|

市场调查报告书

商品编码

1644951

重整单位-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Reformer Unit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

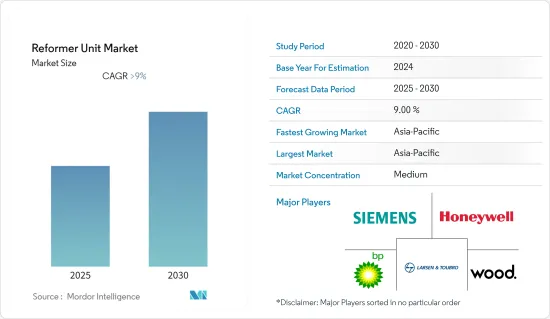

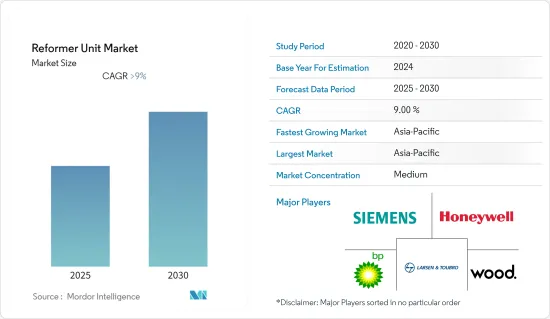

预测期内,重整装置市场预计将以超过 9% 的复合年增长率成长。

2020 年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从中期来看,为满足对更高品质石油产品日益增长的需求,对扩大下游活动的投资不断增加,正在推动重整器市场的需求。

- 另一方面,由于难以以极高的运转率运行,预计设备故障会导致停工,市场分散度也会增加,这将阻碍市场成长。

- 政府关于限制车辆有害排放气体的法规不断增多,预计将为重整装置市场创造重大机会。

- 由于亚太地区(尤其是印度和中国等国家)的石油精製计划数量不断增加,预计预测期内亚太地区将占据市场主导地位。

改革单位市场趋势

石油业可望主导市场

- 近年来,汽油和柴油的需求一直稳定成长,预计中期内不会放缓。这些产品主要用于汽车和重型机械等各种地方。

- 此外,许多国家都致力于减少环境排放。此外,很少有国家设立减少或消除排放的目标。这些透过重整器生产的高辛烷值燃料有助于生产比传统燃料排放量少得多的更清洁的燃料。

- 例如,2022年7月,一群美国参议员提出了一项法案,透过提案含有20%至30%乙醇的高消费量认证测试燃料来增加乙醇的消费量,并要求汽车製造商从2026年开始生产和保固使用这种燃料的汽车。

- 此外,世界各地的石油消费量正在大幅增加。例如,2021年的石油消费量量比2020年增加了6.1%。 2021年石油消费量为每天9,690.8万桶,而2020年约为每天9,136万桶。

- 此外,世界各地也提案了多个石化计划。例如,中国计划在2021年至2025年间建成512座石化工厂并投入营运。根据国际能源总署(IEA)的石化评估,到2050年,除欧洲以外几乎所有地区的初级化学品产量都将增加。

- 因此,由于对清洁燃料的需求不断增加以及政府的支持措施,预计石油业将占据预测领域的主导地位。

亚太地区占市场主导地位

- 预计亚太地区将在预测期内出现显着增长,这得益于石油消费量的增加、下游活动的投资增加、政府对使用高辛烷值燃料的推动力加大、以及该地区利用以柴油为主要燃料的重型机械的开发活动增加。

- 截至 2021 年,亚太地区的精製能力约为每天 36,478,000 桶 (tbpd)。中国和印度是该地区的主要企业,精製能力分别为 16,990 吨桶/天和 5,018 吨桶/天。

- 预计未来几年印度的精製能力将扩大。 2021年,全国原油精製能力将达到2.4987亿吨/年。印度最大的精製印度石油公司(IOC)宣布,计划在 2030 年将其精製能力从每年 8,070 万吨提高到每年 1.5 亿吨。

- 此外,该地区的许多国家都要求使用更清洁的燃料,以减少运输部门的环境排放。例如,2022年8月,澳洲阿尔巴尼斯工党政府提出立法,将澳洲低硫汽油的销售期限延后到2024-2027年。到 2024 年 12 月 15 日,澳洲零售店销售的所有汽油的最大含硫量将为 10ppm。这适用于 91 RON、95 RON、98 RON 和 E85 无铅汽油。

- 因此,基于上述事实,预计亚太地区将凭藉石化产业投资的增加和政府的支持措施在重整器市场中占据主导地位。

重整装置产业概况

全球重整装置市场适度细分。该市场的主要企业(不分先后顺序)包括霍尼韦尔国际公司、伍德集团、英国石油公司、拉森-特布罗有限公司和西门子股份公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 石油工业

- 化工

- 其他的

- 过程

- 热重整

- 催化重整

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 马来西亚

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Chevron Corporation

- Honeywell International

- Chiyoda Corporation

- BP PLC

- KBR Inc.

- McDermott International, Ltd

- Siemens AG

- Wood PLC

- Linde AG

- Larsen & Toubro Limited

- Ventech Engineers

第七章 市场机会与未来趋势

简介目录

Product Code: 93647

The Reformer Unit Market is expected to register a CAGR of greater than 9% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing investments in the expansion of downstream activities to meet the increasing demand for higher quality petroleum products, thus increasing the demand for a reformer unit market.

- On the other hand, the difficulty in operations at extremely high operations leads to increased shutdown or breakdown times due to equipment malfunction, which is expected to hinder market growth.

- Nevertheless, the increasing government regulations on controlling harmful emissions from vehicles are expected to create huge opportunities for the reforming unit market.

- Asia-Pacific is expected to dominate the market during the forecasted period due to the increasing oil refinery projects in the region, especially in countries like India and China.

Reformer Unit Market Trends

The Oil Industry Is Expected To Dominate The Market

- The demand for gasoline and diesel has been on a constant rise in recent years, and the demand will likely maintain its momentum over the medium term. These products are predominantly used in various places, such as for vehicles, heavy machinery, and other sectors.

- Moreover, many countries are focusing on reducing their environmental emissions. Furthermore, few countries have even set targets to reduce or eliminate emissions. These high-octane fuels produced through reformer units help produce cleaner fuels that emit significantly less emission than conventional fuels.

- For instance, in July 2022, a group of senators in the United States proposed legislation to increase ethanol consumption by introducing high-octane certification test fuels containing 20% to 30% ethanol and requiring automakers to build and warranty their vehicles to utilize the fuels beginning in 2026.

- Furthermore, the consumption of oil has increased significantly around the world. For instance, in 2021, oil consumption increased by 6.1% compared to 2020. In 2021 the oil consumption was 96908 thousand barrels per day, and in 2020 the consumption was around 91360 thousand barrels per day.

- Additionally, several petrochemical projects are being proposed around the world. For instance, 512 petrochemical plants will begin operations in China between 2021 and 2025. According to an International Energy Agency (IEA) petrochemicals assessment, practically all areas, except Europe, will grow primary chemical production by 2050.

- Hence, the oil industry is expected to dominate the forecast segment due to increased demands for cleaner fuels and supportive government policies.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region is expected to witness significant growth during the forecasted period due to the increasing consumption of oil, increasing investment in the expansion of downstream activities, increasing push from the government to use high-octane fuel, and increasing development activities in the region that utilizes heavy machinery which uses diesel as the primary source of fuel.

- As of 2021, Asia-Pacific had a refining capacity of roughly 36,478 thousand barrels per day (tbpd). China and India were the region's major players, with oil refining capacities of 16,990 tbpd and 5,018 tbpd, respectively.

- In the future years, India's refining capacity is expected to expand. The country's crude oil refining capacity reached 249.87 million metric tonnes per year in 2021. In addition, Indian Oil Corporation (IOC), India's largest refining firm, announced intentions to boost its refining capacity from 80.7 million metric tonnes per year to 150 million metric tonnes per year by 2030.

- Moreover, many countries in the region are mandating the usage of cleaner fuel in order to curb the environmental emissions from the transportation sector. For instance, in August 2022, the Albanese Labor Government in Australia presented legislation to move the sale of lower-sulfur gasoline in Australia from 2024 to 2027. All petrol in retail outlets in Australia will have a maximum sulfur level of 10 parts per million by December 15, 2024. This applies to unleaded petrol with 91 RON, 95 RON, 98 RON, and E85.

- Therefore, due to the abovementioned facts, the Asia-Pacific region is expected to dominate the reformer market due to increasing investment in the petrochemical sector and supportive government policies.

Reformer Unit Industry Overview

The Global Reformer Unit Market is moderately fragmented. Some key players in this market (in no particular order) are Honeywell International, Wood plc, BP plc, Larsen and Toubro Limited, and Siemens AG., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Oil Industry

- 5.1.2 Chemical Industry

- 5.1.3 Others

- 5.2 Process

- 5.2.1 Thermal Reforming

- 5.2.2 Catalytic Reforming

- 5.3 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Russia

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Malaysia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 UAE

- 5.3.4.3 Nigeria

- 5.3.4.4 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Columbia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Chevron Corporation

- 6.3.2 Honeywell International

- 6.3.3 Chiyoda Corporation

- 6.3.4 BP PLC

- 6.3.5 KBR Inc.

- 6.3.6 McDermott International, Ltd

- 6.3.7 Siemens AG

- 6.3.8 Wood PLC

- 6.3.9 Linde AG

- 6.3.10 Larsen & Toubro Limited

- 6.3.11 Ventech Engineers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219