|

市场调查报告书

商品编码

1273332

FISH(荧光原位杂交)市场——增长、趋势、COVID-19 影响和预测 (2023-2028)Fluorescent In Situ Hybridization Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

FISH(荧光原位杂交)市场预计在预测期内以 6.8% 的复合年增长率增长。

由于部署 FISH(荧光原位杂交)的研究激增,COVID-19 对监控市场产生了巨大影响。 例如,2022 年 11 月发表在 PLOS One Journal 上的一篇论文使用 FISH(荧光原位杂交)检测唾液中的 SARS-CoV-2。 所有唾液样本均使用 Cy3 标记的 SARS-CoV-2 特异性 DNA 探针进行 FISH,并通过荧光显微镜进行手动分析(概念验证)。 然而,由于全球癌症和遗传病患病率上升,预计在预测期内将呈现稳定的增长率。

此外,日益增加的癌症和遗传疾病负担以及 FISH 产品的创新正在对所研究市场的增长产生积极影响。

根据加拿大癌症协会 2022 年 5 月更新,估计 2022 年将有 30,000 名加拿大人被诊断出患有肺癌和支气管癌,占所有新发癌症病例的 13%。 FISH(荧光原位杂交)用于诊断各种类型的癌症以发现染色体异常,从而增加了对 FISH 的需求并推动了市场。

此外,FISH(荧光原位杂交)用于检测和定位染色体上的特定 DNA 序列。 它也被用作诊断遗传性疾病的分子细胞遗传学技术。 例如,根据 2021 年 9 月发布的《世界老年痴呆症报告》,全球有超过 5500 万人患有痴呆症。 预计到 2030 年将达到 7800 万。 并且根据阿尔茨海默氏症协会的 2021 年报告,估计 2021 年美国将有 620 万 65 岁及以上的美国人患有阿尔茨海默氏症痴呆症。 到 2050 年,65 岁及以上患有阿尔茨海默病的人数预计将增加到 1270 万。 阿尔茨海默氏病的全球负担不断增加,对用于这种疾病基因检测的 FISH 的需求激增,导致研究领域市场的增长。

FISH主要用于鑑定特定DNA序列、诊断遗传病、基因作图,在基因组学中的应用极其重要。 据估计,生物技术和製药公司、政府机构等在基因组学领域的研究和创新方面增加资金和投资将推动市场增长。 例如,根据美国国立卫生研究院国家人类基因组研究所(NHGRI)2022年报告,2022年美国总统对人类基因组研究的预算要求为6.33亿美元,比上年增加1700万美元。 为了改善人类健康,NHGRI 与团体合作,开展和资助基因组学研究,并培养下一代基因组学专业人员。 NHGRI 对基因组研究的巨大投资预计将在研究期间利用大量 FISH,并有望在预测期内推动市场增长。

因此,由于上述因素(例如癌症和遗传病的高患病率)以及导致 FISH 的高实用性的资金增加,监测市场预计在分析期间将出现增长。 然而,缺乏对细胞遗传学新兴诊断技术的认识可能会阻碍市场增长。

FISH(荧光原位杂交)市场趋势

FISH(荧光原位杂交)市场有望在癌症领域大幅增长

由于体外诊断的普及、全球癌症的高患病率以及用于癌症诊断的 FISH(荧光原位杂交)技术进步等因素,癌症领域在预测期内将显着增长。预计将占据市场份额。

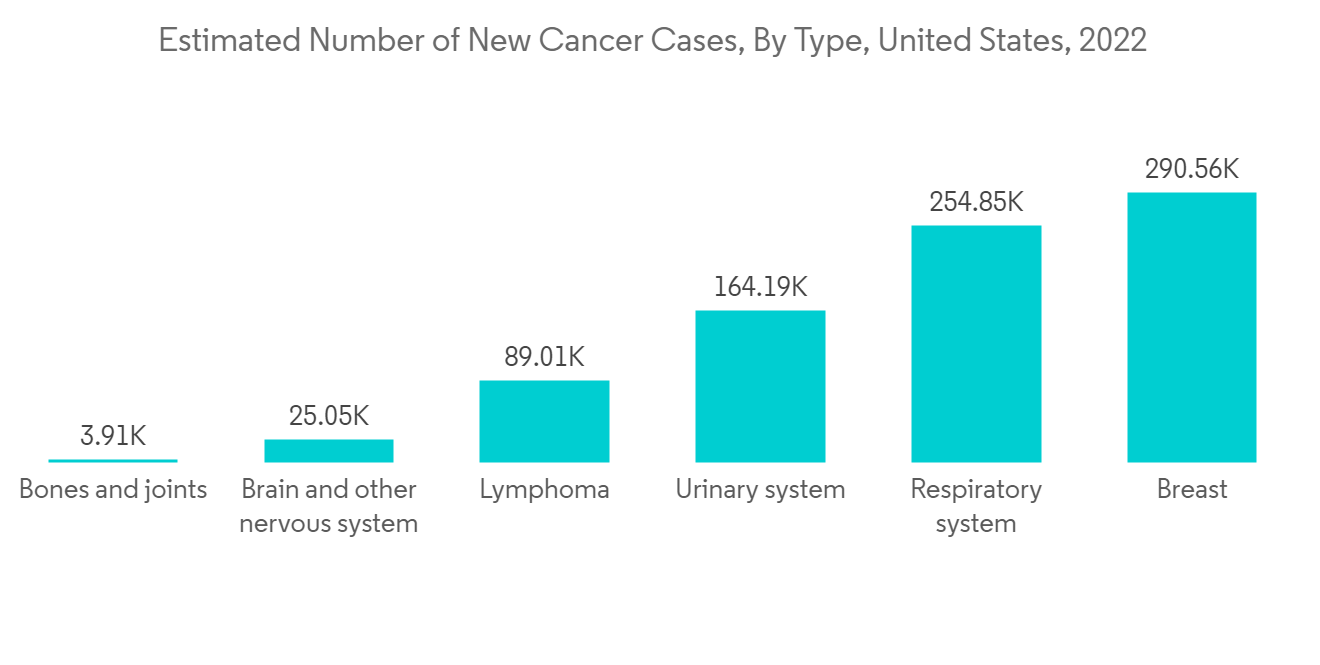

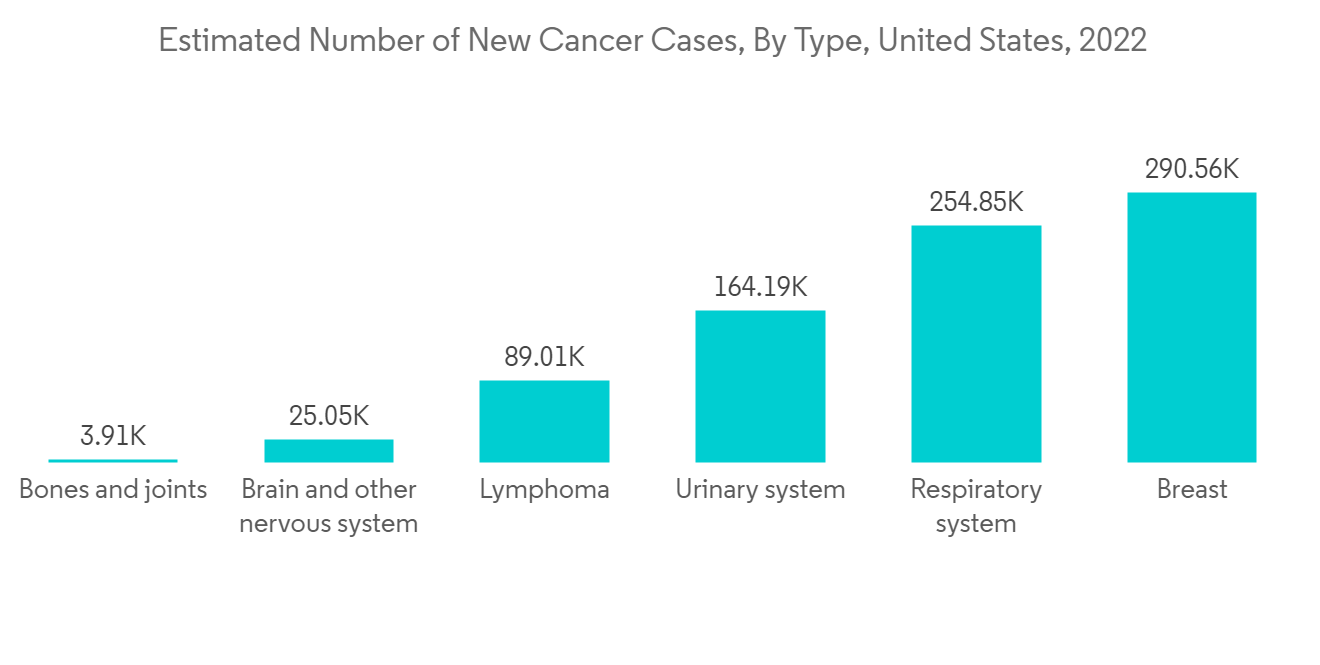

细胞遗传学技术在检测癌症染色体畸变方面发挥着重要作用。 根据美国癌症协会的《2023 年癌症统计》,2023 年美国将诊断出 190 万例新的癌症病例。 根据澳大利亚卫生与公众服务研究所 (AIHW) 2021 年报告,预计 2021 年澳大利亚将新增 150,782 例癌症病例。 此外,ICMR 2021 报告证实,印度的癌症患者人数预计将从 2021 年的 2670 万增加到 2025 年的 2980 万。 由于全球癌症负担高,FISH 在辅助疾病诊断和治疗计划方面的应用越来越广泛,预计将推动该领域的增长。

按照美国 FDA 的建议,在 Her2 基因检测研究中越来越多地使用 FISH 也促进了该领域的发展。 例如,2022 年 8 月发表在 Contrast Media Molecular Imaging Journal 上的一篇研究论文使用 FISH 检测乳腺癌患者的 Her2 基因。 研究论文显示,FISH(荧光原位杂交)技术与荧光显微镜结合,以其检测特异性高、灵敏度高、实验时间长等优点,越来越受到相关领域的认可。 FISH 在检测非小细胞肺癌的 MET(肝细胞生长受体)基因异常和乳腺癌的基因检测方面非常有效。 因此,这些因素有望对荧光原位杂交市场的癌症领域产生积极影响。

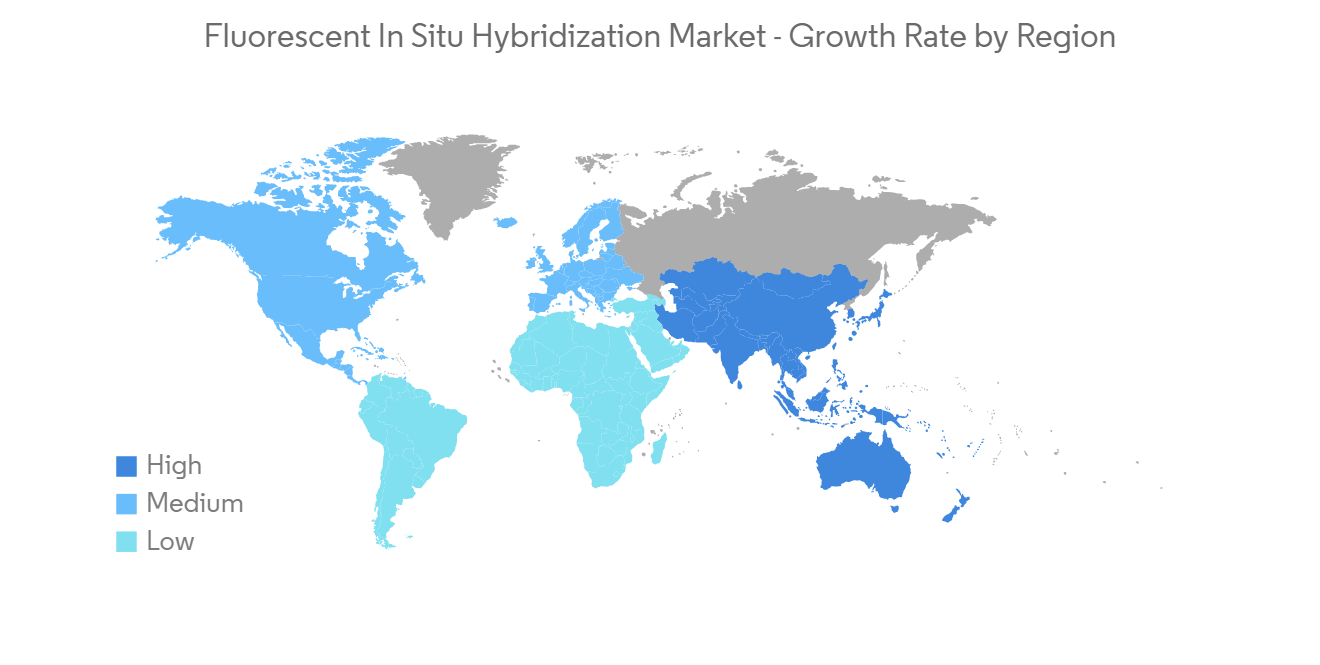

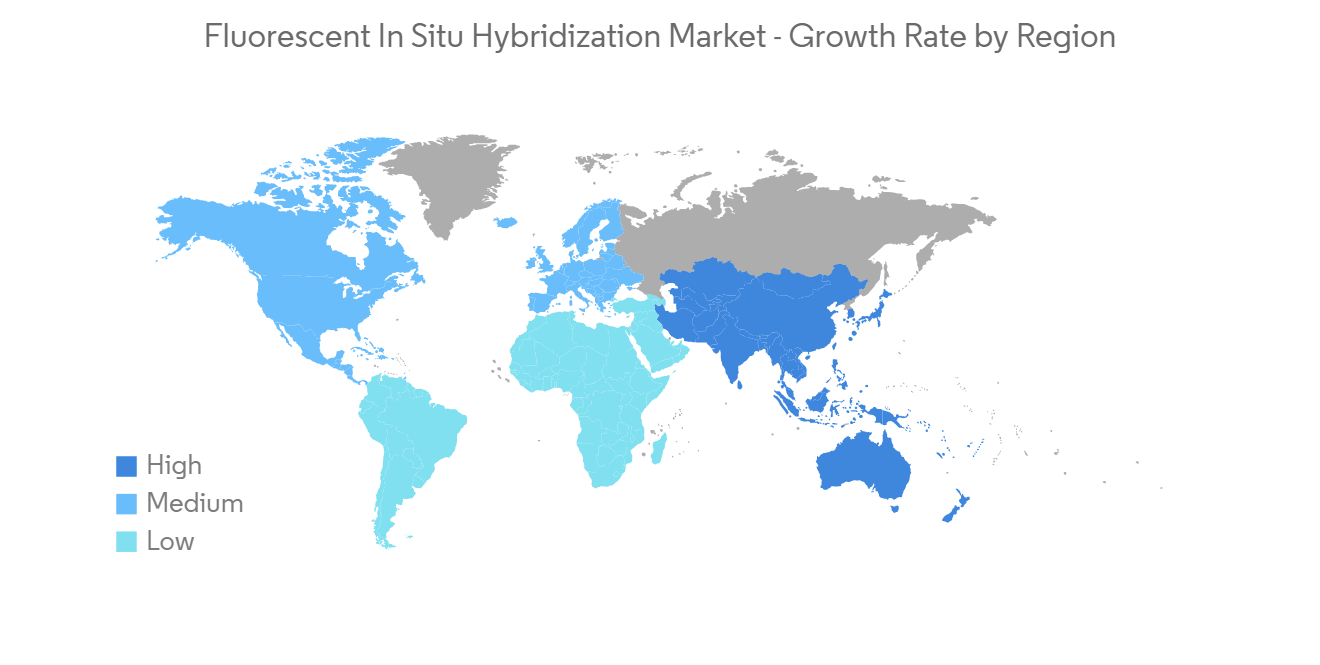

预计在预测期内北美将占据重要的市场份额

由于其高慢性病负担和越来越多的 FISH 相关产品批准,预计北美将成为 FISH(荧光原位杂交)市场的主导区域。

根据加拿大癌症协会的《2022 年乳腺癌统计报告》,估计到 2022 年将有 28,600 名加拿大女性被诊断出患有乳腺癌,占所有新女性癌症病例的 25%。. 平均每天有 78 名加拿大女性被诊断出患有乳腺癌。 由于该地区乳腺癌和遗传疾病的高负担,预计将推动该地区的市场增长。

FISH 用于识别特定的 DNA 序列、诊断遗传病、绘製基因图以及识别导致各种类型癌症的新型致癌基因。 据推测,该地区在癌症基因组学上的更高支出推动了 FISH(荧光原位杂交)的应用。 例如,NIH Research Portfolio Online Reporting Tool (RePORT),2022 年 5 月报告称,美国的癌症基因组学支出到 2021 年将达到 11.6 亿美元,到 2022 年将达到 12.2 亿美元。 在预测期内,该地区基因工程项目支出的增加预计将推动该地区的市场增长。

此外,根据上述 NIH 报告,据报导,2021 年用于遗传学研究的经费为 110.1 亿美元,2022 年为 114.8 亿美元。 美国遗传学的高支出负担将推动正在调查的 FISH 的效用,并有望在预测期内增加该地区的市场增长。

FISH(荧光原位杂交)行业概览

FISH(荧光原位杂交)市场竞争相对激烈,因为有多家公司在全球和区域运营。 竞争格局包括对持有重要或主要市场份额的国际和区域公司的分析。 市场垄断企业包括 Abnova Corporation、Genemed Technologies, Inc.、Biocare Medical, LLC、Qiagen (Exiqon A/S)、Agilent Technologies、Merck KGaA、Biodot Inc、PERKINELMER Inc、ThermoFisher Scientific Inc 和 F HOFFMANN-LA ROCHE LTD。/p>

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 癌症和遗传病的负担不断增加

- 产品进度

- 市场製约因素

- 缺乏对细胞遗传学新诊断技术的认识

- 波特五力

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品类型

- 分析仪器

- 试剂盒和试剂

- 软件与服务

- 通过申请

- 癌症

- 遗传性疾病

- 其他

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Abnova Corporation

- Agilent Technologies

- Biocare Medical, LLC

- Biodot Inc.

- F. HOFFMANN-LA ROCHE LTD.

- Genemed Technologies, Inc.

- Merck KGaA

- PERKINELMER INC

- Qiagen(Exiqon A/S)

- ThermoFisher Scientific Inc.

第七章市场机会与未来趋势

The Fluorescent In Situ Hybridization Market is poised to grow at a CAGR of 6.8% over the forecast period.

COVID-19 profoundly impacted the studied market owing to the rising research studies deploying fluorescence in situ hybridization. For instance, in an article published in the PLOS One Journal in November 2022, fluorescence in situ hybridization (FISH)-based evaluation method was used for the detection of SARS-CoV-2 in saliva. All saliva samples were FISHed with a Cy3-labeled SARS-CoV-2-specific DNA probe and were analyzed manually by fluorescence microscopy (proof-of-concept). However, the market is expected to show a stable growth rate during the forecast period owing to the rising prevalence of cancer and genetic diseases globally.

In addition, the growing burden of cancer and genetic diseases and innovation in FISH products are actively affecting the growth of the studied market.

According to the Canadian Cancer Society May 2022 update, it was estimated that 30 thousand Canadians would be diagnosed with lung and bronchus cancer, representing 13% of all new cancer cases in 2022. As fluorescent in situ hybridization is used to diagnose various types of cancer to find chromosomal abnormalities, there is an increasing demand for FISH, thereby driving the market.

Furthermore, fluorescence in situ hybridization (FISH) is used to detect and locate a specific DNA sequence on a chromosome. It is also used as a molecular cytogenetic technique to diagnose genetic diseases. For instance, according to the World Alzheimer Report published in September 2021, over 55 million people live with dementia worldwide. This is forecasted to reach 78 million by 2030. Also, as per the Alzheimer's Association 2021 report, an estimated 6.2 million Americans aged 65 and older were living with Alzheimer's dementia in 2021 in the United States. By 2050, the number of people aged 65 and older with Alzheimer's dementia is projected to increase to 12.7 million. The increasing burden of Alzheimer's disease globally surges the demand for FISH used in the genetic testing of the disease condition, thereby leading to the growth of the studied segment market.

FISH is mainly used for locating specific DNA sequences, diagnosis of genetic diseases, and gene mapping; its use in genomics is vital. The increasing funding and investment by biotechnology and pharmaceutical companies and government organizations for research and innovation in the field of genomics is estimated to propel market growth. For instance, according to the NIH National Human Genome Research Institute (NHGRI) 2022 report, the FY 2022 United States President's Budget request for human genomics research is USD 633.0 million, an increase of USD 17.0 million compared with the previous year. In order to improve human health, NHGRI interacts with a variety of groups, performs and funds genomics research, and educates the next generation of genomics specialists. The huge investment by the NHGRI in the genomics study is expected to utilize a large amount of FISH during the research, which is expected to propel the market growth during the forecast period.

Therefore, owing to the aforementioned factors, such as the high prevalence of cancer and genetic diseases and rising funding leading to the high utility of FISH, the studied market is anticipated to witness growth over the analysis period. However, a lack of awareness about emerging diagnostic technologies in cytogenetics is likely to impede market growth.

Fluorescent In Situ Hybridization Market Trends

Cancer Segment is Expected to Show a Significant Growth in the Fluorescent In Situ Hybridization Market

The cancer segment is anticipated to hold a significant market share over the forecast period owing to the factors such as the growing presence of in vitro diagnostics, the high burden of cancer globally, and rising technological advancements in fluorescent in situ hybridization used for cancer diagnosis.

Cytogenetic technique plays a crucial role in the detection of cancer chromosomal abnormalities. According to the American Cancer Society Cancer Statistics 2023, 1.9 million new cancer cases are predicted to be diagnosed in the United States in 2023. Also, as per the Australian Institute of Health and Welfare (AIHW) 2021 report, a total of 150,782 new cancer cases were estimated in Australia in 2021. In addition, as per the ICMR 2021 Report, it has been observed that the number of cancer patients in India was expected to rise from 26.7 million in 2021 to 29.8 million in 2025. The huge burden of cancer worldwide boosts the utility of FISH to diagnose diseases and help plan treatment, which is expected to propel segment growth.

The rising use of FISH in research studies for Her2 gene detection, as recommended by the US FDA, is also contributing to segment growth. For instance, according to a research article published in Contrast Media Molecular Imaging Journal in August 2022, FISH was used in the detection of the Her2 Gene in Breast Cancer Patients. According to the research article, due to its benefits of high detection specificity, high sensitivity, and strong experimental duration, fluorescence in situ hybridization (FISH) technology accompanied by a fluorescent microscope has increasingly acquired favor in related fields. FISH is very effective in detecting the abnormalities of the MET (hepatocyte growth receptor factor) gene of non-small cell lung cancer and in breast cancer gene detection. Thus, these factors are expected to impact positively on the cancer segment of the fluorescent in situ hybridization market.

North America is Expected to Hold a Significant Market Share Over The Forecast Period

North America is expected to be a dominant region in the fluorescence in situ hybridization (FISH) market owing to the high burden of chronic disease and growing product approvals related to FISH.

According to the Canadian Cancer Society, Breast cancer statistics 2022 report, it is estimated that 28.6 thousand Canadian women will be diagnosed with breast cancer, representing 25% of all new cancer cases in women in 2022. On average, 78 Canadian women will be diagnosed with breast cancer every day. The high burden of breast cancer and genetic diseases in the region is expected to propel market growth in the region.

The FISH technique is used for locating specific DNA sequences, diagnosis of genetic diseases, gene mapping, and identification of novel oncogenes contributing to various types of cancers. The high spending on cancer genomics in the region is estimated to propel the utility of fluorescence in situ hybridization. For instance, according to NIH Research Portfolio Online Reporting Tool (RePORT), May 2022 report, the spending on cancer genomics in the United States was USD 1,160 million in 2021 and USD 1,220 million in 2022. The rising spending on gene engineering projects in the region is expected to propel market growth in the region during the forecast period.

Furthermore, as per the abovementioned NIH report, the funding for research in genetics was reported to be USD 11,010 million in 2021 and USD 11,480 million in 2022. The high burden of spending on genetics in the United States is expected to propel the utility of FISH during the research, which will augment the market growth in the region during the forecast period.

Fluorescent In Situ Hybridization Industry Overview

The fluorescent in situ hybridization market is moderately competitive in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold significant or major market shares. Some companies dominating the market are Abnova Corporation, Genemed Technologies, Inc., Biocare Medical, LLC, Qiagen (Exiqon A/S), Agilent Technologies, Merck KGaA, Biodot Inc., PERKINELMER Inc., ThermoFisher Scientific Inc., and F. HOFFMANN-LA ROCHE LTD.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Cancer and Genetic Diseases

- 4.2.2 Advancements in Products

- 4.3 Market Restraints

- 4.3.1 Lack of Awareness about Emerging Diagnostic Technologies in Cytogenetics

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Analytical Instrument

- 5.1.2 Kits & Reagents

- 5.1.3 Software & Services

- 5.2 By Application

- 5.2.1 Cancer

- 5.2.2 Genetic Diseases

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abnova Corporation

- 6.1.2 Agilent Technologies

- 6.1.3 Biocare Medical, LLC

- 6.1.4 Biodot Inc.

- 6.1.5 F. HOFFMANN-LA ROCHE LTD.

- 6.1.6 Genemed Technologies, Inc.

- 6.1.7 Merck KGaA

- 6.1.8 PERKINELMER INC

- 6.1.9 Qiagen (Exiqon A/S)

- 6.1.10 ThermoFisher Scientific Inc.