|

市场调查报告书

商品编码

1237834

锂离子电池 (LIB) 的石墨阳极市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Graphite Anode For Lib Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,用于锂离子电池 (LIB) 的石墨阳极的复合年增长率预计将超过 7%。

在 2020 年 COVID-19 大流行期间,三聚氰胺市场受到了负面影响。 市场在2021年有所改善。 汽车製造活动已从封锁中恢復,提振了对汽车和电池等电子元件的需求。 汽车行业正在迅速復苏,预计未来几年将进一步增长,这可能会增加对三聚氰胺的需求。

主要亮点

- 短期内,预计电动汽车行业对锂离子电池 (LIB) 的需求不断增加将推动市场增长。

- 预计对电池废料倾倒的严格监管会阻碍市场增长。

- 然而,电池新材料的开发似乎是一个机会。

- 亚太地区在全球占据主导地位,其中最大的消费来自中国和印度。

锂离子电池(LIB)用石墨负极市场趋势

汽车行业的需求不断增长

- 石墨阳极广泛用于电动汽车製造中的锂离子电池 (LIB)。 随着对电动汽车的需求增加,预计该市场将显着增长。

- 美国是世界上一些主要汽车製造商的所在地,并且正在投资电动汽车行业。 General Motors等汽车製造商将在 2023 年推出 20 款全新纯电动汽车,并向製造设施投资超过 70 亿美元。

- 它还正在成为仅次于中国的巨大电动汽车市场。 根据 EV Volumes,2021 年全国插电式电动汽车保有量将达到 65.69 万辆左右,较 2020 年增长约 100%。

- 根据 IEA 的数据,联邦政府的目标是到 2030 年电动汽车 (EV) 占美国新乘用车和轻型卡车销量的 50%。 此外,根据国际清洁交通委员会的说法,加州政府将在 2020 年宣布一项行政命令,要求到 2035 年在加州销售的所有新车和乘用车都必须是零排放车辆,包括 BEV 和 PHEV。

- 此外,电动汽车在墨西哥的成功销售有望进一步支持汽车生产和销售。 根据 EV Volumes 的数据,到 2021 年,该国的电动汽车註册量与 2020 年相比增长了 80%。

- 美国私营公司 Citizens Resources 的子公司 Link EV Electric Vehicles, Inc. 已宣布计划投资约 2.65 亿美元在墨西哥中部的普埃布拉州建设一家装配厂。 计划于 2022 年下半年开始运营,拥有 4 条生产线,标称产能为 1,200 台。

- 上述所有因素预计将在预测期内推动全球市场的增长。

预计亚太地区将主导市场

- 由于印度和中国等经济强国的存在,亚太地区被认为是最大的电动汽车市场。 然而,东盟国家也在刺激电子元件的生产。

- 随着消费者越来越青睐电池驱动的汽车,中国的汽车行业正在发生趋势转变。 中国政府还预测到 2025 年电动汽车生产的渗透率将达到 20%。

- 儘管大宗商品价格上涨,但乘用车需求依然强劲,因此许多汽车製造商都渴望引进新技术,尤其是电动汽车。 在印度,电动汽车生产得到政府补贴和支持製造方法的优惠政策的支持。

- 该国的电动汽车市场主要由两轮车细分市场驱动,2021 年占 48% 以上。 根据道路、运输和公路部 (MoRTH) 的数据,该国售出了 3,29,190 辆电动汽车,与 2020 年相比增长了 168%。

- 韩国的电动汽车行业有望快速发展。 2021年,全国将销售近7.1万辆电动汽车。 根据韩国汽车技术研究院 (KAII) 收集的数据,2021 年 1 月至 9 月,韩国电动汽车销量激增 96% 至 71,006 辆。 由于欧洲、亚太地区和美洲进口经济体的需求增加,预计销售额将增加。

- 印度尼西亚是东南亚最大的汽车生产基地。 2021年汽车产量将达到1121967辆,比2020年增长63%。 儘管我国电动汽车普及率明显偏低,但我国电动汽车产业的前景一片光明。

- 印度尼西亚政府已决定支持在该国为生产商和消费者引入电动汽车。 此外,政府还为电动汽车消费者提供补贴,为电动汽车製造商提供税收减免。 印度尼西亚正在促进电动汽车和电池生产设施的发展,这也将有助于该国的市场增长。

- 在日本,随着消费者对替代燃料技术的需求增加,预计未来电动汽车的销量将会增加。 这是因为日本的电动汽车製造仍然是一个新兴行业,一些製造商希望在其他亚洲经济体生产。 日本的目标是到 2035 年销售 100% 的电动汽车,日本的电动汽车市场正在增长。 因此,日本电动汽车市场的扩张有望推动市场增长。

- 上述特征有利于该地区的市场增长。

锂离子电池(LIB)石墨负极市场竞争者分析

一些用于锂离子电池 (LIB) 的石墨阳极被整合。 Mitsubishi Chemical Holdings、Nippon Carbon、SGL Carbon、Tokai Carbon、Resonc 等(排名不分先后)。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 电动汽车对锂离子电池 (LIB) 的需求不断扩大

- 其他司机

- 约束因素

- 将加强对倾倒电池废料的监管

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 类型

- 人造石墨

- 天然石墨

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 俄罗斯

- 其他欧洲

- 世界其他地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%) 分析**/排名分析

- 主要参与者采用的策略

- 公司简介

- Beterui New Materials Group Co. Ltd.

- Elkem ASA

- Guangdong Kaijin New Energy Technology Co. Ltd

- JFE Chemical Corporation

- Longbai Group

- Mitsubishi Chemical Holdings Corporation

- Ningbo Shanshan Co. Ltd.

- Nippon Carbon Co. Ltd

- POSCO CHEMICAL

- Resonac

- SGL Carbon

- Shanghai Pu Tailai New Energy Technology Co. Ltd

- Shenzhen XFH Technology Co. Ltd

- Syrah Resources Limited

- Tokai Carbon Co. Ltd

第七章市场机会与未来趋势

- 锂离子电池新材料开发

The graphite anode for the LIB market is projected to register a CAGR of greater than 7% during the forecast period.

The melamine market was negatively impacted during the COVID-19 pandemic in 2020. The market improved in 2021. With automotive manufacturing activities recovering from the lockdown, the demand for automobile components such as batteries and other electronic components increased. The automotive industry is recovering rapidly and is estimated to grow further in the coming years, which may boost the demand for melamine.

Key Highlights

- Over the short term, the rising demand for lithium-ion batteries from the electric vehicles industry is expected to drive the market's growth.

- The stringent regulations against dumping battery waste are expected to hinder the market's growth.

- However, developing newer materials for batteries is likely to be an opportunity.

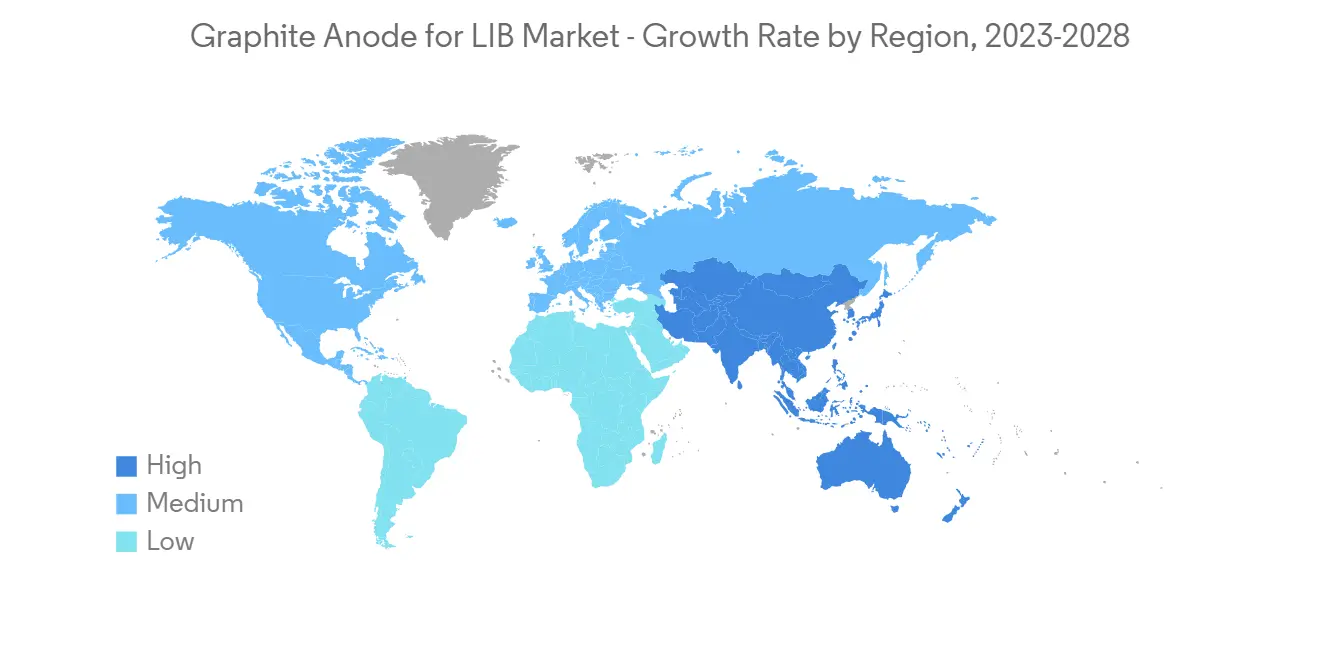

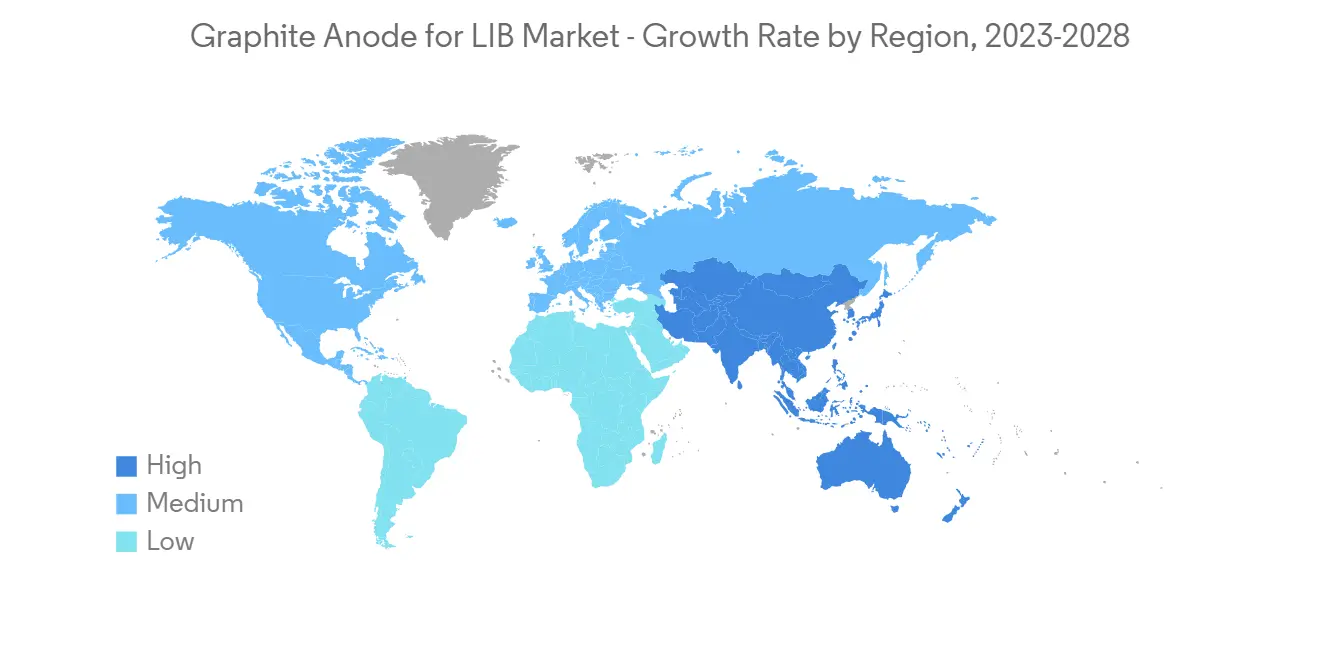

- Asia-Pacific dominates the world, with the most significant consumption from China and India.

Graphite Anode for LIB Market Trends

Increasing Demand from Automobile Industry

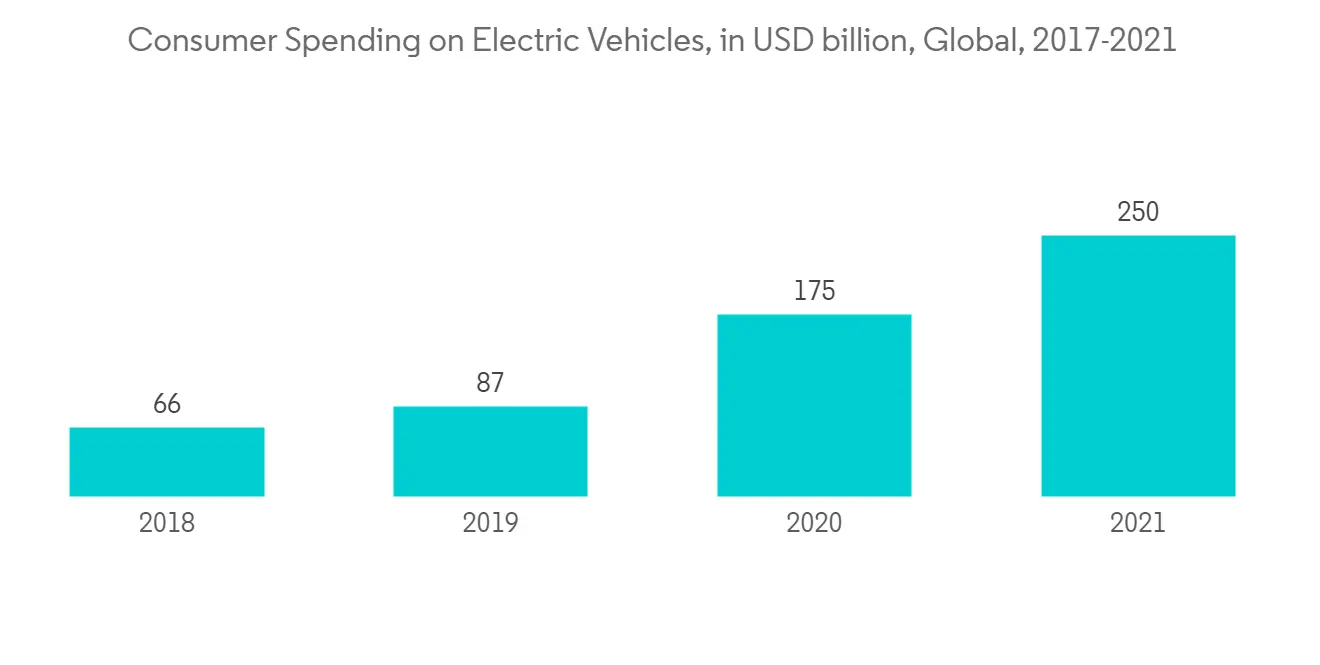

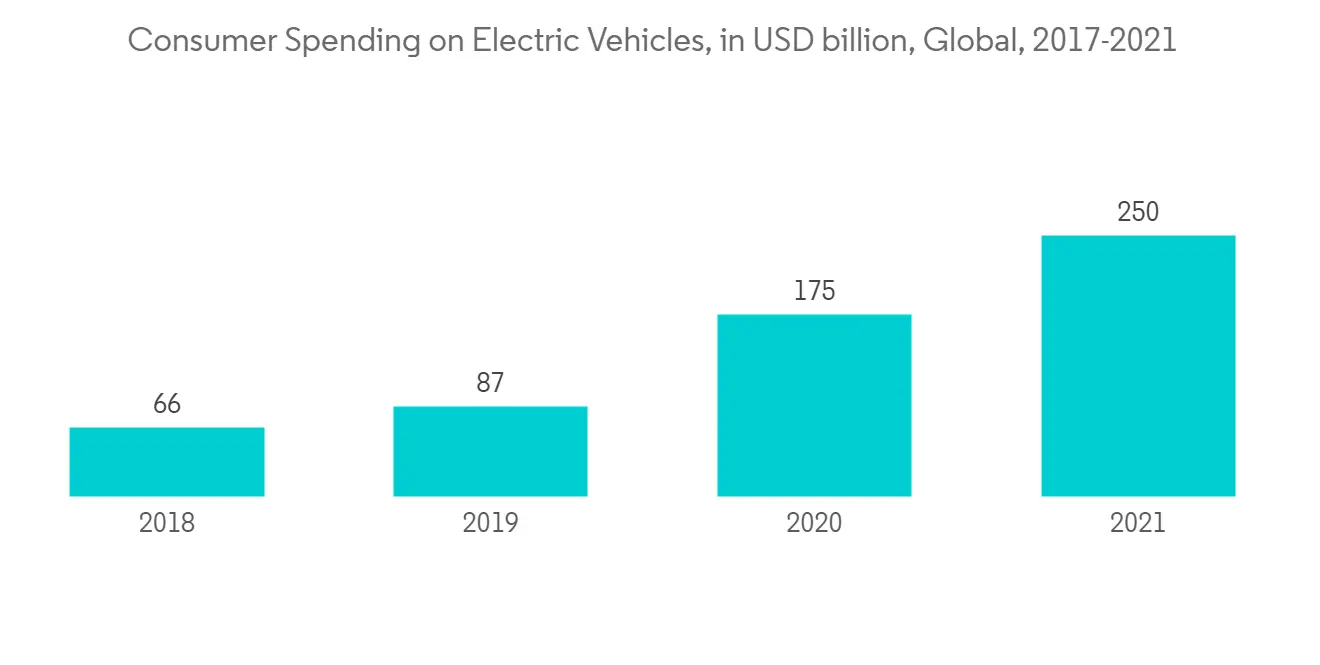

- Graphite anodes are widely used in electric vehicle manufacturing in lithium-ion batteries. With the increased demand for electric vehicles, the market is expected to grow significantly.

- The United States is home to some of the major automotive players in the world, which are investing in the electric car segment. Automakers such as General Motors plan to launch 20 new all-electric vehicles in 2023 and manufacturing facilities with an investment of more than USD 7 billion.

- The country has also emerged as a massive market for electric vehicles after China. According to the EV Volumes, in 2021, the country's total plug-in electrical cars accounted for around 656,900 units, registering a growth rate of ~100% compared to 2020.

- According to the IEA, in the United States, the federal aim is for electric vehicles (EVs) to make up 50% of new passenger cars and light trucks sold by 2030. Moreover, as per the International Council on Clean Transportation, in 2020, the California Government announced an executive order that by 2035 all new cars and passenger trucks sold in California be zero-emission vehicles, which includes BEV and PHEV, and others

- Additionally, the successful sales of electric vehicles in Mexico are further anticipated to support vehicle production and sales. According to the EV Volumes, in 2021, the country's electric vehicle registration witnessed a growth rate of 80% compared to 2020.

- The Link EV Electric Vehicles, a unit of private US energy company, Citizens Resources, announced its plans to build an assembly plant in the central Mexican state of Puebla with an investment of around USD 265 million. The operations are scheduled to begin in the second half of 2022 with four production lines with a nominal capacity of 1,200 units.

- All the above factors will likely drive global market growth during the forecast period.

Asia Pacific Region is Expected to Dominate the Market

- The Asia-Pacific region is deemed to largest market for electric vehicles because of the presence of major economies such as India and China. Although, various ASEAN countries are also pacing up in the manufacturing of electric components.

- The automobile industry in China is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025.

- With demand for passenger vehicles remaining strong despite rising commodity prices, many automakers are eager to adopt new technologies, particularly electric vehicles. In India, the production of electric vehicles is supported by government subsidies and favourable policies supporting manufacturing practices.

- The electric vehicles market in the country is majorly driven by the two-wheeler segment, which accounted for over 48% in 2021. According to the Ministry of Road Transport & Highways (MoRTH), 3,29,190 electric vehicles were sold in the country, representing an increase of 168% compared with the sales in 2020.

- The electric vehicle industry in South Korea is expected to grow at a rapid rate. In 2021, nearly 71,000 units of electric vehicles were sold in the country. South Korean sales of electric vehicles surged by 96% to 71,006 units in the first nine months of 2021, according to data collected by the Korea Automotive Technology Institute (KAII). The sales figure is expected to increase with the growing demand from the importing economies in Europe, Asia-Pacific, and the Americas.

- Indonesia is Southeast Asia's largest automotive production hub. The production of automobiles for the year 2021 accounted for 11,21,967 units an increase of 63% in comparison to 2020. Although the penetration of electric vehicles in the country is admissibly low, the future of the electric vehicle industry in the country looks very bright.

- The Indonesian government is determined to support the adoption of electric vehicles in the country for both producers and consumers. Moreover, the government has been giving subsidies to EV consumers, along with tax cuts to EV automakers. Indonesia is pushing for the development and manufacture of electric vehicles and battery production facilities, which in turn is likely to benefit the market growth in the country.

- Electric vehicle sales in Japan are likely to ascend in the coming future with rising consumer demand for alternate fuel technology. Electric vehicle manufacturing in Japan is still an emerging industry as several manufacturers prefer production in other Asian economies. Japan is transitioning to 100% electric car sales by 2035, and the Japanese electric vehicle market is growing. Expansion of the electric vehicle market in the country is therefore projected to benefit the market growth.

- All the aforementioned attributes are favoring the regional market growth.

Graphite Anode for LIB Market Competitor Analysis

The graphite anode for the LIB market is partially consolidated in nature. These companies include Mitsubishi Chemical Holdings Corporation, Nippon Carbon Co. Ltd, SGL Carbon, Tokai Carbon Co. Ltd, and Resonc (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Lithium-Ion Batteries for Electric Vehicle

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent Regulations Against Dumping of Battery Waste

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Synthetic Graphite

- 5.1.2 Natural Graphite

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 France

- 5.2.3.3 United Kingdom

- 5.2.3.4 Italy

- 5.2.3.5 Russia

- 5.2.3.6 Rest of Europe

- 5.2.4 Rest of World

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Beterui New Materials Group Co. Ltd.

- 6.4.2 Elkem ASA

- 6.4.3 Guangdong Kaijin New Energy Technology Co. Ltd

- 6.4.4 JFE Chemical Corporation

- 6.4.5 Longbai Group

- 6.4.6 Mitsubishi Chemical Holdings Corporation

- 6.4.7 Ningbo Shanshan Co. Ltd.

- 6.4.8 Nippon Carbon Co. Ltd

- 6.4.9 POSCO CHEMICAL

- 6.4.10 Resonac

- 6.4.11 SGL Carbon

- 6.4.12 Shanghai Pu Tailai New Energy Technology Co. Ltd

- 6.4.13 Shenzhen XFH Technology Co. Ltd

- 6.4.14 Syrah Resources Limited

- 6.4.15 Tokai Carbon Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Newer Materials for LIB