), Angiodynamics, Inc. (US), Terumo Corporation (Japan), Nipro Medical Corporation (Japan), and Medtronic Plc (Ireland)

Research Coverage

This report studies the pediatric vascular access market based on type, applications, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of preterm births, advancements in catheter materials in terms of safety and comfort, and growing NICU admissions), restraints (high prices of vascular access devices), opportunities (technological advancements), challenges (balancing innovations with cost-effectiveness)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the pediatric vascular access market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the Pediatric Vascular Access market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the pediatric vascular access industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as BD, Teleflex Incorporated, ICU Medical, Inc., B. Braun SE, AngioDynamics, Inc., Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Insights from industry experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.5.1 METHODOLOGY-RELATED LIMITATIONS

- 2.5.2 SCOPE-RELATED LIMITATIONS

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEDIATRIC VASCULAR ACCESS MARKET

- 4.2 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapidly growing pediatric population

- 5.2.1.2 Rise of pediatric cancer

- 5.2.1.3 Heightened use of vascular access devices in pediatric patients

- 5.2.2 RESTRAINTS

- 5.2.2.1 Costly placement and maintenance of Pediatric vascular access devices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in vascular access devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of skilled healthcare professionals

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Imaging and navigation

- 5.3.1.2 Catheter securement and stabilization

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Artificial intelligence and machine learning

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 Infection control technologies

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 MINIMALLY INVASIVE VASCULAR ACCESS PROCEDURES

- 5.4.2 INNOVATIONS IN CATHETER MATERIALS AND COATINGS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 901839)

- 5.8.2 EXPORT SCENARIO (HS CODE 901839)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY FRAMEWORK

- 5.11.1.1 North America

- 5.11.1.1.1 US

- 5.11.1.1.2 Canada

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.1.4 Latin America

- 5.11.1.5 Middle East & Africa

- 5.11.1.1 North America

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY FRAMEWORK

- 5.12 PATENT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.13.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 VASCULAR ACCESS DEVICE MARKET

- 5.16 UNMET NEEDS/END USER EXPECTATIONS

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI

- 5.20 US 2025 TARIFF

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRY/REGION

- 5.20.4.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.5 IMPACT ON END-USE INDUSTRY

6 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 CATHETERS

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.2.1.1 Increased prevalence of preterm births to drive market

- 6.2.2 PERIPHERAL INTRAVENOUS CATHETERS

- 6.2.2.1 Rapid adoption of minimally invasive procedures to drive market

- 6.2.3 PERIPHERALLY INSERTED CENTRAL CATHETERS

- 6.2.3.1 Need for long-term vascular access in premature neonates to drive market

- 6.2.4 MIDLINE CATHETERS

- 6.2.4.1 Advancements in catheter materials and insertion techniques to drive market

- 6.2.1 CENTRAL VENOUS CATHETERS

- 6.3 CATHETER SECUREMENT & STABILIZATION

- 6.3.1 IMPROVED AWARENESS ABOUT CATHETER STABILIZATION TO DRIVE MARKET

- 6.4 IMPLANTABLE PORTS

- 6.4.1 RISING INCIDENCES OF PEDIATRIC CANCER TO DRIVE MARKET

- 6.5 PORT NEEDLES

- 6.5.1 INCREASED USE OF IMPLANTABLE PORTS IN PEDIATRIC CARE TO DRIVE MARKET

- 6.6 INFUSION PUMPS

- 6.6.1 HEIGHTENED DEMAND FOR PRECISE DRUG DELIVERY IN PEDIATRIC CARE TO DRIVE MARKET

- 6.7 IV CONNECTORS

- 6.7.1 STRINGENT HOSPITAL PROTOCOLS TO DRIVE MARKET

- 6.8 SYRINGES & NEEDLES

- 6.8.1 NEED FOR SAFE DRUG ADMINISTRATION IN PEDIATRICS TO DRIVE MARKET

- 6.9 VASCULAR CLOSURE DEVICES

- 6.9.1 SURGE IN MINIMALLY INVASIVE PROCEDURES IN PEDIATRIC TO DRIVE MARKET

- 6.10 IV SETS & ACCESSORIES

- 6.10.1 RISE IN PEDIATRIC CONDITIONS REQUIRING INTRAVENOUS THERAPY TO DRIVE MARKET

- 6.11 ANESTHESIA INJECTION DEVICES

- 6.11.1 GROWING PEDIATRICS PROCEDURES TO DRIVE MARKET

- 6.12 GUIDANCE DEVICES

- 6.12.1 ESCALATING DEMAND FOR SAFER AND MORE EFFECTIVE VASCULAR ACCESS PROCEDURES TO DRIVE MARKET

- 6.13 CATHETER CAPS & CLOSURES

- 6.13.1 ADOPTION OF INFECTION PREVENTION PROTOCOLS BY PEDIATRIC CARE UNITS TO DRIVE MARKET

- 6.14 INTRAOSSEOUS INFUSION DEVICES

- 6.14.1 RISING PEDIATRIC EMERGENCIES AND SEPSIS CASES TO DRIVE MARKET

- 6.15 OTHER TYPES

7 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 FLUID & NUTRITION ADMINISTRATION

- 7.2.1 NEED FOR PRECISE, CONTINUOUS THERAPY IN PEDIATRIC POPULATION TO DRIVE MARKET

- 7.3 DRUG ADMINISTRATION

- 7.3.1 RISE IN PEDIATRIC HEALTH COMPLEXITIES TO DRIVE MARKET

- 7.4 DIAGNOSTICS & TESTING

- 7.4.1 ELEVATED DEMAND FOR EARLY DISEASE DETECTION, SEPSIS MANAGEMENT, AND MONITORING TO DRIVE MARKET

- 7.5 BLOOD TRANSFUSION

- 7.5.1 PREVALENCE OF PRETERM BIRTHS AND NEONATAL ANEMIA TO DRIVE MARKET

8 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 GROWING NICU ADMISSIONS DUE TO PREMATURE BIRTHS AND CONGENITAL CONDITIONS TO DRIVE MARKET

- 8.3 AMBULATORY SURGICAL CENTERS & CLINICS

- 8.3.1 INCREASING PREFERENCE FOR OUTPATIENT CARE TO DRIVE MARKET

- 8.4 HOMECARE SETTINGS

- 8.4.1 EMERGING TREND OF EARLY HOSPITAL DISCHARGE TO DRIVE MARKET

- 8.5 OTHER END USERS

9 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Increasing burden of pediatric cancer to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising preterm births and NICU admissions to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK

- 9.4.2 JAPAN

- 9.4.2.1 Growing focus on pediatric care to drive market

- 9.4.3 CHINA

- 9.4.3.1 Substantial investments in healthcare infrastructure to drive market

- 9.4.4 REST OF ASIA PACIFIC

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Type footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End user footprint

- 10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING

- 10.6.5.1 List of start-ups/SMEs

- 10.6.5.2 Competitive benchmarking of start-ups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 TELEFLEX INCORPORATED

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 ICU MEDICAL, INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 B. BRAUN SE

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 TERUMO CORPORATION

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Right to win

- 11.1.5.3.2 Strategic choice

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 MEDTRONIC

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 VYGON

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 NIPRO CORPORATION

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 ANGIODYNAMICS

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches & approvals

- 11.1.9.3.2 Deals

- 11.1.10 COOK MEDICAL

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.1 BECTON, DICKINSON AND COMPANY

- 11.2 OTHER PLAYERS

- 11.2.1 CANADIAN HOSPITAL SPECIALTIES LIMITED

- 11.2.2 MERIT MEDICAL SYSTEMS, INC.

- 11.2.3 MEDICAL COMPONENTS, INC.

- 11.2.4 AMECATH

- 11.2.5 ARGON MEDICAL DEVICES

- 11.2.6 HEALTH LINE INTERNATIONAL CORPORATION

- 11.2.7 DELTA MED

- 11.2.8 ACCESS VASCULAR, INC.

- 11.2.9 PAKUMEDMEDICAL PRODUCTS GMBH

- 11.2.10 GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- 11.2.11 PFM MEDICAL

- 11.2.12 POLY MEDICURE LTD

- 11.2.13 NEWTECH MEDICAL DEVICES PVT. LTD.

- 11.2.14 SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD.

- 11.2.15 ANGIPLAST PRIVATE LIMITED

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

List of Tables

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- TABLE 2 IMPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 3 EXPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2024 (USD THOUSAND)

- TABLE 4 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE TYPES

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS, 2022-2024 (USD)

- TABLE 13 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 14 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 UNMET NEEDS/END USER EXPECTATIONS

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR VASCULAR ACCESS DEVICES

- TABLE 18 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 19 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS, BY REGION, 2023-2030 (THOUSAND UNITS)

- TABLE 20 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS, BY TYPE, 2023-2030 (USD MILLION)

- TABLE 21 PEDIATRIC VASCULAR ACCESS MARKET FOR CENTRAL VENOUS CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 22 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERAL INTRAVENOUS CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 23 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERALLY INSERTED CENTRAL CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 24 PEDIATRIC VASCULAR ACCESS MARKET FOR MIDLINE CATHETERS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 25 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER SECUREMENT & STABILIZATION, BY REGION, 2023-2030 (USD MILLION)

- TABLE 26 PEDIATRIC VASCULAR ACCESS MARKET FOR IMPLANTABLE PORTS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 27 PEDIATRIC VASCULAR ACCESS MARKET FOR PORT NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 28 PEDIATRIC VASCULAR ACCESS MARKET FOR INFUSION PUMPS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 29 PEDIATRIC VASCULAR ACCESS MARKET FOR IV CONNECTORS, BY REGION, 2023-2030 (USD MILLION)

- TABLE 30 PEDIATRIC VASCULAR ACCESS MARKET FOR SYRINGES & NEEDLES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 31 PEDIATRIC VASCULAR ACCESS MARKET FOR VASCULAR CLOSURE DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 32 PEDIATRIC VASCULAR ACCESS MARKET FOR IV SETS & ACCESSORIES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 33 PEDIATRIC VASCULAR ACCESS MARKET FOR ANESTHESIA INJECTION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 34 PEDIATRIC VASCULAR ACCESS MARKET FOR GUIDANCE DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 35 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER CAPS & CLOSURES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 36 PEDIATRIC VASCULAR ACCESS MARKET FOR INTRAOSSEOUS INFUSION DEVICES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 37 PEDIATRIC VASCULAR ACCESS MARKET FOR OTHER TYPES, BY REGION, 2023-2030 (USD MILLION)

- TABLE 38 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION, 2023-2030 (USD MILLION)

- TABLE 39 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER, 2023-2030 (USD MILLION)

- TABLE 40 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 42 US: KEY MACRO INDICATORS

- TABLE 43 CANADA: KEY MACRO INDICATORS

- TABLE 44 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 45 JAPAN: KEY MACRO INDICATORS

- TABLE 46 CHINA: KEY MACRO INDICATORS

- TABLE 47 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 48 PEDIATRIC VASCULAR ACCESS MARKET: DEGREE OF COMPETITION

- TABLE 49 REGION FOOTPRINT

- TABLE 50 TYPE FOOTPRINT

- TABLE 51 APPLICATION FOOTPRINT

- TABLE 52 END USER FOOTPRINT

- TABLE 53 LIST OF START-UPS/SMES

- TABLE 54 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 55 PEDIATRIC VASCULAR ACCESS MARKET: PRODUCT LAUNCHES & APPROVALS, 2022-2025

- TABLE 56 PEDIATRIC VASCULAR ACCESS MARKET: DEALS, 2022-2025

- TABLE 57 PEDIATRIC VASCULAR ACCESS MARKET: OTHER DEVELOPMENTS, 2022-2025

- TABLE 58 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- TABLE 59 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED

- TABLE 60 TELEFLEX INCORPORATED: COMPANY OVERVIEW

- TABLE 61 TELEFLEX INCORPORATED: PRODUCTS OFFERED

- TABLE 62 TELEFLEX INCORPORATED: PRODUCT LAUNCHES & APPROVALS

- TABLE 63 TELEFLEX INCORPORATED, INC:. DEALS

- TABLE 64 TELEFLEX INCORPORATED: OTHER DEVELOPMENTS

- TABLE 65 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 66 ICU MEDICAL, INC.: PRODUCTS OFFERED

- TABLE 67 ICU MEDICAL, INC.: DEALS

- TABLE 68 B. BRAUN SE: COMPANY OVERVIEW

- TABLE 69 B. BRAUN SE: PRODUCTS OFFERED

- TABLE 70 B. BRAUN SE: PRODUCT LAUNCHES & APPROVALS

- TABLE 71 B. BRAUN SE: DEALS

- TABLE 72 TERUMO CORPORATION: COMPANY OVERVIEW

- TABLE 73 TERUMO CORPORATION: PRODUCTS OFFERED

- TABLE 74 MEDTRONIC: COMPANY OVERVIEW

- TABLE 75 MEDTRONIC: PRODUCTS OFFERED

- TABLE 76 VYGON: COMPANY OVERVIEW

- TABLE 77 VYGON: PRODUCTS OFFERED

- TABLE 78 NIPRO CORPORATION: COMPANY OVERVIEW

- TABLE 79 NIPRO CORPORATION: PRODUCTS OFFERED

- TABLE 80 ANGIODYNAMICS: COMPANY OVERVIEW

- TABLE 81 ANGIODYNAMICS: PRODUCTS OFFERED

- TABLE 82 ANGIODYNAMICS: PRODUCT LAUNCHES & APPROVALS

- TABLE 83 ANGIODYNAMICS: DEALS

- TABLE 84 COOK MEDICAL: COMPANY OVERVIEW

- TABLE 85 COOK MEDICAL: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PEDIATRIC VASCULAR ACCESS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 7 PEDIATRIC VASCULAR ACCESS MARKET: CAGR PROJECTIONS

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 CATHETERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 FLUID & NUTRITION ADMINISTRATION SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD

- FIGURE 11 HOSPITALS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR VASCULAR ACCESS DEVICES DURING FORECAST PERIOD

- FIGURE 13 RISE OF PEDIATRIC POPULATION TO DRIVE MARKET

- FIGURE 14 NORTH AMERICA TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 15 PEDIATRIC VASCULAR ACCESS MARKET DYNAMICS

- FIGURE 16 VALUE CHAIN ANALYSIS

- FIGURE 17 ECOSYSTEM ANALYSIS

- FIGURE 18 SUPPLY CHAIN ANALYSIS

- FIGURE 19 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE TYPES

- FIGURE 22 PATENT ANALYSIS, 2014-2024

- FIGURE 23 TOP APPLICANT REGIONS, 2014-2025

- FIGURE 24 AVERAGE SELLING PRICE TREND OF CENTRAL VENOUS CATHETERS, BY REGION, 2022-2024 (USD)

- FIGURE 25 VASCULAR ACCESS DEVICE MARKET OVERVIEW

- FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 28 IMPACT OF AI/GEN AI

- FIGURE 29 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION

- FIGURE 30 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS DEVICE MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET SNAPSHOT

- FIGURE 32 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2022-2024

- FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 34 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 35 COMPANY FOOTPRINT

- FIGURE 36 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024

- FIGURE 37 EV/EBITDA OF KEY VENDORS

- FIGURE 38 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 39 BRAND/PRODUCT COMPARISON

- FIGURE 40 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

- FIGURE 41 TELEFLEX INCORPORATED: COMPANY SNAPSHOT

- FIGURE 42 ICU MEDICAL, INC.: COMPANY SNAPSHOT

- FIGURE 43 B. BRAUN SE: COMPANY SNAPSHOT

- FIGURE 44 TERUMO CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 MEDTRONIC: COMPANY SNAPSHOT

- FIGURE 46 NIPRO CORPORATION: COMPANY SNAPSHOT

- FIGURE 47 ANGIODYNAMICS: COMPANY SNAPSHOT