|

市场调查报告书

商品编码

1645732

智慧建筑的Start-Ups(2025年):M&A,投资,引人注目的亚太地区的新兴企业StartUps in Smart Buildings 2025: M&A & Investments, APAC Startups Gaining Traction |

||||||

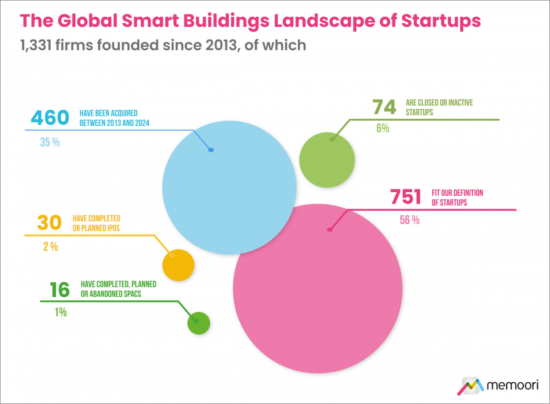

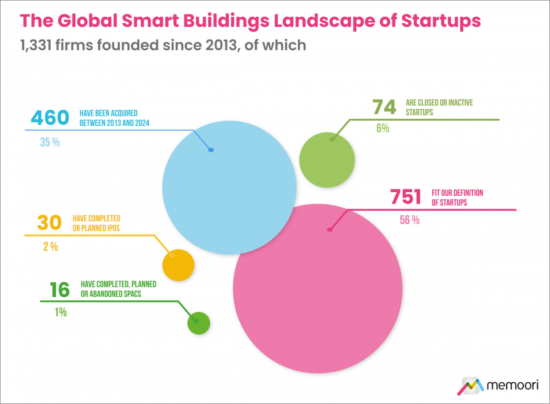

该报告研究了智慧建筑新创企业,并确定了自 2013 年以来全球智慧建筑领域成立的 1,331 家管理和营运阶段新创公司。自2013年以来,已有460家新创公司被收购,占总数的35%。

本研究是对商业房地产生命週期营运和维护阶段的新创公司和扩大规模企业的第六次全面评估。它主要关注过去一年来对新兴公司的风险投资、併购和策略投资。

深入了解引领潮流的亚太地区新创公司。它提供了有关新兴公司如何透过收购、合作和联盟来扩大业务的宝贵资讯。

目录

第1章 全球Start-Ups企业的智慧建筑形势

第2章 创业投资和私人股权的资金筹措

- 2024 年下半年值得关注的十大智慧建筑新创投资

- 室内物联网的外部资金

- 建筑能源管理的外部资金

- 网格互动大楼的外部资金

- Proptech 的外部资金

- 实体安全外部资金

第3章 新兴企业的合併和收购

- 2024年下半年的智慧建筑的值得注意的Start-Ups企业10公司的收购

- IoTStart-Ups企业的收购

- 大楼能源管理Start-Ups企业的收购

- propTecStart-Ups的收购

- 实体安全Start-Ups的收购

第4章 亚洲的智慧建筑Start-Ups气势渐增的

- Accacia

- Aeria

- Ampotech

- Assert AI

- Asuene

- Awiros

- Becis

- Bitkey

- Canopy Power

- Doongji

- EaSyGo

- Ecolibrium

- Enlite

- Facilio

- Green Data

- Mapxus

- Neuron

- Nhance

- Pluxity

- Resync

- Sensor Flow

- Imsys Global

- Smart Joules

- Smarten Spaces

- Spintly

- Jarvis

- Terminus

- Unabiz

- Xurya

- Zevero

This Report is the New 2025 Definitive Resource for Evaluating Startups in the Smart Building & PropTech Space

This research identifies 1,331 startups founded since 2013 in the management and operations phase of the global smart commercial buildings space. In total 460 startups have been acquired since 2013, 35% of the total landscape. 74 are closed or inactive startups, 6% of the total.

It is our 6th comprehensive evaluation of startups and scaleups in the operations and maintenance phase of the lifecycle of commercial real estate. It highlights venture capital funding, M&A, and strategic investments in startups over the last year.

The research includes a spreadsheet listing all startup acquisitions and investments in 2024 AND 2 presentation files with high-resolution charts.

What does this Startups Report tell You?

- Funding from venture capital, private equity, and corporate backers for startups founded since 2013 reached $6.9 billion in 2024, the 3rd highest year in value since 2015 .

- This investment was spread across 279 funding rounds, a 17% increase on 2023.

- There were 56 acquisitions of startups in 2024, a number consistent with 2023 but down on the highs of 2021 and 2022.

The information in this report is based on a rigorous analysis of the smart building market and builds on our previous research into Grid-Interactive Buildings, HVAC Optimization, Artificial Intelligence, the Internet of Things , Video Surveillance, and Access Control.

Our definition of a startup is "a private company formed no earlier than 2013 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is generally financed by venture capital or private equity funding."

Within its 87 Slides and 33 Charts, The Report Sieves out all the Key Facts and Draws Conclusions, so you can Understand how StartUp Companies are Shaping the Future of PropTech.

We take a detailed look at APAC startups gaining traction, with 30 Asian firms including Terminus, Spintly and Asuene selected for this report.

This report provides valuable information into how startup companies are developing their businesses through Acquisitions, Partnerships, and Alliances.

Who Should Buy This Report?

The information contained in this report will be of value to all those engaged in managing, operating, and investing in smart building companies around the world. In particular, those wishing to invest in or acquire startups will find it particularly useful.

Companies Mentioned Include (BUT NOT LIMITED TO):

|

|

Table of Contents

1. The Global Smart Buildings Landscape of Startups

2. Venture Capital and Private Equity Funding

- 2.1. 10 Notable Startup Investments in Smart Buildings H2 2024

- 2.2. External Funding for IoT in Buildings

- IoT Platforms for Smart Buildings

- BIM, Digital Twin & Digitization of Buildings

- Networking & Connectivity in Buildings

- Cyber Security Solutions for Buildings

- 2.3. External Funding for Building Energy Management

- Energy Management Software

- HVAC Optimization Software

- Sustainability & Carbon Management in Buildings

- Energy Efficiency Services

- Energy Management Hardware

- 2.4. External Funding for Grid Interactive Buildings

- Grid Interactive Buildings

- 2.5. External Funding for PropTech

- Asset & Maintenance Management

- Water Management in Buildings

- Drones & Robotics

- Technology for Data Centers

- Technology for the Hospitality Sector

- 2.6. External Funding for Physical Security

- Access Control & Identity Management

- Video Surveillance & Video Analytics

- Mass Notification & Critical Incident Management

3. Mergers & Acquisitions of Emerging Players

- 3.1. 10 Notable Startup Acquisitions in Smart Buildings H2 2024

- 3.2. Acquisitions of Internet of Things Startups

- IoT Platforms for Buildings

- 3.3. Acquisitions of Building Energy Management Startups

- Energy Management & HVAC Optimization Software

- Sustainability & Carbon Management in Buildings

- Grid Interactive Buildings

- 3.4. Acquisitions of PropTech Startups

- Workplace Management & Workplace Experience

- 3.5. Acquisitions of Physical Security Startups

- Video Surveillance & Analytics

- Access Control & Identity Management

4. Asian Smart Building Startups Gaining Traction

- Accacia

- Aeria

- Ampotech

- Assert AI

- Asuene

- Awiros

- Becis

- Bitkey

- Canopy Power

- Doongji

- EaSyGo

- Ecolibrium

- Enlite

- Facilio

- Green Data

- Mapxus

- Neuron

- Nhance

- Pluxity

- Resync

- Sensor Flow

- Imsys Global

- Smart Joules

- Smarten Spaces

- Spintly

- Jarvis (Powered by Staqu)

- Terminus

- Unabiz

- Xurya

- Zevero

List of Charts and Figures

- The Global Smart Buildings Landscape of Startups: 1,331 Firms Founded since 2013

- Smart Building Startup Landscape: Number of Firms Founded since 2009 by Technology Sector

- Regional Distribution of Startups Founded since 2013

- Startups VC and PE Funding: Number & Value of Funding Rounds 2015 to 2024

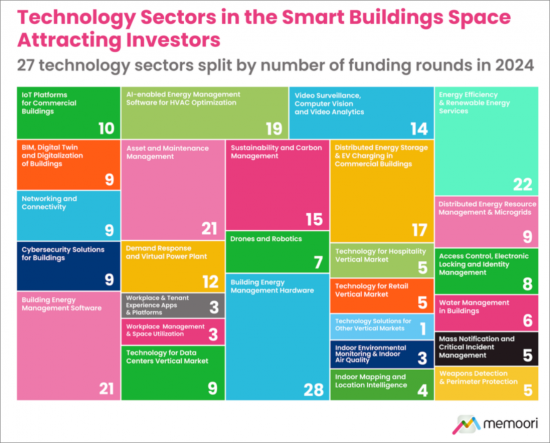

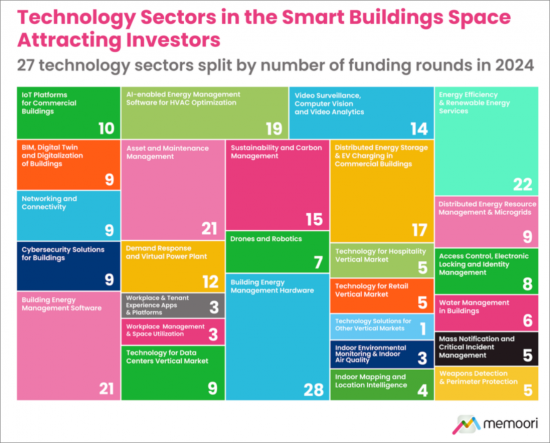

- Technology Sectors in the Smart Buildings Space Attracting Investors

Appendix

- 1. Technology Categories for Startups in the Smart Buildings Landscape

- 2. Funding and Investments in Startups 2024

- 3. Mergers & Acquisitions of Startups 2024

- 4. Asian Startups Gaining Traction 2025