|

市场调查报告书

商品编码

1522840

采矿化学品 -市场占有率分析、产业趋势/统计、成长预测 (2024-2029)Mining Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

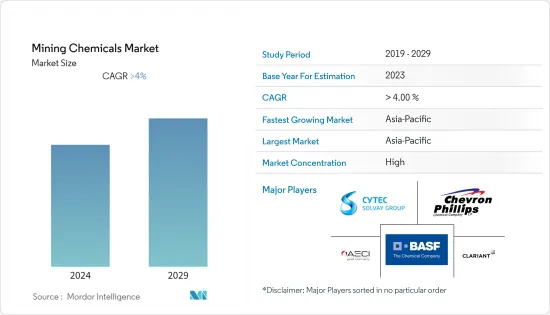

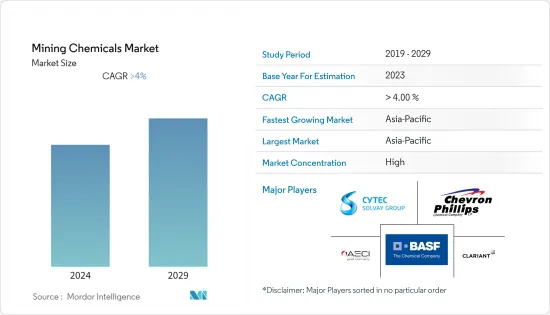

矿用化学品市场的生产规模预计将从2024年的121万吨扩大到2029年的155万吨,预测期间(2024-2029年)复合年增长率为4.26%。

COVID-19 大流行一直拖累采矿化学品市场,多个国家的全国范围内停产和严格的社会疏散措施影响了矿物加工和污水处理应用。然而,由于矿产加工业需求復苏而解除限制后,市场出现了显着成长。

亚太地区和北美采矿活动的增加以及各个最终用途行业对矿物的需求不断增加预计将推动采矿化学品市场的发展。

另一方面,与采矿和危险采矿化学品相关的严格政府法规预计将阻碍市场成长。

非洲尚未发现的采矿活动潜力以及与稀土元素相关的探勘活动的增加预计将在未来几年创造利润丰厚的市场机会。

亚太地区在市场上占据主导地位,预计在预测期内复合年增长率最高。

矿用化学品市场趋势

矿物加工中采矿化学品的使用增加

- 选矿又称选矿。它是一种提取冶金形式,通常从矿石中浓缩有价值的矿物并将其分离成可销售的产品。矿物加工在矿场进行,机械化程度高。选矿各阶段使用的设备类型包括破碎/磨碎设备、分级/分级设备、浓缩设备、脱水设备等。

- 矿山的盈利取决于可以从矿石中提取的所需精矿的数量。因此,选矿加工的目的是在产品供应到市场之前获得最大量的精矿。这是将矿石转化为可出售和用于日常用途的产品的重要步骤。

- 矿物加工包括黄铜矿、铝、矾土、铝土矿、铜、金、铁、赤铁矿、铅、钼、磁铁矿、锌、锡、镍、银和铂等金属,以及煤炭、建筑石材、花岗岩和黏土,用于提取钾盐、石灰石、沙子和大理石等岩石。

- 工业矿石有钻石、重晶石、磷灰石、石榴石、萤石、锆石、石英、宝石、蛭石、硅灰石等。从事矿物加工业务的公司包括BASF、科莱恩、索理思、Syensqo 和 Ecolab。 Syensqo 的浮选药剂广泛应用于采矿业,并与各种加工条件和矿石类型相容。该公司的浮选试剂提高了金、铜、银、钼、多金属、钴、镍、锂和铂族金属等贵金属和基底金属的回收率。

- 公司也向采矿业引入新产品和创新,以获得竞争优势。例如,2023年10月,BASF宣布推出两个针对采矿业的新浮选药剂品牌:Luprofroth和Luproset。这些品牌将扩大公司的浮动业务,并使BASF成为采矿业的完整解决方案提供者。

- 开采铝和钢需要大量化学品用于各种目的,包括提炼、分离、破碎和爆破。使用的化合物包括氢氧化钠、硝酸铵、氢氧化钙、碱灰和石灰。这些物质的使用受到监管,以确保工人和环境的安全。

- 根据世界钢铁协会预测,2022年全球粗钢产量为18.7亿吨。根据国际铝业协会预计,2023年终,铝产量将达7,059万吨,较2022年成长2.25%。

- 因此,由于上述因素,预计选矿业将在预测期内主导采矿化学品市场。

预计亚太地区将在预测期内主导市场

- 预计亚太地区将在预测期内主导采矿化学品市场。中国、日本和印度等国家的选矿和污水处理应用对采矿化学品的需求不断增加。

- 中国是世界上最大的矿业国家之一。中国是全球20多种金属的最大生产国。这些金属包括铝、金、石墨等。中国也是钢铁、铅、镁和稀土的主要生产国。它也是锌的主要出口国。

- 此外,中国主导全球关键矿产供应链,约占全球产量的 60% 和加工能力的 85%。在政府大量投资的支持下,中国正积极开发深海锂和钴资源。这一战略重点使中国成为这一新兴采矿业的主导者,俄罗斯和韩国也在这一领域取得了重大进展。

- 透过实施智慧城市、印度製造宣传活动以及国家电力政策下对可再生能源计划的日益关注等倡议,印度的金属和采矿业正在与基础设施发展同步发展。

- 预计本财年采矿业将成长 8.1%,显着高于 2022-23 年的 4.1%。国营的印度煤炭公司计划于 2024 年 2 月开始营运 5 个新矿井,并增加至少 16 个现有矿井的产能,以满足不断增长的燃料需求。

- 此外,日本正在其专属经济区(EEZ)内积极探索深海采矿,作为减少对进口矿产资源依赖的策略,而进口矿产资源对于先进和环保的技术至关重要。日本采矿业虽然规模相对较小,但以金矿开采为中心,主要集中在北海道、九州和本州三个岛屿。多个黄金探勘计划正在进行中,其中包括由日本黄金公司和巴里克黄金公司主导的项目。此外,住友金属矿业旗下的菱布鲁克斯矿在日本采矿业的扩张中扮演重要角色。

- 由于上述因素,预计亚太地区采矿化学品市场在预测期内将显着成长。

采矿化学品产业概况

采矿化学品市场因其性质而部分分散。市场的主要企业包括(排名不分先后)BASFSE、索尔维、AECI、雪佛龙菲利普斯化学有限公司和科莱恩。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 亚太地区和北美采矿活动增加

- 各种最终用途行业对矿物的需求增加

- 抑制因素

- 关于采矿和危险采矿化学品的严格政府法规

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模)

- 功能

- 漂浮化学品

- 代收代收

- 抑制剂

- 凝聚剂

- 气泡剂

- 分散剂

- 抽取剂

- 冲淡

- 抽取剂

- 助磨剂

- 漂浮化学品

- 目的

- 选矿

- 污水处理

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 澳洲/纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 奈及利亚

- 南非

- 坦尚尼亚

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- AECI

- Arkema

- BASF SE

- Betachem(Pty)Ltd

- Chevron Phillips Chemical Company LLC

- CLARIANT

- CTC(Tennant Consolidated Group)

- Ecolab

- FMC Corporation

- Indorama Ventures Public Limited

- Kemira

- NASACO

- Orica Limited

- Qingdao Ruchang Mining Industry Co. Ltd

- Sasol Limited

- SNF Group

- Solvay

第七章 市场机会及未来趋势

- 非洲采矿活动未被发现的潜力

- 稀土相关探勘活动活性化

The Mining Chemicals Market size in terms of production volume is expected to grow from 1.21 Million tons in 2024 to 1.55 Million tons by 2029, at a CAGR of 4.26% during the forecast period (2024-2029).

The COVID-19 pandemic hampered the mining chemicals market, as nationwide lockdowns in several countries and strict social distancing measures affected mineral processing and wastewater treatment applications. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand from mineral processing industries.

Increasing mining activities in Asia-Pacific and North America and the rising demand for minerals across different end-use industries are expected to drive the market for mining chemicals.

On the other hand, stringent government regulations related to the mining industry and hazardous mining chemicals are expected to hinder the market's growth.

The undiscovered potential of mining activities in Africa and the rising exploration activities related to rare earth metals are expected to create lucrative market opportunities over the coming years.

Asia-Pacific dominates the market studied and is anticipated to witness the highest CAGR during the forecast period.

Mining Chemicals Market Trends

Increasing Use of Mining Chemicals in Mineral Processing

- Mineral processing is also called mineral dressing. It is a form of extractive metallurgy that usually separates valuable minerals from the ore into a concentrated, marketable product. Mineral processing is conducted at the mine site and is highly mechanical. The types of equipment used at each stage of mineral processing include crushing and grinding equipment, sizing and classification equipment, concentration equipment, and dewatering equipment.

- Mine profitability depends on the amount of desirable mineral concentrate that can be extracted from the ore. Hence, mineral processing is designed to yield the maximum amount of mineral concentrate before the product is supplied to the market. It is an essential step in converting ore into a product that can be sold and used for everyday applications.

- Mineral processing is used to extract metals, including chalcopyrite, aluminum, chromite, bauxite, copper, gold, iron, hematite, lead, molybdenum, magnetite, zinc, tin, nickel, silver, and platinum, and rocks, including coal, building stone, granite, clay, potash, limestone, sand, and marble.

- Industrial mineral ore includes diamond, barite, apatite, garnet, fluorite, zircon, quartz, gemstones, vermiculite, and wollastonite. Some of the companies operating in the mineral processing business are BASF, Clariant, Solenis, Syensqo, and Ecolab. Syensqo's floating reagents are broadly used in the mining industry and support a varied range of processing conditions and ore types. The company's flotation chemicals improve the recovery of precious and base metals, including gold, copper, silver, molybdenum, polymetallic, cobalt, nickel, lithium, and platinum group metals.

- Companies are also introducing new products and innovations in the mining industry to gain a competitive edge. For instance, in October 2023, BASF introduced two new flotation reagent brands, Luprofroth and Luproset, for the mining industry. These brands will expand the company's floatation business, and BASF will become a full solution provider for the mining industry.

- Aluminum and steel mining requires numerous chemicals for various purposes, such as refining, separation, grinding, and blasting. Among the compounds utilized are sodium hydroxide, ammonium nitrate, calcium hydroxide, soda ash, and lime. The use of these substances is regulated to guarantee worker and environmental safety.

- As per the World Steel Association, in 2022, the world produced 1.87 billion tonnes of crude steel. According to the International Aluminum Institute, by the end of 2023, aluminum production reached 70.59 million metric tonnes, up 2.25% from 2022 levels.

- Hence, owing to the above-mentioned factors, the mineral processing segment is expected to dominate the market for mining chemicals during the forecast period.

Asia-Pacific to Dominate the Market During the Forecast Period

- Asia-Pacific is expected to dominate the market for mining chemicals during the forecast period. The demand for mining chemicals from mineral processing and wastewater treatment applications is increasing in countries like China, Japan, and India.

- China has one of the largest mining industries in the world. China is the world's largest producer, often by a wide margin, of over 20 metals. These metals include aluminum, gold, graphite, and others. China is also a major producer of iron, steel, lead, magnesium, and rare earth metals. It is also a major exporter of zinc.

- Furthermore, China dominates the supply chain of global critical minerals, accounting for approximately 60% of worldwide production and 85% of processing capacity. The country is actively pursuing lithium and cobalt resources in the deep sea, backed by significant government investments. This strategic focus is positioning China as a dominant player in this emerging extractive sector, with Russia and South Korea also making notable strides in this field.

- The metals and mining industry in India is growing by implementing various initiatives such as the Smart Cities, Make in India Campaign, and rising focus on renewable energy projects under the National Electricity Policy, alongside infrastructure development.

- The growth of the mining sector is projected at 8.1% in the current fiscal year, a significant increase from 4.1% in 2022-23, attributed to the expansion of mining activities across the country. In February 2024, State-run Coal India planned to commence operations at five new mines and enhance the capacity of at least 16 existing ones to meet the escalating demand for fuel.

- Furthermore, Japan is actively seeking pathways to conduct deep-sea mining within its exclusive economic zone (EEZ) as a strategy to reduce dependency on imported mineral resources crucial for advanced and environmentally friendly technologies. Japan's mining sector, though relatively small, is primarily centered on gold mining, predominantly situated on three islands, namely Hokkaido, Kyushu, and Honshu. Several gold exploration projects, including those led by Japan Gold and Barrick Gold, are underway. Additionally, the Hishikari mine, owned by Sumitomo Metal Mining, plays a significant role in expanding Japan's mining industry.

- Owing to the factors mentioned above, the market for mining chemicals in Asia-Pacific is projected to grow significantly during the forecast period.

Mining Chemicals Industry Overview

The mining chemicals market is partially fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, Solvay, AECI, Chevron Phillips Chemical Company LLC, and Clariant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Mining Activities in Asia-Pacific and North America

- 4.1.2 Rising Demand for Minerals Across Different End-use Industries

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Related to Mining Industry and Hazardous Mining Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Function

- 5.1.1 Flotation Chemicals

- 5.1.1.1 Collectors

- 5.1.1.2 Depressants

- 5.1.1.3 Flocculants

- 5.1.1.4 Frothers

- 5.1.1.5 Dispersants

- 5.1.2 Extraction Chemicals

- 5.1.2.1 Diluents

- 5.1.2.2 Extractants

- 5.1.3 Grinding Aids

- 5.1.1 Flotation Chemicals

- 5.2 Application

- 5.2.1 Mineral Processing

- 5.2.2 Wastewater Treatment

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Australia and New Zealand

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Nigeria

- 5.3.5.2 South Africa

- 5.3.5.3 Tanzania

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers And Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AECI

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Betachem (Pty) Ltd

- 6.4.6 Chevron Phillips Chemical Company LLC

- 6.4.7 CLARIANT

- 6.4.8 CTC (Tennant Consolidated Group)

- 6.4.9 Ecolab

- 6.4.10 FMC Corporation

- 6.4.11 Indorama Ventures Public Limited

- 6.4.12 Kemira

- 6.4.13 NASACO

- 6.4.14 Orica Limited

- 6.4.15 Qingdao Ruchang Mining Industry Co. Ltd

- 6.4.16 Sasol Limited

- 6.4.17 SNF Group

- 6.4.18 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Undiscovered Potential of Mining Activities in Africa

- 7.2 Rising Exploration Activities Related to Rare Earth Metals