|

市场调查报告书

商品编码

1489996

钻井化学品市场:依化学品、依流体类型、依应用、按地区Drilling Chemicals Market, By Chemicals, By Fluid Type (Oil-based Fluids, Water-based Fluids, Synthetic-Based Drilling Fluids, and Pneumatic Drilling Fluids), By Application, and By Region |

||||||

2024年钻井化学品市场价值为141.405亿美元,预计到2031年将达到208.444亿美元,2024年至2031年的复合年增长率为5.7%。

| 报告范围 | 报告详情 | ||

|---|---|---|---|

| 基准年 | 2023年 | 2024年市场规模 | 141.405 亿美元 |

| 实际资料 | 2019-2023 | 预测期 | 2024-2031 |

| 2024-2031 年预测期间的复合年增长率: | 5.70% | 2031 年金额预测 | 208.444亿美元 |

钻井化学品,也称为钻井泥浆,是石油和天然气钻井作业中使用的重质黏性流体混合物,用于将岩屑带到地面并润滑和冷却钻头。钻井化学品也适用于较简单的钻孔,例如水井以及金属和矿物开采。根据用途,钻井化学品分为陆上和海上使用。因此,预计钻井化学品需求的增加将在预测期内推动钻井化学品市场的成长。

市场动态

在应用中,陆上钻井领域预计将在全球钻井化学品市场中占据重要的市场占有率。 2021年,以以收益为准,该细分市场约占全球钻井化学品市场70.0%的份额。陆上石油和天然气产业不断发展,开发最佳实践并改进油井设计。这一演变缩短了钻井和完井时间,降低了井总成本,并提高了井性能。

预计到年终,亚太地区将成为潜在投资地区之一。这是由于印度和中国石油和天然气行业的显着增长。根据印度品牌股权基金会预测,到2022年,印度石油和天然气产业预计将吸引250亿美元的探勘和生产计划投资。

本研究的主要特点

- 本报告对钻井化学品市场进行了详细分析,并提供了以2023年为基准年的预测期(2024-2031年)的市场规模和累积年增长率(CAGR%)。

- 它揭示了各个细分市场的潜在商机,并解释了该市场有吸引力的投资提案矩阵。

- 它还提供了有关市场驱动因素、限制因素、机会、新产品发布和核准、区域前景、主要企业采取的竞争策略等的主要考察。

- 它根据公司简介、绩效、产品系列、地理分布、分销策略、主要发展和策略以及未来计划等参数,介绍了全球钻井化学品市场的主要企业。

- 该报告的见解使负责人和公司经营团队能够就未来的产品发布、技术升级、市场扩张和行销策略做出明智的决策。

- 本研究报告针对该产业的各个相关人员,如投资者、供应商、钻井化学品製造商、经销商、新进业者和财务分析师。

- 相关人员可以透过用于分析钻井化学品市场的各种策略矩阵来促进决策。

目录

第一章 研究目的与前提

- 研究目标

- 先决条件

- 简称

第二章 市场展望

- 报告说明

- 市场定义和范围

- 执行摘要

- Coherent Opportunity Map(COM)

第三章市场动态、法规及趋势分析

- 市场动态

- 促进因素

- 抑制因素

- 机会

- 影响分析

- 波特的分析

- 产业动态

- 主要亮点

- 流行病学

- 退款场景

- 监管场景

- 产品上市及核准

- 收购和协作场景

第四章全球钻井化学品市场-冠状病毒 (COVID-19) 大流行的影响

- 整体影响

- 政府倡议

- COVID-19 对市场的影响

第五章全球钻井化学品市场,依流体类型,2019-2031

- 油性液体

- 水性液体

- 合成基钻井液

- 其他的

第六章全球钻井化学品市场,依化学品分类,2019-2031

- 分散剂和胶溶剂

- 化学去除

- 页岩稳定剂

- 钻井泥浆消泡剂和发泡

- 钻井泥浆润滑剂

- 钻井泥浆界面活性剂

- 点样液体

- 失水控制添加剂

- 循环损失材料

- 其他的

第七章 全球钻井化学品市场,依最终用户划分,2019-2031 年

- 土地

- 海

第八章全球钻井化学品市场,按地区,2019-2031

第9章 竞争格局

- 公司简介

- Baker Hughes Company

- Halliburton

- Schlumberger Limited

- Weatherford

- Diamoco Group

- Royal Dutch Shell Plc

- Solvay SA

- The Egyptian Mud Engineering & Chemicals Company

- Kemira Oyj

- BASF SE

- Clariant

- ChampionX

- Lubrizol Corporation

- Stepan Company

- Nouryon

- Albermarle Corporation

- Pure Chemicals Co.

- Ennor Muds &Chemicals

- Core Drilling Chemicals

- SR Chemical

第10章分析师的观点

- 命运之轮

- 分析师观点

- Coherent Opportunity Map

第十一章 参考文献与调查方法

- 参考

- 调查方法

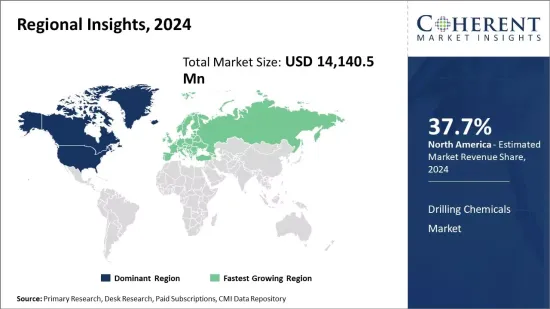

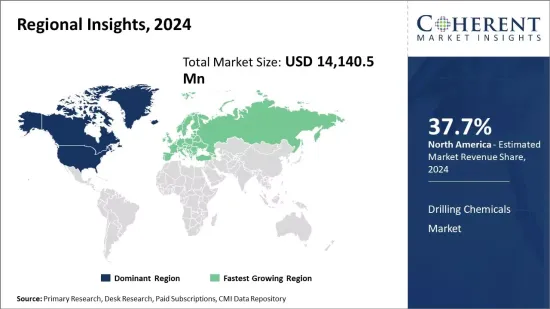

The Drilling Chemicals market is estimated to be valued at USD 14,140.5 Mn in 2024 and is expected to reach USD 20,844.4 Mn by 2031, exhibiting a compound annual growth rate (CAGR) of 5.7 % from 2024 to 2031.

| Report Coverage | Report Details | ||

|---|---|---|---|

| Base Year: | 2023 | Market Size in 2024: | US$ 14,140.5 Mn |

| Historical Data for: | 2019 To 2023 | Forecast Period: | 2024 To 2031 |

| Forecast Period 2024 to 2031 CAGR: | 5.70% | 2031 Value Projection: | US$ 20,844.4 Mn |

Drilling chemicals are also called drilling muds which are heavy, viscous fluid mixture that is used in oil and gas drilling operations to carry rock cuttings to the surface and also to lubricate and cool the drill bit. Drilling chemicals find application in simpler bore holes such as water wells and metal and mineral extraction. Depending on the application, drilling chemicals are classified into onshore and offshore chemicals. Therefore, increasing demand for drilling chemicals is expected to boost the drilling chemicals market growth over the forecast period.

Market Dynamics

Among applications, the onshore drilling segment is expected to witness a significant market share in the global drilling chemicals market. In 2021, the segment accounted for around 70.0% share of the global drilling chemicals market in terms of revenue. The onshore oil and natural gas industry continue to evolve, developing best practices and improving well designs. This evolution resulted in reduced drilling and completion times, lower total well costs, and increased well performance.

Asia Pacific is expected to emerge as one of the potential areas for investment by the end of 2031. This is owing to the significant growth of the oil and gas industry in India and China. According to India Brand Equity Foundation, the oil and natural gas industry in India is expected to attract US$ 25 billion investment in exploration and production projects by 2022.

Key features of the study:

- This report provides in-depth analysis of drilling chemicals market and provides market size (US$ Million) and Cumulative Annual Growth Rate (CAGR%) for the forecast period (2024 - 2031), considering 2023 as the base year

- It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrix for this market

- This study also provides key insights about market drivers, restraints, opportunities, new product launches or approval, regional outlook, and competitive strategy adopted by key players

- It profiles key players in the global drilling chemicals market based on the following parameters - company overview, financial performance, product portfolio, geographical presence, distribution strategies, key developments and strategies, and future plans

- Key companies covered as a part of this study include Anchor Drilling Fluids Inc., MB Holding Company LLC, Tetra Technologies Inc., International Drilling Fluids and Engineering Services (Idec) Ltd., Canadian Energy Services Inc., Weatherford International Ltd., Global Fluids & Chemical Co., Baker Hughes, Newpark Drilling Fluids LLC., Diamoco Group, M-I SWACO, Schlumberger, Oren Hydrocarbons, and Halliburton

- Insights from this report would allow marketers and the management authorities of the companies to make an informed decision regarding their future products launches, technology up-gradation, market expansion, and marketing tactics

- The global drilling chemicals market report caters to various stakeholders in this industry including investors, suppliers, drilling chemicals manufacturers, distributors, new entrants, and financial analysts

- Stakeholders would have ease in decision-making through the various strategy matrices used in analyzing the drilling chemicals market

Detailed Segmentation:

- By Chemicals:

- Dispersants & Deflocculants

- Clean Up Chemicals

- Shale Stabilizers

- Drilling Mud Defoamers and Foaming Agents

- Drilling Mud Lubricants

- Drilling Mud Surfactants

- Spotting Fluids

- Fluid Loss Control Additives

- Loss Circulation Material

- Emulsifiers for Water-based and Oil-based Systems

- Drilling Polymers

- Weight Materials

- Corrosion Inhibitor

- Scavengers & Biocides

- Viscosifiers

- Adhesives & Sealants

- Commercial Chemicals

- By Fluid Type:

- Oil-based Fluids

- Water-based Fluids

- Synthetic-based Drilling Fluids

- Pneumatic Drilling fluids

- By Application:

- Onshore Drilling

- Offshore Drilling

- By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Company Profiles

- Anchor Drilling Fluids Inc.

- MB Holding Company LLC

- Tetra Technologies Inc.

- International Drilling Fluids and Engineering Services (Idec) Ltd.

- Canadian Energy Services Inc.

- Weatherford International Ltd.

- Global Fluids & Chemical Co.

- Baker Hughes

- Newpark Drilling Fluids LLC

- Diamoco Group

- M-I SWACO

- Schlumberger

- Oren Hydrocarbons

- Halliburton

Table of Contents

1. Research Objectives and Assumptions

- Research Objectives

- Assumptions

- Abbreviations

2. Market Purview

- Report Description

- Market Definition and Scope

- Executive Summary

- Market Snapshot, By Fluid Type

- Market Snapshot, By Chemicals

- Market Snapshot, By End User

- Market Snapshot, By Region

- Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact Analysis

- Porter's Analysis

- Industry Trends

- Key Highlights

- Epidemiology

- Reimbursement Scenario

- Regulatory Scenario

- Product Launches and Approvals

- Acquisition and Collaboration Scenario

4. Global Drilling Chemicals Market - Impact of Coronavirus (COVID-19) Pandemic

- Overall Impact

- Government Initiatives

- COVID-19 impact on the market

5. Global Drilling Chemicals Market, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Oil-based Fluids

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Water-based Fluids

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Synthetic-based Drilling Fluids

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Others

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

6. Global Drilling Chemicals Market, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Dispersants & Deflocculants

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Clean Up Chemicals

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Shale Stabilizers

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Drilling Mud Defoamers and Foaming Agents

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Drilling Mud Lubricants

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Drilling Mud Surfactants

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Spotting Fluids

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Fluid Loss Control Additives

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Loss Circulation Material

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Others

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

7. Global Drilling Chemicals Market, By End User, 2019 - 2031, (USD Mn & KT)

- Overview

- Market Share Analysis, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, 2020 - 2031

- Segment Trends

- Onshore

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

- Offshore

- Overview

- Market Size and Forecast, and Y-o-Y Growth, 2019-2031, (USD Mn & KT)

8. Global Drilling Chemicals Market, By Region, 2019 - 2031, (USD Mn & KT)

- Introduction

- Market Share Analysis, By Region, 2024 and 2031 (%)

- Y-o-Y Growth Analysis, For Region, 2020-2031

- Regional Trends

- North America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (USD Mn & KT)

- U.S.

- Canada

- Latin America

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (USD Mn & KT)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Europe

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (USD Mn & KT)

- U.K.

- Germany

- Italy

- France

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (USD Mn & KT)

- China

- India

- Japan

- ASEAN

- Australia

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- Introduction

- Market Size and Forecast, and Y-o-Y Growth, By Fluid Type, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Chemicals, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By End User, 2019 - 2031, (USD Mn & KT)

- Market Size and Forecast, and Y-o-Y Growth, By Country, 2019 - 2031, (USD Mn & KT)

- GCC countries

- Israel

- Rest of Middle East & Africa

9. Competitive Landscape

- Company Profiles

- Baker Hughes Company

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Halliburton

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Schlumberger Limited

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Weatherford

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Diamoco Group

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Royal Dutch Shell Plc

- Company Highlights

- Product Portfolio

- Key Highlights

- Financial Performance

- Market Strategies

- Solvay S.A.

- The Egyptian Mud Engineering & Chemicals Company

- Kemira Oyj

- BASF SE

- Clariant

- ChampionX

- Lubrizol Corporation

- Stepan Company

- Nouryon

- Albermarle Corporation

- Pure Chemicals Co.

- Ennor Muds & Chemicals

- Core Drilling Chemicals

- S.R. Chemical

- Baker Hughes Company

10. Analyst View

- Wheel of Fortune

- Analyst View

- Coherent Opportunity Map

11. References and Research Methodology

- References

- Research Methodology

- About Us and Sales Contact