|

市场调查报告书

商品编码

1685699

矿业化学品:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mining Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

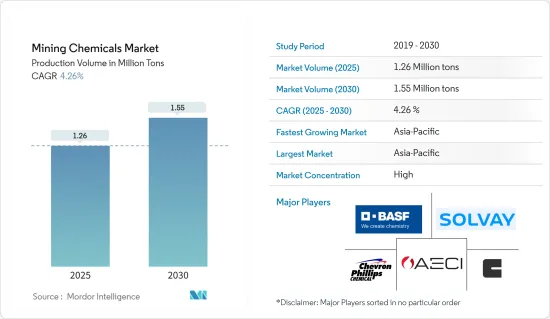

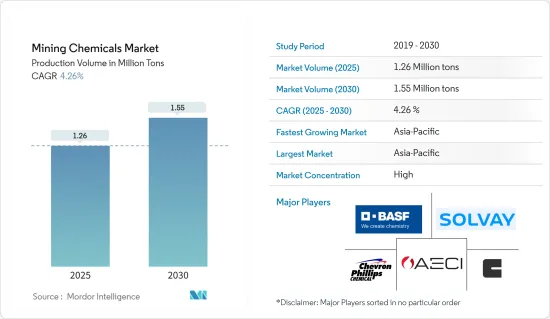

根据产量计算,采矿化学品市场规模预计将从 2025 年的 126 万吨扩大到 2030 年的 155 万吨,预测期内(2025-2030 年)的复合年增长率为 4.26%。

COVID-19 疫情阻碍了采矿化学品市场的发展,一些国家实施全国封锁和严格的社交距离措施,影响了矿物加工和污水处理应用。然而,随着矿产加工产业需求的恢復,放鬆管制后市场实现了显着的成长率。

亚太地区和北美地区采矿活动的增加以及各终端行业对矿物的需求不断增加,预计将推动采矿化学品市场的发展。

另一方面,与采矿和危险采矿化学品相关的严格政府法规预计将阻碍市场成长。

非洲尚未开发的采矿潜力和日益增长的稀土元素相关探勘活动预计将在未来几年创造有利可图的市场机会。

亚太地区占据市场主导地位,预计在预测期内将呈现最高的复合年增长率。

矿业化学品市场趋势

矿物加工中采矿化学品的使用增加

- 矿物处理又称矿物选矿。它是一种提取冶金术,将有价值的矿物(通常从矿石中)浓缩并分离成可销售的产品。矿物加工在矿场进行,且高度机械化。矿物加工每个阶段使用的设备类型包括破碎/研磨设备、分级/筛选设备、浓缩设备和脱水设备。

- 矿山的盈利取决于从矿石中提取的所需矿物精矿的数量。因此,矿物加工的目的是为了在产品交付到市场之前获得最大数量的矿物精矿。这是将矿石转化为可出售和日常使用的产品的重要步骤。

- 矿物加工用于提取黄铜矿、铝、铬铁矿、矾土、铜、金、铁、赤铁矿、铅、钼、磁铁矿、锌、锡、镍、银和铂等金属,以及煤、建筑石材、花岗岩、粘土、钾肥、石灰石、沙子和大理石等岩石。

- 工业矿石有钻石、重晶石、磷灰石、石榴石、萤石、锆石、石英、宝石、蛭石、硅灰石等。从事矿物加工业务的公司包括BASF、科莱恩、索理思、Syensqo 和艺康。 Syensqo 浮选药剂广泛应用于采矿业,适合各种加工条件和矿石类型。该公司的浮选药剂可提高贵金属和基底金属的回收率,包括金、铜、银、钼、多金属、钴、镍、锂和铂族金属。

- 公司也向采矿业引入新产品和创新以获得竞争优势。例如,2023年10月,BASF宣布推出两个针对采矿业的新型浮选药剂品牌Luprofroth和Luproset。这些品牌拓展了公司的浮选业务,使BASF成为采矿业完整解决方案的提供者。

- 铝和钢开采需要大量化学品用于各种目的,包括提炼、分离、破碎和爆破。使用的化合物包括氢氧化钠、硝酸铵、氢氧化钙、碱灰和石灰。这些物质的使用受到管制,以确保工人和环境的安全。

- 根据世界钢铁协会预测,2022年全球粗钢产量将达18.7亿吨。根据国际铝业协会预测,2023年终铝产量将达7,059万吨,较2022年水准成长2.25%。

- 因此,由于上述因素,预计矿物加工部门将在预测期内主导采矿化学品市场。

预计亚太地区将在预测期内占据市场主导地位

- 预计预测期内亚太地区将主导采矿化学品市场。中国、日本和印度等国家对矿物加工和污水处理应用的采矿化学品的需求日益增加。

- 中国是世界最大矿业国家之一。中国是世界上最大的20多种金属生产国。这些金属包括铝、金、石墨等。中国也是钢铁、铅、镁和稀土的主要生产国。中国也是锌的主要出口国。

- 此外,中国在全球关键矿产供应链中占据主导地位,约占全球产量的60%和加工能力的85%。在政府大量投资的支持下,中国正积极开发深海锂和钴资源。这一战略重点使中国成为这一新兴采矿业的主导者,俄罗斯和韩国也在该领域取得了显着进展。

- 由于智慧城市、印度製造宣传活动等多项措施的实施,以及国家电力政策下对可再生能源计划的加强重视,印度金属和采矿业正与倡议同步成长。

- 预计本财年采矿业将成长 8.1%,较 2022-23 年的 4.1% 大幅上升。 2024 年 2 月,国营印度煤炭公司计划在 5 个新矿区开始运营,并增加至少 16 个现有矿区的产能,以满足不断增长的燃料需求。

- 此外,日本正积极探索其专属经济区(EEZ)内的深海采矿,以减少对先进环保技术至关重要的进口矿产资源的依赖。日本的采矿业规模相对较小,但以金矿开采为主,主要分布在北海道、九州和本州三岛。目前已有多个黄金探勘计划正在进行中,其中包括由日本黄金公司和巴里克黄金公司主导的项目。此外,住友金属矿旗下的菱刈矿山在日本采矿业扩张中扮演重要角色。

- 由于上述因素,预计预测期内亚太地区采矿化学品市场将大幅成长。

矿业化学品产业概况

从本质上来说,采矿化学品市场是部分分散的。市场上的主要企业(不分先后顺序)包括BASF SE、Solvay、AECI、Chevron Phillips Chemical Company LLC 和 Clariant。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 亚太地区和北美的采矿活动增加

- 各终端产业对矿物的需求不断增加

- 限制因素

- 政府对采矿和危险采矿化学品有严格的监管

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 功能

- 空气中的化学物质

- 集电极

- 抑制剂

- 凝聚剂

- 冷冻柜

- 分散剂

- 抽取剂

- 冲淡

- 抽取剂

- 研磨助剂

- 空气中的化学物质

- 应用

- 矿物加工

- 污水处理

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 澳洲和纽西兰

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 奈及利亚

- 南非

- 坦尚尼亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- AECI

- Arkema

- BASF SE

- Betachem(Pty)Ltd

- Chevron Phillips Chemical Company LLC

- CLARIANT

- CTC(Tennant Consolidated Group)

- Ecolab

- FMC Corporation

- Indorama Ventures Public Limited

- Kemira

- NASACO

- Orica Limited

- Qingdao Ruchang Mining Industry Co. Ltd

- Sasol Limited

- SNF Group

- Solvay

第七章 市场机会与未来趋势

- 非洲尚未发现的采矿活动潜力

- 稀土探勘活动活性化

The Mining Chemicals Market size in terms of production volume is expected to grow from 1.26 million tons in 2025 to 1.55 million tons by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the mining chemicals market, as nationwide lockdowns in several countries and strict social distancing measures affected mineral processing and wastewater treatment applications. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand from mineral processing industries.

Increasing mining activities in Asia-Pacific and North America and the rising demand for minerals across different end-use industries are expected to drive the market for mining chemicals.

On the other hand, stringent government regulations related to the mining industry and hazardous mining chemicals are expected to hinder the market's growth.

The undiscovered potential of mining activities in Africa and the rising exploration activities related to rare earth metals are expected to create lucrative market opportunities over the coming years.

Asia-Pacific dominates the market studied and is anticipated to witness the highest CAGR during the forecast period.

Mining Chemicals Market Trends

Increasing Use of Mining Chemicals in Mineral Processing

- Mineral processing is also called mineral dressing. It is a form of extractive metallurgy that usually separates valuable minerals from the ore into a concentrated, marketable product. Mineral processing is conducted at the mine site and is highly mechanical. The types of equipment used at each stage of mineral processing include crushing and grinding equipment, sizing and classification equipment, concentration equipment, and dewatering equipment.

- Mine profitability depends on the amount of desirable mineral concentrate that can be extracted from the ore. Hence, mineral processing is designed to yield the maximum amount of mineral concentrate before the product is supplied to the market. It is an essential step in converting ore into a product that can be sold and used for everyday applications.

- Mineral processing is used to extract metals, including chalcopyrite, aluminum, chromite, bauxite, copper, gold, iron, hematite, lead, molybdenum, magnetite, zinc, tin, nickel, silver, and platinum, and rocks, including coal, building stone, granite, clay, potash, limestone, sand, and marble.

- Industrial mineral ore includes diamond, barite, apatite, garnet, fluorite, zircon, quartz, gemstones, vermiculite, and wollastonite. Some of the companies operating in the mineral processing business are BASF, Clariant, Solenis, Syensqo, and Ecolab. Syensqo's floating reagents are broadly used in the mining industry and support a varied range of processing conditions and ore types. The company's flotation chemicals improve the recovery of precious and base metals, including gold, copper, silver, molybdenum, polymetallic, cobalt, nickel, lithium, and platinum group metals.

- Companies are also introducing new products and innovations in the mining industry to gain a competitive edge. For instance, in October 2023, BASF introduced two new flotation reagent brands, Luprofroth and Luproset, for the mining industry. These brands will expand the company's floatation business, and BASF will become a full solution provider for the mining industry.

- Aluminum and steel mining requires numerous chemicals for various purposes, such as refining, separation, grinding, and blasting. Among the compounds utilized are sodium hydroxide, ammonium nitrate, calcium hydroxide, soda ash, and lime. The use of these substances is regulated to guarantee worker and environmental safety.

- As per the World Steel Association, in 2022, the world produced 1.87 billion tonnes of crude steel. According to the International Aluminum Institute, by the end of 2023, aluminum production reached 70.59 million metric tonnes, up 2.25% from 2022 levels.

- Hence, owing to the above-mentioned factors, the mineral processing segment is expected to dominate the market for mining chemicals during the forecast period.

Asia-Pacific to Dominate the Market During the Forecast Period

- Asia-Pacific is expected to dominate the market for mining chemicals during the forecast period. The demand for mining chemicals from mineral processing and wastewater treatment applications is increasing in countries like China, Japan, and India.

- China has one of the largest mining industries in the world. China is the world's largest producer, often by a wide margin, of over 20 metals. These metals include aluminum, gold, graphite, and others. China is also a major producer of iron, steel, lead, magnesium, and rare earth metals. It is also a major exporter of zinc.

- Furthermore, China dominates the supply chain of global critical minerals, accounting for approximately 60% of worldwide production and 85% of processing capacity. The country is actively pursuing lithium and cobalt resources in the deep sea, backed by significant government investments. This strategic focus is positioning China as a dominant player in this emerging extractive sector, with Russia and South Korea also making notable strides in this field.

- The metals and mining industry in India is growing by implementing various initiatives such as the Smart Cities, Make in India Campaign, and rising focus on renewable energy projects under the National Electricity Policy, alongside infrastructure development.

- The growth of the mining sector is projected at 8.1% in the current fiscal year, a significant increase from 4.1% in 2022-23, attributed to the expansion of mining activities across the country. In February 2024, State-run Coal India planned to commence operations at five new mines and enhance the capacity of at least 16 existing ones to meet the escalating demand for fuel.

- Furthermore, Japan is actively seeking pathways to conduct deep-sea mining within its exclusive economic zone (EEZ) as a strategy to reduce dependency on imported mineral resources crucial for advanced and environmentally friendly technologies. Japan's mining sector, though relatively small, is primarily centered on gold mining, predominantly situated on three islands, namely Hokkaido, Kyushu, and Honshu. Several gold exploration projects, including those led by Japan Gold and Barrick Gold, are underway. Additionally, the Hishikari mine, owned by Sumitomo Metal Mining, plays a significant role in expanding Japan's mining industry.

- Owing to the factors mentioned above, the market for mining chemicals in Asia-Pacific is projected to grow significantly during the forecast period.

Mining Chemicals Industry Overview

The mining chemicals market is partially fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, Solvay, AECI, Chevron Phillips Chemical Company LLC, and Clariant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Mining Activities in Asia-Pacific and North America

- 4.1.2 Rising Demand for Minerals Across Different End-use Industries

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations Related to Mining Industry and Hazardous Mining Chemicals

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Function

- 5.1.1 Flotation Chemicals

- 5.1.1.1 Collectors

- 5.1.1.2 Depressants

- 5.1.1.3 Flocculants

- 5.1.1.4 Frothers

- 5.1.1.5 Dispersants

- 5.1.2 Extraction Chemicals

- 5.1.2.1 Diluents

- 5.1.2.2 Extractants

- 5.1.3 Grinding Aids

- 5.1.1 Flotation Chemicals

- 5.2 Application

- 5.2.1 Mineral Processing

- 5.2.2 Wastewater Treatment

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Australia and New Zealand

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Nigeria

- 5.3.5.2 South Africa

- 5.3.5.3 Tanzania

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers And Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AECI

- 6.4.3 Arkema

- 6.4.4 BASF SE

- 6.4.5 Betachem (Pty) Ltd

- 6.4.6 Chevron Phillips Chemical Company LLC

- 6.4.7 CLARIANT

- 6.4.8 CTC (Tennant Consolidated Group)

- 6.4.9 Ecolab

- 6.4.10 FMC Corporation

- 6.4.11 Indorama Ventures Public Limited

- 6.4.12 Kemira

- 6.4.13 NASACO

- 6.4.14 Orica Limited

- 6.4.15 Qingdao Ruchang Mining Industry Co. Ltd

- 6.4.16 Sasol Limited

- 6.4.17 SNF Group

- 6.4.18 Solvay

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Undiscovered Potential of Mining Activities in Africa

- 7.2 Rising Exploration Activities Related to Rare Earth Metals