|

市场调查报告书

商品编码

1493834

智慧建筑新创企业展望(2024):新创企业格局概览,谁最受关注?The Smart Building Startup Landscape 2024 - Overview of the Startup Landscape. Who is Gaining Traction? |

||||||

本报告是评估智慧建筑新创公司状况的最新(2024 年)权威资源。

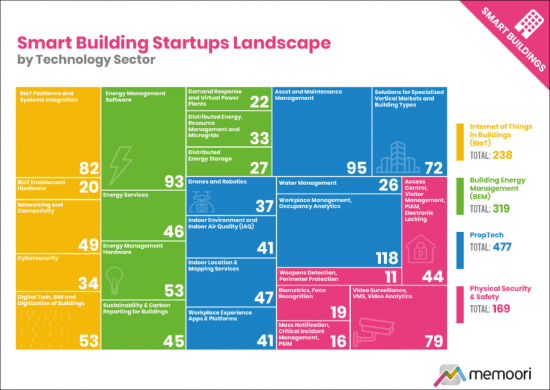

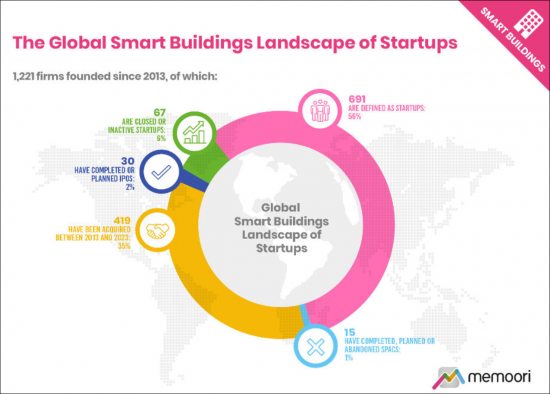

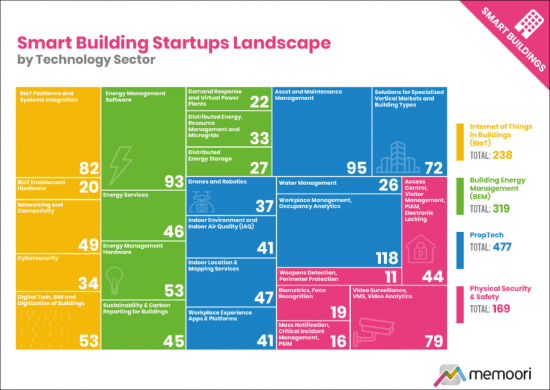

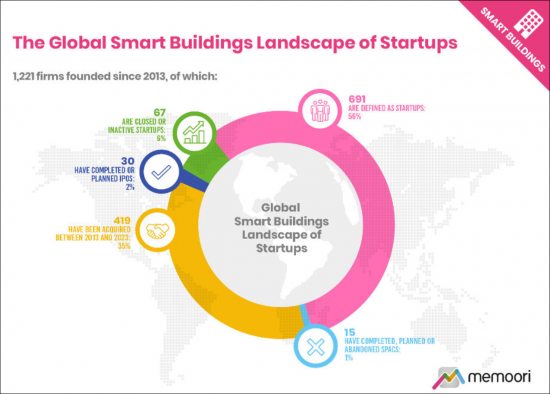

全球智慧商业楼宇市场自2013年以来成立的1,221家家处于管理和营运阶段的公司中,691家公司处于活跃状态,符合新创公司的定义。 在这份报告中,我们从主要细分领域中挑选了100家去年备受关注的新创公司(共16类)进行了详细分析。

新创公司的定义是 "成立不到10年的私人公司,专门从事商业和工业建筑市场,不是大公司的子公司或收购,而是风险投资或私人公司这是一家获得大量股权融资的公司。

此报告包括一个列出所有领先新创公司的电子錶格和一个简报文件,其中包含报告中的高解析度图表和图表,无需额外付费。 该报告也包含在我们最新版本(2024 年)的高级订阅服务中。

本报告的调查详情

- 本报告重点介绍了过去两年在智慧建筑领域关键 16 领域获得关注的 100 家新创公司。其中60%是新进者,尚未在我们先前的报告中被列为驾驶者。

- 这100家公司约占 2013 年以来智慧建筑领域新创公司的 14.5%。

- 本报告涵盖不再经营、不再活跃或已关闭的新创公司(约占所有新创企业的 6%)。我们也确定了过去一年因裁员而失去吸引力的关键新创公司。

本报告中的资讯是基于对智慧建筑市场的严格分析,并基于过去的研究:人工智慧、住宅分析、工作体验应用、物联网、 视讯监控,存取控制。

本报告分为两部分,旨在帮助所有利害关係人和投资者评估新创公司在不断增长的行业中的影响和范围。我们也分析了为什么与其他高科技产业相比,商业建筑的营运和维护阶段的市场扰乱速度较慢。

这份报告由121 页和42 简报幻灯片组成,列出了所有关键事实并得出结论,以便2024 年瞭解2018 年初创企业的状况以及如何这些公司正在塑造房地产科技的未来。

物联网 (IoT) 正在渗透到智慧建筑领域,并且是许多受访的新创公司的关键技术驱动力。 BIoT 类别有 238 家公司,占总数的 19%,所有四个细分市场的新创公司都为物联网技术提供专门的用例,以提高建筑营运效能并增强用户体验,这是一个值得注意的举措。

目录

前言

调查范围与方法

执行摘要

第一章全球智慧建筑新创公司状况

- 智慧建筑新创公司:2015 年以来投资额达 370 亿美元-市场颠覆在哪里?

- 智慧建筑新创公司:依科技领域划分

- 新创公司分布:依地区划分

第 2 章增加智慧建筑新创公司的吸引力

- BIoT(建筑物物联网)

- 建构物联网平台

- 数位孪生解决方案

- 建筑能源管理

- 能源管理软体

- 永续发展与碳管理

- 能源服务

- 能源管理硬体

- 能源储存

- 房地产科技

- 资产管理/维护

- 工作场所管理与工作经验

- 室内测绘与定位服务

- 无人机和机器人

- 室内空气品质 (IAQ)

- 饭店业

- 物理安全

- 门禁/访客管理

- 影片分析/电脑视觉

- 武器探测/周界防御

第三章关闭启动

- 暂停运转期间的启动和关闭

- 对大型新创公司的兴趣下降

第四章智慧建筑新创企业的未来前景

附录

This Report is a New 2024 Definitive Resource for Evaluating the Smart Building Startup Landscape.

Of the 1,221 companies founded since 2013 in the management and operations phase of the global smart commercial buildings space, 691 are active and fit our definition of a startup. This report selects 100 startups for further analysis that have gained traction in the last year across 16 major segments.

Our definition of a Startup is "a private company formed for no more than 10 years, that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is often financed by venture capital or private equity funding."

The report INCLUDES at no extra cost, a spreadsheet listing all the startups gaining traction, and a presentation file with high-resolution charts from the report. This report is also included in our 2024 Premium Subscription Service.

What does this Startup Report tell You?

- It highlights 100 startups that have gained traction in the last two years across 16 major segments in the smart buildings space. 60% of these firms are new entrants, in the sense that they have not been listed before as gaining traction in our previous reports.

- These 100 companies account for around 14.5% of the startups founded since 2013 in the smart buildings space.

- It reviews non-operational or inactive startups and closures, which account for around 6% of the startup landscape. We also identify the major startups that have lost traction through headcount reduction in the last year.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into artificial intelligence, occupancy analytics, workplace experience apps, the Internet of Things, video surveillance, and access control.

This report, the second in a 2-part series, will help all stakeholders and investors to assess the impact and range of startups in growth sectors. It also provides some analysis on why market disruption has been slower in the operation and maintenance phases of commercial buildings compared to other tech industries.

Within its 121 Pages and 42 Presentation Slides, The Report Sieves out all the Key Facts and Draws Conclusions, so you can understand what the StartUp Landscape looks like in 2024 and how these Companies are Shaping the Future of PropTech.

The Internet of Things pervades the smart buildings space and is the major technology driver for many of the startups identified. While the BIoT category accounted for 238 or 19% of the total number of companies, it should be noted that startups are using IoT technology in specialized use cases across all four segments to deliver improved operational performance of buildings and enhanced user experiences.

This report provides valuable information for all stakeholders and investors to assess the impact and range of companies in all growth sectors of the smart buildings space.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startup companies will find it particularly useful. Want to know more?

Table of Contents

Preface

Research Scope and Methodology

Executive Summary

1. The Global Smart Buildings Landscape of Startups

- 1.1. With $37Bn Invested in Smart Building Startups Since 2015, Where is the Market Disruption?

- 1.2. Smart Buildings Startups by Technology Sector

- 1.3. Regional Distribution of Startups

2. Smart Building Startups Gaining Traction

- 2.1. Internet of Things in Buildings (BIoT)

- 2.1.1. Building IoT Platforms

- 2.1.2. Digital Twin Solutions

- 2.2. Building Energy Management

- 2.2.1. Energy Management Software

- 2.2.2. Sustainability and Carbon Management

- 2.2.3. Energy Services

- 2.2.4. Energy Management Hardware

- 2.2.5. Energy Storage

- 2.3. PropTech

- 2.3.1. Asset Management and Maintenance

- 2.3.2. Workplace Management and Workplace Experience

- 2.3.3. Indoor Mapping and Location Services

- 2.3.4. Drones and Robotics

- 2.3.5. Indoor Air Quality (IAQ)

- 2.3.6. Hospitality Sector

- 2.4. Physical Security

- 2.4.1. Access Control and Visitor Management

- 2.4.2. Video Analytics and Computer Vision

- 2.4.3. Weapons Detection and Perimeter Protection

3. Startup Closures

- 3.1. Non-Operational Startups and Closures

- 3.2. Major Startups Losing Traction

4. The Future Outlook for Smart Building Startups

Appendix

- A1 Smart Building Startups Gaining Traction

List of Charts and Figures

- The Global Smart Building Landscape of Startups

- Smart Building Startups Landscape by Technology Sector

- Regional Distribution of Startups

- Internet of Things in Buildings (BIoT)

- Startups Landscape for IoT Platforms in Buildings

- BIoT Platforms Gaining Traction

- Digital Twin Solutions in Buildings Landscape

- Digital Twin Startups Gaining Traction

- Building Energy Management

- Building Energy Management Software Startups Landscape

- Energy Management Software Startups Gaining Traction

- Sustainability and Carbon Management Startups Landscape

- Sustainability and Carbon Management Startups Gaining Traction

- Energy Services Startups Landscape

- Energy Services Startups Gaining Traction

- Energy Management Hardware Startups Landscape

- Energy Management Hardware Startups Gaining Traction

- Distributed Energy Storage Startups Landscape

- Energy Storage Startups Gaining Traction

- PropTech

- Asset Management & Maintenance Startups Landscape

- Asset Management & Maintenance Startups Gaining Traction

- Workplace Management Startups Landscape

- Workplace Management Startups Gaining Traction

- Indoor Mapping & Location Services Startups Landscape

- Indoor Mapping Startups Gaining Traction

- Drones & Robotics Startups Landscape

- Drones & Robotics Startups Gaining Traction

- Indoor Air Quality Startups Landscape

- Indoor Air Quality Startups Gaining Traction

- Hospitality Sector Startups in Buildings Landscape

- Hospitality Sector Startups Gaining Traction

- Physical Security in Buildings

- Access Control, Locking, Visitor Management Startups Landscape

- Access Control Startups Gaining Traction

- Video Surveillance, Analytics & Computer Vision Startups Landscape

- Video Analytics Startups Gaining Traction

- Weapons Detection & Perimeter Protection Startups Landscape

- Weapons Detection Startups Gaining Traction

- Closed or Bankrupt Startups in 2023

- Major Startups Losing Traction in the Smart Buildings Space