|

市场调查报告书

商品编码

1272700

血粉市场——增长、趋势和预测 (2023-2028)Blood Meal Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,血粉市场的复合年增长率预计为 3.1%。

主要亮点

- 由于含氮量高,血粉是製作全价动物饲料的重要成分。 它还用作有机肥料,为植物提供矿物质和养分。 血粉是动物饲料和有机肥料的蛋白质来源,全球市场预计在未来几年将出现适度增长。 随着新兴国家城市化进程的推进,对动物产品的需求不断增加,市场有望进一步活跃起来。

- 血粉作为饲料和肥料在农业中的多方面用途预计将在预测期内略微提振需求。 然而,严格的监管框架是影响全球血粉市场增长的一个因素。 随着对动物福利和环境可持续性的日益关注,预计监管环境将变得更加严格。

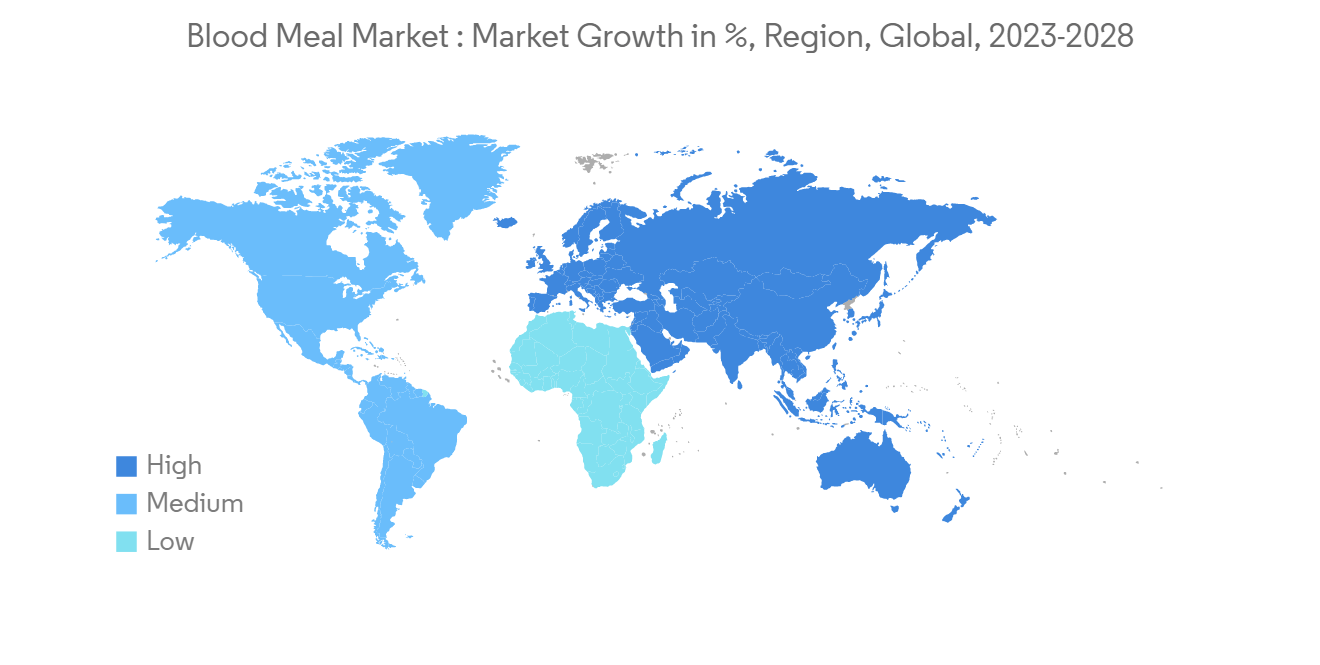

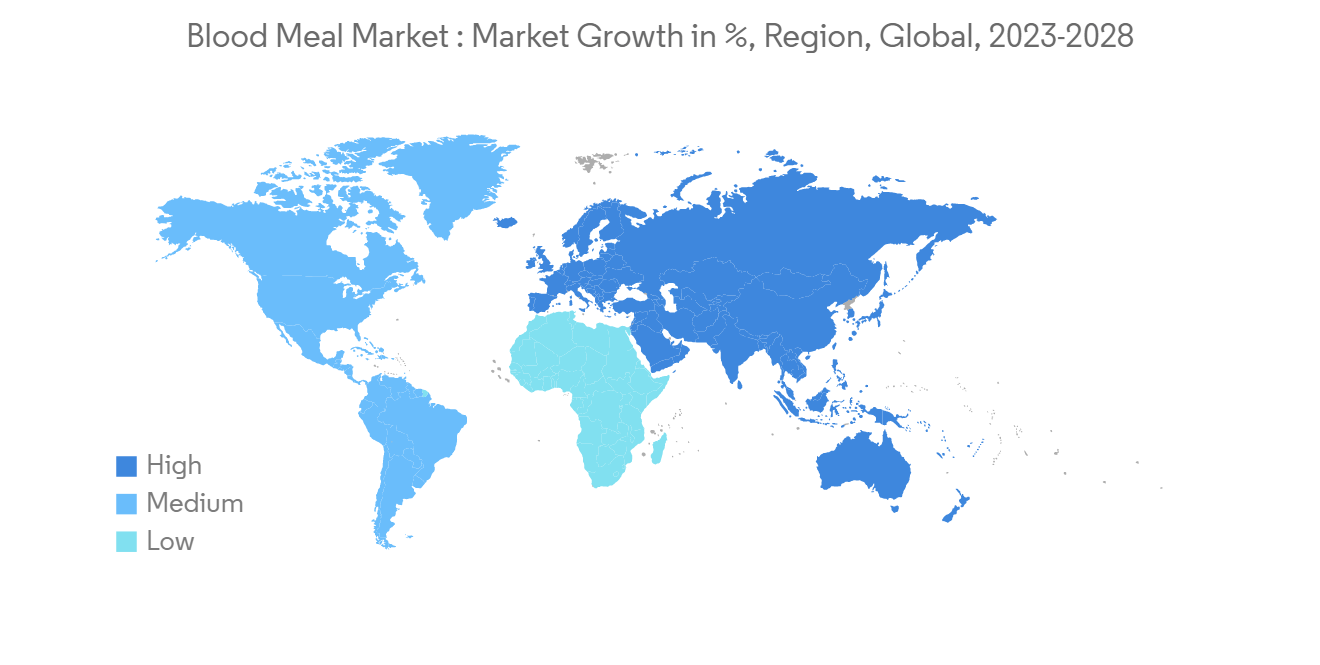

- 亚太地区拥有大量牲畜和广阔的农业区,因此该市场有望快速增长。 此外,该地区的高产能使其成为对血粉製造商具有吸引力的市场。 随着对动物产品的需求增加,该地区的新兴国家正在大力投资农业以满足不断增长的需求。

血粉市场趋势

不断增长的动物肉类需求创造了市场机会

- 血液被认为是一种液体蛋白质,富含赖氨酸等氨基酸,因此比赖氨酸含量较低的植物蛋白更具优势。 推动血粉市场增长的主要因素是可支配收入增加、城市化和对动物蛋白的需求增加。 根据全球饲料调查,2018-2022 年饲料产量增长了 15.4%。 水产养殖业和水产养殖产品的增长也增加了对营养饲料的需求。

- 根据联合国粮食及农业组织 (FAO) 的数据,2021 年全球捕捞鱼类产量将达到 1.793 亿吨,比 2019 年到 2021 年增长 1.9%。 随着对动物衍生产品(不仅仅是动物肉)的需求增加,动物屠宰量增加,为血粉製造商提供了机会。

- 根据粮农组织的数据,从 2018 年到 2020 年,屠宰的动物数量增加了 2.8%,到 2020 年达到 732 亿头。 这些饮食是优质蛋白质和其他营养素的天然来源,并且由于对天然饲料成分的需求不断增加,预计将获得牵引力。

亚太地区是增长最快的市场

- 亚太地区预计将成为血粉市场增长最快的地区。 由于牛肉和猪肉等动物产品的生产和消费不断增加,该地区被认为是一个有吸引力的市场。 据粮农组织称,该地区的牛肉产量将从 2018 年的 1780 万吨增加到 2021 年的 1950 万吨。 中国和越南猪肉等主要肉类消费国的存在也是支持该地区目标市场增长的一个因素。

- 根据经济合作与发展组织 (OECD) 的数据,中国人均猪肉消费量为 24 公斤/人。 而在越南,猪肉占肉类消费量的 70%,估计为每人 25 公斤。 印度和中国等国家的城市化进程加快和人口增长也是推动亚太地区血粉市场增长的因素。

- 到 2022 年,印度将成为最大的反刍动物饲料生产国,产量将达到 5.309 亿吨。 这是由于畜牧业基础设施发展基金 (AHIDF) 等计划的实施,该基金鼓励建立动物饲料製造厂并加强现有工厂。 对复合饲料的需求不断增长,以及通过改善营养来提高农场生产力和盈利能力,预计将在预测期内推动该地区的血粉市场。

血粉行业概况

随着国内外参与者进入市场,全球骨粉市场适度整合。 市场上的主要参与者是 Boyer Valley Company LLC、The Fertrell Company、Darling Ingredients 等。 由于机会越来越多,许多公司有兴趣投资血粉市场。 厂商投资研发,收购竞争对手,推广血粉。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 三个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 市场製约因素

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 的由来

- 猪血

- 家禽血

- 反刍动物血液

- 用法

- 家禽饲料

- 猪肉饲料

- 反刍动物饲料

- 水产饲料

- 天然害虫防治剂

- 有机肥

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲

- 亚太地区

- 印度

- 中国

- 日本

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 阿拉伯联合酋长国

- 沙特阿拉伯

- 其他中东和非洲地区

- 北美

第六章竞争格局

- 最常采用的策略

- 市场份额分析

- 公司简介

- Boyer Valley Company, LLC.

- The Fetrell Company

- Terramar Chile

- Darling Ingredients

- West Coast Reduction Ltd

- Agro-industrial Complex Backa Topola LTD

- Valley Proteins Inc.

- Sanimax

- Allanasons Pvt Ltd

第7章 市场机会未来动向

简介目录

Product Code: 67624

The blood meal market is estimated to register a CAGR of 3.1% during the forecast period.

Key Highlights

- Blood meal is a crucial ingredient in formulating complete feed for animals, owing to its high nitrogen content. It is also used as an organic fertilizer, providing minerals and nutrients for plants. The global market for blood meal, a protein source for animal feed and organic fertilizer, is projected to experience moderate growth in the coming years. The growing demand for animal-based products in emerging countries, driven by increasing urbanization, is expected to further fuel the market.

- The multifaceted applications of blood meal in agriculture as both feed and fertilizer are expected to drive demand slightly during the forecast period. However, the stringent regulatory framework is a factor that may affect the growth of the global blood meal market. The regulatory landscape is expected to become more stringent, with an increasing focus on animal welfare and environmental sustainability.

- The Asia-Pacific region is expected to witness the fastest growth in the market, owing to its high population of livestock and a larger area under agriculture. Additionally, the region's high production capabilities make it an attractive market for blood meal manufacturers. With the growing demand for animal-based products, emerging economies in the region are investing heavily in agriculture to meet the growing demand.

Blood Meal Market Trends

Growing Demand for Animal Meat is creating Market Opportunities

- Blood is considered a liquid protein and is rich in amino acids like Lysine, and has an advantage over plant-based protein with low lysine content. The major factors behind the growth of the blood meal market are the rise in disposable incomes, urbanization, and increased demand for animal proteins. According to the Global Feed survey, feed production increased by 15.4% in 2018-2022. The growth in aquaculture and aquaculture products also increases the demand for nutritional feed.

- According to Food and Agriculture Organization (FAO), the global capture fisheries production in 2021 reached a record of 179.3 million metric tons, an increase of 1.9% between 2019 and 2021. With the increasing demand for animal meat as well as animal-based products, there is an increase in the slaughter of animals leading to the opening of various opportunities for manufacturers of blood meal.

- According to FAO, the number of animals slaughtered increased by 2.8% in 2018-2020 and reached 73.2 billion in 2020. These meals are a natural source of high-quality protein as well as other nutrients and are expected to gain traction owing to the increasing demand for natural feed ingredients.

Asia Pacific is the Fastest Growing Market

- Asia-Pacific is anticipated to record the fastest growth in the blood meals market. The region seems to be an attractive market owing to increasing production as well as consumption of various animal-based products such as beef meat and pork meat. According to FAO, cattle meat production in the region increased from 17.8 million metric ton in 2018 to 19.5 million metric ton in 2021. The presence of major meat-consuming countries such as pork in China and Vietnam is another factor supporting the growth of the target market in this region.

- According to Organisation for Economic Co-operation and Development (OECD), the average pork consumption in China is 24 kg per person. Also, in Vietnam, pork accounts for 70% of the meat consumption and is anticipated as 25 kg per person. In countries like India and China, growing urbanization and increasing population are also factors propelling the growth of the blood meal market in the Asia Pacific region.

- India is the largest ruminant feed producer, with 530.9 million metric tons in 2022. This is due to implementing schemes such as the Animal Husbandry Infrastructure Development Fund (AHIDF), which encourages establishing animal feed manufacturing plants and strengthening existing ones. Increasing demand for compound feed and a focus on farm productivity and profitability through improved nutrition are expected to drive the blood meal market in the region during the forecast period.

Blood Meal Industry Overview

The global bone meal market is moderately consolidated with domestic players and international players in the market. The major players in the market include Boyer Valley Company LLC, The Fertrell Company, and Darling Ingredients. Many companies are taking an interest in investing in the blood meal market owing to increasing opportunities. Manufacturers are investing in R&D, acquiring their competitors, and promoting blood meal products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Porcine Blood

- 5.1.2 Poultry Blood

- 5.1.3 Ruminant Blood

- 5.2 Application

- 5.2.1 Poultry Feed

- 5.2.2 Porcine Feed

- 5.2.3 Ruminant Feed

- 5.2.4 Aqua Feed

- 5.2.5 Natural Pest Deterrent

- 5.2.6 Organic Fertilizer

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Boyer Valley Company, LLC.

- 6.3.2 The Fetrell Company

- 6.3.3 Terramar Chile

- 6.3.4 Darling Ingredients

- 6.3.5 West Coast Reduction Ltd

- 6.3.6 Agro-industrial Complex Backa Topola LTD

- 6.3.7 Valley Proteins Inc.

- 6.3.8 Sanimax

- 6.3.9 Allanasons Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219