|

市场调查报告书

商品编码

1851060

即时支付:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Real-Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

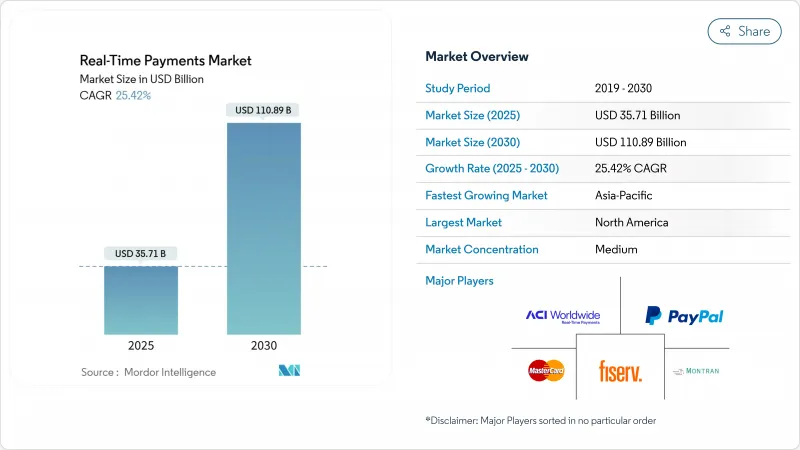

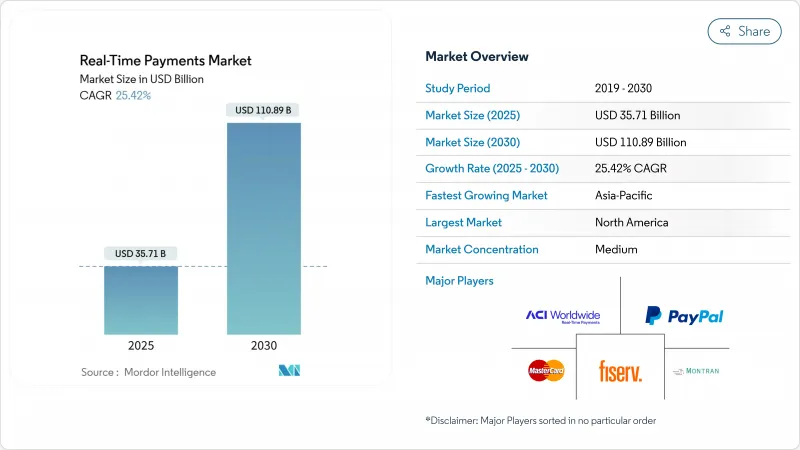

预计到 2025 年,即时支付市场规模将达到 357.1 亿美元,到 2030 年将达到 1,108.9 亿美元,年复合成长率为 25.42%。

监管要求、2025年11月ISO 20022标准的最后期限以及消费者对零售、薪资和帐单支付等工作流程中即时支付的需求,共同推动了即时支付的普及。在北美,FedNow Rails截至2025年4月已接入1300家金融机构,并在2025年第一季处理了131万笔交易,总额达486亿美元,展现出强大的网路效应。欧洲的即时支付监管条例将于2025年1月生效,该条例要求欧元区全天候24小时服务,这将加速银行的技术投资。亚太地区的成长势头得益于印度UPI扩展到更多支付通道以及新加坡的Project Nexus项目,而巴西的PIX预计将在2023年处理420亿笔交易,总额达17.2万亿美元(3.44万亿美元),凸显了政府主导方案的规模经济效益。

全球即时支付市场趋势与洞察

向 ISO 20022 过渡加速基础设施现代化

2025年11月ISO 20022标准的最后期限迫使银行同时更新其通讯和处理引擎,因此采用即时支付轨道成为最具成本效益的合规途径。 SWIFT指出,目前已有32.9%的跨国讯息符合ISO 20022标准,预计2024年第四季,这一比例将增加6个百分点。更丰富的数据有效载荷有助于改善製裁筛选,德意志银行强调了即时合规对企业的益处。随着共存期即将结束,金融机构必须避免双系统带来的额外开销。社区银行正透过将ISO 20022转换和即时支付连接外包给捆绑式第三方处理商来弥补能力差距。

FedNow业务扩张推动其在美洲市场占据领先地位。

FedNow的网路效应显而易见,2025年第一季以季度为基础交易量较上季成长43.1%,交易额较上季成长140.8%,预示着其商业性应用前景广阔。美国联邦储备委员会的目标是在8,000家机构部署该系统,力求实现全国的普及。同时,巴西的PIX 2.0计画于2025年9月推出定期和分期付款功能,标誌着一个成熟的系统正在向多功能平台演进。这些倡议将为其他市场树立跨洲际的绩效标竿。

诈欺监控的复杂性限制了实施速度。

银行被迫为 FedNow、PIX 和 SEPA Instant 分别投资开发不同的规则集。 ACI Worldwide 与 Banfico 合作的欧洲概念验证计画展示了伙伴关係,以满足欧盟 2025 年 10 月的合规期限。 Visa 收购 Featurespace 凸显了基于人工智慧的即时诈欺侦测技术对资本的密集需求。小型金融机构面临平行系统带来的营运负担,以及存取多个网路耗时的流程。

细分市场分析

到2024年,点对点支付将占即时支付市场收入的55.1%,这印证了消费者对点支付的接受度。企业主导的支付流程如今已超过个人转账,随着即时薪水支付和商家支付的普及,企业对点交易正以每年28.61%的速度成长。 FedNow早期针对薪水支付和供应商支付的企业试点计画凸显了这一转变,表明营运资金的益处已引起财务主管的共鸣。虽然企业对企业支付的普及仍处于早期阶段,但考虑到ACH结算需要数天时间,它代表最大的潜在用户群体。随着「先买后付」(BNPL)服务提供者整合帐户间支付,以极低的交换成本实现的消费者对企业支付流程正在加速发展。巴西的PIX系统体现了这种转变,预计到2025年,电子商务商家将透过即时支付创造300亿美元的累计。在海湾合作委员会成员国中,政府对个人的强制规定催生了人们对全天候取款的新基本期望,巩固了即时基础设施作为公共服务标准的地位。

即时薪资发放的趋势重塑了薪资核算经济格局,推动交易频率而非单笔金额成长,并提升了铁路货运总量。企业同步财务和应付帐款流程,从每週支付转向按需推送。跨国企业利用UPI-PayNow等双边支付方式缩短东南亚供应商的付款週期。市场平台引入分期付款模式,同时处理手续费和本金,消除对帐延迟。这些应用场景使得即时支付市场成为优化流动性的关键。

到2024年,平台和解决方案支出将占总收入的75.6%,这显示银行更倾向于整体性改革而非战术性附加功能。讯息转换、诈欺分析和API编配在整合架构上效率最高,这也是ISO 20022标准的实施成为推动这一趋势的催化剂。然而,服务收入年增率为29.23%,反映出银行在分阶段推广方面高度依赖专业整合商。咨询服务包括准备评估、蓝图设计和监管差距分析。金融机构正在将需要全天候执行时间服务等级协定(SLA)的託管服务外包,以确保合规性并减少人员配置。像ACI Worldwide这样的整合合作伙伴在2025年第一季软体业务成长了42%,证明平台和专业服务在中型金融机构中越来越受欢迎。

在预测期内,能够编配即时和批量流程的中间件将至关重要。采用容器化微服务的混合云编排器将实现与传统核心系统的逐步解耦。这种架构将使银行能够透过即时支付 API 为客户提供前端服务,同时逐步淘汰大型主机模组。培训计画将着重于推动营运文化向持续结算和即时流动性监控的转变。

区域分析

预计到2024年,北美地区的收入份额将达到38.1%,这主要得益于FedNow和清算所即时支付网路(RTP)的成熟。随着区域性银行携手合作,并在打包云端连接器的支持下,交易量成长将加速。关于即时借记卡交换费处理的监管政策的明确性将推动商户采用该技术。加拿大计划于2026年推出即时铁路服务,预计开闢一条与美国之间以美元计价的跨国通道。

亚太地区到2030年将维持最高的复合年增长率,达到29.33%。印度的统一支付介面(UPI)在2024财年将处理1,310亿笔交易,交易额达200兆印度卢比(约2.4兆美元),展现了政府支持的开放API模式的规模经济效益。新加坡的「Nexus计划」提出了多边支付的模板,澳洲的「新支付平台」(NPP)最终确定了「PayTo」授权,并扩展了企业收费功能。日本各地区银行正在加速现代化进程,以实现无现金支付比例目标。

自2025年1月起,欧洲将强制实施全天候(24/7)收款,德意志银行当月即时支付业务量激增27%。预计到2025年10月,随着全面发送功能的推出,即时支付的普及率将进一步提高,但监管机构设定的价格上限可能会对续费利润率造成压力。北欧地区暂停实施P27协议意味着SEPA即时支付将成为欧洲事实上的跨境支付标准,各银行正寻求与英国的联邦支付系统(FPS)建立双边连结。

PIX在南美洲处于领先地位,目前正拓展至分期付款及线下支付模式,彻底消除现金的使用场景。哥伦比亚、智利和阿根廷正在考虑复製PIX的官民合作关係模式。中东地区正经历政策主导的成长,沙乌地阿拉伯的Sarie Rail和阿联酋的IPP都强制要求公务员即时领取薪水。在非洲,行动支付企业正在整合开放回路式即时支付系统,将钱包的普及性与银行级清算结合。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在欧洲和亚太地区推广符合 ISO 20022 标准的国内铁路

- FedNow 的扩展和即将推出的 PIX 2.0 将加速美洲地区的普及应用

- 美国零工劳动者对即时薪资核算和已赚工资获取(EWA)的需求

- 欧洲的「先买后付」(BNPL)企业正在转向RTP(即时支付)以实现商家即时支付。

- 海湾合作委员会国家政府强制要求即时支付工资和社会福利

- RippleNet 和 Visa Direct 推动跨境 RTP 通道激增

- 市场限制

- RTP计画中诈欺监控标准分散

- 亚洲二线银行传统核心银行体系现代化改造积压问题

- 卡片标记化和帐户间铁路互通性差距

- 美国商家额外费用法规的不确定性

- 价值链分析

- 监理与标准展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

- 案例研究和应用案例

- RTP交易占总交易量的百分比 - 按地区和主要国家/地区分類的百分比

- 非现金交易中即时支付交易的百分比 - 按地区和主要国家/地区细分

第五章 市场规模与成长预测

- 按交易类型

- P2P(P2P)

- 点对点(P2B)

- 按组件

- 平台/解决方案

- 服务

- 透过部署模式

- 云

- 本地部署

- 按公司规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 零售与电子商务

- BFSI

- 公共产业和电讯

- 卫生保健

- 政府和公共部门

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ACI Worldwide Inc.

- Fiserv Inc.

- PayPal Holdings Inc.

- Mastercard Inc.

- Montran Corporation

- FIS Global

- Temenos AG

- Volante Technologies Inc.

- Finastra Inc.

- Ant Group(Alipay)

- Tencent Holdings Ltd.(WeChat Pay)

- The Clearing House Payments Co.

- Visa Inc.

- SWIFT SCRL

- Worldline SA

- Nets Group

- Nexi SpA

- Ripple Labs Inc.

- Wise PLC

- Pay.UK

- GoCardless Ltd.

- Jack Henry and Associates Inc.

- Infosys Finacle

- VSoft Corporation

- OpenPayd Holdings Ltd.

第七章 市场机会与未来展望

The Real Time Payments market size stands at USD 35.71 billion in 2025 and is forecast to achieve USD 110.89 billion by 2030, reflecting a compelling 25.42% CAGR.

Surging adoption originates from regulatory mandates, the November 2025 ISO 20022 deadline, and customer demand for instantaneous settlement across retail, payroll, and bill-payment workflows. In North America, the FedNow rail welcomed 1,300 institutions by April 2025 and processed 1.31 million transactions worth USD 48.6 billion during Q1 2025, underscoring strong network effects. Europe's Instant Payments Regulation, effective January 2025, requires 24/7 euro-zone coverage, accelerating bank technology investment. Asia-Pacific's momentum is reinforced by India's UPI expansion into additional corridors and Singapore's Project Nexus, while Brazil's PIX processed 42 billion transactions worth BRL 17.2 trillion (USD 3.44 trillion) in 2023, highlighting the scale benefits of government-sponsored schemes.

Global Real-Time Payments Market Trends and Insights

ISO 20022 migration accelerates infrastructure modernization

The November 2025 ISO 20022 deadline compels banks to update messaging and processing engines simultaneously, making real-time payment rail adoption the most cost-efficient compliance path. SWIFT notes that 32.9% of cross-border messages already ride ISO 20022, up six percentage points in Q4 2024. Richer data payloads improve sanctions screening, and Deutsche Bank showcases real-time compliance benefits for corporates. The looming end of the coexistence period forces institutions to avoid dual-system overhead. Community banks mitigate capability gaps by outsourcing to third-party processors that bundle ISO 20022 translation with instant-payment connectivity.

FedNow expansion drives Americas market leadership

FedNow's network effects were evident with a 43.1% quarterly volume spike in Q1 2025 and a 140.8% value leap, signalling widening commercial use cases. The Federal Reserve's ambition to onboard 8,000 institutions positions the rail for nationwide ubiquity. In parallel, Brazil's PIX 2.0 will introduce recurring and instalment capabilities in September 2025, showing how mature systems evolve into multifunction platforms. Combined, these initiatives set cross-continental performance benchmarks that other markets emulate.

Fraud monitoring complexity constrains adoption velocity

Verification-of-Payee frameworks differ across schemes, obliging banks to invest in separate rule sets for FedNow, PIX, and SEPA Instant. ACI Worldwide's European PoC with Banfico illustrates workaround partnerships to meet the EU's October 2025 compliance deadline. Visa's Featurespace acquisition underscores the capital-intensive nature of AI-based instant fraud detection. Smaller institutions face operational strain from parallel systems, slowing onboarding to multiple networks.

Other drivers and restraints analyzed in the detailed report include:

- Earned-wage access transforms payroll economics

- Cross-border RTP corridors reshape international payments

- Legacy infrastructure modernization challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Peer-to-peer transfers accounted for 55.1% of Real Time Payments market revenue in 2024, underscoring widespread consumer adoption. Business-driven flows now outpace personal transfers, with peer-to-business transactions growing 28.61% annually as instant payroll disbursements and merchant settlement take hold. FedNow's early corporate pilots in payroll and supplier payments highlight this pivot, signalling that working-capital benefits resonate with finance executives. Business-to-business adoption remains in early stages but promises the largest addressable pool, given ACH's multi-day settlement drag. Consumer-to-business flows gain momentum where buy-now-pay-later (BNPL) providers embed account-to-account settlement to minimise interchange costs. Brazil's PIX demonstrates this migration, with e-commerce merchants projected to book USD 30 billion in instant-payment turnover during 2025. Government-to-person mandates across GCC economies create a new baseline expectation for 24/7 disbursement, cementing instant infrastructure as a public-service standard.

Real-time salary advances reshape payroll economics, enlarging transaction frequency rather than ticket size, thus increasing absolute rail volume. Corporates synchronise treasury and AP processes, shifting from weekly payment runs to on-demand pushes. Cross-border organisations leverage bilateral links such as UPI-PayNow to shorten supplier settlement cycles in Southeast Asia. Market platforms introduce split-payment models that route commission and principal amounts simultaneously, removing reconciliation delays. These combined use cases reinforce the Real Time Payments market as indispensable for liquidity optimisation.

Platform & solution spending captured 75.6% of 2024 revenue, signalling that banks favour holistic overhauls versus tactical bolt-ons. ISO 20022 migration serves as the triggering event, since message translation, fraud analysis, and API orchestration are most efficient on unified stacks. Yet service revenue rises 29.23% annually, reflecting heavy reliance on specialist integrators for phased rollout. Consulting engagements cover readiness assessments, roadmap design, and regulatory gap analysis. Institutions outsource managed services for SLAs covering 24/7 uptime, ensuring compliance while containing headcount. Integration partners such as ACI Worldwide logged 42% software-segment growth in Q1 2025, proving that combinational platform-plus-professional-services deals resonate with mid-tier institutions.

Over the forecast period, middleware capable of orchestrating real-time and batch flows side-by-side becomes critical. Hybrid-cloud orchestrators with containerised microservices enable progressive decoupling from legacy cores. This architecture allows banks to retire mainframe modules gradually while front-ending customers with instant-payment APIs. Training programmes address the operational culture shift to continuous settlement and real-time liquidity monitoring.

The Global Real-Time Payments Market is Segmented by Transaction Type (Peer-To-Peer (P2P), Peer-To-Business (P2B)), Component (Platform / Solution, Services), Deployment (Cloud, On-Premise), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End-User Industry (Retail and E-Commerce, BFSI, Utilities & Telecom, Healthcare, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America posted 38.1% revenue share in 2024, anchored by FedNow and The Clearing House RTP network maturity. Volume growth accelerates as regional banks join en masse, aided by packaged cloud connectors. Regulatory clarity on interchange treatment for instant debit pushes merchant adoption. Canada plans Real-Time Rail launch in 2026, which could open a USD-denominated cross-border corridor with the United States.

Asia-Pacific delivers the highest CAGR at 29.33% to 2030. India's UPI handled 131 billion transactions worth INR 200 trillion (USD 2.4 trillion) in FY24, illustrating scale benefits of a government-backed open API model. Singapore's Project Nexus presents a template for multi-country clearing, while Australia's NPP finalises PayTo mandates, expanding business billing capabilities. Japan's regional banks accelerate modernization to meet the national cashless-ratio target.

Europe's mandatory 24/7 receiving requirement effective January 2025 induced a 27% instant-payment jump at Deutsche Bank that same month. Full send capability by October 2025 will drive further adoption yet may squeeze fee margins given regulation-imposed price caps. Nordic P27's pause leaves SEPA Instant as the de-facto cross-border option inside Europe, pushing banks toward bilateral links with the UK's FPS.

South America's trajectory centres on PIX, now extending to instalment and offline modes that remove the last cash use-cases. Colombia, Chile, and Argentina examine replicating PIX's public-private partnership structure. The Middle East experiences policy-driven growth where Saudi Arabia's Sarie rail and the UAE's IPP mandate instant salary credits for government workers. Africa witnesses mobile-money players integrating open-loop instant rails, blending wallet ubiquity with bank-grade clearing.

- ACI Worldwide Inc.

- Fiserv Inc.

- PayPal Holdings Inc.

- Mastercard Inc.

- Montran Corporation

- FIS Global

- Temenos AG

- Volante Technologies Inc.

- Finastra Inc.

- Ant Group (Alipay)

- Tencent Holdings Ltd. (WeChat Pay)

- The Clearing House Payments Co.

- Visa Inc.

- SWIFT SCRL

- Worldline SA

- Nets Group

- Nexi SpA

- Ripple Labs Inc.

- Wise PLC

- Pay.UK

- GoCardless Ltd.

- Jack Henry and Associates Inc.

- Infosys Finacle

- VSoft Corporation

- OpenPayd Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of ISO 20022-enabled domestic rails in Europe and Asia-Pacific

- 4.2.2 Expansion of FedNow and upcoming PIX 2.0 accelerating adoption in the Americas

- 4.2.3 Real-time payroll and earned-wage access (EWA) demand among U.S. gig workers

- 4.2.4 BNPL players shifting to RTP for instant merchant settlement in Europe

- 4.2.5 Government mandates for instant salary and welfare disbursement in GCC countries

- 4.2.6 Surging cross-border RTP corridors via RippleNet and Visa Direct

- 4.3 Market Restraints

- 4.3.1 Fragmented fraud-monitoring standards across RTP schemes

- 4.3.2 Legacy core-bank modernisation backlog in Tier-2 Asian banks

- 4.3.3 Interoperability gaps between card tokenisation and account-to-account rails

- 4.3.4 Merchant surcharge regulation uncertainty in the U.S.

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Standards Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Case Studies and Use-cases

- 4.9 RTP Transactions as % of All Transactions - Regional and Key-Country Split

- 4.10 RTP Transactions as % of Non-Cash Transactions - Regional and Key-Country Split

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Transaction Type

- 5.1.1 Peer-to-Peer (P2P)

- 5.1.2 Peer-to-Business (P2B)

- 5.2 By Component

- 5.2.1 Platform / Solution

- 5.2.2 Services

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-Premise

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-User Industry

- 5.5.1 Retail and E-Commerce

- 5.5.2 BFSI

- 5.5.3 Utilities and Telecom

- 5.5.4 Healthcare

- 5.5.5 Government and Public Sector

- 5.5.6 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Colombia

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 ACI Worldwide Inc.

- 6.4.2 Fiserv Inc.

- 6.4.3 PayPal Holdings Inc.

- 6.4.4 Mastercard Inc.

- 6.4.5 Montran Corporation

- 6.4.6 FIS Global

- 6.4.7 Temenos AG

- 6.4.8 Volante Technologies Inc.

- 6.4.9 Finastra Inc.

- 6.4.10 Ant Group (Alipay)

- 6.4.11 Tencent Holdings Ltd. (WeChat Pay)

- 6.4.12 The Clearing House Payments Co.

- 6.4.13 Visa Inc.

- 6.4.14 SWIFT SCRL

- 6.4.15 Worldline SA

- 6.4.16 Nets Group

- 6.4.17 Nexi SpA

- 6.4.18 Ripple Labs Inc.

- 6.4.19 Wise PLC

- 6.4.20 Pay.UK

- 6.4.21 GoCardless Ltd.

- 6.4.22 Jack Henry and Associates Inc.

- 6.4.23 Infosys Finacle

- 6.4.24 VSoft Corporation

- 6.4.25 OpenPayd Holdings Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment