|

市场调查报告书

商品编码

1462330

商业建筑人工智慧(AI)竞争格局(2024)The Competitive Landscape for AI in Commercial Buildings 2024 |

||||||

本报告是截至 2024 年商业建筑供应商人工智慧解决方案市场的最新映射和分析。

这项新研究以Memoori 的2021 年人工智慧(AI) 市场分析为基础,旨在探索AI 的整体能力和专业知识,以实现更智慧、更永续、反应更灵敏的建筑环境。

详细分析描绘了智慧建筑公司人工智慧的国际格局,并提供了市场结构的清晰图像。读者可以评估各种人工智慧应用的成熟度和潜力,并识别业界领先的供应商。

该报告包含一个电子錶格,将 361 家领先公司(比 2021 年的 255 家增加了 42%)分类为 66 个人工智慧用例,无需额外费用。连同其姐妹报告,这是迄今为止发布的关于人工智慧对商业建筑影响的最完整的评估。

本报告是两部分报告中的第二部分。 第 1 部分解释了人工智慧技术、商业机会和用例。 这两份报告均包含在我们的2024 年高级订阅服务中,您可以使用大规模语言模型(LLM) 查询我们的所有研究。 AIM。

主要问题

- 谁是塑造商业建筑人工智慧未来的关键公司? 这份报告详细分析了 361 家在人工智慧领域运作的公司,依照用例、公司成立时间和公司规模进行分类。该报告随附的电子錶格将公司分为 66 个不同的用例,其中人工智慧正在智慧建筑市场中积极开发,以供进一步分析。

- 各大公司的AI策略是什么?本报告审视了 17 家领先公司的策略定位,这些公司在多个人工智慧用例中提供产品和服务。特别是大型楼宇自动化公司(例如Carrier、Honeywell)和大型科技公司(例如Amazon、Microsoft ) ,调查半导体公司(GARM、NVIDIA等)的策略、定位和最新创新。

- 商业建筑人工智慧的投资现况如何? 本报告审查了每个国家披露的平均资金总额以及获得资金的私人公司数量。

这份报告由179页文字和37张图表组成,提取了所有重要事实并得出结论,让您可以瞭解AI技术如何应用于商业建筑,也可以准确瞭解原因;

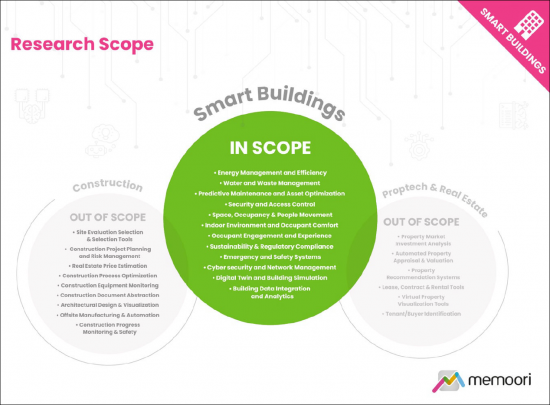

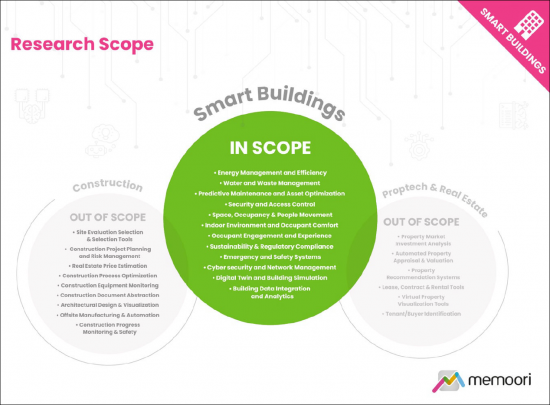

- 本报告重点在于与商业建筑目前营运直接相关的用例,例如建筑性能、永续性和住户体验。另一方面,它没有涵盖人工智慧在设计和施工阶段的使用。

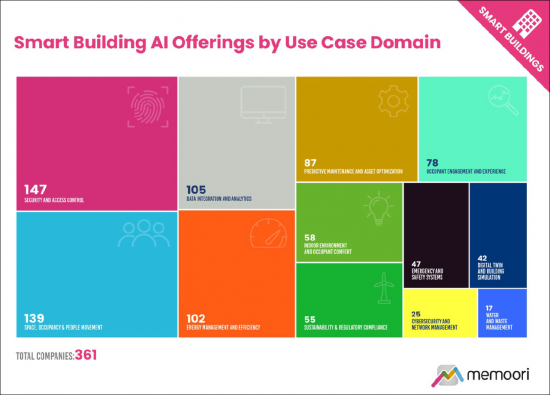

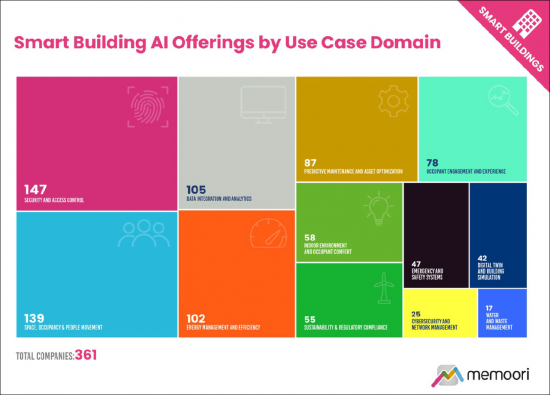

- 纵观所有用例的所有 12 个主要领域(总共 66 个),安全性和存取控制成为最受欢迎的领域 (40.7%)。其次是空间、空缺和人员流动(38.5%)、数据整合和分析(29.1%)以及能源管理和效率(28.3%)。

- 美国在私人投资的人工智慧公司数量上遥遥领先,有 88 家公司,但每家公司披露的平均融资金额为 2 亿日元,最昂贵,为 8700 万美元。

本报告提供了宝贵的信息,可帮助公司改善策略规划并考虑部署人工智慧技术来发展业务的潜力。

目录

前言

调查范围与方法

执行摘要

第一章市场现况及趋势

- 全球智慧建筑人工智慧公司状况

- 智慧建筑人工智慧市场:依用例

- 智慧建筑人工智慧市场:依公司年龄划分

- 智慧建筑人工智慧市场:依公司规模划分

第 2 章依用例划分的竞争格局

- 能源管理/效率

- 供水和污水管理

- 人工智慧硬体运算

- 安全/存取控制

- 空间/空缺/人员流动

- 室内环境/使用者舒适度

- 居民参与度与体验

- 永续性和监管合规性

- 紧急/安全系统

- 网路安全/网路管理

- 数位孪生/建筑模拟

- 资料整合/分析

第三章主要企业策略定位

- 楼宇自动化公司

- ABB

- Carrier

- Honeywell

- Johnson Controls

- Schneider Electric

- Siemens

- Major Tech Firms

- Amazon

- Cisco

- IBM

- Microsoft

- Samsung

- 主要半导体公司

- AMD

- ARM

- Intel

- NVIDIA

- Qualcomm

第四章併购与投资

- 企业併购 (M&A)

- 投资趋势

- 依地区划分的投资趋势

- 着名投资交易

This Report is a New 2024 Mapping and Analysis of Vendor AI Solutions for the Commercial Buildings Market

This new research builds on Memoori's previous 2021 Artificial Intelligence (AI) market analysis, exploring the immense progress that has occurred both in the capabilities of AI and the growing vendor landscape enabling smarter, more sustainable, and more responsive commercial buildings.

The in-depth analysis maps out the global landscape of smart building AI companies, providing a clear picture of the market's structure, and allows the reader to assess the maturity and potential of various AI applications and identify vendors shaping the industry.

It includes, at no extra cost, a spreadsheet that assigns all 361 companies identified (a 42% increase from the 255 companies we identified in 2021) to 66 distinct individual AI use cases. Together with its sister report it is by far the most complete assessment of the impact of AI on commercial buildings published to date.

It is the second in a 2-part series of reports, with the first report providing a review of AI technologies, opportunities and use cases. Both these reports are included in our 2024 Premium Subscription Service, which also gives access to our chatbot AIM, where you can query all our research using the power of Large Language Models (LLMs) .

KEY QUESTIONS ADDRESSED:

- Who are the key players shaping the future of AI commercial building applications? The report provides a granular analysis of 361 companies that we identified as operating in the AI space, segmenting companies by use case, company age, and company size. The spreadsheet that comes with the report provides further in-depth analysis assigning companies to each of the 66 distinct individual use cases where AI is being actively developed for use in the smart buildings market.

- What are the AI strategies of the major players? The report examines the strategic positioning of 17 major players whose offerings typically span multiple use cases for AI. It explores the strategies, positioning and recent innovations of leading building automation firms (e.g. Carrier, Honeywell), big tech (e.g. Amazon, Microsoft), and semiconductor companies (e.g ARM, NVIDIA).

- What does the investment landscape for AI in commercial buildings look like? The report looks at the average total disclosed funding and the number of funded private companies across various countries.

WITHIN ITS 179 PAGES AND 37 CHARTS AND TABLES, THE REPORT FILTERS OUT ALL THE KEY FACTS AND DRAWS CONCLUSIONS, SO YOU CAN UNDERSTAND EXACTLY HOW AI TECHNOLOGY WILL BE APPLIED TO COMMERCIAL BUILDINGS AND WHY;

- The report is focused on the use cases that relate directly to the ongoing operations of commercial buildings, such as building performance, sustainability, and the occupant experience. The scope does not include AI applications for design and construction phases.

- Across 12 distinct use case domains, encompassing a total of 66 individual use cases, Security and Access Control emerges as the most popular domain (40.7%), followed by Space, Occupancy & People Movement (38.5%), Data Integration and Analytics (29.1%), and Energy Management and Efficiency (28.3%).

- In terms of the number of private AI companies being funded, the US is the clear leader with 88, BUT China has the highest average disclosed funding per company at $287 million.

This report provides valuable information to companies so they can improve their strategic planning exercises AND look at the potential for developing their business through implementing AI technology.

WHO SHOULD BUY THIS REPORT?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in commercial buildings (and their advisers) around the world. In particular, those wishing to understand the global landscape of AI & Machine Learning companies in commercial real estate will find it particularly useful.Table of Contents

Preface

Research Scope & Methodology

Executive Summary

1. Market Landscape and Dynamics

- 1.1. The Global Landscape of Smart Building AI Companies

- 1.2. Smart Building AI Market by Use Case

- 1.3. Smart Building AI Market by Company Age

- 1.4. Smart Building AI Market by Company Size

2. Competitive Landscape by Use Case

- 2.1. Energy Management and Efficiency

- 2.2. Water and Waste Management

- 2.3. AI Hardware and Compute

- 2.4. Security and Access Control

- 2.5. Space, Occupancy, and People Movement

- 2.6. Indoor Environment and Occupant Comfort

- 2.7. Occupant Engagement and Experience

- 2.8. Sustainability and Regulatory Compliance

- 2.9. Emergency and Safety Systems

- 2.10. Cybersecurity and Network Management

- 2.11. Digital Twin and Building Simulation

- 2.12. Data Integration and Analytics

3. The Strategic Positioning of Key Players

- 3.1. Building Automation Firms

- ABB

- Carrier

- Honeywell

- Johnson Controls

- Schneider Electric

- Siemens

- 3.2 Major Tech Firms

- Amazon

- Cisco

- IBM

- Microsoft

- Samsung

- 3.3. Major Semiconductor Firms

- AMD

- ARM

- Intel

- NVIDIA

- Qualcomm

4. M&A & Investment

- 4.1. Mergers and Acquisitions

- 4.2. Investment Trends

- Geographic Investment Trends

- Notable Investment Deals

List of Charts and Figures

- Fig 1.0 - Research Scope

- Fig 1.1 - Regional Distribution of Smart Building AI Companies

- Fig 1.2 - AI & Machine Learning Use Cases in Smart Commercial Buildings

- Fig 1.3 - Smart Building AI Offerings by Use Case Domain

- Fig 1.4 - Most Commonly Served Individual Use Cases

- Fig 1.5 - Number of Use Cases Served by Company

- Fig 1.6 - Distribution of Smart Building AI Companies by Age

- Fig 1.7 - Median Company Age by Use Case Domain

- Fig 1.8 - Distribution of Smart Building AI Companies by Size

- Fig 1.9 - Average Company Size by Use Case Domain

- Fig 1.10 - Average Increase in Headcount

- Fig 2.1 - Notable Smart Building AI Companies

- Fig 2.2 - AI for Energy Management & Efficiency in Commercial Buildings

- Fig 2.3 - AI for Water and Waste Management in Commercial Buildings

- Fig 2.4 - AI for Predictive Maintenance and Asset Optimization in Commercial Buildings

- Fig 2.5 - AI for Security and Access Control in Commercial Buildings

- Fig 2.6 - AI for Space, Occupancy & People Movement in Commercial Buildings

- Fig 2.7 - AI for Indoor Environment and Occupant Comfort in Commercial Buildings

- Fig 2.8 - AI for Occupant Engagement and Experience in Commercial Buildings

- Fig 2.9 - AI for Sustainability & Regulatory Compliance in Commercial Buildings

- Fig 2.10 - AI for Emergency and Safety Systems in Commercial Buildings

- Fig 2.11 - AI for Cybersecurity and Network Management in Commercial Buildings

- Fig 2.12 - AI for Digital Twin and Building Simulation in Commercial Buildings

- Fig 2.13 - AI for Data Integration and Analytics in Commercial Buildings

- Fig 4.1 - Global Investment Landscape in AI for Commercial Buildings