|

市场调查报告书

商品编码

1273329

硅铁市场 - 增长、趋势和预测 (2023-2028)Ferrosilicon Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球硅铁市场预计将以低于 3% 的复合年增长率增长。

由于原材料短缺,COVID-19 对全球硅铁市场产生了一定影响。 但是,由于世界半导体领域的不断扩大,硅铁的消耗正在加速。

主要亮点

- 耐腐蚀应用的增加和钢铁行业需求的增加正在推动市场增长。

- 预计用其他替代品替代会阻碍市场增长。

- 建筑和汽车行业不断增长的需求预计会在预测期内为该行业带来新的增长机会。

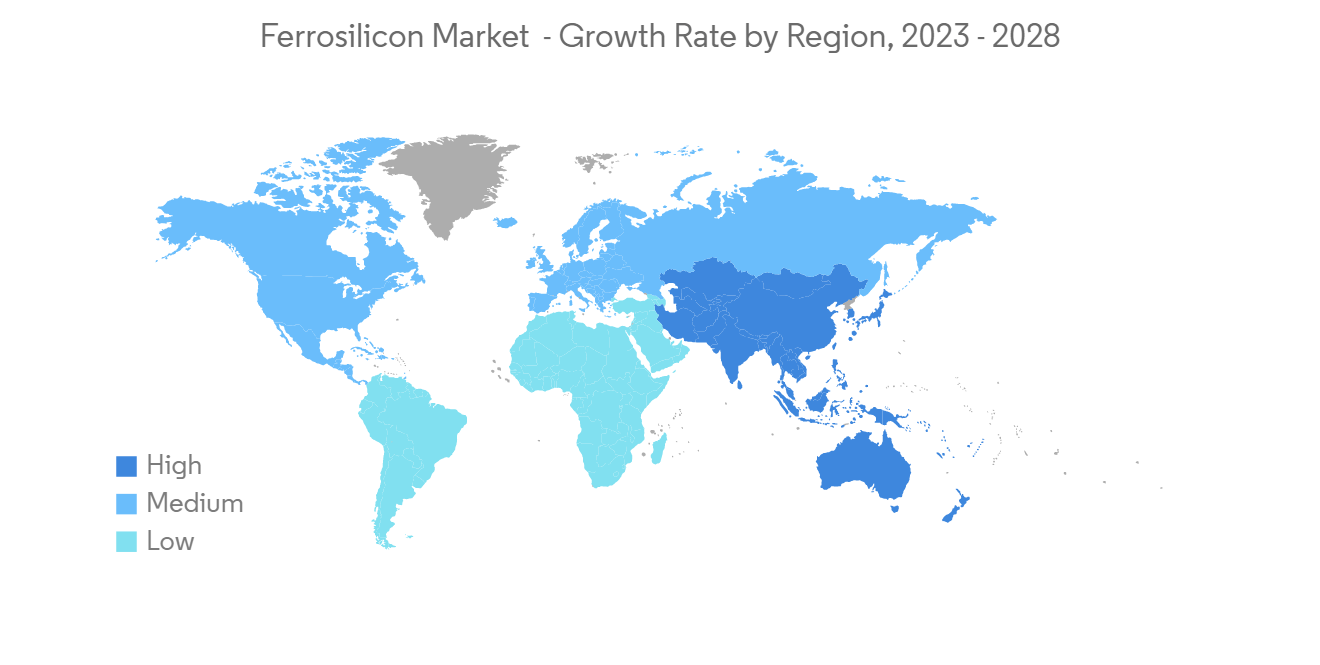

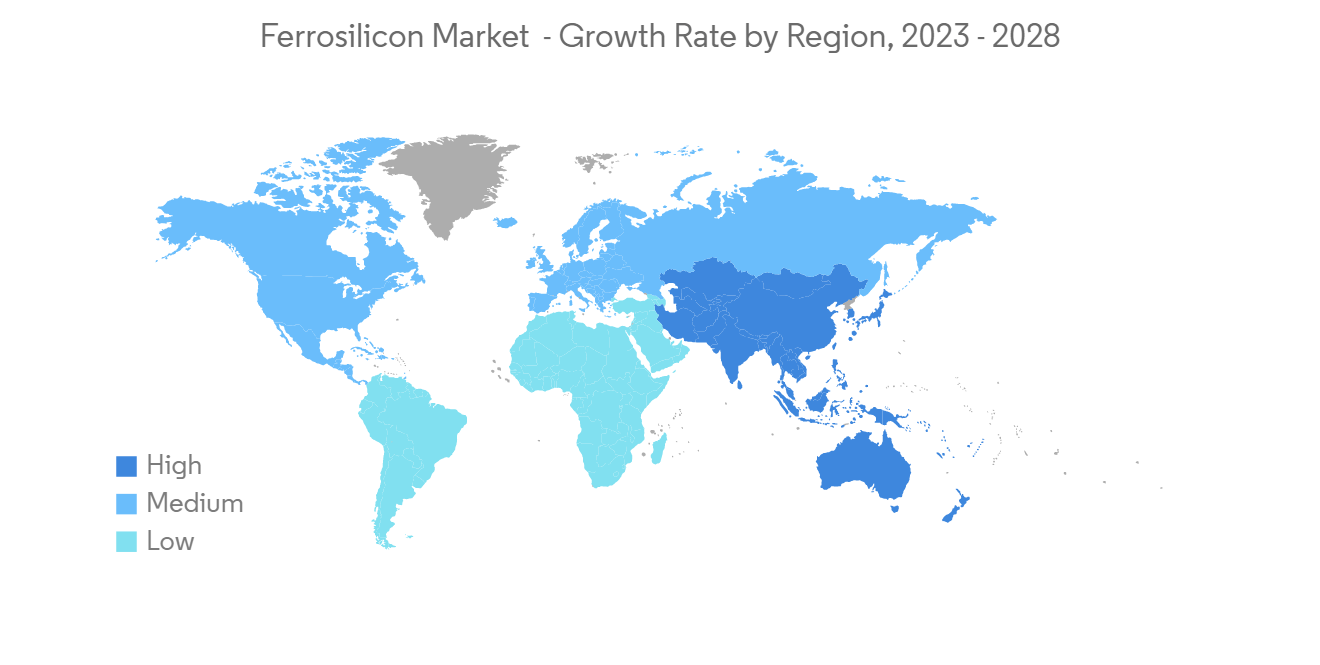

- 亚太地区在全球市场占据主导地位,硅铁应用在中国和印度不断扩大,主要用于冶金和半导体行业。

硅铁市场趋势

冶金行业需求扩大

- 硅铁是一种用于製造钢铁和铸件的合金。 硅铁在冶金、半导体、太阳能和化工领域都有应用。

- 硅铁与钢铁生产行业有着密切的关係。 由于其特性,硅铁被用作钢中的脱氧剂和铸造工业中的孕育剂。

- 硅铁的特性包括耐腐蚀、耐磨、高比重、高强度、高磁性、硬度高、耐高温。 80%以上的硅铁用于钢铁生产。

- 腐蚀会降低强度、降低表面特性并降低流体阻力。 总的来说,它会降低某些材料的机械和化学性能。

- 建筑和汽车行业对耐腐蚀的需求正在增加。 桥樑、结构支撑和车身必须经久耐用,不会受到腐蚀。 因此,许多公司更愿意在建筑和汽车中使用硅铁来提高质量。

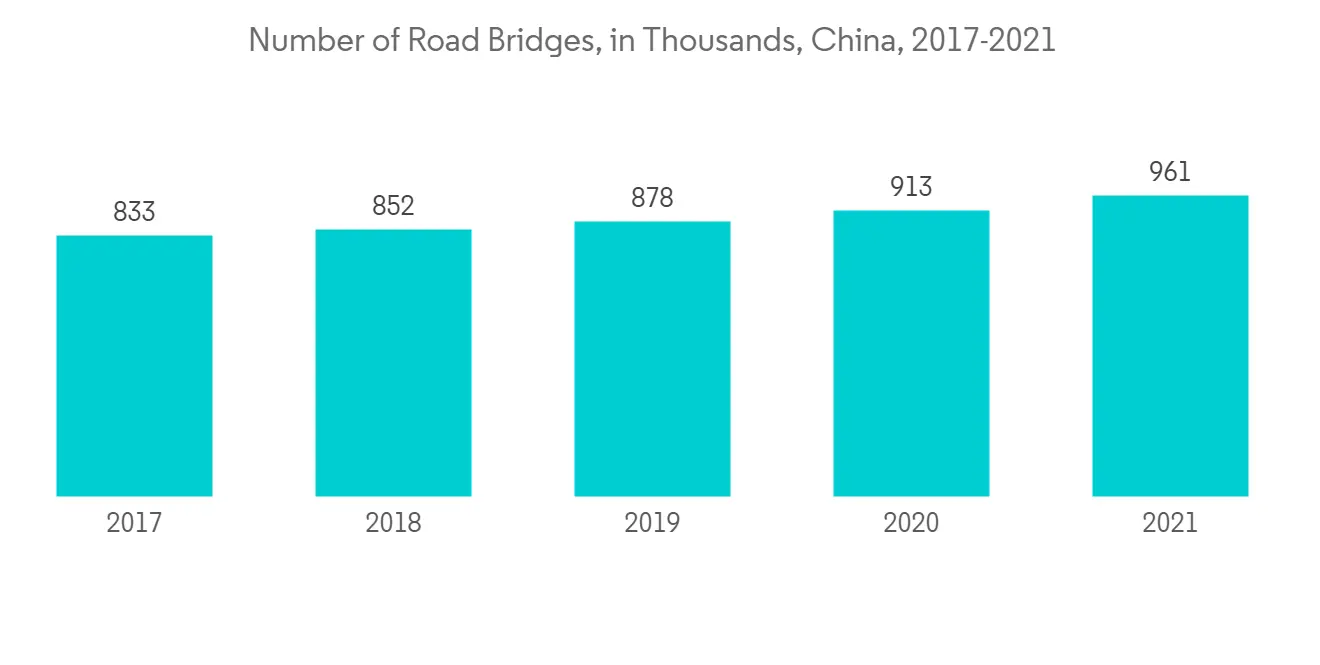

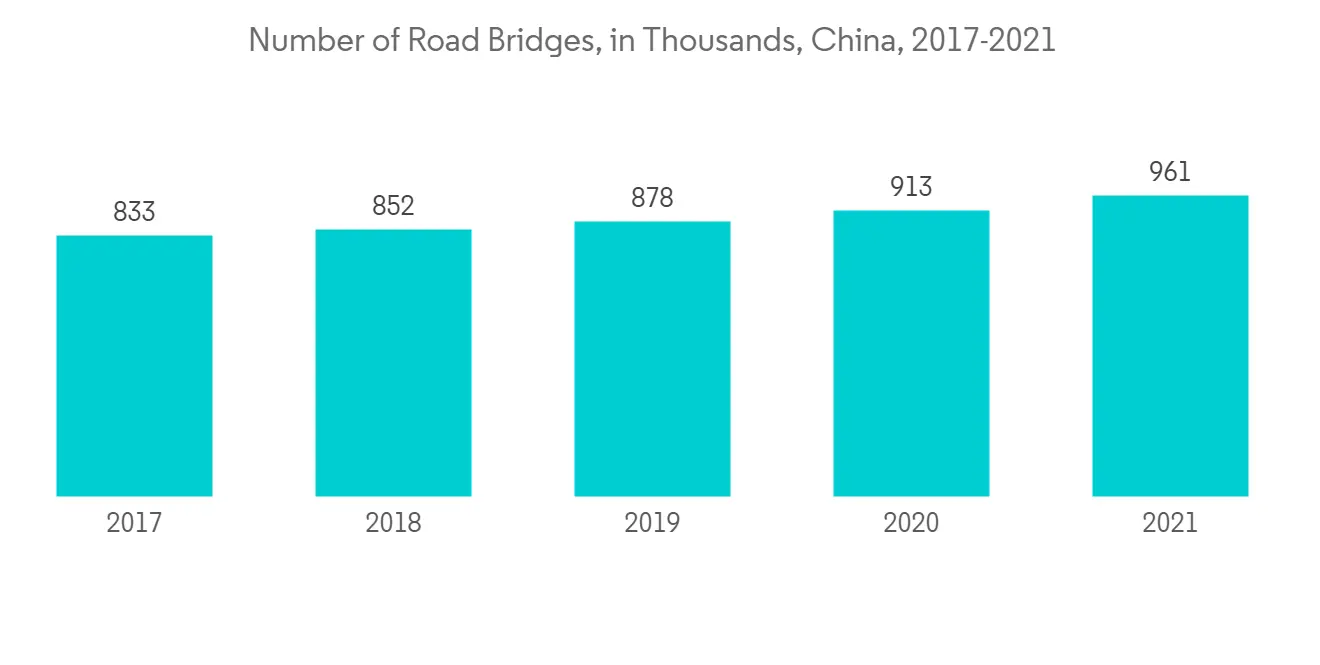

- 2021年,中国将新建公路桥樑96.11万座,比上年增加4.83万座。 在过去的 12 年中,中国的公路桥樑增加了约 46%。

- 通过将硅铁与其他金属製成合金,它成为一种可用于製造半导体的化合物。 电子行业对半导体的需求量很大。 快速的工业化和对电子产品不断增长的需求增加了硅铁在各种应用中的使用。

- 到 2021 年,半导体销售额将达到历史性的 1.15 万亿单位出货量,这是由于晶圆厂利用率远高于通常的 80% "满负荷" 。 而且,为满足长期的芯片需求,全球半导体产业将在2022年投入巨资,支出超过1660亿美元。

- 根据半导体行业协会 (SIA) 的数据,2022 年全球半导体行业销售额将达到 5735 亿美元。 中国仍然是最大的半导体市场,2022 年销售额为 1803 亿美元。

- 此外,每个国家/地区的政府政策和激励措施也有利于改善全球半导体研究和劳动力生态系统。 2021年5月,韩国公布了 "K-Semiconductor Belt" 战略,旨在到2030年打造全球最大的半导体供应链。 此外,2022 年 9 月,墨西哥联邦政府开始起草新的激励方案以吸引半导体投资,特别关注组装、测试和封装。

- 因此,冶金行业对硅铁的需求在未来几年可能会增长。

亚太地区主导市场

- 亚太地区的建筑业高度发达,并且持续投资于发展汽车和建筑业,因此预计亚太地区将主导全球市场。

- 建筑行业的需求正在增加。 根据土木工程师学会 (ICE) 的一项研究,到 2030 年,全球建筑业预计将达到 8 万亿美元,主要由中国、印度和美国推动。

- 含硅铁的合金钢具有多种特性,例如厚度和质量,这增加了它们在汽车行业的需求。

- 中国拥有其他任何地区最大的汽车製造基地,负责亚太地区对硅铁的需求。 根据中国汽车工业协会(CAAM)的数据,2022 年中国汽车製造商的产量将比上年增长 3.4% 至 2702 万辆,销量将增长 2.1% 至 2686 万辆。

- 中国的电动汽车 (EV) 产销量将在 2022 年激增,并在今年最后一个月打破之前的记录。 2022年电动汽车销量689万辆,同比增长93.4%,产量710万辆,同比增长96.9%。

- 亚太地区是最大的电子元件生产国。 近年来,由于几乎所有电子设备都使用半导体,製造半导体对硅铁的需求增加。

- 因此,上述因素有望推动亚太地区的硅铁消费。

硅铁行业概况

全球硅铁市场较为分散,竞争激烈。 主要公司包括中国五矿集团公司、欧亚资源集团、Ferroglobe、OM Holdings Ltd 和 Mechel(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章介绍

- 调查先决条件

- 本次调查的范围

第 2 章研究方法论

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 增加与耐腐蚀相关的应用

- 钢铁行业的需求不断增加

- 抑制因素

- 替换为其他替代品

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于数量)

- 用法

- 冶金

- 半导体

- 太阳能发电

- 化学处理

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- China Minmetals Corporation

- Eurasian Resources Group

- Ferro Alloys Corporation Limited

- Ferroglobe

- Finnfjord

- Mechel

- OM Holdings Ltd.

- Shanghai Shenjia Ferroalloys Co., Ltd

- SKP Group

- Tashi Group

第 7 章市场机会与未来趋势

- 建筑和汽车行业的需求增加

- 其他商业机会

The market for ferrosilicon is expected to grow at a CAGR of less than 3% globally during the forecast period.

COVID-19 moderately impacted the global ferrosilicon market due to the raw materials shortage. However, rising semiconductor sectors across the globe have accelerated the consumption of ferrosilicon.

Key Highlights

- Increasing applications for corrosion resistance and growing demand from steel production industries are driving market growth.

- Replacement by other substitutes factor is expected to hinder the market growth.

- Increasing demand from the construction and automotive industries is projected to offer new growth opportunities to industry growth during the forecast period.

- Asia-Pacific dominated the global market with the rising application of ferrosilicon in China and India, mainly in the metallurgy and semiconductor industry.

Ferrosilicon Market Trends

Growing Demand from Metallurgy Industry

- Ferrosilicon is an alloy used for steel and casting production applications. FerroSilicon finds its application in metallurgy, semiconductors, solar energy, and chemicals.

- Ferrosilicon includes a strong relationship with steel production industries. Because of its properties, ferrosilicon is used as a steel deoxidizer and an inoculant in the casting industries.

- The properties of ferrosilicon include corrosion and abrasion resistance, high specific gravity, high strength, high magnetism, hardness, and high-temperature resistance. More than 80% of ferrosilicon is consumed in producing iron and steel.

- Corrosion can reduce strength, decrease surface properties, and resistance to fluids. Overall, it decreases the mechanical and chemical properties of certain materials.

- The demand for corrosion resistance from the construction and automobile industries is growing. Bridges, structural support materials, and automotive bodies need to last long without any effect of corrosion. So, many companies are preferring ferrosilicon in construction and automobiles for better quality.

- In 2021, 961,100 road bridges were built in China, an increase of 48,300 from the previous year. China's road bridges have grown by about 46% during the last 12 years.

- Alloying ferrosilicon with other metals makes the compound useful in producing semiconductors. Semiconductors have a huge demand from the electronics industry. Rapid industrialization and growing demand for electronics have been increasing the use of ferrosilicon in various applications.

- In 2021, semiconductor unit sales reached a historic 1.15 trillion-unit shipments as a result of increases in fab utilization rates far above the normal "full utilization" rate of 80 percent. Additionally, to meet the long-term chips demand, the global semiconductor industry made significant capital investments in 2022, investing more than USD 166 billion.

- According to the Semiconductor Industry Association (SIA), the global semiconductor industry sales was totaled USD 573.5 billion in 2022. China remained the largest market for semiconductors, with sales totaling USD 180.3 billion in 2022.

- Moreover, government policies and incentives in various countries are also providing benefits to improve the global semiconductor research and workforce ecosystem. In May 2021, South Korea unveiled the "K-Semiconductor Belt" strategy aimed at building the world's largest semiconductor supply chain by 2030. Additionally, in September 2022, the Mexican federal government began to draft a new incentives package to attract semiconductor investment, particularly focused on assembly, testing, and packaging.

- Therefore, the growing demand for ferrosilicon for metallurgy purposes is likely to witness growth in the coming years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market owing to the highly developed construction and continuous regional investments to advance the automobile and construction sectors through the years.

- The demand from the construction industry is increasing. According to a study by the Institution of Civil Engineers (ICE), the global construction industry is expected to reach USD 8 trillion by 2030, primarily driven by China, India, and the United States.

- Alloying steel with ferrosilicon includes various properties that enhance their demand in the automotive sector, such as thickness and quality.

- China includes the largest automobile manufacturing base of any other region, accounting for the demand for ferrosilicon in the Asia-Pacific region. According to the China Association of Automobile Manufacturers (CAAM), Chinese carmakers produced 27.02 million units in 2022, up by 3.4% year on year, while sales rose by 2.1% to 26.86 million units.

- Electric vehicle (EV) production and sales in China grew rapidly in 2022, breaking previous records in the year's final month. Sales of electric vehicles increased by 93.4% to 6.89 million units in 2022, a rise of 7.1 million units or a 96.9% year-on-year increase in production.

- Asia-Pacific is the largest producer of electronic components. In recent years, the semiconductors used in almost every electronic device increased the demand for ferrosilicon in producing semiconductors.

- Therefore, the factors above are expected to boost the consumption of ferrosilicon in the Asia Pacific region.

Ferrosilicon Industry Overview

The global ferrosilicon market is fragmented, with many players competing. Some major companies are China Minmetals Corporation, Eurasian Resources Group, Ferroglobe, OM Holdings Ltd, and Mechel, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications for Corrosion Resistance

- 4.1.2 Growing Demand from Steel Production Industries

- 4.2 Restraints

- 4.2.1 Replacement by Other Substitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Metallurgy

- 5.1.2 Semiconductors

- 5.1.3 Photovoltaic Solar Energy

- 5.1.4 Chemical Processing

- 5.1.5 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 China Minmetals Corporation

- 6.4.2 Eurasian Resources Group

- 6.4.3 Ferro Alloys Corporation Limited

- 6.4.4 Ferroglobe

- 6.4.5 Finnfjord

- 6.4.6 Mechel

- 6.4.7 OM Holdings Ltd.

- 6.4.8 Shanghai Shenjia Ferroalloys Co., Ltd

- 6.4.9 SKP Group

- 6.4.10 Tashi Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Construction and Automotive Industries

- 7.2 Other Opportunities