|

市场调查报告书

商品编码

1923671

智慧建筑新创公司(2026):併购与投资 | 贯穿 AEC/O 生命週期的数位孪生与人工智慧新创公司StartUps in Smart Buildings 2026: M&A & Investments | Digital Twin & AI Startups across the AEC/O Lifecycle |

||||||

智慧建筑新创企业生态系已达到临界点。儘管创投成长放缓,但併购活动却激增,光是 2025 年就发生了 98 起初创企业收购案——较 2024 年成长 75%,创下近十年来的最高年度纪录。这种整合显示市场已趋于成熟,成熟的商业模式正吸引策略性收购者的目光。

本报告深入探讨了智慧建筑业,并提供了一份电子表格,列出了 2025 年涵盖所有融资轮次、企业投资者、併购活动、技术类别以及整个 AEC/O 生命週期的 84 家数位孪生和人工智慧新创公司,以及两个包含高解析度图表的简报文件。本报告包含在我们的 2026 年企业订阅服务中。

为什么这项研究在2026年仍然重要

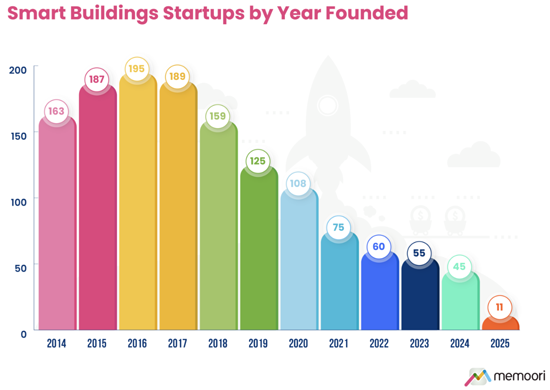

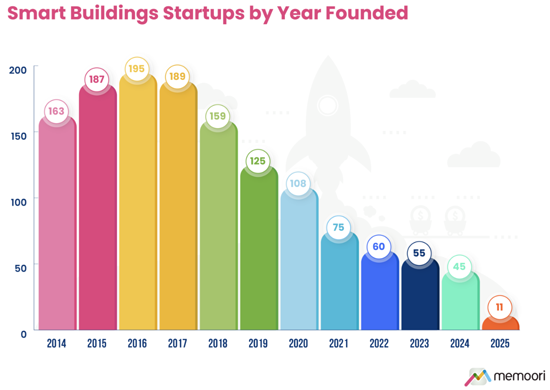

- 整个生态系已从成长阶段根本性地转向整合阶段。 2025年仅有11家新创企业成立,较2016年195家的峰值稳定下降。

- 然而,智慧建筑新创企业的融资活动并未显着减少。 2025年,该领域共完成281轮融资,总额达65亿美元,轮次减少5%,总价值减少14%。

- 此外,种子轮/A轮投资的平均规模正在增加。投资者变得更加挑剔,减少了投资项目的数量,但增加了每笔交易的规模。

- 当前新创企业面临的环境充满挑战。投资难求,投资人更青睐那些根基稳固、收入来源清晰的公司。领先的房地产科技创投公司 Fifth Wall 近期裁员并暂停了积极的融资活动,理由是高利率和川普政府的气候政策。

併购活跃趋势

2025 年併购活动十分活跃,自 2014 年以来成立的新创公司共有 98 家被收购,比 2024 年同期成长了 75%。自 2014 年以来,智慧商业建筑领域的新创公司收购案总数已达 554 起。

2025 年共发生 20 起物联网平台收购案,其中包括 Vertiv 收购 Waylay NV。数位孪生相关交易包括 Oakglen Group 收购 Pupil(英国)和 Zutec 收购 Operance(英国)。

2026 年展望

智慧建筑领域的新创企业格局预计将发生以下重大变化:

- 随着市场日趋成熟,我们预期交易数量将减少,而融资轮次规模将扩大,策略参与将更加普遍。

- 随着现有企业从少数股权投资转向收购平台整合,产业整合将加速。

- 策略性收购者将持续围绕人工智慧增强数位建筑管理系统重组其投资组合。

This Report is the Definitive Resource for Evaluating Startups, Innovation, & Investment Trends in the Smart Building & PropTech Space 2026

The smart building startup ecosystem has reached an inflection point. While venture capital funding has moderated, M&A activity has exploded, with 98 startup acquisitions in 2025 alone, a 75% increase on 2024 and the highest annual total in the last decade. This consolidation signals a maturing market where proven business models are commanding attention from strategic buyers.

It is our 8th comprehensive evaluation of startups and scaleups in the operations and maintenance phase of the lifecycle of commercial real estate. It builds on our previous research into Grid-Interactive Buildings, HVAC Optimization, Artificial Intelligence, the Internet of Things, Video Surveillance, and Access Control.

The research includes a spreadsheet listing all 2025 funding rounds, corporate investors, M&A activity, technology categories, and 84 digital twin and AI startups across the AEC/O lifecycle, plus 2 presentation files with high-resolution charts. This report is included in our 2026 Enterprise Subscription Service.

Why This Research Matters in 2026?

- The ecosystem has fundamentally shifted from a growth phase to a consolidation phase. We identified only 11 new startups founded in 2025, and there has been a steady decline from the peak of 195 in 2016.

- BUT Funding Activity for smart building startups is not down that much. It reached $6.5 billion in 2025, spread across 281 funding rounds, a 5% decrease in the number of rounds, and a 14% decrease in total value.

- AND the average value of Seed and Series A investments has increased. Investors are being much more selective, making fewer but larger investments.

- What does this all mean? Currently, it is a tough environment for startups. Investment is harder to come by, and investors are prioritizing companies with solid fundamentals and clear revenue streams. Fifth Wall, a prominent PropTech VC, recently cut staff and stopped active fundraising, citing high interest rates and the Trump Administration's climate policies as factors in the decision.

Our definition of a startup is "a private company formed no earlier than 2014 that is focused on the commercial and industrial buildings market, is not a subsidiary or an acquisition of a larger company, and is generally financed by venture capital or private equity funding."

Intense M&A Activity

2025 saw an intense year of M&A activity, with 98 startups founded since 2014 acquired in 2025, representing a 75% increase compared to the same period in 2024. Since 2014, we have recorded 554 startup acquisitions in the smart commercial buildings sector.

There were 20 IoT platform acquisitions in 2025, including Vertiv's purchase of Waylay NV. Digital twin deals including Oakglen Group acquiring Pupil (UK) and Zutec purchasing Operance (UK).

NEW in 2026: Digital Twin & AI Startups Across the AEC/O Lifecycle

Part 2 of this report introduces expanded coverage of new companies applying digital twin and AI technologies across all stages of the building lifecycle, from architecture and design through engineering, construction, and operations.

84 companies are profiled in our comprehensive appendix, categorized by: Lifecycle stage (Architecture, Engineering, Construction, Operations), founding date and headquarters location, funding stage, and technology focus (52 AI-focused, 32 digital twin-focused). We profile 20 of these companies with an in-depth analysis of their offering, strategic focus, funding history, and market positioning.

2026 Outlook

We forecast significant shifts in the smart buildings startup landscape:

- Fewer deals, larger rounds, and heavier strategic participation as the market continues to mature.

- Consolidation will accelerate as incumbents move from minority investments to acquisitions and platform consolidation.

- Strategic buyers will continue repositioning portfolios around AI-enhanced digital building operations.

40 Startups Who Gained Traction in 2025

As part of this research, we also identified 40 startups that we believe gained market traction in 2025, selected based on organic growth, innovative business models, strategic investor interest, and headcount growth.

Who Should Buy This Report?

This research will be valuable to:

- Strategic acquirers seeking targets to expand technology portfolios.

- Building owners and operators assessing emerging technologies.

- Technology vendors who want to understand competitive positioning.

- Investors (VCs, PE firms, corporate VC arms) evaluating smart building opportunities.