|

市场调查报告书

商品编码

1272690

自动内容识别市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Automatic Content Recognition Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,自动内容识别市场预计将以 30% 的复合年增长率增长。

随着内容识别技术平台的不断进步,自动内容识别市场发展势头强劲。

主要亮点

- 自动内容识别让您知道您的媒体文件正在显示什么以及您的媒体播放器正在播放什么。 具有 ACR 的设备可以自动收集有关如何在屏幕级别使用内容的信息,而无需用户输入或搜索信息。

- 随着智能手机和智能电视自动识别内容的能力越来越强,全球对自动内容识别解决方案的需求也在增长。 此外,媒体公司在观众测量和广播监控等应用中越来越多地采用自动内容识别也有望推动全球自动内容识别市场的增长。

- 随着家电市场的发展,越来越多的家电製造商将内容自动识别技术安装到电视和手机等智能设备中。

- 此外,新技术的出现和消费者对更多定制内容的需求不断增长,正在显着推动各行业自动内容识别市场的发展。 移动设备普及率的提高有助于最大限度地提高市场的潜在增长率。

COVID-19 的爆发表明各行各业的商业模式存在缺陷。 它还让人们有机会在封锁期间通过使用和添加区块链、物联网、分析、云和人工智能等技术,在整个地区实现业务数字化和发展。 多亏了机器学习和数据分析,大流行病得到了解决。 几乎每个国家/地区都在机器学习和人工智能分析的支持下使用某种形式的自动内容识别来确定大流行病死亡人数和疾病曲线的增长率。

自动内容识别的市场趋势

媒体和娱乐行业预计将显着增长

- DVR、视频点播和每个屏幕上的 Over-the-top 流媒体通过提供观看内容、时间和地点显着改善了观众的生活,但广告对于所有者和内容所有者来说变得更加困难. 因为在过去的几年里,现场观众减少了,整体观众参与度也下降了。 随着智能手机和智能电视自身识别内容的能力越来越强,自动内容识别解决方案在全球范围内的需求量很大。

- 在预测期内,语音、视频和图像识别解决方案预计将成为自动内容识别市场中最受欢迎的解决方案类型。 这是最受欢迎的解决方案类型,因为它可以帮助智能设备识别各种媒体内容。

- 随着智能手机、电视和可穿戴设备等智能设备数量的增加,迫切需要识别、查找和改进内容。 这对公司和最终用户都是如此。 因此,公司开发了自动内容识别工具和服务,这些工具和服务以多种方式成功地简化了我们的生活。 Shazam通过发布基于数字指纹技术的音乐检测软件确立了这一趋势。 此后,许多公司都采用了这种风格,为依赖自动内容识别的智能手机和智能电视发布了第二屏应用程序。 Netflix、Hotstar、Amazon Prime 和 YouTube 等视频点播服务的增长推动了对自动内容识别解决方案和服务的需求。

- 广告商可以使用 DSP 根据用户数据生成广告活动报告,以缩小受众范围并了解有多少人在观看电视广告。 DSP 使用可信和众所周知的数据源。 此数据源包含许多智能电视提供商的信息,这些信息最初是使用自动内容识别 (ACR) 技术收集的。

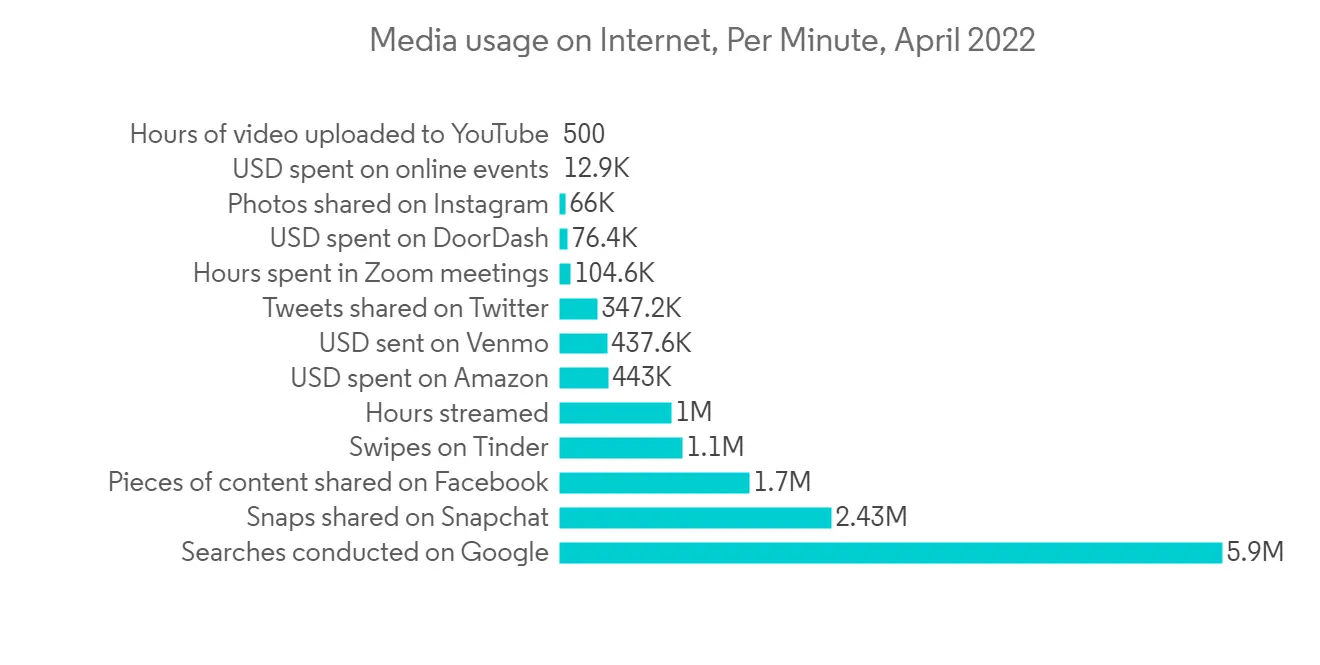

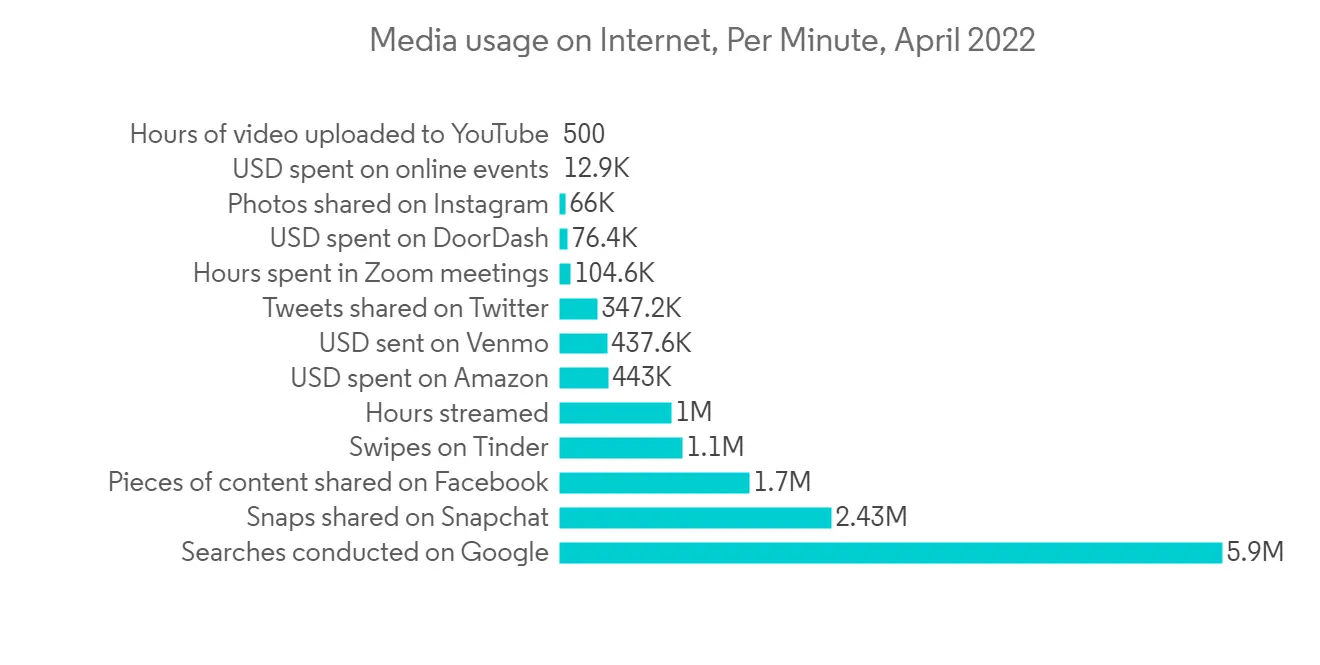

- 在线一分钟内,交换、阅读和上传了数百万条消息、电子邮件和短信,浏览了数十万小时的内容。 一家名为 Domo 的美国软件初创公司声称,到 2022 年,全球用户每分钟将在线流式传输 100 万小时的内容。 全球有数十亿在线用户,媒体和通信是支撑在线活动的两大力量。 数字视频流持续增长,无论是付费订阅服务还是免费视频平台。 这是因为数字基础设施已经到位,数据计划变得越来越便宜。

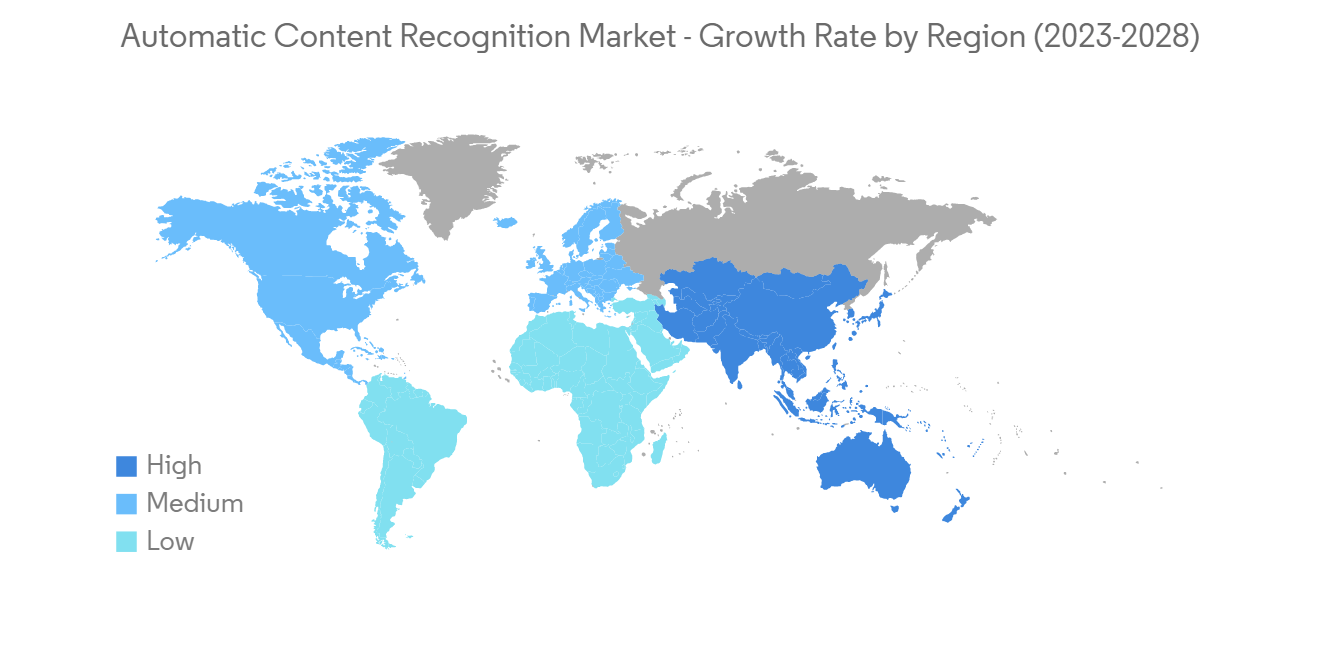

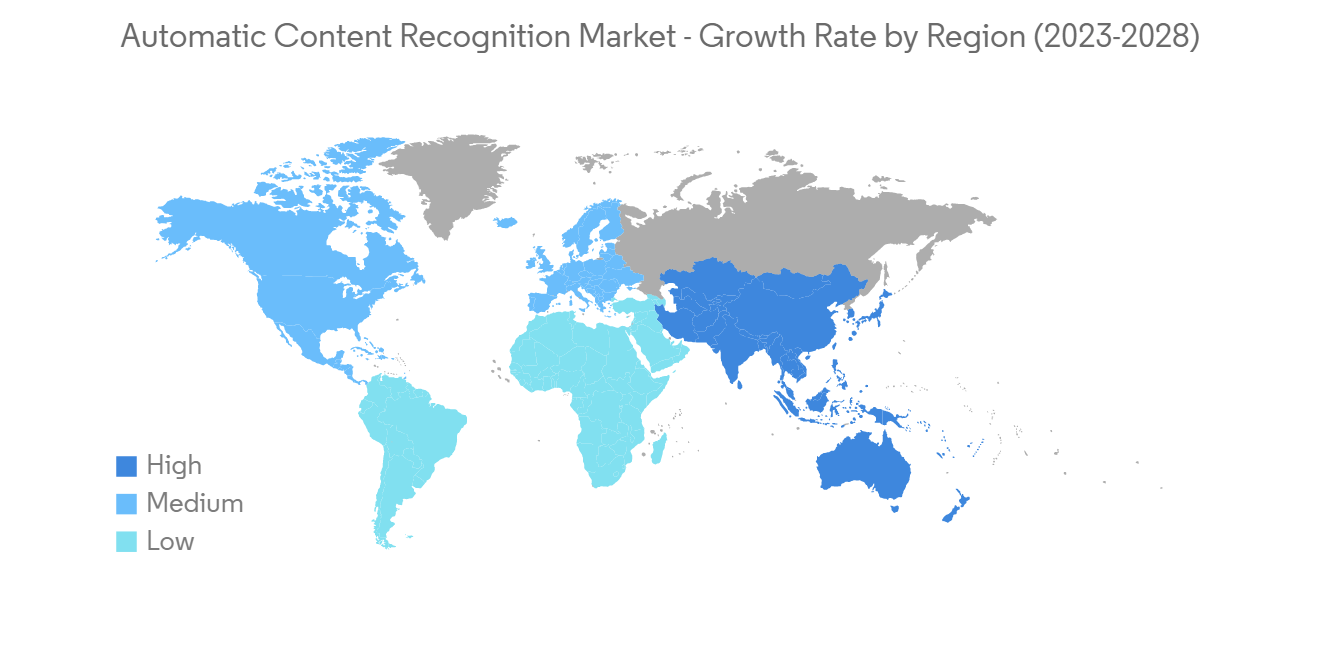

亚太地区成为增长最快的市场

- 在未来几年,预计其增长速度将超过亚太地区其他地区。 这是因为澳大利亚、印度、中国和日本等发展中经济体的技术正在进步。 因此,这些国家正在迅速采用技术支持的智能设备,这有望推动全球市场的发展。

- 预计亚太地区总体上会有很多增长机会。 这是因为该地区人口不断增长,移动用户不断增加,BYOD 技术盛行,IT 和电信蓬勃发展。

- 通过利用该地区强大的 IT 基础设施、卓越的软件和服务,以及在机器人技术等尖端行业的领先地位,该地区的企业可以发展壮大并创造利润。我猜。

- 例如,印度是全球 IT 公司最喜欢的离岸地点。 新兴技术现在为印度 IT 巨头提供了一系列全新的选择,已经展示了他们为全球客户提供在岸和离岸服务的能力。 到 2025 年,印度的 IT 和商业服务部门预计将增长到 199.3 亿美元。 在印度,IT 支出预计到 2023 年将达到 1440 亿美元。 据 IBEF 称,到 2026 年,云渗透可以创造 1400 万个新工作岗位,并使印度的 GDP 增加 3800 亿美元。

- 还将有更多人使用互联网,更多人需要高速互联网,这将有助于在预测期内接受调查的市场。 例如,Internet World Stats 预测该地区到 2022 年的互联网普及率将达到 67.4%,是该地区 2011 年互联网普及率的两倍多。 到 2022 年,使用互联网的人的平均比例将略低于 71%。

自动内容识别行业概览

内容自动识别市场竞争适中,由几家主要参与者组成。 就市场份额而言,一些玩家目前占据市场主导地位。 然而,随着託管服务中内容意识的提高,新的参与者正在增加他们的市场占有率,从而扩大他们在新兴市场的业务足迹。

2022 年 9 月,联网电视和跨屏广告服务 LG Ads Solutions 宣布将在全球范围内为 LG 电视引入其独特的自动内容识别 (ACR) 技术。 作为推出的一部分,欧洲、非洲、亚太地区、拉丁美洲和澳大利亚的数百万台智能电视将获得新的 ACR 解决方案,以取代旧技术。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- ACR 在媒体和娱乐行业的采用率提高

- ACR 在智能手机和可穿戴设备中的发展

- 市场製约因素

- 增加隐私和安全限制

- 行业价值链分析

- 行业吸引力 - 波特五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术快照

- 声音和数字视频指纹识别

- 数字音频/视频水印

- 光学字符识别

第 5 章市场细分

- 通过解决方案

- 实时内容分析

- 语音/语音识别

- 安全和版权管理

- 数据管理和元数据

- 其他解决方案

- 按最终用户行业

- IT/通信领域

- 消费类电子产品

- 媒体和娱乐

- 医疗保健

- 其他最终用户

- 地区

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章竞争格局

- 公司简介

- Apple Inc.(Shazam Entertainment Ltd.)

- Audible Magic Corporation

- Kantar Media SAS

- Digimark Corporation

- Signalogic Inc.

- Vobile Group Limited

- VoiceInteraction SA

- ACRCloud

- Nuance Communications Inc.

- Audible Magic Corporation

- Beatgrid Media B.V

第七章投资分析

第八章市场机会与未来趋势

The automatic content recognition market is expected to register a CAGR of 30% over the forecast period. The market for automatic content recognition is increasing with significant momentum due to the constant advancements in content recognition technology platforms.

Key Highlights

- With automatic content identification, it is possible to figure out what is being shown in a media file or played on a media player. Devices with ACR can automatically collect information about how content is used at the screen level without the user having to enter information or search for it.

- Because smartphones and smart TVs are getting better at automatically recognizing content, the need for automatic content recognition solutions has grown around the world. Additionally, increasing deployment of automatic content recognition by media companies for applications such as audience measurement and broadcast monitoring is anticipated to increase the global automatic content recognition market's growth.

- With the growth of the consumer electronics market, companies that make electronics are putting automatic content recognition technology into more and more smart devices, like TVs and cell phones.

- Moreover, the emergence of new technologies and increased consumer demand for more customized content have boosted the pace of the automatic content recognition market across industries to a great extent. Increased levels of adoption of portable devices have been instrumental in maximizing the growth potential of the market.

The COVID-19 outbreak showed weaknesses in business models across industries. It also gave people the chance to digitize and grow their businesses across regions by using and adding technologies like blockchain, IoT, analytics, cloud, and AI during the lockdown period. The pandemic was combated in part because of machine learning and data analytics. Practically all nations used automatic content recognition supported by machine learning and AI analysis in some capacity to determine the pandemic's death toll and the growth rate of the curve of afflicted people.

Automatic Content Recognition Market Trends

Media & Entertainment Sector is Expected to Grow at a Significant Rate

- With DVRs, Video on Demand, and over-the-top streaming across all screens having made the viewer's life significantly better by allowing them to deliver what, when, and where they watched, things got more difficult for advertisers and content owners. This is because, over the past few years, live audiences have decreased and overall viewer engagement has declined. Automatic content recognition solutions are in high demand around the world because smartphones and smart TVs are getting better at recognizing content on their own.

- During the forecast period, audio, video, and image recognition solutions are expected to be the most popular type of solution in the automatic content recognition market. This is because they are the most in-demand type of solution and help smart devices identify all kinds of media content.

- As the number of smart devices like smartphones, TVs, and wearables grows, there is a pressing need to identify, find, and improve content. This is true for both businesses and end users. This has prompted companies to develop automatic content recognition tools and services, which in many ways have simplified life. Shazam established the trend by releasing music detection software based on digital fingerprinting technology. Later, a lot of businesses adopted the style and released second-screen apps for smartphones and smart TVs that relied on automatic content recognition. The growth of on-demand video services like Netflix, Hotstar, Amazon Prime, and YouTube is driving the demand for automatic content identification solutions and services.

- Advertisers often use a DSP to run campaign reports based on user data so they can target audiences and figure out how well and how many people are seeing their TV ads. The DSP then works with a reliable and well-known data source. This data source has information from many smart TV providers that was first gathered using automated content recognition (ACR) technology.

- In a single online minute, millions of messages, emails, and SMS are exchanged, looked through, and uploaded, and hundreds of thousands of hours of content are seen. A US-based software startup called Domo claims that one million hours of content were streamed online by users all over the world in a single minute in 2022. Among the billions of online users worldwide, media and communications are two major forces behind online activity. Digital video streaming is growing all the time, whether it's done through paid subscription services or free video platforms. This is because digital infrastructure is getting better and data plans are getting cheaper.

Asia-Pacific Region is Registered as the Fastest Growing Market

- In the next few years, APAC is expected to grow faster than the rest of the world. This is because technology is improving in economically developing countries like Australia, India, China, and Japan. As a result, these countries are quickly adopting smart devices that use technology, which is expected to help the global market.

- The Asia-Pacific region is expected to have a lot of growth opportunities across the board. This is because the region's population is growing, the number of mobile users is rising, BYOD technology is becoming more popular, and IT and telecommunications are doing well.

- Businesses in this area could grow and make money by taking advantage of the strong IT infrastructure, good software and services, and leading roles in cutting-edge industries like robotics in this area.

- For instance, India is the most popular offshore location for IT companies worldwide. Emerging technologies are now opening up a whole new range of options for leading IT firms in India, which have already demonstrated their ability to provide both onshore and offshore services to clients worldwide. By 2025, it is anticipated that the Indian IT and business services sector will increase to USD 19.93 billion. In India, spending on IT is anticipated to reach USD 144 billion in 2023. According to the IBEF, widespread cloud use can create 14 million new jobs by 2026 and boost India's GDP by USD 380 billion.

- Also, more people will use the internet and more people will want high-speed internet, which will help the studied market in the time period predicted. For instance, Internet World Stats estimates that in 2022, Asia will have a 67.4 percent internet penetration rate, more than double the region's internet penetration rate in 2011. In 2022, the average percentage of people using the internet was just under 71%.

Automatic Content Recognition Industry Overview

The automatic content recognition market is moderately competitive and consists of a few major players. In terms of market share, some of the players currently dominate the market. However, with the advancement in content recognition across managed services, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

In September 2022, the linked TV and cross-screen advertising service LG Ads Solutions announced the global introduction of its exclusive automated content recognition (ACR) technology across LG TVs. Millions of smart TVs in Europe, Africa, Asia-Pacific, Latin America, and Australia will get the new ACR solution as part of the deployment, which will replace older technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Deployment of ACR in Media & Entertainment Industry

- 4.2.2 Growing Integration of ACR in Smartphones and Wearable Devices

- 4.3 Market Restraints

- 4.3.1 Rising Privacy and Security Constraints

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Acoustic & Digital Video Fingerprinting

- 4.6.2 Digital Audio & Video Watermarking

- 4.6.3 Optical Character Recognition

5 MARKET SEGMENTATION

- 5.1 By Solution

- 5.1.1 Real-time Content Analytics

- 5.1.2 Voice & Speech Recognition

- 5.1.3 Security & Copyright Management

- 5.1.4 Data Management & Metadata

- 5.1.5 Other Solution types

- 5.2 By End-user Industry

- 5.2.1 IT & Telecommunication

- 5.2.2 Consumer Electronics

- 5.2.3 Media & Entertainment

- 5.2.4 Healthcare

- 5.2.5 Other End-user Industry

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Apple Inc. (Shazam Entertainment Ltd.)

- 6.1.2 Audible Magic Corporation

- 6.1.3 Kantar Media SAS

- 6.1.4 Digimark Corporation

- 6.1.5 Signalogic Inc.

- 6.1.6 Vobile Group Limited

- 6.1.7 VoiceInteraction SA

- 6.1.8 ACRCloud

- 6.1.9 Nuance Communications Inc.

- 6.1.10 Audible Magic Corporation

- 6.1.11 Beatgrid Media B.V