|

市场调查报告书

商品编码

1237852

乙酸乙烯酯乙烯 (VAE) 市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Vinyl Acetate Ethylene (Vae) Market - Growth, Trends, And Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

全球醋酸乙烯酯乙烯 (VAE) 市场预计在预测期内的复合年增长率超过 4%。

COVID-19 对 VAE 市场产生了负面影响,因为建筑行业已完全中断。 目前,VAE 市场已经从大流行中恢復过来,并且正在以显着的速度增长。

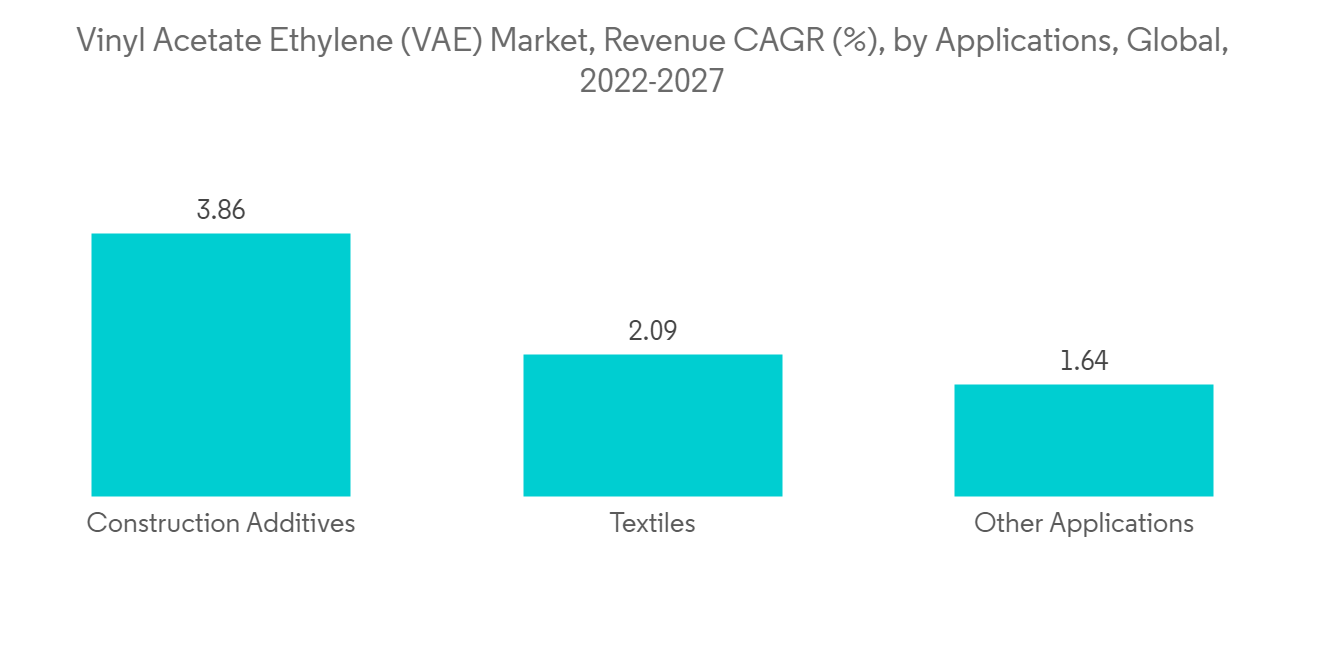

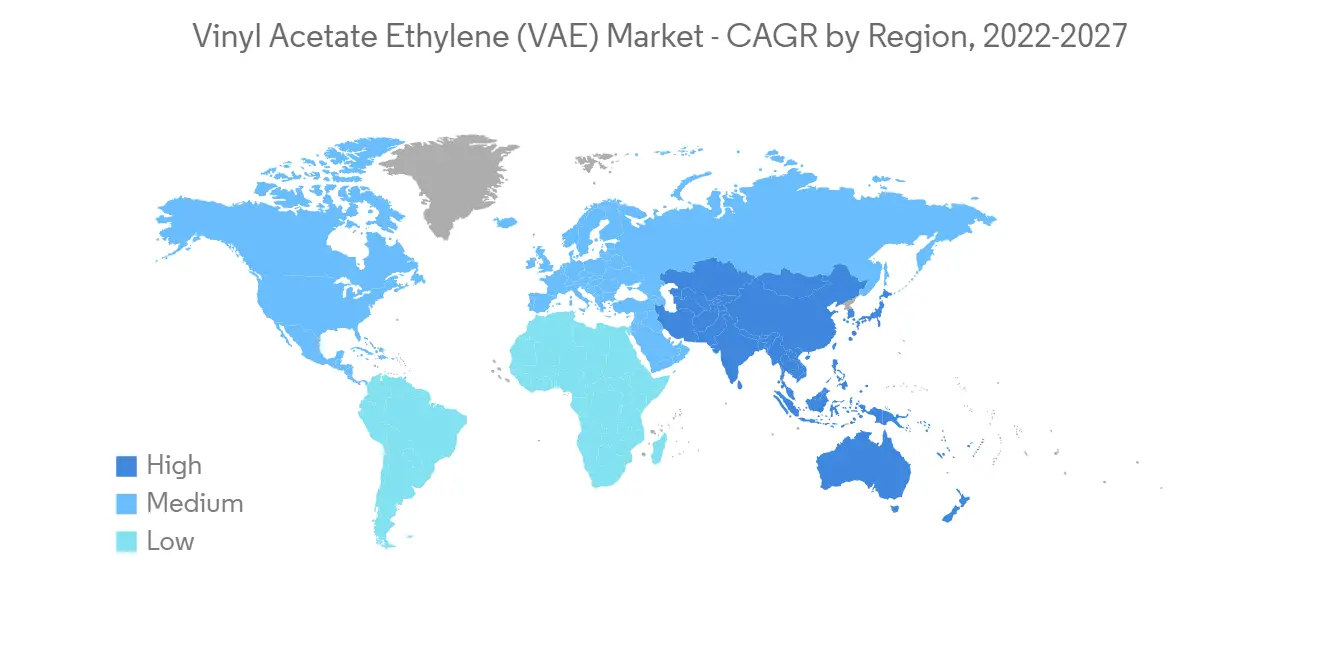

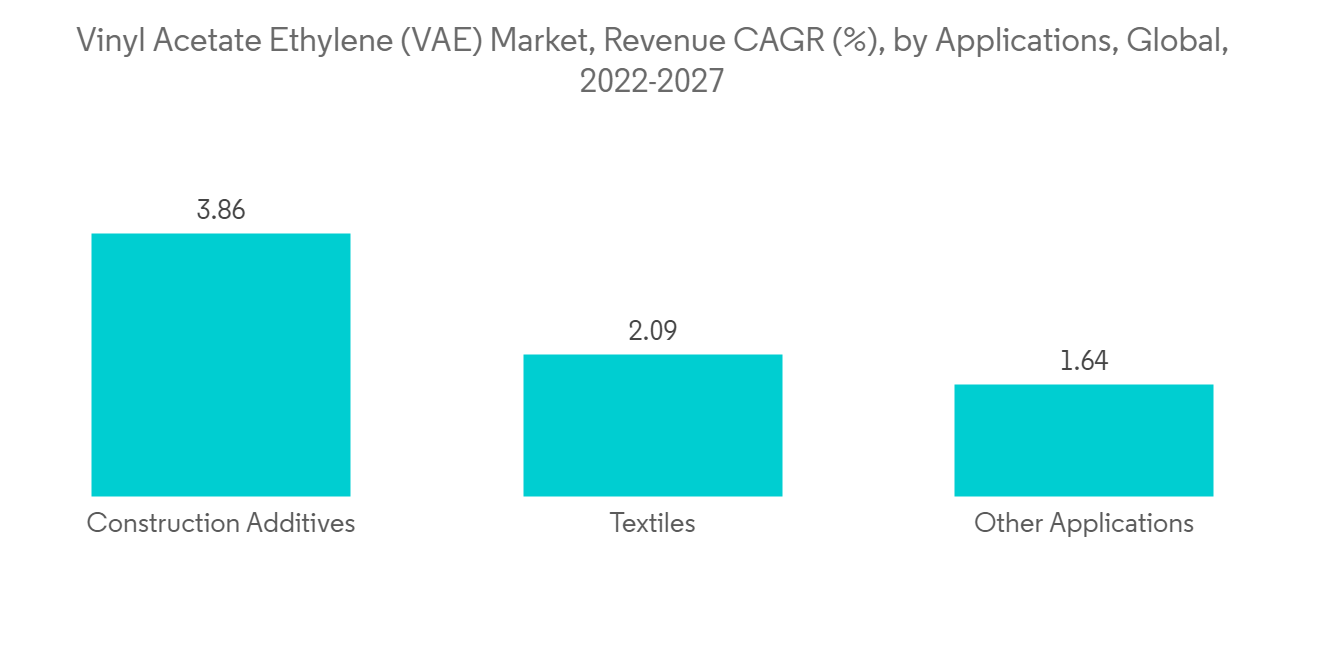

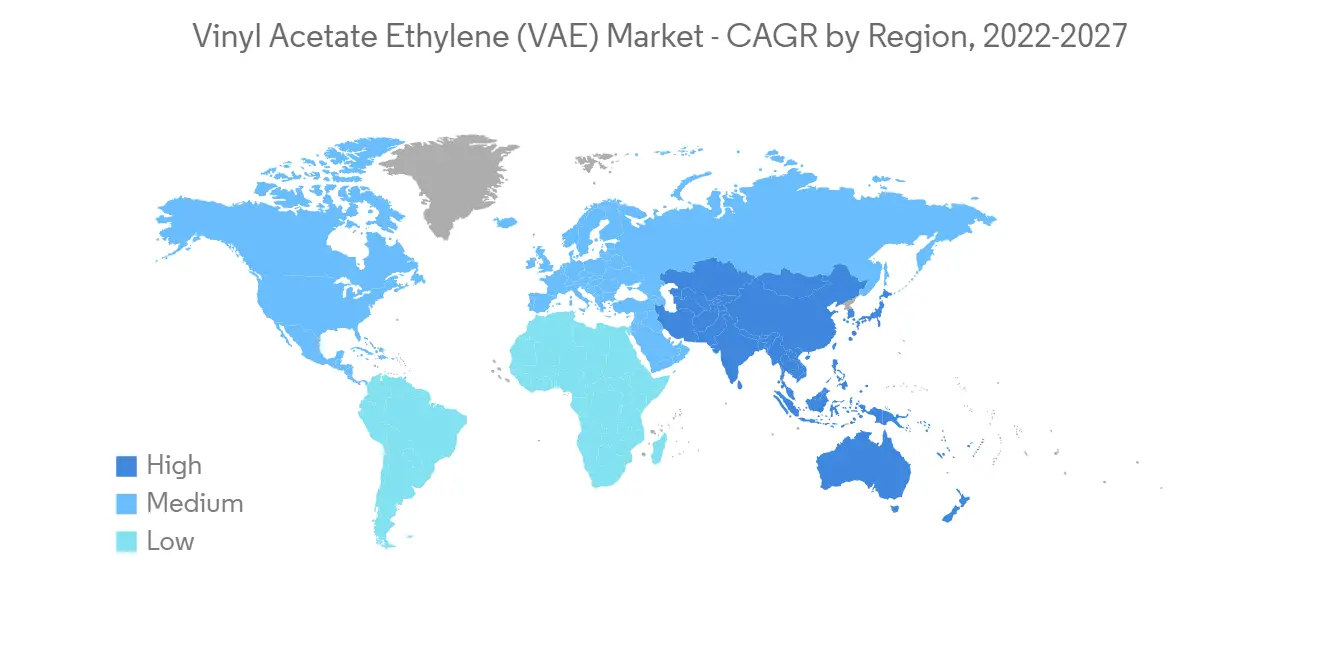

短期内,建筑行业需求的增加推动了市场的发展。 然而,估计原材料价格的波动将很快减少对醋酸乙烯酯(VAE)的需求,预计这将阻碍预测期内全球醋酸乙烯酯(VAE)市场的增长。 也就是说,包装行业不断增长的需求有望在未来提供充足的增长机会。 预计在预测期内市场将出现有利的机会。 在预测期内,预计亚太地区将在全球醋酸乙烯(VAE)市场中占据最高的市场份额,并主导全球市场。

乙酸乙烯酯乙烯 (VAE) 市场趋势

粘合剂需求增加

- 乙烯醋酸乙烯酯 (VAE) 用于纸张和包装(食品包装、信封製造、纸上薄膜层压)、木材(木材上薄膜层压、3D 薄膜压机、EPI 系统)、地板(纤维地板)、柔性covers)等,并可加工成粘合剂。

- VAE 粘合剂具有与 PVA 粘合剂相同的□□可加工性,但对涂层、塑料层压板、乙烯基、金属、玻璃和铝等无孔表面具有出色的粘合力。

- 使用 VAE 的共聚物粘合剂还提供了更柔韧的粘合片、高耐水性和出色的加工性能。 VAE胶粘剂具有优良的耐热性和可塑性,能与各种基材牢固粘接。

- 电子商务和零售业的扩张预计将增加对基于 VAE 的粘合剂的需求。 这些粘合剂还用于包装、木工、家具和汽车应用。

- 根据包装和加工技术协会包装机械製造商协会 (PMMI) 发布的一份报告,全球包装行业的增长受到人口增长、对可持续发展的兴趣日益增长的推动,将达到 42.2 美元由于消费能力增加、对智能包装的需求不断增长等,2021 年将从 2016 年的 368 亿美元增加到 10 亿美元。

- 家居市场和商业或办公市场是家具行业的主要需求信息。 此外,木材约占印度家具市场总量的65%。

- 中国是世界第二大木材消费国。 据中国林产工业协会称,在过去十年中,中国的木材消费量激增了 170% 以上。

- 此外,商业建筑是整个英国建筑业的第二大价值提供者,如果考虑到维修和保养,它占据了近 25% 的市场份额。 办公空间中木质室内设计的增加是推动市场需求的主要因素。

- 在预测期内,这些因素可能会推动家具行业发展并影响对 VAE 粘合剂的需求。

中国主导亚太

- 就市场份额和市场收入而言,醋酸乙烯酯乙烯 (VAE) 市场由中国主导。 该地区将在预测期内继续展现其主导地位。

- 根据 European Coatings 的数据,中国大约有 10,000 家涂料製造商。 立邦涂料、阿克苏诺贝尔、中国远洋涂料、PPG工业、BAF SE和艾仕得涂料等世界领先的涂料製造商大多在中国设有生产基地。 油漆和涂料製造商正在增加在该国的投资。

- 由于建筑、包装、纺织和其他最终用户行业的需求增加,预计在预测期内对乙烯醋酸乙烯酯的需求将会增加。

- 目前,建筑业在中国蓬勃发展。 中国是世界上最大的建筑市场,占全球建筑投资的20%。 到2030年,建设投资将达到约13万亿美元。

- 根据中国国家统计局的数据,2021 年中国的建筑业产值约为 29.31 万亿元人民币。 因此,它对正在考虑的市场产生了巨大的需求。

- 在不断发展的经济的推动下,住宅和商业建筑领域的众多发展推动了该国的扩张。 在中国,香港房屋委员会推出了几项举措,开始建设廉租房。 当局希望在到 2030 年的未来十年内建造 301,000 套公共住房。

- 根据中国国家统计局的数据,2022 年 1 月至 4 月,中国纺织品产量将达到 124 亿米,高于去年同期的 118 亿米。

- 此外,中国政府已在新疆维吾尔自治区投资 80 亿美元,将其设想为纺织和服装製造业的“温床”。 到2030年,西北地区有望成为最广泛的纺织生产基地。

- 因此,预计在预测期内,上述因素等因素将提振对醋酸乙烯乙烯市场的需求。

乙酸乙烯酯乙烯 (VAE) 市场竞争对手分析

全球醋酸乙烯乙烯 (VAE) 市场本质上是分散的。 市场上的主要製造商包括DCC、SINOPEC、Wacker Chemie AG、Gantrade Corporation、VINAVIL SpA等(排名不分先后)。

其他福利。

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 调查范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 建筑行业的需求增加

- 其他司机

- 约束因素

- 原材料价格波动

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第 5 章市场细分

- 通过使用

- 油漆和涂料

- 粘合剂

- 建筑添加剂

- 纺织品

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要参与者采用的策略

- 公司简介

- Celanese Corporation

- Cheng Lung Chemical Co. Ltd

- DCC

- Gantrade Corporation

- Hope Way Chemical Industrial Co. Ltd

- Parkash Group

- Shaanxi Xutai Technology Co. Ltd

- SINOPEC

- VINAVIL SpA

- Wacker Chemie AG

第七章市场机会与未来趋势

- 包装行业不断扩大的需求带来了未来的增长机会

The global vinyl acetate-ethylene (VAE) market is anticipated to register a CAGR of over 4% during the forecast period. COVID-19 negatively affected the VAE market as the construction sector was completely disrupted. Currently, the VAE market has recovered from the pandemic and is growing at a significant rate.

Over the short term, the market has been driven by the increase in demand from the construction industry. However, it is estimated that the demand for vinyl acetate-ethylene (VAE) will decrease shortly due to fluctuations in raw material prices, which are expected to hamper the global vinyl acetate-ethylene (VAE) market growth over the forecast period. Nevertheless, the growing demand from the packaging industry is expected to provide ample growth opportunities in the future. It is likely to create lucrative opportunities for the market over the forecast period. Asia-Pacific is expected to dominate the global market during the forecast period, with the highest market share in the global vinyl acetate-ethylene (VAE) market.

Vinyl Acetate Ethylene (VAE) Market Trends

Blooming Demand in the Adhesives segment

- Vinyl acetate-ethylene (VAE) can be formed into adhesives for a range of applications, including paper and packaging (food packaging, envelope production, film lamination onto paper), wood (film lamination onto wood, 3D membrane pressing, EPI systems), and flooring (textile flooring, flexible coverings), among others.

- VAE adhesives have processing qualities comparable to PVA'c but bind better to non-porous surfaces, such as coatings, plastic laminates, vinyl, metals, glass, aluminum, and others.

- Copolymeric adhesives based on VAE also provide a more flexible adhesive sheet, higher water resistance, and superior processing qualities. VAE adhesives provide great temperature resistance, plasticizers, and strong adherence to a variety of supports.

- The expansion of e-commerce and retail sales is predicted to enhance the demand for VAE-based adhesives. These adhesives are also utilized in packaging, woodworking, furniture, and automotive applications.

- According to a report published by Packaging Machinery Manufacturers Institute (PMMI), an association for packaging and processing technologies, growth in the global packaging industry reached USD 42.2 billion in 2021, up from USD 36.8 billion in 2016, owing to the rising population, growing sustainability concerns, increased spending power in developing regions, rising demand for smart packaging, and other factors.

- The domestic or home market and the commercial or office market are the primary sources of demand for the furniture industry. Furthermore, wood accounted for around 65% of all furniture markets in India.

- China is the world's second-largest user of wood. According to the China Association of Forest Products Industry, the country's wood consumption surged by more than 170% during the last decade.

- Furthermore, commercial construction is the second-largest value supplier for the overall construction industry in the United Kingdom, accounting for nearly 25% of the market share when repair and maintenance are factored in. The rise in wood interior design in office spaces is a major component driving the demand in the market .

- All the aforementioned factors are expected to drive the furniture industry, which may also impact the demand for VAE-based adhesives during the forecast period.

China to Dominate the Asia-Pacific Region

- China dominates the Vinyl Acetate Ethylene (VAE) market in terms of market share and market revenue. The region is set to continue to flourish in its dominance over the forecast period.

- According to European Coatings, China is home to almost 10,000 coatings manufacturers. The majority of the world's leading coating manufacturers, including Nippon Paint, AkzoNobel, Chugoku Marine Paints, PPG Industries, BAF SE, and Axalta Coatings, have manufacturing facilities in China. Paint and coatings manufacturers have increased their investments in the country.

- The demand for vinyl acetate-ethylene is expected to rise over the projected period because of the rising demand from the construction, packaging, textile, and other end-user sectors.

- Currently, the construction industry is flourishing in China. The country is the world's largest construction market, accounting for 20% of all global construction investments. By 2030, the country will have spent approximately USD 13 trillion on construction.

- According to the National Bureau of Statistics of China, construction output in China was worth approximately CNY 29.31 trillion in 2021. As a result, it has generated significant demand for the market under consideration.

- The country's expansion has been fueled by numerous developments in the residential and commercial construction sectors, which have been aided by the expanding economy. In China, the Hong Kong housing authorities launched several initiatives to begin the construction of low-cost housing. Officials hope to build 301,000 public housing units over the next ten years, until 2030.

- According to the National Bureau of Statistics of China, the amount of textile output in China was 12.4 billion meters in the first four months of 2022, up from 11.8 billion meters at the same time in the previous year.

- Furthermore, the Chinese government envisions Xinjiang as a "hotbed" for textile and clothing manufacturing and has spent USD 8 billion in the region. By 2030, it is expected that China's northwest region will have become the country's most extensive textile production base .

- Thus, all the above-mentioned factors are likely to boost the demand for the vinyl acetate-ethylene market during the forecast period.

Vinyl Acetate Ethylene (VAE) Market Competitor Analysis

The Global Vinyl Acetate Ethylene (VAE) market is fragmented in nature. Some of the major manufacturers in the market include DCC, SINOPEC, Wacker Chemie AG, Gantrade Corporation, and VINAVIL SpA, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increase in Demand from the Construction Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 By Applications

- 5.1.1 Paints and Coatings

- 5.1.2 Adhesives

- 5.1.3 Construction Additives

- 5.1.4 Textiles

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Rank Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 Cheng Lung Chemical Co. Ltd

- 6.4.3 DCC

- 6.4.4 Gantrade Corporation

- 6.4.5 Hope Way Chemical Industrial Co. Ltd

- 6.4.6 Parkash Group

- 6.4.7 Shaanxi Xutai Technology Co. Ltd

- 6.4.8 SINOPEC

- 6.4.9 VINAVIL SpA

- 6.4.10 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Packaging Industry will Provide Ample Growth Opportunities in the Future